Abstract

We introduce a new class of bankruptcy problems in which the value of the estate is endogenous and depends on agents’ investment decisions. There are two investment alternatives: investing in a company (risky asset) and depositing money into a savings account (risk-free asset). Bankruptcy is possible only for the risky asset. We define a game between agents each of which aims to maximize his expected payoff by choosing an investment alternative and a company management which aims to maximize profits by choosing a bankruptcy rule. Our agents are differentiated by their incomes. We consider three most prominent bankruptcy rules in our base model: the proportional rule, the constrained equal awards rule and the constrained equal losses rule. We show that only the proportional rule is a part of any pure strategy subgame perfect Nash equilibrium. This result is robust to changes in income distribution in the economy and can be extended to a larger set of bankruptcy rules and multiple types. However, extension to multiple company framework with competition leads to equilibria where the noncooperative support for the proportional rule disappears.

Similar content being viewed by others

Notes

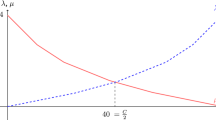

The constrained equal awards rule represents a family of rules favoring smaller claimants, the constrained equal losses favoring larger claimants and the proportional rule lies in between the two. The constrained equal awards (losses) rule is regressive (progressive) and the proportional rule is both regressive and progressive.

Another difference is that in our model agents deposit either zero or all of their endowment whereas in Kıbrıs and Kıbrıs (2013) intermediate decisions are also allowed. However, this is not a major reason for differences in results since if we allow agents to optimally choose their deposit amounts, we would have corner solutions due to our risk-neutrality assumption.

In fact, what we mean by \(w_{l}\) (\(w_{h}\)) is the part of the income that is reserved for investment by a type \(l\) (\(h\)) agent.

Also note that each agent has one information set in each subgame and two actions. Therefore, the terms strategy and action refer to same objects in subgames \(\Gamma ^{P}\), \(\Gamma ^{CEA}\), and \(\Gamma ^{CEL}\).

Note that \(F={ CEL}\) for \(\theta =0\), \(F={ CEA}\) for \(\theta =1\), and \(F=T\) for \( \theta =1/2.\) Moreover, for all \(\theta \in [0,1]\), \(F^{\theta }\) coincides with \({ CEA}\) (on adjusted \(\theta \)-claims) if \(E\le \mathop {\textstyle \sum }\nolimits _{i\in N}\theta c_{i}\) and \({ CEL}\) (on adjusted \((1-\theta )\) -claims) if \(E\ge \mathop {\textstyle \sum }\nolimits _{i\in N}\theta c_{i}\). Finally, note that \( P\) is not a member of the TAL-family.

For this assumption, we further need to assume that there are even number of agents of each type.

I would like to thank an anonymous reviewer for raising this question.

References

Ashlagi, I., Karagözoğlu, E., & Klaus, B. (2012). A non-cooperative support for the equal division in estate division problems. Mathematical Social Sciences, 63, 228–233.

Atlamaz, M., Berden, C., Peters, H., & Vermeulen, D. (2011). Non-cooperative solutions to claims problems. Games and Economic Behavior, 73, 39–51.

Aumann, R., & Maschler, M. (1985). Game theoretic analysis of a bankruptcy problem from the Talmud. Journal of Economic Theory, 36, 195–213.

Bergantiños, G., & Sanchez, E. (2002). The proportional rule for problems with constraints and claims. Mathematical Social Sciences, 43, 225–249.

Cetemen, E. D., Hasker, K. E., & Karagözoğlu, E. (2014). Rewards must be proportional in the core of claim games. Mimeo: Bilkent University.

Chang, C., & Hu, C.-C. (2008). A non-cooperative interpretation of the f-just rules of bankruptcy problems. Games and Economic Behavior, 63, 133–144.

Chun, Y. (1988). The proportional solution for rights problem. Mathematical Social Sciences, 15, 231–246.

Chun, Y. (1989). A noncooperative justification for egalitarian surplus sharing. Mathematical Social Sciences, 17, 245–261.

Dagan, N., Serrano, R., & Volij, O. (1997). A noncooperative view of consistent bankruptcy rules. Games and Economic Behavior, 18, 55–72.

Ertemel, S., & Kumar, R. (2013). Proportional allocation rules under uncertainty. Mimeo: Rice University.

Gächter, S., & Riedl, A. (2005). Moral property rights in bargaining with infeasible claims. Management Science, 51, 249–263.

García-Jurado, I., González-Díaz, J., & Villar, A. (2006). A noncooperative approach to bankruptcy problems. Spanish Economic Review, 8, 189–197.

Hart, O. (2000). Different approaches to bankruptcy. NBER Working Paper No. 7921.

Herrero, C. (2003). Equal awards vs. equal losses: duality in bankruptcy. In M. R. Sertel & S. Koray (Eds.), Advances in Economic Design. Berlin: Springer.

Herrero, C., & Villar, A. (2001). The three musketeers: four classical solutions to bankruptcy problems. Mathematical Social Sciences, 42, 307–328.

Herrero, C., Moreno-Ternero, J., & Ponti, G. (2010). On the adjudication of conflicting claims: An experimental study. Social Choice and Welfare, 34, 145–179.

Ju, B.-G., Miyagawa, E., & Sakai, T. (2007). Non-manipulable division rules in claims problems and generalizations. Journal of Economic Theory, 132, 1–26.

Kıbrıs, Ö., & Kıbrıs, A. (2013). On the investment implications of bankruptcy laws. Games and Economic Behavior, 80, 85–99.

Moreno-Ternero, J. D. (2002). Noncooperative support for the proportional rule in bankruptcy problems. Mimeo: Universidad de Alicante.

Moreno-Ternero, J. D. (2006). Proportionality and non-manipulability in bankruptcy problems. International Game Theory Review, 8, 127–139.

Moreno-Ternero, J. D. (2009). The proportional rule for multi-issue bankruptcy problems. Economics Bulletin, 29, 483–490.

Moreno-Ternero, J. D., & Villar, A. (2006). The TAL-family of rules for bankruptcy problems. Social Choice and Welfare, 27, 231–249.

Moulin, H. (2002). Axiomatic cost and surplus sharing. In K. Arrow, A. Sen, & K. Suzumura (Eds.), Handbook of social choice and welfare (Vol. 1). Amsterdam: Elsevier.

O‘Neill, B. (1982). A problem of rights arbitration from the Talmud. Mathematical Social Sciences, 2, 345–371.

Thomson, W. (2003). Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: A survey. Mathematical Social Sciences, 45, 249–297.

Young, P. (1985). Cost allocation. In P. Young (Ed.), Fair Allocation. Proceedings of Symposia in Applied Mathematics (Vol. 33). Providence, RI: The American Mathematical Society.

Acknowledgments

I would like to thank the associate editor and two anonymous referees for their valuable comments, which significantly improved the paper. I would like to thank Bettina-E. Klaus, for her constant support, encouragement and many helpful comments. The paper benefited from fruitful discussions with Çağatay Kayı, Özgür Kıbrıs, Juan D. Moreno-Ternero, Hervé Moulin, Arno Riedl, William Thomson and, Peyton Young. I would also like to thank Carlos Alós-Ferrer, Salvador Barberá, Kristof Bosmans, Hülya Eraslan, Refet Gürkaynak, Kevin Hasker, Jean-Jacques Herings, Biung-Ghi Ju, Kerim Keskin, Maria Montero, Antonio Nicoló, Hans Peters, Alex Possajennikov, Rene Saran, Stef Tijs, Gisèle Umbhauer, and conference, workshop and seminar participants at 5th Murat Sertel Student Workshop, 28th Annual Meeting of the European Public Choice Society, 3rd Economic Design & Collective Choice Workshop, 9th International Meeting of Society for Social Choice and Welfare, Konstanz Doctoral Workshop in Game Theory, 6th Conference on Economic Design, Nottingham School of Economics, Bilkent University, Sabancı University and Boğaziçi University for their comments. All remaining errors are mine.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Karagözoğlu, E. A noncooperative approach to bankruptcy problems with an endogenous estate. Ann Oper Res 217, 299–318 (2014). https://doi.org/10.1007/s10479-014-1588-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1588-4