Abstract

In this paper we propose a flexible tool to estimate the risk sensitivity of financial assets when exposed to any sort of risks, including extreme ones, from the financial markets and the real economy. This tool works with observations and a priori views. Our contribution is threefold. First, we combine copulas and factorial structures which allow us to capture the whole dependencies between the returns of a large number of assets of multiple classes. We build what we call a Cvine Risk Factors (CVRF) model, which can disentangle financial and explicitely economic like activity, inflation, emerging, etc, and more generally speaking real sphere related risks. Second, this model provides the way to extend the well known linear multibeta relationship in a non-linear version and to assess the exposures of any asset to several factorial risk directions in the cases where the risks are extreme. The exposure measures are relevant Cross Conditional Values at Risk (Cross-CVaR). Third, as an application of the methodology, we solve an optimization program to find portfolios that are the most diversified in capital while being immunized to extreme shocks to a given risk factorial direction. Varying the immunization constraint, we recover the portfolio strategies which are the most widely used today. For example, adopting the ERC (Equal Risk Contribution) rule insures optimal capital based diversification and immunization against inflation risk. Accordingly, we propose a unified view and a rationalization ex post of several current portfolio strategies that appear different at a first glance.

Similar content being viewed by others

Notes

Bad times refer for example to negative growth, high inflation, deflation, high volatility or correlations between assets, illiquidity spiral, debt crises, etc.

Risk factors are indeed reputed to be regime dependent (Page and Taborsky 2011).

Another choice may be US TIPS which are often considered as real rate risk by US long-term investors (Ilmanen 2011).

Table 5 in “Appendix B” reports the Kendall’s tau coefficients for a subset of couples of returns; for sake of place, all coefficients, and particularly the ones for couples of returns outside the factor-type indexes, are not reported; they are indeed negligible. Results are available upon request.

Results are available upon request.

Some returns display a weak auto-regressive dynamics but the simulation results are weakly affected by the autoregressive part. Accordingly, for sake of simplicity, we suppose that there is no autoregressive component whatever the index considered.

The choice of the best copula could be made by using another Information criterion and a goodness-of-fit test could be implemented as suggested by Genest et al. (2009) for example. But, one more time, we mainly judge the quality of the model by its economic and financial consistence.

Dealing with a large portfolio of assets can become very difficult due to the complexity of joint multivariate modelling. Some approaches have been proposed (Cherubini et al. 2012), but most of them are rather complicated to implement and seem to give similar results to simpler methods (Jin and Lehnert 2009).

We could have called the excess CVaR a XCCVaR measure.

The interpretation of the entropy related measure is simple. Indeed, it is equal to 1 (its minimum value) in a fully concentrated position, i.e. when all weights \(\omega _j\) are equal to 0 except for one, equal to 1. On the other hand, it achieves its maximum equal to J in equally weighted portfolios.

We do not consider the Dollar index, as, in general, currencies are indirectly invested in a portfolio through foreign assets.

The exposure of a portfolio to a “Risk” related shock is obtained as the weighted sum of the sensitivities of the individual assets \(j; j=1,\ldots ,J\):

$$\begin{aligned} \gamma _{\alpha }^{(Risk)}(P) = \sum \limits _{j=1}^J \omega _{j}*\gamma _{\alpha }^{(Risk)}(j) \end{aligned}$$where the weights \(\omega _{j}, j=1, \ldots , J\) define the composition of the portfolio.

In risk budgeting strategies the portfolio manager is interested in risk allocations rather than in capital allocations. Thus the weights associated with the different assets in the portfolio are chosen according to their contributions to the risk of the portfolio. Here we assess the risk of a position in terms of volatility.

The fundamental idea of the all-weather portfolio strategy is to compose portfolios that will perform well across all environments, be it a devaluation or something completely different. Generally speaking, an AW like portfolio contemplates allocating a quarter of risk to each of the four scenarios combining rising/falling growth and rising/falling inflation. In our case, we focus on an AW like allocation which insures robustness to real rate and inflation risks.

References

Aas, K., Czado, C., Frigessi, A., & Bakken, H. (2009). Pair-copula constructions of multiple dependence. Insurance: Mathematics and Economics, 44(2), 182–198.

Acharya, V., Engle, R., & Richardson, M. (2012). Capital shortfall: A new approach to ranking and regulating systemic risks. American Economic Review, 102, 59–64.

Alexander, C., & Sheedy, E. (2008). Developing a stress testing framework based on market risk models. Journal of Banking and Finance, 32, 2220–2236.

Ang, A., Chen, J., & Xing, Y. (2006). Downside risk. Review of Financial Studies, 19(4), 1191–1239.

Bedford, T., & Cooke, R. M. (2001). Probability density decomposition for conditionally dependent random variables modeled by vines. Annals of Mathematics and Artificial Intelligence, 32(1–4), 245–268.

Bedford, T., & Cooke, R. M. (2002). Vines-a new graphical model for dependent random variables. Annals of Statistics, 30(4), 1031–1068.

Bender, J., Briand, R., & Nielsen, F. (2010). Portfolio of risk premia: A new approach to diversification. Journal of Portfolio Management, 36(2), 17–25.

Brechmann, E. C., & Czado, C. (2013). Risk management with high-dimensional vine copulas: An analysis of the Euro Stoxx 50. Statistics & Risk Modeling, 30(4), 307–342.

Brechmann, E. C., Hendrich, K., & Czado, C. (2013). Conditional copula simulation for systemic risk stress testing. Insurance: Mathematics and Economics, 53, 722–732.

Brechmann, E.C., & Schepsmeier, U. (2013). Modeling dependence with C- and D-Vine Copulas: The R Package CDVine. Journal of Statistical Software, 52(3), 1–27. http://www.jstatsoft.org/v52/i03/.

Bruder,B., & Roncalli, T. (2013). Managing risk exposures using the risk parity approach, Working Paper, LYXOR Resarch.

Campbell, J. Y., & Cochrane, J. H. (1999). By force of habit: A consumption-based explanation of aggregate stock market behaviour. Journal of Political Economy, 107, 205–251.

Campbell, J. Y., Viceira, L. M., & Sunderam, A. (2013). Inflation bets or deflation hedges? The changing risks of nominal bonds. Critical Finance Review, 6, 263–301.

Chamberlain, G., & Rothschild, M. (1983). Arbitrage, factor structure, and mean-variance analysis on large asset markets. Econometrica, 51(5), 1281–1304.

Cherubini, U., Gobbi, F., Mulinacci, S., & Romagnoli, S. (2012). Dynamic copula methods in finance. England: Wiley.

Choueifaty, Y., Froidure, T., & Reynier, J. (2013). Properties of the most diversified portfolio. Journal of Investment Strategies, 2(2), 49–70.

Clarke, R. G., de Silva, H., & Murdock, R. (2005). A factor approach to asset allocation. The Journal of Portfolio Management, 32(1), 10–21.

Cochrane, J. H. (2011). Discount rates. The Journal of Finance, 66(4), 1047–1109.

Engle, R. F., Lilien, D. M., & Robins, R. P. (1987). Estimating Time varying risk premia in the term structure: The arch-M model. Econometrica, 55(2), 391–407. 1987.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350.

Engle, R., Jondeau, E., & Rockinger, M. (2012). Systemic Risk in Europ. Review of Finance, 19(1), 145–190.

Fama, E. F., & French, K. R. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25, 23–49.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Genest, C., Rémillard, B., & Beaudoin, D. (2009). Goodness-of-fit tests for copulas: A review and a power study. Insurance: Mathematics and Economics, 44(2), 199–213.

Giot, P., & Laurent, S. (2003). Value-at-risk for long and short trading positions. Journal of Applied Econometrics, 18(6), 641–663.

Heinen, A., & Valdesogo, A. (2009). Asymmetric CAPM dependence for large dimensions: The Canonical Vine Autoregressive Model. CORE Discussion Papers 2009069, Université catholique de Louvain, Center for Operations Research and Econometrics (CORE).

Ilmanen, A. (2011). Expected returns: An investor’s guide to harvesting market rewards (1st ed.). New York: Wiley.

Jin, X, & Lehnert, T, (2009). Large Portfolio Risk Management and Optimal Portfolio Allocation with Dynamic Copulas. LSF Research Working Paper, 11-10.

Kurowicka, D., & Cooke, R. M. (2007). Sampling algorithms for generating joint uniform distributions using the vine-copula method. Computational Statistics & Data Analysis, 51(6), 2889–2906.

Lee, B. S. (2009). Stock returns and inflation revisited. Working paper, available at SSRN: http://ssrn.com/abstract=1326501.

Lehnert, T. & Jin, X., (2009). Large portfolio risk management and optimal portfolio allocation with dynamic copulas. LSF Research Working Paper, 11-10.

Maillard, S., Roncalli, T., & Teiletche, J. (2010). The properties of equally weighted risk contribution portfolios. The Journal of Portfolio Management, 36(4), 60–70.

Mausser, H. (2003). Calculating quantile-based risk analytics with L-estimators. Journal of Risk Finance, 4(3), 61–74.

Meucci, A. (2006). Beyond Black–Litterman in practice: A five-step recipe to input views on non-normal markets. Available at SSRN: http://ssrn.com/abstract=872577.

Meucci, A. (2007). Risk contributions from Generic User-defined Factors. symmys.com.

Meucci, A. (2010). The Black–Litterman approach: Original model and extensions. The encyclopedia of quantitative finance. New York: Wiley.

Meucci, A., Santangelo, A., & Deguest, R., (2014). Measuring portfolio diversification based on optimized uncorrelated factors. Available at SSRN: http://ssrn.com/abstract=2276632.

Page, S., & Taborsky, M. (2011). The myth of diversification: Risk factors vs. asset classes. The Journal of Portfolio Management, 37(4), 1–2.

Ross, S. (1976). The arbitrage theory of capital pricing. Journal of Economic Theory, 13, 341–360.

Sklar, A. (1959). Fonctions de répartition à n dimensions et leurs marges. Publications de l’Institut de Statistique de l’Université de Paris, 8, 229–231.

Tumminello, F. L., & Mantegna, R. N. (2007). Hierarchically nested factor model from multivariate data. EPL (Europhysics Letters), 78, 30006.

Weiss, G. (2013). Copula-GARCH versus dynamic conditional correlation: An empirical study on VaR and ES forecasting accuracy. Review of Quantitative Finance and Accounting, 41(2), 179–202.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Alexis Flageollet: The views expressed are those of the author and do not reflect the position of Natixis Asset Management of Seeyond.

Appendices

A Presentation of the data

See Table 3.

B Dependence structure

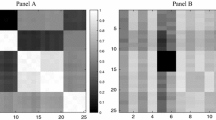

A value 1 (resp. 0) in cell (i, j) means that return of asset i depends on ( resp. is independent from) return of asset j, conditionally on the returns of the previous assets \(j-1\), \(j-2\), ...if \(j>1\), and unconditionally otherwise.

All diagonal entries are equal to 1 since the return of each asset is obviously linked with itself; imposing that all elements of the three first columns are equal to 1 means that the returns of all assets depend on the returns of the three main indexes: World Inflation Linked Bonds and World Government Bonds which capture interest rate risk and MSCI World which account for the so-called market risk.

The value 0 in the (15, 4)-cell indicates that the returns of the US High Yields bonds and Euro Sovereign bonds indexes are independent, once conditioned by the returns of the three indexes associated with the first three columns ans so on.

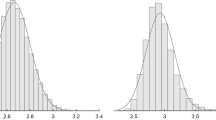

A negative coefficient between equity and real rate factor (\(-\,0.21\)) is consistent with the low inflation and flight-to-quality periods observed through our sample.

C Algorithm for conditional simulations

D Diffusion of extreme shocks to fixed income indexes

The results reported in next table show how a shock to a fixed income index spreads out to the other assets and how the responses to this shock can be decomposed into the contributions of the different risk factors.

This shock may be to a global factor.

For example, the shock is to the World Inflation Linked Bonds index, associated with the real rate risk, that is a drop in the return of the index by \(-6.3 \%\); thus the column named “Rear rate” gives the responses of all assets to this shock. For example, the response of the MCI index is an increase of its return by \(4.4\%\).

The shock may be more specific.

For example, a shock to the Sovereign Bond index, that is a drop in its return by \(-4.6\%\) (in sub-table “IBoxx Euro Sovereigns”) can be decomposed into the contributions of Real rate risk by \(-1.4\%\) Inflation risk by \(-1.1\%\) , Market risk by\(-0.1\%\) Eurodebt risk by \(-2\%\) .

In the same way and for the same shock, the response of the MSCI index can be decomposed into a partial response to real rate with magnitude \(3.1\%\), \(5.6\%\) to inflation and \(-4.3\%\) to market risk (Table 6).

E Risk-based diversification

The Effective Number of Bets approach to risk parity proposed by Meucci et al. (2014) builds on one decomposition of the portfolio return as a combination of bets, or uncorrelated factors:

that are obtained by a specific de-correlating transformation, the minimum torsion linear transformation, that least disrupts the original factors.

Once specified the relative contributions to total risk from each bet:

with \({\overline{F}}_k\) denoting bet k, the risk-based diversification measure is defined in a similar way to the weight-based one and gives the number of bets, between 1 and K for the respective case of maximal concentration and maximal diversification:

F Sensitivity analysis

1.1 F.1 Sensitivities of the baskets

As expected, the baskets composed of Government bonds and Other bonds respectively are mainly exposed to real rate and inflation/and or nominal rate risks, while the baskets composed of equities or commodities are especially affected by market and commodity risks.

1.2 F.2 Portfolio optimization

1.3 F.3 Risk factor sensitivities of standard benchmark portfolios

Rights and permissions

About this article

Cite this article

Bruneau, C., Flageollet, A. & Peng, Z. Economic and financial risk factors, copula dependence and risk sensitivity of large multi-asset class portfolios. Ann Oper Res 284, 165–197 (2020). https://doi.org/10.1007/s10479-018-3112-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3112-8

Keywords

- Complex dependence

- Regular vine copula

- Factors

- Non-linear multibeta relationship

- Portfolio management

- Risk management

- Risk parity

- Extreme risks

- Stress testing