Abstract

Despite the advantages of holding monopoly power, unions rarely coordinate their wage demands across countries. In this paper, I argue that the costs of coordination and externalities can explain such behaviour. In the model, monopolistic unions set the wage in each country, and the firm keeps the right-to-manage. If the domestic union raised its wage, the firm would substitute production of the domestic good for the foreign one, reducing employment. The union would be worse off and it would have no incentives to deviate. Upon coordination, unions can raise the wage, share the loss of employment, and be better off. Two extensions are provided: right-to-manage model and differentiated costs of coordination.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Despite the increasing globalisation in the corporate and political spheres, coordination of labour unions across countries seems to be still in its infancy. A few salient examples of union coordination are in regions where economic integration is sufficiently deep, such as the European Union. The managerial decisions of multinational enterprises (MNE) have consequences across the European plants over the well-being of workers. As a result, unions are interested in coordinating their actions, or at least to agree to some minimum standards and policies whenever managerial practices are hurtful for workers. Some examples of international unions at the European level are IndustriAll for manufacturing, ETF for transport and the EFJ for journalists among others. These organisations have the capacity to negotiate with their correspondent employer’s associations and influence the policy making in the European Union.

Nonetheless, the same could be laid down with the trade vis-a-vis with other countries such as the USA and China. However, in these cases, there are no trade union organisations that agree on minimum standards or wage demands. So, the question still remains, why do unions fail to coordinate across countries, in spite of the advantages of holding monopoly power? This paper delivers a rationale of why unions are interested in synchronising their actions or why they fail to coordinate internationally based on the costs of coordination and the internalisation of externalities. The discussion in this paper accommodates realities in which union coordination is observed and realities where is non-existent.

The main point is that MNEs with production facilities in different countries dilute the strength of unions to set a higher wage by flooding domestic markets with close substitutable products from other countries. If a domestic union demanded a higher wage, the firm would reduce the production in the domestic plant and would flood the market with a close substitute from abroad. This is exemplified in an excerpt from El Confidencial, a Spanish newspaper, on 17 July 2018.

Fred Padje, chief operations officer for Amazon Spain and Italy, already warned about it previous the strike in March. “We work with a network of 46 plants in all the continent and with that we can cover the demand in the whole of Europe”. With this, they achieved to deactivate a protest in one of the plants in the north of Italy during the last Black Friday.

The firm would increase the production, and the demand for labour in a foreign country, which ultimately would facilitate unions in other countries to demand a wage rise.

The domestic union is worse off because it loses employment, whereas foreign unions will be undoubtedly better off as they enjoy higher levels of employment and wages. Because this is the case in the other countries where the firm operates, no union demands a wage rise in the first place. Workers acknowledge that this mechanism can dilute their bargaining position and need some kind of coordination as this extract from La información, another Spanish newspaper, on 27 April 2018 exemplifies.

Harper (CCOO) insist that the “logistic plumbery” carried out by Amazon during the strike, delivering orders from other plants,...

Thus, unions pose on each other a positive externality that if it were internalised would grant them the opportunity to raise wages and share the employment loss in such a way that both unions would be better off.

So, what if unions coordinate? The firm cannot threaten to fill the void with other products because costs have risen in all markets, the firm reduces production in every market and unions enjoy higher wages that compensate for the loss of employment; in this way, unions internalise the positive externality posed on each other. Of course, coordination is costly, unions collude only if the benefits of the internalisation are sufficiently high, or in other words if products are very substitutable, so as to compensate for the costs of coordination.

In the context of the European Union, multinational firms have taken advantage of the elimination of tariffs, quotas and regulations. Specifically, MNEs have been able to set operations abroad in search of cheaper labour and for weakening the bargaining power of unions (Naylor 1999). The incentives of unions might seem to coordinate their actions across countries in order to curtail the advantage gained by firms when trade is liberalised (Straume 2002). Yet, examples of international coordination among unions is scarce, Schmidt and Keune (2009) survey some examples of transnational bargaing and describe mechanisms that prevent this cooperation.

According to a survey carried out in 2010 in fourteen European countries, (Larsson 2012), the most important ‘hard’ factors in preventing international unions from coordinating are differences in financial resources, different legal frameworks and policies, employer’s associations, similarities of occupational interests and priorities among the leaders and members of the unions. Other factors called ‘soft’ are cultural, ideological, religious and linguistic dissimilarities, which are regarded by unions as much less important for international cooperation than the ‘hard’ ones.

Among the ‘hard’ factors, differences in financial resources among unions and diversity of labour market policies and regulations are the most important hurdles that avoid coordination. Not surprisingly, these hard factors are on the top list of hurdles for sectors that are heavily exposed to international competition like manufacturing. These factors can be traced back to the costs that unions have to bear when coordinating across countries.

In the model presented here, I introduce the costs of coordination among unions in different countries that negotiate with a firm. This firm operates two plants in two countries that sell differentiated products in an integrated product market, think of the European Common Market. The labour market is not integrated, maybe because the costs of moving to a different country are too high for example. when product markets are very integrated, the demand of one product affects the demand for the other product. In the case that unions do not coordinate, there is a positive externality of one union on the other when products are substitutes. The more integrated the economy the more substitutable the products are and the stronger the incentives of unions to coordinate. However, upon coordination, unions face a cost. Unions will coordinate whenever the internalisation of the positive externalities of coordination are higher than the costs.

Similar to this paper, Straume (2002) analyses the incentives of firms and unions to collude when trade is liberalised. In that paper, unions collude to set a common wage above the equilibrium level in the one-shot game. Whenever countries being compared have the same level of productivity it is reasonable that they will set a common wage so as not to fall into reciprocal dumping. In this paper, I consider that countries do not necessarily share the same level of productivity and unions will negotiate the wage in each country taking into account the positive externalities that they pose on each other. Other works following the same vein as that of Straume (2002) are Borghijs and Du Caju (1999) and Buccella (2013).

In a somewhat related paper, Eckel and Egger (2017) explore dissimilarities in union utilities to give a rationale for why they do not coordinate. In their paper, monopoly unions in each country negotiate with a firm in autarky, and then after trade is liberalised unions are better or worse off depending on their wage orientation. In addition, when coordinating unions form a supranational entity with different objectives than individual partners, thus unions that improve their welfare under liberalisation do not engage in coordination if the supranational union has different preferences to them. Even though differences in priorities have been proven to be an obstacle to union collusion, here I explore the incentives of unions to coordinate under transactional costs and internalisation of externalities. Furthermore, I do not assume a supranational union, but I consider the case of collaboration which seems a more natural step towards deeper international cooperation. So, unions in this setting will preserve their national preferences and objectives; and they coordinate their wages so as to internalise the effects of their strategies.

There is also a close branch of literature based on foreign direct investment (FDI) and multinational enterprises (MNEs) related to the present paper. Pioneering works of Mezzetti (November 1989) and Zhao (1995) find that unions might be welfare-improving depending if they are wage or employed-oriented. Also, they find the bargain wage under FDI is usually lower and profits of firms and welfare higher. The mechanism that they consider is the threat of a firm to a union to move production abroad if wages are too high. Here I present a different scenario in which markets are already integrated and there are no tariffs, goods can be traded in any country at the same operating cost as the domestic firm. As said previously, firms dilute the bargaining power of unions by flooding the market with close substitutes that prevent unions from coordinating in the first place.

The rest of the paper is organised as follows. Section 2 develops the general model and proposes simplifying assumptions to gain more insight. In Section 3, the right-to-manage model and its consequence over coordination is considered. Section 4 analyses the coordination outcome under different transactional costs. Section 5 models explicitly the coordination decision. Section 6 concludes.

2 Model

2.1 Setting

There is one monopolistic firm operating two plants in two countries, A and B. The two plants produce differentiated products, \(I={1,2}\), that are sold in an integrated product market. In the product market, plants compete a là Cournot and the firm maximises the total profits of both plants internalising the negative or positive externalities that each plan could pose on each other through prices, also plants producing these goods can be seen as brands. Competition a là Cournot makes more sense for analysing firms with high fix costs, and in which firms are not able to adapt their capacity in the short run. For example, MNEs face high fix costs to export and set subsidiaries abroad; you can think of an international car manufacturer or firms with extensive networks.

Also in each plant, there is a monopoly union that supplies \(n_i\) unit of labour at a rate \(w_i\). I consider an economy with a continuum of workers with a quadratic utility functionFootnote 1 that is separable and linear in money, which prevents income effects on the monopolistic sector where the firm operates (Singh and Vives 1984). More precisely:

Which gives rise the to the following inverse demand functions:

where \(q_i\) is the good supplied by the plant i, \(\alpha _i\) is a taste parameter for the good i, \(\beta _i = \beta _{ii}\) is the sensitivity of price of good i when quantity varies and \(\gamma = \beta _{ij} = \beta _{ji} \ge 0\) is the sensitivity of the price with respect to the good sold by the other brand, which in this case they will be imperfect substitutes.Footnote 2 Since, in the present model goods are substitutes there is no point in considering Bertrand competition, as the profits of each plant would be lower than those if they played Cournot (Singh and Vives 1984).

The production of each brand is given by a production technology that uses one unit of labour to produce one unit of the product, i.e. \(q_i = n_i\), so the plant producing the good i maximises

The firm, which has its headquarters in country A, operates both plants internalising the negative externalities that both plants could pose in each other, then the firm maximises

with respect to both quantities.

Finally, \(n_i\) is the amount of labour employed in plant i and their wages are set by monopoly unions that maximise the wage bill net of coordination costs, where the outside option of workers has been normalised to zero. Unions can take the decision of coordinating or not, \(d_i \in \left\{ 0,1 \right\} \). If they decide to synchronise their actions, they bear cost c per unit of labour.Footnote 3 Then, their respective objective functions are as follows:

where \(\textbf{w} = (w_1 \; w_2)\) is a vector of prices and \(\textbf{d} = (d_1 \; d_2)\) is the vector of decisions of coordination. Here, the implicit assumption is that wages are publicly known by everyone. In the case of the firm negotiating with unions, this is not a far-fetched assumption since unions hold information about the wages of their members; furthermore, in most legal frameworks firms are obliged to share this information with the union. The case of the two unions revealing their wage structures to each other is more debatable, one possible rationale is that they avoid conjectures about each other actions that could be taken advantage by the firm. So, the decision of revealing this information is already taken, although allowing this possibility is an interesting avenue as in Kopel and Putz (2021).

In case of coordination, i.e. \(d_1 = d_2 = 1\), they maximise their objective functions as if they were perfectly synchronised, or in other words:

where the decision variables of unions are wages and coordination.

The bargain between the union and the firm is that monopoly union model, which is a special case of the right-to-manage model when the union has all the bargaining power (Booth 1995). The right-to-manage model is widely used in the literature of international unionised oligopolies as opposed to efficient bargaining, even though there should be efficiency gains of doing so and parties should choose this model instead. However, one possible rationale of why not to use efficient bargaining, i.e. negotiate over wages and employment, is that related to Charles (1984), in which he drops the assumption of certainty. Under uncertain conditions of firm revenues, firms might be unwilling to lock themselves in a contract that they are not going to be able to fulfil. The case of a monopoly union model is more debatable, but it highlights the point made in this paper, reducing the mathematical burden considerably, Section 3 deals with the case where unions do not hold all the bargaining power, generalising the results to the right-to-manage model and its consequences. As is common in the literature the game is built in two stages, first unions set wages, coordinating their actions or not, and then after the firm knows the costs of labour, it chooses the level of employment according to its demand schedule. Then, the model is solved by backward induction.

2.2 Competition in the product market

In the last stage, the firm chooses output and employment to maximise its profits. Substituting (1) and (2) into (3) and taking into account that the technology is \(n_i=q_i\), the profit function of the firm is as follows:

Applying the first-order conditions for an optimum on (4):

Which are the reaction functions of one plant as a function of the employment of the other. Solving the system of equations, we have the optimal decisions of the firm as a function of wages set by the unions:

The denominator indicates the strength of the relative responsiveness of prices with respect to quantities of products in both plants. Naturally, The higher the influence of products in its own price, i.e. indicated by \(\beta _1,\beta _2\), with respect to the cross-influence of one product into the price of the other, i.e. \(\gamma \), the more freedom has the firm to set the quantities in each plant that maximise profits without the need to consider the externalities that plants pose on each other. As a consequence, inverse demands become less elastic, being relatively less responsive to wages. In the extreme case when \(\gamma = 0\) the firm operates two separate monopolies, one in each country.

In the numerator, \((\alpha _i-w_i)\) is the excess of willingness to buy the product by consumers with respect to the cost of the product, in this case, the wage. These terms are multiplied by the sensibilities of the other product since what matters at this point is how this excess is siphoned off to the demand of the other brand. Clearly, the demand for labour is negative in its own wage and positive in the wage of the other plant. Putting it more formally

and seemingly for the labour demand of union 2. The second result is due to the fact that goods are substitutes.

Note that for the problem to be well defined and labour demands to be positive, we need the following conditions to be satisfied. (1) \((\alpha _i-w_i)>0\), meaning that the cost of producing the good i cannot be higher than the maximum price that the consumers are willing to pay for it. (2) \(\beta _2(\alpha _1-w_1)>\gamma (\alpha _2-w_2)\), the strength of the siphoning has to be greater for the own product than the product in the other brand. And (3) \(\sqrt{\beta _1\beta _2}>\gamma \), the combined influence of inverse demands with respect to their quantities should be greater than how they cross-affect each other. We do not need considering the negative part as products are substitutes.

In this case, the firm takes wages as given in its labour demands of each product. It is straightforward to see that the labour demand to produce each product is decreasing in its own wage and it is increasing on the wage of the other plant. In this way, the firm is able to replace the losses of one good due to an increase in costs with a product of the other plant, cushioning the bargaining power of unions, see Lommerud et al. (2006) for a thorough explanation about this mechanism.

2.3 No union coordination

In this section, unions decide wages to maximise the wage bill without coordinating their actions, so they will decide simultaneously the level of wages that will maximise the wage bill taking the wages of the other union as given. In this case, unions do not bear costs of coordination as their decision is \(\textbf{d} = (0\; 0)\) and consequently the objective function of each union is given by

Plugging (5) and (6) into (7) and (8) respectively, the objective functions of the unions are

The objective functions are quadratic equations in their own wage, the quadratic term has a negative sign and the optimum is a maximum. This reflects the fact that the union’s objective functions are increasing wages and employment, but employment is a decreasing function of wages. In addition, these functions are increasing in the wage set by the other union. Clearly, if one union raises wages the production of its plant will be undercut, because both goods are substitutes the firm will fill this void with products of the other brand, demanding more labour and increasing the wages of the union in the other country.

Applying the first-order conditions for an optimum, we can derive the wage of set by the union in one plant as a function of the wage set in the other plant:

These are nothing else than the reaction functions of each union with respect to the wages of the other. It is worth noticing that because products are substitutes, wages are strategic complements in the labour market, so an increase in the wage of union 2 will make union 1 to set a higher wage, or in other words \(\frac{\partial w_1}{\partial w_2}>0\). A Nash equilibrium in this setting is a pair of wages such that \(w_1^* = w_1(w_2^*)\) and \(w_2^* = w_2(w_1^*)\), the solution to this system of equations is

Here, the denominator indicates how wages are affected by the externalities that products pose on each other because of quantities. Obviously, they depend positively in the taste parameter of their own product and negatively with the quantity produced by the other product, which is denoted here by \(\frac{\alpha _2 \gamma - \alpha _1\beta _2}{\beta _1\beta _2-\gamma }\). Plugging 9 and 10 into 7 and 8, the union’s objective functions are

which should be compared to those when unions coordinate their actions.

2.4 Union coordination

Following the outline of the previous point, the first-order conditions, wages, and objective functions of unions are derived when they decide to coordinate their actions. In this case, they will maximise their utilities as if they were colluding, nonetheless, each union sets its own wage according to its demand schedule. The key factor to bear in mind is that unions internalise the possible negative externalities that they might pose on each other upon setting the wage. The objective function of each union isFootnote 4

As mentioned before they maximise their objective function as if they were one, the objective function that both unions maximise is

Applying the first-order conditions over (15)

Again these are the reaction functions of one union with respect to the wages of the other union. Comparing the reaction function with and without coordination, we see that in the former unions weigh wages differently, actually, they double the weight given to wages of the other union so as to internalise any negative externalities. Of course, the other difference is the coordination cost.

Now, in this case, the change in wage provokes a stronger reaction in the other union. Solving the system of equations

Notice that in this case there are no cross effects of one wage into the other, clearly, unions take into account the externalities that they exert into each other and minimise them when coordinating, or in other words, they behave so as to remove the externalities. This leaves the final result as an average between the costs of coordination and the willingness to pay for the product, intuitively unions demand higher wages to compensate for the increases in costs. As shown by the objective function of the unions, higher wages come with the downside of depressing demand for labour. The corresponding objective functions at the optimal wages are

Before we jump to the direct comparison of functions under both situations, it will be illustrative to work out the change in objective functions when the costs of coordination change at the time of coordinating. Looking at the expressions 13 and 14 there is one direct effect of how costs affect the value of the union and another indirect effect via labour demand. Without loss of generality, we can Differentiate the objective function of union 1 with respect to the costs of coordination

The final effect will depend on the net forces acting on the labour demands, at this point I shall assume that the wage bill, net of costs, becomes smaller with the costs of coordination.

2.5 Coordination vs non-coordination

At this stage unions decide whether to coordinate or not, they compare the value attained under both situations. Union 1 decides to coordinate whenever:

and seemingly for union 2. Solving for the costs of coordination in the quadratic inequality 20, the next proposition states that

Proposition 1

Firms decide to coordinate whenever \(c \le \hat{c}^M:= \alpha _1 -\frac{1}{2(\beta _2-\gamma )}\) \(\left( \alpha _2 \gamma - \sqrt{\Phi } \right) \) where the expression of \(\Phi \) is left in the Appendix A.1.

Proof

Solve for c in (20). The positive part can be discarded since the cost of coordination cannot be higher than the taste parameter.

The equality derived in the previous proposition is a difficult and hardly explorable expression. In order to illustrate the point made in this paper some further assumptions are to be taken into account. I shall assume that goods have some degree of substitutability, for which \(\alpha _1=\alpha _2=\alpha \) and \(\beta _1=\beta _2=\beta \), then \(\frac{\gamma }{\beta }\) is a measure of the substitutability of the goods. Following the same steps as in the previous proposition, Proposition 1 is rewritten as follows:

Proposition 2

Unions decide to coordinate whenever \(c \le \tilde{c}^M:= \alpha - \frac{2\alpha \sqrt{\beta (\beta -\gamma )}}{(2\beta -\gamma )}\).

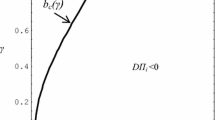

Clearly, the more substitutable goods are the greater the negative externalities that unions pose on each other. The reason is that consumers can trade off one good for the other without diminishing much their utility, the firm takes advantage of this fact by providing a close substitute good from abroad, reducing the capacity of unions to demand a wage rise. When unions coordinate their action they offset these externalities, but concerting their actions comes at a cost. Then, unions will decide to act as a monopoly at an international level, whenever the savings of internalisation are above the costs of coordination. Figure 1 shows the region of coordination in the \(c\gamma \)-plane. As it is clear from the graph the more substitutability between the goods the larger the minimum cost for which they start to coordinate. For illustration purposes consider the line \(\gamma = 0.3\), for which the minimum cost below which they start coordinating is \(c=0.1\), any cost less than that will cause the unions to go together, and to negotiate separately for higher values of c.

The point done in the previous paragraph is made clear in Fig. 2. For \(c=0.1\), we see how the objective functions of the unions behave for different levels of substitutability. When \(\gamma =0\), both markets are independent and the firm acts as a monopoly in each market, obviously the value of the unions of not coordinating is higher than when coordinating as they incur in a cost but there are no externalities to be internalised. Union values under each situation are decreasing on the substitutability of goods; however, the rate at which the value of a union decreases is faster under non-coordination that under coordination, because of the internalisation. As a limiting example, when goods are perfect substitutes, i.e. \(\gamma =\beta \), the firm is able to extract all the surplus from the unions. If a union raises its wage marginally more than the other union, the firm will swift all the production to the other plant and will operate from there. This is not so when unions coordinate, in this case, unions raise wages in both plants, preventing the firm from flooding domestic markets with goods from other countries and retaining part of the surplus for themselves.

2.6 Welfare analysis and outcomes

Regarding the social welfare, it is fair to ask if the coordination decisions of unions are socially desirable. Also, it is important to acknowledge how the different components of the welfare change under both situations. In this respect, the social welfare function is defined as

where k indicates the coordination structure, either unions are coordinated \(k=C_M\) or they are not \(k=N_M\). Remember that the production technology is such that one unit of the good is produced with one unit of labour. What is more, because the objective functions of consumers, the firm and the unions are linear in \(q_i\), the revenues of one agent is the cost of the other, simplifying the above expression to

This expression will allow us to evaluate the possible gains or losses of the decisions of unions, which is stated in this proposition:

Proposition 3

Social welfare is superior under non-coordination than under coordination, i.e. \(W\left( \textbf{q}^{N_M}\right) \ge W\left( \textbf{q}^{C_M}\right) \)

Proof

See Appendix B.1.

From Proposition 2, we can consider two cases. On the one hand, \(c>\tilde{c}^M\) and unions decide not to coordinate because the would be worse off. On the other hand, \(c\le \tilde{c}^M\) and unions collude. Table 1 summarises the outcomes of prices, product/labour demands and wages for the second case. Direct comparison of both states shows that prices and wages are higher under coordination, whereas product demand, or equivalently labour demand, is lower.

Clearly, the fact that social welfare is lower in the case of union coordination does not mean that every agent is worse off, indeed unions are better off as a result whereas the firm and consumers are both of them worse off, below is left a sum-up table with the main idea (Table 2):

Particular forms of profits and consumer surpluses are left in the Appendix to be compared.

3 Right-to-manage model of union coordination

In reality, unions cannot set the wage unilaterally but have to bargain with the employer to a certain wage level, whereas the employer retains the right-to-manage. Under this scenario union’s strategies do not generate as many externalities as in the monopoly case and the profits of internalisation are lower, then unions find it relatively more costly to coordinate and the chances of collusion are lower. So why unions hold less bargaining power? In the negotiating process, there are several factors that tilt the balance towards the side of the employers’ associations.

First of all is the density, or the share of workers affiliated to a union. Trade unions have had a constant decline of membership since the 1980s across the developed world due to a changes in law and the production technology (Addison 2020). So employers can substitute unionised with non-unionised labour more easily and better impose their wage demands.

Secondly the free-rider problem. Collective agreements are a source of public goods from which free-riders can reap the benefits of the union without being affiliated, which ultimately lowers their bargaining position (Booth 1985; Booth and Bryan 2004).

Apart from that, how easy it is for employers to substitute labour for other factors of production affects the union’s position to negotiate. Even if the union has the monopoly of the labour supply, when labour and capital are highly substitutable, employers can swiftly replace workers with capital to circumvent the union’s demands.

Without being exhaustive, the bargaining structure also affects the outcomes of the negotiation, either by the level of bargaining or because of the intense coordination among different unions (Calmfors and Driffill 1988). Also Visser (2013) thoroughly examines the impact of the structure of negotiation over bargained outcomes across OCDE countries after the Great Recession. The gist of his paper is that different structures lead to bargaining outcomes closer or farther from the union’s objectives.

All of these factors erode the union’s capacity to negotiate, also empirical analysis suggests that still unions bargain wages that are well above the reservation wages of workers, so there must be a point in between where the union can impose at least some of its demands. How close unions are to the competitive outcome or the monopoly union is an empirical matter not analysed here. However, it is illustrative to consider how unions change their decisions as their bargaining position changes.

3.1 No union coordination

In this section, as well as the following ones, I assume that goods have some degree of substitutability, i.e. \(\alpha _1 = \alpha _2=\alpha \) and \(\beta _1 = \beta _2 \ne \gamma \). The step that is changing is the bargaining solution between the union and the firm, hence the consumer’s utilities and the firm reaction functions with respect to the product of each plant are still the same.

The wage that unions and the firm negotiate over, solves the following Nash-Bargaining programme:

Clearly, for the particular case when \(\delta = 1\), we are back to the monopoly union model. As in the previous section, the wage of union 1 depends on the one set by union 2, solving the system of equations for each wage, the result is

In the limiting case in which \(\delta = 0\) the wage attained by the union coincides with the reservation wage, which here has been normalised to 0. The corresponding objective function of the union under this regime is

Naturally, as unions have less bargaining power as in the monopoly union model the value the objective function attained under the right-to-manage model is lower for values of \(\delta \in (0,1)\). This can be proven by direct comparison

which is true for every value of \(\delta \in [0,1)\).

3.2 Union coordination

If both unions decide to coordinate the decision vector takes the value \(\textbf{d} = (1, 1)\). There is only one problem that needs to be solved with respect to both wages, namely

Since the problem is symmetric both unions set the same wage, which is

The negotiated wage is the average between what the union can extract from the product and the costs it has to bear, weighted by the bargaining power. It is reasonable that the higher the bargaining power of the union the more can be extracted from the product and bears less of the costs. Plugging this wage into the objective function of the union when coordinating, we arrive at

As in the case of non-coordination, the value attained under the right-to-manage model is always lower than under the monopoly union, which can be proven again by direct inspection of the two value functions:

for \(\delta \in [0,1)\).

3.3 Comparison under right-to-manage model

In order to know the cost threshold from which unions start coordinating, we have to compare the objective functions under both situations:

The next proposition applies for the right-to-manage model

Proposition 4

-

1.

Unions decide to coordinate whenever \(c< \tilde{c}^R:= \alpha -\frac{2\alpha \sqrt{\beta (\beta -\gamma )}}{(2 \beta -\gamma )}\frac{1}{\sqrt{\left( 1-\delta ^2\right) }}\)

-

2.

\(\tilde{c}^R<\tilde{c}^M, \quad \forall 0<\gamma <\beta \).

Proof

-

1.

Solve for c in (22). The positive part can be discarded since, for the problem to be well defined, the cost of coordination cannot be higher than the taste parameter.

-

2.

\(\tilde{c}^M-\tilde{c}^R= \frac{1}{\root \of {1-\delta ^2}}-1>0\)

The second part of the proposition states that: for unions to coordinate abroad they need to be strong at home. As one can see from Fig. 3, the coordination region under the right-to-manage shrinks as the bargaining power of unions decreases. This is because, having less bargaining power in their respective countries the gains of coordination are smaller. In this case, for a given level of substitutability of goods, the threshold at which unions start coordinating is much lower, meaning that they are not willing to assume as many costs as when they are a monopoly. The first point of the proposition goes along the same lines as in the monopoly model, meaning that when costs are sufficiently low unions will decide to coordinate.

Figure 4 shows a direct comparison of objective functions under both regimes and decisions, from the figure, we can distinguish four regions. First, that under sufficiently low costs of coordination, coordination is always a superior outcome for the union than no coordination under both regimes. Second, for high enough costs, unions will always decide to negotiate vis-a-vis with the company, as the gains are not sufficient to cover the costs. Third, if these costs were in an intermediate range, the union would be better off negotiating on its own, provided it had monopoly power. And last, for this intermediate range it could be the case that the union would decide to coordinate before not coordinating, provided it had enough bargaining power (see that no coordination is still superior).

4 Different costs

This section analyses the consequences of dropping the assumption of equal costs of coordination. The difficulty of this analysis resides in accounting from the feedback effect of the costs of one union into the reaction function of the other. The main result is that both costs need to be relatively low in order to induce workers’ representatives to coordinate. It is not sufficient that only one of the unions has low costs, since it would be willing to reduce the wage to increase employment, persuading the firm to export the production to the foreign country. Consequently, the firm would reduce production and employment in the foreign plant, leaving the foreign union with less benefits when colluding. Finally, if coordination benefits turn out to be too small, actually lower than the cost of coordination, the foreign union will not cooperate.

There are several reasons of why unions might face different costs upon collusion. Maybe some unions are more efficient at organising or some union leaders are more willing to take action towards coordination than others. Another possible rationale could be the disparity of legal frameworks among countries, protecting or making it easier for unions to take action in this way. Also, different financial strength is a key factor preventing unions from organising abroad. Of course, other reasons make different costs of coordination plausible, like employers’ actions to prevent union coordination among others.

4.1 Comparison under different costs

Here, we turn back to the monopoly union model with substitutable goods. The difference with respect to Section 2 is in the objective functions of unions when they coordinate. The functions to consider now are

Since unions have all the bargaining power, they just need to choose the wages that fit them best, under differentiated costs, the wages are as follows:

The interpretation of these expressions goes along the same lines exposed in Section 2. As it is the case in the previous sections, wages should increase linearly with the costs of coordination. Notice that unlike Straume (2002), unions do not necessarily agree to a common wage, but they choose the one according to the productivity of their plant. The utilities when coordinating are as follows:

Before we jump to the direct comparison of functions under both situations, it will be exemplified to work out the derivative of the objective function with respect to both coordination costs. Looking at the expressions 23 and 24 there is one direct effect of how costs affect the value of the union and another indirect effect via labour demand. Differentiating the objective function with respect to both costs of coordination

The interesting equation is the second one, it shows that the wage bill net of coordination costs is increasing in the costs of union 2, as explained previously unions raise their demand for higher wages to partially offset costs of coordination when this is done by union 2 it depresses its demand for labour and products. The firm partially fills the void with the product of the other brand, raising the demand for labour in country 1 and increasing its wage demands as a consequence. Conversely, a reduction in the costs of union 2 means lower utility for union 1, this reduction in utility might lead to union 1 opting out of an agreement. Regarding the first equation, it states what intuition previously suggested, that the wage bill net of coordination costs is decreasing in these costs.

When comparing utilities, we can discern the regions under which both unions coordinate for a given cost of the other union, the utilities to be compared are as follows:

As said before the objective function of the union when it does not coordinate under different costs is the same as in the monopoly union model. Then, with no loss of generality

Proposition 5

Union 1 decides to coordinate whenever

Proof

Same steps as in Proposition 1.

The same equation applies for the region of the other union as the problem is symmetric. This equation sets the maximum cost that a union is willing to bear in order to coordinate actions. If union 2 has an increase in costs of coordination, it means that union 1 will be more willing to coordinate since it will be able to reap more profits out of the relation. The maximum cost that union 1 can bear is \(\alpha \) which is the price of the product at which the demand is zero, and this is stated in the following proposition.

Proposition 6

The maximum value at which union 1 is willing to coordinate as \(c_2\rightarrow \infty \) is \(\hat{c}_1(c_2)=\alpha \)

Proof

Complete the square for the terms related to \(c_2\) inside the squared root and discard the rest as \(c_2\rightarrow \infty \), since they become arbitrarily relatively small. Then, operate and the result follows.

Of course, this is from the point of view of union 1, the other union will face the same situation. It is the case that for high costs of coordination for union 2, it will no longer be willing to collude. Since the problem is symmetric both unions will have to have relatively low levels of costs for the coordination to be profitable. However, the relation is not linear, the fact that unions are willing to coordinate for a given level of costs does not imply that for lower cots of one union the relation is still profitable for both of them. Actually, It might be the case that for lower costs of the rival union, it might not be able to extract enough profits out of the relationship.

For example, consider the orange-shaded region in Fig. 5a. This is the region of under which union 2 is willing to coordinate as the costs of union 1 change, and seemingly for the blue-shaded area. The double-shaded area is the region where both of them coordinate. Now take a look at the locus (.1, .1), at this point, both are willing to coordinate; however, if one of the unions would have lower costs of coordination, e.g. \(c_2\) is lower, it would be able to extract more from the relation leaving the rival union with less to enjoy, making the relation to breaking apart.

In summary, in order to unions to be willing to coordinate actions, costs of coordination of each union have to be relatively small for each other. Or in other words when \(c_1\le \hat{c}_1(c_2) \) and \(c_2\le \hat{c}_2(c_1)\) ought to be met simultaneously.

To gain more insight, we can see how these regions change as we consider goods with different grades of substitutability. In Fig. 5b, the light-shaded area represents the regions in which unions are keen to coordinate, this works along the same lines as Fig. 5a. As goods with less grades of substitutability are considered unions are less agreeable, the regions at which they could reach an agreement shrink, dark-shaded area. As in previous sections, the negative externalities that they pose on each other become smaller and the levels of costs that the are keen to support become smaller as well.

5 Discussion

Coordination costs have remained constant throughout the paper. Still, one could ask the role of unions in dealing with these costs. There are examples of unions that create international organisations able to cope with different legal frameworks or coordinate financial resources to those subsidiaries where their effect are felt most, and hence they reduce the costs of collusion. In line with supranational organisations, deeper integration at the international level is needed to avoid fails of coordination. A good example of such an international organisation is the European Trade Union Confederation (ETUC).

Another issue is, what policy makers can do and what are the effects on welfare? Of course, the policy implemented depends on the agenda of the policy maker. A policy maker worried about worker’s welfare could harmonise the legal framework with countries that domestic MNEs trade most; also, financial resources can be provided to promote collusion across borders. This comes at a cost, overall welfare would be diminished due to unions being potentially able to coordinate and reduce production. A policy maker worried about total welfare could maximise it by making coordination costs sufficiently high so as to avoid the domestic union coordinating, as one needs the agreement of both unions.

A policy maker can also act on the bargaining power of unions, which is a key element of coordination. To this end, a policy maker that cares for unions could give more bargaining power to them, for instance by protecting union leaders and workers from employer’s harassment. To this end, unions could gain in the two margins, because they can extract more rents from their current employers and because they can coordinate. As in the previous paragraph, the same discussion applies for a policy maker who worries about total welfare.

6 Conclusion

In this paper, I have shown that in situations with deep product integration and harmonised legal systems like the EU, unions are interested in coordinating their actions because their strategies are very interrelated and transactional costs are low. In other instances with deep integration of production chains but very different legal systems, like the USA-China trade relationship, union coordination is not profitable. Upon coordination, unions ration labour, decrease production, and thus total welfare.

Also, two extensions were considered. In the first one, I have shown the right-to-manage model in which unions hold less bargaining power, maybe because the legal framework makes it difficult to organise workers or policy makers not interested in cross-border union collusion. As a result, unions’ actions did not produce large externalities so as to compensate for the costs of coordination. Hence the coordination region shrinks accordingly.

In the second extension, I considered different costs of coordination for each union, thinking of a legal framework that eases the organisation of workers like the Nordic countries, against one that prevents it like Hungary. Clearly, it was not enough that unions have low coordination costs, but they must be relatively low with respect to each other; too low transactional costs for the foreign union reduce the wage demanded by it, and the firm shifts production from the domestic product to the foreign one and the domestic union losses from coordination.

Notes

The assumption of the quadratic utility function is for simplicity. Nonetheless, a similar result would be obtained with a utility function that leads to an iso-elastic product demand as pointed out by Naylor (1995)

Look at Singh and Vives (1984) second and third notes for conditions of imperfect and perfect substitutability and the range of gamma.

Here, c captures the notion of costs associated with the number of workers to coordinate, which affects the decision to coordinate and the strategy of unions. However, considering a fixed cost, say F, would trivially affect the decision to coordinate but not the strategy of unions, see Subsection 2.4 for reference.

Setting \(c=0\) and adding a fixed cost F, it is clear that F does not affect the point at which union maximises utility, even though externalities have to be greater than F for coordination.

References

Addison JT (2020) The consequences of trade union power erosion. IZA World of Labor

Booth AL (1985) The free rider problem and a social custom model of trade union membership. Q J Econ 100(1):253–261

Booth AL (1995) The economics of the trade union. Cambridge University Press

Booth AL, Bryan ML (2004) The union membership wage-premium puzzle: is there a free rider problem? ILR Rev 57(3):402–421

Borghijs A, Du Caju P (1999) EMU and European trade union cooperation

Buccella D (2013) The sustainability of unions wage coordination in an integrated economy. Int J Sustain Econ 5(1):53–75

Calmfors L, Driffill J (1988) Bargaining structure, corporatism and macroeconomic performance. Econ Policy 3(6):13–61

Charles RB (1984) Optimal wage bargains. Economica 51(202):141–149. https://www.jstor.org/stable/2554206

Eckel C, Egger H (2017) The dilemma of labor unions: local objectives vs. global bargaining. Rev Int Econ 25(3):534–566. https://doi.org/10.1111/roie.12273

Kopel M, Putz EM (2021) Information sharing in a Cournot Bertrand duopoly. Managerial and Decision Economics

Larsson B (2012) Obstacles to transnational trade union cooperation in Europe - results from a European survey. Ind Relat J 43(2):152–170. https://doi.org/10.1111/j.1468-2338.2012.00666.x

Lommerud KE, Straume OR, Sørgard L (2006) National versus international mergers in unionized oligopoly. RAND J Econ 37(1):212–233

Mezzetti C, Dinopoulos E (1991) Domestic unionzation and import competition. J Int Econ 31:79–100

Naylor R (1995) Product market competition, bargaining and trade. Mimeo

Naylor R (1999) Union wage strategies and international trade. Econ J 109:102–125. https://doi-org.are.uab.cat/10.1111/1468-0297.00394

Schmidt V, Keune M (2009) Global capital strategies and trade union responses: towards transnational collective bargaining? Int J Labour Res 1(2):9–26. https://hdl.handle.net/11245/1.325802

Singh N, Vives X (1984) Price and quantity competition in a differenciated duopoly. Rand J Econ 15(4):546–554. https://doi.org/10.2307/2555525

Straume OR (2002) Union collusion and intra-industry trade. Int J Ind Organ 20(5):631–652. https://doi.org/10.1016/S0167-7187(01)00091-1

Visser J et al (2013) Wage bargaining institutions–from crisis to crisis. European Economy-Economic Papers 2008–2015 (488)

Zhao L (1995) ECONOMIC. Cross-hauling direct foreign investment and unionized oligopoly. Eur Econ Rev 39:1237–1253

Acknowledgements

I would like to thank an anonymous referee for their valuable comments. I also gratefully acknowledge the financial support of the Autonomous University of Barcelona through the contract ‘Personal Investigador Pre-doctoral en Formación’ and the support of the European Research Council (ERC), through Starting Grant n. 804989.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A. Functional forms

1.1 A.1 Form of \(\Phi \)

The form of \(\Phi \) in Proposition 1 is

1.2 A.2. Forms of firm profits and consumer surplus

Expressions of firm profits are as follows:

-

\(\Pi _1^{N_M^*} = \frac{\beta _1 \beta _2 \left( \alpha _2^2 \beta _1 \left( 3 \gamma ^2-4 \beta _1 \beta _2\right) +\alpha _1^2 \beta _2 \left( 3 \gamma ^2-4 \beta _1 \beta _2\right) +2 \alpha _1 \alpha _2 \gamma ^3\right) }{4 \left( \gamma ^2-4 \beta _1 \beta _2\right) {}^2 \left( \gamma ^2-\beta _1 \beta _2\right) }\)

-

\(\Pi _1^{C_M^*} = \frac{\alpha _2^2 \beta _1+\alpha _1^2 \beta _2-c^2 \left( -\beta _1-\beta _2+2 \gamma \right) -2 \alpha _2 c \left( \beta _1-\gamma \right) -2 \alpha _1 \left( \alpha _2 \gamma +c \left( \beta _2-\gamma \right) \right) }{16 \left( \beta _1 \beta _2-\gamma ^2\right) }\)

And those of consumer surpluses are as follows:

-

\(CS^{N_M^*} = \frac{\beta _1 \beta _2 \left( \alpha _2^2 \beta _1 \left( 3 \gamma ^2-4 \beta _1 \beta _2\right) +\alpha _1^2 \beta _2 \left( 3 \gamma ^2-4 \beta _1 \beta _2\right) +2 \alpha _1 \alpha _2 \gamma ^3\right) }{8 \left( 4 \beta _1 \beta _2-\gamma ^2\right) {}^2 \left( \beta _1 \beta _2-\gamma ^2\right) }+q_0\)

-

\(CS^{C_M^*} = \frac{\alpha _2^2 \beta _1+\alpha _1^2 \beta _2+\beta _1 c^2+\beta _2 c^2-2 \gamma c^2-2 \alpha _1 \left( \alpha _2 \gamma +c \left( \beta _2-\gamma \right) \right) -2 \alpha _2 \beta _1 c+2 \alpha _2 \gamma c}{32 \left( \beta _1 \beta _2-\gamma ^2\right) } + q_0\)

Appendix B. Proofs

1.1 B.1 Proof of Proposition 3

We claimed that

For our purposes, it will suffice to show that \(U\left( \textbf{q}^{N_M}\right) - U\left( \textbf{q}^{C_M}\right) \ge 0\), since the second term in the right-hand side enters with a negative sign. After substituting the expressions of quantities in the utility functions, we arrive at

First, let us focus on the first and third terms. Notice that \(\beta _1,\beta _2>\gamma \), then expressions in parenthesis in these terms are positive, the rest are positive parameters or quadratic expressions and as a result, they are positive as well. The second term is clearly positive because of the conditions stated in Section 2. The fourth term requires more work to sign it, the interesting term is the one set in parenthesis which can be written as

Notice that the matrix A is positive definite and as such \(x^TAx>0, \quad \forall x\in \mathbb {R}^2\), as a consequence the final term is positive concluding the result.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Perez-Sanz, R. International monopoly union coordination under the presence of externalities and costs. Int Econ Econ Policy 21, 181–205 (2024). https://doi.org/10.1007/s10368-023-00581-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-023-00581-w