Abstract

In this paper we propose to study the dynamics of financial contagion between the credit default swap (CDS) and the sovereign bond markets through effective transfer entropy, a model-free methodology which enables to overcome the required hypotheses of classical price discovery measures in the statistical and econometric literature, without being restricted to linear dynamics. By means of effective transfer entropy we correct for small sample biases which affect the traditional Shannon transfer entropy, as well as we are able to conduct inference on the estimated directional information flows. In our empirical application, we analyze the CDS and bond market data for eight countries of the European Union, and aim to discover which of the two assets is faster at incorporating the information on the credit risk of the underlying sovereign. Our results show a clear and statistically significant prominence of the bond market for pricing the sovereign credit risk, especially during the crisis period. During the post-crisis period, instead, a few countries behave dissimilarly from the others, in particular Spain and the Netherlands.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The rapid development of credit derivative products, in particular by the first decade of 2000, led to a remarkable financial innovation which could considerably improve the protection of market participants against the exposure to the credit risk of a specific entity. Among credit derivatives, credit default swap (CDS) has become one of the most widely traded instruments, especially in the aftermath of the collapse of the investment bank Lehman Brothers in September 2008. When the market pricing of government and company debt was significantly affected during the crisis outbreak, investors all over the world widely used the CDS market to hedge their credit exposures as well as to extend their investment opportunities. The CDS premium, which depends on the default probability of the underlying entity, played a growing role as an instrument through which information on credit risk is disclosed, potentially in competition with the bond market (Coudert and Gex 2013). Indeed, the CDS premium should be approximately equal to the spread of a bond over a risk-free rate on the same reference entity and of the same maturity, since both instruments price the credit risk associated with a specific underlying entity. As a consequence, an approximate arbitrage relation between the bond spread and the CDS premium exists, as clearly discussed by Duffie (1999).

These topics drew the attention of many statisticians and empirical researchers, who have widely investigated sovereign bond, credit default swaps and their related risks from a variety of viewpoint over the recent past (see, e.g. Reale and Wilson 2001; Bee 2005; Giudici and Parisi 2017, 2018; Hirk et al. 2019; Frattarolo et al. 2020; Adelfio et al. 2020; Bottone et al. 2020; Pagnottoni et al. 2021). A consistent branch of the literature investigated the relationship between the CDS and the bond market across governments, in order to examine which market is the most efficient in pricing the information of the sovereign credit risk, and especially to examine if the CDS market could be entitled as a leader in the price discovery process for sovereign entities as well. In particular, research has verified whether there has been any lead-lag relationship between the time series of CDS and bond yields of different countries at the same (or at a different) time. In other words, they analyze the time series in a pairwise way and conduct price discovery analysis at a country-level. However, results are found to be very mixed and ambiguous for sovereigns, as discussed by Augustin (2014). Different authors suggest that these discrepancies in the price discovery analysis may be related for example to the relative liquidity of both markets (see Ammer and Cai 2011) or to market frictions, such as counterparty risk and funding costs (see Arce et al. 2013) or to differences in how the bond spread is calculated (see Gyntelberg et al. 2013). As a consequence, no unique results have been found on the leadership between the two markets so far. Leadership is a well established term in the price discovery literature. Indeed, in such a literature researchers distinguish between price discover leaders and followers. The first ones are those who drive a financial instrument’s price discovery process, i.e. the “setters”, the second ones are those who, instead, follow the leader instruments and adjust prices consequently.

As a common point discussed by the extant literature, the arbitrage relation between the CDS premium and the bond spread is not perfect, and whether bond markets dominate CDS prices or the other way round is still an open question. Market imperfections, such as the cheapest-to-deliver (CTD) option, unavailability of instruments with exactly matching maturity dates, or liquidity premia can impair the relationship between the two markets in the long-run. Indeed, the existence of a long-run equilibrium relationship is not always proved and, when the lack of this assumption occurs, information measures based on Vector Error Correction Models (VECM) cannot be applied. This is usually circumvented by means of the Granger causality test based on a Vector Autoregressive Model (VAR), able to detect lead-lag relationship between the two markets when no evidence of cointegration is found—see, e.g. Palladini and Portes (2011), Corsi et al. (2018). However, as for the VECM, Granger causality requires restrictive assumptions for the linear dynamics of the model. Thus, the failure to provide the existence of a long-run equilibrium relationship between the two time series and the restrictive assumptions for the linear dynamics of the models require additional techniques to detect a possible interaction between the CDS and the bond market.

Our modelling strategy is related to the statistical and econometric literature on interconnectedness, systemic risk and spillover measurement. The information shares developed by Hasbrouck (1995) and the common factor components of Gonzalo and Granger (1995) have been widely employed in the empirical literature—see, for instance, Mizrach and Neely (2008), Pagnottoni and Dimpfl (2019), Grammig and Peter (2013). Additionally, the systemic risk and spillover framework proposed by Diebold and Yilmaz (2012), Diebold and Yılmaz (2014) has given rise to a variety of financial applications—e.g. Demirer et al. (2018), Giudici and Pagnottoni (2020), Giudici and Pagnottoni (2019) and Giudici et al. (2021). Differently from these VAR and VECM based approaches, we do not rely on the assumption of linear relationships, nor on the assumption of cointegration across time series. Such empirical strategies, along with network models, can also enhance investment management practices such as portfolio allocation and technical analysis—see, e.g. Pagnottoni (2019), Resta et al. (2020), Giudici et al. (2020), Spelta et al. (2022).

In this paper we cope with the missing cointegration relation between the CDS premium and the bond spread, and we measure the interactions between the CDS and the bond markets by means of the methodology proposed by Dimpfl and Peter (2013). It consists of an alternative methodology which uses the concept of transfer entropy to examine the information flow between two data time series. Based on the concept of Shannon Entropy developed in information theory by Shannon (1948), transfer entropy has been subsequently introduced by Schreiber (2000) to measure the dependency between two variables in time. Such a measure is a model-free approach able to detect statistical dependencies without being restricted to linear dynamics. Indeed, the use of the transfer entropy does not require the assumptions of the standard models, like cointegration in the present context, and can be applied more easily in a variety of areas in research. Further, the use of effective transfer entropy allows us to eliminate small sample biases induced by traditional transfer entropy settings, as well as to make inference on the estimated information flows between financial time series.

Against this background, our aim is to analyze the interactions between the CDS and the government bond market for countries of the European Union, and to propose a statistical modelling scheme to address the question of which market is the first to reflect new information in pricing sovereign credit risk in any situation. Given the puzzling conclusions for sovereign entities provided by the literature so far, we aim to shed some light on the price discovery leadership between the CDS and bond markets. This is done through the transfer entropy methodology outlined by Dimpfl and Peter (2013). Therefore, our contribution to the literature is mainly twofold.

Firstly, we contribute to the statistical and econometric literature by employing the effective transfer entropy to the CDS and bond market in the sovereign context. As a matter of fact, due to the increasing evidence of the highly nonlinear market interactions in the framework of econophysics (see, e.g. Cavalli et al. 2017; Zhao et al. 2017; Spelta et al. 2020), transfer entropy has become an appealing tool and has been widely used from the quantification of information flow between stock indices (Marschinski and Kantz 2002) to the interaction between exchange rates and stock markets (Sensoy et al. 2014). However, to the best of our knowledge, there is no study yet examining price discovery in the sovereign CDS and bond market using such a technique, which allows us to overcome restrictive assumptions on the time series data.

Secondly, the choice of the selected period from 1 January 2010 to 31 December 2018 gives a relevant contribution to the reference financial literature. Indeed, most of the analyses conducted on European countries did not deeply investigate the relationship between the two markets after 2012, when still the situation in the Eurozone was changing drastically, especially for the countries with slower economic growth and higher spread. On the contrary, analyzing a wider time span allows us to yield results for both the European sovereign crisis and the post-crisis period, characterized by very low bond yields.

Results show evidence of a significant bi-directional information flow between the CDS and the bond market and a clear dominance of the bond market from a price discovery point of view. In particular during the period which covers the sovereign debt crisis, the information flow from the bond to the CDS market is more remarkable with respect to that from the CDS to the bond market, especially for core countries of the European Union with lower yield. During the post-crisis period, less information flow between both markets is observed and a few sovereigns behave dissimilarly, although generally speaking the bond market still dominates the CDS market in terms of price discovery.

Our results on the dominance of the bond market might give relevant insights for policy makers and market participants. From a risk management prospective, our findings highlight the importance of the bond spread as a reliable market indicator of sovereign credit risk during a crisis period, provided that it is able to respond faster to economic fundamentals and global financial market factors. This suggests to policy makers that an extensive use of the CDS market as a hedging instrument does not directly lead to a consequent increase of funding costs of the sovereigns, and hence to high level of bond spread. In addition, institutional investors can benefit to know which market has a leadership role on the other, so to take advantage of market imperfections and to set up profitable arbitrage strategies.

The remainder of this paper is structured as follows. Section 2 provides a literature review on the relation between the CDS and the bond market and on the transfer entropy. Section 3 introduces the concept of transfer entropy. In Sect. 4 the data will be presented and analyzed. Section 5 illustrates and discusses the empirical outcomes. Section 6 concludes.

2 Literature review

This paper relates to a branch of the literature based on the relation between the CDS and the bond markets and especially on the identification of the leading market in pricing the credit risk. To give a better understanding of the fundamental empirical and methodological framework, we firstly introduce the literature regarding price discovery and efficiency between the two markets. After that, we discuss the methodological background linked to our analysis.

2.1 Price discovery mechanisms in CDS and Bond markets

As explained in theory by Duffie (1999), the spread on a par floating-rate bond over a risk-free benchmark should be equal to the CDS premium for the same entity and maturity, since both markets offer a similar exposure to the credit risk of the underlying entity. Therefore, the two markets are linked by an approximate arbitrage relationship. Against this background, the CDS premium and the bond spread should be cointegrated and driven by a common stochastic trend, interpreted in this case as the efficient price of credit risk. This relationship led many researchers to analyze the dynamic behavior of the two assets, in order to ascertain the informationally dominant market.

The pillar methodologies of the price discovery analysis in this field were applied in first place by Blanco et al. (2005). They used a VECM to find an equilibrium long-run relation between the pricing in the two markets for a sample of 33 investment-grade North American and European firms in a restricted period of 18 months between 2001 and 2002. As far as the firms for which the equilibrium holds are concerned, the empirical measures of Hasbrouck (1995) and Gonzalo and Granger (1995) highlight that the CDS market leads the bond market in determining the price of credit risk. Consecutive studies found the predominance of the CDS market with respect to the bond market in corporate entities (e.g., Zhu 2006; Baba and Inada 2009; Molleyres 2018), and a common point of the aforementioned literature regards the discussion of various market imperfections that can hinder the equal price of the two markets in the long term, making the arbitrage relationship not perfect. Such market imperfections move the so-called “basis”, defined as the difference between the premium on the CDS and the corresponding bond spread on the same entity and with the same maturity, away from the theoretical value of zero. The arbitrage opportunity due to such deviations from the parity led various researches to analyze the topic from two main viewpoints.

On the one hand, a branch of literature discusses empirical causes of a non-zero basis, especially in the area of sovereign entities in times of market stress (e.g., Ammer and Cai 2011; Palladini and Portes 2011; Arce et al. 2013; Fontana and Scheicher 2016; Gyntelberg et al. 2017). Among the main factors that can deviate the basis away from the theoretical value of zero, particular attention has been dedicated to the CTD option. By means of the CTD option, the buyer of the CDS has the incentive to deliver the lowest valued bond of the underlying entity in case of default, causing disadvantage for the seller and a higher CDS premium. Liquidity premia is another factor that can, for example, increase the bond spread if the risk-free bond market is more liquid than the risky bond. The counterparty risk of the seller of a CDS can also affect the basis, due to the over-the-counter nature of the respective derivative market. The perception of a lower quality of the contract sold may affect the price of the CDS, hence yielding to a negative value of the basis.

On the other hand, a wide stream of literature employ a variety of investigation strategies to examine the relationship between the two markets with the aim of identifying the leading one in terms of price discovery in sovereign contexts. Ambiguous results in sovereign entities can be found in the literature, with consequent considerations regarding the key determinants of price discovery. The relationship has initially been investigated among emerging countries. Chan-Lau and Kim (2004) examined the equilibrium price relationship and the price discovery process for eight emerging sovereigns in the period between 2001 and 2003, but the mixed results accomplished by the Granger causality test combined with the price discovery measures did not deliver to the authors any strong conclusion about the price discovery leadership. Using data for nine emerging sovereigns for the period from 2001 to 2005, Ammer and Cai (2011) found that bond spread leads the CDS premium more often than what had been found for investment-grade corporate entities. This finding has been reported for emerging economies that have issued more bonds, confirming the key determinant role of liquidity in capturing the relative contribution to price discovery, as discussed by Chakravarty et al. (2004). In contrast, Li and Huang (2011) found that in emerging sovereigns the CDS market plays a greater role than the bond market in the price discovery process for the period between 2004 and 2008, by means of an empirical analysis based on VECM and Granger causality tests.

Consecutive studies have been conducted on European economies, and still divergent results persisted. Fontana and Scheicher (2010) studied weekly CDS premia and bond spreads of ten countries of the European Union for the period between 2006 and 2010 and found heterogeneous outcomes on the lead-lag relationship between the two markets. Delis and Mylonidis (2011) focused on Southern European countries with fiscal vulnerabilities, such as Greece, Italy, Portugal, and Spain, performing a series of rolling Granger causality test and showed that the CDS market Granger causes the government bond market after since the start of the global financial crisis in 2007. A notable contribution in the methodology has been proposed by Delatte et al. (2012), who used a Panel Smooth Transition Error Correction Model to overcome the restricting hypothesis of the linear specifications. The model, applied to eleven European Union countries in the phase of the global financial crisis, revealed the bond market of core European economies as leader of the price discovery process during calm periods. A leadership in the CDS market was instead found during distress periods. A considerable contribution to the extant literature is that of Coudert and Gex (2013), who focused on the interaction between the two markets during the global financial crisis, from the beginning of 2007 to 2010. By means of the Gonzalo and Granger (1995) measure, they showed the leadership of the CDS market in the price discovery process for a sample of 17 financial companies. However, the same analysis conducted on 18 sovereigns, including both advanced and emerging economies, delivered different results and highlighted a leader role of the bond market for low-yield government issuers. Recently, Agiakloglou and Deligiannakis (2020) investigated the relationship for eight European Union countries between the two markets using Granger causality. They did not find evidence of cointegration between the two markets during calm period, and conclude that the bond market led the price discovery process during the post-crisis period. Another recent analysis has been conducted by Patanè et al. (2019), who analyzed the link between the CDS premium and the bond spread for core and peripheral countries in the Eurozone during a wider time span, ranging from 2011 to 2018. When cointegration was found, they concluded that the bond market played a leader role in the price discovery process during the period of financial distress, and only during the subsequent period between 2014 and 2018 the CDS market gained more importance.

The ambiguity of results in the literature may be caused by the differences in the analyzed time spans and by the different maturities of the relative assets used in the analysis, as discussed in Gyntelberg et al. (2013). Additionally, different econometric procedures are usually implemented, due for example to the nonlinearity mechanism between the bond market and the CDS market, as discussed in Delatte et al. (2012), and to the lack of cointegration that motivates the use of the Granger causality test. In order to overcome these problems, this paper gives a considerable contribution to the sovereign analysis proposed by the literature so far, making use of a model-free approach, which enables us to circumvent restrictive assumptions and model configurations.

2.2 Transfer entropy in economic and financial contexts

Various time series analysis approaches have been recently introduced in order to widen the class of statistical models applied in social sciences. The growing evidence of nonlinear market interactions animated the literature to investigate the stock markets making a considerable use of methods borrowed from the statistical physics. Among these, the development of the transfer entropy turned out to be a very useful instrument to quantify information flows between financial time series. The concept of transfer entropy has been originally introduced by Schreiber (2000), based on the theory of Shannon entropy, to quantify the statistical coherence between systems evolving in time. As explained by the author, the mutual information developed by Shannon (1948) was widely used to quantify the overlap of information content of two systems. However, since the mutual information does not express dynamical or directional information, the transfer entropy concept has been developed upon it, taking the dynamics of information transport into account (Schreiber 2000, p. 461).

The introduction of the transfer entropy delivered to the financial literature an appealing tool to estimate information flows between time series in different contexts. One of the first research analyzing the information flows between financial time series has been accomplished by Marschinski and Kantz (2002). They proposed a modified version of the transfer entropy, called the effective transfer entropy, which overcomes the likely biased estimates due to small sample effects yielded by the methodology of Schreiber (2000). The authors investigated the information flow between the Dow Jones Industrial Average and the DAX stock index. The improvement of their results performed by the straightforward implementation of the estimator paved the way to a new measure able to quantify the information flows between various financial time series.

A stream of literature started to apply the transfer entropy and the modified version proposed by Marschinski and Kantz (2002) across international financial markets. Baek et al. (2005) focused on the daily closure price of 135 stocks listed on NYSE of different business sectors in order to investigate which industry influences at most the whole market. Kwon and Yang (2008a) examined the information flow between the S&P 500 index, the Dow Jones index and the stock price of 125 individual companies. Similarly, Kwon and Yang (2008b) analyzed the strength and direction of information flows among 25 stock indices. Reddy and Sebastin (2008) studied the interactions between the Indian stock and commodity market, while Sensoy et al. (2014) investigated the information flow between exchange rates and stock prices in different emerging countries. Bekiros and Marcellino (2013) examine the dependence structure and predictability of currency markets across different timescales by means of an entropy based methodology. Using the concept of Rényi transfer entropy, Dimpfl and Peter (2014) analyzed the dynamic interactions between European and US stock markets during overlapping trading hours, finding evidence of higher information flow throughout the time of the financial crisis.

Dimpfl and Peter (2013) offer a contribution to the literature which is very close to ours, as they studied the relationship between the corporate CDS and the bond market through the transfer entropy methodology. Because of a possible lack of cointegration between CDS premium and bond spread, price discovery measures that rely on the existence of a cointegration relationship cannot be applied. To cope with this, they quantified the information flow between the two markets using the effective transfer entropy on 27 iTraxx Europe companies from January 2004 to December 2011. The provided results showed the dominance of the CDS market in pricing the credit risk, especially during the financial crisis period, in line with the existing literature (see Blanco et al. 2005). In addition, Dimpfl and Peter (2013) proposed to assess the statistical significance of the estimated information flows through a bootstrap procedure of the underlying Markov process, which allows to derive the distribution of the estimated transfer entropy under the null hypothesis of no information flow and to subsequently evaluate the significance of results.

In this paper we employ the transfer entropy methodology and the statistical significance metrics proposed by Dimpfl and Peter (2013) to the sovereign framework, rather than to the corporate one. In this way we are able to investigate the relation between the CDS premium and the bond spread for every sovereign analyzed, even as regards to the countries for which a cointegrating relationship is not supported by the data.

3 Methodology

The concept of transfer entropy in the context of time series has been firstly introduced by Schreiber (2000), and the foundations of such methodology are based on the information theory originally proposed by Shannon (1948). Shannon (1948) constructed a measure for uncertainty by averaging the amount of information gained from a certain state of a random variable over all possible states that can be assumed by the random variable itself.Footnote 1 In order to address a theoretical explanation, consider a discrete random variable J with probability distribution p(j), where j denotes the different outcomes that the variable J can take. According to Shannon (1948), the average number of bits needed to optimally encode independent draws from the distribution of J is given by

where the \(\log \) is taken to be to the base 2 in order to indicate bits as units in which the information is measured, and the sum extends over all states j that can be assumed by the variable J. Strictly speaking, the higher the entropy measured by \(H_j\), the higher is the uncertainty about the random variable J. Therefore, the Shannon entropy in Eq. (1) shows the largest amount of uncertainty when all possible states of J are equally likely to be observed.

The Shannon entropy combined with the concept of Kullback–Leibler divergence (see Kullback and Leibler 1951) allows to measure the information flow between two processes. The Kullback–Leibler divergence is used to measure the difference between two probability distributions, assuming that one of them represents an approximation of the other. As mentioned by Schreiber (2000), the Kullback entropy gives the excess number of bits needed in the encoding when a different probability distribution is used. In the bivariate case, the Kullback entropy is known as the formula for mutual information. In addition to J, consider another discrete random variable I with probability distribution p(i). The corresponding Kullback entropy of the two random variables I and J, whose joint probability distribution is defined by \(p_{IJ}(i,j)\), is given by

where p(i) and p(j) represent the marginal probability distributions of I and J, and the sum extends over all states i and j which can be assumed by the variables I and J, respectively. The mutual information in Equation (2) measures the deviation from the independence of the two random variables, and can be thought of as the reduction of uncertainty about one variable given by the knowledge of the other. However, it must be mentioned that the direction of information cannot be distinguished due to the symmetry of the measure.

For the application of these measures in time series context, Schreiber (2000) introduced a dynamical structure by considering transition probabilities. The relative measure to quantify the information flows is derived under the assumption that the dynamical structure of a discrete random variable I corresponds to a stationary Markov process of order k, implying that the probability to observe I at time \(t+1\) in state i conditional on the k previous observations is \(p(i_{t+1}|i_t,\ldots ,i_{t-k+1})=p(i_{t+1}|i_t,\ldots ,i_{t-k})\). The average number of bits needed to encode one more state—or one more time series observation in the present case—if the previous states are known is then represented by

where \(i_t^{(k)}=(i_t,\ldots ,i_{t-k+1})\). In the case of two processes I and J, still assuming that both are stationary Markov processes with k and l representing their respective order, Schreiber (2000) proposed to quantify the information flow from J to I by measuring the deviation from the generalized Markov property \(p(i_{t+1}|i_t^{(k)})=p(i_{t+1}|i_t^{(k)},j_t^{(l)})\). The deviation from this assumption, embodied in the Kullback–Leibler divergence, defines the transfer entropy (TE), which is computed as

where \(TE_{J \rightarrow I}\) measures the amount of information flow from process J to process I. If the previous observations of J do not affect the transition probability of I, then the transfer entropy \(TE_{J \rightarrow I}\) is zero and no information flow in this direction is found. Since the transfer entropy is an asymmetric measure, \(TE_{I \rightarrow J}\) can be similarly computed and it measures the information flow from I to J. Hence the difference between \(TE_{J \rightarrow I}\) and \(TE_{I \rightarrow J}\) allows to discover the dominant direction of the information flow.

As mentioned in Schreiber (2000), common choices of the order of the Markov process for l are \(l=k\) or \(l=1\), and the last is usually preferred. Thus, the analysis in the current study is conducted by setting \(k=l=1\).

Since the transfer entropy measure in Eq. (4) is constructed for discrete data, a partition of the time series into discretized values is necessary to conduct it for continuous ones, as it is frequently done in empirical applications. Following Dimpfl and Peter (2013), the symbolically encoded series S(t) is obtained by partitioning the time series y(t) into three bins as follows:

In this way it is possible to replace each value of the time series \(y_t\) by a corresponding integer (1,2,3). As we will discuss further, the distribution of changes in the CDS premium and bond spread series motivates the choice of the quantiles in this setting.

Most of the related studies on financial time series data are conducted using a modification of the above transfer entropy, proposed by Marschinski and Kantz (2002). The adjustment suggested by the authors derives by the fact that small sample effects may lead the estimates of the transfer entropy to be biased. Therefore, a modified version called effective transfer entropy (ETE) is obtained by subtracting from the transfer entropy shown in Eq. (4) the transfer entropy computed by using a shuffled version of the time series of the variable J. The effective transfer entropy can be formulated as follows:

where the transfer entropy calculated with a shuffled version of the series J is represented by \(TE_{J_{\mathrm{shuffled}} \rightarrow I}(k,l)\). This methodology nullifies both the statistical dependencies between the two time series J and I and the time series dependencies of J, since a new time series is generated by a realignment of randomly drawing values from the time series J. As a consequence, \(TE_{J_{\mathrm{shuffled}} \rightarrow I}(k,l)\) converges to zero when the sample size increases and values of \(TE_{J_{\mathrm{shuffled}} \rightarrow I}(k,l)\) different from zero are due to small sample effects. As mentioned by Dimpfl and Peter (2013), it is common to shuffle the series many times and to use the transfer entropy estimate averaged over the replications in order to calculate the effective transfer entropy.

To conduct inference on the estimated information flows, we rely on the methods discussed in Dimpfl and Peter (2013). In other words, we assess statistical significance of the transfer entropy estimates by bootstrapping the underlying Markov process n times. By means of this procedure, the statistical dependencies between the series J and I are eliminated, but the dependencies within them are retained. Consequently, the distribution of the estimates under the null hypothesis of no information flow can be obtained by repeating the estimation of the transfer entropy using the simulated time series. Given the bootstrapped distribution of the transfer entropy estimates, the dominant direction of the information flow can be confirmed by deriving standard errors and p-values for the effective transfer entropy.

In more detail, we rely on the Markov block bootstrap procedure as in Dimpfl and Peter (2013), built on Horowitz (2003), who propose to bootstrap the underlying Markov process. The main difference with respect to shuffling the data itself is that such approach preserves the dependencies within the variables J and I, but eliminates the statistical dependencies between them. The repeated estimation of transfer entropy yields the distribution of the parameter estimates under the null hypothesis of null information flow and the associated p value is given by \(1-\hat{q}_{TE}\), with \(\hat{q}_{TE}\) denoting the quantile of the simulated distribution of the transfer entropy estimate.

4 Data description and preliminary analysis

We analyze daily data on five-year sovereign CDS premia and sovereign bond yields for eight countries of the European Union, i.e. Italy, Belgium, Austria, France, the Netherlands, Ireland, Portugal and Spain.Footnote 2 The sample includes both core countries of the European Union (Belgium, Austria, France and the Netherlands) and peripheral countries with higher spreads (Italy, Ireland, Portugal and Spain). The time period examined ranges from 1 January 2010 to 31 December 2018. The time series of CDS premia and bond yields are collected from Thomson Reuters Datastream. The time series of CDS premia and sovereign bond yields have the same maturity as well as they are all denominated in Euro.

The use of five-year maturity contracts with respect to the ten-year is justified by the higher liquidity of the CDS market, especially when the sovereign debt crisis intensified, as documented in Gyntelberg et al. (2013). The analysis of five-year maturity contracts is also in line with most of the extant literature.

In order to determine the government bond spread, the difference between the five-year bond yield of each sovereign and a five-year risk-free rate has to be computed. The risk-free rate is usually chosen between the swap rate or the bond yield of the country considered as less risky of a certain area. The use of the swap rate would be justified by the introduction in the analysis of Germany, which is the benchmark of the Euro area and hence usually used as the risk-free rate. Nevertheless, using the Euro interest swap rate yields negative values of the bond spread related to countries with high creditworthiness in the sample. To avoid this, the five-year German bond yield is used as risk-free rate in the present paper, as it benefited from a lower interest rate on debt with respect to the other countries in the sample.

The sample period is selected to analyze the relationship between the two markets in crucial times for the European Union, i.e. from the beginning of the sovereign debt turmoil to the post-crisis period. Such a wide period allows us to adequately separate the sample into two phases and to independently conduct two selected sub-period analyses, one for the sovereign crisis period and the other for the post-crisis period. The phase from 2010 to the end of 2014 aims to detect the leading market for credit risk considering a larger interval of time than that usually adopted by previous literature. By doing so, the results are carried out both for the great intensity phase of the crisis in 2011 and 2012, when longer-term refinancing operations and bail-out programs were conducted by the International Monetary Fund and European Union institutions, and for the end of the year 2014, marked by the decline of government bond spreads due to the start of the programme of Outright Monetary Transactions implemented by the European Central Bank. These results are then compared with the ones of the period from 2015 to the end of 2018, characterized by a relatively tranquil period and flattening of the analyzed curves, as a result of the European Central Bank monetary policies, the quantitative easing started at the beginning of 2015 and a lower trading activities in the CDS market as well.

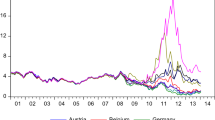

The dynamics of the CDS premium and bond spread time series across countries are shown in Fig. 1. During the sample period considered, both markets increased and reached their maximum level between 2011 and 2013, the peak of the European debt crisis. This effect levelled out and low levels of both CDS premium and bond spread can be observed in the subsequent years.

From the descriptive statistics reported in Table 1 we may notice a clear distinction between the core and peripheral countries. A significant similarity among the core countries consists of their low mean and volatility of both CDS premium and bond spread. This group maintains an average of the CDS premium below 61 basis points for the entire sample period. In contrast, there is a marked heterogeneity across the peripheral countries. The Portuguese’s credit risk is the one with the highest and most volatile figures across the sample. The Portuguese CDS premium reached the maximum level of 1521.50 basis point in January 2012, when the country was going through what was arguably one of the most severe moments of its economic crisis. A similar level is reached by Ireland, followed by Italy and Spain.

Before we employ our approach, we need to ensure that the time series we model are stationary. We test for stationarity to detect the order of integration of each time series by means of the Augmented Dickey Fuller (ADF). The results of the ADF tests for the entire sample period in levels and on first difference are reported in Table 2. The t-statistics of the ADF test indicate that the null hypothesis of a unit root cannot be rejected at a 5% significance level for all countries for both CDS premium and bond spread. The results for the other two sub-periods are also reported in Table 2. The null hypothesis of a unit root cannot be rejected at any conventional significance level for all the time series during the period between 2010 and 2014, given the increasing default probability of the sovereign states. We obtain a different result for bond spreads during the recovery phase for countries such as Belgium, Austria, France, the Netherlands, Ireland, and Spain, when the persistence of low bond yield led to a stationary behaviour of the time series. The ADF test statistics applied on the first difference series indicates that the unit root hypothesis is always rejected for every period and every country, hence stationarity is confirmed. Thus we model returns for our analysis.

We analyze then the cointegrating relationship between CDS premium and bond spread. We argue that this is not always proven for such time series, making it necessary to find alternative methodologies such as the transfer entropy measures to investigate their price discovery process. We examine cointegration through the Johansen Trace and Maximum Eigenvalue tests, whose results are reported in Table 3. It is clear that the hypothesized cointegrating relationship between the two time series is not always supported by the data. With respect to the entire sample period, cointegration is not confirmed by both tests for three out of eight countries. Furthermore, the absence of a long-run relation between the two markets in the two sub-period is observed for almost all the entities. According to the Maximum Eigenvalue test, cointegration is found to be statistically significant at 5% only for France, Ireland and Portugal during the period between 2010 and 2014. The same test on the period between 2015 and 2018 shows significant cointegrating relationships at 5% for Austria and Ireland, and no evidence is found for the remaining countries. This finding revealed the difficulty to assess a cointegration relationship between the CDS premium and the bond spread during period of low financial stress, as also discussed by previous studies (see Fontana and Scheicher 2010; Agiakloglou and Deligiannakis 2020).

To derive the information flow between the CDS premium and the bond spread with the transfer entropy methodology we need to partition the observations of the time series into discretized values following Equation (5). By doing so, the series are partitioned into three bins. The analysis is conducted setting the 0.05 quantile for \(q_1\) and the 0.95 quantile for \(q_2\), maintaining a large intermediate bin. This partition of the time series permits to obtain a symbolically encoded series where extreme negative values are contained in the first bin, while the third bin contains extreme positive values. The motivation of this choice depends on the excessive kurtosis found in the distribution of the series of the CDS premium and bond spread series in first difference, which are illustrated together with their associated normal distributions using the time series mean and variance of the returns in Fig. 2. The series deviate from the normal distribution, showing fatter tails and a peaked center. If a market is found to be informationally dominant, the extreme changes in this market should be incorporated consequently into the other market’s price. Thus, the data in the tails of the distribution of the first difference series turn out to be of extreme relevance. By keeping the intermediate bin large, extreme changes can be identified more clearly, especially when a significant amount of market micro-structural noise in the series occurs.

The modelling strategies for the estimation of the effective transfer entropy are based on the paper of Behrendt et al. (2019). The estimates are calculated by setting the number of shuffles equal to 100 and the number of bootstrap replications to obtain the distribution of the entropy estimates under the null hypothesis of no information flow to 300. The robustness analysis reported in the “Appendix” confirms the stability of our results with respect to the different modelling strategies.

5 Empirical results and discussion

The effective transfer entropy estimates for the entire sample and the two sub-periods 2010–2014 and 2015–2018 are reported in Table 4. We also illustrate the net information flow from the CDS to the bond market, meaning that when this quantity is positive, the CDS informationally dominates the bond market, whereas when it is negative, the bond market leads.

As far as the entire sample period is concerned, the null hypothesis of no information flow between the CDS and the bond market can be rejected at any conventional significance level for all the European countries. In other words, there is a significant bi-directional information flow between the two markets. The net information flow shows a larger information transmission from the bond to the derivative market. Hence, the results suggest that the bond spread dominates the market for credit risk for all the countries of the analysis. The largest net information flow is found for Ireland, followed by countries of the core group such as France, Austria, and Belgium. The high estimate of the effective transfer entropy from the bond to the CDS market is noteworthy also for Spain, the Netherlands, and Portugal, while for Italy a relatively smaller net information flow is observed.

When considering the period 2010–2014, we find again a clear dominance of the bond market across all the countries. Specifically, bi-directional information flow is not found to be statistically significant at any conventional significance level for every sovereign, and such finding reveals an interesting distinction between core and peripheral countries.

For core countries, the effective transfer entropy from the bond to the CDS market is larger and with higher significance than the one in the opposite direction. This is the case for Austria, France, and even more remarkable for the Netherlands. With respect to the analysis conducted on the full sample, the information flow for France and the Netherlands shows a huge increase from the bond to the CDS market.

For peripheral countries, there is still significant bi-directional information flow. The interactions between the CDS and the bond market are relatively strong and significant in both directions for Ireland, Portugal, and Spain. The net information flow still reveals the dominance of the bond market also in the periphery.

These outcomes are in line with the previous literature. The results for the core countries lead to the same conclusion of Coudert and Gex (2013) and Fontana and Scheicher (2010), who found a leadership of the bond market in low yield sovereigns during the high stress caused by the financial crisis. Similar outcomes are also derived by Patanè et al. (2019), who found a dominant role of the bond market for Germany and France during the period between April 2011 and May 2014. According to the results of Coudert and Gex (2013) and Fontana and Scheicher (2010), the bond market leads the price discovery process in countries exhibiting low bond yields. During the period of the crisis, investors could have moved their own positions towards these sovereign bond markets, considered as arguably safe. Indeed, the CDS market has been less used by the investors to hedge their credit exposure on countries with a low probability of default. Additionally, the liquidity of the government bond market of core economies is greater than the one of the CDS market, given the higher size of the respective market. To illustrate, the International Monetary Fund reports that at the end of 2011 the total government debt outstanding was 50 trillion USD, whereas the size of the sovereign CDS reached only 3 trillion USD.Footnote 3 This could have played a role in determining the bond asset as the leader market, since the market that is able to incorporate faster the information of the underlying entity is usually the most liquid one.

During the crisis period, the bond market dominated the CDS one also when considering countries with higher spread. The effective transfer entropy from the bond market exceeds that from the CDS market for all the four sovereigns, confirming the bond market as the dominant one in the sovereign credit risk sphere. Previous results in the literature regarding the leader market in the price discovery process could not lead to a specific conclusion. Even though the effective transfer entropy estimates of the core countries are in line with the findings of Coudert and Gex (2013) and Fontana and Scheicher (2010), results for countries with weak fiscal vulnerabilities are in contrast to them, but in line with others: Arce et al. (2013) showed that that the bond market led the price discovery process during the crisis period in the Eurozone for peripheral countries; Gyntelberg et al. (2017) found evidence of bond leadership in the Irish market.

In addition to liquidity, counterparty risk may have also played a role in contrasting the leadership of the derivative market in the price discovery process. Due to the over-the-counter nature of the derivative market in question, a negative effect on the CDS price may be the consequence of a high counterparty risk of the seller of the CDS contract, and hence a lower quality of the protection sold. Therefore, the lower quality of the protection sold may have affected the capability of the derivative market in reflecting better than the bond market the credit risk of the sovereign entities. This explanation has been proved by Arce et al. (2013), who showed how the contribution of the bond market becomes greater after an increase in the counterparty risk.

In light of what has emerged, the bond market holds a dominant role during the entire period of the debt sovereign crisis, from the drastic increase of risk among the countries to a more stable financial situation after the implementations of programs by the European Central Bank. The interest rate could have also played an important role in determining the dominance of the bond market. Especially for the safest governments, investors might have moved their own positions towards the bond markets when the yield was constantly decreasing, expecting a greater price of the sovereign bond in the future and making a considerable profitable investment.

The lower information flow on the period 2015–2018 is not surprising. A difficulty to verify a cointegrating relationship, hence a co-movement between the CDS and the bond market during no-crisis periods is a common result of the literature. During periods of low financial turbulence, the higher safety of the sovereign debts could lead the market participants to make less use of the credit derivative market to protect their own exposure. As a matter of fact, CDS premia are relatively constant in the aftermath of the crisis, due to the lower trading activities in the CDS market. As explained by Fontana and Scheicher (2010), for the period before the financial crisis of 2008, CDS premia and bond spreads across sovereigns exhibited weaker relationships due to the lower arbitrage forces between the two markets. The low information flow in the period after the sovereign crisis confirm the weaker relationship of the two markets during such times.

The information flows highlight the existence of three main groups of countries in terms of behaviour. The first one is composed by Italy, France, Ireland and Portugal, whose leading market remains the bond one, as it was during the sovereign debt crisis period. The second group consists of the Netherlands and Spain, which show that the CDS market became informationally dominant to the detriment of the bond one during the post-crisis period. The last group is the one including countries for which there is no information flow between the two markets, i.e. Belgium and Austria.

In detail, effective transfer entropy estimates are found to be statistically significant in both directions only for France and Portugal, and the two estimates still confirm the role of the bond market in incorporating faster the information of the sovereign credit risk. Information flow is significant only in one direction for Italy, Ireland, Spain and the Netherlands, and as far as the latter two countries evidence provides that the CDS market dominates the bond one, though with lower levels of significance. Hence the results related to the recovery period do not reveal a unique market leader across all analyzed countries, but they suggest that—even if to a smaller extent—the bond market is still dominating the CDS one.

Overall, our results show significant information transmission between the CDS and the bond market across all the countries for the whole period 1 January 2010–31 December 2018 and a clear dominance of the bond market. When focusing on the crisis period, the effective transfer entropy confirms that information on the sovereign credit risk are expected to be reflected initially in the bond market. This strong conclusion cannot be drawn for every country during the post-crisis period, when the information flow between the two markets decreased.

6 Concluding remarks

This paper explores the dynamic relationship between the CDS premium and the bond spread of European Union countries using the concept of effective transfer entropy. The lack of a cointegrating framework between the CDS premium and the bond spread requires alternative methodologies to detect the informationally dominant market between the CDS and the bond one. Hence, we make use of a model-free approach, without being restricted to linear dynamics, to discover which market incorporates faster the information on sovereign credit risk. Further, the methodology is able to correct for small sample biases which affect the traditional transfer entropy measures, as well as it allows to make inference on the estimated directional information flows.

Our results show a significant bi-directional information flow between the CDS and the bond market for the European Union countries, and a dominant position for the bond market. During the European debt crisis, we find a strong predominance of the bond market, especially as regards to core countries. During the post-crisis period, the information flow between the CDS and the bond market significantly weakens in almost all countries, mainly due to the lower turmoil and trading activities in the CDS market. However, although some countries behave dissimilarly, we still find an overall predominance of the bond market also during the recovery period.

We remark that, given the premises of strong hypotheses in the classical price discovery framework, there is room for further investigations in this field by means of alternative modelling strategies. Effective transfer entropy is just an example of class of techniques which economic and financial theory could still much benefit from, and the interdisciplinary future trajectories of research call for a more in depth investigation of these topic from a wider variety of viewpoints.

Notes

As shown in the related literature, the quantity \(\log (1/p_j)\), with \(p_j\) indicating the probability of the event j, gives the amount of information that can be gained from the particular outcome j. The average amount of information per outcome over the total n outcomes, presented as \(\sum _{j=1}^{n}p_j \, \log \, (1/p_j),\) brings to the formula of Shannon (1948).

Data is retrieved from Thomson Reuters.

For further details, see the Global Financial Stability Report of April 2013: https://www.imf.org/en/Publications/GFSR/Issues/2016/12/31/Old-Risks-New-Challenges.

The result is in line with the finding of Agiakloglou and Deligiannakis (2020).

References

Adelfio G, Agosto A, Chiodi M, Giudici P (2020) Financial contagion through space-time point processes. Stat Methods Appl 20:1–24

Agiakloglou C, Deligiannakis E (2020) Sovereign risk evaluation for European union countries. J Int Money Financ 103(102):117

Ammer J, Cai F (2011) Sovereign CDS and bond pricing dynamics in emerging markets: does the cheapest-to-deliver option matter? J Int Financ Markets Inst Money 21(3):369–387

Arce O, Mayordomo S, Peña JI (2013) Credit-risk valuation in the sovereign CDS and bonds markets: Evidence from the euro area crisis. J Int Money Financ 35:124–145

Augustin P (2014) Sovereign Credit Default Swap Premia. J Invest Manag (Forthcoming)

Baba N, Inada M (2009) Price discovery of credit spreads for Japanese mega-banks: evidence from bond and credit default swap markets. J Int Finanv Markets Inst Money 19(4):616–632

Baek SK, Jung WS, Kwon O, Moon HT (2005) Transfer entropy analysis of the stock market. arXiv preprint physics/0509014

Bee M (2005) Estimating rating transition probabilites with missing data. Stat Methods Appl 14(1):127–141

Behrendt S, Dimpfl T, Peter FJ, Zimmermann DJ (2019) Rtransferentropy-quantifying information flow between different time series using effective transfer entropy. SoftwareX 10(100):265

Bekiros S, Marcellino M (2013) The multiscale causal dynamics of foreign exchange markets. J Int Money Financ 33:282–305

Blanco R, Brennan S, Marsh IW (2005) An empirical analysis of the dynamic relation between investment-grade bonds and credit default swaps. J Financ 60(5):2255–2281

Bottone M, Petrella L, Bernardi M (2020) Unified Bayesian conditional autoregressive risk measures using the skew exponential power distribution. Stat Methods Appl 2020:1–29

Cavalli F, Naimzada A, Pecora N (2017) Real and financial market interactions in a multiplier-accelerator model: Nonlinear dynamics, multistability and stylized facts. Chaos 27(10):103,120

Chakravarty S, Gulen H, Mayhew S (2004) Informed trading in stock and option markets. J Financ 59(3):1235–1257

Chan-Lau JA, Kim YS (2004) Equity prices, credit default swaps, and bond spreads in emerging markets. 4-27, International Monetary Fund

Corsi F, Lillo F, Pirino D, Trapin L (2018) Measuring the propagation of financial distress with granger-causality tail risk networks. J Financ Stab 38:18–36

Coudert V, Gex M (2013) The interactions between the credit default swap and the bond markets in financial turmoil. Rev Int Econ 21(3):492–505

Delatte AL, Gex M, López-Villavicencio A (2012) Has the CDS market influenced the borrowing cost of European countries during the sovereign crisis? J Int Money Financ 31(3):481–497

Delis MD, Mylonidis N (2011) The chicken or the egg? A note on the dynamic interrelation between government bond spreads and credit default swaps. Financ Res Lett 8(3):163–170

Demirer M, Diebold FX, Liu L, Yilmaz K (2018) Estimating global bank network connectedness. J Appl Econom 33(1):1–15

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Diebold FX, Yılmaz K (2014) On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econom 182(1):119–134

Dimpfl T, Peter FJ (2013) Using transfer entropy to measure information flows between financial markets. Stud Nonlinear Dyn Econom 17(1):85–102

Dimpfl T, Peter FJ (2014) The impact of the financial crisis on transatlantic information flows: An intraday analysis. J Int Financ Markets Inst Money 31:1–13

Duffie D (1999) Credit swap valuation. Financ Anal J 55(1):73–87

Fontana A, Scheicher M (2010) An analysis of euro area sovereign CDS and their relation with government bonds. European Central Bank working paper (no. 1271)

Fontana A, Scheicher M (2016) An analysis of euro area sovereign CDS and their relation with government bonds. J Bank Finance 62:126–140

Frattarolo L, Parpinel F, Pizzi C (2020) Combining permutation tests to rank systemically important banks. Stat Methods Appl 29(3):581–596

Giudici P, Pagnottoni P (2019) High frequency price change spillovers in bitcoin markets. Risks 7(4):111

Giudici P, Pagnottoni P (2020) Vector error correction models to measure connectedness of bitcoin exchange markets. Appl Stoch Model Bus Ind 36(1):95–109

Giudici P, Parisi L (2017) Sovereign risk in the Euro area: a multivariate stochastic process approach. Quant Finance 17(12):1995–2008

Giudici P, Parisi L (2018) Corisk: Credit risk contagion with correlation network models. Risks 6(3):95

Giudici P, Pagnottoni P, Polinesi G (2020) Network models to enhance automated cryptocurrency portfolio management. Front Artif Intell 3:22

Giudici P, Leach T, Pagnottoni P (2021) Libra or librae? Basket based stablecoins to mitigate foreign exchange volatility spillovers. Finance Res Lett 202:102054

Gonzalo J, Granger C (1995) Estimation of common long-memory components in cointegrated systems. J Bus Econ Stat 13(1):27–35

Grammig J, Peter FJ (2013) Telltale tails: a new approach to estimating unique market information shares. J Financ Quant Anal 2013:459–488

Gyntelberg J, Hördahl P, Ters K, Urban J (2013) Intraday dynamics of euro area sovereign CDS and bonds. BIS working paper (no.423)

Gyntelberg J, Hördahl P, Ters K, Urban J (2017) Arbitrage costs and the persistent non-zero cds-bond basis: Evidence from intraday euro area sovereign debt markets. BIS working paper (no.631)

Hasbrouck J (1995) One security, many markets: determining the contributions to price discovery. J Financ 50(4):1175–1199

Hirk R, Hornik K, Vana L (2019) Multivariate ordinal regression models: an analysis of corporate credit ratings. Stat Methods Appl 28(3):507–539

Kullback S, Leibler RA (1951) On information and sufficiency. Ann Math Stat 22(1):79–86

Kwon O, Yang JS (2008) Information flow between composite stock index and individual stocks. Phys A 387(12):2851–2856

Kwon O, Yang JS (2008) Information flow between stock indices. EPL (Europhys Lett) 82(6):68,003

Li N, Huang AY (2011) Price discovery between sovereign credit default swaps and bond yield spreads of emerging markets. J Emerg Market Finance 10(2):197–225

Marschinski R, Kantz H (2002) Analysing the information flow between financial time series. Eur Phys J B-Condens Matter Complex Syst 30(2):275–281

Mizrach B, Neely CJ (2008) Information shares in the us treasury market. J Bank Finance 32(7):1221–1233

Molleyres J (2018) Price discovery dynamics of corporate credit default swaps and bonds. SSRN 2817819

Pagnottoni P (2019) Neural network models for bitcoin option pricing. Front Artif Intell 2:5

Pagnottoni P, Dimpfl T (2019) Price discovery on bitcoin markets. Digit Finance 1(1):139–161

Pagnottoni P, Spelta A, Pecora N, Flori A, Pammolli F (2021) Financial earthquakes: Sars-cov-2 news shock propagation in stock and sovereign bond markets. Phys A 582(126):240

Palladini G, Portes R (2011) Sovereign CDS and bond pricing dynamics in the euro-area. Tech. rep, National Bureau of Economic Research

Patanè M, Tedesco M, Zedda S et al (2019) Cds-bond basis dynamic and credit spread price discovery: a test for European corporate and sovereign bond markets. Modern Econ 10(08):1984

Reale M, Wilson GT (2001) Identification of vector ar models with recursive structural errors using conditional independence graphs. Stat Methods Appl 10(1–3):49–65

Reddy Y, Sebastin A (2008) Are commodity and stock markets independent of each other? A case study in India. J Alternat Invest 11(3):85–99

Resta M, Pagnottoni P, De Giuli ME (2020) Technical analysis on the bitcoin market: trading opportunities or investors’ pitfall? Risks 8(2):44

Schreiber T (2000) Measuring information transfer. Phys Rev Lett 85(2):461

Sensoy A, Sobaci C, Sensoy S, Alali F (2014) Effective transfer entropy approach to information flow between exchange rates and stock markets. Chaos Solitons Fractals 68:180–185

Shannon CE (1948) A mathematical theory of communication. Bell Syst Tech J 27(3):379–423

Spelta A, Flori A, Pecora N, Buldyrev S, Pammolli F (2020) A behavioral approach to instability pathways in financial markets. Nat Commun 11(1):1–9

Spelta A, Pecora N, Pagnottoni P (2022) Chaos based portfolio selection: A nonlinear dynamics approach. Expert Syst Appl 188:116055

Zhao X, Shang P, Huang J (2017) Mutual-information matrix analysis for nonlinear interactions of multivariate time series. Nonlinear Dyn 88(1):477–487

Zhu H (2006) An empirical comparison of credit spreads between the bond market and the credit default swap market. J Financ Serv Res 29(3):211–235

Acknowledgements

We thank two anonymous reviewers for their useful suggestions and comments, which we believe have notably improved the quality of the paper. We thank Prof. Thomas Dimpfl for useful ideas and discussions on the topic, which gave the authors most of the motivation to conduct the research and write the present manuscript. We thank Prof. Paolo Giudici for useful discussions on the topics concerning credit risk measurement. P.P. gratefully acknowledges financial support from the European Union’s Horizon 2020 training and innovation programme “FIN-TECH”, under the Grant Agreement No. 825215 (Topic ICT-35-2018, Type of actions: CSA).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Here we assess the robustness of our empirical results with respect to alternative modelling strategies.

1.1 A.1 Number of shuffles

We let the number of shuffles vary from 100 to 300. The effective transfer entropy estimates, reported in Table 5, seem just slightly influenced by the change of number of shuffles, and bi-directional information flow is still confirmed across all the sovereigns. Hence, results do not change from a qualitative viewpoint.

1.2 A.2 Number of bootstrap replications

We let the number of bootstrap replications vary from 300 to 600. Results are reported in Table 5. Also in this case, effective transfer entropy estimates are statistically significant for both directions, and the magnitude of information transmitted from the bond market still exceeds that of the CDS market.

1.3 A.3 Different sub-samples

We also investigate the information flows in a tighter sub-sample related to the sovereign crisis. Results for the estimates information flow from January 2010 to December 2013 are shown in Table 6. Except for Spain,Footnote 4 the significance of our analysis strengthen the conclusions on the leadership of the bond market for core countries.

1.4 A.4 Different quantiles

To partition the observations of the time series into discretized values, the analysis is conducted setting the 0.05 quantile for \(q_1\) and the 0.95 quantile for \(q_2\), maintaining a large intermediate bin. We let the quantiles vary to 0.04 for \(q_1\) and 0.96 for \(q_2\), and then to 0.10 for \(q_1\) and 0.90 for \(q_2\). Overall, empirical evidence shows that results are robust under the different chosen quantile values. In particular, the significant directional effective transfer entropy estimates confirm our results, with few slightly different coefficients’ significance, such as in the case of France and Portugal’s effective transfer entropy transferred from the CDS to the credit market during the period of low bond yields.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Caserini, N.A., Pagnottoni, P. Effective transfer entropy to measure information flows in credit markets. Stat Methods Appl 31, 729–757 (2022). https://doi.org/10.1007/s10260-021-00614-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10260-021-00614-1