Abstract

The sovereign debt literature suggests the possibility that a self-fulfilling default crisis might be avoided if markets believe the central bank will act as lender of last resort. This paper investigates the extent to which changes in belief about an intervention of the European Central Bank (ECB) explain the sudden reduction of government bond spreads for the distressed countries in summer 2012. The authors study Twitter data and extract belief using machine learning techniques. They find evidence of strong increases in the perceived likelihood of ECB intervention and show that those increases explain subsequent decreases in the bond spreads of the distressed countries.

Similar content being viewed by others

Change history

28 December 2021

A Correction to this paper has been published: https://doi.org/10.1007/s10290-021-00447-w

Notes

See ECB, (2012a).

The OMT program was officially announced after the meeting of the ECB Governing Council on September 6th 2012. However, the ECB communication had already changed in the previous two months, so that the literature includes earlier speeches as part of the OMT announcement (Falagiarda & Reitz, 2015; Altavilla et al., 2016; Ambler et al., 2017; Van Der Heijden et al., 2018; Krishnamurthy et al., 2017).

In fact, there were two other ECB programs involving purchases of government bonds on secondary markets, the Securities Market Programme (SMP) in 2010, which was replaced by the OMT program, and the expanded Asset Purchase Programme (APP) in 2015. Both programs are quite different to the OMT. According to the ECB, both SMP and APP target both public and private securities with the objective of ensuring the monetary policy transmission and price stability. In contrast, the OMT program is specifically designed to reduce yields of distressed countries. Furthermore, the SMP is different because it featured de-facto limits on the purchased amounts of debt and the ECB had seniority on the bonds it purchased (Bruegel, 2012). The APP is a quantitative easing program in which government bonds are purchased but not specifically targeting a specific country, and not allowing for an unlimited amount.

However, none of the results in the main text depend on this assumption and an earlier working paper contains those results. This version is available upon request.

Our perspective is that a retweet represents a potential change in belief because when users retweet, they repeat and spread a tweet under their own user names to their networks. We take this to be a tacit endorsement of or agreement with the content of the tweet, in line with Metaxas (2017).

For this exposition, we remove links/hashtags from the tweets to ease readability.

Stemming or lemmatizing the text do not improve the results. Therefore, we decide to continue our analysis without applying these methods. Stemming is a process that allows to reduce words to their word stems while lemmatization is a process that groups different inflected forms of a word to one single unit.

There is a trade-off between allowing for higher n-grams—that is allowing for more combinations of tokens to capture more meaning—and overfitting since one then allows for many features specific to a single tweet. This trade-off is solved by cross-validating the model on a hold-out set to determine which n-gram model performs best, as explained below.

We also tried other kinds of machine learning classifiers such as Logistic Regression, Random Forest, Naive Bayes, k-Nearest Neighbors. However, their performances in terms of predictive accuracy, recall and precision, were worse than what was obtained by the SVM classifier.

See Fig. 4 in the appendix for an illustration of the procedure.

The output of the principal component analysis is shown in Table 13 in the Appendix.

In the following sections, we will argue that there is a strong connection between our belief index and the spreads. We would like to maintain at this point that both measures are distinct. Above all, bond spreads are a country-specific measure of default expectations, capturing both fundamental factors as well as sentiment-driven factors. Our belief index is generated solely using tweets expressing an opinion about the ECB’s willingness to intervene, without taking into account default probabilities or country-specific factors. Of course, as the later sections will show, the expectation about the ECB’s behavior is a core factor for spread movements during this time period, but our belief index is, by construction, a different measure than a country’s individual default probability.

We acknowledge that the lag in the belief index cannot completely eliminate any reverse causality concerns in the presence of serial correlation in the time series, in part because it is inherent to the nature of spreads.

In Table 14 in the Appendix, we also run a regression with government bond yields instead of government bond spreads as the dependent variable. In order to make the results comparable to the spreads expressed in basis points, we consider the change in yields multiplied by 100. The data now also include the yields for Germany, which were used to construct the spreads, so that there are more observations. The results using the yields are very similar to the results using spreads, demonstrating that there was a decrease in yields of crisis countries, rather than an increase of German yields as a reversal of a flight to safety mechanism.

In related, unreported results, we obtain a coefficient of similar size and significance when we exclude all event days from the regressions (instead of explicitly controlling for those days).

References

Altavilla, C., Giannone, D., & Lenza, M. (2016). The financial and macroeconomic effects of the OMT announcements. International Journal of Central Banking, 12(3), 29–57.

Ambler, S., & Rumler, F. (2017). The effectiveness of unconventional monetary policy announcements in the euro area: An event and econometric study. (Oesterreichische Nationalbank Working Paper 212).

Azar, P. D., & Lo, A. W. (2016). The wisdom of Twitter crowds: Predicting stock market reactions to FOMC meetings via Twitter feeds. Journal of Portfolio Management, 42(5), 123.

Bocola, L., & Dovis, A. (2019). Self-fulfilling debt crises: A quantitative analysis. American Economic Review, 109(12), 4343–77.

Bollen, J., Mao, H., & Zeng, X. (2011). Twitter mood predicts the stock market. Journal of Computational Science, 2(1), 1–8.

Bruegel. (2012). The SMP is dead. long live the OMT. Reterived August 13, 2018 from http://bruegel.org/2012/09/the-smp-is-dead-long-live-the-omt/.

Bulligan, G. & Monache, D. D. (2018). Financial markets effects of ECB unconventional monetary policy announcements (Vol. 424). (Bank of Italy Occasional Paper).

Calvo, G. A. (1988). Servicing the public debt: The role of expectations. The American Economic Review, 647–661.

Christensen, J. H., & Krogstrup, S. (2018). Transmission of quantitative easing: The role of central bank reserves. The Economic Journal, 129(617), 249–272.

Cole, H. L., & Kehoe, T. J. (1996). A self-fulfilling model of Mexico’s 1994–1995 debt crisis. Journal of international Economics, 41(3–4), 309–330.

Cole, H. L., & Kehoe, T. J. (2000). Self-fulfilling debt crises. The Review of Economic Studies, 67(1), 91–116.

Corsetti, G. (2015). The mystery of the printing press. Schumpeter Lecture at the EEA.

Corsetti, G., & Dedola, L. (2016). The mystery of the printing press: Monetary policy and self-fulfilling debt crises. Journal of the European Economic Association, 14(6), 1329–1371.

D’Amico, S. (2016). Discussion of "the financial and macroeconomic effects of the OMT announcements". International Journal of Central Banking, 12(3), 59–68.

De Grauwe, P., & Ji, Y. (2012). Mispricing of sovereign risk and macroeconomic stability in the eurozone. Journal of Common Market Studies, 50(6), 866–880.

Di Cesare, A., Grande, G., Manna, M., & Taboga, M. (2013). Recent estimates of sovereign risk premia for euro-area countries. (Bank of Italy Occasional Paper No. 128).

ECB (2012a). Introductory statement to the press conference (with Q&A). Retrieved March 19, 2018 from https://www.ecb.europa.eu/press/pressconf/2012/html/is120906.en.html.

ECB (2012b). Introductory statement to the press conference (with Q&A). Retrieved March 19, 2018 from https://www.ecb.europa.eu/press/pressconf/2012/html/is120802.en.html.

ECB (2012c). Introductory statement to the press conference (with Q&A). Retrieved March 19, 2018 from https://www.ecb.europa.eu/press/pressconf/2012/html/is120802.en.html.

El País (2012). Draghi says ECB buying short-term bonds does not breach eu treaty. Retrieved August 14, 2018 from https://elpais.com/elpais/2012/09/03/inenglish/1346696018_263197.html.

Falagiarda, M., & Reitz, S. (2015). Announcements of ECB unconventional programs: Implications for the sovereign spreads of stressed euro area countries. Journal of International Money and Finance, 53, 276–295.

Fendel, R., & Neugebauer, F. (2019). Country-specific euro area government bond yield reactions to ECB’s non-standard monetary policy program announcements. German Economic Review

Gholampour, V. (2019). Daily expectations of returns index. Journal of Empirical Finance, 54, 236–252.

Gholampour, V., & Van Wincoop, E. (2017). What can we learn from euro-dollar tweets? NBER Working Paper No. 23293.

Hansen, S., & McMahon, M. (2016). Shocking language: Understanding the macroeconomic effects of central bank communication. Journal of International Economics, 99, 114–133.

Hansen, S., McMahon, M., & Prat, A. (2018). Transparency and deliberation within the FOMC: A computational linguistics approach. The Quarterly Journal of Economics, 133(2), 801–870.

Krishnamurthy, A., Nagel, S., & Vissing-Jorgensen, A. (2017). ECB policies involving government bond purchases: Impact and channels. Review of Finance, 22(1), 1–44.

Les Echos (2017). Il y a cinq ans, Draghi sauvait l’euro en une phrase. Retrived August 14, 2018 from https://www.lesechos.fr/amp/57/2104457.php.

Meinusch, A., & Tillmann, P. (2017). Quantitative easing and tapering uncertainty: Evidence from twitter. International Journal of Central Banking, 13(4), 227–258.

Metaxas, P. (2017). Retweets indicate agreement, endorsement, trust: A meta-analysis of published twitter research. Computer Science Department: Wellesley College.

Roch, F., & Uhlig, H. (2018). The dynamics of sovereign debt crises and bailouts. Journal of International Economics, 114(136), 1–13.

Scotti, C. (2016). Surprise and uncertainty indexes: Real-time aggregation of real-activity macro-surprises. Journal of Monetary Economics, 82, 1–19.

Szczerbowicz, U. (2015). The ECB unconventional monetary policies: Have they lowered market borrowing costs for banks and governments? International Journal of Central Banking, 11(4), 91–127.

Van Der Heijden, M., Beetsma, R., & Romp, W. (2018). `Whatever it takes’ and the role of Eurozone news. Applied Economics Letters, 25(16), 1166–1169.

Wang, Z., Hale, S., Adelani, D. I., Grabowicz, P., Hartman, T., Flöck, F., & Jurgens, D. (2019). Demographic inference and representative population estimates from multilingual social media data. In The world wide web conference (pp. 2056–2067).

Zhang, X., Fuehres, H., & Gloor, P. A. (2011). Predicting stock market indicators through Twitter “I hope it is not as bad as I fear.” Procedia-Social and Behavioral Sciences, 26, 55–62.

Acknowledgements

We would like to thank, without implicating, Marcel Aloy, Jess Benhabib, Hamza Bennani, Hagop Boghazdeklian, Renaud Bourlès, Sebastian Dörr, Frédéric Dufourt, Gilles Dufrénot, Michael Ehrmann, Mathias Hoffmann, Martin Mandler, Egor Maslov, Elias Moor, Charles Lai Tong, Sebastien Laurent, Ralph Ossa, Céline Poilly, Frank-Alexander Raabe, Morgan Raux, Lorenzo Rotunno, Grigorios Spanos, Peter Tillmann, Alain Venditti, Tobias Wekhof and two anonymous referees for useful comments and suggestions. This paper also benefited from seminar participants at the 3rd ICFBP EMU, April 2018, University of Konstanz, May 2018, 14th CEUS Workshop WHU, May 2018, SoFiE Summer School in Brussels, June 2018, 20th Workshop for Young Economists ZEW, July 2018, 2nd CARMA conference València, July 2018, EDGE Jamboree Munich, September 2018, 43rd SAEe Madrid, December 2018, Young Swiss Economists Meeting Zurich, February 2020. This work was supported by the French National Research Agency Grant ANR-17-EURE-0020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The original online version of this article was revised: The legend of figure 2 has been corrected

Appendix

Appendix

See Fig. 4 and Tables 8, 9, 10, 11, 12, 13, 14, 15 and 16.

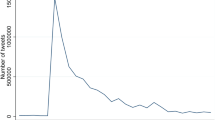

Double cross-validation procedure. This figure shows how our dataset is organized. The tweets in A are manually labeled while those in B will be predicted by a machine learning classifier. The last two layers describe our double cross-validation procedure. The set A is randomly split into a training set (90 percent) and a validation set (10 percent). To select our model (to “hypertune” the parameters of the SVM classifier), we proceed with a grid search using a 5-fold cross-validation. The accuracy of the selected model is then assessed on the validation set

About this article

Cite this article

Stiefel, M., Vivès, R. ‘Whatever it takes’ to change belief: evidence from Twitter. Rev World Econ 158, 715–747 (2022). https://doi.org/10.1007/s10290-021-00443-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-021-00443-0