Abstract

Focusing on EU countries, we analyze the influence of immigration flows on the demand for different aggregate categories of final consumption goods. Using the cross-country heterogeneity in immigration flows and preference structures, we find that when people move from a country to another, the sectoral preferences characterizing the origin country affect the preference structure of the host country. Furthermore, we find evidence that the transmission mechanism is reinforced by both the intensity of the immigration flows and the share of immigrants already living in the host country, suggesting a higher propensity to assimilate different consumption standards in more pluralistic countries. Our contribution is twofold. First, differently from most of the literature that analyzes the supply-side consequences of immigration, this study focuses on the impact of immigration on the demand side at the aggregate level. Second, we show that sectoral consumer preferences, even if elicited only residually, represent aggregate variables that can be transferred across countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As migration represents a prominent global phenomenon, extensive economic literature investigates its effects on the host economies. In this line, many contributions analyze the impacts on the labor market outcomes, particularly on wages and unemployment (Dustmann et al., 2016). Other lively research areas concern entrepreneurship, innovation, productivity, international trade, and growth [see Chiswic and Miller (2014), for a comprehensive discussion]. Overall, most of the extant literature takes a supply-side perspective, while the impact of immigration on the structural characteristics of the demand remains surprisingly overlooked. Our contribution aims at filling this gap by taking a demand-side perspective. Indeed, we consider immigrants as consumers, and we investigate their influence on the sectoral composition of the final consumption expenditure in the host countries.

To this purpose, we use a theoretical model to identify aggregate consumer preferences, and we conduct an empirical analysis using the immigration and consumption data of a panel of European Union (EU, hereafter) countries. We find that immigrants’ preferences have a significant impact on the preference structure of the host countries and that the impact increases with both the intensity of new immigration flows and the share of resident immigrants in the total population. From our analysis, it emerges that immigration flows contributed significantly to reduce the difference in terms of preference and expenditure structure among the analyzed panel of EU countries. Furthermore, they modified the relative relevance of the consumption sectors, keeping the expenditure share of the Food sector higher by 2% points, and affecting negatively the expenditure shares of Recreation & culture, Restaurants & hotels, and Miscellaneous sectors by around 1% point.

Beyond providing important elements for understanding the aggregate demand-side structure, our paper remarks on a theoretical point. Indeed, it shows that sectoral preferences have an important impact on the economic systems and, for this reason, they are worth specific analysis in macroeconomics, even if they can be elicited only residually.

The results of several contributions (discussed in the next Section) corroborate the relevance of our findings. These contributions argue that supply-side mechanisms can explain only a part (more or less large, according to the authors) of the observed changes in the sectoral composition of aggregate variables (such as consumption, value-added, and employment).

The paper is structured as follows. Section 2 discusses the motivation and provides references to the relevant contributions about immigration, consumer preferences, and multi-sectoral macroeconomic models. In addition, it provides examples of the use of latent variables to analyze aggregate dynamics. Section 3 presents the data concerning the final consumption expenditure and the migration flows, and the methodology followed to elicit sectoral preferences. Section 4 describes the empirical strategy to assess the impact of immigration on preference dynamics and reports the main results. Section 5 conducts some robustness analyses of the empirical estimation and considers some extensions of the baseline model. Section 6 illustrates counterfactual exercises to simulate the evolution of preferences and expenditure shares in the absence of immigration flows and the preference transmission mechanism. Finally, Sect. 7 provides some concluding remarks.

2 Literature and Motivation

Our paper draws from different streams of literature that can be organized into two blocks. One aims at developing the conceptual framework. The other provides the methodological framework.

2.1 Conceptual framework

With regard to the first block, our starting point is that consumption preferences may differ across countries. In this sense, we rely on the literature on culture and economics, which emphasizes how differences in social attitudes across countries are linked to cross-country differences in economic outcomes [for a survey, see Guiso et al. (2006), Fernández (2008, 2011)]. According to several studies, these cultural elements may play a significant role when comparing the economic outcomes of natives and immigrants,Footnote 1 including consumption patterns. These differences may be driven by the consumption of ethnic goods (Chiswic & Miller, 2014; Chiswick, 2009),Footnote 2 by the status-seeking of minorities (Charles et al., 2009) or, more generally, by differences in social attitudes (Fernández, 2011).

While the literature that analyzes individual choices among substitute goods, or goods that differ in terms of quality is quite consolidated, there is no economic analysis, to the best of our knowledge, on the influence of immigration on the aggregate composition of the final consumption expenditure. The lack of attention to this topic is probably due to the small share of immigrants over total consumers in the host country. Nevertheless, we consider the possibility that individuals influence each other as a result of the socialization process. According to this view, a minority (e.g., immigrants) can assume aggregate relevance if their preference structure affects, even slightly, the preference structure of the majority (e.g., natives). In this sense, we refer to the literature on interdependent preferences. Since Pollak (1976) seminal contribution, the literature has adopted the idea of interdependency to analyze distinct aspects both at the aggregate level (external habits, as in Abel, 1990) and at the sectoral level (deep external habits, as in Ravn et al., 2006), and has conducted empirical investigations to test the presence of such mechanism.Footnote 3

Our contribution is related to the cited literature, although two important differences are worth discussing. The first one concerns the reference group and the level of aggregation. Most of the literature investigates individual households’ choices and tries to identify the concept of proximity [geographical, in Alvarez-Cuadrado et al. (2016); social, in Maurer and Meier (2008)], which may have the highest impact on individual behavior. Instead, we work with aggregate variables and we consider two representative agents, namely, residents and immigrants. Focusing on immigrants as a reference group has the advantage of reducing the risks related to the “reflection problems” highlighted earlier by Manski (1993, 2003). Essentially, co-movements in actual consumption might result from individuals sharing some unobserved characteristics that are often difficult to detect (Maurer & Meier, 2008). In this sense, our analysis is less likely to be harmed by Manski’s reflection problem as changes are induced by differences among people coming from different countries observed in the previous year. Notwithstanding, we run a robustness analysis to control for co-movements and convergence in preferences in Sect. 5.

A second difference concerns the mechanism through which the interdependence occurs. In the cited papers, it is other people’s level of consumption or the distribution of the expenditure shares that affects individual choices. This assumption is convenient for developing an empirical analysis, and it is also reasonable as it assumes that individual consumption choices are affected by actual (and observable) consumption choices of the reference group. However, this kind of formalization does not consider the pure socio-cultural effect that defines the “taste shifters” [as called in Alvarez-Cuadrado et al. (2016)]. Actual consumption is indeed the outcome and it is affected by several variables; thus, its changes may not reflect similar changes in preferences. We argue that to better identify the interdependence of preferences, it is important to elicit preferences and use them as actual variables.Footnote 4 From this perspective, even if with several differences (research question, level of aggregation, methodology to elicit preferences), our contribution is in line with Moriconi and Peri (2019), who identify country-specific preferences and analyze how they influence the labor-supply choice of the first and second generations of immigrants.

2.2 Methodological approach

Moving to the methodological aspects, our study relies on the theoretical and empirical models developed in the macroeconomic literature to study the change in the sectoral composition of the aggregate variables. This literature has mostly tried to assess the role of different mechanisms underlying the surge of the services sector and the fall of the agricultural sector observed in the last decades [see Schettkat and Yocarini (2006), and Herrendorf et al. (2014), for the review of the literature].

When focusing on the analysis of the final expenditure, it emerges that a relevant part of the evolution of the expenditure shares is not explained by relative price dynamics, stimulating research on other possible determinants of sectoral composition (among the others, see Van Neuss (2019), for a discussion on this point). A first consequence has been the introduction of non-homothetic preference as a driving force to explain long-run paths. In this track, a novel and already widely applied approach in the field has been introduced by Comin et al. (2021).Footnote 5 We decided to adopt the preference structure defined in their contribution as it can be extended to an indefinite number of sectors and it is characterized by persistent differences in sectoral income elasticities.Footnote 6 After estimating the parameters that determine the price elasticity and the sectoral income elasticities, this theoretical framework allows us to elicit the level, and to analyze the dynamics, of consumer preferences for different categories of goods.

The choice of considering the aggregate preference dynamics represents a characterizing element of our contribution.Footnote 7 In fact, rather than characterizing immigration flows exclusively according to the country of origin, as if they would represent an element that always induces the same effects, we characterize migration flows by the time-varying preference structure emerged in the country of origin. To facilitate the intuition, let us suppose that there are migration flows from country X to country Y and country X is characterized by preferences for sector i higher than country Y during the first part of the considered time span, while the opposite occurs in the second part. In this case, and without information about the corresponding preference structure, the analysis of the effects of immigration flows from country X to country Y would be incomplete and it would probably produce statistically not significant estimates. On the contrary, according to our perspective, once the evolution of the preferences is considered, the analysis should show a significant effect of migration flows, initially generating an increase and then a decrease in the preferences for sector i in country Y.

In this sense, the way we treat preferences is similar to how vast literature has treated total factor productivity (TFP, hereafter) or other variables related to technical progress which are not directly observed in the data, but that can be extracted using structural models.Footnote 8 To our purposes, it is worth emphasizing the methodological similarities, in that we use: i) a structural model to elicit preferences [instead of TFPs, as in De la Fuente and Domenech (2001)] as differences between observed data and model-predicted values; ii) the differences in sectoral preferences among countries [rather than differences in sectoral TFPs, as in Mc Morrow et al. (2010)] as the main independent variable affecting preference (instead of TFP) dynamics; iii) the immigration flows [rather than FDI, as in Woo (2009)] as a channel of transmission.

3 Preference assessment

In this Section, we describe the procedure to identify the sectoral preferences of residents and immigrants. Initially, we introduce data sources and describe the sample of countries used in the empirical analysis. Successively, we briefly describe the theoretical framework and the econometric/calibration approach employed to elicit the time series of the sectoral preferences characterizing each country. Starting from these preferences and taking into account the immigration-flow data, we show how to build up the sectoral preferences of the representative immigrant for each host country. Finally, we present some descriptive statistics concerning the sectoral preferences of residents and immigrants.

3.1 Data

Data on final consumption expenditure are taken from Eurostat database. The data are organized by consumption purpose according to COICOP classification at two-digit level (twelve categories), and are available for the period 1998–2017.Footnote 9 Price data are constructed using the COICOP time series in current prices and in chain-linked volumes, issued by Eurostat. As shown later, this set of information is sufficient to estimate the parameters of the structural model and to elicit time-varying sectoral preferences.

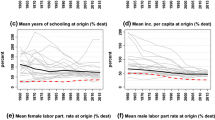

Migration flows data by nationality and destination country are taken from OECD.stat data warehouse. Unfortunately, data on migration flows by country of origin and destination are not available for all 28 European countries and, because of this limitation, our sample reduces to 20 countries observed over the period from 1998 to 2017.Footnote 10 These data represent, on average, the 72% of EU28 yearly flows directed to the countries in our sample. Through this set of information, we assess, for each host country, the relative incidence of the immigration flows by country of origin. As explained in Sect. 3.2, relative incidences are used as weights to build up the preference structure profile of the representative immigrant for the corresponding host country [later, Eq. (4)].

Finally, data regarding the stocks of total foreign citizens by EU member state are taken from Eurostat. The share of immigrants in total population of each country is used as an indicator for the transferability degree of immigrants’ preferences to local consumers. The average value of this indicator in our panel of countries is 8.5% with a standard deviation equal to 9.4% points, revealing substantial heterogeneity across countries.

3.2 Theoretical Framework

With regards to the identification of the sectoral preferences we follow Comin et al. (2021), where the utility function is monotonically increasing in the composite consumption bundle, \(C_{t}\), which is implicitly defined over the consumption of n types of goods, as follows:

where, \(C_{i,t}\) is the consumption of sector i goods at time t, \(\Omega _{i,t}\) represents sector i preference weight, \(\sigma\) is the price elasticity of substitution, and \(\epsilon _{i}\) determines the income elasticity for sector i.Footnote 11 For a generic country r, under standard model assumptions, the optimality conditions associated to Eq. (1) lead to the following system of equations:

where, on the left-hand side it is reported the logarithm of the ratio between the expenditure share of each sector i, \(\omega ^{r} _{it}\), and the expenditure share of a specific consumption sector which is used as a benchmark, \(\omega ^{r} _{ft}\). Similarly, on the right-hand side, it is reported the logarithm of the ratio between the price of each sector i, \(P^{r} _{it}\), and the price of the benchmark sector, \(P^{r} _{ft}\); \(\zeta _i^{r}\) are the country-sector fixed effects, while \(\varepsilon _{it}^{r}\), is the error term. We estimate this system of equations, through Seemingly Unrelated Regression (SUR, hereafter), to control for the simultaneous correlation among residuals. Furthermore, we impose the same price elasticity of substitution and constant sectoral income elasticities across countries.Footnote 12

Then, we elicit country r preferences for sector i at each time t rearranging the theoretical solution of the sectoral expenditure shares and substituting the estimated coefficients:

where \(E_{t}^{r}\) is the final consumption expenditure at current prices, while \(\hat{\sigma }\) and \(\hat{\epsilon } _{i}\) are the estimates of the corresponding parameters of Eq. (2). Finally, preferences are normalized to sum up to one in each country and time period.

Before describing how we build immigrants’ preferences, it is important to point out that Eq. (2) estimates might not be consistent if relative prices or income are correlated with relative demand shocks. From a theoretical perspective, these issues can be mitigated by assuming that markets operate in perfect competition and that sectoral demand shocks do not significantly affect the marginal rate of substitution between leisure and consumption.Footnote 13

More caution is needed on the empirical ground as the reference literature has not indicated a straightforward way to address this issue when running estimations using aggregate data. For this reason, as a robustness analysis in Appendix (Section D), we repeat our benchmark analysis taking the values of the elasticity of substitution from two influential papers in the field (Herrendorf et al., 2014; Comin et al., 2021).

To build the preference structure representing the sectoral preferences of the flows of immigrants in each country r at each time period t, \(\Omega _{i,t}^{r,im}\), the sectoral preferences of each country of origin are aggregated applying weights that are proportional to their contribution to immigration flows in country r. As we consider the flows between 20 EU countries, it follows that:

where \(v_{t}^{r,j}=m_{t}^{r,j}/\sum_{j=1 (j\ne r)}^{20}m_{t}^{r,j}\), and \(m_{t}^{r,j}\) is the flow of immigrants from country j to country r at time t. It is worth to point out that the preferences of the representative immigrant are time-varying. More specifically, they adjust according to both the changes in the preference structure of each origin country and the composition of immigration flows in the host country.

3.3 Preference structure

The first step consists of estimating the demand system associated with Eq. (2) using the final consumption expenditure data. The elasticity of substitution is estimated equal to 0.8,Footnote 14 a value that is consistent with relative prices to be correlated negatively to relative volumes (\(\sigma >0\)) and positively to relative expenditure shares (\(\sigma <1\)).Footnote 15 The values of the sectoral income elasticities, reported in the Appendix (Table 8), confirm that the expenditure on Food decreases, in relative terms, with overall consumption. In addition, the highest levels of income elasticities are observed for categories with high content of services (i.e. Communication, Miscellaneous, and Recreation & culture).

On the basis of the estimated coefficients and the theoretical conditions imposed by Eqs. (3) and (4), it is possible to elicit the time series of the sectoral preferences that characterize both the residents and the immigrants in each country. Summary statistics for these two variables, organized by COICOP two-digit categories, are reported in Table 1. Columns 2 and 4 show the cross-country averages of the within-country averages of sectoral-preferences for immigrants and residents, respectively. Columns 3 and 5 report the cross-country standard deviations of the within-country averages of sectoral-preferences for immigrants and residents, respectively. The averages are distributed differently among residents and immigrants and differences are particularly high in Food and in Restaurants & hotels (column 6). Indeed, sectoral differences are statistically significant at the 1% level in all sectors, except for Furnishing, as shown by the small t-test standard errors (column 7). Columns 3 and 5 show that the sectoral standard deviations of the average values are always higher for residents, suggesting that immigration flows have contributed to the convergence in the preference structure. Finally, the last column is particularly informative in the light of our main hypothesis. It reports, for each sector, the number of countries in which there has been at least one change in the sign of the difference between the preferences of immigrants and residents. The presence of changes makes it particularly relevant to track preference dynamics, and not just immigrants’ origin or amount. It emerges that each sector experienced one or more changes in the sign at least in 9 countries, and that it has been particularly frequent for Miscellaneous, Clothing, and Furnishings.

4 The impact of immigration flows on preferences

In this Section, we describe the empirical strategy to assess the impact of immigration flows on the preference structure of the host countries, and we discuss the results obtained from the different econometric specifications.

4.1 Empirical strategy

Once the sectoral preferences of both the host country and the corresponding representative immigrant have been elicited from the structural model, it is possible to estimate the baseline version of our model (Model 1). The main hypothesis to be tested is that the variation in sectoral preferences in the host countries depends on the difference in sectoral preferences between the representative immigrant and the host country, as emerged in the previous year.Footnote 16 Specifically:

where \(\Omega _{i,t}^{r}-\Omega _{i,t-1}^{r}\) is the time variation in the preference for sector i in country r, \(\alpha _{i}^{r}\) controls for the presence of country-specific trend in the preference for sector i, \(\gamma _{i,t}\) controls for sectoral temporal shocks, and \(\left( \Omega _{i,t-1}^{r,im}-\Omega _{i,t-1}^{r}\right)\) is the previous period difference in preferences for sector i between the representative immigrant and the host country.Footnote 17 Under this specification, \(\beta _{1}\) is the main parameter testing the hypothesis that the higher the difference in preferences, the higher the impact of immigration on preference dynamics.

Since Eq. (5) represents a system of linearly dependent equations, it is convenient to subtract from each sector i the equation referred to a benchmark sector, indicated with f. It follows that the final system of equations is given by:

where \(y_{i,t}^{r}=\left( \Omega _{i,t}^{r}-\Omega _{i,t-1}^{r}\right) -\left( \Omega _{f,t}^{r}-\Omega _{f,t-1}^{r}\right)\), \(\alpha _{if}^{r}= \alpha _{i}^{r} -\alpha _{f}^{r}\), \(\gamma _{if,t} = \gamma _{i,t} - \gamma _{f,t}\), \(x_{i,t-1}^{r}=\left( \Omega _{i,t-1}^{r,im}-\Omega _{i,t-1}^{r}\right) - \left( \Omega _{f,t-1}^{r,im}-\Omega _{f,t-1}^{r}\right)\), and \(\phi _{if,t}^{r}\) is the residual. Similarly, to the demand system described in Eq. (2), the system of equations described in Eq. (6) is estimated with a SUR.

In addition to the benchmark version represented by Eq. (6), two extensions are estimated. In Model 2, we verify if the effect on sectoral preference dynamics is driven, or at least affected, by the intensity of the immigration flows. As a measure of intensity, we take \(s_{t}^{r}\), given by the ratio between the total flows of immigrants from the 20 EU countries and the resident population in the host country r. The equation to be estimated becomes

With respect to Model 1, \(\beta _{3}\) indicates if the effect of the preference differential is amplified by the intensity of the immigration flows, while \(\beta _{2,i}\) is the effect on sector i of an increase of immigration flows when residents and the representative immigrant hold the same sectoral preference.

The other extension is represented by Model 3, which aims at verifying if pluralistic societies experience a more intense influence of immigrants’ preferences. To this purpose, we introduce \(k_{t}^{r}\), which measures the share of immigrants in the population of country r. Accordingly, the econometric specification of Model 3 is given by:

The interpretation of the estimated parameters of Eq. (8) is straightforward: a positive and statistically significant \(\beta _{5}\) indicates that the influence of immigrants’ preferences is amplified in more pluralistic hosting countries.

Finally, it is worth noting that the inclusion of immigrants’ flows and immigrants’ stocks in Eqs. (7) and (8), respectively, helps to control for any other impact that immigration might have on final-consumption’ composition. For example, these variables may capture the effect of immigration flows on the variety of supplied goods (Mazzolari & Neumark, 2012; Khanna & Lee, 2020) and, through this channel, on sectoral relative preferences (if we assume love for variety).Footnote 18 Similarly, these variables controls for the effects that immigrants might have on income, although the empirical literature indicates that this impact is null or slightly positive (Edo, 2019; Roodman, 2020).

4.2 Results

Table 2 reports the estimates of the econometric specifications introduced in Sect. 4.1. Model 1 refers to Eq. (6), which considers solely the role of the differences in preferences between the representative immigrant and the host country, without accounting for any reinforcing effect neither from the intensity of immigration flows nor from the population share of immigrants already residing in the host country. The outcome indicates that the relative sectoral preferences in the host country are increasing in the difference in preferences between immigrants and the host country. The estimated coefficient is positive (0.06) and statistically significant (at 1%). Therefore, one more (less) percentage point in the difference in relative preferences in sector i induces a rise (decrease) of 0.06 percentage points in relative preferences for the same sector in the host country. To get a glimpse of the magnitude of the estimated effect, let us consider the average values characterizing the Food sector. Table 1 shows that immigrants and residents, on average, recorded sectoral relative preferences equal to 0.256 and 0.224, respectively (with a mean difference equal to 0.032). If these values had characterized a specific country in one year, immigration would have raised relative preferences for Food in the host country up to 0.226 (obtained as \(0.224+0.06*0.032\)).Footnote 19

Model 2 tests the hypothesis that the magnitude of the transmission effect depends on the intensity of the immigration flows, as described by Eq. (7). Since this variable is always greater than zero, \(s_{t-1}^{r}\) has been centered on its median value to obtain estimates with a straightforward interpretation. Thus, the coefficient \(\beta _{1}\) in Model 2 measures the effect of the difference in preferences between the representative immigrant and the host country when the intensity of immigration flows is at the median value (which is equal to 0.15%).Footnote 20 The result for the interaction coefficient (i.e., \(\beta _{3}\)) is positive (7.007) and statistically significant (at 1%), indicating that the intensity of immigration indeed strengthens the transmission effect. Considering the estimated coefficients of \(\beta _{1}\) and \(\beta _{3}\), and the distribution of the intensity of the immigration flows, for one-percent-point difference in sectoral preferences, the impact on preference variation is equal to 0.044% points in a country with a low level of immigration flows (specifically, at the 25th percentile) and equal to 0.065% points in a country with high immigration flows (at the 75th percentile).

Model 3 tests the hypothesis that the higher \(k_{t-1}^{r}\), which is the share of foreign-born citizens living in the host country, the higher the transmission effect, as described by Eq. (8). Also, this variable has been centered on the median value (equal to 5.49%). Estimates do not reject this hypothesis as \(\beta _{5}\) is positive, 0.701, and highly significant (at 1 percent). Considering the distribution of the incidence of foreign-born people in the sample, the impact of the difference in preferences is equal to 0.049% points in countries characterized by low presence of foreigners (where they represent \(2.59\%\) of the population, which corresponds to the 25th percentile) and equal to 0.095% points in countries with high presence of immigrants (where they represent 9.25% of the population, which corresponds to the 75th percentile).

These outcomes suggest that the transmission effect increases with both the immigrants’ flows and the immigrants’ share in the population. Unfortunately, the two variables are highly correlated with each other; thus, it is difficult to disentangle their effects by joining model 2 and model 3 together. Alternatively, we estimate Model 2 on two sub-samples of countries: the first one includes only the ten countries with the highest share of immigrants in the total population, while the second one comprises the remaining ten countries. We are interested in estimating \(\beta _{1}\) in the two sub-samples, all else being equal. For this reason, both estimates are obtained by centering the variable \(s_{t-1}^{r}\) on the median value of the full sample distribution. The results in the last two columns of Table 2 point out that the estimates of \(\beta _{1}\) for the two sub-samples are statistically different from each other. In fact, the transmission effect estimated for the top ten countries is more than twofold the one estimated for the sub-sample of countries with the lowest share of immigrants in the total population.

Before discussing some model extensions reported in the next Section, it is worth mentioning that we repeated the previous analysis assuming different values of the price elasticity. Indeed, our estimate of \(\sigma\) is higher than others in the literature (see footnote 15). To verify if, and to what extent, our results depend on high values of the price elasticity, we carried out a sensitivity analysis using two alternative values taken from notable contributions in the field. The first one, \(\sigma = 0.25\), is taken from Comin et al. (2021). The second one, \(\sigma = 0.13\), is taken from Herrendorf et al. (2014). After imposing alternatively the two values, we re-estimated the corresponding income elasticities and the preferences for both the representative immigrant and the host country. The results are not statistically different from those reported in Table 2 (See Appendix, Table 11 for \(\sigma = 0.25\), and Table 12 for \(\sigma = 0.13\)).

5 Robustness and extensions

In this Section, we provide some robustness checks and we extend our baseline model [Eq. (6)] in several directions. Initially, we build a counterfactual version of immigrants’ preferences without keeping track of preference changes in the origin countries of immigrants. Then, we modify the dynamics of the baseline model (i) by introducing an autoregressive process of order one for the endogenous variable, and (ii) by estimating the effect of immigrants’ preferences on a longer time horizon. Finally, we control for the existence of a convergence process in sectoral relative preferences among EU countries and we verify if immigration flows play a significant role in the process.

5.1 Counterfactual estimates with constant preferences in the countries of origin

To motivate our analysis, we argued that considering people nationality as a constant factor may lead to underestimate the effect of immigrants’ preferences on the preference structure of the hosting economy. To verify this statement, we run the same regressions illustrated in the previous section, keeping constant the preferences in the countries of origin. More in detail, we re-construct the preference structure of the representative immigrant in each country r using only the preferences estimated at the initial period, that is, we replace \(\Omega _{i,t}^{j}\) with \(\Omega _{i,1998}^{j}\) in Eq. (4), \(\forall\) \(t=1,...,T\).

In this way, the counterfactual preference variation of the representative immigrant is driven only by changes in the composition of immigration flows, without any further variation induced by the preference dynamics in the country of origin. Accordingly, Eqs. (6)–(8) are re-estimated, and the results are shown in Table 3. The outcomes indicate that the transmission effects considerably decrease when we disregard the preference dynamics in the origin countries as, for each of the three models, the estimates of \(\beta _{1}\) are less than half of the corresponding estimates presented in Table 2 and the differences are statistically significant. These results reinforce the idea that not to track the evolution of preferences in the countries of origin of immigrants may cause the loss of important information.

5.2 Controlling for sluggish adjustment in preferences

Our benchmark analysis assumes no persistency in preference dynamics. We now relax this assumption by conducting two additional checks. First, we let preference dynamics depend on its own past realizations by estimating the following dynamic version of Eq. (6):

where \(y_{i,t-1}^{r}\) is the lagged value of the dependent variable. Similarly, we estimate the dynamic version of Eqs. (7) and (8). We apply the system GMM (Blundell & Bond, 1998; Arellano & Bover, 1995), which allows us to correct for possible endogeneity of both the lagged dependent variable and our variable of interest. The results are reported in Table 4. The Arellano-Bond tests for autocorrelation of disturbances in the first-differenced equation indicate that we can use past values as valid instruments, whilst, as expected, there is first-order autocorrelation. We estimate two model specifications, namely, Model 4 with only the lagged dependent variable (with no role for immigration) and Model 5, which corresponds to Eq. (9). Following the advice of Roodman (2009), the number of instruments is kept below the number of groups, which are equal to 220 (i.e., 20 countries by 11 COICOP sectors). As it emerges from Table 4, the positive effect of immigrant preferences is robust to both the inclusion of the lagged dependent variable and different specifications of the fixed effects (compare Models 5 and 6).

Second, we investigate the impact of immigrant preferences on future changes of preferences in the host country.Footnote 21 To this end, we apply the local projection method proposed by Jordå (2005) to estimate the baseline model in Eq. (6).Footnote 22 We run separate regressions of Eq. (6) using for each regression a different horizon length of the dependent variable, which is now defined as \(y_{i,t+h}^{r}\), where \(h = 0,1,2,..,9\) and \(y_{i,t+h}^{r} = \Omega _{i,t+h}^{r}-\Omega _{i,t-1}^{r}\). As shown in Fig. 1, the cumulative effect of our main explanatory variable increases with the horizon length until \(t+9\). This result suggests that the influence of new immigrants’ preferences propagates over time.

5.3 Controlling for convergence in preference dynamics among EU countries

As discussed in Sect. 2.1, some contributions have highlighted the presence of convergence in consumer preferences across European countries. The underlying assumption is that the intensification of cultural and commercial exchanges pushes toward homogeneous compositions of the final consumption expenditure. Differently from our contribution, this literature does not empirically identify a specific channel of transmission. In order to take into account the role of other latent forces affecting preference dynamics (beyond immigration), Therefore, we estimate a modified version of Eq. (6) as follows:

where \(\Omega _{i,t}^{r-EU_{r}} = \Omega _{i,t}^{r}-\Omega _{i,t}^{EU_{r}}\) is the deviation of country r relative preferences for sector i from the average value in the rest of the sample. The dependent variable is the change in the deviation, therefore it indicates whether country r preferences are converging or diverging from the average preferences of the other EU countries included in our sample. A positive value for \(\rho _{1}\) indicates persistence in the adjustment process. A negative value for \(\beta _{0}\) indicates convergence of the sectoral preferences among the EU countries. Finally, \(\beta _{1}\) assesses the impact of intra-EU migration in the convergence process of preferences. The estimation results are reported in Table 5. The estimates of \(\rho _{1}\) and \(\beta _{0}\) have the expected signs and are statistically significant independently from the inclusion of immigrants’ preferences. The positive and statistically significant sign of \(\beta _{1}\) in Model 8 hints at migration as a channel in the process of preference convergence among the considered 20 European countries.

6 Counterfactual exercises

In this section, we simulate the evolution of preferences in the absence of the impact of immigration flows to assess how much intra-EU immigration flows contribute to shaping sectoral preferences and expenditure shares in EU countries.

For this reason, we simulate the counterfactual dynamics of the sectoral preferences and expenditure shares as if immigration had no effect on preferences. Referring to Model 1, we initially partial-out the effect of immigration from preference changes: \(z_{i,t}^{r}= (\Omega _{i,t}^{r}-\Omega _{i,t-1}^{r}) - \hat{\beta _{1}} \left( \Omega _{i,t-1}^{r,im}-\Omega _{i,t-1}^{r}\right)\). Successively, we use only the remaining component of preference dynamics, \(z_{i,t}^{r}\), to simulate the counterfactual time series, \(\Omega _{i,t}^{r,c}\), as follows: \(\Omega _{i,t}^{r,c} = \Omega _{i,t-1}^{r,c} + z_{i,t}^{r}\). Once defined the counterfactual preferences, we use Eq. (3) to obtain counterfactual expenditure shares, \(\omega _{i,t}^{r,c}\). Table 6 reports the median, the mean, the standard deviation and the ratio between the standard deviation and the mean of the cross-country distributions of the sectoral preferences and expenditure shares in 2017. The aim is to provide some quantitative indications of how the distributions would have evolved without the influence of immigration flows along the analyzed time span. The most striking result concerns the impact on the standard deviations. For both sectoral preferences and expenditure shares, the sectoral standard deviations would have been higher without the influence of immigration. The impact is even more evident when the standard deviations are normalized with respect to the mean values. Moving to the impact on the median and mean values of the sectoral distributions, some sectors emerge to be particularly affected. The Food sector would have achieved significantly lower values in terms of median and mean, for both sectoral preferences and expenditure shares, without immigration flows. According to our counterfactual exercise, for example, the median and average expenditure share in Food would have been, respectively, about 3 and 2% points lower. On the other hand, migration flows impacted negatively on Housing, Recreation & Culture, Restaurant & hotels, and Miscellaneous sectors. As a result, without migration, the average value of Restaurant & hotels would have been 1.2% points higher in terms of both sectoral preferences and expenditure shares.

Furthermore, we are interested in representing how immigrants’ flows would have directly affected the distributions of sectoral preferences, \(\Omega _{i,t}^{r,d}\), and expenditure shares, \(\omega _{i,t}^{r,d}\), simply through the induced change in the population composition. To this purpose, we follow the same approach used to build the representative immigrant preferences. We assume that each group of agents contributes to aggregate preferences proportionally to its demographic relevance. Consequently, we use the shares of new immigrants over resident people to define the relative weights. It follows that the counterfactual preferences are built as: \(\Omega _{i,t}^{r,d} = (1-s_{t-1}^{r})\Omega _{i,t-1}^{r,d}+s_{t-1}^{r}\Omega _{i,t-1}^{r,im} + z_{i,t}^{r}\).

Figures 2 and 3 report the kernel approximations of the sectoral-preference and expenditure-share distributions, as they emerge at the end of the considered time period (2017), comparing both types of counterfactual data to the actual (for the expenditure shares) and model-based (for the preferences) data. Notwithstanding the differences among sectoral distributions, common characteristics emerge. First, as anticipated by the standard deviations reported in Table 6, the distributions of \(\Omega _{i,t}^{r,c}\) show higher across-country dispersion, which indicates that immigration induced convergence among the EU countries in the sample. Second, the distributions of \(\Omega _{i,t}^{r,d}\) do not differ significantly from the distributions of \(\Omega _{i,t}^{r,c}\). This result reinforces the idea that the impact of immigration on preference structures has been beyond the demographic relevance of the immigration flows.

7 Concluding remarks

Using the consumption and immigration data of 20 EU countries, we found that immigration flows do contribute to change the patterns in the sectoral consumption preferences of the host countries and, thus, in the composition of final consumption expenditure. Furthermore, we verified that such influence is amplified by the intensity of immigration flows and by the share of foreign-born people. We tested the robustness of the results, including sluggish in the adjustment process and considering other mechanisms that may induce convergence in preferences. Finally, through counterfactual simulations, we showed that the impact of immigration is not just statistically significant, but it is also relevant in quantitative terms and it contributed to convergence in preferences in the considered 20 EU countries. In terms of the relative relevance of the different consumption sectors, on average, 2% points of the expenditure share for Food can be attributed to the influence of migration flows, while some service sectors have been pushed downward by about 1% point.

Even if developed mainly through empirical analysis, our contribution highlights a conceptual point. Indeed, we showed that even if not directly observed, sectoral consumption preferences are variables that can be identified, and their influence in the economic system can be analyzed. They might represent another “measure of our ignorance” (Abramovitz, 1956), but our results highlight their role, thus they should not be disregarded. In this sense, further investigation of the preference-structure determinants would represent a natural development of our contribution. At the same time, we would consider highly interesting the introduction of our perspective in a general equilibrium framework to simultaneously analyze the impact of immigration on both the demand and the supply side of the economy.

Notes

According to Chiswic and Miller (2007) “ethnic goods” refer to those consumption characteristics that immigrants do not share with natives.

Alessie and Kapteyn (1991), Grinblatt et al. (2008), and Alvarez-Cuadrado et al. (2016) are just a few examples of studies testing the relevance of interdependent preferences using household data, while Verhelst and Van den Poel (2014) use European zip code at different levels of product aggregation.

Similar considerations apply to the literature investigating the convergence in consumption patterns across different countries such as Kónya and Ohashi (2007), Lyons et al. (2009), and Michail (2020). In these contributions, there is the underlying idea of preference changes induced by income or globalization in line with Levitt (1983), but preferences are never elicited.

Among the few examples analyzing sectoral consumption dynamics at the aggregate level, see Addessi et al. (2017). Focusing on the Italian economy, they elicit sectoral preferences using a standard CES aggregator and analyze the impact of preference changes on sectoral employment.

Among the many examples: De la Fuente and Domenech (2001) use country level data, calculate the TFP as residual, and then regress TFP dynamics on the difference between the TFP of each country and the TFP of the US [remarkable is the methodological difference with Michail (2020), who explicit a “controlled” version of expenditure shares rather than “model-elicited” preferences to analyze preference dynamics); Woo (2009) investigates the role of FDI for TFP diffusion, showing that the FDI from developed countries to developing countries are particularly effective; Mc Morrow et al. (2010) use EUKLEMS estimates of TFP and analyze the relationship between TFP dynamics and TFP distance from the frontier at sectoral level.

The twenty countries are: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Italy, Latvia, Luxembourg, Netherlands, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, United Kingdom (before Brexit).

Notice that, contrary to the standard representation of the preference structure, preference weights are considered time varying.

It is a common practice in the literature to impose the same elasticities across countries and to let preference weights be country specific. It is also worth mentioning that from a theoretical perspective, the consumption bundle defined in Eq. (1) may differ from the real consumption per capita reported in the data. To take into account such difference, we should estimate a different system of equations, characterized by non-linear constraints [see Comin et al. (2021)]. Nevertheless, as highlighted in Matsuyama (2019), differences between the theoretical definition and structure of the empirical data may also emerge when the homothetic CES aggregator is used. Furthermore, Comin et al. (2021) show that a log-linear equation approximates very well the relationship between real income and theoretical consumption. Thus, due to a large number of sectors and countries included in the regression, we chose to overlook the issue and to apply the simplified version represented in Eq. (2) as the results do not depend on the choice of the benchmark sector.

Demand factors may have a prompt and significant impact on prices in sectors characterized by non-constant returns to scale and imperfect competition but not when firms operate in perfect competition. Concerning the effect of relative demand shock on income, Addessi and Busato (2010, 2011) show that relative preference shocks affect the marginal utility of the overall consumption and, through this channel, the labor supply and income. Our model, in line with most of the growth models, assumes constant labor supply and takes immigration flows as exogenous, precluding a possible source of correlation between tastes and income.

The value of \(\sigma\) is derived from the estimate of the parameter \((1-\sigma )\) in Eq. (2). The estimated value for the parameter \((1-\sigma )\) is equal to 0.20 and is highly statically significant (at 1% with a standard error equal to 0.009).

The estimated value of \(\sigma\) is higher than other estimates that emerged in the literature [see, for example, Comin et al. (2021), Lewis et al. (2022), Marcolino (2022)] but in line with Addessi (2018). The difference can be explained by the number of sectors included in the analysis, as most of the cited literature considers two or three sectors. It is reasonable to expect that the elasticity of substitution is increasing in the level of disaggregation.

Roughly speaking, it is like to assume that immigrants arrive at the end of the time period, so that they do not affect preferences (and expenditure choices) until the following period. As the influence of immigrants’ preferences on residents might not conclude in one period, in Sect. 5 we test if data signal the presence of prolonged effects.

As the main explanatory variable is a difference between two variables, we examined its correlation with the two components. The results reported in Appendix (Table 10) show that the variation of the explanatory variable is mainly correlated to changes in immigrant preferences.

We have further investigated the possibility of a “Rybczynski effect” of immigrant workers by looking at the correlation (by COICOP) between the change in relative preferences experienced along the entire time period (i.e. T-t1) and the share of immigrant workers. The results reported in the Supplemental material (Tables I.2, I.3) show that there is no correlation between immigrant workers shares and changes in preferences by COICOP sectors.

Once the impact of immigration on the dynamics of the sectoral preferences in the host country is calculated, it is possible to assess the impact on sectoral expenditure shares using Eq. (3), which can be reformulated as \(\omega ^{r}_{i,t}=K^{r}_{i,t}\Omega ^{r}_{i,t} \quad \textrm{with} \quad K^{r}_{i,t} = \left( \frac{P^{r}_{i,t}}{E^{r}_{t}}\right) ^{1- \hat{\sigma }} (C^{r}_{t})^{\left( 1- \hat{\sigma }\right) \hat{ \epsilon _{i}}} >0\). It follows that preference variations induce changes of expenditure shares in the same direction, but the size of the variations depends on a combination of sectoral and aggregate variables and parameters. In Sect. 6, we develop a counterfactual exercise showing how the evolution of the sectoral preferences and expenditure shares would have been without immigration.

See Table 9 in Appendix for summary statistics on migration variables.

We thank the anonymous reviewer for this suggestion.

Recently, Montiel Olea and Plagborg-Møller (2021) demonstrated that this technique is robust to both highly persistent data and the estimation of impulse response at long horizons.

References

Abel, A. B. (1990). Asset prices under habit formation and catching up with the joneses. The American Economic Review, 80(2), 38–42.

Abramovitz, M. (1956). Resource and output trends in the United States since 1870. The American Economic Review, 46(2), 5–23.

Addessi, W. (2018). Population age structure and consumption expenditure composition: Evidence from European countries. Economics Letters, 168(C), 18–20.

Addessi, W., & Busato, F. (2010). Relative-preference shifts and the business cycle. The B.E. Journal of Macroeconomics, 10(1).

Addessi, W., & Busato, F. (2011). Preference shifts between consumption goods and sectoral changes. Economics Letters, 111(3), 213–216.

Addessi, W., Pulina, M., & Sallusti, F. (2017). Impact of changes in consumer preferences on sectoral labour reallocation: Evidence from the Italian economy. Oxford Bulletin of Economics and Statistics, 79(3), 348–365.

Alesina, A. G., Alesina, P., & Giuliano, A. (2010). The power of the family. Journal of Economic Growth, 15(2), 93–125.

Alessie, R. J. M., & Kapteyn, A. (1991). Habit formation, interdependent preferences and demographic effects in the almost ideal demand system. The Economic Journal, 101, 404–419.

Algan, Y., & Cahuc, P. (2005). The roots of low European employment: Family culture? In NBER international seminar on macroeconomics 2005, NBER Chapters (pp. 65–109). National Bureau of Economic Research, Inc.

Alvarez-Cuadrado, F., Casado, J. M., & Labeaga, J. M. (2016). Envy and habits: Panel data estimates of interdependent preferences. Oxford Bulletin of Economics and Statistics, 78(4), 443–469.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Boppart, T. (2014). Structural change and the Kaldor facts in a growth model with relative price effects and non-Gorman preferences. Econometrica, 82(6), 2167–2196.

Charles, K. K., Hurst, E., & Roussanov, N. (2009). Conspicuous consumption and race. The Quarterly Journal of Economics, 124(2), 425–467.

Chiswic, B. R., & Miller, P. W. (2007). Do enclaves matter in immigrant adjustment? The Economics of Language: International Analyses, 4(1), 493–529.

Chiswic, B. R., & Miller, P. W. (2014). Handbook of the economics of international migration (Vol. 1B). North-Holland.

Chiswick, C. (2009). The economic determinants of ethnic assimilation. Journal of Population Economics, 22(4), 859–880.

Comin, D., Lashkari, D., & Mestieri, M. (2021). Structural change with long-run income and price effects. Econometrica, 89(1), 311–374.

De la Fuente, A., & Domenech, R. (2001). Schooling data, technological diffusion, and the neoclassical model. American Economic Review, 91(2), 323–327.

Dustmann, C., Schönberg, U., & Stuhler, J. (2016). The impact of immigration: Why do studies reach such different results? Journal of Economic Perspectives, 30(4), 31–56.

Edo, A. (2019). The impact of immigration on the labor market. Journal of Economic Surveys, 33(3), 922–948.

European Commission Regulation. (2002). Commission regulation (EC) No 113/2002: Amending Council Regulation (EC) No. 2223/96 with regard to revised classifications of expenditure according to purpose. Official Journal of the European Communities.

Fernández, R. (2008). Culture and economics. In The New Palgrave dictionary of economics. Palgrave Macmillan.

Fernández, R. (2011). Does culture matter? In Handbook of social economics.

Fernández, R., Fogli, A., & Olivetti, C. (2004). Mothers and sons: Preference formation and female labor force dynamics. The Quarterly Journal of Economics, 119(4), 1249–1299.

Grinblatt, M., Keloharju, M., & Ikäheimo, S. (2008). Social influence and consumption: Evidence from the automobile purchases of neighbors. Review of Economics and Statistics, 90(4), 735–753.

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, 20(2), 23–48.

Herrendorf, B., Rogerson, R., & Valentinyi, Á. (2013). Two perspectives on preferences and structural transformation. American Economic Review, 103(7), 2752–2789.

Herrendorf, B., Rogerson, R., & Valentinyi, Á. (2014). Chapter 6—Growth and Structural Transformation. In P. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth, Volume 2 of handbook of economic growth. Elsevier.

Jordå, O. (2005). Estimation and inference of impulse responses by local projections. American Economic Review, 95(1), 161–182.

Khanna, G., & Lee, M. (2020). 73High-skill immigration, innovation, and creative destruction. In The roles of immigrants and foreign students in US science, innovation, and entrepreneurship. University of Chicago Press.

Kónya, I., & Ohashi, H. (2007). International consumption patterns among high-income countries: Evidence from the OECD data. Review of International Economics, 15, 744–757.

Levitt, T. (1983). The globalization of markets. Harvard Business Review, May-June, 92–102.

Lewis, L. T., Monarch, R., Sposi, M., & Zhang, J. (2022). Preference shifts between consumption goods and cross-sectoral co-movement. Journal of the European Economic Association, 20(1), 476–512.

Lyons, S., Mayor, K., & Tol, R. S. (2009). Convergence of consumption patterns during macroeconomic transition: A model of demand in Ireland and the OECD. Economic Modelling, 26(4), 702–714.

Manski, C. F. (1993). Identification of endogenous social effects: The reflection problem. The Review of Economic Studies, 60(3), 531–542.

Manski, C. F. (2003). Identification problems in the social sciences and everyday life. Southern Economic Journal, 70(1), 11–21.

Matsuyama, K. (2019). Engel’s law in the global economy: Demand-induced patterns of structural change, innovation, and trade. Econometrica, 87(2), 497–528.

Maurer, J., & Meier, A. (2008). Smooth it like the ‘Joneses’? Estimating peer-group effects in intertemporal consumption choice. The Economic Journal, 118(527), 454–476.

Mazzolari, F., & Neumark, D. (2012). Immigration and product diversity. Journal of Population Economics, 25, 1107–1137.

Mc Morrow, K., Röger, W., & Turrini, A. (2010). Determinants of TFP growth: A close look at industries driving the EU-US TFP gap. Structural Change and Economic Dynamics, 21(3), 165–180.

Michail, N. A. (2020). Convergence of consumption patterns in the European union. Empirical Economics, 58, 979–994.

Montiel Olea, J. L., & Plagborg-Møller, M. (2021). Local projection inference is simpler and more robust than you think. Econometrica, 89(4), 1789–1823.

Moriconi, S., & Peri, G. (2019). Country-specific preferences and employment rates in Europe. European Economic Review, 116, 1–27.

Marcolino, M. (2022). Accounting for structural transformation in the U.S. Journal of Macroeconomics, 71.

Pollak, R. (1976). Interdependent preferences. American Economic Review, 66(3), 309–320.

Ravn, M., Schmitt-Grohé, S., & Uribe, M. (2006). Deep habits. The Review of Economic Studies, 73(1), 195–218.

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in STATA. Stata Journal, 9(1), 86–136. (51).

Roodman, D. (2020). The domestic economic impacts of immigration. arXiv:2007.10269.

Schettkat, R., & Yocarini, L. (2006). The shift to services employment: A review of the literature. Structural Change and Economic Dynamics, 17(2), 127–147.

Sposi, M. (2019). Evolving comparative advantage, sectoral linkages, and structural change. Journal of Monetary Economics, 103, 75–87.

Van Neuss, L. (2019). The drivers of structural change. Journal of Economic Surveys, 33(1), 309–349.

Verhelst, B., & Van den Poel, D. (2014). Deep habits in consumption: A spatial panel analysis using scanner data. Empirical Economics, 47(3), 959–976.

Woo, J. (2009). Productivity growth and technological diffusion through foreign direct investment. Economic Inquiry, 47(2), 226–248.

Funding

Open access funding provided by Università degli Studi di Cagliari within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflict of interest associated with this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank the participants to Orani Workshop (2019) and the \(60^{a}\) RSA of SIE (2019). We are also particularly thankful to Giovanni Peri and the anonymous referee for their valuable comments and suggestions.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

A Appendix: definitions

See Appendix Table 7.

B Income elasticities

See Appendix Table 8.

C Summary statistics

D Additional robustness

See Appendix Tables 11, 12 and 13.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Addessi, W., Etzo, I. International immigration and final consumption expenditure composition. Rev World Econ 160, 427–454 (2024). https://doi.org/10.1007/s10290-023-00501-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-023-00501-9