Abstract

The rapidly growing research landscape in finance, encompassing environmental, social, and governance (ESG) topics and associated Artificial Intelligence (AI) applications, presents challenges for both new researchers and seasoned practitioners. This study aims to systematically map the research area, identify knowledge gaps, and examine potential research areas for researchers and practitioners. The investigation focuses on three primary research questions: the main research themes concerning ESG and AI in finance, the evolution of research intensity and interest in these areas, and the application and evolution of AI techniques specifically in research studies within the ESG and AI in finance domain. Eight archetypical research domains were identified: (i) Trading and Investment, (ii) ESG Disclosure, Measurement and Governance, (iii) Firm Governance, (iv) Financial Markets and Instruments, (v) Risk Management, (vi) Forecasting and Valuation, (vii) Data, and (viii) Responsible Use of AI. Distinctive AI techniques were found to be employed across these archetypes. The study contributes to consolidating knowledge on the intersection of ESG, AI, and finance, offering an ontological inquiry and key takeaways for practitioners and researchers. Important insights include the popularity and crowding of the Trading and Investment domain, the growth potential of the Data archetype, and the high potential of Responsible Use of AI, despite its low publication count. By understanding the nuances of different research archetypes, researchers and practitioners can better navigate this complex landscape and contribute to a more sustainable and responsible financial sector.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Within the realm of finance, the research landscape that investigates broad environmental, social, and governance (ESG)-related issues and the associated Artificial Intelligence (AI) applications that underlie the discourse are highly diversified and growing fast. Studies deliberating on ESG considerations straddle economic-financial areas from trading and investments to corporate governance and risk management, supported by a myriad of AI tools and resources (Abdalmuttaleb et al. 2022; Stanley 2023). This erects a favorable barrier-to-entry for incumbents; a new researcher looking to enter the field may be overwhelmed by the notion of where to start reading. This said, a seasoned practitioner may also be uncertain about the diversity and evolution of this field.

The overarching goal of this study is to illuminate the intricate web of research themes, track the intensity of research efforts, and understand the diverse AI techniques employed within these domains through a systematic literature mapping approach. Kumar et al. (2022) examined AI’s role in sustainable finance using bibliometric analysis, a method that, despite its merits, overlooks a detailed examination of thematic content and methodological evolution. Conversely, Burnaev et al. (2023) explored practical AI applications in ESG studies but did not extend this into the finance domain. Our objective is to address a distinct gap in the literature: the unavailability of a comprehensive resource that coherently unifies the themes, evolution, and AI methodologies within ESG, AI, and finance, a shortfall evident to both emerging researchers and established academics in this broad and evolving domain (Kumar et al. 2022; Burnaev et al. 2023).

The objective of this study is to review this landscape through a systematic literature mapping approach. The systematic literature mapping study is the “study concerned with the mapping and structuring of a topical research area, the identification of gaps in knowledge, and the examination of possible research topics” (Petersen et al. 2015; Lim et al. 2023). Mappings help trace concurrent developments across lineages of research and provide the basis of systemized reviews, as a best form of evidential synthesis towards a methodological thematic scoping of a research landscape. The notable lack of research covering holistic ESG-related finance areas and the use of extensive AI techniques provide the research novelty and value to this work.

The following research questions were investigated:

-

RQ1: What are the key research themes that outline the research scape for ESG and AI in finance?

Utilizing topic modeling and network analysis, this question aimed to discern specific archetypical research domains prevalent in current studies. In every identified thematic area, the study, when possible, also sought to pinpoint well-defined research sub-themes supported by existing literature. This analysis offers a structured categorization and overview of the current research landscape.

-

RQ2: How has research intensity and interest in various archetypical domains evolved over time?

This question aimed to discern the research intensity and interest by examining publication and citation counts within each archetypical research domain, and to explore their progression over recent years. This analysis offers a perspective on the scale and trajectory of pivotal research endeavors and their relevance in the research landscape.

-

RQ3: Which AI techniques have been employed in studies across the archetypical domains, and how have their usages changed over time?

This question sought to pinpoint unique trends in the application of AI techniques across each archetypical research domain and to track the progression of these techniques over time. This analysis sheds light on the variety and development of primary AI methods employed in the research landscape.

Results of this study found eight archetypical research domains within the field, namely: (i) Trading and Investment, (ii) ESG Disclosure, Measurement and Governance, (iii) Firm Governance, (iv) Financial Markets and Instruments, (v) Risk Management, (vi) Forecasting and Valuation, (vii) Data, and (viii) Responsible Use of AI. Research identified Trading and Investment as the archetype generating the highest research publications, while Risk Management and Responsible Use of AI were the archetypes exhibiting high citation impacts. Further, while the AI techniques were dominated, on an overall basis, by multivariate regression and natural language processing, research in each archetype engaged distinctive AI techniques, ranging from ensemble and deep learning methods for the Forecasting and Valuation archetype, to generative AI for the Data archetype.

The significance of this study is to: (i) understand and consolidate knowledge pertaining to what was previously explored in research straddling the intersection of ESG, AI and finance, (ii) provide an ontological inquiry into the research scape to understand the nuances of different research archetypes, and (iii) identify key takeaways for practitioners and researchers. By categorizing and analyzing the vast body of work in this domain, we not only consolidate existing knowledge but also spotlight areas that have been underexplored, paving the way for future research endeavors.

Our findings offer tangible benefits to a broad spectrum of stakeholders. For researchers, this study provides a consolidated foundation, highlighting areas ripe for further exploration. Policymakers can glean insights into the evolving dynamics of ESG and AI in finance, informing more robust and future-ready policy frameworks. Practitioners, on the other hand, can harness the synthesized knowledge to drive innovative strategies and solutions in their respective domains. Moreover, other stakeholders, such as investors and industry leaders, can leverage the insights to make informed decisions, ensuring alignment with both technological advancements and ESG considerations.

The reminder of this paper is organized as follows: (i) the Background and Literature Review section introduces research that straddles the intersection of ESG, AI and finance through a survey of existing literature; (ii) the Methodology section explains the systematic literature mapping protocol, describes the tools and AI techniques utilized, discusses research validity issues and highlights limitations to the study; (iii) the Findings section presents the ontological and time-series results from topic modeling, network analyses and full paper reviews, (iv) the Discussion section looks to summarize the results into actionable insights that can be utilized by researchers and practitioners, and (v) the Conclusion section provides a closing, and proposes future work that can be undertaken by researchers and practitioners.

2 Background and literature review

2.1 AI in finance

Artificial intelligence refers to the use of algorithms and other computational techniques to automate or augment decision-making processes. In finance, AI is used to analyze large data sets, identify patterns and insights, and make predictions based on historical data. Generative AI, a subset of AI, has emerged as a powerful tool that can generate new data instances, simulate financial scenarios, and even propose innovative financial strategies by learning from vast amounts of data. Advances in AI have transformed how modern financial and economic entities operate, interact, transact and collaborate with the environment and participants (e.g., regulators, markets and consumers).

It has effected a slew of changes to existing economic-financial systems and services, creating new innovations and opportunities in economic-financial models, efficient infrastructure and intelligent mechanisms, personalized products and user-friendly real-time services, and new assets and secure cost-effective transactions, among others.

AI in finance is defined as the machine mimicry of human-like behavior and consciousness to achieve financial objectives, through the utilization of technological tools and resources that allows digital systems to perform tasks commonly associated with intelligent beings. Generative AI, in this context, can be seen as a method to simulate potential financial market movements, generate synthetic financial data for backtesting, or even create hypothetical financial products. The term ‘AI in finance’ is often used interchangeably with the terms ‘machine learning in finance’, ‘data mining in finance’, ‘data science in finance’, ‘data analytics in finance’, and sometimes ‘deep learning in finance’, ‘reinforcement learning in finance’, and their variants. This said, there exists distinct differences between the terms.

AI as a superset, comprises machine learning, and in turn, deep learning and reinforcement learning as subsets. Researchers in the machine learning field of inquiry look to understand and design computing methods that can enable instrumentalized and automated learning through data-driven decisions. Deep learning utilizes a specific class of machine learning methods, or neural networks, to make out representation elements of a dataset, to learn features and perform tasks. Reinforcement learning is where machine learning methods are utilized for intelligent agents to perform an action, such that some notion of reward is optimized in a pre-specified environment. The remainder three concepts—data science in finance, data mining in finance, and data analytics in finance—are related but distinct concepts that lie within the broader field of AI in finance. Data science in finance refers to the application of advanced analytics, machine learning, and statistical modeling techniques to financial data in order to gain insights, make predictions, and improve decision-making in financial services. This involves collecting, storing, processing, and analyzing large and complex data sets from various sources such as financial markets, customer behavior, and economic indicators. Data mining in finance is a subset of data science that specifically focuses on the extraction of patterns and insights from financial data using techniques such as clustering, classification, and association rule mining. The goal of data mining in finance is to discover hidden relationships and patterns that can inform investment decisions, risk management, and other financial activities. Data analytics in finance involves the use of statistical and quantitative methods to analyze and interpret financial data in order to identify trends, patterns, and insights. This includes techniques such as regression analysis, time series analysis, and hypothesis testing. The goal of data analytics in finance is to provide a clear understanding of financial performance and to inform decision-making.

2.2 Convergence of ESG and AI in finance research

ESG is defined as the “environmental, social or governance matters that may have a positive or negative impact on the financial performance or solvency of an entity, sovereign or individual” (EBA 2021). ESG is commonly used interchangeably with the term ‘sustainable finance’, which is defined as “process of taking ESG considerations into account when making investment decisions in the financial sector, leading to more long-term investments in sustainable economic activities and projects” (European Commission 2021). ESG was first mentioned in an influential report “Who Cares Wins: Connecting Financial Markets to a Changing World” in 2004, where the United Nations encouraged the integration of ESG considerations into the financial industry, including security brokerage services, asset management and associated research functions (The Global Compact 2004). Since then, a wealth of ESG research has emerged in finance literature. Tabulation of publication from Google Scholar indicated a six-times growth from 2460 in the 5 years between 2004 and 2008, to 18,000 in the years between 2018 and 2022. ESG research efforts are known to be inundated by large data volume; it was not surprising that ESG research efforts in finance literature that were supported by artificial intelligence (AI) techniques, stood to represent about one-fifth of the publications on ESG in finance in the latter five years. The integration of ESG considerations and artificial intelligence in finance has broader implications for the finance industry and society as a whole.

For instance, one area where ESG and AI can have a significant impact is in risk management. Generative AI can be employed to simulate various ESG scenarios, helping financial institutions to visualize potential future landscapes and adjust their strategies accordingly. By using AI-powered risk assessment tools that integrate ESG considerations, financial institutions can identify and mitigate potential risks associated with environmental and social factors, such as climate change, labor practices, and human rights violations (e.g., Yang and Broby 2020; Ranta and Ylinen 2021; Patterson et al. 2022; Apel et al. 2023). This can help financial institutions reduce their exposure to financial and reputational risks, as well as contribute to sustainable and responsible business practices. Furthermore, the integration of ESG and AI in finance can also contribute to the development of more inclusive and equitable financial systems (e.g., Katterbauer and Moschetta 2022a, b). By using AI-powered tools to analyze demographic and socioeconomic data, financial institutions can identify and address disparities in access to financial services and opportunities. AI-powered credit scoring models can take into account factors beyond traditional credit history, such as education, employment, and social capital, to provide fairer and more inclusive credit assessments. In another example, the integration of ESG and AI in finance can also have broader societal implications, contributing to the achievement of sustainable development goals and addressing global challenges such as climate change, poverty, and inequality (e.g., Angelova et al. 2021; Chen 2021; Kharlanov et al. 2022). By employing AI to support investment in companies and projects that contribute to positive social and environmental outcomes, financial institutions can play a critical role in promoting sustainable and responsible business practices, as well as driving positive social and environmental change.

There has been increasing engagement on this convergent topic. In a special issue at Journal of Sustainable Finance and Investment at March 2022 that aimed to provide a platform “to shine new light on [the] debates [on AI in ESG and sustainable finance]”, Abdalmuttaleb et al. (2022) shared that “sustainable investments and sustainable business models can be achieved by acknowledging the importance of CSR reporting, ethical considerations of AI, assessing ESG risks, and the future of AI and FinTech”. Beyond this, the paper acknowledged Kumar et al. (2022) by broadening the scope of the convergent topic to include “all activities and factors that would make finance sustainable and contribute to sustainability including [AI] systems, applications and models”.

To date, there is a dearth of systematic literature mapping papers that map this convergent topic. This study seeks to provide (i) an objective data-driven mapping of the landscape of extant literature previously published; (ii) a cross-sectional gauge of how pivotal each research area were and their associated AI techniques; and (iii) an understanding of their evolution across time for trend evaluation purposes.

3 Methodology and data

Systematic literature mapping provides a comprehensive overview of a research domain, using a systematic protocol to identify trends, gaps, and research methods, ensuring reproducibility and minimizing bias. Unlike traditional literature reviews, which synthesize knowledge on a topic without a strict protocol, systematic literature mapping focuses on breadth over depth. In contrast, bibliometric analysis quantitatively evaluates publication patterns without delving into content depth.

The systematic literature mapping approach was conducted utilizing the methodology applied in, Kabudi et al. (2021), Lim et al. (2023), and Petersen et al. (2015). The mapping approach included the following three methodological stages, namely: (i) search and selection, (ii) classification and analysis, and (iii) validity evaluation.

EndNote X9, NVivo11 and Excel spreadsheets were utilized for the organization of information. Other tools and resources employed for information extraction, visualization of analyses, and AI techniques and tools are elaborated in the next sub-sections.

3.1 Search and selection

As a guideline employed to conduct the search and selection phase, the Preferred Reporting Items for Systematic Reviews and Meta-Analyses or the PRISMA approach recommends a protocol including details such as eligibility criteria, information source, search rules, data recording and data synthesis, as part of the PRISMA-P checklist (Moher et al. 2009). The PRISMA process is diagrammatically represented in Fig. 1.

Google Scholar is widely rated as the most comprehensive and multidisciplinary bibliometric crawler-based search system with the largest citation coverage (Martín-Martín et al. 2018), covering an estimated total of over 300 million records (Delgado López-Cózar et al. 2019). As the research topic was framed by a broad theme with vast scholarship, the study utilized Google Scholar at the first stage of PRISMA, or the identification stage, to identify the eligible papers to be included in the analyses. The search entry was as follows: + finance + (“ESG" OR green OR climate OR inclusive OR carbon OR sustainability OR “social impact” OR ecology) + (“artificial intelligence” OR “machine learning” OR “supervised learning” OR “unsupervised learning” OR “reinforcement learning” OR “deep learning”). Subject relevant keywords, such as green or sustainability, informed and refined from the literature, were added to the search entry to achieve a more extensive level of search results in the search records. Google Scholar indexes titles, abstracts, and the full text of papers. While search results prioritize matches in a paper’s title and abstract, results from the full text of papers would be returned. Further, the search was limited to English language results, and the publication year from 2008 onwards. This research coverage period compassed 15 full years. The decision to focus on publications from 2008 onwards was driven by recency considerations. Given the rapid advancements in both AI and ESG domains, especially in the last decade and a half, it was deemed essential to concentrate on more recent literature to capture the most relevant and up-to-date trends, methodologies, and insights in the field. This stage identified a corpus of 18,000 papers.

The next stage of PRISMA, the screening stage, involved a meticulous review process:

-

i.

Title and abstract review: Initial scanning of titles and abstracts was conducted to exclude papers that were clearly unrelated to the research topic. This step removed a significant number of papers that, while matching the search criteria, were not directly relevant to the intersection of AI, ESG, and finance.

-

ii.

Duplication check: Duplicated papers were identified and removed. Given the extensiveness of Google Scholar’s database, there were instances where the same paper was indexed multiple times.

-

iii.

Full text review: For papers that passed the initial screening, a full review of the text body was conducted to assess their suitability. Only papers that had fully accessible text and were directly relevant to the research topic were retained.

-

iv.

Relevance and quality check: Papers that did not provide substantive insights or lacked rigorous methodology, even if they touched upon the research topic, were also excluded to ensure the quality of the final sample.

Through this rigorous process, 17,630 papers were omitted, leaving a total of 370 papers retained for the systematic literature mapping review. Data extracted from Google Scholar included: (i) author names, (ii) article title; (iii) publication title, (iv) year of publication, (v) publisher, and (vi) citation count.

3.2 Classification and analysis

First, the study undertook a thorough paper-by-paper review of the 370 papers for the purposes of tabulating the following information:

-

i.

AI application(s): This distinguishes the type(s) of AI technique and specific learning algorithm(s) applied (e.g., decision tree algorithm utilized for supervised learning etc.) in each paper.

-

ii.

Research areas: This details how each paper examines ESG within the field of finance (e.g., examining stock excess returns following ESG news events etc.).

-

iii.

Type of paper: This includes original research, review article, book, case study, perspective, opinion and commentary paper, and regulatory study or guideline.

Next, research employed a corpus analysis platform known as CorTexT (Breucker et al. 2016) to parse the text data. Unsupervised pattern recognition text mining techniques of topic modelling and network mapping were performed to identify key latent thematic representations within the corpus, so as to understand the research archetypes within the landscape of research areas.

Topic modelling was performed utilizing the Python library pyLDAvis (Sievert and Shirley 2014). Building upon the Latent Dirichlet Allocation algorithm, topic modelling produced a topic representation of the research areas corpus’ textual fields, which characterizes latent topics based on relevant research areas keywords. In essence, the text mining process considered each topic as a keyword probability distribution, and each document as a topic probability distribution. Based on the number of topics defined, topics were probabilistically assigned to documents to infer the topic model, and mapped using a muti-dimensional scaling algorithm into a 2-dimensional plane for the purposes of visualization.

While topic modelling accorded an initial assessment of the possible latent topics based on the research areas, performance of network analysis further allowed a visualization of thematic representations of research areas, through the clustering of distinct research areas connected via similarity measures. This required the use of Louvain hierarchical community detection algorithm (Aynaud 2020). Louvain algorithm is efficient in large networks; it utilizes modularity optimization to compute the optimal linkage densities, accounting for between-cluster and within-cluster linkages.

A cross examination of the results of topic modelling, network analysis and the full papers would allow the inference of distinctive research archetypes. The discovered archetypes would then be further analyzed to examine the research impact, and the machine learning techniques employed for each distinct class of archetype. Finally, the study would put together a summary of findings to allow generalization and generate practical takeaways for each distinct archetypical domains for practitioners and researchers.

3.3 Validity evaluation

To evaluate if the methodology was robustly constructed in the application of systematic literature mapping, it was useful to consider the types of research validity. This included: (i) external and internal validity, (ii) interpretive validity, (iii) descriptive validity, and (iv) theoretical validity (Petersen and Gencel 2013). This could enhance research repeatability.

-

i.

External and internal validity: External validity describes the generalizability and extendibility of the results to other studies. Internal validity looks at whether the study design, implementation and analysis support the research claims and represent the truth in the population studied. It was of the view that since the methodology employed in the systematic literature mapping review was generally supported by a wide multidisciplinary range of similar literature, there should not exist major threats for generalizability of the study. However, it was acknowledged that external validity may be influenced by factors including the type of bibliometric database used (Martín-Martín et al. 2021), and future studies can help alleviate this concern.

-

ii.

Interpretive validity: This describes the validity of the conclusions drawn, based on the data extracted and coded. One area of concern may be researcher biasness. To reduce threats in interpretation, this was mitigated by ensuring that no papers written by authors were included in the 370 primary papers evaluated.

Further, an independent external reviewer played a crucial role in ensuring the validity and accuracy of the classifications. In addition to auditing the methodology and data extraction process, the reviewer also examined the accuracy of paper classifications, both from the automated process and the subsequent manual verification. Any discrepancies identified were addressed, and the classification model was refined accordingly. This dual-layered approach ensured that the classifications were both consistent with the study’s objectives and accurate in their representation of the papers’ content.

-

iii.

Descriptive validity: This describes the presence of accurate and objective observations. This threat was mitigated through the objectification of the data extraction process, using a systematic and prolific bibliometric search system (in the form of Google Scholar), and use of data extraction software (in the forms of EndNote X9 and NVivo 11) and coding spreadsheet designed to support data recording and interventive correction to ensure accuracy.

-

iv.

Theoretical validity: This describes if the study was able to capture what was purported to be captured. The study sought to ensure that the patterns of the real world were depicted accurately by the thematic phenomena established by the paper. To lower the probability of excluding or underrepresenting critical research information, Google Scholar was employed as a comprehensive web-crawler based search engine to enhance the diversity of data sources. In terms of paper screening, the recency of literature, extensive in-depth reviews were applied in the titles, abstracts and full texts to validate if each paper included was relevant. To reduce potential biasness and for quality assessment, the methodology, data extraction process and analytical tools were audited by an independent external reviewer, who holds subject matter expertise. This step shields against biased interpretation and judgment in the screening of papers for conceptual consistency and thematic compatibility.

3.4 Limitations

Google Scholar is widely agreed to be vast source for bibliometric data retrievals, especially for the field of business, economics and management, where it outperforms bibliometric databases like Web of Science (WOS) and Scopus by large margins, owing to its automated and inclusive approach of indexing papers through the use of robotic web crawlers (Martín-Martín et al. 2019, 2021). It has the added advantage of coverage beyond journal articles and conference papers, by indexing, among others, monographs, institutional reports, and regulatory guidelines, which extends the output formats for bibliometric search. In contrast, bibliometric databases such as Scopus and Web of Science have limited coverage of their journal articles, as they produce a curated set of scholarly documents, but may suffer from issues of biasness owing to their selective indexing criteria (Martín-Martín et al. 2019).

However, the approaches across the use of different bibliometric databases differ in the notion of rigor (i.e., reproducibility), against effort (i.e., programmatic or manual process) (Buyuklieva and Raimbault 2023). Relative to bibliometric databases like WOS and Scopus, Google Scholar’s search filter criteria are limited in functionality (e.g., filtering by discipline, or peer review status etc.), and papers can vary significantly in terms of quality due to the lack of curation (Martín-Martín et al. 2021). This increases the onus on the researcher to perform manual screening and eligibility inclusion. Further, metadata such as abstract or references can be selected to be included in the data extraction step at WOS or Scopus for further analysis; for Google Scholar, these information are not included, and the researcher would have to perform manual web scrapping. This research seeks to provide a comprehensive coverage of the landscape, and Google Scholar is fit for purpose. However, for future research, to improve the quality of metadata obtained, curated bibliometric databases such as WOS and/or Scopus may be considered.

4 Findings

4.1 RQ1: What are the key research themes that outline the research scape for ESG and AI in finance?

To generate an optimal number of topic clusters with the highest topic coherence, the study performed topic modelling. The topic modelling results were cross examined with the topic clustering outputs of network analysis. The latter was undertaken for pattern recognition to collectively cluster similar topics using an unsupervised learning approach.

Both topic modelling and network analysis identified eight latent topics, and their results mirrored well with each other. The cluster members derived from network analysis in Fig. 2 corresponded well to the top keywords from the latent topics in Table 1. As an illustration, Fig. 3 shows the topic modelling output for the latent topic ESG Disclosure, Measurement and Governance.

Cross examination of topic modelling, network analysis and full paper reviews allowed the identification of eight research thematic archetypes. The archetypical domains were as follows, namely: (i) Trading and Investment, (ii) ESG Disclosure, Measurement and Governance, (iii) Firm Governance, (iv) Financial Markets and Instruments, (v) Risk Management, (vi) Forecasting and Valuation, (vii) Data, and (viii) Responsible Use of AI.

The eight research thematic archetypes are introduced hereforth. To improve the granularity of insights into the archetypical domains, the study further broke down the archetypes into sub-research themes, wherever possible. Selected recent literature were discussed in Tables 2, 3, 4, 5, 6, 7, 8, 9 to provide a thematic disposition of the state-of-the-art.

4.1.1 Trading and investment

This research archetype comprises papers involving the applications of AI in trading and investment activities within the ESG domain, associated with ESG news or factors, or expressing ESG considerations.

Efficient and effective investment strategies and portfolio selection and optimization have been major areas of research in finance. In recent years, the application of AI techniques has revolutionized investment management. These techniques enable automation and intelligent investment, which involves predicting market trends, recommending trading signals, and minimizing risk through causal representations of limit order book markets (Cao 2020).

Incorporating ESG factors into investment strategies and portfolio selection has become increasingly important. One example of this is portfolio risk analysis, for instance, where AI techniques are employed to detect exceptional decoupling scenarios such as correlation changes, structural breaks or simultaneous asset shocks in portfolio assets to minimize risk (e.g., Taleb et al. 2020; Fabozzi and Karagozoglu; 2021; Serafeim and Yoon 2022; Zhang et al. 2022). AI techniques can also be used to analyze the impact of ESG factors on investment performance (e.g., Erhardt 2020; Ielasi et al. 2020; Ullah et al. 2021; Twinamatsiko and Kumar 2022; Yoo 2022). For instance, natural language processing (NLP) can be applied to analyze news and social media content to identify ESG-related trends and issues.

One of the critical areas of exploration is designing and implementing intelligent trading and investment decision-support platforms, online services, and mobile applications that consider ESG factors (e.g., Hakala 2019; Yang et al. 2020; He et al. 2021; Sokolov et al. 2021b; Katterbauer and Moschetta 2022a, b; Katterbauer et al. 2022). For example, machine learning-enabled recommenders and game theory can be used to analyze loan supply–demand equilibrium and risk-return balance in peer-to-peer lending loans. Personalized stock recommendations can also be made by considering investor preferences, behaviors, past performance, and ESG factors.

This thematic area had the highest number of papers (\(n=91\)), with average citation count of 17.3. The publication types were diversified, in the form of book (\(n=1\)), case study (\(n=1\)), review article (\(n=1\)), perspectives, opinions and commentaries (\(n=3\)), and original research (\(n=85\)). Publication avenues include Journal of Banking and Finance, Journal of Sustainable Finance and Investment, Journal of Portfolio Management, Journal of Impact and ESG Investing, Journal of Financial Data Science, Sustainability, Decision Support Systems, IEEE Symposium on Computational Intelligence for Financial Engineering and Economics, and ACM International Conference on AI in Finance.

Papers from this thematic area can be further segregated into the following sub-research themes: (i) trading and investing design and strategies, (ii) online and offline portfolio optimization, (iii) automated and smart investment, and (iv) market anomaly analysis (Table 2).

4.1.2 ESG disclosure, measurement and governance

This research archetype relates to research associated with ESG disclosure, measurement and governance aspects that involves the application of AI, spanning across from firm to macro level considerations. Examples of related literature in the sub-research themes ESG disclosure, measurement, governance are shown in Table 3.

ESG disclosure refers to the information that companies provide to investors about their ESG performance. This information can include data on a company’s environmental impact, social policies, and governance practices. Analyzing ESG disclosure data can identify trends and insights associated with equity research and investor sentiment analysis, among others (e.g., Goloshchapova et al. 2019; Clarkson et al. 2020; Raman et al. 2020). One example of how AI is being used to analyze ESG disclosure data is through textual analysis. Researchers have used machine learning algorithms to analyze corporate ESG reports and identify trends and insights associated with credit assessment. Another approach is the use of NLP to examine corporate social responsibility (CSR) disclosures and identify the specific ESG issues that companies are addressing.

ESG measurement refers to the process of measuring the social and financial impact of ESG factors on companies and investments. AI is being used to develop ESG measurement tools such as indices (e.g., Green Sentiment Index) that help investors and analysts anticipate changes in a company’s ESG performance and make decisions accordingly (e.g., Chang and Lee 2019; Briere and Ramelli 2021; Reig-Mullor et al. 2022; Huang et al. 2023).

ESG governance refers to the processes and structures that companies have in place to identify and assess potential ESG risks, as well as to monitor and ensure compliance with relevant regulations and policies. AI is being used to automate the tracking and analysis of ESG data, which can assist regulators in enforcing ESG regulations and encourage companies to improve their ESG governance practices (e.g., Chen et al. 2022a, b, c; Fan and Wu 2022).

This thematic area had the second highest number of papers (\(n=77\)), with average citation count of 10.5. The publication types were diversified, in the form of book (\(n=1\)), review article (\(n=4\)), perspectives, opinions and commentaries (\(n=2\)), regulatory study or guidelines (\(n=1\)), and original research (\(n=69\)). Publication avenues include Journal of Business Ethics, Review of Accounting Studies, European Journal of Finance, Economic Research, Sustainability, Technological Forecasting and Social Change, Machine Learning and Knowledge Extraction, and AAAI Workshop on Knowledge Discovery from Unstructured Data in Financial Services.

4.1.3 Firm governance

This research archetype relates to research on the application of AI on firm-related ESG studies, specifically encompassing several sub-research themes: (i) smart operations, CSR and regulations, (ii) intelligent e-commerce and supply chain management, (iii) corporate finance, (iv) intelligent marketing. Examples of related literature are shown in Table 4.

Smart operations, CSR and regulations involve a thorough analysis, optimization, and evaluation of operational, financial, and service risks to enhance performance and mitigate low-performing areas, failures, and losses (e.g., Seele 2017; Hernandez-Perdomo et al. 2019; Chava et al. 2021; Svanberg et al. 2022). For instance, firms can adopt an ESG perspective to assess and mitigate environmental risks associated with business operations. This can include identifying and reducing energy waste, monitoring and reducing carbon emissions, and predicting and preventing equipment failure can help firms reduce their carbon footprint.

Intelligent e-commerce and supply chain management require the estimation, prediction, and optimization of various business aspects, including pricing, demand, supply, production, storage, logistics, delivery, marketing, risk, and fraud (e.g., Coqueret and Tran 2022; Soni et al. 2022; Jebamikyous et al. 2023). To adopt an ESG perspective, firms can optimize logistics and delivery processes and predict demand for sustainable products and services to reduce their carbon footprint.

Corporate finance involves the analysis, prediction, and optimization of various financial aspects of business, including corporate financial budget, accounting integrity, auditing issues, and payment accuracy. Firms must detect and mitigate financial fraud, irregularities, and unethical behavior by company executives. From an ESG perspective, analyzing the impact of environmental policies and regulations on financial performance is necessary. Evaluating the social impact of corporate financial decisions, such as layoffs and plant closures, can help companies improve their overall governance practices (e.g., Chava 2014; Teoh et al. 2019; De Lucia et al. 2020; Turunen 2021; Bussmann et al. 2022; Yadav et al.; 2022).

In terms of intelligent marketing, AI can help firms analyze marketing performance, recommend and optimize marketing campaigns, and understand customer needs, sentiment, satisfaction, and concerns (e.g., Dash and Kajiji 2020; He et al. 2021; Akter et al. 2022; Wirtz et al. 2023). To adopt an ESG perspective, firms can analyze the social impact of marketing campaigns and recommend socially responsible marketing strategies that address issues like diversity and inclusion. Firms should also consider the environmental impact of marketing campaigns and recommend sustainable marketing strategies to reduce their carbon footprint.

This thematic area had the third highest number of papers (\(n=52\)), with average citation count of 20.8. The publication types were in the form of review article (\(n=4\)), and original research (\(n=48\)). Publication avenues include Management Science, Journal of Applied Corporate Finance, Journal of Enterprise Information Management, Technological Forecasting and Social Change, Journal of the Operational Research Society, and Sustainability.

4.1.4 Financial markets and instruments

This research archetype relates to research on the application of AI on ESG issues pertinent to the financial markets, market participants, products, activities and technology solutions. In particular, papers from the cluster can be further segregated into: (i) market systems and simulation, (ii) smart banking and payment, (iii) financial products and services, and (iv) financial technology (Table 5).

Market systems and simulation (i) examines the interplay, associations, and effects among macro and microeconomic elements, and (ii) emulates and evaluates market mechanisms, models, hypotheses, policies, innovative products and services, trading rules, and regulations using multiagent systems. It involves developing models to understand the impact of various economic, social, cultural, and political factors on financial markets and their resilience. From an ESG perspective, this encompasses studying the consequences of environmental threats on economic expansion, investigating the role of societal and cultural components on financial markets, and examining the outcomes of policy interventions on sustainable economic growth (e.g., Semet et al. 2021; Wang et al. 2021; Tufail et al. 2022; Yu et al. 2022; Zhang and Han 2022).

Smart banking and payment addresses the design and analysis of intelligent, secure, and risk-averse digital banking and payment methods, tools, behaviors, and services. The goal is to study and forecast banking and payment trends, growth, risk, fraud, security, and malfunctions. From an ESG perspective, this involves supporting eco-friendly banking practices, investing in sustainable initiatives, ensuring access to banking services for underserved populations, safeguarding customer data and privacy, and promoting financial literacy among customers (e.g., Oro et al. 2020; Nguyen et al. 2023).

Financial products and services studies a range of products and services, ranging from wealth management products to internet finance services. For instance, in the area of insurance, studies focus on estimating, predicting, optimizing, and recommending insurance products and services, along with their pricing and market positioning. It also involves personalized product customization, fraud detection, and risk assessment. From an ESG standpoint, this includes identifying environmental risks linked to insured assets and liabilities, evaluating the carbon footprint and environmental impact of insured assets and services, and developing sustainable insurance products and services (e.g., Cherrington et al. 2020; Dugo 2021; Duchin et al. 2022; Sætra 2022).

The realm of financial technology can include studies on blockchain systems and mechanisms. This involve analyzing the intricacies of blockchain systems to improve their design and functioning, evaluating and enhancing bitcoin and cryptographic contract models, and optimizing pricing and portfolio management. From an ESG standpoint, this includes ensuring that blockchain systems are energy-efficient to minimize the environmental impact of cryptocurrency mining, examining the ESG implications of blockchain on various industries, such as supply chain transparency, ethical sourcing, and carbon footprint reduction, and developing sustainable crypto models (e.g., Yu 2022; Jebamikyous et al. 2023).

This thematic area had the forth highest number of papers (\(n=50\)), with average citation count of 10.8 The publication types were in the form of review article (\(n=7\)), case study (\(n=1\)), and original research (\(n=42\)). Publication avenues include Journal of Corporate Finance, Research in International Business and Finance, Review of Financial Economics, Economic Research, Omega, Technological Forecasting and Social Change, ACM Computing Surveys, Journal of Artificial Intelligence and Technology, Computational Intelligence and Neuroscience, Neural Computing and Applications, and Annals of Operations Research.

4.1.5 Risk management

This research archetype comprises papers involving the application of AI on risk management, spanning from macro level risk to portfolio level risk. In particular, papers from the cluster can be further segregated into: (i) risk management, and (ii) credit management (Table 6).

Within the realm of risk management, AI techniques are employed to model, forecast, and control risk elements, implications, and intensity, as well as fraud, criminal activity, security incidents, and money laundering linked to a wide range of financial products, methods, markets, and participants. With respect to ESG, this involves utilizing ESG data to identify and prevent fraud and crime, estimate and tackle the repercussions of ESG-related occurrences, and enhance risk management approaches by incorporating ESG factors (e.g., Roy and Shaw 2021; Yang et al. 2022).

Credit management entails the application of AI to assess, forecast, and fine-tune credit scores, ceilings, assessments, timelines, defaults, repayments, refinancing, risk management, and fraud prevention. In the context of ESG, this encompasses providing green financing for renewable energy initiatives, granting credit accessibility for disadvantaged communities, determining the carbon footprint of credit portfolios, endorsing eco-friendly business operations, and supporting equitable lending practices (e.g., Liermann et al. 2021; Gobet and Lage 2021; Brogi et al. 2022; Mansouri and Momtaz 2022).

This thematic area had the fifth highest number of papers (\(n=41\)), with average citation of 25.1. The publication types were in the form of review article (\(n=1\)), perspectives, opinions and commentaries (\(n=3\)), and original research (\(n=37\)). Publication avenues include Risks, Risk Management, The Accounting Review, Sustainability and Journal of Big Data.

4.1.6 Forecasting and valuation

This research archetype comprises papers involving the application of AI to forecast ESG-related asset pricing, ratings or scores, or value ESG-related instruments, carbon emissions or biodiversity. In particular, papers from the cluster can be further segregated into: (i) Valuation, and (ii) Forecasting (Table 7).

Valuation research area is centered on the use of AI for estimating and predicting values, prices, demand, and supply with an emphasis on ESG factors. For instance, optimization of pricing, movement, supply, and demand for various energy sources, including electricity, oil, solar, gas, wind, nuclear, and water power. This research area also involves determining the environmental impact of factors such as carbon emissions, water consumption, and waste management. Additionally, it ascertains the supply and demand for sustainable practices in areas like investments (e.g., Cherrington et al. 2020; Dugo 2021; Duchin et al. 2022; Sætra 2022).

Forecasting focuses on developing models to predict market movements, trends, volatility, anomalies, and events from an ESG perspective. This includes anticipating the consequences of environmental and social events, such as natural disasters and resource depletion, on financial markets. Furthermore, it entails forecasting the influence of CSR practices on financial performance and projecting the future effects of governance policies on market volatility. Predicting pricing, movement, supply, and demand within the energy market is also an integral part of this research area (e.g., Anas et al. 2020; Jabeur et al. 2021; Larsson and Ling 2021; Gao et al. 2022; Guliyev and Mustafayev 2022).

This thematic area had the sixth highest number of papers (\(n=38\)), with the second smallest average citation of 4.7. All publications belonged to the original research category. Publication avenues include Decisions in Economics and Finance, Computational Management Science, Journal of Sustainable Finance and Investment, Sustainability, Science of the Total Environment, and Journal of Environment Management.

4.1.7 Data

This research archetype comprises papers discussing issues related to the utilization of ESG data or methodologies proposed to create new ESG datasets. Examples of related literature are shown in Table 8.

This approach aims to identify and extract ESG-related information from vast amounts of unstructured data, including news articles, social media posts, company reports, and satellite images. Such data can be used to quantify various environmental factors, such as deforestation, air pollution, and water usage. From an ESG perspective, among other techniques, this research area includes leveraging textual data from corporate sustainability reports to extract ESG-related information. By using natural language processing techniques, researchers can create ESG scores for companies, which can help evaluate their ESG performance (e.g., Lopez et al. 2020; Gupta et al. 2021; Sokolov et al. 2021b; Geissler et al. 2022).

This thematic area had the second smallest number of papers (\(n=14\)), with average citation of 14.7. All publications belonged to the original research category. Publication avenues include Journal of Applied Corporate Finance, Journal of Impact and ESG Investing, Global Economic Review, Sustainability, and Big Data and Society.

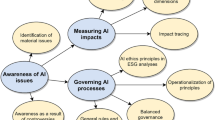

4.1.8 Responsible use of AI

This research archetype comprises papers discussing issues related to the responsible and explainable use of AI in finance, including but not limited to more efficient management of carbon emissions when developing AI models, and the introduction of firm or industry level ESG policing and governance to manage AI assets, capabilities and activities. Examples of related literature are shown in Table 9.

By adopting techniques like explainable AI, financial institutions can develop more transparent and interpretable models. This allows for a better understanding of the decision-making process, ensuring that it is responsible and ethical. From an ESG standpoint, key considerations include preventing machine learning algorithms from exacerbating or amplifying biases against any social or demographic group and guaranteeing the transparency and interpretability of models and their decisions (e.g., Lacoste et al. 2019; Hoepner et al. 2021; Fritz-Morgenthal et al. 2022).

This thematic area was the smallest in terms of number of papers (\(n=7\)) published, with however, the highest average citation of 46.3. The publication types were in the form of review article (\(n=1\)), perspectives, opinions and commentaries (\(n=3\)), and original research (\(n=3\)). Publication avenues include European Journal of Finance, Frontiers in Artificial Intelligence, and Nature Machine Intelligence.

Through the identification of distinct thematic research focal areas and sub-themes that underlie existing research efforts, as evidenced by extant literature, this review provides a thematic classification and disposition of the state-of-the-art.

4.2 RQ2: How has research intensity and interest in various archetypical domains evolved over time?

To understand the magnitude of key research efforts, broken down by the archetypical domains, we next studied the overall research intensity. Table 10 provides an indication of the overall research intensity for each thematic research cluster, in terms of total paper count, total citation count and citation impact. A citation-based research metric, the Citation Impact, measures research impact by normalizing the citation count in terms of the number of publication, to obtain the average number of times each publication is cited (McMaster University 2022).

Research covered 370 publications generating a total of 5749 citations. This translated to a mean citation count per publication of 15.5. On an overall basis, it was observed that Trading and Investment generated the highest research attention in terms of the total number of papers published, and in turn the highest total citation count, translating to an above average citation count per publication. ESG Disclosure, Measurement and Governance followed in second place, but its overall citation count was relatively low, resulting in the second lowest citation count per publication.

Interestingly, it was Responsible Use of AI that brought about the highest traction in terms of citation impact of 46.3, followed by Risk Management and Firm Governance. In contrast, Forecasting and Valuation generated a meagre 4.7 in terms of citation count per publication; a one order-of-magnitude difference with Responsible Use of AI. Alongside Forecasting and Valuation, the aforementioned ESG Disclosure, Measurement and Governance, and Financial Markets and Instruments round up the bottom three positions.

The next natural question to evaluate was how the archetypical domains evolved across time. Figure 4 shows the absolute publication numbers, broken down by the archetypical domains, between 2008 and 2022. It was observed that 2018 appeared to be the inflexion point, beyond which research efforts grew significantly.

In terms of the evolution of the absolute citation count as shown in Fig. 5, Trading and Investment had historically generated the highest interest across the years. Citations within the Risk Management, Firm Governance and ESG Disclosure, Measurement and Governance domains grew considerably in the later years. The other domains generated relatively smaller absolute citation count numbers.

To measure the citation impact contribution of each research domain across the years, the study proportioned the citation impact values such that the relative contributions of each archetypical domain to the total contributions of all domains across time could be observed (Fig. 6).

In Fig. 6, it was noted that while Trading and Investment was a crowded space in terms of total publication numbers and citation counts, the relative research impact per publication was reduced over time. In contrast, while research within the Risk Management and Responsible Use of AI domains started later, their relative citation impacts were higher, and these impacts were picked up within a relatively short space of time.

Other further points to note in terms of relative research interest were as follows: (i) as a relative proportion to the collective papers in the search space, citation impact for the Trading and Investment and Firm Governance domains appeared to exhibit downward trends, and (ii) while citation impacts for the domains of Data, ESG Disclosure, Measurement and Governance, Financial Markets and Instruments and Forecasting and Valuation appeared to exhibit small tractions, these were offset by their continued growth trends and relatively late entries into the research space. They could yet make impressive strides going forward.

The insights above allow researchers to recognize where and how research intensity and interest, and their evolution occurred in recent years, so as to better assess and allocate their present research efforts going forward.

4.3 RQ3: which AI techniques have been employed in studies across the archetypical domains, and how have their usages changed over time?

It was interesting to see that different research archetypes exhibited different dominant AI techniques, as observed in Fig. 7.

-

i.

Trading and Investment: The AI techniques used by the papers in this domain were highly diversified, ranging from the application of relatively simple tree-based algorithms such as decision trees (e.g. Lanza et al. 2020) and ensemble models such as tree-based regression (e.g. Reyners 2021), to portfolio optimization algorithms such as Michaud optimization (e.g. De Spiegeleer et al. 2021; He et al. 2021), and deep reinforcement learning algorithms such as Q-learning (e.g. Yang et al. 2020; Maree and Omlin 2022).

-

ii.

ESG Disclosure, Measurement and Governance: ESG information obtained through sources such as web scrapped reporting disclosure might be text-based. Text mining algorithms represented a significant proportion of papers in this domain. Text mining algorithms, most commonly applying Bidirectional Encoder Representations from Transformers (BERT), or other BERT variants such as RoBERTa, LinkBERT, FinBERT, ClimateBERT or SBERT, were applied to extract insights (e.g., Bingler et al. 2022; Ghosh and Naskar 2022; Koloski et al. 2022; Huang et al. 2023).

-

iii.

Firm Governance: The majority of papers in Firm Governance utilized multivariate regression to examine the impact of ESG at the company level (e.g., Heath et al 2021; Alkaraan et al. 2022).

-

iv.

Financial Markets and Instruments: Research practices in this domain applied multivariate regression and/or unsupervised analysis to examine relationships between ESG and macro market issues, market microstructure, market participants, financial products and activities, and technology influence (e.g., Ishizaka et al. 2021; Klusak et al. 2021; Bai et al. 2022). Evolutionary learning, deep learning and text mining have been applied to create new ESG products, such as ESG index construction (e.g., Chang et al. 2021; Slimane 2021; Sokolov et al. 2021a).

-

v.

Risk Management: The domain of Risk Management employed multivariate regression to analyze risk factors and contributions (e.g., Brogi, Lagasio and Porretta, 2018; Michalski and Low 2021), text mining and deep learning to detect changes in risk level or predict negative screening ESG lists (e.g., Hisano et al. 2020; Jan 2021), and unsupervised learning and computer vision to recognize risk patterns (e.g., Patterson et al. 2020, 2022; Yang and Broby 2020).

-

vi.

Forecasting and Valuation: This domain primarily employed supervised learning approaches, which might be augmented by ensembling through different regularization (e.g., lasso) and boosting (e.g., XGBoost, LightBoost) techniques (e.g., Semet et al. 2021; Guliyev and Mustafayev 2022). Deep learning methods were increasingly being utilized to improve forecasting results (e.g., Jabeur et al. 2021; Wang et al. 2021), and finely grained news events could be integrated through text mining to achieve real-time prediction (e.g., Yu et al. 2018; Chen et al. 2019; Zhang 2022).

-

vii.

Data: The domain of Data might involve simple supervised learning and natural language processing (e.g., Gupta et al. 2021; Sokolov et al. 2021b), to the use of generative AI (e.g., Geissler et al. 2022) for the creation of ESG scores and rating datasets. Only 36% of the papers reviewed employed AI techniques. The majority of the papers were concerned about providing qualitative assessments to the quality and use of ESG data.

-

viii.

Responsible Use of AI: This domain was relatively scarce in terms of the employment of AI techniques, with only 29% of the papers reviewed employing some form of AI techniques. For instance, neural network had been employed as a tool to quantify carbon emissions of machine learning systems (Lacoste et al 2019), and assess token offerings to finance socially good sustainable entrepreneurship (Mansouri and Momtaz 2022). Other useful AI techniques include algorithmic fairness and bias mitigation techniques, and feature importance analysis, model interpretation, and local explanation methods for explainable AI. The majority of the papers reviewed discussed qualitatively on AI ethics issues and social good initiatives.

When viewed across time, it was observed that the use of AI techniques, in terms of the number of unique techniques employed, was growing at an exponential rate (Table 11). 2018 appeared to be the inflexion point. In 2018, there were a count of seven unique AI techniques applied by the papers in this emerging field. By 2022, this number grew by more than 18 times, to 129.

The bump graph analysis in Fig. 8 provided a visualization of the evolution. While only the more dominant techniques were represented in the graph, it could be clearly observed that a myriad of AI techniques were adopted and applied in recent years across different papers to uncover hidden ESG driven insights. Multivariate regression (and its various regularized or ensemble forms) continued to dominate, especially for papers looking to evaluate relationships between ESG and non-ESG attributes. This was followed by natural language processing techniques, which were useful to inspect semi-structured or unstructured alphanumeric ESG-related datasets.

The analyses above provide researchers insights into how each research archetypical domain can differ in terms of the application of AI techniques. A time-series review of the techniques also revealed that while the application of unique techniques was experiencing exponential growth, multivariate regression continued to command the largest influence, and natural language processing models were increasingly dominant. This review provides an insight into the use and evolution of different AI techniques within the research scape.

5 Discussion

This section summarizes the key findings presented above, to provide explicit takeaways for practitioner insights. Figure 9, which provides a summary of takeaways, shows a visualization of the total citation count across time, and the relative contribution of citation impact in the research space, against all archetypes across time.

The archetype of Trading and Investment was the most popular and crowded research space; however, on average, the marginal research impact of each publication relative to other archetypical domains had been falling over the years. Given that journals place high attention to impact factors and have strong incentives to publish in popular fields, working on this archetype domain allows a safe route to publishing, although the contribution to popular literature may turn out to be minor (Edmans 2022). Incorporating ESG factors into investment strategies and portfolio selection is becoming increasingly important. Diversified AI techniques, ranging from multivariate regression to reinforcement learning, have been used to minimize portfolio risk, analyze the impact of ESG factors on investment performance, and improve portfolio selection, optimization, and management. By designing intelligent trading and investment decision-support platforms that consider ESG factors, financial professionals can make more informed decisions that align with the values of their clients.

Papers within the archetype of ESG Disclosure, Measurement and Governance were later entrants into this research space, largely appearing since 2018. While the overall citation count was the second highest, the relatively late entry into the space affected the average citation impact of these papers (second lowest among all archetypes). From a time-series perspective, research in this archetypical domain was experiencing fair growth. Practitioners can leverage AI tools to analyze ESG disclosure data, develop ESG measurement tools, and improve ESG governance practices. Text mining algorithms, particularly those using BERT or its variants, are commonly used to extract insights from ESG-related text data.

The archetype of Firm Governance was also a relatively crowded research space. It generated the third highest absolute number of publications, second highest citation count and third highest citation impact. These said, on average, the marginal research impact of each publication relative to other archetypical domains had also been falling over the years, similar to Trading and Investment. To achieve sustainable and responsible governance practices, firms must prioritize ESG considerations throughout all aspects of their operations, including smart operations, supply chain management, corporate finance, and marketing. Analyzing and mitigating environmental risks associated with business operations, improving supply chain sustainability, and optimizing logistics and delivery processes can help reduce a company’s carbon footprint. Additionally, detecting and mitigating financial fraud, irregularities, and unethical behavior and evaluating the social impact of corporate financial decisions can help firms maintain their financial integrity and social responsibility. Finally, recommending socially responsible marketing strategies that address issues like diversity and inclusion, environmental impact, and governance principles can improve customer engagement and satisfaction. Most papers in this archetype utilize multivariate regression.

Papers within the archetype of Financial Markets and Instruments were also late entrants into this research space, largely appearing since 2020. While this affected its citation impact (third lowest among all archetypes), its publication count and citation count were ranked at fourth and fifth respectively, a demonstration of strong recent interest. Researchers and practitioners in the financial sector can benefit from understanding the intricacies of market systems and simulation, smart banking and payment methods, the various financial products and services available, and the evolving landscape of financial technology. By considering the ESG perspective, they can contribute to a more sustainable, socially responsible, and ethically sound financial environment (e.g., energy-efficient and environmentally friendly blockchain systems, which also promote transparency, ethical sourcing, and carbon footprint reduction). Studies applied multivariate regression and/or unsupervised learning to investigate the effects and interplay between ESG and macro market concerns, market microstructure, market players, financial products and operations, and the impact of technology. Techniques such as evolutionary learning, deep learning, and text mining have been utilized to develop novel ESG offerings, including the creation of ESG indices.

Papers within the archetype of Risk Management were less than half the absolute number of publications in Trading and Investment. However, its citation impact was 45% higher (ranked second among all archetypes) On average, the marginal research impact of each publication relative to other archetypical domains grew respectably since 2014. Financial sector researchers and practitioners are encouraged to explore the advantages of AI in improving risk and credit management techniques. By integrating ESG principles, they can not only refine conventional risk and credit management procedures but also address issues related to sustainability, social responsibility, and ethical considerations. This methodology can lead to enhanced fraud and crime prevention, fine-tuned risk management strategies, encouragement of sustainable funding, and advocacy for fair lending practices. Multivariate regression was used to examine risk elements and their influence, while text mining and deep learning were employed for identifying shifts in risk levels or forecasting negative ESG screening lists. Additionally, unsupervised learning and computer vision were applied to discern risk patterns.

The archetype of Forecasting and Valuation exhibited subdued growth since 2018. Although it is fifth in terms of absolute publication numbers, it generated by far the lowest citation impact—a paltry 4.7, against an average of 15.5 across all archetypes. This said, its muted performance may be offset by its late entry into the research space, and it may yet exhibit research traction in the coming years. The Forecasting and Valuation research archetype offers valuable insights for researchers and practitioners in understanding the role of ESG factors in financial markets in resource and asset valuation, anticipating market trends, and understanding the supply and demand dynamics of assets and markets, through the application of AI. Under this archetype, supervised learning methods are predominantly used, which can be enhanced by combining various regularization techniques (such as ridge and lasso) and boosting methods (like CatBoost and XGBoost). The use of deep learning approaches is on the rise to refine forecasting outcomes, and detailed news events can be incorporated using text mining for real-time prediction capabilities.

The archetype of Data exhibited rising potential. On average, the marginal research impact of each publication relative to other archetypical domains had grown since 2018. Although its absolute publication number was ranked seventh among all archetypes, its citation impact was ranked fifth—10 more than the archetype of Forecasting and Valuation, at 14.7. By considering ESG as an alternative data source, this research area demonstrates the potential of harnessing unstructured data to evaluate various environmental factors and assess companies’ ESG performance. Ultimately, this research contributes to the development of more accurate and comprehensive ESG metrics that can inform sustainable and responsible decision-making in the financial sector. AI techniques may range from basic supervised learning and natural language processing to employing generative AI for generating ESG scores and rating datasets. Most of these studies primarily focused on delivering qualitative evaluations regarding the quality and application of ESG data.

The archetype of Responsible Use of AI exhibited high potential, and more research can be done in this area. Although the absolute publication count was the lowest, its average citation impact was more than three times above mean (ranked first among all archetypes). Research under this archetype highlights the importance of ethical and explainable AI applications in finance. By focusing on transparency, interpretability, and the avoidance of biases, this research area contributes to the development of more responsible AI solutions. Ultimately, this fosters a more equitable and sustainable financial sector, aligning with ESG principles and goals. Most of the papers analyzed primarily focused on qualitative discussions regarding AI ethical concerns and initiatives for social good. Other AI approaches involve algorithmic fairness and bias reduction techniques, as well as feature importance analysis, model interpretation, and local explanation methods for explainable AI.

Adapted and modified from Cao (2020), Table 12 provides a high-level overview of this research space, segregated into the eight archetypical domains.

6 Conclusion

The integration of ESG and AI in finance represents a promising direction for research and practice, offering new opportunities for sustainable and ethical investment practices. The latest research in this field has shown the potential of using machine learning algorithms to analyze ESG data and inform investment decisions, as well as the development of AI-powered platforms that can help investors integrate ESG considerations into their investment processes.

In conclusion, this study provides a comprehensive and systematic analysis of the research landscape concerning ESG, AI, and finance. Eight archetypical research domains were identified: Trading and Investment, ESG Disclosure, Measurement and Governance, Firm Governance, Financial Markets and Instruments, Risk Management, Forecasting and Valuation, Data, and Responsible Use of AI. The study offered valuable insights into the evolution of research intensity, interest, and AI techniques within each domain, contributing to a more nuanced understanding of this dynamic and rapidly growing field.

Future research directions can focus on the following areas:

-

i.

Investigating the potential of emerging AI techniques, such as graph neural networks, federated learning and generative models, for enhancing ESG-related financial applications and addressing concerns in attractive research potential areas, such as Responsible Use of AI. The exploration of these emerging AI techniques could enhance how financial institutions process and interpret ESG data, leading to more accurate predictions, better risk management, and more informed decision-making processes.

-

ii.

Exploring the interrelationships and synergies between the identified research archetypes, to develop more holistic and integrated approaches in addressing ESG, AI, and finance challenges. By understanding these interrelationships, the financial sector can potentially unlock new avenues of innovation, creating integrated solutions that address multiple challenges simultaneously. This holistic approach might lead to the development of novel financial products and strategies that are both profitable and sustainable.

-

iii.

Assessing the impact of regulatory frameworks, industry standards, and stakeholder expectations on the adoption and integration of ESG and AI in the financial sector, to guide future policy development and best practices. This should also consider the regulatory and ethical challenges posed by generative AI, especially in terms of data authenticity and the potential for misuse in ESG-related financial simulations. By doing so, the financial sector can ensure that AI-driven ESG initiatives are both compliant and effective. This could pave the way for a more transparent, accountable, and ethical financial industry, where stakeholders can trust AI-driven processes and decisions.

-

iv.

Search parameter in the PRISMA process for the domain area is limited to ‘finance’. It will be interesting to extend this search to include closely related search terms such as ‘audit and assurance’ and ‘accounting information systems’. This could enrich the research, for instance, in the areas of firm governance and risk management. Broadening the scope to encompass these related domains could reveal new opportunities and challenges, catalyzing a deeper understanding of the research landscape.

-

v.

A bibliometric analysis incorporating bibliographic coupling, citation analysis, co-word analysis, and co-authorship analysis (Khanra et al. 2022) may extend and add value to this study. While systematic literature mapping provides a structured overview of existing literature, bibliometric techniques may help reveal the interconnectedness of publications, the influence and impact of specific works, the evolution of key terms and concepts, and collaborations among researchers. This multi-faceted approach provides a richer, more nuanced understanding of the research domain, highlighting influential nodes, emerging trends, and the collaborative nature of the field.

By delving further into these research directions, scholars and practitioners can advance the understanding of ESG and AI’s role in shaping a more sustainable, responsible, and equitable financial sector, and drive meaningful innovation and progress in the years to come.

Data availability

Data is available upon reasonable request.

References

Abdalmuttaleb MA, Al-Sartawi M, Hussainey K, Razzaque A (2022) The role of artificial intelligence in sustainable finance. J Sustain Fin Invest. https://doi.org/10.1080/20430795.2022.2057405

Agarwala M, Burke M, Klusak P, Kraemer M, Volz U (2022) Nature loss and sovereign credit ratings. Report, Finance for Biodiversity Initiative. https://www.bennettinstitute.cam.ac.uk/wp-content/uploads/2022/06/NatureLossSovereignCreditRatings.pdf. Accessed 25 Mar 2023

Akter S, Dwivedi YK, Sajib S, Biswas K, Bandara RJ, Michael K (2022) Algorithmic bias in machine learning-based marketing models. J Bus Res 144:201–216. https://doi.org/10.1016/j.jbusres.2022.01.083

Ali S, Liu B, Su JJ (2022) Does corporate governance have a differential effect on downside and upside risk? J Bus Financ Acc 49(9–10):1642–1695

Alkaraan F, Albitar K, Hussainey K, Venkatesh VG (2022) Corporate transformation toward Industry 4.0 and financial performance: the influence of environmental, social, and governance (ESG). Technol Forecast Soc Change 175:121423. https://doi.org/10.1016/j.techfore.2021.121423

Allman E (2022) Pricing climate change risk in corporate bonds. J Asset Manag 23:596–618. https://doi.org/10.1057/s41260-022-00294-w

Amin MH, Mohamed EK, Elragal A (2021) CSR disclosure on Twitter: evidence from the UK. Int J Account Inf Syst 40:100500. https://doi.org/10.1016/j.accinf.2021.100500

Anas M, Mujtaba G, Nayyar S, Ashfaq S (2020) Time-frequency based dynamics of decoupling or integration between Islamic and conventional equity markets. J Risk Fin Manag 13(7):156. https://doi.org/10.3390/jrfm13070156

Angelova D, Bosello F, Bigano A, Giove S (2021) Sovereign rating methodologies, ESG and climate change risk: an overview. SSRN Electron J. https://doi.org/10.2139/ssrn.3841948

Anquetin T, Coqueret G, Tavin B, Welgryn L (2022) Scopes of carbon emissions and their impact on green portfolios. Econ Model 115:105951. https://doi.org/10.1016/j.econmod.2022.105951

Antoncic M (2020) Uncovering hidden signals for sustainable investing using big data: artificial intelligence, machine learning and natural language processing. J Risk Manag Fin Inst 13(2):106–113

Antoncic M, Bekaert G, Rothenberg RV, Noguer M (2020) Sustainable investment—exploring the linkage between alpha, ESG, and SDGs. SSRN Electron J. https://doi.org/10.2139/ssrn.3623459

Apel M, Betzer A, Scherer B (2023) Real-time transition risk. Financ Res Lett 53:103600. https://doi.org/10.1016/j.frl.2022.103600