Abstract

We study the problem of exchange when agents are endowed with heterogeneous indivisible objects, and there is no money. In this setting, no rule satisfies Pareto-efficiency, individual rationality, and strategy-proofness; there is no consensus in the literature on satisfactory second-best mechanisms. A natural generalization of the ubiquitous Top Trading Cycles (TTC) satisfies the first two properties on the lexicographic domain, rendering it manipulable. We characterize the computational complexity of manipulating this mechanism; we show that it is \(\mathbf {W[P]}\)-hard by reduction from MONOTONE WEIGHTED CIRCUIT SATISFIABILITY. We provide a matching upper bound for a wide range of preference domains. We further show that manipulation by groups (when parameterized by group size) is \(\mathbf {W[P]}\)-hard. This provides support for TTC as a second-best mechanism. Lastly, our results are of independent interest to complexity theorists: there are few natural \(\mathbf {W[P]}\)-complete problems and, as far as we are aware, this is the first such problem arising from the social sciences.

Similar content being viewed by others

Notes

In school choice, students have priorities at various schools instead of ownership, and TTC is the most fair strategy-proof and Pareto-efficient mechanism [2, 28]. The FAA’s mechanism for the exchange of airplane landing slots is improved upon by a variant of TTC [36]. For the more general “mixed-ownership” economies when some objects can be collectively owned, the three properties help characterize a TTC variant [40, 41]. Dropping individual rationality, the full class of Pareto-efficient and strategy-proof mechanisms features agents trading objects in cycles [30, 33].

An allocation is in the core if no group of agents would rather secede and trade amongst themselves. Strategy-proofness rules out beneficial manipulation by means of an agent misrepresenting their preference over objects.

To see that any lexicographic \(R_i\) is additive, for each \(\alpha \in \mathcal {O}\), let \(u_i(\alpha )=2^{k(\alpha )}\) where \(k(\alpha )=|\{\beta \in {\mathcal {O}} : ~\alpha \mathrel {R_i} \beta \}|\).

For example, \(a \mathrel {P}_i b \mathrel {P}_i c\) implies that \(\{a,b,c\} \mathrel {P}_i \{a,b\} \mathrel {P}_i \{a,c\} \mathrel {P}_i \{a\} \mathrel {P}_i \{b,c\} \mathrel {P}_i \{b\} \mathrel {P}_i \{c\}\).

Formally, 1) \(a \mathrel {P}_i b \mathrel {P}_i c\), 2) for each \(x\in \omega _i \setminus \{a,b,c\}\), it holds that \(c \mathrel {P}_i x\), and 3) for each each \(x\in \omega _i\), and each \(y\in {\mathcal {O}} \setminus (\omega _i \cup \{a,b,c\})\), it holds that \(x \mathrel {P}_i y\).

See also [4] where a weaker version of this property is referred to as splitting invariance.

We also provide an additional example of this construction for a circuit with one internal gate in Appendix A.1.

We also provide steps of TTC for a similar construction when the output gate is an \(\vee\)-gate, instead, in Appendix A.3.

For intuition, see Fig. 6. There, if agent 1 topranks \(x_{1,6}^1\), then \(\{x_{1,6}^1,\dots ,x_{1,1}^1\}\) are included in the first trading cycle. Thus, for each of the six copies, the respective objects representing input gate \(x_1\) are removed. This indicates that input gate \(x_1\) takes value 1 in each copy.

References

Abdulkadiroğlu, A., & Sönmez, T. (1998). Random serial dictatorship and the core from random endowments in house allocation problems. Econometrica, 66(3), 689–701.

Abdulkadiroğlu, A., & Sönmez, T. (2003). School choice: A mechanism design approach. American Economic Review, 93(3), 729–747.

Abrahamson, K. A., Downey, R. G., & Fellows, M. R. (1995). Fixed-parameter tractability and completeness IV: On completeness for W[P] and PSPACE analogues. Annals of Pure and Applied Logic, 73(3), 235–276.

Altuntaş, A., Tamura, Y., & Phan, W. (2022). Some characterizations of generalized top trading cycles. Working paper.

Azevedo, E. M., & Budish, E. (2019). Strategy-proofness in the large. The Review of Economic Studies, 86(1), 81–116.

Biró, P., Klijn, F., & Pápai, S. (2019). Balanced exchange in a multi-object Shapley-Scarf market. Working paper.

Bredereck, R., Chen, J., Faliszewski, P., Nichterlein, A., & Niedermeier, R. (2016). Prices matter for the parameterized complexity of shift bribery. Information and Computation, 251, 140–164.

Budish, E., & Cantillon, E. (2012). The multi-unit assignment problem: Theory and evidence from course allocation at Harvard. American Economic Review, 102(5), 2237–71.

Cai, L., Chen, J., Downey, R., & Fellows, M. (1995). On the structure of parameterized problems in NP. Information and Computation, 123(1), 38–49.

Cesati, M. (2003). The Turing way to parameterized complexity. Journal of Computer and System Sciences, 67(4), 654–685.

Chen, Y., Flum, J., & Grohe, M. (2005). Machine-based methods in parameterized complexity theory. Theoretical Computer Science, 339(2–3), 167–199.

Downey, R. G., & Fellows, M. R. (1995). Fixed-parameter tractability and completeness II: On completeness for W[1]. Theoretical Computer Science, 141(1), 109–131.

Downey, R. G., & Fellows, M. R. (1999). Parameterized complexity. Monographs in computer science. Springer.

Dur, U., & Morrill, T. (2018). Competitive equilibria in school assignment. Games and Economic Behavior, 108, 269–274.

Ergin, H., Sönmez, T., & Ünver, M. U. (2017). Dual-donor organ exchange. Econometrica, 85(5), 1645–1671.

Ergin, H., Sönmez, T., & Ünver, M. U. (2020). Efficient and incentive-compatible liver exchange. Econometrica, 88(3), 965–1005.

Flammini, M., & Gilbert, H. (2020). Parameterized complexity of manipulating sequential allocation. In 24th European conference on artificial intelligence (ECAI 2020).

Fujita, E., Lesca, J., Sonoda, A., Todo, T., & Yokoo, M. (2015). A complexity approach for core-selecting exchange with multiple indivisible goods under lexicographic preferences. In Proceedings of the twenty-ninth AAAI conference on artificial intelligence, AAAI’15 (pp. 907–913). AAAI Press.

Fujita, E., Lesca, J., Sonoda, A., Todo, T., & Yokoo, M. (2018). A complexity approach for core-selecting exchange under conditionally lexicographic preferences. Journal of Artificial Intelligence Research, 63, 515–555.

Kennes, J., Monte, D., & Tumennasan, N. (2014). The day care assignment: A dynamic matching problem. American Economic Journal: Microeconomics, 6(4), 362–406.

Klaus, B. (2008). The coordinate-wise core for multiple-type housing markets is second-best incentive compatible. Journal of Mathematical Economics, 44(9–10), 919–924.

Konishi, H., Quint, T., & Wako, J. (2001). On the Shapley-Scarf economy: The case of multiple types of indivisible goods. Journal of Mathematical Economics, 35(1), 1–15.

Liu, Q., & Pycia, M. (2016). Ordinal efficiency, fairness, and incentives in large markets. Working paper.

Ma, J. (1994). Strategy-proofness and the strict core in a market with indivisibilities. International Journal of Game Theory, 23(1), 75–83.

Majunath, V., & Westkamp, A. (2021). Strategy-proof exchange under trichotomous preferences. Journal of Economic Theory, 193, 105197.

Miyagawa, E. (2002). Strategy-proofness and the core in house allocation problems. Games and Economic Behavior, 38(2), 347–361.

Monte, D., & Tumennasan, N. (2015). Centralized allocation in multiple markets. Journal of Mathematical Economics, 61, 74–85.

Morrill, T. (2015). Making just school assignments. Games and Economic Behavior, 92, 18–27.

Papadimitriou, C. M. (1994). Computational complexity. Addison-Wesley.

Pápai, S. (2000). Strategyproof assignment by hierarchical exchange. Econometrica, 68(6), 1403–1433.

Pápai, S. (2003). Strategyproof exchange of indivisible goods. Journal of Mathematical Economics, 39(8), 931–959.

Pápai, S. (2007). Exchange in a general market with indivisible goods. Journal of Economic Theory, 132(1), 208–235.

Pycia, M., & Ünver, M. U. (2017). Incentive compatible allocation and exchange of discrete resources. Theoretical Economics, 12(1), 287–329.

Roth, A. E., & Postlewaite, A. (1977). Weak versus strong domination in a market with indivisible goods. Journal of Mathematical Economics, 4(2), 131–137.

Roth, A. E., Sönmez, T., & Ünver, M. U. (2004). Kidney exchange. The Quarterly Journal of Economics, 119(2), 457–488.

Schummer, J., & Vohra, R. V. (2013). Assignment of arrival slots. American Economic Journal: Microeconomics, 5(2), 164–185.

Shapley, L., & Scarf, H. (1974). On cores and indivisibility. Journal of Mathematical Economics, 1(1), 23–37.

Sikdar, S., Adali, S., & Xia, L. (2017). Mechanism design for multi-type housing markets (pp. 684–690). AAAI.

Sönmez, T. (1999). Strategy-proofness and essentially single-valued cores. Econometrica, 67(3), 677–689.

Sönmez, T., & Ünver, M. U. (2005). House allocation with existing tenants: An equivalence. Games and Economic Behavior, 52(1), 153–185.

Sönmez, T., & Ünver, M. U. (2010). House allocation with existing tenants: A characterization. Games and Economic Behavior, 69(2), 425–445.

Sonoda, A., Fujita, E., Todo, T., & Yokoo, M. (2014). Two case studies for trading multiple indivisible goods with indifferences. In Twenty-eighth AAAI conference on artificial intelligence.

Sun, Z., Hata, H., Todo, T., & Yokoo, M. (2015). Exchange of indivisible objects with asymmetry. In Twenty-fourth international joint conference on artificial intelligence.

Svensson, L.-G. (1999). Strategy-proof allocation of indivisible goods. Social Choice and Welfare, 16(4), 557–567.

Todo, T., Sun, H., & Yokoo, M. (2014). Strategyproof exchange with multiple private endowments. In Twenty-eighth AAAI conference on artificial intelligence (pp. 805–811).

Wang, J., Su, W., Yang, M., Guo, J., Feng, Q., Shi, F., & Chen, J. (2015). Parameterized complexity of control and bribery for d-approval elections. Theoretical Computer Science, 595, 82–91.

Acknowledgements

A large part of this research took place while the first author was at the University of Helsinki and the second author was at Aalto University in Finland. The project began with a chance meeting in the sauna of Töölö Towers; we thank the wonderful staff there. We also thank Jukka Suomela, Patrick Harless, and Vikram Manjunath for many useful discussions.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

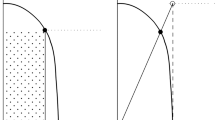

In this section we provide several fully worked examples of the constructions defined in the main text. Previously, in Figs. 5 and 6, we considered a simple circuit with no internal gates, and depicted the corresponding economies \(\mathcal {E}'_\mathcal {C}\) and \(\mathcal {E}_\mathcal {C}\). In Figs. 8 and 9 we consider a circuit with one internal gate (Fig. 3), and provide the full constructions of the corresponding \(\mathcal {E}'_\mathcal {C}\) and \(\mathcal {E}_\mathcal {C}\). In Figs. 10 and 11 we detail several steps of TTC for two different circuits and their resulting economy \(\mathcal {E}'_\mathcal {C}\) constructions.

1.1 Appendix A.1: a circuit with one internal gate

Consider the circuit from Fig. 3 equivalent to the formula \(x_1\wedge (x_1\vee x_2)\). It is degenerate in a certain sense: it is equivalent to the circuit with a single gate \(x_1\) serving as input and output. Thus there is only one satisfying assignment of weight 1, in which \(x_1=1\) and \(x_2=0\). In Fig. 8, we depict the corresponding economy \(\mathcal {E}'_\mathcal {C}\) following the definitions in Sect. 3.1.

By design, there is a beneficial misreport of a particular form corresponding to the satisfying assignment of weight 1. Consider the possible preference relations that agent 1 can report. Recall that their true preference is \(R_1= (\alpha ,\beta ,e_\alpha ,e_\beta ,e_k,e_{k-1},\ldots ,e_1)\). If agent 1 reports the truth, then they receive \(\{\alpha ,e_\alpha ,e_\beta \}\). If agent 1 reports \(R'_1=(x_1^2,\alpha ,\beta ,\square )\) (which represents the satisfying assignment \(x_1=1\)), then they receive \(\{x_1^2,\alpha ,\beta \}\) and are better off. If agent 1 reports \(R''_1=(x_2^1,\alpha ,\beta ,\square )\) (which represents a non-satisfying weight 1 assignment \(x_2=1\)), then they receive \(\{x_2^1,\alpha ,e_\beta \}\) and are worse off.

Next, we show the result of the duplication process to construct \(\mathcal {E}_\mathcal {C}\) for \(k=1\) in Fig. 9. As in Fig. 6, we omit the objects \(\alpha\), \(\beta\), \(\gamma\) , \(e_\alpha\), and \(e_\beta\) in this diagram for readability.

1.2 Appendix A.2: steps of TTC for economy from Fig. 5

The economy from Fig. 5 is the construction \(\mathcal {E}'_\mathcal {C}\) where circuit \(\mathcal {C}\) is equivalent to \(x_1\wedge x_2\) and \(k=1\). Recall that the true preference of agent 1 is \(R_1=(\alpha ,\beta ,e_\alpha ,e_\beta ,e_1)\), and that they are allocated \(\{\alpha ,e_\alpha ,e_\beta \}\).

In Fig. 10, we show the result of applying TTC when agent 1 misreports to \(R'_1=(x_1^*,\alpha ,\beta ,\square )\). For readability, we omit drawing agent 1’s preference except where necessary. In the top left, we depict Step 1 of TTC. Since agent 1 topranks \(x_1^*=x^1_1\), we have the cycle \((x_1^*,\gamma _1,e_1)\). All objects that agent 1 owns point to \(x_1^*\) as well, but we omit these directed edges. We resolve this cycle. In the top right of the figure, we depict Step 2. We remove objects that were in a cycle in Step 1 (now greyed) and update all agents’ preferences over remaining objects. For example, since \(e_1\) is gone, the owner of \(\gamma\) now topranks \(e_\alpha\). Agent 1 owns \(e_\alpha\) which now topranks and points to \(\alpha\). Two cycles appear: \((x_2^1,h_3^2)\) and \((\alpha ,\gamma ,e_\alpha )\). We select the former to resolve. In Step 3 (bottom left), we update preferences, and since \(h_1^3\) only ranked one object in the previous step, they now toprank their own object. Again there are two cycles: \((h_1^3)\) and \((\alpha ,\gamma ,e_\alpha )\). We select the former to resolve. In Step 4 (bottom right), \((\alpha ,\gamma ,e_\alpha )\) is the only cycle. In Step 5 (not shown), \((y,\beta )\) form a cycle. Thus, we have that agent 1 is allocated \(\{x_1^*,\alpha ,e_\beta \}\). This outcome is worse than the outcome if they had told the truth.

Note that in Step 2, removing \(h_3^2\) from the graph corresponds to the second predecessor of the \(\wedge\)-gate \(g_3\) taking value 0. Thus, the output \(\wedge\)-gate \(g_3\) takes value 0. The result, by design, is that y cycles with \(\beta\), taking away the opportunity for agent 1 to receive \(\beta\).

1.3 Appendix A.3: steps of TTC for economy another circuit

In Fig. 11, we show the construction of \(\mathcal {E}'_\mathcal {C}\) where \(\mathcal {C}\) is the circuit equivalent to \(x_1 \vee x_2\) and \(k=1\). The true preference of agent 1 is \(R_1=(\alpha ,\beta ,e_\alpha ,e_\beta ,e_1)\), and they are allocated \(\{\alpha ,e_\alpha ,e_\beta \}\). We show the result of applying TTC when agent 1 misreports to \(R'_1=(x_1^*,\alpha ,\beta ,\square )\). Note that this is a satisfying assignment of weight 1 for the circuit. By design, the misreport \(R'_1=(x_1^*,\alpha ,\beta ,\square )\) will be beneficial.

In the top left, we depict Step 1 of TTC. Since agent 1 topranks \(x_1^*=x^1_1\), we have the cycle \((x_1^*,\gamma _1,e_1)\). We resolve this cycle. All objects that agent 1 owns point to \(x_1^*\) as well, but again we omit these directed edges. In Step 2 (top right), given updated preferences, we have three cycles: \((h^2_3,x_2^1)\), \((y,h_3^1)\), and \((\alpha ,\gamma ,e_\alpha )\). We select the first cycle to resolve. In Step 3 (bottom left), cycles are \((y,h_3^1)\), and \((\alpha ,\gamma ,e_\alpha )\). Again, we select the first cycle to resolve. In Step 4 (bottom right), \((\alpha ,\gamma ,e_\alpha )\) is the only cycle. In Step 5 (not shown), \((\beta ,e_\beta )\) form a cycle. Thus, we have that agent 1 is allocated \(\{x_1^*,\alpha ,\beta \}\). This outcome is preferred to the one where they told the truth.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Phan, W., Purcell, C. The parameterized complexity of manipulating Top Trading Cycles. Auton Agent Multi-Agent Syst 36, 51 (2022). https://doi.org/10.1007/s10458-022-09578-2

Accepted:

Published:

DOI: https://doi.org/10.1007/s10458-022-09578-2