Abstract

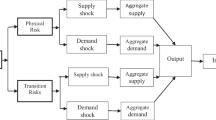

This research examines the global implications of agricultural production and price fluctuations via Global Bayesian Vector Autoregression (GBVAR) model. We develop a novel Paasche agriculture price index, based on the relative time-varying contribution of four dominant food commodities shifting contributions of major food commodities (rice, maize, soybeans, wheat), pivotal for global sustenance. The analysis reveals that while agricultural production shocks are important, they exert a comparatively lesser impact than agriculture price shocks. Higher agriculture inflation can be destabilizing via lower output and higher aggregate inflation.

Similar content being viewed by others

Notes

We convert nominal global GDP (FRED mnemonic NYGDPMKTPCDWLD), which is denominated in U.S. Dollars (FRED mnemonic CPALTT01USA661S), to real GDP by dividing the former with the U.S. CPI.

The CPI data is based on the first principal component of aggregate CPI data for 25 countries (see Sect. 2.1).

The data is publicly available https://www.worldbank.org/en/research/commodity-markets.

Our choice of countries in the sample is based on data availability. The 25 economies include: Australia (”AUS”), Austria (”AUT”), Belgium (”Belgium”), Canada (”CAN”), Switzerland (”CHE”), Germany (”DEU”), Spain (”ESP”), Finland (”FIN”), France (”FRA”),United Kingdom (”GBR”), Greece (”GRC”), India (”IND”), Iceland (”ISL”), Italy (”ITA”), Japan (”JPN”), South Korea (”KOR”), Luxembourg (”LUX”), Netherlands (”NLD”), Norway (”NOR”), New Zealand (”NZL”), Portugal (”PRT”), Sweden (”SWE”), Turkey (”TUR”), United States (”USA”) and South Africa (”ZAF”).

Our results are similar to Ratti and Vespignani (2016), who show that the first principal component captures 89.6% of the variation for prices relating to the G5 countries. Figure 1 shows noticeable fluctuations of the inflation rate attributed to ISL and TUR. We provide an additional scree plot in Fig. 9 in the Appendix, where the first principal component captures 86.3% of the total variance when excluding ISL and TUR.

While the Laspeyres index also holds a place in economic analysis, we opt for the Paasche index due to its adaptability to account for fluctuating quantities across time. Unlike the Laspeyres counterpart, which remains rooted in the initial period’s quantities, the Paasche index factors in changing production patterns over time. This approach ensures the index’s relevancy by mirroring the shifting composition of agricultural output.

Hamilton (2021) uses OECD industrial production index plus six additional countries as opposed to shipping costs. Hamilton (2021) shows that oil inflation is driven by the OECD industrial production and is statistically significant, whereas the influence of the Kilian index from Kilian (2009) is not statistically significant. Furthermore, while the Kilian index identifies 2016 as the worst downturn, Hamilton (2021) used the OECD production index which he posits as a better indicator, which now shows the global financial crisis having a more negative cyclical component. Hamilton (2021) cautions that using shipping costs is problematic for 2016 considering “a big factor in the record low shipping prices in 2016 was overbuilt shipping capacity, not a severe global economic contraction.” Lastly, Hamilton (2021) finds that industrial production has statistically significant coefficients for every commodity except aluminum, whereas the Kilian-Zhou index (see Kilian & Zhou, 2018) does not exhibit any statistical significance.

The World Bank “Pink Sheet” includes the “Cereals” aggregate price index based on the rice, wheat, maize and barley. In the empirical analysis, the Baseline model is based on rice, wheat, maize and soybean grains prices. To make the empirical analysis comparable, we remove soybeans and add barley in the Paasche index.

Bibliography

Al-Shawarby, S., & Selim, H. (2012). Are international food price spikes the source of Egypt’s high inflation? (Policy Research Working Paper Series 6177). The World Bank.

Alquist, R., & Kilian, L. (2010). What do we learn from the price of crude oil futures? Journal of Applied Econometrics, 25(4), 539–573.

Anand, R., Prasad, E. S., & Zhang, B. (2015). What measure of inflation should a developing country central bank target? Journal of Monetary Economics, 74, 102–116.

Angelini, E., Lalik, M., Lenza, M., & Paredes, J. (2019). Mind the gap: A multi-country BVAR benchmark for the eurosystem projections. International Journal of Forecasting, 35(4), 1658–1668.

Arezki, R., & Bruckner, M. (2011). Food prices and political instability (IMF Working Papers 2011/062). International Monetary Fund.

Arouri, M., Rault, C., & Teulon, F. (2014). Economic policy uncertainty, oil price shocks and GCC stock markets. Economics Bulletin, 34(3), 1822–1834.

Banbura, M., Giannone, D., & Lenza, M. (2015). Conditional forecasts and scenario analysis with vector autoregressions for large cross-sections. International Journal of Forecasting, 31(3), 739–756.

Baquedano, F. G., & Liefert, W. M. (2014). Market integration and price transmission in consumer markets of developing countries. Food Policy, 44(C), 103–114.

Barnett, W., & Park, H. (2023). Have credit card services become important to monetary aggregation?: An application of sign restricted Bayesian VAR. Technical report, University of Kansas, Department of Economics.

Barrett, C., & Bellemare, M. (2011). Why food price volatility doesn’t matter. Foreign Affairs.

Bellemare, M. (2015). Rising food prices, food price volatility, and social unrest. American Journal of Agricultural Economics, 97(1), 1–21.

Bodenstein, M., Erceg, C., & Guerrieri, L. (2011). Oil shocks and external adjustment. Journal of International Economics, 83(2), 168–184.

Bogmans, C., Osunsade, F., Pescatori, A., & Prifti, E. (2021). Income versus prices: How does the business cycle affect food (In)-security? Working Paper No. 2021/238, International Monetary Fund.

Canova, F., & De Nicolo, G. (2002). Monetary disturbances matter for business fluctuations in the G-7. Journal of Monetary Economics, 49(6), 1131–1159.

Cecchetti, S. G., & Moessner, R. (2008). Commodity prices and inflation dynamics. BIS Quarterly Review.

Ciccarelli, M., & Mojon, B. (2010). Global inflation. The Review of Economics and Statistics, 92(3), 524–535.

Cimadomo, J., Giannone, D., Lenza, M., Monti, F., & Sokol, A. (2022). Nowcasting with large Bayesian vector autoregressions. Journal of Econometrics, 231(2), 500–519.

Cross, J., Hou, C., & Poon, A. (2020). Macroeconomic forecasting with large Bayesian VARs: Global-local priors and the illusion of sparsity. International Journal of Forecasting, 36(3), 899–915.

Crump, R., Eusepi, S., Giannone, D., Qian, E., & Sbordone, A. (2021). A large Bayesian VAR of the United States economy. FRB of New York Staff Report, (976).

Falkendal, T., Otto, C., Schewe, J., Jaegermeyr, J., Konar, M., Kummu, M., Watkins, B., & Puma, M. (2021). Grain export restrictions during COVID-19 risk food insecurity in many low-and middle-income countries. Nature Food, 2(1), 11–14.

Faust, J. (1998). The robustness of identified VAR conclusions about money. In Carnegie-Rochester conference series on public policy, vol 49. Elsevier. p 207–244.

Fernandez, A., Schmitt-Grohe, S., & Uribe, M. (2017). World shocks, world prices, and business cycles: An empirical investigation. Journal of International Economics, 108, S2–S14.

Ferrucci, G., Jimenez-Rodrıguez, R., & Onorantea, L. (2012). Food price pass-through in the Euro Area: Non-linearities and the role of the common agricultural policy. International Journal of Central Banking, 8(1), 179–218.

Fry, R., & Pagan, A. (2011). Sign restrictions in structural vector autoregressions: A critical review. Journal of Economic Literature, 49(4), 938–960.

Gelos, G., & Ustyugova, Y. (2017). Inflation responses to commodity price shocks – How and why do countries differ? Journal of International Money and Finance, 72(C), 28–47.

Giannone, D., Lenza, M., & Primiceri, G. (2015). Prior selection for vector autoregressions. Review of Economics and Statistics, 97(2), 436–451.

Ginn, W. (2023a). The impact of economic policy uncertainty on stock prices. Economics Letters, 233, 111432.

Ginn, W. (2023b). World output and commodity price super cycles. International Economic Journal, 37(4), 530–554.

Ginn, W., & Pourroy, M. (2019). Optimal monetary policy in the presence of food price subsidies. Economic Modelling, 81, 551–575.

Ginn, W., & Pourroy, M. (2020). Should a central bank react to food inflation? Evidence from an estimated model for Chile. Economic Modelling, 90, 221–234.

Ginn, W., & Pourroy, M. (2022). The contribution of food subsidy policy to monetary policy in India. Economic Modelling, 113, 105904.

Hamilton, J. (1983). Oil and the macroeconomy since World War II. Journal of Political Economy, 91(2), 228–248.

Hamilton, J. (2008). Oil and the macroeconomy. The New Palgrave Dictionary of Economics, 2.

Hamilton, J. (2021). Measuring global economic activity. Journal of Applied Econometrics, 36(3), 293–303.

Holtemoeller, O., & Mallick, S. (2016). Global food prices and monetary policy in an emerging market economy: The case of India. Journal of Asian Economics, 46, 56–70. Money Exchange Rates in Emerging Asia.

Jacks, D., & Stuermer, M. (2020). What drives commodity price booms and busts? Energy Economics, 85, 104035.

Joets, M., Mignon, V., & Razafindrabe, T. (2017). Does the volatility of commodity prices reflect macroeconomic uncertainty? Energy Economics, 68, 313–326.

Johnson, D. (1975). World agriculture, commodity policy, and price variability. American Journal of Agricultural Economics, 57(5), 823–828.

Kang, W., de Gracia, F., & Ratti, R. (2017). Oil price shocks, policy uncertainty, and stock returns of oil and gas corporations. Journal of International Money and Finance, 70, 344–359.

Kilian, L. (2009). Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. American Economic Review, 99(3), 1053–1069.

Kilian, L. (2014). Oil price shocks: Causes and consequences.

Kilian, L., & Zhou, X. (2018). Modeling fluctuations in the global demand for commodities. Journal of International Money and Finance, 88, 54–78.

Kose, M., Otrok, C., & Whiteman, C. (2003). International business cycles: World, region, and country- specific factors. American Economic Review, 93(4), 1216–1239.

Kuschnig, N., & Vashold, L. (2021). BVAR: Bayesian vector autoregressions with hierarchical prior selection in R. Journal of Statistical Software, 100, 1–27.

Lagi, M., Bertrand, K., & Bar-Yam, Y. (2011). The food crises and political instability in North Africa and the Middle East. Political Economy: Development eJournal.

Mallick, S., & Sousa, R. (2012). Real effects of monetary policy in large emerging economies. Macroeconomic Dynamics, 16(S2), 190–212.

Monfort, A., Renne, J.-P., Rueffer, R., & Vitale, G. (2003). Is economic activity in the G7 synchronized? Common shocks versus spillover effects. CEPR DiscussionPaper Series (November 2003).

Peersman, G. (2022). International food commodity prices and missing (dis) inflation in the euro area. Review of Economics and Statistics, 104(1), 85–100.

Peters, M., Langley, S., & Westcott, P. (2009). Agricultural commodity price spikes in the 1970s and 1990s: Valuable lessons for today. In Amber waves: The economics of food, farming, natural resources, and rural America, p 16–23.

Pourroy, M., Carton, B., & Coulibaly, D. (2016). Food prices and inflation targeting in emerging economies. International Economics, 146, 108–140.

Ratti, R., & Vespignani, J. (2016). Oil prices and global factor macroeconomic variables. Energy Economics, 59, 198–212.

Roberts, M., & Schlenker, W. (2013). Identifying supply and demand elasticities of agricultural commodities: Implications for the US ethanol mandate. American Economic Review, 103(6), 2265–2295.

Schnittker, J. (1973). The 1972–73 food price spiral. Brookings Papers on Economic Activity, 1973(2), 498–507.

Smith, T. (2014). Feeding unrest: Disentangling the causal relationship between food price shocks and sociopolitical conflict in urban Africa. Journal of Peace Research, 51(6), 679–695.

Sumner, D. (2009). Recent commodity price movements in historical perspective. American Journal of Agricultural Economics, 91(5), 1250–1256.

Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381–419.

Walsh, J. (2011). Reconsidering the role of food prices in inflation (IMF Working Papers 11/71). International Monetary Fund.

Winne, J. D., & Peersman, G. (2021). The impact of food prices on conflict revisited. Journal of Business & Economic Statistics, 39(2), 547–560.

You, W., Guo, Y., Zhu, H., & Tang, Y. (2017). Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Economics, 68, 1–18.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Supporting information

The data that support the findings of this study are available from the corresponding author upon request. Compliance with Ethical Standards: no funding was received for conducting this study.

Disclosure of potential conflicts of interest: the author confirms there is no conflict of interest.

Research involving human participants and/or animals: this article does not contain any studies with animals performed by the author.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

International inflation data: scree plots (Figs. 8 and 9)

2.1 Production cycle for grains

The year in which the crop was harvested could be different from year in which the crop was planted. Based on the G20 Agricultural Market Information System (AMIS), we provide a general summary of the production cycle by each commodity at monthly frequency:

-

Wheat: planting in the fall or early spring, depending on the variety and the climate. Winter wheat is typically planted in the fall and harvested in the early summer, while spring wheat is planted in the spring and harvested in late summer. Harvesting: late spring or early summer for winter wheat, and late summer for spring wheat.

-

Corn (Maize): planting in the spring is the common planting time when soil temperatures are suitable, usually between April and June. Harvesting: late summer to early fall, typically around September to October.

-

Rice: planting is usually done in the spring in warmer regions, while in cooler regions, it may be planted in late spring to early summer. Harvesting: late summer to early fall, typically around September to October.

-

Soybean: planting is often done in the spring when soil temperatures are suitable for germination. Planting usually occurs from April to June, depending on the region. Harvesting is usually harvested in the fall, typically from September to November.

We also plot the crop production cycle for grains by month for the largest producers (source: AMIS) in Fig. 10. Overall, these insights show that planting and harvesting may occur over a longer period, which may extend beyond a single year.

Source: G20 AMIS. See https://www.amis-outlook.org/fileadmin/user_upload/amis/docs/Crop_Calendar/AMIS_Crop_Calendar.pdf

Production Cycle: Leading Producers.

IRFs (Additional models) (Figs. 11, 12, 13 and 14)

About this article

Cite this article

Ginn, W. Agricultural fluctuations and global economic conditions. Rev World Econ (2024). https://doi.org/10.1007/s10290-023-00522-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s10290-023-00522-4