Abstract

This paper explores how the international exposure of companies influenced their strategies in responding to the COVID-19 crisis, and the extent to which they were affected. Our conceptual framework formulates two hypotheses that can be empirically tested. First, we posit that international companies, due to their connections with domestic and foreign markets, are more vulnerable to the crisis, being affected through both demand and supply channels. Second, despite their heightened exposure, we anticipate that international companies will exhibit greater resilience during the crisis compared to their domestic counterparts. This resilience can be attributed to their enhanced global connectivity and productivity. The empirical analysis, based on a large firm-level survey undertaken in 2020 in 133 countries, documents how different types of firms were affected by COVID-19 crisis and how they reacted to the disruptions, providing empirical support for both hypotheses.

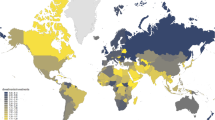

Source ITC COVID-19 Business Impact Survey. Data collected from 21 April to 24 August 2020. Note Prediction based on sample enumeration based on regression in Table 4

Source ITC COVID-19 Business Impact Survey. Data collected from 21 April to 24 August 2020. Note Prediction based on sample enumeration based on regression in Table 5

Similar content being viewed by others

Data availability

The data that support the findings of this study should be requested to the International Trade Centre. Restrictions apply to the availability of these data. Data can be made available from the authors if the International Trade Centre provides permission.

Notes

We use the following categorization throughout the paper. Resilient strategy includes any of the following actions: temporarily reduced employment, teleworking, rescheduled bank loans, increased marketing, online sales, launching new or customized products, sourcing from new suppliers, or loaned employees to other enterprises. Retreat includes the following actions: filed for bankruptcy, laid off employees, other, or took no action. Firms adopting multiple coping mechanisms were classified as retreating if they took any retreating action.

Our results, therefore, capture the immediate effects of the COVID-19 on firms and their short-term reactions and cannot make inferences on the longer time horizon. Other papers have attempted on analysing the impact of the COVID-19 on firms over a longer time horizon albeit without distinguishing between international and domestic firms (Khan, 2023; Rocha et al., 2021; Waldkirch, 2021).

Some firms employed multiple coping mechanisms to respond to the crisis. In cases where firms used a combination of retreating and resilient mechanisms, the strategy is coded as “Retreat”.

The regressions presented in the main body of the paper are unweighted. In the Appendix 1, we show that the results are robust to alternative weighting methods and specifications.

Lockdown variable coded as 0 whenever a firm submitted survey responses prior to the start of lockdowns in their country.

Firm size and industry fixed effects are based on large categories. Industry fixed effects encompass three categories: Primary, Manufacturing and Services. Firm size fixed effects include four categories: Micro, Small, Medium-sized and Large. This is due to the available data, as well to the fact that some countries had little or no observations in specific sectors within industries.

Firm size fixed effects, to some extent, control for productivity differences, given the absence of a direct measure of productivity in our data. This data constraint makes it challenging to fully disentangle whether it is the international status of the firm or its productivity that shapes the empirical regularities.

We recognize that shocks may affect domestic and trading firms differently depending on a broad range of firm characteristics, such as firms’ management and operational procedures. A potential avenue for future research lies in obtaining more refined and comprehensive data that to fully discern whether the observed differentials in reactions are predominantly driven by inherent firm characteristics or are indeed a consequence of trade linkages.

We use a linear probability model for ease of interpretation. However, the results are robust to nonlinear specifications and estimates from probit and logit models are shown in the Appendix 1.

These additional regression results tables are available from the authors upon request.

As an additional test, we add a control variable capturing the self-reported impact of the pandemic on each firm, represented by a binary variable indicating firms reporting being "strongly affected" by the pandemic. The inclusion of this control to the baseline does not change the results: international firms are more likely to take resilient approaches. The coefficients on international status and being strongly affected have opposite signs. In addition, the coefficient on international status is larger in magnitude than the coefficient on strongly affected (0.1 and − 0.04 respectively). In other words, being an international firm was often enough to overcome the strong effects of the pandemic.

Regression results with different samples and the sample split into two periods are available from the corresponding author.

References

Adams-Prassl, A., Boneva, T., Golin, M., & Rauh, C. (2020). Inequality in the impact of the coronavirus shock: Evidence from real time surveys. Journal of Public Economics, 189, 104245.

Alvarez, R., & Lopez, R. A. (2005). Exporting and performance: Evidence from Chilean plants. Canadian Journal of Economics/revue Canadienne D’économique, 38(4), 1384–1400.

Andersson, M., Lööf, H., & Johansson, S. (2008). Productivity and international trade: Firm level evidence from a small open economy. Review of World Economics, 144(4), 774–801. https://doi.org/10.1007/s10290-008-0169-5

Apedo Amah, M. C., Avdiu, B., Cirera, X., Vargas Da Cruz, M. J., Davies, E. A. R., Grover, A. G., Iacovone, L., Kilinc, U., Medvedev, D., Maduko, F. O., Poupakis, S., Torres Coronado, J., & Tran, T. T. (2020a). Unmasking the Impact of COVID-19 on Businesses: Firm Level Evidence from Across the World. Policy Research Working Paper Series, Article 9434. https://ideas.repec.org//p/wbk/wbrwps/9434.html

Apedo-Amah, M. C., Avdiu, B., Cirera, X., Cruz, M., Davies, E., Grover, A., Iacovone, L., Kilinc, U., Medvedev, D., & Maduko, F. O. (2020b). Unmasking the impact of covid-19 on businesses: Firm level evidence from across the world.

Baldwin, R., & Freeman, R. (2020). Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’from the COVID concussion. VoxEU.Org.

Baldwin, R., & Tomiura, E. (2020). Thinking ahead about the trade impact of COVID-19. Economics in the Time of COVID-, 19, 59.

Balleer, A., Link, S., Menkhoff, M., & Zorn, P. (2020). Demand or supply? Price adjustment during the Covid-19 pandemic. CESifo Working Paper Series 8394, CESifo. https://ideas.repec.org/p/ces/ceswps/_8394.html

Bartik, A. W., Bertrand, M., Cullen, Z. B., Glaeser, M. L., & Stanton, C. T. (2020). How are small businesses adjusting to COVID-19? Early evidence from a survey. National Bureau of Economic Research, No. w26989.

BDI. (2020). Export Controls and Export Bans over the Course of the Covid-19 Pandemic. https://www.wto.org/english/tratop_e/covid19_e/bdi_covid19_e.pdf

Beck, T., Flynn, B., & Homanen, M. (2020). COVID-19 in emerging markets: Firm-survey evidence. COVID Economics, 38, 37–67.

Bernard, A. B., & Jensen, J. B. (1999). Exceptional exporter performance: Cause, effect, or both? Journal of International Economics, 47(1), 1–25.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Boehm, C. E., Flaaen, A., & Pandalai-Nayar, N. (2019). Input linkages and the transmission of shocks: Firm-level evidence from the 2011 Tōhoku earthquake. Review of Economics and Statistics, 101(1), 60–75.

Bonadio, B., Huo, Z., Levchenko, A. A., & Pandalai-Nayar, N. (2021). Global supply chains in the pandemic. Journal of International Economics, 133, 103534. https://doi.org/10.1016/j.jinteco.2021.103534

Brinca, P., Duarte, J. B., & Faria-e-Castro, M. (2020). Is the COVID-19 pandemic a supply or a demand shock?. Available at SSRN 3612307.

Buchheim, L., Dovern, J., Krolage, C., & Link, S. (2020). Firm-level Expectations and Behavior in Response to the COVID-19 Crisis.

Canuto, O., Arbouch, M., Zhang, P., & Ali, A. A. (2023). GVCs, Resilience, and Efficiency Considerations: Improving Trade and Industrial Policy Design and Coordination.

Dai, R., Hu, J., & Zhang, X. (2020). The Impact of Coronavirus on China’s SMEs: Findings from the Enterprise. Center for Global Development. https://www.Cgdev.Org/Sites/Default/Files/Impact-Coronaviruschinas-Smes-Findings-from-Esiec.Pdf

Eppinger, P., Felbermayr, G. J., Krebs, O., & Kukharskyy, B. (2020). Covid-19 Shocking Global Value Chains. CESifo Working Paper Series, Article 8572. https://ideas.repec.org//p/ces/ceswps/_8572.html

Eppinger, P. S., Meythaler, N., Sindlinger, M., & Smolka, M. (2018). The great trade collapse and the Spanish export miracle: Firm-level evidence from the crisis. The World Economy, 41(2), 457–493.

Espitia, A., Mattoo, A., Rocha, N., Ruta, M., & Winkler, D. (2021). Pandemic trade: Covid‐19, remote work and global value chains. The World Economy.

Evenett, S., Fiorini, M., Fritz, J., Hoekman, B., Lukaszuk, P., Rocha, N., Ruta, M., Santi, F., & Shingal, A. (2021). Trade policy responses to the COVID-19 pandemic crisis: Evidence from a new dataset. The World Economy.

Fabiani, S., Lamo, A., Messina, J., & Rõõm, T. (2015). European firm adjustment during times of economic crisis. IZA Journal of Labor Policy, 4(1), 1–28.

Fairlie, R. W. (2020). The impact of Covid-19 on small business owners: Evidence of early-stage losses from the April 2020 current population survey (0898–2937). National Bureau of Economic Research.

Falciola, J., Mohan, S., Ramos, B., & Rollo, V. (2023). Drivers of SME resilience in Southeast Asia during COVID-19. The Journal of Development Studies. https://doi.org/10.1080/00220388.2023.2219126

Gerschel, E., Martinez, A., & Mejean, I. (2020). Propagation of shocks in global value chains: The coronavirus case. Halshs-02515364.

Goedhuys, M., & Sleuwaegen, L. (2013). The impact of international standards certification on the performance of firms in less developed countries. World Development, 47, 87–101.

Goldin, C., & Olivetti, C. (2013). Shocking labor supply: A reassessment of the role of World War II on women’s labor supply. American Economic Review, 103(3), 257–262.

Hellevik, O. (2009). Linear versus logistic regression when the dependent variable is a dichotomy. Quality & Quantity, 43(1), 59–74.

Helpman, E., Itskhoki, O., Muendler, M.-A., & Redding, S. J. (2017). Trade and inequality: From theory to estimation. The Review of Economic Studies, 84(1), 357–405.

Henson, S., Masakure, O., & Cranfield, J. (2010). Do fresh produce exporters in sub-Saharan Africa benefit from GlobalGAP certification? World Development, 39(3), 375–386.

Hoarau, J.-F. (2022). Is international tourism responsible for the outbreak of the COVID-19 pandemic? A cross-country analysis with a special focus on small islands. Review of World Economics, 158(2), 493–528. https://doi.org/10.1007/s10290-021-00438-x

Hyun, J., Kim, D., & Shin, S.-R. (2020). The Role of Global Connectedness and Market Power in Crises: Firm-level Evidence from the COVID-19 Pandemic. Covid Economics, CEPR.

IFC. (2020). The Impact of COVID-19 on Logistics. International Finance Corporation. https://www.ifc.org/wps/wcm/connect/2d6ec419-41df-46c9-8b7b-96384cd36ab3/IFC-Covid19-Logistics-final_web.pdf?MOD=AJPERES&CVID=naqOED5

ITC. (2020). SME Competitiveness Outlook 2020. COVID-19: The Great Lockdown and its Impact on Small Business. https://intracen.org/resources/publications/sme-competitiveness-outlook-2020-covid-19-the-great-lockdown-and-its-effects

Jansen, M., Lennon, C., & Piermartini, R. (2016). Income volatility: Whom you trade with matters. Review of World Economics, 152(1), 127–146. https://doi.org/10.1007/s10290-015-0238-5

Khan, S. U. (2023). The firm-level employment impact of COVID-19: International evidence from World Bank Group’s Enterprise Surveys. Eastern European Economics, 61(5), 457–490. https://doi.org/10.1080/00128775.2023.2173235

Kurz, C., & Senses, M. Z. (2016). Importing, exporting, and firm-level employment volatility. Journal of International Economics, 98, 160–175.

Latouche, K., & Chevassus-Lozza, E. (2015). Retailer supply chain and market access: Evidence from French agri-food firms certified with private standards. The World Economy, 38(8), 1312–1334.

Lindsay, A., Jain, N., Mahajan, D., Maxwell, M. N., & Pandher, A. S. (2020). Tracking US small and medium-sized business sentiment during COVID-19. McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/tracking-us-small-and-medium-sized-business-sentiment-during-covid-19

Luttmer, E. G. (2007). Selection, growth, and the size distribution of firms. The Quarterly Journal of Economics, 122(3), 1103–1144.

Manova, K. (2013). Credit constraints, heterogeneous firms, and international trade. Review of Economic Studies, 80(2), 711–744.

Martincus, C. V., Carballo, J., & Graziano, A. (2015). Customs. Journal of International Economics, 96(1), 119–137.

Mayer, T., Melitz, M. J., & Ottaviano, G. I. (2016). Product mix and firm productivity responses to trade competition. Review of Economics and Statistics 1–59.

McGeever, N., McQuinn, J., & Myers, S. (2020). SME liquidity needs during the COVID-19 shock (Financial Stability Notes 2/FS/20). Central Bank of Ireland.

Miroudot, S. (2020). Resilience versus robustness in global value chains: Some policy implications. In R. Baldwin & S. J. Evenett (Eds.), COVID-19 and trade policy: Why turning inward won’t work (pp. 117–130). CEPR Press.

OECD. (2020a). Culture shock: COVID-19 and the cultural and creative sectors.

OECD. (2020b). Productivity gains from teleworking in the post COVID-19 era: How can public policies make it happen?. https://doi.org/10.1787/a5d52e99-en

Pahl, S., Brandi, C., Schwab, J., & Stender, F. (2020). Cling together, swing together: The contagious effects of COVID‐19 on developing countries through global value chains. The World Economy.

Pavcnik, N. (2002). Trade liberalization, exit, and productivity improvements: Evidence from Chilean plants. The Review of Economic Studies, 69(1), 245–276.

Ramelli, S., & Wagner, A. F. (2020). Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies, 9(3), 622–655.

Rocha, L. A., Cárdenas, L. Q., Silva, N. G. A., & de Almeida, C. A. S. (2021). The Covid-19 pandemic and its impact on the performance of firms: An analysis based on World Bank Microdata. The Journal of Developing Areas, 55(3), 411–433.

Schwartz, J., Guasch, J. L., & Wilmsmeier, G. (2009). Logistics, Transport and Food Prices in LAC: Policy Guidance for Improving Efficiency and Reducing Costs. IDB Publications (Working Papers), Article 2541. https://ideas.repec.org//p/idb/brikps/2541.html

Seric, A., Görg, H., Mösle, S., & Windisch, M. (2020). Managing COVID-19: How the pandemic disrupts global value chains. https://iap.unido.org/articles/managing-covid-19-how-pandemic-disrupts-global-value-chains

Stellinger, A., Berglund, I., & Isakson, H. (2020). How trade can fight the pandemic and contribute to global health. In R. Baldwin & S. J. Evenett (Eds.), COVID-19 and trade policy: Why turning inward won’t work (pp. 21–30). CEPR Press.

Todo, Y., Nakajima, K., & Matous, P. (2015). How do supply chain networks affect the resilience of firms to natural disasters? Evidence from the Great East Japan Earthquake. Journal of Regional Science, 55(2), 209–229.

Vannoorenberghe, G. (2012). Firm-level volatility and exports. Journal of International Economics, 86(1), 57–67.

Waldkirch, A. (2021). Firms around the World during the COVID-19 Pandemic. Journal of Economic Integration, 36(1), 3–19.

WTO. (2020). Standards, regulations, and COVID-19—What actions taken by WTO members?. https://www.wto.org/english/tratop_e/covid19_e/standards_report_e.pdf

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

At the time of working on this paper Olga Solleder’s affiliation was with the International Trade Centre.

Appendices

Appendix 1. Sensitivity analyses

1.1 Alternative specifications

1.2 Alternative weighting methods

Appendix 2. ITC COVID-19 Business Impact Survey

2.1 Survey questionnaire

See Table 10.

2.2 Survey coverage by country

See Table 11.

2.3 Description of variables

See Table 12.

About this article

Cite this article

Borino, F., Carlson, E., Rollo, V. et al. International firms and COVID-19: evidence from a global survey. Rev World Econ (2024). https://doi.org/10.1007/s10290-024-00525-9

Accepted:

Published:

DOI: https://doi.org/10.1007/s10290-024-00525-9