Abstract

A recent debate on globalization addresses the importance of skills for firms’ performance in developing countries. Employing microdata from Indonesian manufacturing, we examine the externality effects of inward foreign direct investment (FDI) on labor demand by skill in local firms and identify the relative contribution of each effect to their skill structure. The results show that local firms replace unskilled workers with skilled ones to enable transactions with foreign firms in downstream industries. However, severe labor market competition for skilled workers with foreign firms hinders them from upgrading the skill structure. Moreover, severe product market competition decreases demand for unskilled workers in local firms. Thus, an adequate supply of skilled workers is crucial for the better performance of local firms. The results also highlight the necessity of policies to mitigate the negative impact of inward FDI on unskilled employment in the host economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A recent debate on globalization in developing countries has focused on its effects on the local labor market and analyzed its implications for firm performance and the residents’ welfare (Amiti & Cameron, 2012; Feenstra & Hanson, 1997; Kis-Katos & Sparrow, 2015; McCaig & Pavcnik, 2018; Topalova, 2010). Trade liberalization should encourage firms in developing countries to specialize in production that uses unskilled workers intensively. However, improvements in information and communication technologies enable firms in developed countries to fragment their production process across nations (Baldwin, 2016). Generally, the benefits of Global Value Chains’ (GVCs) participation tend to be focused on firms engaging in skill-intensive tasks such as research and development. Other manufacturers who specialize in unskilled labor-intensive assembly tasks pay lower wages and are more vulnerable to changes in a business environment. Thus, Gereffi (2018) argues that skilled workers are the key to upgrading to higher value-added positioning in the GVCs. However, Rodrik (2018) indicates that the growing demand for skills that are in short supply in developing countries has caused a reduction in the number of jobs created through export. Stated differently, GVC participation makes it difficult for firms in developing countries to utilize their labor cost advantage. Therefore, identifying globalization’s impact on local firms’ skill structure should provide important implications for their performance and residents’ welfare.

The literature argues that transactions with foreign firms affect the skill structure of local firms in developing countries. Kasahara et al. (2016) demonstrate that the use of foreign intermediate goods encourages local Indonesian firms to adopt skill-biased technology, thereby increasing the relative demand for skilled workers. The presence of multinational enterprises (MNEs) also exerts a significant influence on the demand for skilled labor in local firms. For example, inward foreign direct investment (FDI) in upstream industries enables local firms to purchase high-quality intermediates and capital goods (Bajgar & Javorcik, 2020; Ciani & Imbruno, 2017; Liang, 2017), which require skilled workers. Moreover, local firms must satisfy strict requirements about product quality and technological sophistication to become suppliers to MNEs in downstream industries (Javorcik & Spatareanu, 2009). These instances indicate that domestic transactions with MNEs induce skill-upgrading of local firms by improving skilled workers’ production efficiency. Nonetheless, existing literature has scarcely studied FDI’s impact on local firms’ employment situation (Hale & Xu, 2016). Dinga and Münich (2010) and Karlsson et al. (2009) find that the impact of inward FDI on employment is positive in the Czech Republic and China, respectively, but they do not consider skill differences between workers. Recently Jia and López (2021) have found that inward FDI increases the relative demand for skilled labor in local Chilean firms.

Contrastingly, Goldberg and Pavcnik (2007) indicate that because of the complementarity between capital and skilled workers, the increase in capital inflows into developing countries yields a larger demand for skilled workers. Combined with the inelastic supply of skilled workers, the increased inflow of foreign firms implies a more intensified labor market competition for skilled workers. Consequently, inward FDI into developing countries may hinder local firms’ skill upgrading by raising the relative wages of skilled workers. Several studies (e.g., Alfaro & Chen, 2018; Javorcik & Spatareanu, 2005) demonstrate that the entry of MNEs intensifies competition in the product and labor market in the host economy, thereby reducing the production and employment of local firms. However, they do not distinguish workers by their skill level and, thus, whether inward FDI intensifies labor market competition for skilled workers and hinders the skill upgrading of local firms remains unaddressed.

This study examines the impact of inward FDI on the host economy’s local labor market. Specifically, the externality effects on labor demand for skilled and unskilled workers in local firms are examined.Footnote 1 Externality effects comprise knowledge spillovers and peculiar externalities (Javorcik, 2015; Smeets, 2008). The former takes place through demonstration effects, labor turnovers, and knowledge transfer through vertical linkages. The latter arises from market mechanisms. Empirical evidence of externality effects on wages and productivity is abundant (e.g., Cardoso et al., 2021; Girma et al., 2015; Lipsey & Sjöholm, 2004; Todo & Miyamoto, 2006); results indicate that they are larger for skilled workers than unskilled ones, widening the wage gap between them (e.g., Johansson & Liu, 2020; Lin et al., 2013). However, they do not consider the channels through which externality effects affect wages. Improvement in the efficiency of and severe labor market competition for skilled workers predict an increase in their wages, but they have the opposite implication for skilled employment in local firms. Thus, this study’s contribution is to determine the effect of MNEs on the relative demand for skilled workers in local firms by distinguishing the overall externality effects into the individual ones.

This study is related to the identification of the underlying mechanisms of externality effects. Poole (2013) examines the impact of labor turnover using a measure of the existence of workers previously employed by MNEs (see also Balsvik, 2011; Görg & Strobl, 2005; Markusen & Trofimenko, 2009). Many studies have evaluated the impact of externality effects using measures of vertical linkages between MNEs and local firms (Bajgar & Javorcik, 2020; Blalock & Gertler, 2008; Ciani & Imbruno, 2017; Havranek & Irsova, 2011; Javorcik, 2004; Negara & Adam, 2012). For example, Lu et al. (2017) distinguish the externality effects into agglomeration and competition effects to explain the negative externality effects arising from horizontal FDI in China. Newman et al. (2015) disentangle productivity gains arising from direct transactions between domestic and foreign firms along the supply chain from indirect FDI spillovers. This study introduces a measure that intends to capture the peculiar externalities arising from labor market competition. Specifically, we follow Ellison et al. (2010) to measure similarities in the composition of employment by occupation among industries. The underlying assumption is that if local firms and MNEs employ similar worker types, local firms would face severe competition. The use of multiple measures for the FDI presence in the host economy allows the identification of each channel’s relative contribution to the skill structure of local firms.

Hence, this study employs microdata from Indonesia. Indonesia experienced a significant inflow of FDI after the Asian financial crisis and, therefore, makes an interesting case to study FDI’s impact on the host economy’s local labor market. Our results indicate that the impact of inward FDI on the skill structure of local firms varies depending on the type of foreign firms. The entry of foreign firms employing similar worker types as local firms intensifies labor market competition for skilled workers, reducing the skill intensity of local firms. Furthermore, facing fierce product market competition with foreign firms operating in the same industry, local firms decrease unskilled employment. In contrast, inward FDI into downstream industries encourages local firms to increase their skilled employment and skill intensity. Overall, labor market competition has a greater negative impact on the skill structure of local firms, outweighing the skill upgrading effects of vertical linkages with MNEs.

This paper is organized as follows. Section 2 provides a more detailed description of Indonesia’s economy. Section 3 discusses the empirical methodology used for analysis. Section 4 describes the data and variable construction. Section 5 presents the estimation results. Finally, Section 6 presents the conclusions, a summary of the results, and some policy implications.

2 Inward foreign direct investment and local Indonesian firms

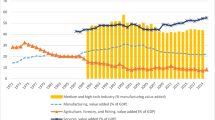

Indonesia’s economy was predominantly based on agriculture and mining, but a sharp decline in oil prices in the early 1980s drove the government to diversify its economic structure. It adopted trade liberalization and export-oriented industrialization policies and attracted MNEs (Kis-Katos & Sparrow, 2015). There was a drop in its FDI during the Asian financial crisis and subsequent political turmoil in the late 1990s and early 2000s, but the MNEs subsequently increased their presence in the economy. Figure 1 shows that they have increased the number and revenue share by 3.1% and 1.5% points, respectively, annually on average from 2001 to 2012. Currently, Indonesia constitutes an important part of the international production networks for MNEs and attracts considerable research attention regarding the impact of international trade and inward FDI on the performance of local firms (e.g., Amiti & Cameron, 2012; Blalock & Gertler, 2008; Kasahara et al., 2016; Lipsey & Sjöholm, 2004; Takii, 2005).

Table 1 compares the basic characteristics of MNEs and local firms. Column (1) shows that the total number of workers in MNEs is, on average, four times more than in local firms. Moreover, MNEs pay higher wages (column 2). Hence, the entry of MNEs should have a considerable impact on the local labor market. To examine this more closely, we classify the workers into two types: skilled and unskilled workers.Footnote 2 Columns (3) and (4) indicate that, regardless of the type of workers, average wages are higher in MNEs. Moreover, wages for skilled workers are twice as high as for unskilled workers in MNEs and local firms. Next, column (5) shows that MNEs, on average, have a higher skill intensity, the share of skilled workers to total employment. Hence, the entry of MNEs is likely to intensify competition for skilled workers in the local labor market. Finally, column (6) compares the export intensity between MNEs and local firms. Prior research (e.g., Feenstra & Hanson, 1997; Hanson et al., 2005; Harrison & MacMillan, 2011) argues that MNEs invest in developing countries to conduct parts of their production processes that require relatively low skill levels such as assembling, and that their products are mostly exported to other countries. According to column (6), this argument is partly supported in our case: MNEs are much more export-oriented than local firms. However, since the majority of MNEs’ production is destined for sale in the domestic market, their entry should have a pro-competitive effect in the local product market. Notably, these findings are robust to the inclusion of additional controls (rows 3–5).

To conclude, Indonesia experienced a significant increase in inward FDI in the 2000s. MNEs attracted to the country were, on average, larger and more skill-intensive, compared to local firms. In the following sections, we quantify the extent to which this jump in FDI affected the labor demand in local firms in Indonesia.

3 Empirical framework

Consider the following conditional labor demand function for type \(h=S,U\) workers of firm \(i\) in industry \(j\) in region \(r\) at period \(t\), where \(S\) and \(U\) stand for skilled and unskilled workers, respectively.

\({w}_{jrt}^{h}\), \({\varphi }_{ijrt}\), and \({Q}_{ijrt}\) in Eq. (1) denote local wages for type \(h\) workers, and firm \(i\)’s productivity and output, respectively. \(MN{E}_{jrt}\) in parentheses measures the presence of MNEs in the local market, and is included in Eq. (1) to indicate that wages, productivity, and output are affected by inward FDI. The entry of MNEs intensifies labor market competition and increases local wages, thereby reducing employment in local firms along the labor demand curve. Knowledge spillovers from MNEs improve local firms’ productivity. The local product market’s expansion due to inward FDI increases the demand for goods produced by local firms, while a fierce competition with MNEs decreases it. These three forces affect employment in local firms by shifting their labor demand curves.

Based on Eq. (1), we consider the following empirical specification:

where \(\mathbf{X}\) is a vector of control variables; \(\mathbf{F}\) is a vector of fixed effects to control for unobserved firm, industry, or regional shocks on employment; and \({\varepsilon }_{ijrt}^{h}\) represents disturbances. Following previous studies (e.g., Blalock & Gertler, 2008; Havranek & Irsova, 2011; Javorcik, 2004), we define \(MN{E}_{jrt}\) as the revenue share of MNEs in region \(r\). The following two specifications are considered here. First, as discussed in the Introduction, we employ a measure that allows for a heterogeneous impact on the local labor market, depending on the industry affiliation of the MNEs that enter it (Ellison et al., 2010).

where \(i\in krt\) refers to a firm in a given industry, region, and period; \(Revenu{e}_{i}\) is the revenue of firm \(i\); \(MNE\_Revenu{e}_{i}\) is the revenue of firm \(i\) if it is multinational, and zero otherwise; and \({\rho }_{jk}\) denotes the correlation coefficient of the employment share by occupation between industries \(j\) and \(k\). Since the dataset does not provide employment data at the detailed occupation level, we employed individual-level data from the population census. Specifically, we counted the number of individuals nationwide by industry and occupation. Next, we obtained the share of individuals by occupation for each industry and calculated the correlation coefficient for each industry pair.Footnote 3 As with other FDI indices based on input–output table defined below, we could not observe firm-level employment similarity between local firms and MNEs. Thus, Eq. (3) captures the industry-average impact of peculiar externalities arising from the local labor market: the more similar worker types industries \(j\) and \(k\) employ, the greater the impact of the entry of MNEs in industry \(k\) in the labor market on local firms in industry \(j\).

Second, we introduce three measures of vertical linkages between MNEs and local firms (Blalock & Gertler, 2008; Javorcik, 2004):

here \({\nu }_{kj}\) is the share of inputs purchased by industry \(j\) from industry \(k\); and \({\theta }_{jk}\) is the proportion of industry \(j\)’s output supplied to industry \(k\). Equation (4) measures the level of inward FDI into the same industry and region as firm \(i\) (horizontal FDI), while Eqs. (5) and (6) measure investment level for upstream (forward FDI) and downstream (backward FDI) industries for the concerned product in the concerned region, respectively. These three measures aim to see the channels’ impact such as the knowledge transfer through vertical linkages and the peculiar externalities arising from the local product market. Specifically, \({MNE}_{jrt}^{HZN}\) measures the competition level in the product market, \({MNE}_{jrt}^{FWD}\) and \({MNE}_{jrt}^{BWD}\) measure the degree of knowledge transfer through vertical linkages, and \({MNE}_{jrt}^{BWD}\) measures the demand for local firms’ products from downstream foreign firms.

Two comments are in order. First, by employing the revenue share of MNEs by region, we implicitly assume that the externality effects are localized, and that labor and product markets are regionally segmented. Previous studies provide partial support for these. Amiti and Cameron (2007) described the friction in labor mobility between regions that result from residents’ strong ties to the land in Indonesia. Quantitatively, a 10% increase in the distance between two Indonesian regions leads to a 7% reduction in the proportion of people migrating between the regions (Bryan & Morten, 2019). Furthermore, since the inter-regional transportation infrastructure within and between islands is underdeveloped, the flow of goods and knowledge is highly localized (Amiti & Cameron, 2007; Blalock & Gertler, 2008).

Second, the coefficients on \({MNE}_{jrt}\) in Eq. (2) may suffer from simultaneity bias. Since MNEs invest in regions where they expect strong economic growth and/or labor market competition to be not severe, \({MNE}_{jrt}\) and \({L}_{ijrt}^{h}\) are likely to be correlated if local firms react to the current economic shocks in determining the employment level. The fixed effects in Eq. (2) can alleviate it to the extent that they control for the unobserved shocks. To address this endogeneity further, we estimate Eq. (2) using an instrumental variable (IV) estimation. To construct instruments, the total revenue of MNEs in industry \(j\) in region \(r\) at period \(t\) is estimated based on the corresponding values at the initial period and the growth rate of the total revenue of MNEs in regions other than \(r\) (Diamond, 2016; Glaeser et al., 2006; Saiz, 2010):

Indonesia is geographically divided into provinces, which are further divided into districts. We use each district (kabupaten or kota) as a geographical unit representing \(r\) because the regional labor markets are well defined at this level (Kis-Katos & Sparrow, 2015). The subscripts \(-R\) and \(0\) in \({MNE\_Revenue}_{j-R0}\) denote all provinces other than province \(R\) to which the district \(r\) belongs, and the initial year of the observation period, respectively. Therefore, the second term in parentheses measures the growth rate of the total revenue of MNEs in industry \(j\) from the initial period to period \(t\) in all provinces other than \(R\). The estimated total revenue of MNEs from Eq. (7) is substituted into Eqs. (3–6) to obtain the corresponding instruments (i.e., \({MNE}_{jrt}^{m}\_IV\), \(m=LAB, HZN, FWD, BWD\)).

Our IV strategy should work properly for the following reasons. First, the firm fixed effects in Eq. (2) reflect any impact that \(MNE\_{Revenue}_{jr0}\) may have on the employment in local firms in the following years. In other words, \(MNE\_{Revenue}_{jr0}\) is exogenous to the shocks in employment, after controlling for firm fixed effects. Second, the threat that the shocks occurring in region \(r\) may spill over to the neighboring regions, affecting the growth rates in Eq. (7), is mitigated by excluding the growth in revenue in other districts in province \(R\) (Baum-Snow & Ferreira, 2015). Furthermore, because the shocks are aggregated over all provinces other than \(R\), they are less likely to be correlated with those specific to region \(r\) after controlling for the shocks specific to industry \(j\) at period \(t\), but common to all regions by industry-year fixed effects.

4 Data and variable construction

The primary source of data for this study is the Annual Survey of Medium and Large Manufacturing Establishment published by Statistics Indonesia (Badan Pusat Statistik, BPS). The estimation period is from 2003 to 2012.Footnote 4 The total number of observations made is around 240,000 before data cleaning, implying that 24,000 firms exist each year on average, and approximately 10% are MNEs.Footnote 5 This dataset comprises production and cost information, including the total production value, the number of skilled and unskilled workers, the book value of fixed capital assets, material, electricity, energy inputs, and labor costs for each worker type. A limitation of this dataset is the size threshold. Microdata are only available for firms with 20 or more employees. Nevertheless, our revenue-based measures of MNE presence (\({MNE}_{jrt}\)) reasonably reflect their actual presence in the local economy for the following reasons. First, MNEs are generally larger than local firms (see Table 1) and are more likely to be included in the data. Second, sample coverage rates are around 60% for value added (Ramstetter, 2009).

Variables used in this study are constructed as follows; Value-added is obtained by subtracting intermediate consumption—material, electricity, and energy inputs—from revenue and is deflated by the wholesale price index. Capital stock is constructed by the perpetual inventory method, assuming a depreciation rate of 9% (Brandt et al., 2012).Footnote 6 Firm-level wages are estimated by dividing labor costs, adjusted by the consumer price index, with the number of workers. We obtain regional wages by finding the average of firm-level wages, specifically, those for all workers, and unskilled and skilled workers across the industry, district, and year.Footnote 7

The dataset also reports the industry classification for the firm’s main product and the share of foreign capital. The industry is defined based on the three-digit International Standard Industrial Classification (ISIC) Revision 3.Footnote 8 Following Blalock and Gertler (2009), we define MNEs as firms whose foreign capital share is higher than 20%.Footnote 9 Local firms are those without any foreign ownership throughout the estimation period. We confirmed that the results were essentially the same even when we used a 10% threshold as an alternative definition of MNEs or if we defined local firms as those whose foreign capital share was less than 20%. Finally, the employment share by occupation for each industry is obtained from the Intercensal Population Survey 2005 in Indonesia (Minnesota Population Center, 2019). The industry and occupation are defined based on the three-digit ISIC and the three-digit International Standard Classification of Occupations, respectively.

The total factor productivity is obtained by estimating the Cobb–Douglas value-added production function for each two-digit ISIC industry. We estimate the production function using a methodology proposed by Ackerberg et al., (2015; ACF), who extend the work of Olley and Pakes (1996) and Levinsohn and Petrin (2003) to address the simultaneity bias between unobserved firm productivity and inputs, and the potential collinearity in the first stage of the Levinsohn and Petrin estimator.Footnote 10 Following ACF, we obtain two types of productivity using either material or investment as a proxy for unobserved productivity. In the following section, we present results where productivity is obtained by using material as a proxy. Notably, our results are robust even if we use the other type of productivity measure. See Table 2 for the summary statistics of the variables.

5 Estimation results

5.1 Inward foreign direct investment and labor market competition

First, we examine the impact of inward FDI on labor market competition for skilled and unskilled workers, and the skill intensity of local firms.Footnote 11 All the models in Tables 3, 4 and 5 are estimated by the IV method. Table 3 and Table 6 in the Appendix present our baseline results and the corresponding first-stage estimates, respectively. The number of observations is reduced from the original sample size for the following reasons. First, we take the lag of the independent variables and thus the samples are limited to those that are available at least for two consecutive years. Second, there are many firms that have missing records, and such firms are excluded from the estimation.Footnote 12 The entry of MNEs employing similar worker types as local firms negatively impacts the ratio of skilled to unskilled employment in local firms (column 1). Notably, replacing the ratio with skill intensity does not alter the conclusion (column 2). However, neither column (1) nor (2) indicates whether local firms reduce only skilled employment or change unskilled employment as well. Clarifying this aspect has implications for the welfare of workers. The comparison between columns (3) and (4) reveals that inward FDI reduces unskilled and skilled employment in local firms, and their skill intensity by decreasing the latter more than the former. As a result, the total number of workers in local firms declines (column 5).

Equation (1) indicates that regional wages, productivity, and production of firms are affected by the presence of MNEs. Therefore, if workers are more mobile among industries employing similar worker types, our measure for the FDI presence (\({MNE}_{jrt}^{LAB}\)) may reflect knowledge spillovers arising from labor turnover, affecting productivity and employment of local firms. To address this, we include the lagged productivity, value-added, and capital stock of firms in Table 3.Footnote 13 As long as these firm-level control variables capture the effects of knowledge spillovers arising from labor turnover or other types of externalities, the negative signs on \({MNE}_{jrt}^{LAB}\) in columns (1–5) indicate that inward FDI intensifies labor market competition, specifically for skilled workers, in the host economy.

Regarding control variables’ interpretation, local firms increase unskilled and skilled labor inputs to expand their production, but high-productivity firms can save them to some extent. Capital intensive firms can also reduce labor input. However, the complementarity between capital and skilled workers increases the relative demand for skilled workers. Engaging in international trade also affects the labor demand in local firms. Exporting activity increases unskilled and skilled employment but does not affect the skill intensity. In contrast, importing material increases skilled more than unskilled employment, increasing the skill intensity, a finding consistent with Kasahara et al. (2016). Finally, large first-stage F-statistics imply that the weak instrument problem is not severe.Footnote 14

Table 4 examines whether inward FDI increases regional wages. Since our dependent variable varies at industry-district-year level, it is difficult to find appropriate control variables. Instead, we include district-year and industry-year fixed effects to control for unobserved regional or industry-level contemporaneous shocks on regional wages. We observe that an increase in inward FDI raises the relative wages for skilled workers (column 1). Specifically, inward FDI raises wages for unskilled and skilled workers, and the relative wages for skilled workers by increasing the latter more than the former (columns 2 and 3). Quantitatively, one standard deviation increase in inward FDI raises the relative wages for skilled workers, and wages for unskilled and skilled workers by 4.4%, 9.3%, and 13.7%, respectively. Combined with the results in Tables 3 and 4 supports our argument that inward FDI intensifies labor market competition in the host economy, specifically, for skilled workers. As a result, the entry of MNEs employing similar worker types as local firms hinders the skill upgrading of local firms. However, as previous studies indicate, transactions with foreign firms through supply chains may induce local firms to adopt skill-intensive production. In the following subsection, we introduce measures of vertical linkages with MNEs to identify the relative contribution of each channel to local firms’ skill structures.

5.2 Vertical linkages and employment in local firms

Table 5 adds three measures of vertical linkages between MNEs and local firms to the specification in Table 3. Columns (1) and (2) show that the entry of MNEs employing similar worker types as local firms has a negative and significant impact on the ratio of skilled to unskilled employment and the skill intensity. Among variables measuring the vertical linkages, only inward FDI into downstream industries has a positive and significant impact on the relative demand for skilled workers in local firms. Blalock and Gertler (2008) find the positive externality effects of backward FDI on the productivity of local Indonesian firms. Thus, our results imply that local firms increase their skill intensity to upgrade their production technology so that they can supply their products to the MNEs (Javorcik & Spatareanu, 2009). Blalock and Gertler (2008) also argue that MNEs in Indonesia are export-oriented and generally do not supply to local firms. Unless there exist transactions between local and foreign firms, inward FDI into upstream industries is unlikely to exert a significant impact on local firms’ skill structures.

Columns (3) and (4) decompose FDI’s impact on the ratio into its components. We find that local firms reduce skilled employment when they face severe labor market competition with MNEs employing similar worker types. Given the inelastic supply of skilled workers in Indonesia, the increased inflow of foreign firms should considerably intensify labor market competition. Next, the more foreign firms operate in the same industry, the more severe competition local firms will face in the product market. As a result, they decrease their production by adjusting unskilled labor input. This finding is consistent with Kosová (2010), who argues that the entry of MNEs intensifies competition in the local product market in the Czech Republic. Finally, inward FDI into downstream industries induces local firms to replace unskilled workers with skilled ones to increase their skill intensity.

Table 7 in the Appendix shows the correlation matrix between different measures for FDI presence. Overall, \({MNE}_{jrt}^{LAB}\) is positively correlated with \({MNE}_{jrt}^{HZN}\), \({MNE}_{jrt}^{FWD}\), and \({MNE}_{jrt}^{BWD}\). To evaluate how this correlation affected our results, we re-estimated the same model as Table 5 by excluding \({MNE}_{jrt}^{LAB}\), but we obtained qualitatively the same results as Table 5: backward FDI induces local firms to increase their skill intensity, while horizontal FDI decreases labor inputs in local firms.

The impact of inward FDI on employment in local firms can be summarized as follows: Intensified competition in the product and labor markets due to inward FDI decreases unskilled and skilled employment, respectively. Backward FDI increases skilled employment in local firms but at the expense of unskilled employment. Economically, one standard deviation increase in inward FDI into downstream industries increases the ratio of skilled-to-unskilled employment by 7.4%. However, the corresponding increase in inward FDI employing similar worker types as local firms decreases this ratio by 16.5%. Thus, the negative impact of labor market effects outweighs the skill-upgrading effects of backward FDI.

6 Summary and conclusions

To achieve economic development in a globalized world, developing countries have implemented various policies that open their economies, such as trade liberalization, attracting inward FDI, and participation in GVCs. Recent studies have addressed the importance of skills for the better performance of local firms under such circumstances. Therefore, identifying globalization’s impact on the skill structure of local firms has significant implications for the firms’ performance and residents’ welfare. In this study, we focused on the externality effects of inward FDI on the local labor market in the host economy. Specifically, we identified how the entry of MNEs affects the wage gap between skilled and unskilled workers and the relative demand for skilled workers in local firms.

Employing microdata from Indonesian manufacturing, we found that the impact of inward FDI on local firms’ skill structure varies depending on the type of foreign firms. The entry of MNEs employing similar worker types as local firms intensifies the labor market competition for skilled workers, lowering local firms’ skill intensity. Moreover, facing severe product market competition with foreign firms operating in the same industry, local firms reduce unskilled employment. In contrast, inward FDI into downstream industries induces local firms to upgrade their technology by employing more skilled workers. Quantitatively, the reduction in skill intensity due to a one standard deviation change in labor market effects outweighs the skill upgrading effects due to the same one standard deviation change in the vertical linkage effects.

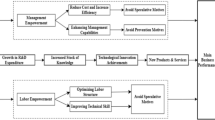

These results underscore the importance of identifying the underlying mechanisms of the externality effects of inward FDI in designing effective development policies. Local firms in GVCs increase their demand for skilled workers to have transactions with foreign firms in downstream industries. Nonetheless, severe labor market competition for skilled workers with MNEs hinders them from upgrading the skill structure. Thus, an adequate supply of skilled workers is crucial for the better performance of local firms. Further, attracting inward FDI has implications for unskilled employment in the host economy. GVC participation is likely to encourage local firms to replace unskilled with skilled workers. Severe product market competition with MNEs further decreases unskilled employment in local firms. Consequently, in addition to ensuring a sufficient supply of skilled workers, the government should carefully monitor the impact of attracting MNEs on the welfare of unskilled workers.

Two issues remain to be addressed in future research. First, owing to data availability, we could not evaluate the impact of inward FDI on employment in small enterprises. Since these firms account for more than half of the employment in Indonesian manufacturing (Ramstetter, 2009), identifying their impact would have important implications for society. Second, this study focused on Indonesian manufacturing, but its implications are applicable to other developing countries, where the lack of skilled workers is a bottleneck for the sustained growth of local firms. We found that GVC participation affected the skill structure of local firms, implying that the value of skilled workers increased more than that of unskilled workers. Human capital investment can alleviate the negative impact of unskilled employment in the host economy by transforming unskilled workers into skilled workers. Additionally, Rodrick (2018) argued that strengthening the connection between foreign firms, local manufacturers, and the domestic labor force could be effective in mitigating this issue. Exploring the effectiveness and welfare implications of these policy measures remains important for future investigation.

Availability of data and materials

The data that support the findings of this study are available from Statistics Indonesia (Badan Pusat Statistik, BPS) at URL: https://www.bps.go.id/ with BPS permission.

Code availability

Code is available from authors upon readers’ request.

Notes

The dataset distinguishes labor between production and non-production workers. We regard production workers as unskilled and non-production workers as skilled labor for the following reasons: first, non-production workers are those who engage in non-manual work, such as factory supervision, administration, logistics, and research and development; second, non-production workers have a higher education level on average. Information on the composition of workers based on their education level is available in the 2006 version of our survey. Approximately 10% of non-production workers have completed university education, and 63% have completed high school. Meanwhile, only 1% of production workers have completed university, and 42% have completed high school. The classification of workers as skilled and unskilled based on their occupation is common in the literature on international trade. See Bernard and Jensen (1997) and Amiti and Cameron (2012). An exception is Kasahara et al. (2016), who argue that along with occupation, the number of years of education should be considered when classifying workers as skilled or unskilled.

Technically, \({\rho }_{jk}\) ranges from -1 to 1, but we set \({\rho }_{jk}=0\) if \({\rho }_{jk}\) takes a negative value. The underlying assumption is that the entry of MNEs employing the opposite types of workers from local firms does not affect labor market competition. Its average is 0.175.

Information on firms’ location was not available at the district level in 2001. We use observations from 2002 only to construct instruments in Eq. (7) to reduce the endogeneity risk in the initial year.

“Plants” would be a more accurate expression because production and cost information are provided at the plant level in our dataset. However, since most firms in Indonesia are single-plant firms (Kasahara et al., 2016), this distinction is not critical. To avoid confusion, we used the term “firm” rather than “plant” in this study.

The initial capital stock is proxied by fixed tangible assets, deflated by the price index for gross fixed capital formation in Indonesia’s System of National Accounts.

The obtained regional wages do not reflect wages paid by small enterprises. However, no alternative data sources allow us to infer this information. For example, the National Labor Force Survey (Sakernas) records the employment status, industry affiliation, occupation, and wage of each household member, but wage data disaggregated at the industry-district-year level are not publicly available. Economic Census (Sensus Ekonomi) is not suitable for our purpose either as it is conducted once every 10 years and does not provide information on wages by skill.

Some firms switch from one industry to another during sample periods; the overall switching rate is around 5%. We assign the industry classification to a firm based on the sector it belongs to most frequently during the sample periods.

According to Blalock and Gertler (2009), the samples of foreign affiliated firms obtained under this definition are mostly equivalent to those doing business under the foreign capital investment licenses in Indonesia.

We use the Stata code used in De Loecker and Warzynski (2012) for the production function estimation. We exclude outlier firms whose value-added, number of workers, intermediate inputs, or capital stock lie in the top or bottom 1% of each industry.

Employing the 1996 and 2006 versions of the data, which provide information on the composition of workers by education level, we attempted to examine the impact of inward FDI on employment by educational level, regarding workers with a high school degree or above as skilled workers. Although the observations were limited to firms that survived for 10 years, we found that inward FDI has a negative (positive) impact on skilled (unskilled) employment. However, the first-stage F statistics were very low, implying that our instrument could not comprehensively address the change in the presence of MNEs during this period, presumably due to the huge economic shocks caused by the Asian Financial Crisis and the subsequent political turmoil.

Although such sample selection is common in developing countries (Blalock and Gertler 2008), the data are representative, and the selection bias is not a problem unless the sample selection is concentrated in specific types of firms. On average, five firms are active per region, industry, and year.

We use the lagged value to mitigate the endogeneity issue.

Kleibergen-Paap Wald F statistic is a weak instrument test statistic robust to non-i.i.d. errors. Baum et al. (2007) indicate that weak identification is not considered a problem when it exceeds a value of 10.

References

Ackerberg, D., Caves, K., & Frazer, G. (2015). Identification properties of recent production function estimators. Econometrica, 83(6), 2411–2451.

Alfaro, L., & Chen, M. (2018). Selection and market reallocation: Productivity gains from multinational production. American Economic Journal: Economic Policy, 10(2), 1–38.

Amiti, M., & Cameron, L. (2007). Economic geography and wages. Review of Economics and Statistics, 89(1), 15–29.

Amiti, M., & Cameron, L. (2012). Trade liberalization and the wage and skill premium: Evidence from Indonesia. Journal of International Economics, 62(2), 277–287.

Arnold, J., & Javorcik, B. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in Indonesia. Journal of International Economics, 79(1), 42–53.

Bajgar, M., & Javorcik, B. (2020). Climbing the rungs of the quality ladder: FDI and domestic exporters in Romania. Economic Journal, 130, 937–955.

Baldwin, R. (2016). The great convergence. Belknap Press.

Balsvik, R. (2011). Is labor mobility a channel for spillovers from multinationals? Evidence from Norwegian manufacturing. Review of Economics and Statistics, 93(1), 285–297.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2007). Enhanced routines for instrumental variables/generalized method of moments estimation and testing. Stata Journal, 7(4), 465–506.

Baum-Snow, N., & Ferreira, F. (2015). Causal inference in urban and regional economics, in G. Duranton, J. V. Henderson, & W. Strange (Eds.), Handbook of regional and urban economics (vol. 5A). Elsevier.

Bernard, A. B., & Jensen, J. B. (1997). Exporters, skill upgrading, and the wage gap. Journal of International Economics, 42, 1–25.

Blalock, G., & Gertler, P. (2008). Welfare gains from foreign direct investment through technology transfer to local suppliers. Journal of International Economics, 74(2), 402–421.

Blalock, G., & Gertler, P. (2009). How firm capabilities affect who benefits from foreign technology. Journal of Development Economics, 90(2), 192–199.

Brandt, L., Biesebroeck, J., & Zhang, Y. (2012). Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. Journal of Development Economics, 97(2), 339–351.

Bryan, G., & Morten, M. (2019). The aggregate productivity effects of internal migration: Evidence from Indonesia. Journal of Political Economy, 127(1), 2229–2268.

Cardoso, M., Neves, P., Afonso, O., & Sochirca, E. (2021). The effects of offshoring on wages: A meta-analysis. Review of World Economics, 157, 149–179.

Ciani, A., & Imbruno, M. (2017). Microeconomic mechanisms behind export spillovers from FDI: Evidence from Bulgaria. Review of World Economics, 153, 703–734.

De Loecker, J., & Warzynski, F. (2012). Markups and firm-level export status. American Economic Review, 102(6), 2437–2471.

Diamond, R. (2016). The determinants and welfare implications of US workers’ diverging location choices by skill: 1980–2000. American Economic Review, 106(3), 479–524.

Dinga, M., & Münich, D. (2010). The impact of territorially concentrated FDI on local labor markets: Evidence from the Czech Republic. Labour Economics, 17, 354–367.

Ellison, G., Glaeser, E., & Kerr, W. (2010). What causes industry agglomeration? Evidence from coagglomeration patterns. American Economic Review, 100(3), 1195–1213.

Feenstra, R., & Hanson, G. (1997). Foreign direct investment and relative wages: Evidence from Mexico’s maquiladoras. Journal of International Economics, 42, 371–393.

Gereffi, G. (2018). Global value chains and development: Redefining the contours of 21st century capitalism. Cambridge University Press.

Girma, S., Gong, Y., Görg, H., & Lancheros, S. (2015). Estimating direct and indirect effects of foreign direct investment on firm productivity in the presence of interactions between firms. Journal of International Economics, 95, 157–169.

Glaeser, E., Gyourko, J., & Saks, R. (2006). Urban growth and housing supply. Journal of Economic Geography, 6(1), 71–89.

Goldberg, P., & Pavcnik, N. (2007). Distributional effects of globalization in developing countries. Journal of Economic Literature, 45(1), 39–82.

Görg, H., & Strobl, E. (2005). Spillovers from foreign firms through worker mobility: An empirical investigation. Scandinavian Journal of Economics, 107(4), 693–709.

Hale, G. & Xu, M. (2016). FDI effects on the labor market of host countries (Federal Reserve Bank of San Francisco Working Paper 2016–25).

Hanson, G., Mataloni, R., Jr., & Slaughter, M. (2005). Vertical production networks in multinational firms. Review of Economics and Statistics, 87(4), 664–678.

Harrison, A., & McMillan, M. (2011). Offshoring jobs? Multinationals and U.S. manufacturing employment. Review of Economics and Statistics, 93(3), 857–875.

Havranek, T., & Irsova, Z. (2011). Estimating vertical spillovers from FDI: Why results vary and what the true effect is. Journal of International Economics, 85(2), 234–244.

Javorcik, B. S. & Spatareanu, M. (2005). Disentangling FDI spillover effects: What do firm perceptions tell us? In T. Moran, E. Graham, & M. Blomstrom (Eds.), Does foreign direct investment promote development? Peterson Institute for International Economics.

Javorcik, B. S. (2004). Dose foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605–627.

Javorcik, B. S. (2015). Does FDI bring good jobs to host countries? World Bank Research Observer, 30(1), 74–94.

Javorcik, B. S., & Spatareanu, M. (2009). Tough love: Do Czech suppliers learn from their relationships with multinationals? Scandinavian Journal of Economics, 111(4), 811–833.

Jia, W., & López, R. (2021). Foreign direct investment, product sophistication, and the demand for skilled and unskilled labor in Chilean manufacturing. Journal of Development Studies, 57, 70–87.

Johansson, A., & Liu, D. (2020). Foreign direct investment and inequality: Evidence from China’s policy change. World Economy, 43, 1647–1664.

Karlsson, S., Lundin, N., Sjöholm, F., & He, P. (2009). Foreign firms and Chinese employment. World Economy, 32(1), 178–201.

Kasahara, H., Liang, Y., & Rodrigue, J. (2016). Does importing intermediates increases the demand for skilled workers? Plant-level evidence from Indonesia. Journal of International Economics, 102, 242–261.

Kis-Katos, K., & Sparrow, R. (2015). Poverty, labor markets and trade liberalization in Indonesia. Journal of Development Economics, 117, 94–106.

Kosová, R. (2010). Do foreign firms crowd out domestic firms? Evidence from the Czech Republic. Review of Economics and Statistics, 92(4), 861–881.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Review of Economic Studies, 70(2), 317–341.

Liang, F. (2017). ‘Does foreign direct investment improve the productivity of domestic firms? Technology spillovers, industry linkages, and firm capabilities. Research Policy, 46, 138–159.

Lin, S.-C., Kim, D.-H., & Wu, Y.-C. (2013). Foreign direct investment and income inequality: Human capital matters. Journal of Regional Science, 53(5), 874–896.

Lipsey, R., & Sjöholm, F. (2004). FDI and wage spillovers in Indonesian manufacturing. Review of World Economics, 140(2), 321–332.

Lipsey, R., Sjöholm, F., & Sun, J. (2013). Foreign ownership and employment growth in a developing country. Journal of Development Studies, 49(8), 1137–1147.

Lu, Y., Tao, Z., & Zhu, L. (2017). Identifying FDI spillovers. Journal of International Economics, 107, 75–90.

Markusen, J., & Trofimenko, N. (2009). Teaching locals new tricks: Foreign experts as a channel of knowledge transfers. Journal of Development Economics, 88(1), 120–131.

McCaig, B., & Pavcnik, N. (2018). Export markets and labor allocation in a low-income country. American Economic Review, 108(7), 1899–1941.

Minnesota Population Center. (2019). Integrated public use microdata series, international: version 7.2. Minneapolis, IPUMS.

Negara, S., & Adam, L. (2012). Foreign direct investment and firms productivity level: Lesson learned from Indonesia. ASEAN Economic Bulletin, 29(2), 116–127.

Newman, C., Rand, J., Talbot, T., & Tarp, F. (2015). Technology transfers, foreign investment and productivity spillovers. European Economic Review, 76, 168–187.

Olley, S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1297.

Poole, J. (2013). Knowledge transfers from multinational to domestic firms: Evidence from worker mobility. Review of Economics and Statistics, 95(2), 393–406.

Ramstetter, E. (2009). Firm- and plant-level analysis of multinationals in Southeast Asia: The perils of pooling industries and balancing panels (ICSEAD Working Paper, 2009–22).

Rodrik, D. (2018). New technologies, global value chains, and the developing economies (Pathways for Prosperity Commission Background Paper Series 1).

Saiz, A. (2010). The geographic determinants of housing supply. Quarterly Journal of Economics, 125(3), 1253–1296.

Smeets, R. (2008). Collecting the pieces of the FDI knowledge spillovers puzzle. World Bank Research Observer, 23(2), 107–138.

Takii, S. (2004). Productivity differentials between local and foreign plants in Indonesian manufacturing, 1995. World Development, 32(11), 1957–1969.

Takii, S. (2005). Productivity spillovers and characteristics of foreign multinational plants in Indonesian manufacturing 1990–1995. Journal of Development Economics, 76(2), 521–542.

Todo, Y., & Miyamoto, K. (2006). Knowledge spillovers from multinational enterprises and the role of R&D activities: Evidence from Indonesia. Economic Development and Cultural Change, 55(1), 173–200.

Topalova, P. (2010). Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India. American Economic Journal: Applied Economics, 2, 1–41.

Acknowledgements

This study was conducted as a part of the Microdata project on “Microdynamics of Industrial Development and Trade and Industry Policy” undertaken at the Economic Research Institute of ASEAN and East Asia (ERIA) for the fiscal year 2018. The authors wish to thank Ju Hyun Pyun, Isao Kamata, Masatoshi Kato, Ni Bin, Nobu Yamashita, Taiji Furusawa, Shujiro Urata, Chin Hee Hahn, Jean Claude Thill, and other seminar participants at ERIA, the University of Tokyo, Kwansei Gakuin University, the 2019 Western Economic Association in San Francisco, and the 2019 North American Meetings of the Regional Science Association International. This study is supported by JSPS KAKENHI Grant 18H036337 and 16H02018 (Matsuura) and 18K01602 (Saito).

Funding

JSPS KAKENHI Grant 18H036337 and 16H02018 (Matsuura) and 18K01602 (Saito).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Matsuura, T., Saito, H. Foreign direct investment and labor demand by skill in Indonesian manufacturing firms. Rev World Econ 159, 921–941 (2023). https://doi.org/10.1007/s10290-022-00485-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-022-00485-y