Abstract

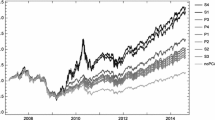

We analyze a negative-parameter variant of the diversity-weighted portfolio studied by Fernholz et al. (Finance Stoch 9(1):1–27, 2005), which invests in each company a fraction of wealth inversely proportional to the company’s market weight (the ratio of its capitalization to that of the entire market). We show that this strategy outperforms the market with probability one over sufficiently long time-horizons, under a non-degeneracy assumption on the volatility structure and under the assumption that the market weights admit a positive lower bound. Several modifications of this portfolio are put forward, which outperform the market under milder versions of the latter no-failure condition, and one of which is rank-based. An empirical study suggests that such strategies as studied here have indeed the potential to outperform the market and to be preferable investment opportunities, even under realistic proportional transaction costs.

Similar content being viewed by others

References

Banner, A.D., Fernholz, D.: Short-term relative arbitrage in volatility-stabilized markets. Ann Finance 4, 445–454 (2008)

Banner, A.D., Ghomrasni, R.: Local times of ranked continuous semimartingales. Stoch Process Appl 118(7), 1244–1253 (2008)

Bayraktar, E., Huang, Y.-J., Song, Q.: Outperforming the market portfolio with a given probability. Ann Appl Probab 22(4), 1465–1494 (2012)

Fernholz, D., Karatzas, I.: On optimal arbitrage. Ann Appl Probab 20(4), 1179–1204 (2010)

Fernholz, D., Karatzas, I.: Optimal arbitrage under model uncertainty. Ann Appl Probab 21(6), 2191–2225 (2011)

Fernholz, R.: Portfolio generating functions. In: Quantitative Analysis in Financial Markets. River Edge, NJ: World Scientific (1999)

Fernholz, R.: Equity portfolios generated by functions of ranked market weights. Finance Stoch 5, 469–486 (2001)

Fernholz, R.: Stochastic Portfolio Theory. Berlin: Springer (2002)

Fernholz, R., Karatzas, I.: Stochastic Portfolio Theory: a survey. In: Bensoussan, A., Zhang, Q. (eds) Handbook of Numerical Analysis. Vol. XV. Special Volume: Mathematical Modeling and Numerical Methods in Finance, Volume 15 of Handbook of Numerical Analysis. Amsterdam: Elsevier/North-Holland (2009)

Fernholz, R., Karatzas, I., Kardaras, C.: Diversity and relative arbitrage in equity markets. Finance Stoch 9(1), 1–27 (2005)

Ichiba, T., Papathanakos, V., Banner, A., Karatzas, I., Fernholz, R.: Hybrid Atlas models. Ann Appl Probab 21(2), 609–644 (2011)

Karatzas, I., Sarantsev, A.: Diverse Market Models of Competing Brownian Particles with Splits and Mergers. Ann Appl Probab. arXiv preprint arXiv:1404.0748 (2014, to appear)

Osterrieder, J.R., Rheinländer, T.: Arbitrage opportunities in diverse markets via a non-equivalent measure change. Ann Finance 2, 287–301 (2006)

Pal, S., Wong, T.-K.L.: Energy, Entropy, and Arbitrage. arXiv preprint arXiv:1308.5376 (2013)

Pal, S., Wong, T.-K.L.: The Geometry of Relative Arbitrage. arXiv preprint arXiv:1402.3720 (2014)

Sarantsev, A.: On a class of diverse market models. Ann Finance 10(2), 291–314 (2014)

Strong, W., Fouque, J.-P.: Diversity and arbitrage in a regulatory breakup model. Ann Finance 7, 349–374 (2011)

Wong, T.-K.L.: Optimization of relative arbitrage. Ann. Finance 11(3) (2015). doi:10.1007/s10436-015-0261-5

Acknowledgments

Wharton Research Data Services (WRDS) was used in preparing the data for this paper. This service and the data available thereon constitute valuable intellectual property and trade secrets of WRDS and/or its third-party suppliers.

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors are greatly indebted to Adrian Banner, Robert Fernholz, Thibaut Lienart, Michael Monoyios, Vassilios Papathanakos, Julen Rotaetxe, Johannes Ruf, and an anonymous referee for their very careful reading of the manuscript and their many, insightful, and helpful suggestions. Alexander Vervuurt gratefully acknowledges Ph.D. studentships from the Engineering and Physical Sciences Research Council, Nomura and the Oxford-Man Institute of Quantitative Finance. Research supported in part by the National Science Foundation under Grant NSF-DMS-14-05210.

Rights and permissions

About this article

Cite this article

Vervuurt, A., Karatzas, I. Diversity-weighted portfolios with negative parameter. Ann Finance 11, 411–432 (2015). https://doi.org/10.1007/s10436-015-0263-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-015-0263-3

Keywords

- Portfolios

- Portfolio generating functions

- Relative arbitrage

- Stochastic Portfolio Theory

- Diversity-weighted portfolios