Abstract.

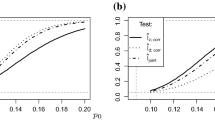

In the context of ACD models for ultra-high frequency data different specifications are available to estimate the conditional mean of intertrade durations, while quantiles estimation has been completely neglected by literature, even if to trading extent it can be more informative. The main problem arising with quantiles estimation is the correct specification of durations’ probability law: the usual assumption of Exponentially distributed residuals, is very robust for the estimation of parameters of the conditional mean, but dramatically fails the distributional fit. In this paper a semiparametric approach is formalized, and compared with the parametric one, deriving from Exponential assumption. Empirical evidence for a stock of Italian financial market strongly supports the former approach.

Similar content being viewed by others

Author information

Authors and Affiliations

Corresponding author

Additional information

Paola Zuccolotto: The author wishes to thank Prof. A. Mazzali, Dott. G. De Luca, Dott. M. Sandri for valuable comments.

Rights and permissions

About this article

Cite this article

Zuccolotto, P. Quantile estimation in ultra-high frequency financial data: a comparison between parametric and semiparametric approach. Statistical Methods & Applications 12, 243–257 (2003). https://doi.org/10.1007/s10260-003-0058-y

Issue Date:

DOI: https://doi.org/10.1007/s10260-003-0058-y