Abstract

This paper addresses the trade and welfare implications of a bilateral trade agreement between the U.S. and Japan. In 2019, the two countries signed a “stage one” trade agreement, with the U.S.-Japan Trade Agreement (USJTA) and the U.S.-Japan Digital Trade Agreement as two small trade agreements. A comprehensive bilateral free trade agreement (FTA) is currently under discussion between Washington and Tokyo, with the U.S. government alternatively joining the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP). Based on the theoretical model of Caliendo and Parro (Rev Econ Stud, 82(1):1–44, 2015) , I analyze the welfare gains of such a bilateral FTA in the style of Aichele et al. (Where is the value added? China’s WTO entry, trade and value chains, ZBW-Deutsche Zentralbibliothek für Wirtschaftswissenschaften, Leibniz, 2014). I simulate trade and welfare impacts for the USJTA and the U.S.-Japan Digital Trade Agreement, as well as for a deep bilateral FTA. In addition, I examine and compare the welfare implications of the established CPTPP with the scenario of the U.S. or China joining CPTPP. My findings show that Japan’s welfare increases by 0.3% and U.S. welfare increases by 0.14% as a result of the FTA. Welfare of both countries would increase if the U.S. entered CPTPP, with Japanese welfare being even higher if China acceded to CPTPP.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past decades, the value of U.S. exports has risen sharply from $1.3 trillion in 2005 to more than $2.5 trillion in 2019.Footnote 1 In 2019, 52% of U.S. exports went to countries with an established U.S. trade agreement.Footnote 2 It is worth noting that Japan, as the world’s third largest economy (by GDP in 2019), is one of the United States’ most important trading partners without a trade agreement in place. To address this issue, the Trans-Pacific Partnership (TPP) was sought to structure trade relations between the two countries. However, after the 2016 U.S. election, one of the first steps taken by the new administration was to put TPP negotiations on hold and focus on bilateral free trade agreements (FTAs) in order to have greater negotiating power.

In October 2019, the U.S. and Japan concluded their negotiations on a “stage one” trade agreement, which includes the U.S.-Japan Trade Agreement (USJTA) and the U.S.-Japan Digital Trade Agreement. The USJTA accounts for 5% of bilateral trade between the two countries and is therefore considered a rather small trade agreement. The U.S. agreed to reduce its tariffs on goods in the industrial sector, while Japan reduced its tariffs in the agricultural sector. The U.S.-Japan Digital Trade Agreement was established as a precursor to other Digital Trade Agreements to reduce non-discriminatory treatment of digital services and improve the flow of data across countries. Stage two of the bilateral trade agreement is expected to be a deeper and more comprehensive FTA. Moreover, Japan joined the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP), the TPP successor without the U.S., in late 2018. This resulted in lower Japanese import tariffs for CPTPP countries, putting U.S. exporters at a disadvantage. In addition, China made its first attempt to join the CPTPP in September 2021, which would make the CPTPP a major regional trade agreement.

Surprisingly, little research has been done on the trade and welfare implications of a U.S.-Japan trade agreement, particularly with respect to a “stage one” and “stage two” agreement. The ongressional Research Service (2020) provides a good overview of “stage one” developments and recent “stage two” negotiations. To this point, only reports have examined the bilateral FTA from a geopolitical and advisory perspective, but not from the economic side (Scissors & Blumenthal, 2017; Cooper, 2014).

Far more research has been conducted on other FTAs such as the EU-Japan Economic Partnership Agreement or the EU-South Korea FTA. Chowdhry and Felbermayr (2021) focus on the EU-South Korea trade agreement from the French perspective, Grübler and Reiter (2021) study the impact of tariffs and non-tariff measures (NTMs) of the EU-South Korea FTA. A comprehensive analysis is done by Civic Consulting and Ifo Institute (2018) who rely on the World Input-Output Database (WIOD). Felbermayr et al. (2019) examine the EU-Japan Economic Partnership Agreement and their work is closest to my paper as it has a similar theoretical approach and also uses the WIOD as the main data source. Regarding the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Li and Whalley (2021) use a general equilibrium (GE) model to analyze different scenarios of the CPTPP. Li and Li (2021), disentangle the trade impacts between the CPTPP and the Regional Comprehensive Economic Partnership Agreement (RCEP), while Le (2021) examines the CPTPP from a Vietnamese viewpoint.

In this paper, I fill the gap by analyzing a U.S.-Japan FTA using the theoretical model of Caliendo and Parro (2015), which builds on the assumptions of New Quantitative Trade Theory (NQTT).Footnote 3 Applying the model provides several advantages: First, the model solves for a counterfactual equilibrium in relative changes through which structural parameters that are difficult to identify cancel out and do not have to be estimated empirically. Hereby the approach is borrowed from Dekle et al. (2008). Second, their model is a multi-sector multi-country model with intermediate goods. The focus on trade in intermediates (global supply chains) is particularly useful for the investigation of the FTA between Japan and the U.S., as the impact of trade agreements does not only depend on the degree of policy changes but also on the interrelation between industries. The international economy can be seen as an interlinked production network where the output of one sector can become the input for another. An impulse of trade policy can be passed on and impact other sectors as well. A difference between my paper and Caliendo and Parro (2015) is that this paper tries to predict the effect of the potential FTA ex-ante. Several studies use an ex-ante trade policy approach, for example for Brexit (Felbermayr et al., 2018) or on the elimination of EU and U.S. import tariffs in the automotive sector (Jung & Walter, 2018).

To solve for the welfare gains I apply the ex-ante empirical strategy of Aichele et al. (2014). The approach is useful as it takes not only tariffs, but also NTMs into account. In general, trade agreements can take on different intensity levels to remove trade impediments. These can vary from reducing tariffs to deeper integration, where NTMs are minimized. The reduction of NTMs can include the standardization of regulatory legislation and industry standards as well as the opening of markets to foreign investments. To estimate the impact of NTMs, I apply the top-down method and use past trade agreements as a benchmark to quantify the possible welfare impact of the FTA.Footnote 4

This paper contributes to the literature in two ways. Not only is it one of the first to address the welfare implications of a FTA between Japan and the U.S., but it also simulates different scenarios by conducting a counterfactual analysis. In particular, I examine the trade and welfare consequences of the “stage one” trade agreement, which comprises the USJTA and the U.S.-Japan Digital Trade Agreement. In addition, I explore the impact of a potential “stage two” trade agreement as a deep FTA, in which all bilateral tariffs are reduced to zero and NTMs are sharply reduced. To link my paper to the current discussion, I extend the analysis and examine and compare the welfare effects of the established CPTPP with the scenario of China or the U.S. joining the CPTPP.

To exercise the counterfactual simulation, I use the well-established World Input-Output Database (WIOD) (Timmer et al. 2015) as well as the UNCTAD’s TRAINS and the World Integrated Trade Solution (WITS) database for tariffs as the main data sources. The WIOD contains only data of six CPTPP countries, namely Japan, U.S., Canada, Mexico, Chile and Australia.Footnote 5 However, those countries are responsible for 96% of the CPTPP members’ GDP, through which valid interpretations are possible. I take the WIOD for the most recent year, 2014; to be more current and to take into account developments in trade policy since then, I counterfactually construct a new baseline for 2019. To do this, I use the 2014 input-output data along with the 2014 tariff data as the old baseline. I then counterfactually simulate the new baseline year of 2019, taking into consideration the 2019 tariff data as well as trade policy developments that took place between these years, such as the signing of the EU-Japan trade agreement, thus ensuring the reduction of NTMs that have been reduced since then. A baseline is established for each scenario, i.e., the U.S.-Japan FTA, the established CPTPP and CPTPP with the U.S., and the CPTPP with China. This is necessary because each scenario depends on different circumstances. For example, for the FTA, I consider the fact that the CPTPP already exists. When calculating the impact of the established CPTPP, I do not consider the CPTPP for the new baseline. This is also true for the extended CPTPP with the U.S. or China.

My results show that the impact of the “stage one” trade agreement is small. The trade effects of the U.S.-Japan Trade Agreement (USJTA) display that the U.S. imports from Japan increase by $5.3 billion and the Japanese imports from the U.S. rise by $2.9 billion. Since the U.S.-Japan Digital Trade Agreement mainly targets the services industry, the impact on trade is even smaller. Overall, the “stage one” trade agreement increases welfare by 0.008% for the U.S. and 0.021% for Japan, due to the USJTA. Only a marginal contribution is made by the digital trade agreement. The deep FTA as a “stage two” agreement leads to higher welfare for the U.S. (0.14%) and Japan (0.3%). In Japan, it is primarily the Motor Vehicle sector that benefits most, while in the U.S. the food and agricultural sectors profit from the agreement. Moreover, my results show that it is not a symmetric reduction in NTMs over all sectors that count, but rather that NTM reductions in some sectors are more important for welfare gains than in others. With respect to the CPTPP, I find that the U.S. (0.69%) and Japan (0.44%) benefit more if the U.S. joins the CPTPP than they would under a bilateral FTA. I also find that Japan would benefit even more if China joined the regional trade agreement (1.1%) instead of the U.S. joining the CPTPP. In this case, China’s welfare would increase by (0.51%), while the U.S. would benefit marginally by (0.02%).

The structure of the paper is as follows. Section 2 elaborates on the stylized facts, while Sect. 3 gives a brief overview of the gravity model used in the analysis. Section 4 outlines the strategy for determining the change in trade costs and the parameter identification. Section 5 presents the research results. A conclusion is drawn in Sect. 6.

2 Stylized facts

Imports from Japan to the U.S. are constantly larger than exports from the U.S. to Japan, as shown in Fig. 1. For 2019, the U.S. has a trade deficit with Japan of about $69 billion. The chart shows that trade flows between the two countries were severely affected during the financial crisis in 2008. Imports from Japan to the U.S. were hit much harder than exports from the U.S. to Japan. One of the reasons for this was the decline in domestic demand in the U.S.. When the global economic situation stabilized, trade between the U.S. and Japan reached its pre-crisis levels.

Source: World Input Output Database, Timmer et al. 2015; WITS; Author‘s own illustration

U.S. Imports & Exports.

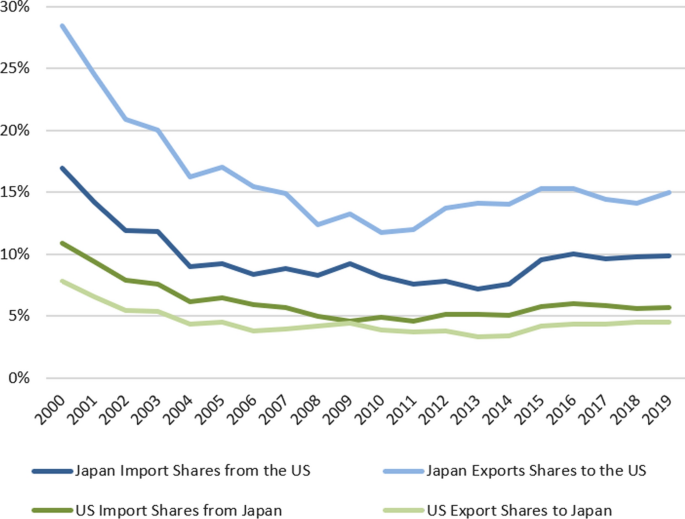

Figure 2 shows the importance of bilateral trade relations for Japan. It presents the import and export shares for both countries over the last two decades.Footnote 6 Thereby, both shares are significantly larger for Japan. However, the import and export shares for Japan decreased by almost 50%, e.g., the import share for Japan decreased from 28% to 15% (from 2000 to 2019). Note, that the largest decline in both shares occurred between 2000 and 2004. In the U.S., import and export shares declined less than in Japan, reaching an import share of 6% and an export share of 4.5% in 2019.

Source: World Input Output Database, Timmer et al. 2015; WITS; Author‘s own illustration

Import & Export Shares.

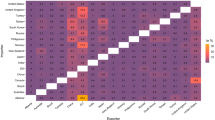

In Fig. 3, I display bilateral exports at the sectoral level. In 2019, Japan exported manufacturing goods worth about $120 billion to the U.S.. In particular, the automotive industry as the largest export sector, and the machinery and electronics sector stand out. Manufacturing is also the largest U.S. export sector to Japan, with about $32 billion, and includes the manufactured articles, vehicles, machines and electronics sectors. The chemical sector also plays an important role in exporting goods to Japan with $10.5 billion. Other sectors play a minor role, as for example for Japan, spending on textiles and clothing accounts for $700 million and for agriculture $400 million, while for the U.S., agricultural exports to Japan are more important, as the U.S. exports about $10.5 billion worth of agricultural products to Japan.

Source: World Input Output Database, Timmer et al. 2015; WITS; Author‘s own illustration

Bilateral Sector Exports (in 2019).

The average U.S. import tariff on Japanese products is already low at 2.5% and has been fairly constant over the past 15 years, while import tariffs on the Japanese side are higher on average (Fig. 4). However, the tariff rate has decreased from around 10% in 2001 to around 4.5% in 2019. Therefore, Japan pursues a more protectionist bilateral trade policy in terms of tariffs than its U.S. counterpart. A closer look at the tariffs reveals that Japan mainly protects its textile, food and agricultural sectors as well as the metal industry. In the Japanese agricultural sector in particular, there is a high degree of tariff heterogeneity. On the one hand, Japan protects especially its rice industry (which consists of many small farms) with tariffs, quotas and subsidies. On the other hand, Japan also relies on other imports in the food sector. This heterogeneity is also reflected in trade policy: According to Felbermayr et al. (2017b), 25% of tariffs in agriculture are duty-free, while other agricultural products face tariffs of up to 300%. On the U.S. side, tariffs are more even across sectors. On average, the highest tariffs are imposed on electronics (4%), as well as textiles (4.2%) and food (3.4%).

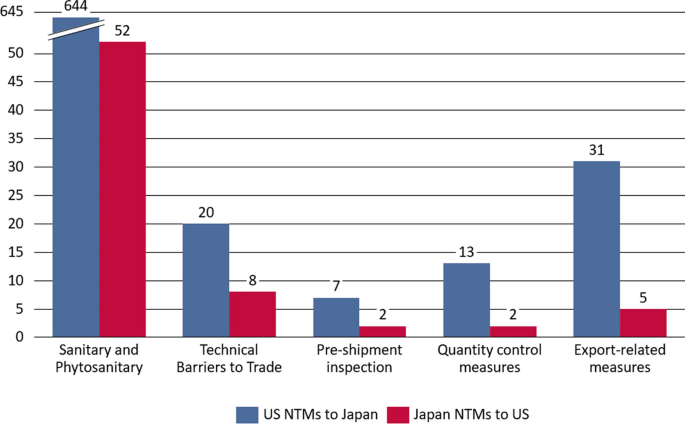

However, trade costs depend not only on tariffs, but also include NTMs. Figure 5 displays the number of NTMs that were in force between the U.S. and Japan in 2018. Because the quality of NTMs is generally harder to measure, the quantity of NTMs that I present in Fig. 5 can provide an indication of the cost of trade barriers. The U.S. clearly has more NTMs in place than Japan. In particular, U.S. regulations in the area of sanitary and phytosanitary measures far exceed Japanese regulations: 644 U.S. NTMs compared to Japan’s 52 NTMs. The number of barriers on the U.S. side is also much greater in the area of export-related measures and technical barriers to trade.

In summary, Japan and the U.S. have a significant economic relationship, but trade shares between the two countries have declined slightly over the past decade. This is due to stronger Japanese trade relations with China and other Asian countries, as well as growing U.S. trade with Mexico and China. The U.S. trade deficits with Japan are mainly due to manufacturing trade deficits. On average, U.S. import tariffs on Japanese goods and services are 2% percentage points lower than in the reverse case. In addition, Japan protects its agricultural sector, especially the corps and animal sector, which includes the rice industry. The Japanese automotive industry is also less open to foreign manufacturers, as only a small proportion of the cars sold in Japan come from foreign companies.

3 Gravity model

The Caliendo and Parro (2015) model includes multiple sectors, multiple countries, and input-output linkages that provide realistic numerical results. At the core of the model is the structural gravity approach and allows a good fit between theory and empirical analysis, since the key parameters can be derived from the gravity equation. Further, the model enables the calculation of quantitative simulations of fundamental changes. In doing so, the simulations move away from a marginal analysis to an analysis of discrete changes, especially trade costs. Moreover, the approach in relative changes omits other parameters that are difficult to estimate. The model builds on the well-known Eaton and Kortum (2002) Ricardian framework. It assumes that technology is not deterministically but stochastically determined. The limitation of the framework is that it assumes homogeneous firms and perfect competition. Costinot and Rodriguez-Clare (2014) note that in terms of gians from trade, market structure, such as monopolistic competition, matters. But compared to other economic channels such as multiple sectors or tradable intermediates, the effects are less severe.

The setup of the model includes intermediate goods, composite intermediate goods and heterogeneity in sectoral productivity. It involves the following assumptions: There are \(n=1,\ldots ,N\) countries which are referred to as n and i; and include \(j=1,\ldots ,J\) sectors indicated by j and k. The only factor of the country that enters into production is labor \(L_n\) that earns the wage \(w_n\). Labor is mobile across sectors, but it is not mobile across countries. It is assumed that all markets are perfectly competitive, so that price equals marginal cost.

3.1 Households

In each country n there are \(L_n\) representative households with Cobb–Douglas preferences. The households buy final goods in the amount of \(C_n^j\) for the price of \(P_n^j\), hence the consumer maximization problem becomes:

Here, \(\alpha _n^j\) is the share of demand for the final good in sector j of country n. It is an exogenous parameter, and it holds \(\sum _{j=1}^J\alpha _n^j=1\) as well as \(\alpha _n^j\ge 0\). \(I_n\) is the income of the household of country n and includes labor income, tariff revenue and trade surplus. The solution of the price index of the final good is given by \(P_n=\prod _{j=1}^J\left( P_n^j/\alpha _n^j\right) ^{\alpha _n^j}\).

3.2 Composite intermediate goods

Composite intermediate goods (materials) are produced by intermediate goods from the same sector. Composite intermediate goods \((q_n^j)\) are used for the production of sector-specific final goods \(C_n^j\) and intermediate goods \(q_n^j(x_n^j)\). Producers of the composite intermediate good purchase the sector specific intermediate good from that country which offers the lowest price for the intermediate good. The solution of the minimization problem leads to the intermediate good demand function of \(q_n^j(x^j)=\left( \frac{p_n^j(x^j)}{P_n^j}\right) ^{-\eta ^j}q_n^j\) with \(P_n^j\) as the price of the material and \(p_n^j(x^j)\) as the lowest price for the sector specific intermediate good \(x^j\) across all countries. The constant elasticity of substitution is represented by \(\eta ^j\) and varies across sectors. A change in tariffs affects the aggregated price index of intermediate goods, which in turn influences the material price as well. This is a key mechanism in the model.

3.3 Intermediate goods

Labor and composite intermediate goods from all sectors, are used as inputs to produce the intermediate good \(x_n^j\). Hereby, the production function is defined as:

where \(l_n^j(x_n^j)\) is the labor demand. The efficiency of producing the intermediate good in sector j in country n is given by \([x_n^j]^{-\theta ^j}\). The parameter \(\theta ^j\) captures the dispersion of productivity and intensifies the productivity draws. The amount of materials from sector k used in the production of the intermediate good \(x_n^j\) is given by \(m_{n}^k(x_n^j)\). The share of composite intermediate goods from sector k used to create the intermediate good \(x_n^j\) in sector j is given by \(\gamma _n^{k,j}\ge {0}\). It holds \(\sum _{k=1}^J\gamma _n^{k,j}=1-\beta _n^j\), where \(\beta _n^j\) is the share of value added in sector j of country n. The solution of the producer maximazation problem for labor demand is given by \(l_n^j(x_n^j)= \beta _n^j\frac{p_n^j(x_n^j)q_n^j(x_n^j)}{w_n}\) and the demand for composite intermediate goods by \(m_{n}^k(x_n^j)= \gamma _n^{k,j}(1-\beta _n^j)\frac{p_n^j(x_n^j)q_n^j(x_n^j)}{P_n^k}\). The price of an intermediate good is then given by \(p_n^j(x_n^j)=\frac{B^j}{[x_n^j]^{{-\theta }^{j}}}c_n^j\) where \(B^j\) is a constant. The cost of the input bundle, \(c_n^j\), is described by the equation \(c_n^j= w_n^{\beta _n^j}\left( \prod _{k=1}^J(P_n^k)^{\gamma _n^{k,j}}\right) ^{1-\beta _n^j}\).

3.4 Introduction of trade costs

The model distinguishes between two types of costs. The first type of cost is defined as the ad valorem flat-rate tariff \(\tau _{ni}^j\) that occurs when intermediate goods are imported from country i into country n. The second type of trade cost \(d_{ni}^j\) is called “iceberg cost” and is the physical loss that goods suffer when traded between countries. “Iceberg costs” can take the form of a function that includes various variables such as bilateral distance or common border.

In this paper, I borrow from the Aichele et al. (2014) approach to estimate the impact of NTMs. They apply the top-down approach to estimate a realistic reduction in trade costs. This approach examines past trade agreements and their impact on reducing trade costs. The results are then used as benchmarks to predict the impact of future trade agreements. In this context, a dummy variable \(PTA_{deep}\) is used, leading to the international trade cost of \(k_{ni}^j={\tilde{\tau }}_{ni}^jd_{ni}^j{\text { with }}{\tilde{\tau }}_{ni}^j=(1+\tau _{ni}^j){\text { and }}d_{ni}^j=D_{ni}^{\rho ^j}e^{({\delta _{deep}^jPTA_{deep,ni}+\zeta ^jR_{ni})}}\).Footnote 7 Taking into account international trade costs, the price of the intermediate good depends not only on the cost of the input bundle and the efficiency of production of the intermediate good, but also on the trade cost \(k_{ni}^j\). Producers buy the goods from the supplier with the lowest cost in the economy. Thus, the price of intermediate goods of sector j in country n is \(p_n^j(x^j)=\min _i\left[ \frac{B^jc_i^j}{[x_i^j]^{{-\theta }^{j}}k_{ni}^j}\right]\). Then, the gravity equation indicating the trade flow and expenditure share of country n on goods from country i can be identified.

3.5 Counterfactual equilibrium

In the context of sectoral input-output linkages, equilibrium wages and prices are such that they maximize consumer utility and firm profits for each sector in each country. In addition, the goods and labor market clearing conditions must be met. Empirically, it is challenging to estimate total productivity \(\lambda _i^j\) and iceberg costs \(d_{ni}^j\) for each sector and country. To avoid estimating these exogenous parameters and still be able to solve for equilibrium, the model relies on the method of relative changes by Dekle et al. (2008). Let x be a variable of the initial baseline and \(x'\) be a variable of the counterfactual baseline. The relative change is then defined as \({x}\equiv {x}'/x\). Equilibrium is found for the change in relative wages and prices by shifting the tariff structure from \(\tau\) to \(\tau '\).

Definition

Let \((w,P,\pi ,c,X)\) be an equilibrium under tariff structure \(\tau\) and let \((w',P',\pi ',c',X')\) be an equilibrium under tariff structure \({\hat{\tau }}\). Then, define \(({\hat{w}},{\hat{P}},{\hat{\pi }},{\hat{c}},{\hat{X}})\) as an equilibrium under \(\tau '\) relative to \(\tau\). The general equilibrium equations are solved for an equilibrium in relative changes:

Cost change of the input bundle:

Change in the price index of materials:

Change of bilateral trade shares:

Expenditure \(X_{n}^{j'}\) in each sector j and country n:

Trade balance:

Let the income under the new trade policy be

\(I'_n=\left[ {\hat{w}}_nw_n L_n+\sum _{j=1}^JX_n^{j'}\left[ 1-F_n^{j'}\right] -S_n\right]\), where \(\hat{w_n}=\frac{w'_n}{w_n}\), \(F_n^{j'}=\sum _{i=1}^N\frac{\pi _{ni}^{j'}}{\left( 1+\tau _{ni}^{j'}\right) }\) and \(S_n\) is the trade surplus. Note that for the general equilibrium in relative changes, the trade cost equation \({\hat{k}}_{ni}^j\) becomes:

where \(D_{ni}\) and \(R_{ni}\) cancel out.

3.6 Solving the model

Given these counterfactual equilibrium conditions, the system of equations can be solved by an algorithm. The algorithm reduces the system of equations to one equation per country, with the countries’ wages as the only unknown parameter. The correct vector of wage changes is \({\hat{w}}=({\hat{w}}_1,\ldots ,{\hat{w}}_n)\) when the equilibrium equations are balanced. For a detailed description, I refer to the Appendix B. Based on the solution of the equilibrium conditions, the approach delivers static level effects on the change in real income, which serves as a measure of welfare effects.

4 Data

In this section, I bring the data into the model and identify the parameters necessary to empirically solve the model for a change in trade policy. Hence, the tariff changes from \(\tau\) to \(\tau '\) and/or the non-tariff barrier changes from \(PTA_{deep}\) to \(PTA'_{deep}\). Due to the use of the general equilibrium in relative changes, I do not have to estimate the parameters \(\lambda _i^j\), \(D_{ni}\) and \(R_{ni}\) empirically.

4.1 Parameter identification

I use the WIOD released in 2016 as the main data source. To conduct the counterfactual analysis I take the World Input–Output Table of the year 2014 as it is the most recent year available in the WIOD. It covers 43 countries as well as an aggregate for the Rest of the World (ROW) and includes 56 sectors which are classified according to the ISIC Rev. 4. This dataset is useful as it covers around 90% of the global GDP. To avoid calculation difficulties, I apply the approach of Felbermayr et al. (2017a) and summarize the sectors with zero outputs. This is particularly the case for some service sectors. In addition, I use the approach of Costinot and Rodriguez-Clare (2014) to eliminate negative inventories. This is necessary because otherwise the final demand turns out to be negative when summing up over investments, changes in inventories, and the final consumption expenditure by households and government.Footnote 8

I obtain several parameters directly from the World Input–Output Table. I calculate the share of value added \(\beta _n^j\) by dividing the value added \(VA_n^j\) over the gross output for each sector j of country n and identify the input-output coefficient by adding all intermediate inputs of sector i from all countries into sector j and then dividing it by the total intermediate costs of sector j. Further, I obtain the trade flows for each sector j and country n from the WIOD, \(\theta ^j\) for the agriculture, mining and manufacture sectors I take from Felbermayr et al. (2017a).Footnote 9 Regarding the service sectors and non-tradable goods sectors Egger et al. (2012) estimate the trade cost elasticity to be 5.959. In this paper I apply those elasticity of demand for the service sectors.Footnote 10 Once the parameters above are identified I can calculate the share of the final demand good in sector jFootnote 11 and the bilateral trade shareFootnote 12.

4.2 Strategy to determine changes in trade costs

The change in trade cost \({\hat{k}}_{ni}^j\) depends on the tariffs \(\tau\) and the counterfactual tariffs \(\tau '\), as well as the dummy variables \(PTA_{deep}\), \(PTA'_{deep}\) and the parameter \(\delta _{deep}^j\).

I collect tariff data from UNCTAD Trade Analysis Information System (TRAINS) for 2014 and tariff data from World Integrated Trade Solution (WITS) for 2019 at the HS-based tariff line level (two-digit HS) and transform them to International Standard Industrial Classification Revision 4 (ISIC Rev. 4). Furthermore, to simulate the reduction of the NTMs, I use the dummy variables of the top-down method, borrowed from Aichele et al. (2014).Footnote 13 For the classification of \(PTA_{deep}\) they rely on the Design of Trade Agreements (DESTA) database of Dür et al. (2014). This database covers over 790 PTAs, which include different types of FTAs and customs unions for the time span between 1947 and 2010. The database ranks the PTAs according to their strength of NTM reductions. The index of the ranking ranges from 0 to 7.Footnote 14 Aichele et al. (2014) classify trade agreements that have an index between 0 and 4 as a shallow trade agreement. With values above 4 the trade agreements are considered as deep preferential trade agreements. The meaning of a \(PTA_{deep}\) dummy variable is that it captures the effect if the FTA goes beyond the average NTM reduction.Footnote 15 In addition, I adopt the parameters for \(\delta _{deep}^j\). Those parameters are based on the WIOD (Timmer et al. 2015) for the year 2011, which I transform to fit according to the sectors of the WIOD (Timmer et al. 2015) of the year 2014. After determining the parameters for \(\delta _{deep}^j\), I can estimate the trade costs \({\hat{k}}_{ni}^j\) for each scenario.

4.3 Baseline equilibria

My simulations are based on the 2014 World Input–Output Table, as this is the most recent country-and sector-level dataset available and is also used as a standard source for trade policy analysis with input-output linkages in recent papers such as Eppinger et al. (2021), Antràs and Chor (2021), and Grübler and Reiter (2021). For the counterfactual analysis, I run robustness checks for several other years using data from the WIOD and find similar counterfactual results with no changes in the pattern.

To account for trade policy developments since 2014 and to tie the analysis more closely to current discussions, I address trade policy changes by calibrating new baselines for 2019. In particular, I calibrate a baseline necessary for different simulations, namely for the situation of a bilateral FTA between the U.S. and Japan, a baseline for the established CPTPP, and for the CPTPP with the U.S. and one for the CPTPP with China. To simulate the new bilateral FTA baseline that I can use for the USJTA, USJDTA, and the deep FTA scenarios, I apply the 2014 WIOD data and the 2014 tariff schedule (TRAINS) as the old baseline. I calibrate the new baseline and its new trade flows by incorporating the 2019 tariff schedule (WITS) and changes in NTMs that have occurred since 2014. This is done through counterfactual simulations that consider the impact of recent major trade agreements, such as CPTPP (in effect since December 30, 2018) and the Japan-EU FTA (in effect since February 1, 2019). To calibrate the three CPTPP cases, I use the old 2014 baseline (WIOD and tariff data (TRAINS)) along with the 2019 tariff data (WITS). I also consider the changes in trade policy, such as the Japan-EU FTA, and simulate the new baseline, but leave the tariffs and NTMs for each CPTPP case at the 2014 level. In the case of the established CPTPP, tariffs and NTMs between member countries remain constant for the new baseline. In the case of a CPTPP with the U.S., bilateral tariffs and NTMs are additionally held constant. The same principle applies to the CPTPP and China’s accession. Therefore, I obtain three baseline scenarios for each CPTPP case. To simulate the impact of each CPTPP case, I apply the respective new baseline of 2019 and eliminate tariffs and lower NTMs according to each scenario.

5 Simulation results

In the following, I analyze the impact of different trade policy scenarios.Footnote 16 In the first scenario I dissect the trade and welfare effect of the “stage one” trade agreement. As the “stage two” trade agreement is pending, I focus in the second scenario on a potential deep FTA, where all tariffs are reduced to zero and the NTMs are profoundly scaled-down. This is the most likely scenario, as the Japan administration is eager to reduce the U.S. NTMs in order to have better market access. Lastly, I evaluate the welfare effects of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) at the current state (that is a deep regional trade agreement, with its 11 member countries). Interestingly, the U.S. as well as China are associated with joining CPTPP. Although the U.S. withdrew from the original TPP negotiations, the possibility of acceding still exists under the Biden administration. In addition, China official requested in September 2021 to join CPTPP. It is politically unlikely that both China and the U.S. become a member of the CPTPP at the same time, therefore I will examine the welfare effects of each joining unilaterally.

5.1 “Stage One” trade agreement

The “stage one” trade agreement consists of two smaller trade agreements, that is the US-Japan Trade Agreement (USJTA) and the US-Japan Digital Trade Agreement (USJDTA). It includes trade policy issues that Japan and the U.S. could mutually agree on. More sensitive subjects, such as tariffs on rice for Japan, were left out and are subject to the next stage trade agreement. The USJTA covers about 5% of bilateral trade and has its focus on the reduction of tariff lines in the agriculture and manufacturing sectors. Japan agreed to decrease it tariffs on over 600 agriculture products, whilst the U.S. decided to severely cut its tariffs on Japanese industrial goods such as machines, electrical tools and chemical products. In order to simulate the impact of the USJTA I eliminate the Japanese tariffs on U.S. goods in the agriculture sector (Crops & Animals A01) and cut the U.S. tariffs on Japanese industrial imports.Footnote 17

For Japan and the U.S. the US-Japan Digital Trade Agreement is meant to serve as a new gold standard on cross-country digital trade. It enforces bilateral rules and standards to enhance digital trade between both countries. In particular, it reduces digital trade barriers by prohibiting non-discriminatory treatment on digital services and ensures conditions of market access for cross-border data flows. As the digital trade agreement aims to enhance digital trade, those service industries that deal with digital finance, software development, e-commerce, e-publishing and telecommunication are mainly impacted. In my I analysis, I therefore reduce the NTMs for the following services sector: Publishing J58, Media Services J59–J60, Telecommunications J61, Computer & Information Services J62–J63, Legal and Accounting M69–M70, Business Services M71, M73–M75, Admin. & Support Services N.

Table 1 presents the results for the “stage one” trade agreement and dissects the impact of the USJTA and US-Japan Digital Trade Agreement on bilateral imports between the U.S. and Japan.Footnote 18 The bilateral imports take account of intermediate and final goods from all sectors, including the service sectors.

The results for the USJTA show that the U.S. imports from Japan increase by $5.3 billion, which can be traced back to the tariff reduction on Japanese industrial goods. Japan raises its U.S. imports by $2.9 billion, driven by agricultural products. The relative change in bilateral imports is for the U.S. (4.36%) and Japan (4.65%) roughly the same. As the US-Japan Digital Trade Agreement mainly targets service sectors its impact on bilateral imports is lower. For Japan the reduction of NTMs leads to an increase of $1.6 billion (which corresponds to an import increase of 2.45%), while the U.S. imports would grow by $0.96 billion (increase of 0.78%). Hence, the “stage one” trade agreement rises the bilateral imports for both countries. In total, the U.S. import are in absolute changes with $6.2 billion larger than those of Japan ($6.2 billion), while Japanese imports from the U.S. grow more strongly in relative changes (Tables 2, 3).

Concerning the welfare effects (in terms of change in real income) of the “stage one” trade agreement, I show in Table 4 that Japan (0.024%) would benefit more than the U.S. (0.01%). For both countries, the increase in real income is driven by the trade cost reduction through the USJTA. The digital trade agreement and the NTM reduction on digital services have only a small welfare impact for the U.S. and Japan. The effects of the “stage one” trade agreement might appear small compared to other FTAs. However, one should keep in mind that “stage one” includes only the two minor trade deals and the next stage of the trade agreement is expected to be a deeper one.

In Table 3 I display the sectoral bilateral import change for the “stage one” trade agreement, including USJTA and the US-Japan Digital Trade Agreement. On the sectoral level, I show that the “stage one” trade agreement increases the Japanese imports in the agriculture sector by 48%, induced by the agriculture tariff reduction through the USTJA. Further, my findings indicate a rise in imports for those U.S. sectors which experience a decrease in tariffs through the USJTA. The largest increase is in the Land Transport (23.9%), Chemical (13.9%), Fabricated Metal (13.2%) and Electronic (11.8%) sector. The large rise in the Land Transport sector can be traced back to a small amount of imports in the baseline scenario and a modest change in absolute numbers, which however translates into a larger change in relative import change. The impact of the Digital Trade Agreement is relatively strong for the directly affected service sectors. As for the case of the Land Transport sector, this is due to a small import amounts in the baseline scenario and a stronger increase through the reduction of the NTMs.

5.2 Deep FTA

Next, I examine the impact of a potential deep FTA between the U.S. and Japan. Starting from the baseline, I eliminate the bilateral tariffs for all sectors between the U.S. and Japan and reduce the NTMs as in other deep FTAs (see Sect. 4.2).

Figures 6 and 7 display the impact of the bilateral tariff elimination on the reduction of trade cost. On the Japanese side the largest trade cost reduction occurs in the Textile, Food and Agriculture sector as well as in the Fabricated Metal sector. The reduction of Japanese tariffs has a larger trade cost effect, as the Japanese tariffs on U.S. goods are on average lager than the U.S. tariffs on Japanese products (JPN: 4.27 vs. U.S.: 3.47). However, the U.S. is charging tariffs on more products from Japan than vice versa. On the U.S. side the tariff elimination for Japanese goods leads to a trade cost reduction in the Agriculture, Forestry, Textile sector as well as for Electronics and Optical products.

In Fig. 8 I show the sectoral trade cost reduction through NTMs which applies for both countries. By the use of the coefficient estimates the NTM trade cost reduction is calculated for each sector in the following way: \((e^{\delta ^j}-1)*100\). My findings indicate that compared to the tariff trade cost reduction, the NTMs have on average a larger impact on the reduction of trade costs (−8.03). The largest trade cost reductions occur in the sector of Motor Vehicles (−21.7%), Fabricated Metal (−18.4%), Textiles, Apparel, Leather (−17.8%), Other Transport Equipment (−16.2%).

Source: Aichele et al. (2014); Author’s own calculations

Trade cost reduction through NTMs.

The different reduction of tariffs and NTMs inevitably leads to varying effects of the FTA for different sectors. Some sectors benefit from the FTA, while other sectors even lose through the trade agreement. In Fig. 9 we see the top 10 export sectors and the last 10 sectors, which benefit and loses the most in terms of exports for the U.S. and Japan. In general, the effects for the top 10 sectors are stronger than those of the top 10 exporters for the U.S.. This indicates that the trade agreement impacts Japan more strongly. The strongest profiteer is with an export increase of 1.9% the Motor Vehicle sector. This can be traced back to the large NTM trade cost reduction (−22%) by the FTA. Other sectors benefit from the NTM reduction as well, namley the Other Transport Equipment, Fabricated Metal and Electronics & Optical Products. Sectors which have the highest decrease in exports are the Wholesale Trade, Basic Metals and Machinery & Equipment sector. On the U.S. side the top exporters are the Food, Beverages & Tabacco, Crops & Animals, Other Transport Equipment sectors. While the Machinery & Equipment, Wholesale Trade and Insurance sector do benefit the least from the deep FTA.

In Table 4 I show the importance of value added and the level of interrelations between sectors on welfare. The data indicate a share of added value for the U.S. of \(\beta =0.51\) and for Japan of \(\beta =0.47\) (average across sectors), which leads to a welfare growth through the deep FTA of 0.14% for the U.S. and 0.30% for Japan. In the counterfactual case with no interrelations between sectors and all inputs come from the same sector (\(\beta =1\)) the welfare increase would be lower for both countries (U.S.: 0.083%, Japan: 0.17%).Footnote 19

In Table 5 I show the impact of a deep FTA for the reduction of tariffs and various levels of NTMs. In the case that only tariffs are eliminated through the trade agreement the welfare increases for Japan by 0.036% and for the U.S. by 0.011%, furthermore Japan sees an GDP increase of 0.1% and the U.S. by 0.017%. If, in addition to the elimination of tariffs, NTMs are reduced bilaterally (in all sectors) by 1%, welfare and GDP growth for both countries are even higher than in the tariff case. The results in the table also indicate that welfare and GDP increase when NTMs are reduced. A deep FTA lowers NTMs by 8% on average across all sectors; if NTMs are reduced by 8% across all sectors, welfare increases by 0.21% in Japan and 0.084% in the U.S.. For the case where the reduction in NTMs exceeds the deep FTA (10%), my results show a welfare increase of 0.263% (Japan) and 0.11% (U.S.). Comparing the results of the case in Table 5, in which tariffs are eliminated and NTMs are reduced symmetrically by 8% in all sectors, with the results in Table 4, in which NTMs are also reduced by 8% on average (some sectors reduce NTMs more than others), the welfare gain in Table 4 is higher (JPN: 0.3%, U.S.: 0.14%). This finding suggests that the size of the sectoral NTM reduction matters for the welfare effect.

To examine the sectoral welfare effects of a deep FTA, I show in Fig. 10 the sectoral contribution to welfare that eliminating bilateral tariffs and reducing NTMs would make to the U.S. and Japan. In the case of Japan, my results show that the largest contribution to Japanese welfare growth comes from the Motor Vehicles (0.044%), Other Transport Equipment (0.039%) and Electronic & Optical Products (0.033%) sectors. The Food, Beverage & Tobacco (0.020%) and Chemicals (0.014%) sectors make a small contribution. Tariffs contribute only marginally to welfare growth. In the case of a bilateral tariff reduction, the following sectors contribute most: Food, Beverage & Tobacco (0.008%), Electronic & Optical Products (0.0063%), and Chemicals (0.0058%). The bilateral tariff elimination and the reduction in NTMs in the Crops & Animals sector contribute almost equally to the welfare gain.

In Fig. 11, I show for the U.S. that tariffs have a small impact on welfare; compared to Japan, they are not as spread out across sectors and the impact on welfare is not as high. The Motor Vehicles sector (0.021%) as well as Other Transport Equipment (0.018%) Electronics & Optical Products (0.014%) sector contribute the most the welfare gains. The U.S. Food, Beverages & Tabacco sector does not play such an important role for welfare as it does for Japan. Bilateral NTM reductions in the Crops & Animals sector have little impact on U.S. welfare growth. The bilateral elimination of tariffs results in a higher welfare gain than as the NTMs reduction. This is the only case when looking at the welfare effects for the U.S. and Japan.

5.3 Various CPTPP scenarios

In this section, I present the counterfactual simulation results for different CPTPP scenarios that are likely to occur, namely the CPTPP as originally signed in 2018, a CPTPP with the U.S., and a CPTPP with China.

Looking first at the welfare effects of the original CPTPP in Table 6, my results show that Australia (0.5%), Canada (0.44%), and Mexico (0.44%) benefit the most from the regional trade agreement. The welfare gain for Japan is 0.18%, which is lower than under a deep FTA (0.3%). The U.S. is slightly positively affected (0.01%), while China experiences no change in welfare. In the event that the U.S. changes its position and decides to join the CPTPP, U.S. welfare increases by 0.69%, which is higher than a bilateral comprehensive FTA (0.14%). With a welfare increase of 0.44%, Japan benefits more than with a deep FTA. Other CPTPP members would also have a greater benefit from the U.S. accession to CPTPP. Not surprisingly, Canada (3.05%) and Mexico (3.39%), as major trading partners, would profit the most from the extended trade agreement, while China’s welfare would decline slightly by −0.01%. The scenario of China joining the CPTPP is politically more likely, as China has already officially requested to join the CTPP. China’s welfare would increase by 0.51%, and Japan as a neighboring country would benefit strongly with 1.1%. However, Australia would gain even more with 1.46%. The U.S. would profit slightly with a welfare increase of 0.02%.

In Table 7 the normalized Herfindahl index (HHI) reveals that Japan’s export sectors are three times more specialized than those of the U.S., when comparing the HHI between Japan (0.0757) and U.S. (0.025) in the baseline case. As the HHI shows, implementing a CPTPP with the U.S. has some specialization effects for Japan and has even larger effects in the case of the China-CPTPP. For the U.S. the HHI demonstrates a small diversion of the export shares in the case of the established CPTPP as well as when the U.S. is joining. No changes occur through an CPTPP with China.

Table 8 displays the results of CPTPP’s with the U.S. trade effects in relative changes. The findings clearly indicate a strong increase in exports for all CPTPP countries. Japan exports goods to the U.S. with the value of $169 billion in total. Compared to the status quo this is an increase of 38.3%, which is however smaller as through the deep FTA (46%). The U.S. export, $97.5 billion to Japan - an export increase of 53.6%. This is slightly less when contrasted with the impact of the deep FTA (60%). Canada, Mexico and the U.S. already have strong trade relationships with a large amount of exports. This is the case because they are geographically close to each other and well-connected through USMCA. Additionally, those three countries could intensify their trade through CPTPP. Hereby, the high export growth rate between Canada and Mexico (70.2%) stands out. The reason for this is that the export from Canada to Mexico has been the lowest between the USMCA members and therefore CPTPP’s trade cost reduction leads to a relatively strong export enhancing effect. In addition, Australia’s exports to Canada (70.5%) and to Japan (73.6%)Footnote 20 are strongly growing, and the exports to Mexico (75.6%) increase even more. The low exports between Australia and Mexico before CPTPP are the reasons for this strong export growth. Within all CPTPP countries the exports from Australia to Mexico are the smallest ($0.5 billion) and grow through the regional trade agreement by $0.85 billion, which leads to the high export growth in relative changes. Moreover, the increase in Mexican exports to Japan and Chile is one of the highest among CPTPP members.

For the remaining countries in the sample, Fig. 12 compares the welfare effects of the established CPTPP, CPTPP with the U.S., and a CPTPP with China. The graph shows that the impact of the original CPTPP (blue line) on welfare is the smallest compared to the other two scenarios. The welfare growth is relatively low for all countries and declines for countries such as Korea (−0.013%), Taiwan (−0.01%) and the aggregate of the Rest of the World (−0.06%). The welfare effect of a CPTPP with U.S. accession leads to welfare increases in countries such as Cyprus (0.03%), Malta (0.02%), Norway (0.02%) and the United Kingdom (0.02%). Countries that lose the most in this scenario are Korea (−0.08%), Taiwan (−0.06%), Germany (−0.03%), Hungary (−0.03%) and Ireland (−0.03%). In the case of China joining the CPTPP, Luxembourg (0.05%), the Netherlands (0.03%) and the Rest of the World aggregate (0.03%) benefit the most, while China’s neighbors, Taiwan (−0.1%) and Korea (−0.06%), lose out due to trade divergence.

6 Conclusion

I use the framework of Caliendo and Parro (2015) and the empirical ex-ante approach of Aichele et al. (2014) to examine the trade and welfare effects of a trade agreement between the U.S. and Japan. I employ the well-established WIOD (published in 2016) for my analysis. The data cover 50 sectors and 43 countries, plus the Rest of the World. I rely on the most recent input–output table from 2014. I add to the literature by calibrating new baselines for 2019 that include current tariffs and the modifications in NTMs. The new baselines are necessary to take into account the trade policy changes since 2014 and thus contribute to the current trade policy discussions.

Although Japan and the U.S. together account for about 30% of world GDP, they are only linked by a “stage one” trade agreement, consisting of two small trade agreements. The USJTA covers trade between both countries in the agricultural and industrial sectors. The digital trade agreement targets the services sector to enable more and easier cross-border digital trade flows. A “stage two” trade agreement is under negotiation between the U.S. and Japan.

For the “stage one” trade agreement, this paper finds only modest trade and welfare effects, which is not surprising given that only a small fraction of trade is covered by the “stage one” trade agreement. However, a potential comprehensive trade agreement that eliminates all bilateral tariffs and sharply reduces NTMs increases welfare by 0.14% for the U.S. and 0.3% for Japan. I add to the ongoing debate by showing that both countries would benefit from the U.S. accession to the CPTPP. However, it is questionable whether the U.S. will actually join the CPTPP, as China also made a first attempt to accede to the CPTPP in September 2021 by submitting an official request to enter the CPTPP. Based on my results, I conclude that Japan would benefit even more if China joined the CPTPP, with a welfare increase of 1.1%.

Notes

World Bank (2021).

International Trade Administration (2021).

See Ottaviano (2014) and Costinot and Rodriguez-Clare (2014) for more details. Kehoe et al. (2017) compares the new quantitative trade models with standard applied general equilibrium (AGE) models (also known as computable general equilibrium (CGE) models) and find ambiguous effects on the performance of both types of models.

The other CPTPP countries not included in the input-output table are Brunei, New Zealand, Peru, Singapore, Vietnam and Malaysia.

Export shares are defined as U.S. exports to Japan relative to all U.S. exports; the same holds true for import shares.

This includes bilateral distance \(D_{ni}\) and \(R_{ni}\) as the vector containing other possible trade costs with respective parameters \(\rho ^j\) and \(\zeta ^j\), as well as \(PTA_{deep}\) with its parameter \(\delta _{deep}^j\).

The approach is also used in other papers as for example in Krebs and Pflüger (2015).

\(\theta ^j\) as a measure of the dispersion of productivity for each sector are used also in other papers, e.g. Felbermayr et al. (2017c).

The share of the final demand good in sector j is given by \(\alpha _n^j=({Y_n^j-S_n^j-\sum _k^J\gamma _n^{j,k}(1-\beta _n^j)Y_n^k})/{I_n}\).

Bilateral trade share can be obtained by \(\pi _{ni}^j=\nicefrac {Z_{ni}^j}/{(Y_n^j-S_n^j)}\). This is done first by calculating domestic sales \(Z_{nn}^j\) in each country, where \(Z_{nn}^j=Y_n^j-\sum _{i=1,i\ne {n}}^IZ_{in}^j\). Domestic sales are defined as the difference between gross production in country n and its total exports. Second, by calculating the surplus (net export) for each country n and each sector j, \(S_n^j=\sum _{i=1}^IZ_{in}^j-\sum _{i=1}^IZ_{ni}^j\).

I am aware that Aichele et al. (2014) use the Global Trade Analysis Project (GTAP) as a database for the estimations. Ideally, the parameters should be drawn from the same database. One might argue that the GTAP database would be a better choice, since it also includes the other CPTPP countries (Brunei, New Zealand, Peru, Singapore, Vietnam and Malaysia) which are not included in WIOD. Due to high access costs of the GTAP database I apply the WIOD as a well-established alternative in my analysis.

Dür et al. (2014) present seven key provisions after which the depth of PTAs is ranked: The provision captures the basic preferential trade agreement, services trade, investments, standards, public procurement, competition and intellectual property rights. If the trade agreement captures only one provision, it is ranked with 1, and so on.

According to Aichele et al. (2014) most trade agreements are shallow PTAs, as for example the ASEAN and MERCOSUR treaties, whereas only \(10\%\) of the PTAs are considered deep PTAs, e.g. the European Union.

To conduct the simulation I adopt and adjust the codes provided by Caliendo and Parro (2015).

The manufacturing sectors include the classified ISIC Rev. 4 sectors: Chemicals C20, Rubber & Plastics C22, Basic Metals C24, Fabricated Metal C25, Electronics & Optical Products C26, Electrical Equipment C27, Machinery & Equipment C28, C33 and Land Transport H49.

I conduct the results from the status quo, without a change in trade policies.

CPTPP boosts Australia’s exports to Japan from $47 billion to $83 billion.

References

Aichele, R., & Heiland, I. (2014). Where is the value added? China’s WTO entry, trade and value chains. Kiel und Hamburg: ZBW-Deutsche Zentralbibliothek für Wirtschaftswissenschaften, Leibniz-Informationszentrum Wirtschaft.

Aichele, R., Felbermayr, G. J., & Heiland, I. (2014). Going deep: The trade and welfare effects of TTIP. CESifo Working Paper Series (Vol. 5150).

Aichele, R., Felbermayr, G., & Heiland, I. (2016). Going deep: The trade and welfare effects of TTIP revised. Ifo-Working Paper 219.

Antràs, P., & Chor, D. (2021). Global Value Chains. Research National Bureau of Economic.

Baier, S. L., & Bergstrand, J. H. (2007). Do free trade agreements actually increase members’ international trade? Journal of international Economics, 71(1), 72–95.

Caliendo, L., & Parro, F. (2015). Estimates of the trade and welfare effects of NAFTA. The Review of Economic Studies, 82(1), 1–44.

Chowdhry, S. & Felbermayr, G. J. (2021). Trade liberalization along the firm size distribution: The case of the EU-South Korea FTA. CESifo Working Paper.

Civic Consulting and Ifo Institute (2018). Evaluation of the Implementation of the Free Trade Agreement between the EU and its Member States and the Republic of Korea. European Commission: Directorate-General for Trade.

Congressional Research Service (2020). U.S.-Japan Trade Agreement Negotiations. Retrieved from http://crsreports.congress.gov accessed 11.09.2021.

Cooper, W. H. (2014). Free trade agreements: Impact on US trade and implications for US trade policy. Current Politics and Economics of the United States, Canada and Mexico, 16(3), 425.

Costinot, A. & Rodriguez-Clare, A. (2014). Trade theory with numbers: Quantifying the consequences of globalization. In Gita Gopinath, Elhanan Helpman, and Kenneth Rogoff, eds., Handbook of International Economics (Vol. 4, chapter 4, pp. 197–261).

Dekle, R., Eaton, J., & Kortum, S. (2008). Global rebalancing with gravity: Measuring the burden of adjustment. IMF Economic Review, 55(3), 511–540.

Dür, A., Baccini, L., & Elsig, M. (2014). The design of international trade agreements: Introducing a new dataset. The Review of International Organizations, 9(3), 353–375.

Eaton, J., & Kortum, S. (2002). Technology, geography, and trade. Econometrica, 70(5), 1741–1779.

Egger, P., Larch, M., & Staub, K. E. (2012). Trade Preferences and Bilateral Trade in Goods and Services: A Structural Approach. CEPR Discussion Papers 9051, C.E.P.R. Discussion Papers.

Eppinger, P., Felbermayr, G. J., Krebs, O., & Kukharskyy, B. (2021). Decoupling Global Value Chains. CESifo Working Paper.

Felbermayr, G., Gröschl, J., & Heiland, I. (2017a). The European Union in Turmoil: A General Equilibrium Analysis of Trade and Welfare Effects. Technical report. Mimeo: ifo Institute.

Felbermayr, G., Gröschl, J. K., & Steininger, M. (2018). Quantifying Brexit: From ex post to ex ante using structural gravity. Technical report, CESifo Working Paper.

Felbermayr, G., Steininger, M., & Yalcin, E., et al. (2017c). Global Impact of a Protectionist US Trade Policy. ifo Forschungsberichte.

Felbermayr, G., Kimura, F., Okubo, T., & Steininger, M. (2019). Quantifying the EU-Japan economic partnership agreement. Journal of the Japanese and International Economies, 51, 110–128.

Felbermayr, G., Kimura, F., Okubo, T., Steininger, M., Yalcin, E., et al. (2017b). On the economics of an EU-Japan free trade agreement. Wirtschaftsforsch: Ifo-Inst. f.

Grübler, J., & Reiter, O. (2021). Non-tariff trade policy in the context of deep trade integration: An ex-post gravity model application to the EU-South Korea agreement. East Asian Economic Review, 25(1), 33–71.

International Trade Administration. (2021). Free Trade Agreements. Retrieved from https://www.trade.gov/fta Accessed 02 Oct 2021.

Jung, B., & Walter, T. (2018). Handels-und Wohlfahrtseffekte einer Nulllösung: Wegfall der EU- und US-Importzölle im Automobilsektor. ifo Schnelldienst, 71(15), 26–29.

Kehoe, T. J., Pujolas, P. S., & Rossbach, J. (2017). Quantitative trade models: Developments and challenges. Annual Review of Economics, 9, 295–325.

Krebs, O., & Pflüger, M. (2015). How deep Is your love? (p. 9021). IZA-Discussion Paper: A Quantitative Spatial Analysis of the Transatlantic Trade Partnership.

Le, T. A. T. (2021). The impact of tariffs on Vietnam’s trade in the comprehensive and progressive agreement for trans-Pacific partnership (CPTPP). The Journal of Asian Finance, Economics and Business, 8(3), 771–780.

Li, C., & Li, D. (2021). When regional comprehensive economic partnership agreement (RCEP) meets comprehensive and progressive trans-Pacific partnership agreement (CPTPP): Considering the “Spaghetti Bowl” effect. Emerging Markets Finance and Trade, 1–16.

Li, C., & Whalley, J. (2021). Effects of the comprehensive and progressive agreement for trans-pacific partnership. The World Economy, 44(5), 1312–1337.

Ottaviano, G. I. (2014). European Integration and the Gains from Trade. Chapter prepared for the Handbook of the Economics of European Integration, edited by Harald Badinger and Volker Nitsch, Routledge.

Scissors, D. M. & Blumenthal, D. (2017). The Framework for a US-Japan Free Trade Agreement. Retrieved from https://project2049.net Accessed 17.05.2018.

Tariff, U. N. C. T. A. D. (2018). Tariff Data in Trade Analysis Information System (TRAINS). Retrieved from http://databank.worldbank.org Accessed 18.05.2018

Timmer, M. P., Dietzenbacher, E., Los, B., Stehrer, R., & Vries, G. J. (2015). An illustrated user guide to the World Input–Output database: The case of global automotive production. Review of International Economics, 23(3), 575–605.

UNCTAD NTB. (2018). NTM Data in Trade Analysis Information System (TRAINS). Retrieved from http://unctad.org. Accessed 18 May 2018.

WITS. (2019). Tariff Data in World Integrated Trade Solution (WITS). Retrieved from http://wits.worldbank.org Accessed 18 Sept 2021.

World Bank. (2021). Exports of Goods and Services. Retrieved from https://data.worldbank.org Accessed 17 Sept 2021.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I would like to thank Benjamin Jung, Wilhelm Kohler, Konstantin Wacker, Henning Mühlen, Jonas Frank, Sophie Therese Schneider, the workshop participants at the European Trade Study Group (ETSG) in Warszawa, the Midwest International Economics Group at the Vanderbilt University in Nashville, Göttingen University and Hohenheim University for valuable comments and suggestions.

Appendices

Appendix

Solving the system of equations

Given those counterfactual equilibrium conditions, the system of equations can be solved through an algorithm, which reduces the system of equations to one equation per country with the wage as the only unknown parameter. The first step is to calculate the trade cost change \({\hat{k}}_n^j\), given the trade policies of \(\tau\) and \(\tau '\). To solve the algorithm, it is assumed that \(\pi _{in}^j\), \(\gamma _n^{j,k}\), \(\beta _n^j\), \(\alpha _n^j\) as well as the parameter of productivity \(\theta ^j\) are given for each sector. The next step is to guess a vector of wage changes \({\hat{w}}=({\hat{w}}_1,\ldots ,{\hat{w}}_n)\). Together with \({\hat{k}}_n^j\), \(\pi _{in}^j\), \(\gamma _n^{j,k}\), \(\beta _n^j\), \(\delta ^j\) the wage vector \({\hat{w}}\) is used to solve for equilibrium input costs \({\hat{c}}_n^j({\hat{w}})\) and prices \({\hat{P}}_n^j({\hat{w}})\) in each sector and country. After that, the bilateral trade shares under the new trade policy \(\pi _{ni}^{j'}({\hat{w}})\) are calculated; using \({\hat{c}}_i^j({\hat{w}})\), \({\hat{P}}_n^j({\hat{w}})\) and \({\hat{k}}_{in}^j\) and \(\theta ^j\) via \({\hat{\pi }}_{ni}^j\). Given \(\pi _{ni}^{j'}({\hat{w}})\) and \(\tau '\), the value of weighted tariffs \(F_{n}^{j'}\) can be identified. After that solve for the total expenditure of each sector j of country n under the new trade policy, which is \(X_n^{j'}({\hat{w}})\). This is done by inserting \(\alpha _n^j\), \(\beta _n^j\), \(\gamma _n^{j,k}\), \(\tau '\) , \(F_{n}^{j'}\) and \(\pi _{in}^{j'}({\hat{w}})\) into Eq. (8) and converting it into \(X_n^{j'}({\hat{w}})\), which is consistent with the wage vector. This is then inserted together with \(\pi _{in}^{j'}({\hat{w}})\), \(S_n\), \(\tau '\) into Eq. (8), which leads to the trade balance conditions of \(\sum _{j=1}^J\sum _{i=1}^N\frac{\pi _{ni}^{j'}({\hat{w}})}{\left( 1+\tau _{ni}^{j'}\right) }X_n^{j'}({\hat{w}})+S_n=\sum _{j=1}^J\sum _{i=1}^N\frac{\pi _{in}^{j'}\left( {\hat{w}}\right) }{\left( 1+\tau _{in}^{j'}\right) }X_i^{j'}({\hat{w}})\). Through this mechanism the system of equations is reduced to one equation per country, containing the countries’ wages as the only unknown parameter. The last step is to identify the correct vector of wage changes \({\hat{w}}=({\hat{w}}_1,\ldots ,{\hat{w}}_n)\). The correct vector is found if the equilibrium equation is in balance. If the equations do not hold, the vector of wage changes has to be guessed again, and the process is repeated. The procedure continues, until the correct vector in wage changes \({\hat{w}}\) is found.

Empirics

See Appendix See Tables

, 10

, 11

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Walter, T. Trade and welfare effects of a potential free trade agreement between Japan and the United States. Rev World Econ 158, 1199–1230 (2022). https://doi.org/10.1007/s10290-022-00459-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-022-00459-0

Keywords

- New quantitative trade model

- Trade policy

- Free trade agreement

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)