Abstract

We study pricing decisions in firm-to-firm trade. Using novel detailed transaction-level data from a Danish multinational firm, we uncover considerable price dispersion across countries, customers, and, surprisingly, within the same customer. In fact, we find that transaction-specific characteristics are the most important factors in explaining price variation. The extent of price dispersion within a customer relationship can be affected by the firm’s price setting strategy. Our unique dataset allows us to examine the consequences of introducing price lists containing recommended and minimum prices. We find that prices converge towards the recommended price, and that price dispersion within a customer can decline if the price lists successfully narrow the pricing range for the products that the customer purchases.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A well-known reason for violations of the Law of One Price (LOP) is that firms engage in price discrimination across customers with varying willingness to pay. This type of price discrimination has been documented in both firm-to-consumer trade (Simonovska, 2015) and firm-to-firm trade (Fontaine et al., 2020). However, most firm-to-firm trade consists of repeated interactions between a sales agent and a customer, with sales agents often possessing some discretion in applying discounts. Therefore, the same product can be sold at different prices to the same customer, reflecting different characteristics of an order—such as quantities or urgency—or different willingness to pay of the customer across interactions. In spite of the widespread presence of these types of relationships, detailed firm-to-firm transaction level data is rare, resulting in limited evidence on price setting within customer-seller relationships. In this paper, we leverage unique barcode-level data on the universe of firm-to-firm transactions of a Danish multinational to investigate the deviations from the LOP within customers and to examine the firm’s strategy for addressing these deviations.

First, we document substantial price dispersion across countries, customers, and even within the same customer-country. Notably, transaction-specific characteristics account for the largest fraction of price variation. While observed factors such as quantity discounts and bundling contribute to some of this variation, the majority is driven by unobserved transaction characteristics, which are at least partially related to the customer’s willingness to pay and the interaction between the customer and sales agent. Second, our unique dataset allows us to study a change in the firm’s pricing strategy following the introduction of a list of recommended and minimum prices. We find that these lists guide the pricing of sales agents and reduce price dispersion within the same customer. This indicates that the balance between delegation and centralization in price setting has tangible consequences for the prices customers pay and, ultimately, the observed deviations from the LOP. Furthermore, we find that the new price lists are applied differently across countries and customer types, suggesting a link between the degree of delegation to sales agents and price discrimination across customers and destinations.

To guide the empirical analysis and establish a theoretical foundation for the external validity of our findings, we build a simple model of transactions in firm-to-firm trade. In the model, a sales agent is able to observe only part of the willingness to pay of the customer. This variability in willingness to pay across transactions justifies the existence of price discrimination within the same customer. The presence of an unobserved component in the customer’s willingness to pay warrants the introduction of minimum and recommended prices. Through numerical simulations, we show that the implementation of price lists can be profit-enhancing when minimum and recommended prices are appropriately selected, by altering the sales agent’s objective function. Price lists enable sales agents to charge higher prices and extract more surplus from customers with a high willingness to pay. This outweighs the loss in profits for customers with low willingness to pay who choose not to make a purchase. We also show how the effectiveness of price lists varies with model parameters, reflecting differences in customers’ demand or, more generally, in the market environment across destinations.

Our data contains the universe of transactions of life-saving equipment by Viking, a Danish multinational operating in 27 countries, with customers spanning various segments, such as cargo ships and offshore platforms. The data covers the 4-year period from 2015 to 2018. Viking’s product portfolio is diverse, including items like lifebuoys and fire extinguishers. The products are defined at a highly granular level, equivalent to a barcode. This is a key advantage of our study, as datasets with more aggregate product definitions cannot rule out that price differences are driven by quality differences (Koren & Halpern, 2007; Fontaine et al., 2020). For this reason, our paper bridges the gap between the growing literature on firm-to-firm trade, which has generally limited information on the products exchanged (Dhyne et al., 2020; Grennan, 2013; Dhyne et al., 2022), and the literature on firm-to-consumer trade, which now benefits from highly detailed scanner data (Handbury & Weinstein, 2014; Hitsch et al., 2019; Feenstra et al., 2022).

In the first part of our empirical analysis, we quantify the contributions to price dispersion of customer, destination, time, product category, and transaction characteristics. We achieve this by performing a variance decomposition of price deviations for the same product across the listed dimensions. Transaction characteristics explain the largest portion of the variance, accounting for over 70%, while customer characteristics contribute for approximately 15% and destination characteristics to 3%. Although we find that a customer may be charged different prices for the same product due to quantity or bundling discounts, these factors only partially explain price dispersion. The majority of the variance is driven by unobserved transaction characteristics, which we speculate are likely related to shocks in the customer’s willingness to pay. For instance, in the cargo ship segment, the sudden need to replace life-saving equipment due to usage or unexpected malfunctions can significantly increase a customer’s willingness to pay, as ships must comply with safety requirements before leaving port. Consequently, the willingness to pay for a product may vary across different transactions for a single ship, and it may vary even more for customers with multiple ships managed by different employees. Finally, discounts might also be a response from sales agents to customers expressing a willingness to terminate the relationship.

These examples of transaction shocks are likely unobserved by the headquarters, as the price-setting decision is delegated to sales agents. However, firms can influence these decisions to varying degrees, such as by using price lists. In March 2018, Viking introduced a list of recommended and minimum prices for over 60% of its product range, intending to increase product prices and reduce their dispersion. If a sales agent charges a price below the minimum, they must justify the decision to a superior. Before March 2018, pricing decisions for the products analyzed were fully decentralized to the sales force. Full delegation of pricing decisions is relatively rare; a survey by Frenzen et al. (2010) found that only 11% of firms adopt such a strategy, while the majority of firms (58%) tend to delegate a significant degree of pricing authority while still maintaining some centralized control.Footnote 1

In the second part of our empirical analysis, we evaluate the effects of this new pricing strategy by exploiting the heterogeneity in the recommended and minimum prices across destinations. We find that, after March 2018, prices moved towards the recommended price, with increases or decreases depending on the recommendation’s level relative to the product’s average price before 2018. Similarly, we find that implementing the price lists reduced price dispersion for products whose pre-2018 prices had greater dispersion than the range implied by the new price lists, but not for products with less dispersed prices. This indicates that the degree of centralization in price setting, as implied by the price lists, has an impact only when it effectively restricts the pricing range available to sales agents. This empirical finding aligns with our model’s predictions.

Our results provide new insights into price discrimination across customers and destinations. Our analysis of price lists reveals that price discrimination is significantly influenced by the pricing strategy firms employ in managing firm-to-firm trade. For example, the price of an item in country A might be higher than in country B not only due to differences in recommended prices but also because the countries vary in their adherence to those recommendations. This phenomenon also occurs across customers: while Viking typically offers larger discounts to customers making larger purchases, we find that the new pricing strategy is only applied to a limited extent for these larger customers. This suggests that it is more challenging to adjust the prices charged to larger customers.

Related literature Our paper contributes to the multidisciplinary literature on price discrimination. The textbook case of price discrimination across consumers has garnered significant attention in the industrial organization literature, particularly in terms of the welfare effects of such discrimination (Robinson, 1933; Schmalensee, 1981; Varian, 1985; Katz, 1987; Holmes, 1989; Valletti, 2003; Stole, 2007; Gerardi & Shapiro, 2009). Additionally, the international trade literature has highlighted the importance of price discrimination across destinations, where trade costs and income differences play a role (Goldberg & Verboven, 2005; Atkeson & Burstein, 2008; Alessandria & Kaboski, 2011; Simonovska, 2015; Jäkel, 2019). Our analysis reveals that firms also engage in price discrimination across transactions for the same customer-destination, controlling for quantity and the number of products within an order. We investigate the determinants of this additional channel and focus on the role of price lists in controlling the degree of price discrimination.

Our paper relates to the growing literature that leverages highly detailed data obtained from a limited number of firms. For instance, Haskel and Wolf (2001) use data for Ikea, Cavallo et al. (2014, 2015) for Apple, Ikea, H &M, and Zara, and Simonovska (2015) for Mango. These papers build on publicly available information, as prices in firm-to-consumer trade are easily accessible. By contrast, obtaining detailed information on prices for identical products in firm-to-firm trade is more challenging due to their sensitive and strategic nature. Our paper fills this gap and sheds light on pricing in firm-to-firm relationships, which can inform the burgeoning theoretical literature on firm-to-firm trade (Huneeus, 2018; Bernard et al., 2019; Dhyne et al., 2022, 2020; Bernard et al., 2021). Furthermore, our study is the first to examine the role of price lists, a prevalent tool used by firms to set prices (Hansen et al., 2008; Frenzen et al., 2010).

Our papers most closely relates to Koren and Halpern (2007) and Fontaine et al. (2020), who study deviations from the LOP and price discrimination in firm-to-firm trade using international data from Hungary and France. Our paper broadens the evidence provided by these papers and provides insights on firm-to-firm trade by documenting a more comprehensive set of price determinants. Although our data focuses solely on one firm, our product definition is more detailed than any of the cited studies.Footnote 2 A similar level of disaggregation is also found in Grennan (2013), who explores pricing in domestic firm-to-firm trade for a single product, coronary stents, using information on both buyers and sellers.Footnote 3

Our paper is also related to the organizational economics literature on decision delegation. Largely driven by principal-agent models, this literature has primarily focused on the causes and consequences of decision delegation from a theoretical perspective.Footnote 4 As noted by Foss and Laursen (2005), empirical research on delegation within a firm is limited. Both Foss and Laursen (2005) and Frenzen et al. (2010) document a positive relationship between environmental uncertainty and price delegation. Lo et al. (2016) explore the degree of delegation as a function of sales agent ability and experience.Footnote 5 Our contribution to the literature is to assess the effects of one common centralization tool: price lists. Instead of concentrating on the rationale behind the extent of pricing decision delegation, we examine the impacts of a reduction in delegation across all sales agents.

The paper is organized as follows: Sect. 2 presents the model. Section 3 describes the dataset, Viking, and the introduction of the new price lists. Section 4 analyzes the degree of deviations from the LOP in Viking’s transactions. Section 5 evaluates the impact of Viking’s new price lists. Section 6 concludes.

2 A simple model of pricing

In this section, we build a simple model of the pricing decision of a sales agent, to understand the motivation for price discrimination within a customer relationship and evaluate the effects of Viking’s introduction of minimum and recommended prices. The environment of the model is the individual transaction between an agent and a customer, which constitutes the largest source of variation in prices, as we document in Sect. 4.

2.1 Benchmark

We start with a model of a decentralized pricing strategy, where sales agents have full control over the price they charge and have complete knowledge of the customers’ willingness to pay. Our focus is on the pricing decision for a generic item requested by the customer at time t. Demand for the item in the benchmark model (denoted with superscript b) has the following general form:

where \(a_t\) is a demand shifter which varies with t and can be interpreted as the customer’s willingness to pay. In our data, the demand shifter varies across destinations, customers, and interactions. In this model, we concentrate solely on its variation across interactions, which we show to be quantitatively more significant. The parameter \(\gamma\) captures the demand curvature, and we constrain it to be positive.

For simplicity, we assume that the demand shifters \(a_t\) are i.i.d.. Furthermore, we assume that customers cannot store the items or, equivalently, that the items are perishable and, hence, an item purchased in t cannot be used in \(t+1\). This assumption is supported by the data, as Viking’s items are typically purchased directly by end users (e.g., ships in port, offshore platforms, etc.) and are not generally stored in warehouses.Footnote 6 Finally, we assume that unit costs for the item equal zero.

The sales agent maximizes profits \(\pi _t=d_t p_t\) choosing price \(p_t\). The optimal price equals:

If the demand shifter \(a_t\) varies across transactions and the sales agent observes these variations, she will optimally charge a different price for each transaction. Notice that changes in \(a_t\) result in a change in demand elasticity, which is reflected by the differing optimal prices.Footnote 7

2.2 Unobserved willingness to pay

Under perfect information and no misaligned incentives between the sales agent and the firm, the chosen price maximizes profits and there exist no better alternative pricing strategy. If a firm introduces price lists, profits can only increase if some of these conditions are violated. For instance, price lists can boost profits if customers prefer sellers with lower price volatility. Another possible rationale for price lists is to prevent collusion between the sales agent and the buyer, who might share the applied discounts with each other. In this section, we consider the simplest possible mechanism by which price lists can improve profits, which relies on the imperfect ability of sales agents to observe a customer willingness to pay.

Consider the following version of the demand function (denoted with superscript u for the unobserved willingness to pay):

The customer’s demand shifter depends on two components: \(a_t\) is observed by the sales agent and \(\mu _t\) is unobserved. Without loss of generality, we assume that the expected value of the unobserved component is zero, i.e., \(E[\mu _t]=0\). The sales agent is risk-neutral and chooses the price to maximize profits given the expected demand \(E[d^u_t]=a_t -\frac{p_t^\gamma }{\gamma }\). Thus, the expected profits for the sales agent are given by: \(E[\pi _t]=E[d^u_t]p_t\). The optimal price charged by the sales agent is identical to the case of full information in Eq. (2). Since there are no price lists, we refer to this as decentralized pricing strategy.

The quantities exchanged depend on the realization of the unobserved component of the customer willingness to pay, \(\mu _t\). In particular:

If \(\mu _t<0\) and has a large enough magnitude, the customer can reject the offer, and no quantity is exchanged. This is in contrast with the case of full information, where demand is always positive. The realized profits are given by \(\pi _t=d^u_tp^u_t\).

2.3 Minimum and recommended prices

We model minimum and recommended prices by augmenting the objective function of the sales agent in Sect. 2.2 with two additional costs associated with charging a price different from the recommended price \(p_R\) or below the minimum price \(p_{min}\). In particular, the expected objective function for the sales agent become:

If the agent charges a price below the minimum price \(p_{min}\), she must incur a cost m. In the Viking case, this cost is associated with having to justify the pricing decision to the local manager. Furthermore, we model another cost which is proportional to how different the charged price is from the recommended price \(p_R\). In the Viking case, information on these costs is not known to the researcher.

The first order condition yields the following implicit solution for the optimal price \(p_t^*\)Footnote 8

For \(\theta =0\), the price is the same as (2), while for \(\theta \rightarrow \infty\), the price equals \(p_R\).

If the optimal price found in (5) is less than the minimum price, the sales agent compares her expected objective function evaluated at a price \(p^*_t\), \(E[\pi _t(p^*_t)]\), which includes the minimum price penalty m, to the objective function evaluated at the minimum price \(E[\pi _t(p_{min})]\). The pricing rule is:

The customer’s realized demand is \(d_t=\max \left\{ a_t + \mu _t-\frac{p_t^\gamma }{\gamma };0\right\}\), and the realized profits for the firm are \(\pi _t=d_tp^*_t\).

2.4 Results

We simulate the model and evaluate the effects of the new pricing strategy on price dispersion and profits. We draw a large number of observed and unobserved demand shifters from a normal distribution and apply the pricing equations discussed above. In the figures, we present the average and 95% CIs of price dispersion and profits over the demand shifters. The details of the simulation and additional figures are in “Appendix 1”. In Fig. 1, we show the ratio of total profits obtained with the use of price lists relative to the decentralized pricing strategy discussed in Sect. 2.2. The two scenarios only differ in the pricing strategy: The parameters and the draws of demand shifter are identical in each case. We vary the minimum and recommended price separately in the two panels.

Profits exhibit a non-monotonic, hump-shaped relationship to the level of the minimum and recommended prices. Increasing the minimum price increases the profitability of the average sale and the total profits, but only up to a certain point. Once the minimum price is above the optimal level, average and total profits begin to decline as agents sacrifice sales due to the high minimum price, until they become lower than in the decentralized strategy. A similar pattern occurs with the recommended price. However, the mechanism is slightly different, as higher levels of the recommended price increase the profitability of each sale. At a high level of the recommended price, a larger number of sales is not concluded, and this reduction in the number of sales generates the hump-shaped relationship between recommended prices and profits in the new strategy relative to the old one.

The positive effect of minimum and recommended prices on the company’s profits is due to the asymmetric effects of the unobserved demand shifter. In fact, while there is no upper limit to the profits that the firm can obtain from customers with high willingness to pay, the lower bound for profits is zero. For some values of our parameters, charging higher prices extracts more surplus from customers with high willingness to pay, which more than offsets the loss in profits for customers with low willingness to pay, who do not make a purchase.Footnote 9

Performance of price lists relative to decentralized strategy: profits. Notes: total profits with the price lists relative to the decentralized pricing strategy and 95% CI resulting from model simulation for a range of values for the minimum price level (a) and the recommended price level (b). Details in “Appendix 1”

Figures 3 and 4 show that values of the minimum price and recommended price that increase total profits also cause an increase in the average price, as sales agents follow the new price rules. This is the key prediction of the model and we test it in Sect. 5.1 of the empirical analysis. Furthermore, minimum prices cause a decline in price dispersion, as both the standard deviation of prices and the 95/5 percentile ratio decrease while total profits increase. The effect of the recommended price on price dispersion is less clear, as higher \(p_R\) leaves the 95/5 percentile ratio almost unchanged but increases the standard deviation of prices due to the higher average price. In Sect. 5.2 of the empirical analysis, we test whether the effect of minimum prices dominates and whether price dispersion falls with the implementation of the price lists.Footnote 10

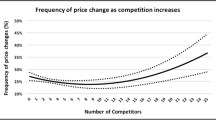

The level of certainty that the sales agent has about the customer’s willingness to pay is also an important determinant of the overall effect of minimum and recommended prices. In Fig. 7, we show that minimum and recommended prices have a larger impact when the dispersion in \(\mu _t\) is greater. The dispersion in \(\mu _t\) can reflect both the agent’s and the customer’s characteristics. In particular, we would expect this variance to be lower for repeat customers, whose willingness to pay the sales agent has had the opportunity to learn, and for large customers, who make up a significant share of the company’s sales and need to be kept satisfied. Therefore, we expect these types of customers to be less affected by a push towards price centralization. In our empirical analysis, we test for this hypothesis by considering the heterogeneous impact of price lists on customers of different classes. Furthermore, we show that a higher demand curvature, \(\gamma\), is associated with lower expected profits from the price lists (see Fig. 8). Differences in the demand curvature across items or customers suggest that firms may optimally enforce the new price lists differently. Finally, we show that our results are robust to having the demand shifter be log-normally or Pareto distributed (see Fig. 9).

In “Complements and substitute items” of “Appendix”, we consider an extension of our baseline model in which the sales agent sells two items that can be either substitutes or complements. In the decentralized case, we show the textbook result that the sales agent optimally charges higher prices for substitute items and lower prices for complement items, reflecting the difference in cross-price elasticities for the two goods. In the following sections, we will test this prediction by analyzing prices of items within the same product category. Furthermore, we show that the effects of price lists are heterogeneous across the two types of goods: When goods are complements price lists have a larger effect on total profits than when goods are substitutes.

3 Viking and the introduction of price lists

Viking Life-Saving Equipment A/S is a large Danish multinational firm that operates in the maritime, offshore, and fire safety sectors. Viking’s core production includes lifeboats, evacuation systems, and life-rafts. In March 2018, Viking introduced a new global pricing strategy by providing its sales organizations with price lists that include minimum and recommended prices for various items. This section describes the dataset provided by Viking and the nature and implementation of the new pricing strategy.

3.1 Data

The data contain transaction-level information on prices and quantities for all trade products sold by Viking in 27 countries between 2015 and 2018. The name of trade products refers to a range of safety-related items that are not part of Viking’s production of lifeboats, evacuation systems, and life-rafts. These items are not manufactured by Viking and can be considered as carry-along trade (Bernard et al., 2018). Examples of these products include fire extinguishers, lifebuoys, signal lights, first aid kits, navigation equipment, and more. Although these items do not constitute Viking’s primary activity, the company sells over 3500 of them annually, generating revenues exceeding EUR 15 million, which accounts for about 6% of total revenues. Typically, demand for these items arises when customers need to stock or replace them due to usage, breakage, or expiration (e.g., fire extinguishers).

Viking assigns a unique identifier to each item, which can be considered analogous to a barcode in retail trade. These items are then aggregated into 333 product categories. For example, one product category is “light lifebuoy”, which includes various types of light lifebuoys. While Viking products are subject to multiple regulations in each country, there is considerable variation in product pricing and characteristics within each product category, indicating a degree of vertical and horizontal differentiation. Viking sells its products to 27 destinations worldwide, with the US, Germany, and Denmark accounting for the largest sales.

Consistent with the literature on multi-product firms (Arkolakis et al., 2021), product sales are skewed towards a small fraction of best performing products: In 2018, the top 1% of products account for 50% of total sales.Footnote 11 Table 10 presents yearly sales, transactions, customers, and products, with panel B highlighting a significant degree of product churning, as more than 1300 new products were introduced and a similar number were discontinued each year.Footnote 12 The distribution of sales by customer is also highly skewed, with the top 1% of customers accounting for 26% of total sales in 2018. Additionally, there is a significant degree of customer churning, with a thousand new customers appearing every year and a smaller number of customers making their final purchase each year.

Viking assigns an identifier to each customer. Viking sells to more than 2500 customers every year, and the number has increased from 2015 to 2018. While there are some customers who purchase from Viking in multiple destinations (3% of customers in 2017), the majority of customers are firms that only purchase in one country. However, some of these firms may be divisions or subsidiaries of larger multinationals, such as a shipping company with separate Danish and Norwegian divisions and distinct employees and demand. For this paper, we treat these divisions as separate customers, as Viking classifies them.Footnote 13

Viking records additional characteristics for its customers, including their classification into four classes: VIP, A, B, and C. These classes are determined by the customers’ size and past sales revenue and each class accounts for a quarter of Viking’s sales. Customer types are ranked according to their average sales, with VIP customers spending an average of EUR 40k from 2015 to 2018, while C customers spent an average of EUR 2.4k (see Table 12). Furthermore, customers are divided into seven segments based on their operation: cargo, defense, fire, fishing, offshore, passenger, and yachting. The cargo segment is the largest accounting for 48% of total sales, followed by offshore (18%) and passenger (12%) segments. Customers in the defense segment tend to be the largest buyers (see Table 13).

Viking provides an identifier of the latest employee responsible for the orders of each customer, although this information is only available for about 70% of customers. The dataset does not include any changes in the employee responsible for each customer and only reports the latest recorded. In other words, we have information about the last sales agent involved in a transaction with a customer, but not which sales agent was responsible for previous transactions. There are 220 recorded employees, with the number ranging from 2 in Panama to 25 in Singapore. On average, this amounts to around 65 orders managed per employee in 2018 across countries. In each destination, there is a highly skewed distribution of orders, as only a few employees are linked to the majority of orders.

3.2 The introduction of price lists

In March 2018, Viking introduced price lists to its sales organizations in all destinations, containing minimum and recommended prices for a large group of items. The primary objective of the price lists was to increase product prices and reduce their dispersion. The lists vary across destinations in terms of both the products they cover and the type of strategy employed (e.g., minimum and recommended price, either, or neither). The incentives associated with the new pricing structure are unknown and likely destination-specific. Prior to March 2018, pricing decisions were fully decentralized to the sales force, but after, sales agents must justify any decision to charge below the minimum price to their superior. Although the official introduction time of the price lists is March 2018, we cannot rule out the possibility of informal circulation of price lists before that time or delays in implementing the new strategy.Footnote 14

To describe and analyze the price lists, we restrict the dataset in order to focus on items sold before and after the implementation of the price lists by destination. We focus on items by the destination where they are sold, i.e., item-destinations. Around 19% of the transactions occur after the implementation of the strategy change, and approximately 96% of transactions involve items that are included in the price lists. However, only about 83% of all items are included in the price lists, which implies that the products in the price lists are sold more frequently.Footnote 15 While minimum and recommended prices have a high coverage in the price lists, they are not overlapping, as 99% of items have a recommended price, while 93% have a minimum price.

In Figs. 2 and 13, we show how minimum and recommended prices compare to average prices in all destinations. Given that the items sold and customers serviced vary across time and destinations, we regress the log of real prices of items included in the price lists over month dummies, controlling for item-customer fixed effects and transaction characteristics for each destination.Footnote 16 We plot the constant plus the coefficients of the time dummies and compare them with the log of minimum (in red) and recommended prices (in green) net of item-customer fixed effects. We also include 95 percent confidence intervals.

In most destinations, the recommended prices are very close to the pre-March 2018 average price. However, in Estonia, Turkey, South Africa, and in Panama, prices are closer to the minimum price, suggesting that price lists in these countries had the more complicated role of steering prices up. There are large differences across destinations between the variance of prices and the new pricing range implied by the minimum and recommended prices. In Spain, Singapore, and Sweden, the pricing strategy implies a much smaller range than the observed pricing range, while in most other countries, the pricing range is similar or larger than the observed one. In Panama, Singapore, and the US, prices were decreasing pre-change, while in Iceland, Germany, and Italy, prices were on an upward trend. There is no obvious common trend in prices post-March 2018: While in most destinations there is no change, the figures suggest at least a temporary rise in Germany, Iceland, US, and South Africa.

Overall, Fig. 2 suggests that price lists were implemented differently across destinations, with substantial variation in the level and distance between minimum and recommended prices relative to price variance, thus ideally providing sales agents with a different range of options. Appendix Figs. 11 and 12 depict how minimum and recommended prices compare to average prices by customer class and trade segment. Unclassified customers, who tend to be smaller and non-returning, pay prices close to the minimum price, while all other classes pay above the minimum price. This trend is confirmed by Fig. 12, where we observe that sectors with smaller customers (Fishing and Yachting) pay prices close to the minimum price. Recommended prices tend to be higher than prices paid, particularly for customers of class C and sales in Cargo, Fire, and Yachting.

Minimum and recommended prices, by destinations (selected countries). Notes: sample: all transactions in the period 2015–2018 of products sold continuatively in 2016–2018 in Denmark, Iceland, Norway, Estonia, Spain, and the USA. Figure 13 includes all destinations where we observe above 500 transactions over the period, excluding UAE and Australia. We exclude products in sale organizations where the minimum price is assigned to be above the recommended price. Source: Viking Life-Saving Equipment A/S. For each destination: OLS of log of real prices over month dummies, item-customer fixed effects and transaction characteristics, including a dummy for if the product is sold in a bundle with other products, and the revenue of the sale in thousands of real March 2018 euros. Sample includes all items included in the price lists with both recommended and minimum prices. In blue, the estimated constant plus the coefficients of the time dummies, 95% CI. Minimum prices (in red) and recommended prices (in green) net of fixed effects. Black vertical lines: the official implementation of the new pricing strategy (colour figure online)

4 Price dispersion in firm-to-firm trade

4.1 Facts on price dispersion

In this section, we provide some basic facts on the price dispersion of Viking products. First, we provide information on the distribution of price dispersion to allow for a comparison of our findings with the literature. We show that a significant fraction of an item’s price dispersion occurs within the same customer relationship. Second, we confirm the result using a fixed effect regression model: The standard deviation of prices within item-customer-destinations is more than half of the standard deviation of prices within items.

We begin by measuring price dispersion using three methods: (1) the coefficient of variation of prices, calculated by dividing the yearly standard deviation by the mean price of an item, (2) the standard deviation of log prices for an item in a year, and (3) the ratio of the 95th percentile to the 5th percentile of the price of an item in a year. We define a product as either an item, an item-destination (to remove cross-country differences in prices), or an item-destination-customer (to remove cross-customer differences in prices). We also consider the case of products defined as item-destination-customer and, further, only select transactions where such products are sold as single products in one order. By doing this, we can control for bundling discounts that may occur within the transaction.Footnote 17 We restrict the sample for each product definition to include only those with at least 10 observations in the year considered.Footnote 18

In Table 1, we present the distribution measures for the three price dispersion methods in 2018. For the sample with all items, the average coefficient of variation is 0.21 and the median is 0.2. When we define a product as an item-destination to remove cross-country differences, the coefficient of variation reduces to 0.15. Price dispersion still persists even when we consider products within a customer. Defining a product as an item-destination-customer yields an average coefficient of variation of 0.10. When we consider only products sold as single products (SP in the table) within a customer, we find similar measures of dispersion. This indicates that the dispersion in the price of the same product for the same customer is not solely driven by bundling discounts within the transaction, i.e., the fact that products are often sold together with varying discounts.

The results are similar when we consider the other two measures of price dispersion. The average standard deviation is 0.19, which reduces to 0.13 when controlling for price differences across destinations and to 0.09 when controlling for price differences across customers. This latter value does not change when we only consider items sold as single products in an order. Finally, we examine the 95/5 percentile ratio, which has an average of 2.5. Eliminating cross-country and cross-customer differences reduce the average to 2.2 and 1.5, respectively. When we only consider products sold individually, the percentile ratio reduces to 1.36.Footnote 19

Our results align with the limited literature on price dispersion in firm-to-firm trade. Ignatenko (2019) documents a coefficient of variation of prices for the same good across buyers ranging from 0.2\(-\)0.4 depending on the sample. Similarly, Fontaine et al. (2020) reports an average coefficient of variation of 0.3 for products across buyers. However, when examining the firm-to-consumer literature, we find that prices within Viking exhibit more dispersion than prices across U.S. retailers. Hitsch et al. (2019) reports an average standard deviation of approximately 0.16, which is slightly smaller than our estimate of 0.19. However, the 95/5 percentile ratio reported by Hitsch et al. (2019) is around 1.5–1.7, much smaller than our measure of 2.5.

Our results are generally consistent across years (see Tables 14, 15, and 16 in the “Appendix”). We also consider two additional samples in Table 17 in the “Appendix”: The top 1% of items by revenues and the items purchased by the top 1% of customers by revenues. For these two subsamples, we define a product as an item. Even when focusing on the top items and top customers, the average 95/5 percentile ratio is around 1.7. Interestingly, top items and items for top customers exhibit a smaller dispersion than the sample of all items at all percentiles of the distribution.

To further illustrate the significant portion of price variance that occurs within the same customer relationship, we run the following regression:

where we regress the log price of item j, sold in destination d, to customer c, in month t, in transaction o, on a vector of fixed effects and calculate the standard deviation of the error term \(\epsilon _{jdcto}\). In Table 2, we report the results. Unlike in Table 1, we do not place any restrictions on the sample of transactions used. For reference, we also run a regression with only item fixed effects and report the standard deviation of the residual in the first row of Table 2, which is 0.32.

When we include item, customer, destination, and time fixed effects in the regression, the standard deviation of the error term reduces to 0.27, a value comparable to the reference value. However, when we interact the fixed effects and consider item-customer-destination fixed effects, the standard deviation decreases to 0.18, which is more than half of the reference value.Footnote 20 This finding further confirms the substantial variation of prices within the same customer relationship. In fact, if a customer always received the same price for the same item, the standard deviation would be zero.

Finally, when we include item-customer-destination-time fixed effects, the standard deviation of the residual is still a substantial 0.13.Footnote 21 Notably, with this set of fixed effects, we are controlling for shocks that affect the price of an item in a given month, such as seasonal changes in demand. This result implies that the same item can be priced differently for the same customer within the same month. However, this tends to occur for a relatively small fraction of customers. In fact, roughly 64% of items are sold to the same customer at the same price within a given month; it is only the remaining occurrences, in which prices vary, that drive the result. By contrast, when we consider items sold to the same customers in any month, only 16% of item-destination-customers exhibit no changes in their prices. Thus, while deviations from the LOP within customers are common, deviations from the LOP within customers and month are rarer but not impossible. This suggests that, at least for some customers, there is variability in the willingness to pay perceived by Viking within the same month. To further illustrate this point, consider the example of a shipping company that needs to purchase the same fire extinguisher for different ships in the same month. The price difference may be due to a different level of urgency required or due to the fact that different employees are responsible for the purchase of equipment for each ship.

4.2 Determinants of price dispersion

To investigate the determinants of the deviations of prices from the LOP, we conduct a variance decomposition exercise. First, we demean the log price of each item by its average \({\bar{p}}_{j}\), computed across all transactions. Second, we decompose the log of the demeaned price of item j, sold in destination d, to customer c, in month t, in transaction o, of product category h as follows:

where FE denotes a fixed effect. We estimate (8) with customer, destination, time (month–year), and product category fixed effects.Footnote 22 We assume that the remaining price dispersion not explained by these factors is attributable to transaction-specific characteristics. We also consider further refinements of the model and allow interactions between fixed effects to assess the robustness of the explanatory power of transaction characteristics. To account for the variance of the price deviations explained by each fixed effect, we use the variance decomposition approach developed by Hottman et al. (2016) and Bernard et al. (2021): We regress the estimated fixed effect on \(\ln \left( \frac{p_{jdctoh}}{{\bar{p}}{j}}\right)\) without a constant term, and the resulting coefficient represents the percentage of variance of the log prices explained by the fixed effect in question. We report the explanatory power of each variable in Table 3.Footnote 23

Customer characteristics account for 14.9% of the variation in prices, suggesting that Viking practices price discrimination across customers. This finding is consistent with the results of Ignatenko (2019), who found that 20% of price variance can be explained by buyer characteristics, and Cajal-Grossi et al. (2019), who report a larger value of 33%. On the other hand, destination characteristics account for only about 3% of price variation. This result is in line with Koren and Halpern (2007) who find that destination characteristics account for 6% of the price variation, and buyer characteristics account for 14%. The low explanatory power of destination characteristics is partly due to the fact that few customers purchase across multiple destinations, and some of the variation in destination characteristics is captured by the customer fixed effects. The product category accounts for 1% of the variance, while the month and year of the transaction accounts for 0.5%. The residual, which includes the interactions between fixed effects and transaction-specific characteristics, accounts for the majority of price variation (80%).Footnote 24

To test the robustness of our finding, we adopt more restrictive specifications of (8) and interact fixed effects together. The goal is to show that even reducing the variation left in the residual as much as possible, such variation still accounts for a large fraction of price dispersion. In column (1) of Table 4, we repeat the specification of Table 3. In column (2), we include customer-destination fixed effects, which aligns with the analysis of Sect. 5. The explanatory power of the transaction-specific characteristics remains relatively unchanged. The explanatory power of the customer-destination fixed effect is 18% (see Table 20). In column (3), we introduce destination-time fixed effects, which capture time-varying demand factors in the destination and changes in competition. Destination-time fixed effects only account for 3% of the variance (see Table 21), and they further reduce the variance of prices in the residual by 2.3 percentage points. Finally, in column (4), we consider a model with customer-destination-time fixed effects, which captures time-varying characteristics of a customer in a destination, such as the type of the match. In this case, the variance left in the residual, which only captures transaction-specific characteristics, is 66%, while the explanatory power of customer-destination-time is 33% (see Table 22).Footnote 25

As mentioned in Sect. 3.1, we are unable to control for sales agent fixed effects since we lack information on the agent that managed a particular order. We only have information on whether a customer has an assigned employee and who the last responsible employee was. Thus, we cannot dismiss the possibility that the observed price discrimination is due to different sales agents charging different prices. However, since the number of employees relative to the number of orders is small, and few employees in each destination are attached to most of the orders, it is likely that price dispersion also occurs within sales agents.Footnote 26

4.2.1 Transaction-specific characteristics

Since our primary empirical finding is a significant deviation from the LOP within the same product and customer, this section aims to investigate which observable transaction characteristics determine price dispersion. To achieve this, we consider the following regression of the demeaned price on a vector of transaction characteristics \({X_{oj}}\):

The vector \({X_{oj}}\) consists of

-

Quantity of item j in transaction o.

-

Total sales in transaction o, excluding sales from item j.

-

Total number of items in transaction o.

-

A dummy variable which equals 1 if the invoice currency of transaction o is the destination currency, and 0 otherwise.

-

The average log price of products sold in the same transaction o that belong to the same product category h as item j, excluding item j itself. The variable equals zero if no other product in the same category is sold in the same order as product j.

-

The average log price of products sold in the same transaction o that belong to a different product category \(h'\ne h\) than item j. The variable equals zero if no product is sold in a different category in the same order.

Our ability to control for transaction-specific characteristics is limited by the available data. For instance, we lack information on the order’s urgency or the requested delivery time of the products, which could reveal the customers’ willingness to pay. Nevertheless, the variables at our disposal account for crucial channels of price discrimination: Price variations for the same product and customer can result from differences in value across orders, together with the presence of discounts. Additionally, bundling discounts may also play a role: The price of a product depends on the number of other products the customer purchases. We excluded the relevance of this channel in Table 1.

In Table 5, we present the results of the regression, which reveal that Viking applies quantity discounts. Doubling the units sold leads to a 5% reduction in the price per unit. Additionally, Viking employs discounts that depend on the other items sold in the same order: Larger transaction values are associated with lower prices of the items within the transaction, and transactions involving a larger set of items tend to receive discounts. Doubling the number of products in a transaction results in an almost 3% reduction in the price of the items within that transaction, which suggests the presence of bundling discounts.Footnote 27 Finally, transactions invoiced in the local currency tend to be 5% cheaper.

A higher average price of products in the same product category is associated with higher prices, indicating some degree of substitutability between items in the same product category.Footnote 28 Conversely, the coefficient on the average price of items outside the category to which item j belongs is negative and significant, indicating that items across product categories tend to be complements.

As evidenced by the \(R^2\) of the regressions, these additional variables explain up to 11% of the variance remaining in the residual after accounting for customer, destination, time, and category fixed effects. To further validate the robustness of these results, in column (7) of Table 5, we control for all possible fixed effects interactions and discover that a significant portion of the variance remains unexplained.

Another explanation for the high degree of price dispersion within the same customer relationship may be attributed to the type of transaction. Several of the items sold by Viking are part of mandatory safety requirements and, as mentioned in Sect. 3.1, demand for these items may arise when a customer needs to replace them due to usage, breakage, or expiration. In some cases, the customer may have a tight schedule for the replacement and may be willing to pay more for prompt service. For instance, a cargo ship may be stuck in Panama until all mandatory security items are stocked, and the wait could be costly. However, as previously stated, we lack information on the type of transaction to verify this mechanism.

The large dispersion in prices within the same customer motivates our focus on price lists in the following sections. These transaction-specific shocks are unknown to both the researchers and Viking’s headquarters, who do not closely monitor all interactions between sales agents and customers. The variation in prices depends not only on the unobserved customers’ willingness to pay but also on how Viking handles the transaction shocks. The pricing decisions of sales agents are constrained by recommended and minimum prices, and we aim to examine whether these tools ultimately impact price dispersion.

4.2.2 Customer characteristics

To understand the relationship between prices and customer characteristics, we consider the following regression of the demeaned price on a vector of customer characteristics \({X_c}\):

The vector \({X_{cj}}\) consists of

-

Total sales on customer c, where we exclude sales of item j in transaction o.

-

Total number of items purchased by customer c.

-

Total number of transactions by customer c.

-

A dummy variable that equals one if customer c has an associated Viking’s employee at the end of the data period.

-

A dummy variable that equals one if customer c did not purchase from Viking in the previous year (new customer).

-

A dummy variable that equals one if customer c did not purchase from Viking in the following year (lost customer).

The results are reported in Table 6. Larger customers generally receive lower prices, which confirms the findings of Ignatenko (2019). In fact, customers who purchase higher values, a greater number of items, or larger transactions are offered lower prices. Viking provides more substantial discounts to customers who buy many products, controlling for their value and the number of orders [column (5)]. Customers assigned to an employee receive a 4% discount. Lost customers and new customers are offered prices that are 3% higher than other customers.

There is evidence of price discrimination across customer segments and customer classes. To show this, we run regression (10) by incorporating the division of customers into classes and segments as dummy variables and present the results in Table 33 of the “Appendix”.Footnote 29 Using the complete set of controls for customer characteristics, we find that, relative to the yachting segment, the offshore and passenger segments are offered higher prices. Holding quantities and the number of products purchased constant, VIP customers are charged higher prices than class C customers. This outcome implies that Viking assigns to the VIP category customers with a high willingness to pay, or that Viking provides VIP customers with additional services, which justify higher prices. The variables we investigated in this section only account for a small portion of the explanatory power of customer characteristics on prices. Indeed, the \(R^2\) of our regressions barely surpasses 9%, which is close to the combined explanatory power of destination, time, and product category characteristics.

4.2.3 Destination characteristics

To understand the relationship between prices and destination characteristics, we consider the following regression of the demeaned price on per capita income, GDP, and the destination’s distance from Denmark:

We collect per capita income and GDP data from the World Development Indicators and distance information from CEPII. Table 7 shows a negative relationship between GDP and prices: Larger economies pay lower prices for Viking’s products. On the other hand, Viking charges higher prices to richer destinations, even controlling for GDP. The two coefficients become statistically significant when we control for distance. This is largely driven by the fact that in the sample of countries where Viking operates, the richer countries are also the ones closest to Denmark. This result is in line with the evidence of Fontaine et al. (2020) for firm-to-firm trade and from pricing in firm-to-consumer (Simonovska, 2015). When we control for customer fixed effects, both variables lose their statistical significance (column 4). This result is likely due to the fact that only 3% of customers purchase from more than one destination. The coefficient on distance is positive: Prices are higher in more distant destinations from Denmark. However, this does not appear to be the result of trade costs, as the items examined here are not produced by Viking and are bought by the local sales organizations in each country.

5 Impact of the price lists

This section evaluates the impact of minimum and recommended prices on Viking’s pricing behavior. We leverage the varying recommended and minimum price levels across items and countries to conduct our analysis. Our approach consists of two parts. First, we examine the effect of price lists on prices, using the dataset described in Sect. 3.2. Second, we investigate the impact of price lists on price dispersion at the item-destination-customer level.

Although we are not privy to the precise reasons behind Viking’s decision to include or exclude items from their price lists, we can infer that it was a move to optimize or rectify their previous pricing strategy. Consequently, we expect that the items included in and excluded from the price lists will differ somewhat. In Appendix Table 34, we present the summary statistics for items on and off the price lists, and with and without minimum prices. The items not included in the price lists tend to be pricier, and are less likely to receive significant discounts. Conversely, the items on the price lists sell more frequently, and might require a clearer pricing strategy. Additionally, the items on the price lists with only minimum prices could be items that were previously sold at prices that were too low. Figure 2 shows that minimum and recommended prices vary across sales destinations and align with the existing price trends. These factors suggest that we should exercise caution when interpreting our results in this section as causal. Nevertheless, they provide a valuable insight into how the introduction of the new pricing strategy influenced prices within Viking.

Our focus is on the variations between items with recommended and minimum prices that are either higher or lower than the average price before 2018. Our findings show that prices tend to move in the direction indicated by the minimum and recommended prices. For instance, items with an average price before March 2018 that was lower than the minimum price tend to experience an increase in price, while items with an average price above the recommended price tend to experience a decrease in price. Furthermore, we document a reduction in price dispersion that occurs for those items that previously had prices outside the pricing range suggested by the minimum and recommended prices. Although we cannot examine the effect of the price lists on Viking’s profits, these results align with the model’s predictions in Sect. 2.

5.1 Impact of the price lists on prices

5.1.1 Empirical strategy

Our baseline regression equation for studying the impact of Viking’s new pricing strategy on prices is the following:

where \(\ln \left( p_{jdcto}\right)\) is the log of the real price of item j, sold in destination d, to customer c, in month t, in transaction o. \(\text {Post}_t\) is a binary variable that equals one if the new pricing strategy is active in month t, when month t is March 2018 or later. \(\text {New Strategy}_{jd}\) indicates whether the item is covered by the new pricing strategy or not.Footnote 30 We define \(\text {New Strategy}_{jd}\) in several ways. Our preferred definition splits the treatment into the possible scenarios generated by the difference between the average price charged before 2018 (\(p_{pre}\)), and the new recommended and minimum prices (\(p_{rec}\) and \(p_{min}\)). There are three scenarios listed hereFootnote 31:

-

1.

\(p_{rec}> p_{pre}\), \(p_{min}> p_{pre}\). As both recommended and minimum prices are higher than the average price, we expect the price for these products to increase.

-

2.

\(p_{rec}< p_{pre}\), \(p_{min}< p_{pre}\). As both recommended and minimum prices are lower than the average price, we expect the price for these products to decrease.

-

3.

\(p_{rec}> p_{pre}\), \(p_{min}< p_{pre}\). The effect of the new pricing strategy in this case is ex-ante ambiguous. In fact, the price can increase to become closer on average to the recommended price, or it can decrease because of the larger margin for discounts.

Therefore, we split \(\text {New Strategy}_{jd}\) into four different treatments: (1) both recommended and minimum prices above the average unit price (10% of item-destinations), (2) both recommended and minimum prices below the average unit price (26%), (3) recommended price above and minimum price below the average unit price (52%), (4) items lacking the minimum or recommended price (12%).

The main coefficient of interest is \(\beta\), which measures the effect of the interaction between the new pricing strategy and the Post indicator. A positive coefficient for the first scenario above would indicate that the introduction of the minimum and recommended prices is linked to an increase in the price of items whose historical average was lower than the minimum price.

For completeness, we consider two additional measures for \(\text {New Strategy}_{jd}\). First, we use a dummy which equals one if the item-destination is in the price list. With this specification, we compare items in the price lists to items not in the price lists using the entire dataset. Second, we narrow the sample down to only include items on the price lists and compare items with a minimum price to those without.Footnote 32

As in Sects. 3.2 and 4, we control for item-destination and customer-specific characteristics with item-destination-customer fixed effects. These capture any product, destination, and customer characteristics that, alone or interacted, affect the price setting for a product in the same way across time. As each customer belongs to only one segment, item-destination-customer fixed effects automatically control for segment characteristics. Additionally, we include month fixed effects. Finally, \(X_{jdcto}\) is a vector of additional controls that includes a dummy variable for whether the product is sold in a bundle with other products and the revenue generated from the sale, measured in thousands of real March 2018 euros.

Pre-trends. If we are comparing prices of items that followed distinct trends before the price lists were implemented, we might be concerned that our findings are driven by these trends rather than the introduction of the pricing lists. To address this, we display the trend of average log prices for items on and off the price lists in panel (a) of Appendix Fig. 16. Both follow similar increasing trends, with the average prices for items not on the price lists being less stable due to the lower transaction volume. Intriguingly, post-March 2018, there appears to be a flattening of both time series and, at least temporarily, a decrease in the prices of items not on the price lists. In panel (b) of Fig. 16, we run regression (12), interacting the dummy for the new pricing strategy with month dummies rather than \(\text {Post}_t\), and plot the estimated coefficients. Net of item-destination-customer fixed effects and transaction characteristics, the prices of items on and off the price lists do not appear to consistently diverge or converge over the time period. Post-March 2018, there is not a significant change, and if anything, the prices of items on the price lists decrease slightly. In panels (c) and (d) of Fig. 16, we repeat the above analysis by comparing prices of items on the price list with and without a minimum price. Items on the price list with and without a minimum price follow the same trend before March 2018 and appear to flatten post-March 2018.

In our preferred specification, we focus on the differences between items with recommended and minimum prices above and/or below the pre-2018 average unit price. Thus, we repeat the price trend analysis for items in the price lists with minimum and recommended prices below and above the average pre-2018 unit price in panels (e) and (f) of Fig. 16. Panel (e) displays the raw trends, indicating that prices of items with an average pre-2018 unit price below the minimum or above the recommended prices were flat over the period. By contrast, prices of items with a pre-2018 price between the minimum and recommended prices demonstrated an upward trend before 2018. After controlling for item-destination-customer fixed effects in panel (f), we find that the trends are less apparent in 2015–2017. While there was some price convergence starting in 2017, prices for the three types of items in 2017 were comparable, and we observe a clear price convergence after 2018, notably due to a rise in prices of items with a pre-2018 unit price below both the minimum and recommended price. Overall, although the implementation of the price lists is non-random, the analysis of pre-trends is reassuring.

5.1.2 Results

Table 8 presents the results of Eq. (12). In columns 1 and 2, we compare prices before and after March 2018 for items on and off the price lists. Columns 3 and 4 present outcomes for the sample of items on the price lists, comparing prices before and after March 2018 for items with and without a minimum price. In columns 2 and 4, we present the findings for our preferred specification, with the treatment split into four scenarios, as discussed in Sect. 5.1.1.

We find that there is no effect of the introduction of the price lists or of the minimum price for items on the price lists. However, this overall zero effect conceals substantial heterogeneity based on whether the average price of the item-destination was above or below the minimum and recommended prices. We find that prices of items above (below) both recommended and minimum prices before 2018 decreased (increased) by 6%, while prices of items between the minimum and recommended prices saw a small and barely significant increase of between 1 and 2%.Footnote 33

We are also interested in understanding if the implementation of the price lists affects price discrimination across customers, segments, and destinations. To investigate this, we estimate Eq. (12) with the specification of column (4) of Table 8 by customer classification, trade segment, and destination. We separate item-destination-customer fixed effects and control for item-destination and customer-specific characteristics with item-destination and customer fixed effects. The results are presented in Fig. 17. The first blue bar in panels (a-c) represents the result for the entire sample. Our findings suggest that the application of the new pricing strategy is not uniform across customers and destinations. Although prices converge towards the range between the recommended and minimum prices, this convergence is not uniform: for VIP customers, it is only suggestive and not significant, while it is clear and significant for customers of classes B and C. The results by trade segment follow a similar pattern, with the defense sector being the only outlier, while the pattern by destinations is not clear. The overall results suggest heterogeneity in the enforcement and application of the new price lists across countries and customers, leading to differences in price setting across customers and destinations and partially driving price discrimination.

5.2 Impact of the price lists on price dispersion

5.2.1 Empirical strategy

To study the effect of imposing recommended and minimum pricing directly on price dispersion, we consider the following baseline regression:

where \(d_{jdcq}\) is an indicator of dispersion of the real price of item j, sold in destination d, to customer c, in quarter q. Our main indicator of price dispersion is the coefficient of variation measured as the standard deviation of the price of an item j, sold in destination d, to customer c, in quarter q divided by the average price, all multiplied by 100. As an alternative measure of price dispersion we use the log of the 95/5 percentile ratio of the quarterly price.Footnote 34

\(\text {Post}_q\) is a binary variable that equals one if the new pricing strategy is active in quarter q, i.e., starting in the second quarter of 2018.Footnote 35 Our main coefficient of interest is \(\beta\), which quantifies the effect of the interaction between the new pricing strategy and the Post indicator. As in the Sect. 5.1.1, we consider different measures of \(\text {New Strategy}_{jd}\), including dummies for whether the item is included in the price lists.

As previously discussed, the effectiveness of the new pricing strategy depends on the distribution of prices before the implementation of the price lists, in relation to the minimum and recommended prices within the new pricing range. Intuitively, if the price distribution before 2018 was outside the new range, we would expect a reduction in price dispersion. Conversely, if the price distribution before 2018 was already within the new price range, we would expect no effect on price dispersion, or possibly an increase. Therefore, we have created two indicators to determine whether the observed price range in the years before 2018 was inside or outside the pricing range implied by the new minimum and recommended prices. We have defined the price range using the 5th and 95th percentiles of the distribution, and we have run robustness checks using the 1st and 99th percentiles, as well as the 10th and 90th percentiles. The two price ranges are defined as follows:

-

1.

In range: \(p5_{pre} > p_{min}\), \(p95_{pre} \le p_{rec}\)

-

2.

Out of range: \(p5_{pre} \le p_{min}\), \(p95_{pre} > p_{rec}\)

As the recommended price is not a maximum price, the range defined above is skewed towards the lower end. Consequently, we have conducted robustness checks using the recommended price multiplied by 1.5 and 2 as the upper bounds of the new price range.

5.2.2 Results

Table 9 shows the results of Eq. (13) for both our indicators of price dispersion,Footnote 36 Table 9 shows that the coefficient of variation of items that before the implementation of the new pricing strategy had a p5–p95 range outside of the minimum-recommended price range showed a significant decrease of 3.5 percentage points relative to the other items. This finding is further supported by the 10% reduction in the ratio between the 95th and the 5th percentiles of the quarterly real price distribution. These results suggest that the new pricing strategy had an effect on price setting by reducing price dispersion for item-destination-customer combinations that had prices outside of the desired range.

On the other hand, we find that the coefficient of variation of items that before the implementation of the new pricing strategy had a p5-p95 range inside of the minimum-recommended price range showed an increase of 1.5 percentage points relative to the other items, significant at the 5% level. The corresponding 3.3% increase in the ratio between the 95th and the 5th percentiles of the quarterly real price distribution is instead not significant. These results suggest that pricing for this category of products is becoming more flexible after the introduction of the new pricing strategy, probably because sales managers are now justified in practicing higher or lower prices than before.

We find interesting heterogeneous results across customer classes, trade segments, and destinations. In Appendix Fig. 18, we present the results of the regression in column 2 of Table 9 by customer class, trade segment, and destination. Our findings reveal that the significant reduction in price dispersion is driven by customers in the VIP and C classes, who are active in cargo and offshore operations in Norway, France, and South Africa.Footnote 37

6 Conclusions

Using data from a Danish multinational, we study price dispersion in firm-to-firm trade. Our analysis reveals that a significant portion of the variation in prices for a given product is transaction-specific, even after controlling for a rich set of fixed effects. To examine the role of sales agents’ negotiation freedom in influencing price dispersion, we investigate the impact of a centralization in pricing decisions through the implementation of a list of recommended and minimum prices. Our findings suggest that these prices are an effective tool in regulating price setting. Specifically, a stricter pricing range than what was previously applied by sales agents leads to a decrease in price dispersion.

We also document a a significant level of heterogeneity in the implementation of the new pricing strategy across destinations, which implies that some degree of decentralization is inherent to the company’s organizational structure. These differences could depend on Viking’s particular history in the various destinations, on area-specific features such as the prevalence of competitors or trade patterns, or on cultural differences that influence business practices. Investigating how cultural norms impact bargaining and price setting in firm-to-firm trade presents an intriguing avenue for future research.

Overall, we find a high degree of price discrimination across customers. Moreover, we find that VIP customers are less affected by the new pricing strategy. This can be attributed, in part, to the fact that the recommended prices in the price lists have been established near the prices paid by VIP customers. This outcome is not surprising, as sales agents have collected more data on the willingness of large repeat customers to pay and use this information when determining prices. Therefore, it is reasonable to expect that the implementation of price lists would have a relatively smaller effect on these customers.

Notes

A similar distribution of delegation decisions across firms is documented by Hansen et al. (2008).

Firm-to-firm trade is also studied by Ignatenko (2019) using data from Paraguay and by Cajal-Grossi et al. (2019) using data from Bangladesh. The most disaggregate product definition in the literature is in Ignatenko (2019), who combines the Harmonized System 8-digit codes with brand names and detailed product description. The other papers mentioned examine goods defined at the 8- or 6-digit level. Due to the more aggregated data used in the literature, price differences for the same product across buyers may reflect product differentiation. However, in our paper, price differences for a product are solely attributed to price discrimination.

Grennan (2013) focuses on alternative pricing configurations from the point of view of buyers while our paper is focused on sellers. Always in a domestic context, Grennan and Swanson (2020) have information on a wider set of health products purchased by a large number of hospitals. However, the authors cannot study price discrimination and focus on the effects of information on buyers’ prices.

Lo et al. (2016) measure the extent of delegation by the maximum discount off a price list that a sales agent is allowed to offer without having to report to its manager.

An equivalent but less analytically tractable approach is to allow the demand curvature \(\gamma\) to vary across interactions. We do not model bargaining and instead assume that the sales agent makes a take-it-or-leave-it price offer. We abstract from bargaining because, in our data, we would not be able to distinguish between bargaining ability and willingness to pay.

In the case of linear demand (i.e., \(\gamma =1\)), we can find an explicit solution for prices, which equal a weighted average of the price in the decentralized strategy (2) and the recommended price: \(p^*_t=\frac{2}{\theta +2}\left( \frac{a_t}{2}\right) + \frac{\theta }{\theta +2}\left( p_R\right)\).

Since total profits depend on the realized demand shifters, it is difficult to gauge the optimal minimum and recommended price, and whether the two pricing tools are complements or substitutes. To gather some intuition, we consider the average profits across 100 iterations of our simulations in Fig. 6. We find that using both pricing tools generates larger profits than using only one. Furthermore, it appears that the two pricing tools are imperfect substitutes in the neighborhood of the optimal values. For instance, increasing the minimum price reduces the level of the recommended price that generates the largest average profits.

Fig. 5 shows the effects of varying the minimum price penalty m and the recommended price penalty \(\theta\) on total profits.

See online appendix A for the distribution of sales by product and customer.

A large share of product churning occurs within product categories, likely reflecting new products replacing older ones. Figure 14 shows the distribution of net product introduction (i.e., the difference between the number of new products and the number of discontinued products) by product category, with nearly 40% of product categories experiencing zero net entry in 2016 and approximately 73% of categories having a net entry of products between \(-1\) and 1.

Table 11 in the “Appendix” provides the list of destinations with the associated sales, number of customers, and products.

An interesting aspect of the pricing decision of Viking is the fact that variation of prices for the same product within a client may discourage the client from coming back to Viking. To fully explore the retention effects of the pricing decisions of Viking, we would need information about the total purchases of clients of life-saving equipment regardless of whether they were acquired from Viking or not. Such data is not available.

Appendix Table 34 confirms this: The average total quantity sold of items not in the price lists is about one fourth of the quantity sold of items in the price lists.

To compute real prices, we divide the price of a product in a transaction by the corresponding monthly CPI for G20 economies from Eurostat.

We cannot exclude the possibility of bundling discounts occurring in different transactions within a short time span. However, further restricting the sample to products sold in single-product orders that occur in different months leaves us with too few observations to compute the various measures of dispersion. Nonetheless, we explore the impact of this type of bundling in Sect. 4.2.

In 2018, our sample includes 617 items, 900 item-destinations, 333 item-destination-customers that meet this criterion, and 68 item-destination-customers which are sold as the only product in at least 10 orders.

It is worth noting that this combination of fixed effects is also used in Sect. 5, where we investigate the effects of price lists within the same item-customer-destination.

The number of observations in Table 2 decreases as we drop a larger number of singleton observations when we interact fixed effects. However, the results barely change if we restrict the sample so that the number of observations is the same in all four specifications. See Table 18 for details. Additionally, we have verified that daily exchange rate movements are not driving the results by repeating the analysis in Table 2 with a sample of transactions invoiced in local currency only, Danish kroners only, and euro only. See Table 19 for details.