Abstract

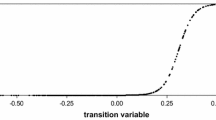

This study revisits an important issue in financial theory: the instability of market beta. To this end, we demonstrate that the linear constant risk model is misleading and does not reproduce changes in beta correctly. We develop a new nonlinear market model to capture beta instability over time for three main states: bear, normal, and bull markets. Our model endogenously identifies these states and their thresholds. We then apply this econometric specification to four major sustainable stock indexes in the US, Europe, Asia, and the World for 2004–2015. The results provide three main findings. First, the market beta is time-varying and changes asymmetrically and nonlinearly, suggesting that the systematic risk statistically differs between market regimes for the US, Europe, and the World. Second, the positive sign of beta in the bull market for these three regions suggests that systematic risk increases as economic conditions improve. Third, the lowest level of beta in the bear market indicates the usefulness of the sustainable stock index to hedge and cover investors’ portfolios against risk, particularly in a bear market.

Similar content being viewed by others

Notes

Many related studies focused on beta for different financial assets: individual securities (Fabozzi and Francis 1977; Kim and Zumwalt 1979), mutual funds (Fabozzi and Francis 1979), size based portfolios (Wiggins 1992; Howton and Peterson 1998), risk based portfolios (Wiggins 1992), exchange rates, and so on.

Chen (1982) and Wiggins (1992) used the excess market return to zero for the threshold. Bhardwaj and Brooks (1993) used the median return for the threshold. Woodward and Marisetty (2005) used different proxies to identify bear and bull markets (6-month rolling moving average, coincident economic indicator, 4-month lagged yield spread, and excess market return). Ang et al. (2006) showed that market return does not help to identify market states and prefer the trend base market indicator, which provides a smoother indicator. Woodward and Anderson (2009) used a moving average specification of the market return, which capturers the cyclical upturn and downturn, and therefore bull and bear markets. Chiarella et al. (2011) used a market trend to capture the change in investors' behavior.

The parameter d denotes the delay parameter when the transition variable is a lagged variable.

We omit the unit root test results to save space, but they are available upon request.

The Teräsvirta and Lukkonen (1988) tests use same hypotheses H \( _{01} \), H \( _{02} \), H \( _{03} \), and H \( _{12} \). While the first test tests linearity against a smooth transition autoregressive model, the second tests linearity against an STR (Smooth Transition Regression) model; the threshold variable might be an exogenous explanatory variable.

Using these two classes of tests enables a check of the appropriate transition speed between market states and resolves the limitation in Woodward and Anderson (2009) regarding the transition function choice.

The difference in market model specification for the World and the US data might be justified by the fact that sustainable funds are not well represented when considering the World data.

References

Ahmed, P., & Lockwood, L. J. (1998). Changes in factor betas and risk premiums over varying market conditions. The Financial Review, 33(3), 149–168.

Altman, E. I., Jacquillat, B., & Levasseur, M. (1974). Comparative analysis of risk measures: France and the United States. The Journal of Finance, 29(5), 1495–1511.

Andersen, T. G., Bollerslev, T., Diebold, F. X., & Wu, J. G. (2005a). A framework for exploring the macroeconomic determinants of systematic risk. The American Economic Review, 95(2), 398–404.

Andersen, T. G., Bollerslev, T., & Meddahi, N. (2005b). Correcting the errors: Volatility forecast evaluation using high-frequency data and realized volatilities. Econometrica, 73(1), 279–296.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 61(1), 259–299.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1–22.

Bawa, V. S., & Lindenberg, E. B. (1977). Capital market equilibrium in a mean-lower parital moment framework. Journal of Financial Economics, 5(2), 189–200.

Ben Salem, M., & Perraudin, C. (2001). Tests de linéarité, spécification et estimation des Modèles à seuil à transition brutale: Une analyse comparée des méthodes de Tsay et de Hansen. Economie et Prévision, 148(2), 157–176.

Bhardwaj, R., & Brooks, L. (1993). Dual betas from bull and bear markets: Reversal of the size effect. Journal of Financial Research, 16(4), 269–283.

Black, F. (1972). Capital market equilibrium with restricted borrowing. Journal of Business, 45(3), 444–455.

Blume, M. E. (1975). Betas and their regression tendencies. Journal of Finance, 30(3), 785–795.

Bollerslev, T., Engle, R. F., & Wooldridge, J. M. (1988). A capital asset pricing model with time-varying covariances. Journal of Political Economy, 96(1), 116–131.

Bos, T., & Newbold, P. (1984). An empirical investigation of the possibility of stochastic systematic risk in the market model. Journal of Business, 57(1), 35–41.

Braun, Ph. A., Nelson, D. B., & Sunier, A. M. (1995). Good news, bad news, volatility, and betas. Journal of Finance, 50(5), 1575–1603.

Brennan, M., & Copeland, T. (1988). Beta changes around stock splits: A note. Journal of Finance, 43(4), 1009–1013.

Brock, W., & Hommes, C. (1998). Heterogenous beliefs and routes to chaos in a simple asset pricing model. Journal of Economic Dynamics and Control, 22(8–9), 1235–1274.

Brock, W. A., & LeBaron, B. (1995). A dynamic structural model for stock return volatility and trading volume. Review of Economics and Statistics, 78(1), 94–110.

Chen, S. N. (1981). Beta nonstationarity, portfolio residual risk and diversification. Journal of Financial and Quantitative Analysis, 16(1), 95–111.

Chen, S. (1982). An examination of risk return relationship in bull and bear markets using time varying betas. Journal of Financial and Quantitative Analysis, 17(2), 265–285.

Chen, N. F., Roll, R., & Ross, S. A. (1986). Economic forces and the stock market. Journal of Business, 59(3), 383–403.

Chiarella, C., Dieci, R., & He, X. Z. (2011). The dynamic behaviour of asset prices in disequilibrium: A survey. International Journal of Behavioural Accounting and Finance, 2(2), 101–139.

Collins, D. W., Ledolter, J., & Rayburn, J. (1987). Some further evidence on the stochastic properties of systematic risk. Journal of Business, 60(3), 425–448.

DeJong, D. V., & Collins, D. W. (1985). Explanations for the instability of equity beta: Risk-free rate changes and leverage effects. Journal of Financial and Quantitative Analysis, 20(1), 73–94.

Fabozzi, F. J., & Francis, J. C. (1977). Stability tests for alphas and betas over bull and bear market conditions. Journal of Finance, 32(4), 1093–1099.

Fabozzi, F. J., & Francis, J. C. (1979). Mutual fund systematic risk for bull and bear markets: An empirical examination. Journal of Finance, 34(5), 1243–1250.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

Fama, E., & French, K. (2006). The value premium and the CAPM. Journal of Finance, 61(5), 2163–2185.

Ghysels, E. (1998). On stable factor structures in the pricing of risk: Do time-varying betas help or hurt? Journal of Finance, 53(2), 549–573.

Gooding, A. E., & O’Malley, T. P. (1977). Market phase and the stationarity of beta. Journal of Financial and Quantitative Analysis, 12(5), 833–857.

Granger, C. W. J., & Silvapulle, P. (2002). Capital asset pricing model, bear, usual and bull market conditions and beta instability: A value-at-risk approach. NBER Working paper, Vol. 1062.

Guillaume, D. M., Dacorogna, M. M., Davé, R. R., Müller, U. A., Olsen, R. B., & Pictet, O. V. (1997). From the bird’s eye to the microscope: A survey of new stylized facts of the intra-daily foreign exchange markets. Finance and Stochastics, 1(2), 95–129.

Hansen, B. E. (1996). Inference when a nuisance parameter is not identified under the null hypothesis. Econometrica, 64(2), 413–430.

Harlow, V., & Rao, R. (1989). Asset pricing in a generalized mean-lower partial moment framework: Theory and evidence. Journal of Financial and Quantitative Analysis, 24(3), 285–311.

He, Z., & Kryzanowski, L. (2008). Dynamic betas for Canadian sector portfolios. International Review of Financial Analysis, 17(5), 1110–1122.

Howton, S. W., & Peterson, D. R. (1998). An examination of cross-sectional realized stock returns using a varying-risk beta model. Financial Review, 33(3), 199–212.

Keenan, D. M. (1985). A Tukey nonadditivity type test for time series nonlinearity. Biometrica, 72(1), 39–44.

Kim, D. (1993). The extent of nonstationarity of beta. Review of Quantitative Finance and Accounting, 3(2), 241–254.

Kim, K. H., & Kim, T. (2016). Capital asset pricing model: A time-varying volatility approach. Journal of Empirical Finance, 37, 268–281.

Kim, M. K., & Zumwalt, K. J. (1979). An analysis of risk in bull and bear markets. Journal of Financial and Quantitative Analysis, 14(5), 1015–1025.

Lamoureux, C., & Poon, P. (1987). The market reaction to stock splits. Journal of Finance, 42, 1347–1370.

Levy, R. A. (1974). Beta coefficients as predictors of return. Financial Analysts Journal, 30(1), 61–69.

Li, H. (2013). Integration versus segmentation in China’s stock market: An analysis of time-varying beta risks. Journal of International Financial Markets, Institutions and Money, 25, 88–105.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47(1), 13–37.

Luukkonen, R., Saikkonen, P., & Terasvirta, T. (1988). Testing linearity against smooth transition autoregressive models. Biometrika, 75(3), 491–499.

Lux, T. (1995). Herd behaviour, bubbles and crashes. The Economic Journal, 105(431), 881–896.

Maheu, J., & McCurdy, T. H. (2000). Identifying bull and bear markets in stock returns. Journal of Business and Economic Statistics, 18(1), 100–112.

Patton, A. J., & Verardo, M. (2012). Does beta move with news? Firm-specific information flows and learning about profitability. The Review of Financial Studies, 25(9), 2789–2839.

Peterson, R. A. (1994). A meta-analysis of Cronbach's coefficient alpha. Journal of Consumer Research, 21, 381–391.

Petruccelli, J., & Davies, N. (1986). A portmanteau test for self-exciting threshold autoregressive-type nonlinearity in time series. Biometrika, 73(3), 687–694.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19(3), 425–442.

Teräsvirta, T. (1994). Specification, estimation and evaluation of smooth transition autoregressive models. Journal of the American Statistical Association, 89(425), 208–218.

Tong, H. (1990). Non-linear time series: A dynamical system approach. Oxford: Oxford University Press.

Tong, H., & Lim, K. S. (1980). Threshold autoregression, limit cycles and cyclical data. Journal of the Royal Statistical Society, 42(3), 245–292.

Tsay, R. (1989). Testing and modelling threshold autoregressive processes. Journal of the American Statistical Association, 84(405), 231–239.

Tsay, R. S. (1986). Nonlinearity tests for time series. Biometrika, 73(2), 461–466.

Wiggins, J. B. (1992). Beta changes around stock splits revisited. Journal of Financial and Quantitative Analysis, 27(4), 631–640.

Woodward, G. (2011). A comprehensive investigation of fund performance: A new technique. Banking and Finance Review, 3(2), 41–62.

Woodward, G., & Anderson, H. M. (2009). Does beta react to market conditions? Estimates of `bull’ and `bear’ betas using a nonlinear market model with an endogenous threshold parameter. Quantitative Finance, 9(8), 913–924.

Woodward, G., & Marisetty, V. B. (2005). Introducing non-linear dynamics to the two-regime market model: Evidence. Quarterly Review of Economics and Finance, 45(4–5), 559–581.

Zivot, E., & Andrews, K. (1992). Further evidence on the great crash, the oil price shock, and the unit root hypothesis. Journal of Business and Economic Statistics, 10(3), 251–270.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jawadi, F., Louhichi, W., Cheffou, A.I. et al. Modeling time-varying beta in a sustainable stock market with a three-regime threshold GARCH model. Ann Oper Res 281, 275–295 (2019). https://doi.org/10.1007/s10479-018-2793-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2793-3