Abstract

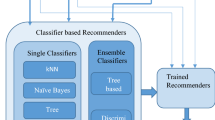

The goal of this report is to equip equity portfolio managers with a new tool to assist them in the crucial task of narrowing down a broad universe to a list of stocks to be analysed in depth. We explore a number of alternative approaches to building a recommender system, i.e. a predictive model which generates stock recommendations based on observable characteristics and previous investor behaviour. The empirical analysis uses data on a large set of global active mutual funds, observed between 2005 and 2016, to calibrate the models and test their predictive ability out of sample. Our main conclusion is that a simple dimension reduction technique achieves the best compromise between precision and recall. Moreover, our recommender system displays good predictive power, particularly when used to forecast future buy trades.

Similar content being viewed by others

Notes

Standard financial data platforms like Bloomberg and FactSet offer sophisticated screening tools for professional investors.

A useful survey of the literature can be found in Ekstrand et al. (2011).

Hau and Rey (2008) contains empirical evidence and a useful survey of the literature.

There are exceptions, e.g. Hsu et al. (2004) use as the dependent variable the number of items purchased.

To be precise, we focused on the largest 25 US mutual funds classified as GARP and identified potential buys as stocks for which buyers outnumber sellers by at least 3 in the period May–August 2016. We then selected ten names with equal probabilities. A similar approach is used to pick sells.

We repeated the exercise with 20 buys and 20 sells and found that 9 out of 10 recommended companies had reported a profit. However, the median fund in our sample reports 17 buys and 4 sells and therefore our illustration with 20 simulated trades seems more realistic.

References

Anderson A, Brockman P (2018) An examination of 13F filings. J Financ Res 41:295–324

de Campos LM, Fernandez-Luna JM, Huete JF, Rueda-Morales A (2010) Combining content-based and collaborative recommendations. Int J Approx Reason 51:785–799

Eichberger J, Grant S, King SP (1999) On relative performance contracts and fund manager’s incentives. Eur Econ Rev 43:135–161

Ekstrand MD, Riedl JT, Konstan JA (2011) Collaborative filtering recommender systems. Found Trends Hum Comput Interact 4:81–173

Ervolini MA (2014) Managing equity portfolios. MIT Press, Cambridge

Hau H, Rey H (2008) Home bias at the fund level. Am Econ Rev 98:333–338

Hotelling H (1936) Relations between two sets of variates. Biometrika 28:321–377

Hsu C-N, Chung H-H, Huang H-S (2004) Mining skewed and sparse transaction data for personalized shopping recommendation. Mach Learn 57:35–59

Ilmanen A (2011) Expected returns: an investor’s guide to harvesting market rewards. Wiley, Chichester

Lakonishok J, Shleifer A, Vishny RW (1992) The impact of institutional trading on stock prices. J Finance 32:23–43

Langseth H, Nielsen TD (2012) A latent model for collaborative filtering. Int J Approx Reason 53:447–466

Pesaran MH, Timmemann A (1992) A simple nonparametric test of predictive performance. J Bus Econ Stat 10:461–465

Pesaran MH, Timmemann A (1994) A generalisation of the nonparametric Henriksson-Merton test of market timing. Econ Lett 44:1–7

Resnick P, Varian HR (1997) Recommender systems. Commun Assoc Comput Mach 40:56–58

Shiller RJ, Pound J (1989) Survey evidence on diffusion of interest and information among investors. J Econ Behav Organ 10:47–66

Tversky A, Kahneman D (1973) Availability: a heuristic for judging frequency and probability. Cognit Psychol 5:207–232

Acknowledgements

We would like to thank participants at the Axioma Quant Forum 2016, the AI, Machine Learning and Sentiment Analysis Applied to Finance event 2017, the Risk.net Machine Learning Forum 2018, Andrew Lapthorne, Tony Guida and an anonymous referee for useful comments. All remaining errors are our own. The views expressed in this article reflect the views of the named authors. Nothing in this article should be considered as an investment recommendation or investment advice. This article is based on information obtained from sources believed to be reliable and no representation or warranty is made that it is accurate, complete or up to date. Macquarie accepts no liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this article.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

De Rossi, G., Kolodziej, J. & Brar, G. A recommender system for active stock selection. Comput Manag Sci 17, 517–547 (2020). https://doi.org/10.1007/s10287-018-0342-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-018-0342-9