Abstract

In a developing country, trade liberalization affects firms’ production choices through different channels: intensification of foreign competition, reductions of production factor costs, and enhanced access to foreign consumers and technology. Using firm-level data from India, we investigate how firms with different characteristics adjust their domestic sales and capital accumulation to output and input tariff changes. Our findings suggest that India’s trade liberalization has heterogeneous effects depending on firms’ export, import, ownership status and financial constraints. Firms serving only the domestic market have experienced a contraction of domestic sales and capital accumulation due to import competition. They were not able to benefit from the access to lower costs imported inputs and capital goods. Exporting and importing firms and foreign affiliates have expanded their sales and capital investments thanks to the reduction of imported inputs and capital goods costs and thereby, they have been able to face foreign competition. Our findings also suggest that credit constraints affect the relationship between trade liberalization and firms’ capital accumulation. These findings are in line with recent models of trade with heterogeneous firms.

Similar content being viewed by others

Notes

We complete the evidence on this with export shares.

Next section provides a more detailed discussion on the theoretical literature.

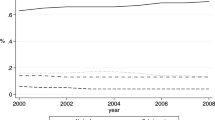

Section 3 describes the policy instruments applied by the Indian Government during this reform.

Using effectively applied most-favorite-nation (MFN) tariffs data and input-output matrices, we construct input and capital goods tariffs as described in Sect. 4.2.

This result contrasts with Pavcnik (2002)’s finding. The reason is that she assumes an increased schedule of trade liberalization over time. Bas and Ledezma (2010) compute specific trade-costs measures since tariffs where homogeneous and indeed rose (and did not declined) during most of the period under analysis in Pavcnik (2002).

Similar positive relationships between input tariffs and other firm-level performances have been observed. Goldberg et al. (2010) documents that input-tariff reductions in India are also associated with an expansion of the number of domestic products. Other studies also show that input-liberalization enhance export performance (Bas 2012).

Using plant level data from Mexico, Kandilov and Leblebicioglu (2012) find that final goods tariffs cuts reduce firms’ investments.

The objectives of the ‘Ninth Plan’ are explained in detail in the Web site from the Planning Commission of the Government of India: http://planningcommission.nic.in/.

During the first wave of trade liberalization (1989–1997), the number of firms in the Prowess dataset in the manufacturing sector raise from around 1100 in 1989 to 2500 in 1997, while during the second reform (1997–2006) the number of firms ranges from 2500 in 1997 to 2749 in 2006.

The CMIE is an independent economic center of India. For more information see: http://www.cmie.com/database.

This dataset has been already used in several studies on the productivity of Indian firms during the first wave of liberalization. See Topalova and Khandelwal (2011), Topalova (2004), Goldberg et al. (2010), Goldberg et al. (2009), Bas and Berthou (2012), Alfaro and Chari (2009) and DeLoecker et al. (2016).

We use correspondence tables to convert tariffs into ISIC rev 3.1. that match almost perfectly with NIC classification. This dataset is available at http://wits.worldbank.org/wits/.

Capital goods industries are tractors and agriculture machinery, industrial machinery, industrial machinery (others), office computing machines, other non-electrical machinery, electrical industrial machinery, communication equipments, other electrical machinery, electronic equipments, ships and boats, rail equipments, motor vehicles motor cycles and other transport equipments.

See Sect. 2 for a more detailed theoretical discussion.

The total effect of output tariff reductions for firms that export during the whole period is the sum of coefficient of output tariffs and the interaction term.

We thank an anonymous referee for suggesting investigating this channel.

We thank an anonymous referee for suggesting investigating this channel.

Unfortunately, the Prowess dataset does not report information on different skills.

References

Alfaro, L. & Chari, A. (2009). India transformed? Insights from the firm level 1988–2005 (NBER Working Papers 15448).

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Baldwin, J., & Gu, W. (2009). The impact of trade on plant scale, production-run length and diversification. In T. Dunne, J. B. Jensen, & M. J. Roberts (Eds.), Producer dynamics: New evidence from micro data. Chicago: University of Chicago Press.

Bas, M. (2012). Input-trade liberalization and firm export decisions: Evidence from Argentina. Journal of Development Economics, 97, 481–93.

Bas, M., & Berthou, A. (2012). The decision to import capital goods in India: Firms’ financial factors matter. World Bank Economic Review, 26(3), 486–513.

Bas, M., & Berthou, A. (2017). Does input-liberalization affect firms’ foreign technology choice? World Bank Economic Review, 31, 351–384.

Bas, M., & Ledezma, I. (2010). Trade integration and within-plant productivity evolution in Chile. The Review of World Economics, 1, 113–146.

Bas, M., & Ledezma, I. (2015). Trade liberalization and heterogeneous technology adoption. Review of International Economics, 23, 738–781.

Bas, M., & Strauss-Kahn, V. (2014). Does importing more inputs raise exports? Firm level evidence from france. Review of World Economics, 150(2), 241–275.

Berman, N., & Héricourt, J. (2010). Financial factors and the margins of trade: Evidence from cross-country firm-level data. Journal of Development Economics, 93(2), 206–217.

Bernard, A. B., Jensen, J. B., Redding, S., & Schott, P. (2018). Global firms. Journal of Economic Literature, 56(2), 389–405.

Bernard, A. B., Jensen, J. B., & Schott, P. K. (2009). Importers, exporters, and multinationals: A portrait of firms in the U.S. that trade goods. In T. Dunne, J. B. Jensen, M. J. Roberts (Eds.), Producer dynamics: New evidence from micro data. University of Chicago Press.

Bond, S., Elston, J., Mairesse, J., & Mulkay, B. (2003). Financial factors and investment in Belgium, France, German and the UK: A comparison using company panel data. Review of Economics and Statistics, 85, 153–165.

Bond, S., & Meghir, C. (1994). Dynamic investment models and the firm’s financial policy. Review of Economic Studies, 61(2), 197–222.

Bustos, P. (2011). Trade liberalization, exports and technology upgrading: Evidence on the impact of mercosur on argentinean firms. American Economic Review, 101, 304–340.

DeLoecker, J., Goldberg, P. K., Khandelwal, A. K., & Pavcnik, N. (2016). Prices, markups and trade reform. Econometrica, 84, 445–510.

DeLoecker, J., & Warzynski, F. (2012). Markups and firm-level export status. American Economic Review, 6, 2437–71.

Ethier, W. (1979). Internationally decreasing costs and world trade. Journal of International Economics, 9, 1–24.

Ethier, W. (1982). National and international returns to scale in the modern theory of international trade. The American Economic Review, 72, 389–405.

Fernandes, A. (2007). Trade policy, trade volumes and plant-level productivity in Colombian manufacturing industries. Journal of International Economics, 1, 52–71.

Goldberg, P., Khandelwal, A., Pavcnik, N., & Topalova, P. (2009). Trade liberalization and new imported inputs. American Economic Review Papers and Proceedings, 99(2), 494–500.

Goldberg, P. K., Khandelwal, A. K., Pavcnik, N., & Topalova, P. (2010). Imported intermediate inputs and domestic product growth: Evidence from India. The Quarterly Journal of Economics, 125(4), 1727–1767.

Greenaway, D., Guariglia, A., & Kneller, R. (2007). Financial factors and exporting decisions. Journal of International Economics, 73(2), 377–395.

Grossman, G., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge: MIT.

Kandilov, I., & Leblebicioglu, A. (2012). Trade liberalization and investment: Firm-level evidence from mexico. World Bank Economic Review, 2, 320–349.

Kugler, M., & Verhoogen, E. (2011). Prices, plant size, and product quality. The Review of Economic Studies, 79(1), 307–339.

Lapham, B., & Kasahara, H. (2013). Productivity and the decision to import and export: Theory and evidence. Journal of International Economics, 89, 297–316.

Manova, K. (2013). Credit constraints, heterogeneous firms, and international trade. The Review of Economic Studies, 80(2 (283)), 711–744.

Melitz, M. (2003). The impact of trade on intra-industry reallocations and agregate industry productivity. Econometrica, 71, 1695–1725.

Melitz, M., & Ottavianno, G. (2008). Market size, trade, and productivity. Review of Economic Studies, 75, 295–316.

Navas, A., & Sala, D. (2015). Innovation and trade policy coordination: The role of firm heterogeneity. The World Economy, 38(8), 1205–1224.

Pavcnik, N. (2002). Trade liberalization, exit and productivity improvement: Evidence from Chilean plants. Review of Economic Studies, 69, 245–276.

Rajan, R., & Zingales, L. (1998). Financial dependence and growth. American Economic Review, 3, 559–86.

Rivera-Batiz, L., & Romer, P. (1991). International trade with endogenous technological change. European Economic Review, 35(4), 971–1001.

Schor, (2004). Heterogeneous productivity response to tariff reduction: Evidence from brazilian manufacturing firms. Journal of Development Economics, 75, 373–396.

Secchi, A., Tamagni, F., & Tomasi, C. (2014). The micro patterns of export diversification under financial constraints. Industrial and Corporate Change, 25, 1595–1622.

Secchi, A., Tamagni, F., & Tomasi, C. (2015). Financial constraints and firm exports: Accounting for heterogeneity, self-selection and endogeneity. Industrial and Corporate Change, 25, 813–827.

Topalova, P. (2004). Overview of the Indian corporate sector: 1989–2002 (IMF Working Papers 04/64).

Topalova, P., & Khandelwal, A. (2011). Trade liberalization and firm productivity: The case of India. The Review of Economics and Statistics, 93, 995–1009.

Trefler, D. (2004). The long and short of the Canada-U.S. free trade agreement. American Economic Review, 4, 870–895.

Whited, T. M. (1992). Debt, liquidity constraints, and corporate investment: Evidence from panel data. Journal of Finance, 47(4), 1425–60.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We have benefited from discussions with Marius Brulhart, Mathieu Crozet, Swati Dhingra, Lionel Fontagne, Philippe Martin, Thierry Mayer, Cristina Terra and Thierry Verdier.

Appendix

Appendix

See Tables 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17.

About this article

Cite this article

Bas, M., Ledezma, I. Trade liberalization and heterogeneous firms’ adjustments: evidence from India. Rev World Econ 156, 407–441 (2020). https://doi.org/10.1007/s10290-019-00366-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-019-00366-x

Keywords

- Trade liberalization

- Firms’ domestic sales and capital accumulation

- Heterogeneous firms

- Firm-level data