Abstract

Bioethanol production from rice-straw is carbon neutral and less competitive with food supplies, so it provides great possibilities for resolving global issues. This study aims to conduct economic and environmental evaluations on rice-straw bioethanol production in Vietnam, where huge amounts of unused rice-straw are available, by a top–down life-cycle assessment by means of an input–output table. The economic impacts are evaluated by total costs, total production, and total added value; the environmental impacts are assessed by greenhouse gas emissions with consideration of life-cycle, i.e., the plant construction phase, production phase, and plant scrapping phase. Three technology scenarios are assumed: (1) present technology, (2) advanced technology with higher conversion rates, and (3) innovative technology with a new production method and economies of scale. The results demonstrate that, first, rice-straw bioethanol production can reduce annual gasoline consumption by more than 20 %, and plant construction costs account for 8–22 % of the total investment in Vietnam. Second, under the present technology, both economic and environmental net benefits are negative. However, the innovative technology makes both benefits positive. Third, under the advanced technology, the environmental net benefit is positive, while the economic net benefit is negative. This implies that satisfying economic viability is more difficult than attaining environmental viability in rice-straw bioethanol production. Therefore, technological development and transfer are necessary to make rice-straw bioethanol production feasible.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A reduction in emissions of greenhouse gases (GHG) is a critical issue for sustainable growth of economies and mitigation of global warming. One effective strategy to reduce GHG is the promotion of renewable energy such as bioethanol, solar power, and wind power. Bioethanol can be carbon neutral and directly substituted for fossil oil used in vehicles. In particular, if bioethanol is produced from non-edible parts of agricultural products, it can be less competitive with food supplies. As the prices of fossil fuels and food are rising, researchers as well as business organizations pay great attention to bioethanol produced from rice-straw, a by-product of rice production. Hence, it is called second-generation bioethanol.

Vietnam produces crude oil but has only one refinery within the country. The crude oil is exported to neighboring countries, such as Singapore, to be refined and then re-imported. Even with a rise in world oil prices, Vietnam does not benefit because the rise in imported oil prices cancels the export benefit. On the other hand, Vietnam is one of the largest rice-exporting countries, so there are huge amounts of rice-straw burnt or left unused in the fields. If rice-straw can be used as an energy source, Vietnam can receive economic benefits. In this sense, Vietnam has a great economic motivation to produce rice-straw bioethanol. As that symbol, an experimental rice-straw bioethanol production was launched at the Ho-Chi-Minh City University of Technology with support from JICA (Japan International Cooperation Agency) and JST (Japan Science and Technology Agency) in 2010. The authors participated in this project. The project is called “Sustainable Integration of Local Agriculture and Biomass Industries” and aims to commercialize rice-straw bioethanol plants across Vietnam. This study drew experiences from this project.

Environmental effects of bioethanol production are generally evaluated by life-cycle assessment (LCA). There are several previous studies applying LCA to bioethanol production in Thailand (Silaertruksa and Gheewala 2009; Nguyen et al. 2007; Papong and Malakul 2010), China (Ou et al. 2009; Fukushima and Chen 2009) and Japan (Saga et al. 2010; Koga 2008; Ueda 2011). These studies pointed out that the substitution of bioethanol for gasoline consumption reduced GHG emissions, but some of the studies ignored other related processes, such as agricultural production and scrapping of a plant. Furthermore, the degree of improvement varied with differences in the raw material crop and the country (von Blottniz and Curran 2007), so LCA should be modified according to the objects and country.

Economic efficiency of bioethanol production using corn in the US was evaluated (Urbanchuk 2009) and cost-benefit analysis was applied to the production plant (Polagye et al. 2007). As for Asian countries, Hu et al. (2004) examined the economic benefits of bioethanol production using sugar cane in China. Hayashi (2010) measured the ripple effects of bioethanol produced from sugar beet in Japan. These studies showed that first-generation bioethanol production was effective under the increasing trends of oil prices in the world, if material costs were kept relatively low. As far as we know, there were few comprehensive studies that evaluate the economic viability of rice-straw bioethanol production in Asian countries where a large amount of rice-straw is produced.

The present study aims to show the economic and environmental impacts of rice-straw bioethanol production in Vietnam. This study (i) targets second-generation bioethanol production, (ii) assesses life-cycle economic and environmental effects with three different technology scenarios, and (iii) uses the 2009 input–output (I/O) table estimated from the GTAP-7 database which was commonly used in economic analyses.

Methodology

Estimation of production potential

The weight of rice-straw generated is considered proportional to the total weight of rice harvested. Thus, the available amount of bioethanol production with rice-straw, Q BE, is

where Q RICE is the annual production of unpolished rice (ton/year) published in the Statistical Yearbook of Vietnam (Statistical Bureau of Vietnam); SRR is the dry weight ratio of rice-straw to unpolished rice produced; UR is the ratio of usable rice-straw, which is currently burnt in the field against total rice-straw produced; and CR is the conversion rate.

Rice is usually grown twice or three times a year in Vietnam. The period between one planting and the next is short, so there is not enough time for rice-straw to decompose in the soil. Some farmers burn rice-straw in the field even though such burning is prohibited by the government. Some rice-straw is collected from the field for use in compost and feed of cows, but this amount is small. If farmers are paid collection costs, rice-straw can be used as a material for other purposes. Hence, the use of rice-straw as a material for bioethanol production does not degrade fertility of farmland and does not change the present style of farming and livestock feeding, if collection is not excessive.

According to a field survey in Thailand (Mori et al. 2004), where the style of rice farming is similar to Vietnam, the value of UR was 0.2–0.6 depending on farmers, so 0.2 is used as a moderate estimation. SRR is set as 1.1 according to our field survey results in Thai-My Village near Ho-Chi-Minh City. CR is assumed to be 150 L ethanol/dry ton of straw after considering experimental data obtained from our plant in Ho-Chi-Minh City. When CR is increased under advanced and innovative technologies as explained later, the total amount of bioethanol production can be increased. However, to equally set the conditions, the total amount of production is assumed the same and some rice-straw remains unused under these technologies.

Estimation of production costs, plant construction costs, and scrap costs

Since production costs vary depending on technology, three technology scenarios are assumed for cost estimation. The characteristics of each technology scenario are as follows:

-

Present technology: uses the concentrated sulfuric acid hydrolysis method to hydrolyze rice-straw and uses natural yeast for fermentation. Production scale of the plant is assumed to be 20 million L/year, a minimum for commercial bioethanol plants using corn in the US.

-

Advanced technology: also uses the concentrated sulfuric acid hydrolysis method and scale of plant is the same as the present technology, but conversion rate (CR = 240 L/ton) is 1.6 times higher than the present technology.

-

Innovative technology: uses a new production process, Wet Disk Milling Pretreatment Method, developed by the National Institute of Advanced Industrial Science and Technology (AIST), and the conversion rate (CR = 366 L/ton) is 2.44 times higher than the present technology. In addition, scale of the plant is 70 million L/year so as to materialize economies of scale. This method first breaks down the lignin in the rice-straw with heated water and mechanochemical treatment and then simultaneously carries out both saccharification by enzymes and fermentation by yeast in a single tank. The processing time can be shortened and the efficiency of saccharification can be improved (Hideno et al. 2009).

Annual production costs are based on the results of previous studies. Costs under the present technology are estimated on the basis of Shiina et al. (2009), while costs under the advanced and innovative technologies basically follow the values of Asano and Minowa (2007). These studies categorized the production costs into material costs, management costs, repair costs, labor costs, and capital costs. In addition to these costs, we add the cost of waste treatment which is 20 % of the material costs. As for the material costs, Asano and Minowa (2007) included woody materials in addition to rice-straw. We therefore do not employ their values, but assume the material costs under advanced and innovative technology to be 63 and 41 %, respectively, of the costs under the present technology. These rates are calculated by (CR in the present technology)/(CR in both technologies). Furthermore, production costs in the previous studies are for Japanese rice-straw bioethanol plants, so they may differ from the actual costs in Vietnam. Hence, we modify these costs based on experiences in our experimental plant built in Ho-Chi-Minh City. Table 1 shows the cost items, the corresponding input sectors in the I/O table and supplementary explanations about the estimations. Given these costs, a gap exists between the production costs and the market price, which is assumed to be the same as the gasoline price ($0.96/L) to compete in the market. Such a gap is fulfilled by subsidies from the government or surplus of the producers. In the I/O analysis, the total costs of rice-straw bioethanol production in the whole country of Vietnam are set equal to the input values after multiplying the unit costs (dollar per liter) by the total production calculated with Eq. 1.

Construction costs, which appear as investment input in the I/O analysis, are similarly drawn from Shiina et al. (2009) and Asano and Minowa (2007) and then modified to Vietnamese costs as capital costs according to the methods described in Table 1. To quantify the input values for the construction costs by sectors, the total construction costs in each technology are divided into the values in each sector by the converter, the share rate of input by sectors, of private investments in the I/O table. Here, the cost components of the bioethanol production plant are assumed to be the same as those of other plants shown in the present I/O tableFootnote 1.

Scrap costs for the plant are assumed to be 10 % of the construction costs and half of the costs are input from the construction sector and the other half from the public service sector including waste treatment. These numbers are drawn from the cost-benefit analysis of irrigation and drainage facilities in Japan.

Estimation of the latest I/O table

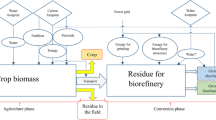

A top–down LCA method based on the I/O analysis has an advantage in that it easily maintains consistency in economic and environmental evaluations. We measure the ripple effects as total production and total added value induced from investments for plant construction from the annual production after plant completion and from the scrap of the plant. Induced production is then used for environmental evaluations.

A base I/O table is derived from the Global Trade Analysis Project ver. 7 (GTAP-7) database developed by Purdue University. The number of sectors in the I/O table is 57. Precise information about the sector classifications is explained by Narayanan (2011). We use the GTAP database rather than a domestic table in Vietnam because the balance of input and output is fully satisfied in the GTAP database. In addition, the database makes available the GHG emission coefficients that are consistent with outputs of each sector.

The Vietnamese economy has rapidly grown in recent years so the GDP in 2009 was 1.8 times higher than in 2004, the reference year of the GTAP database. To reflect recent economic development, the base I/O table is modified with national account statistics and the RAS method to create a 2009 table. The method to estimate the 2009 I/O table from the original 2004 I/O table is as follows. First, we calculate the rate of change in the total production, total consumption, total investment, total import, and total export between 2009 and 2004 from data in the Statistical Yearbook of Vietnam. Total values in the intermediate inputs and final demands are estimated for sectors and components by multiplying these rates. Second, the total values are set as the control total and then the RAS method is applied to balance the matrix of intermediate input coefficients. Third, the total values of added value and final demand by sectors are calculated by subtracting the total intermediate inputs from the total production. The labor costs, capital costs as annual depreciation, management surplus, and tax minus subsidies in the added value are then calculated with a converter, i.e., the share rate of these values. The values of final demand for each sector and term, i.e., consumption, investment, export, and import, are also calculated with a converter in the same way as the added value.

Induced production and induced GHG emissions

Based on the estimated I/O table, the induced production (X) and the induced added value (Y) as economic impacts are estimated by the model with endogenous consumption. This model is defined as (Miyazawa 1975; Okuyama et al. 2010)

and,

Hereafter, gothic characters show the vector or the matrix. B is the inverse matrix calculated by \( {\bf{B}} = \left[ {{\bf{I}} - \left( {{\bf{I}} - {\bf{M}}} \right){\bf{A}}} \right]^{ - 1} \); I is the identity matrix; M is the import coefficient matrix; A is the matrix of the intermediate input coefficients; C is the consumption coefficient vector that shows the consumption of each commodity against one unit of income increase; and K is the multiplier related to the income increase and calculated by \( {\bf{K}} = \left( {{\bf{I}} - {\bf{VBC}}} \right)^{ - 1} \); V is the income coefficient vector that shows the income increased against one unit of production in each industrial sector; V′ is the vector of the added value rate that shows the rate of the added value occupied in the production of each industrial sector; ΔF X is the vector of the increase in the final demand relating to the intermediate industry; ΔF Y is the scalar of the increase in labor income; and ΔF Z is the scalar of the exogenous increase in the added value except for labor income. A, M, V, and V′ are computed from the 2009 I/O table estimated above, and C is calculated by multiplying the average propensity of consumption (0.67) with the share rate of commodity consumption in each sector.

The first term on the right side of Eq. 2 is the ripple effect induced through the industry linkage among intermediate industries (the first effect). The second term is further ripple effects induced through the following steps (the second effect). The first effect improves labor income as labor costs in each sector and then increases consumption that becomes demand for intermediate production in each sector. This process repeats at the next stage by increasing consumption with some leakage through savings until the increased production converges with zeroFootnote 2. The third term shows another ripple effect caused by exogenous income, inducing consumption through an increase in the intermediate demand (the third effect). As shown by a comparison of Eqs. 2 and 3, this model does not consider induced production caused by an increase in ΔF Z .

ΔF X is respectively substituted with the construction investments of the plant, expenses for annual production regarding with intermediate inputs, and expenses for scrapping the production plant. ΔF Y is respectively substituted by the labor costs required for production as labor income, surplus occurring from the gap between selling price and production costs, and subsidies (as negative input) from the government to meet the total needed costs at market price. ΔF Z is substituted by capital costs.

From the induced production calculated by Eq. 2, the environmental impacts of the induced emissions of GHG are estimated as

where E is the vector of the GHG emission coefficient in each sector. This coefficient corresponds to the amounts of GHG emitted by the unit-production. All GHG emissions are expressed in CO2 equivalents. Emissions data for calculation of this coefficient are drawn from the GTAP-7 database. Carbon contained in bioethanol itself is evaluated as zero because it is carbon neutral according to the measurement method used in the Kyoto Protocol, even though GHG emitted through production of bioethanol is counted.

Life-cycle assessment (LCA)

To comprehensively evaluate economic and environmental impacts, life-cycle costs (LCC), life-cycle production (LCP and LCY), and life-cycle GHG emissions (LCE) are measured. LCC consists of all costs used for bioethanol production from the construction phase to the scrapping phase. This index can be defined as

where C is the total cost; c t is the annual cost in year t; and superscripts inv, prod, labor, capital, and scrap show the life-cycle phases, i.e., the initial construction phase, production phase with regard to intermediate input, production phase with regard to labor costs, production phase with regard to capital costs and scrapping phase. r is the discount rate to evaluate the present value of future costs. The value of r is set at 6.7 %, which equals a nominal interest rate of 15 % minus inflation rate of 8.3 %.

LCP and LCY are respectively the total induced production and the total induced added value during the life-cycle of the plant. That is

and,

where SX and sx are the summation of elements by sectors in X in Eq. 2 with regard to total costs and annual costs; Y and y are the induced added value and induced annual added value calculated by Eq. 3, respectively; and the superscripts surplus and subsidy show surplus for suppliers and subsidies from the government during the production phase.

The total GHG emissions during the life-cycle of the plant (LCE) are

where GHG is the total GHG emitted in each life-cycle phase and calculated by Eq. 4.

Results and policy implications

Available production potentials and costs

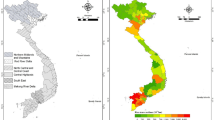

Figure 1 shows the potential of rice-straw bioethanol production across the whole country in 2009. The Mekong Delta region accounts for more than 50 % of the total production. The total production potential corresponds to 22 % of the national gasoline consumption of 5,400 million L in 2009. The amount of bioethanol in this comparison considers the heat ratio (0.67) of bioethanol to gasoline.

Figure 2 shows the plant construction costs and scrapping costs in each industrial sector. Total costs for investment are large and amount to 8–22 % of the total private investments ($26321 million) in 2009. More than half of these costs relate to the construction industry, whereas 40 % of the costs are for the machinery and equipment industry. Purchases from the agricultural sector are low during the plant construction phase. However, investments for plant construction mostly occur in rural areas rather than urban areas because it is best for a bioethanol plant to be located near paddy fields to minimize the costs of transporting rice-straw. Therefore, investments for plant construction may revitalize rural economies.

Figure 3 shows the unit-production cost in Japan (original values in previous studies) and in Vietnam (based on Table 1). Table 2 shows total costs of annual production by sectors for inputs of the I/O analysis. As explained in the former section, material costs in Japan include woody material in addition to rice-straw, whereas in Vietnam only rice-straw is used. From this assumption, the material costs in Vietnam are higher than the study in Japan. Nevertheless, one-third of the production costs are the material costs, and another third are the capital costs. According to the report of F.O. Licht GmbH and Agra CEAS Consulting (2007), 70 % of the total costs were material costs in first-generation bioethanol production from corn in Thailand. The material costs of rice-straw bioethanol production are low in comparison. By contrast, its capital costs are higher than the first-generation bioethanol production, because the production process is more complex.

Annual bioethanol production costs in Japan and Vietnam. Production costs in Japan are the original costs of previous studies. Costs in Vietnam are estimated according to Table 1. The exchange rate used here is $1 = 100 Yem

The total cost for production is $752 million (Table 2), and this value is evaluated from the total bioethanol production and gasoline price with consideration of heat ratios. As shown by the surplus minus subsidies in the table, the profit is negative under the present technology. This loss is covered by the government as subsidies to sell bioethanol in the market. On the other hand, under the advanced technology the need for such subsidies is trivial, indicating the total cost is near the total revenue. Under innovative technology, total sales exceed the total costs with a profit from bioethanol production.

Economic impacts

Table 3 shows the LCC, LCP, and LCY calculated by Eqs. 5–7. In this table, the total cost and induced production at each life-cycle phase are shown to compare the impacts of each phase. During the construction phase, the induced production is 1.29 times higher than total input. Comparison of the three scenarios indicates that construction costs under the present technology are the highest. This is because many small-scale plants have to be constructed under the present technology scenario. However, there are few differences in the values of the multiplier among the technologies because the converter of the construction investment for a bioethanol plant is assumed to be the same in all technologies.

The annual operation costs regarding to intermediate inputs induced approximately 1.1 times higher production, whereas labor costs induced 0.94–0.99 times higher production. The multiplier during the annual operation phase is slightly lower than during the plant construction phase. The scrap costs as input induced the highest (1.8 times higher) production. This is because the construction and public sectors relating to scrap phase tend to produce their products domestically.

In general, the multiplier in Vietnam is low compared to other countries such as Japan where the multiplier for private investment is 2.38 (in 2000). This is because of a high import rate especially in the chemical and manufacturing industries closely related to bioethanol production. Furthermore, the rate of labor costs is low in the total added value in each industrial sector making the income induced effect lower.

Induced production and induced added value are the highest in the present technology because this technology has the highest input costs regarding to the intermediate sectors. Of course, such input costs need to be covered by subsidies, so large induced production under the present technology relies heavily on subsidies, showing unfavorable growth. On the other hand, induced production under innovative technology is the lowest, but there is no need for subsidies.

The comparison between LCC and LCP shows that under the present and advanced technologies, the ratio of LCP to LCC is smaller than one and the net benefit calculated by LCP minus LCC is negative indicating these technologies are not viable. In contrast, the net benefit becomes positive under innovative technology.

Environmental impacts

Table 4 shows the results of LCE by Eq. 8, the total GHG emissions during the life-cycle period, and emissions which are reduced by a decrease in gasoline consumption replaced by bioethanol. Comparisons of GHG emissions in each life-cycle phase indicate the emissions from the production phase are the largest among the life-cycle periods. This is because the chemical industry sectors which produce numerous inputs used in the annual operation phase generally have higher GHG emission coefficients than the construction sector that relates to the plant construction and scraping phases.

Total GHG emissions of bioethanol under the present technology are larger than the total reduction of GHG emissions from gasoline consumption replaced by bioethanol. This indicates bioethanol production under this scenario cannot contribute to a reduction in GHG emissions. However, advanced and innovative technologies show positive contributions to GHG reduction. Comparisons between Tables 3 and 4 show the net economic benefit is negative, but net environmental benefit is positive in the advanced technology.

Policy implications

Policy implications are noted as follows. First, higher performances of the advanced and innovative technologies strongly indicate that more research and development efforts should be encouraged with the involvement of public sectors in both developed and developing countries.

Second, even under present technology, there are some rooms of reducing material costs that account for around 30 % of the total cost. Development of new collecting machines and new storage method can reduce material costs. Therefore, improvement of field technology relating to collection method as well as chemical conversion technology is also important for rice-straw bioethanol production.

Third, investments for plant construction are extremely huge, so it is difficult for only Vietnam to pay such costs. Investment funds need to be collected from foreign countries to promote investment. Although the technology of second-generation bioethanol production can be realized and is feasible in Vietnam as shown by the experimental project located in the Ho-Chi-Minh City, some difficulties in patent and costs exist for developing countries to incorporate such technology. In addition to financial assistance, technological assistance from countries that have developed the technology is needed.

Conclusions

The present study evaluated economic and environment impacts of rice-straw bioethanol production in Vietnam. We considered different technologies for production, i.e., present technology, advanced technology with a higher conversion rate, and innovative technology with a new production method and realization of economies of scale. For comprehensive evaluation, life-cycle costs, life-cycle production, and life-cycle added values were measured to determine the economic impacts, and the life-cycle GHG emissions were quantified to determine the environmental impacts.

Results demonstrated that, first, rice-straw bioethanol production can displace 22 % of annual gasoline consumption in Vietnam, if most of the rice-straw now burned in the field is used for bioethanol production. Furthermore, the total investments for plant construction are 8–22 % of the total annual investment in Vietnam, implying bioethanol production can be a large national project.

Second, construction investments for a production plant induced 1.29 times higher production than the initial investment. Annual production brought about 0.9–1.1 times higher production than the input costs. In spite of these multiple effects, total production during the life-cycle period (LCP) was smaller than the life-cycle costs (LCC) under the present and advanced technologies, because of subsidies that cover differences between costs and market price. This indicates these technologies are not commercially and macro-economically effective. Innovative technology, in contrast, showed a positive economic benefit.

Third, as for the life-cycle GHG emissions (LCE), the annual production phase emitted more GHG than the construction and scrapping phases. Under the present technology, total life-cycle GHG emissions were larger than the total reduction in GHG emissions from gasoline consumption replaced by bioethanol. However, under the advanced and innovative technologies, the total life-cycle GHG emissions were lower than the reduction in GHG emissions, showing positive contributions to total GHG emissions. Interestingly, advanced technology exhibited contrastive results with a positive environmental net benefit (GHG reduction) and a negative economic net benefit. This suggests the economic hurdle for rice-straw bioethanol production is higher than the environmental hurdle.

As shown by the above results, rice-straw bioethanol production under the present technology is difficult to accept from both economic and environmental points of view. However, rice-straw bioethanol production can be a promising investment if innovative technology is realized. Advanced technology is in between the present and innovative technologies. These estimations may not be noticed by policy makers if there is no empirical and quantitative analyses. Therefore, the analysis method employed here is useful for policy-making.

There are several issues remaining. Although LCA by a bottom-up approach with more precise inventory is not used in this study, comparisons of the bottom-up approach and the top–down approach of this study are interesting. Methodologies of this study are applicable to other countries, particularly to neighboring East Asian countries. With a similar analysis, concrete benefits for developed countries such as Japan and South Korea can be measured and provide stronger recommendations for these countries. As mentioned in the introduction, an experimental plant is already functional in Ho-Chi-Minh, Vietnam, so future studies can use more precise data from this plant to improve the analysis.

Notes

The share rate of each component for plant construction of a Japanese experimental plant in Akita is 54.8 % for machinery-and-equipment and 45.1 % for construction, whereas shares in investments 48 and 52 %, respectively. Since detailed components of plant construction are unknown and a corporate secret, the share rate of private investments is used in this study.

The ultimate ripple effects calculated by the second term may not be realized in 1 year in the real economy. Previous studies considered income-induced effects as the first step just one time. However, this study considers the whole effects including future effects because the study aims to evaluate impacts during whole life-cycle periods. As shown in the latter part, 75–85 % of total income-induced effects come from the first step and the rest depend on the subsequent processes in Vietnam. Hence, the evaluation employed here does not show values different from the evaluation using only the first step.

References

Asano K, Minowa T (2007) An analysis of bioethanol production costs and CO2 reduction costs in Japan. AIST/BTRC Discussion Paper. https://unit.aist.go.jp/btrc/research_result/documents. Accessed 30 March 2007 (in Japanese)

Fukushima Y, Chen SP (2009) A decision support tool for modifications in crop cultivation method based on life cycle assessment: a case study on greenhouse gas emission reduction in Taiwanese sugarcane cultivation. Int J Life Cycle Assess 14(7):639–655

F.O.Licht GmbH and Agra CEAS Consulting (2007) Ethanol production costs: a worldwide survey. Agra Informa Ltd., Kent. www.agra-net.com

Hayashi T (2010) Evaluating the economic-environment co-benefit of bio-fuel production; an application of eco-efficiency. J Agric Policy Res 18:41–57 (in Japanese)

Hideno A, Inoue H, Tsukahara K, Fujimoto S, Minowa T, Inoue S, Endo T, Sawayama S (2009) Wet disk milling pretreatment without sulfuric acid for enzymatic hydrolysis of rice straw. Bioresour Technol 100(10):2706–2711

Hu Z, Pu G, Fang F, Wang C (2004) Economics, environment and energy life cycle assessment of automobiles fueled by bio-ethanol blends in China. Renew Energy 29(14):2183–2192

Japan Machinery Center for Trade and Investment (2008) Report on PCI/LF. https://www.jmcti.org/img/pcl-lf2008.pdf. Accessed 28 January 2010

Koga N (2008) An energy balance under a conventional crop rotation system in northern Japan: perspectives on fuel ethanol production from sugar beet. Agric Ecosyst Environ 125(1–4):101–110

Miyazawa K (1975) Introduction of input–output analysis. NIKKEI Inc., Japan (in Japanese)

Mori Y, Matsumoto S, Kosugi A, Furuhashi T, Murata Y (2004) The middle and small scale distributed biomass usage technology. The final report of comprehensive strategy on biomass research and development in ASEAN countries, National Institute of Advanced Industrial Science and Technology, Hokkaido, pp 98–107 (in Japanese)

Narayanan GB (2011) Overview of GTAP 7 data base and the data goal. Presentations on GTAP Data Base. https://www.gtap.agecon.purdue.edu/databases/v7/. Accessed 19 May 2011

Nguyen TLT, Gheewala SH, Garivait S (2007) Energy balance and GHG-abatement cost of cassava utilization for fuel ethanol in Thailand. Energy Policy 35(9):4585–4596

Okuyama Y, Sonis M, Hewings JDG (2010) Economic impacts for an unscheduled disruptive event: a Miyazawa multiplier analysis. Understanding and Interpreting Economic Structure, Springer, New York, pp 113–143

Ou XM, Zhang XL, Chang SY, Guo QF (2009) Energy consumption and GHG emissions of six biofuel pathways by LCA in People’s Republic of China. Appl Energy 86:S197–S208

Papong S, Malakul P (2010) Life-cycle energy and environmental analysis of bioethanol production from cassava in Thailand. Bioresour Technol 101:S112–S118

Polagye B, Hodgson KT, Malte PC (2007) An economic analysis of bio-energy options thinning from overstocked forests. Biomass Bioenergy 31(2–3):105–125

Saga K, Imou K, Yokoyama S, Minowa T (2010) Net energy analysis of bioethanol production system from high-yield rice plant in Japan. Appl Energy 87(7):2164–2168

Shiina T, Orikasa T, Tokuyasu K, Poritosh R, Inoue T, Kojima H, Nakamura N (2009) Evaluation on cost and energy balance and CO2 emission from bioethanol production by rice straw. Research Highlights of National Agriculture and Food Research Organization, Mie. http://www.nfri.affrc.go.jp/research/seika/seikah21/. Accessed 24 November 2009 (in Japanese)

Silaertruksa T, Gheewala SH (2009) Environmental sustainability assessment of bio-ethanol production in Thailand. Energy 34(11):1933–1946

Ueda T (2011) Feasibility study on producing domestic biofuels from agricultural biomass in Japan. Tech Rep Natl Inst Rural Eng 211:131–151

Urbanchuk JM (2009) 2008 Contributions of the ethanol industry to the economy of the United States. In: RFA reports and studies. Renewable Fuels Association, Jefferson City

von Blottniz H, Curran MA (2007) A review of assessments conducted on bio-ethanol as a transportation fuel from a net energy, greenhouse gas, and environmental life cycle perspective. J Clean Prod 15(7):607–619

Acknowledgments

This study was supported by a Grant-in-Aid for Scientific Research [22530256] (Ministry of Education, Science, Sports, and Culture) and the joint project-SATREPS of JICA, JST and Ho-Chi-Minh City University entitled “Sustainable Integration of Local Agriculture and Biomass Industries.” The authors greatly appreciate their support.

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Kunimitsu, Y., Ueda, T. Economic and environmental effects of rice-straw bioethanol production in Vietnam. Paddy Water Environ 11, 411–421 (2013). https://doi.org/10.1007/s10333-012-0332-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10333-012-0332-4