Abstract

This paper studies the impact on consumption of the exogenous changes in public wages in Portugal during and after the economic and financial assistance program (2011-2014), by exploiting the variability in the size of such changes across municipalities. The initial wage cuts triggered a marked reduction of private consumption, while the reinstatements in the later years gave rise to an increase, albeit of a smaller magnitude. The consumption response was larger for employees with relatively lower wages. Households smoothed the impact on consumption of negative income shocks partly by drawing down their deposits. Consumer credit did not play such a role, as households deleveraged as a response to those negative shocks.

Similar content being viewed by others

1 Introduction

Understanding the transmission of income shocks to consumption decisions is critical to anchor the modelling of households’ decisions and to assess the impact of public policies. Uncovering reliable estimates of the marginal propensity to consume (MPC) out of income shocks has been the subject of an extensive literature for several decades (see Jappelli and Pistaferri (2010, 2017) for comprehensive reviews). These studies have found that the MPC depends on the size, sign and persistence of income shocks, on households’ characteristics and on the degree of credit market frictions. Such work comprises, among others, Shapiro and Slemrod (1995), Shea (1995), Parker (1999), Souleles (1999), Browning and Collado (2001), Gross and Souleles (2002), Souleles et al. (2006), Agarwal et al. (2007), Parker et al. (2013), Mian et al. (2013), Misra and Surico (2014), Jappelli and Pistaferri (2014), Agarwal and Qian (2014), Sahm et al. (2015), Bunn et al. (2018), Dupor et al. (2023), Kueng (2018), Christelis et al. (2019), Fagereng et al. (2021), Gelman (2021) and Lewis et al. (2021). Despite the richness of literature, there is considerable disagreement on the source and direction of MPC heterogeneity. In addition, a convincing identification of the response of consumption to income shocks is still work in progress. Isolating truly exogenous income shocks has proven a daunting task.

We contribute to this work by analysing a quasi-experimental framework arising in Portugal in the context of the sovereign debt crisis. In this period, there were large changes in public wages (cuts and reinstatements) decided at a national level. These wage changes had a progressive nature implying different magnitudes across municipalities given variation in the characteristics of civil servants and size of the public sector. We use a rich dataset by municipality comprising full card withdrawals and payments, which approximate private consumptionFootnote 1, as well as household financial data. In this context, we study responses of household consumption and financial variables to income shocks.

The use of regional data to estimate MPCs and identify potential layers of heterogeneity adds to a rapidly growing literature employing regional settings to address macroeconomic issues (Chodorow-Reich 2019). Three features add particular interest to our contribution. Firstly, we are able to track the full cycle of public wage cuts and subsequent reinstatements over about half a decade. Indeed, at the beginning of the sovereign debt crisis, around 2011-2012, there were very strong and largely unanticipated cuts to public wages. These were afterwards unwound, but the reversal was gradual and on occasion there were temporary setbacks, with public wages rising and falling within the same year. This process was only completed by 2016-17. We can therefore disentangle the effects of positive and negative shocks under a common setting.

Secondly, we are in a position to assess heterogeneity of the MPC on the basis of the characteristics of agents, because we compute the shocks from microdata, at the worker level. While this is standard in the literature assessing MPCs on the basis of households’ replies to survey questions, it is less common in the quasi- experimental literature based on regional shocks. Thirdly, we combine datasets with monthly data for both consumption and household deposits and consumer credit at the municipality level, making it possible to study also the response of these financial variables to income shocks. This allows us to shed some light on the financial channels mediating the transmission of income shocks to consumption decisions, which are typically postulated but rarely inferred from the data in the literature.

Our key findings are as follows. First, the MPC is highly dependent on the nature and characteristics of the income shock. There was a strong consumption response to the large and negative public wage shocks at the beginning of the sovereign debt crisis in the first years of our sample. These shocks were arguably unexpected and perceived at the time as very persistent. Afterwards, following in particular a Constitutional Court decision partly overturning some of the initial wage cuts, expectations that all cuts would eventually be reverted became prevalent. From 2013 onwards, we estimate smaller and less persistent impacts following positive income shocks vis-a-vis those of negative shocks in the initial years, which may be explained by anticipation of shocks. In turn, the negative shocks that occurred during this later period are estimated to have had no impact on consumption, in line with agents’ having largely perceived them as transitory.

We also find heterogeneity in the MPC both as a function of income and age. As regards income, in general, the response of consumption is larger the lower the wages of those experiencing the shock. This is particularly clear following the large negative income shocks at the beginning of the sample. As regards age, the estimates suggest a decreasing pattern of MPCs as households get older.

Finally, the financial counterpart to the consumption decisions has to be interpreted on the backdrop of the financial constraints prevailing in the context of the financial and sovereign debt crises. This implied that the response of consumption was mediated to a large extent by changes in deposits and not through the recourse to the credit market. In fact, for 2011-2012 we estimate a significant fall in deposits as a response to negative income shocks, in line with some degree of smoothing of consumption. Looking at heterogeneity, such an effect was less pronounced among the higher-income workers, which is a surprising result to a certain extent. In turn, consumer credit responded negatively, probably relating to the deterioration in households’ net worth in the wake of negative income shocks, implying more binding credit constraints. The estimates for the second part of the sample are not so clear-cut. Nevertheless, in the case of the negative shocks, which were transitory, there is evidence of a decline in deposits, again in line with the smoothing of consumption by households. As regards credit market decisions, we estimate a fall in consumer credit after positive wage shocks, indicating that households decided to deleverage more.

The remainder of the article is organized as follows. Section 2 describes the sequence of cuts and reinstatements of public sector wages in Portugal, and Section 3 the two approaches used to derive the shocks. Section 4 deals with the computation of shocks from wage data and their heterogeneity across municipalities, and Section 5 with the identification of shocks. Section 6 describes the econometric specification. Section 7 presents the data on consumption, deposits and consumer credit. Section 8 documents the estimated aggregate MPC, and Sections 9 and 10 the heterogeneity of MPCs by income and age of the workers affected by the shocks. Section 11 focuses on households’ financial response. The concluding remarks are made in Section 12.

2 Cuts and reinstatements of public wages in Portugal over the period 2011-2016

The shocks analysed in this paper are based on the sequence of cuts and reinstatements of public wages implemented around the Portuguese Economic and Financial Assistance Program (May 2011 - June 2014), agreed between the Portuguese authorities, the European Union and the International Monetary Fund.Footnote 2 In this section, we describe the legislative measures underlying such wage changes and provide a brief account of the context and rationale behind them.

In order to help understand what follows, we note that civil servants in Portugal earn a monthly wage, comprising a base amount plus, for some workers, extra allowances. In addition there are two annual bonuses («holiday» and «Christmas») equal to one monthly base wage each. Prior to the economic and financial crisis these bonuses used to be paid in June and November. Some of the changes in salaries we consider were enacted through special legislation, but most of them were passed through the annual State Budgets. In normal circumstances, in Portugal the State Budget is presented by government to the Parliament by mid-October and the general approval takes place around early November. This was always the case in the years from 2011 to 2014, in time for the Budget to come into force on January 1, after the final approval of Parliament and enactment by the President of the Republic.

Table 1 presents the full chronology of measures. This chronology starts with the cut of the full monthly wage (i.e. base amount plus allowances) set out in the 2011 Budget and in force from the beginning of the year, some months before the start of the Assistance Programme. This pay-cut had a progressive nature, ranging from 0 to 10 percent, depending on the wage earned.Footnote 3 The 2011 Budget was not explicit about the possibility of a reversal of the wage cut. This is likely to have been perceived as very persistent, given the difficult circumstances of the Portuguese economy at the time. The Constitutional Court was called to evaluate this wage cut in September 2011 and decided to uphold it, considering that the measure would last while the «fiscal emergency» lasted.

The difficult situation of public finances led the new government (which took office in June 2011) to pass a second wage cut in the 2012 Budget, suspending or reducing the payment of the Holiday and Christmas bonuses for most workers while the Assistance Programme lasted. This second cut was also progressive, but the number of affected workers was larger. The Constitutional Court was called to rule on the lawfulness of this measure and, in July 2012, decided that it was unconstitutional, but the ruling would only take effect from the beginning of 2013. This outcome came largely as a surprise at the time.

In order to cope with the Court’s last decision, the government reinstated the payment of one of the bonuses in full in the 2013 Budget, ruling further that this was to be paid in 12-monthly instalments. The fact that the government did not incorporate fully the Court’s decision into the Budget raised controversy during its discussion, and prompted the President of the Republic to request an assessment by the Constitutional Court of the relevant provisions immediately after the budget came into force.Footnote 4 The response came in April 2013 when the Court decided that the government would have to reinstate the full amount of the second bonus as well. Legislation coming into force in June 2013 ruled that the payment of the part of the bonus concerned by the decision would take place in November (the part that had not been cut would be paid in June as previously scheduled).

Following the Court’s decision of April 2013, the government prepared legislation to enlarge the initial 2011 pay-cut (which was still in force), in order to make up for the reinstatement of the bonuses to some extent. Such a legislation was passed in the 2014 Budget, setting out more extensive cuts of the monthly full wage. These were also progressive and ranged from 0 to 12 percent, taking as a reference the initial 2010 wage (prior to the implementation of the 2011 cut). Such cuts were in place from January to May 2014, date at which the Constitutional Court announced its decision to overturn them (a decision possibly anticipated by agents to a large extent). A short period followed in which wages went back to the pre-2011 level, until a law passed in September 2014 ruled the reintroduction of the original 2011 cut. The first bonus that had been paid in 12-monthly instalments was paid without any cut during this interim period, and the second bonus was similarly paid without any reduction in June.

Against the background of the end of the Assistance Programme (June 2014), the government prepared in July 2014 legislation foreseeing the phasing out of the 2011 cut, which had been suspended and was to be re-introduced soon. According to this legislation, 20 percent of the cut would be reversed from 1 January 2015 on, while the reversal of the remaining part should occur over a period of up to four years (i.e. up to 2018). The President of the Republic sought an assessment of the Constitutional Court before it come into force. In August 2014 the Court ruled that the full reversal should occur up to 2016, given the conclusion of the Assistance Programme. The law, passed in September 2014, established the reversal of 1/5 of the 2011 cut from 1 January 2015 on, but left open the way how further reversals would occur. The 2015 State Budget did not include any further provisions in this respect. The government indicated that it would pay back only a further 1/5 of the cut during 2016, if it won the coming elections.

A new government coming out of the October 2015 elections, supported by different political forces, took office in November. At the end of December, legislation was approved setting out the calendar for the full reinstatement of the 2011 cut, in the course of 2016. This was to occur cumulatively over the year, by an extra 1/5 at the beginning of each quarter.

Two distinct periods stand out in this narrative. The first one starts with the presentation of the 2011 Budget and extends approximately over the following two years. It is dominated by the severity of the economic and financial crisis. The two key negative wage shocks enacted in this context (the 2011 cut and the suspension of bonuses in 2012) are likely to have been regarded as very persistent by agents. The subsequent years saw a gradual improvement in the macroeconomic conditions and in the prospects that Portugal would complete successfully the adjustment programme by mid-2014. This allowed the reversal of the wage cuts, in a process sped up by the decisions of the Constitutional Court. The negative shocks enacted in these later years essentially replaced measures previously overturned by the Court and as such agents most likely regarded them as temporary.

3 Two approaches for deriving the shocks

On the basis of the narrative presented in the previous section, it is possible to derive more than one shock series, depending on the assumptions made about the moment agents reacted to the shocks, and the change in income they perceived the shock to entail. We follow two alternative approaches in doing this: the payment approach and the announcement approach, which are summarised in Table 2. These two approaches are based on the methods followed by narrative studies about the effect of taxes, such as Romer and Romer (2010), Cloyne (2013) and Pereira and Wemans (2015). Note further that shocks are computed on a monthly frequency as the consumption and financial data are available at that same frequency.

The payment approach assumes that households reacted to shocks when wages actually changed and by the amount of the change. This is consistent with the empirical literature (in particular, associated with natural tax experiments) which documents that households react to changes in disposable income, even in the case of richer households, for whom liquidity constraints should be less binding. This approach is straightforward in the case of a change to the monthly wage: the shock is given by such change and assigned to the month this took effect. However, there is a difficulty in the case of changes affecting the Christmas and holiday bonuses, which are intermittent payments occurring in two specific months of the year.Footnote 5 A strict application of the payment approach is unfeasible in this case, as it would require recording a shock in the month the bonus was paid and to cancel it out in the following month, and proceed with such a recording in the subsequent years (given the non-transitory nature of the shock). We assume, as an alternative, some degree of smoothing, i.e. that employees received this income uniformly over the year following the date of payment. Specifically, to implement the payment approach we compute a reference monthly salary equal to the regular wage in t plus 1/12th of the bonuses received in t or up to 11 months before. The shock is given by the percentage change in this reference salary.

The announcement approach tries to capture the possibility that agents without liquidity constraints may have modified their behaviour once they learned about the coming changes in wages, even before these impacted actual payments. If this was the case, it is also likely that agents took into account the full impact of the measure on the salary (considering the regular wage and bonuses) and disregarded the precise timing of implementation of the measure, and their short-term impacts. Specifically, to implement the announcement approach we calculate a reference monthly salary, given the regular wage and 1/12th of the bonuses as set out in the legislation «credibly announced» in t (and remaining unchanged legislation). The shock is given by the percentage change in this reference salary vis-a-vis the previous announcement, or otherwise zero.

A practical difficulty with the announcement approach is to ascertain the time of the credible announcement of legislated measures. We chose to date the shocks to the time of approval of the respective legislation,Footnote 6 except where anticipation to a prior date was possible on the basis of Constitutional Court decisions. For example, the partial suspension of the Christmas and holiday bonuses is assigned for the full amount to January 2012, the date of approval, instead of June and November in the payment approach. The December 2015 measure reinstating the pre-2011 wages is recorded taking as a reference the final amount, while in the payment approach the recording follows the gradual pace of the reinstatement. We allow anticipation of the measures prompted by previous decisions of the Constitutional Court which implied a reasonably clear course of action by government. In this instance, the shocks are dated to the moment of the decision. This is the case of the obligation to re-instate the second bonus, in April 2013, and of the overturn of the 2014 wage cut, in May of that year. In contrast, we do not allow anticipation of measures preceded by Constitutional Court decisions for which there was uncertainty about how and when government would implement them. Examples of the latter are the Court decisions, respectively, of July 2012 overturning the cut in Christmas and holiday bonuses, and of August 2014 recommending the reinstatement of the pre-2011 wage level.

Figure 1 illustrates the evolution of the reference salaries in the two approaches, as driven by the legislated measures. We take as an example ten workers whose salaries in 2010 - ranging from 500 to 5000 euros - approximately covered the entire span of the distribution of public wages. The progressive nature of salary cuts is evident: salaries below 1000 euros were hardly affected, while those around 5000 euros had cuts reaching 20% at their maximum extent. Besides the precise timing of the shocks, the profile of salaries as driven by the shocks in each approach also differs. In particular, the temporary return of wages to the pre-2011 level, after the Constitutional Court rejected the 2014 wage cut, does not give rise to a shock in the announcement approach. Moreover, in the latter approach, the full reversal of the initial cut was concluded in just one step in January 2016, while in the payment approach this reversal extended further in time, reflecting its gradual nature.

Evolution of reference salaries as driven by the legislated measures for ten workers earning from 500 to 5000 euros in 2010. Note: Reference salaries chosen to approximately cover the entire span of the distribution of public salaries in 2010, ranging from 500 to 5000 euros, with 500-euro intervals. These salaries include the regular wage plus 1/12th of the bonuses (see Table 2 and the text for calculation).

4 Wage data and computation of shocks at the municipality level

The legislated changes throughout the analysed period have been first simulated at the worker level, from the initial values of reference salaries in 2010 - as exemplified in Fig. 1. The simulations were based on microdata from the 2005 Public Administration Census (Recenseamento Geral da Administração Pública), for Central Government and Regional Government of Madeira.Footnote 7 This Census was carried out for the last time in 2005 and encompasses detailed information at the level of the worker including the base wage and extra allowances (recall that the bonuses are defined by reference to the base wage). In the case of Local Government, data from the previous Census - dating from 1999 - were used, as the 2005 Census had an incomplete coverage of this government sector. Prior to the simulations, the wages as given in the Censuses were updated to 2010 (to proxy the level when the first cut was enacted), on the basis of the annual changes in the wage scale in the interim periods.

Shocks are thus computed on the basis of a projected rather than the actual distribution of salaries. This procedure, entailing the use of the wage distribution in the Censuses and the update to 2010 on the basis of the wage scale, is acceptable given the freezing of career progression (essentially the other source of changes in public wages, besides the wage scale) for most of the time from 2005 until the years after the economic and financial crisis.Footnote 8 Naturally there were also changes in the composition of the public workforce, driven by retirement and hiring of employees (dismissal of civil servants is only allowed in very special circumstances in Portugal), but it is reasonable to assume that the distribution of public wages within each municipality did not change substantially.

Given that data on private consumption and financial variables are available at the municipality level (see Sect. 7), we must aggregate individual shocks to that level, prior to assessing impacts. Following the simulation of individual wages and wage changes throughout the analysed period, figures have been added up to the municipality on the basis of the worker’s place of residence. There are 289 municipalities in total (those of Azores are excluded). Shocks across them have first been computed as a percentage of the public wage bill and then weighted to represent the change in the municipalities’ total income (as consumption data are also for the municipality as a whole). In doing so, we take 2010 fixed weights for the remaining income components. Specifically the private sector wage bill by municipality for 2010 is from Quadros de Pessoal, also a worker level database. We do not have data with the corresponding level of disaggregation for pensions and other sources of income. For these household income components, we used weights taken from the Household Expenditure Survey (Inquérito às despesas das famílias) 2010-2011, at the NUT2 level (an aggregated geographical classification, with only 7 regions in total). The fact that weights remain fixed throughout the simulation has the advantage of preventing that economic activity feeds backs into them (thereby generating endogeneity).

Table 3 presents - for the legislated measures enumerated in Table 1 - the corresponding shocks in the two approaches, aggregated to the municipality level. The median and first and third quartiles across the 289 municipalities show a great deal of sectional variation. For example, the interquartile range of the holiday bonus cut (2012) in the payment approach is 0.54 percent of municipality income for a median of 1.07 percent; this interquartile range is 0.35 percent for a median of 0.63 percent in the 2011 wage cut in the announcement approach. Such a sectional variability in the size of shocks across municipalities is a key ingredient, as it is the basis to estimate their effects. Figure 2 complements the evidence on Table 3, presenting the shocks’ time series and the full range of magnitudes across the 289 municipalities. This full range is for several shocks rather wide, varying from close to zero to up to two percent of the overall municipality income (over four percent for the largest shocks).

4.1 Assessing heterogeneity on the basis of affected workers’ characteristics

We investigate heterogeneity in the impacts of shocks by studying how these vary along the characteristics of affected workers, taking advantage of the fact that shocks are calculated from microdata. The first such characteristic is their position in the distribution of salaries - considering the joint distribution in the public and private sectors in 2010. We also investigate the existence of this kind of interaction with workers’ age. We note that this way of assessing heterogeneity is preferable to using indicators for the municipality as a whole, which may diverge from those for the population affected by shocks, particularly in municipalities where the share of private sectors workers is dominant.

As mentioned in Sect. 2, all wage cuts enacted in the period were progressive, affecting disproportionally civil servants in the upper part of the public wage distribution. When the distribution of private salaries is brought in, cuts become even more progressive as public employees tend to earn more than their private sector counterparts (mainly reflecting higher educational attainment). For instance, in 2010, the median salary in public administration was 77 percent above that in the private sector. Figure 3 illustrates such a progressivity. In this figure, workers in the public and private sectors were ranked according to their salaries in 2010, and the rank was normalized to the interval (0,1). The markers in the charts show the position within this rank of the 1st, 25th, 50th, 75th and 99th percentiles of the distribution of workers affected by shocks. For instance, only workers in the upper quintile of the private-public wage distribution had their wage reduced by the 2011 cut, while the partial suspension of the Christmas and holiday bonuses in 2012 was less progressive, affecting workers in the three upper quintiles.

Position of the workers affected by the shocks within the overall rank of public- private wages. Note: The salary rank is computed taking the workers in the public and private sectors, and normalized to the interval (0,1). The markers show the position within this rank of the 1st, 25th, 50th, 75th and 99th percentiles of the distribution of workers affected by shocks

There is nevertheless variation across municipalities in the location in the wage distribution of the affected workers. Panel (a) of Fig. 4 presents the average location across municipalities in the payment approach (similar evidence holds for the announcement approach). In the regressions we interact this average with the shocks to study how impacts vary with income. We carry out a similar exercise for average age which - as shown in Panel (b) - also denotes some variation across municipalities.

Characteristics of the workers affected by the shocks, averages by municipality. Note: Results for the payment approach. The position in the salary distribution is calculated on the basis of the rank presented in Fig. 3

5 Identification of shocks

This paper focus on changes in public salaries. Public salaries are not simultaneously determined with other economic variables in contrast to private salaries, nor they respond to current economic developments in a setting based on high frequency data such as monthly, contrary to taxes. Nevertheless, public salaries may respond to lagged economic activity if, for instance, policymakers when deciding about changes in wages took into consideration the state of the economy directly or indirectly. Therefore, not the full variation of public wages is suitable to assess the response of consumption. The exogenous source of variation used in this paper is the change in the public salary income by municipality holding fixed overall macroeconomic conditions, characteristics of municipalities and the trajectory of consumption at the municipality level at the time of the shock. Specifically, in the tradition of the narrative approach, the impact of shocks is assessed by means of a reduced-form specification (which is presented formally in the next section) controlling for:

National macroeconomic conditions

The changes in public wages in Portugal under analysis were triggered by the deterioration of public finances, which were themselves impacted by the overall macroeconomic situation of the country. Changes in the national macro conditions are controlled for by the inclusion of a time fixed effect.

Characteristics of municipalities

Shocks at the level of the municipality may be correlated with the characteristics of municipalities. For example, progressive shocks tend to affect disproportionately richer municipalities whose consumption may also behave differently in comparison to poorer ones during the crisis. Pure cross-sectional variation is controlled for by municipality fixed-effects.

Municipality-specific path of consumption prior to the shock

Several negative events were hitting economic agents in Portugal, particularly in the period up to 2013, notably other shocks of a fiscal nature (to taxes) and financial. It is conceivable that some them were correlated across municipalities with public wage shocks: for instance, tax shocks are also likely to have affected wealthier municipalities more severely. The inclusion of lags of municipality consumption controls for the impact of all factors affecting this variable around the time of wage shocks. At the same time the use of data at a monthly frequency makes it less likely that those other shocks took place systematically in the same time period as wage shocks, which could also be an issue.

In addition, we control for the lags of the wage shock itself and the change in the number of automated teller machines and point of sale terminals by municipality, which may cause unwanted variation in our measure of consumption (described in Sect. 7). A final point to note is that we weigh the wage shocks so that these represent the proportion of total municipality income (see Sect. 4) on the basis of fixed 2010 weights for the public vs private wage bill and remaining income categories. While this may introduce some measurement error in the shocks, as described above, such weights are fully pre-determined in relation to the post-2010 events and do not introduce any endogeneity by themselves.Footnote 9

6 Estimation of impacts using local projections

We use a reduced-form specification in which changes in consumption are regressed on the shock and a wide set of controls (see the previous section). This also bears some similarity (although in a dynamic panel setting) to the specifications used by authors such as Souleles et al. (2006) and Misra and Surico (2014) to assess the impact on consumption of income changes. Moreover, impulse-responses are estimated through local projections (Jordà 2005), similarly to Auerbach and Gorodnichenko (2013), Leduc and Wilson (2013), Romer and Romer (2017), Ramey and Zubairy (2018) and Fieldhouse et al. (2017), to mention just a few.

The responses of private consumption to changes in income, as a result of changes in public wages, are thus estimated by a series of regressions, for horizons (i.e. months ahead) h = 0, 1, ..., H

where i indexes municipalities, t indexes time, \({\text{ln}}c\) is the log of card withdrawals and payments, which proxy consumption, and \(\Delta W\) are the wage shocks. \({\varvec{C}}{\varvec{t}}{\varvec{r}}{\varvec{l}}\) is a vector of controls including \(\Delta {\text{ln}}c\), \(\Delta W\) and the change in the number of automated teller machines and point of sale terminals by municipality. We include a full year of lags of controls which is the standard in the literature.

As explained in Sect. 5, our shock is arguably exogenous conditional on the controls included. We are thus in a position to use a standard fixed-effects estimator. Standard errors are computed by the Driscoll and Kraay (1998) method, which is robust to the presence of broad patterns of correlation in the residual variables, notably across time and municipalities. The regressions are weighted by the weight of the municipality public and private wage bill in the national total. The regressions above yield the percentage response of consumption h months ahead to a 1 percent change in income, driven by a change in the public wage bill. We report in the tables the average cumulative response of consumption (percentage) over the horizon, computed as These figures are then converted into marginal propensities to consume (MPCs), which we will be looking at in the text. The analysis of average cumulative responses is convenient for MPCsFootnote 10, and it smooths out the noise in the responses stemming from using data a monthly frequency. We compute the impact of income shocks on the changes in household deposits and consumer debt on the basis of regressions similar to the ones above, considering as the dependent variable the change in the log of the respective stocks between t − 1 and t + h. For these financial variables, we report in the tables the average cumulative responses of the differences (not of the levels),Footnote 11 which are given by the coefficients of the shock averaged out over the horizon

We also study the impact of negative and positive shocks, and modify the specification above accordingly, including in the same regression the contemporaneous values and lags of both kinds of shocks. Moreover, we study the interaction of the shock with variables such as the means by municipality of the position in the overall wage distribution and of the age of the affected workers. This is done on the basis of specifications (in the case of consumption) of the type

where Z is each one of the interaction variables, and controls now include the lags of the interactions of the shock, in addition to the other variables. In this instance, the estimates reported in the tables refer to the overall marginal effect of the shock, including the interaction term.

7 Data on consumption and financial variables

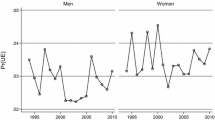

Household consumption is approximated by cash withdrawals at automated teller machines and payments at point of sale terminals by municipality, on a monthly basis (source: SIBS - Sociedade Interbancária de Serviços).Footnote 12 Such withdrawals and payments capture around 60 percent of purchases of non-durable goods plus durables excluding cars (cars are typically paid in a different way).

The series of card withdrawals and payments enters the regressions in first differences of logarithms, approximating percentage changes. In terms of percentage changes, the national total of card transactions has a correlation with private consumption in quarterly National Accounts over 90 percent for year-on- year rates, and close to 70 per cent for chain rates (this holds both for total and non-durable consumption). Figure 5 shows the evolution of the quarterly year-on- year rates of change.

Besides analysing the effects on consumption we study the impact of the wage shocks on household financial variables, namely deposits and consumer credit (source: Banco de Portugal ). These data are also available by municipality, on a monthly basis. All data were adjusted for seasonality and working day effects using the X13-ARIMA procedure and deflated using the Harmonised Index of Consumer Prices.

8 Response of private consumption

8.1 Payment approach

In the payment approach, shocks span between January 2011 and June 2017.Footnote 13 The data used in the local projection regressions start in 2010:1 (but the first year is lost in first-differencing) and end in 2018:12, given that we compute impulse- responses for up to 18 months ahead. Furthermore, we split the sample into the period up to 2012 and the subsequent years, in line with the two main periods that emerge from the narrative presented in Sect. 2.

Table 4 presents the impact of wage shocks - equal to one percent of household income - on consumption for the payment approach. The estimated impacts - where statistically significant - have the conventional positive sign: negative wage shocks decrease consumption, while positive shocks increase it. It is also apparent that impacts are quite different for the two subsamples and separating out positive and negative shocks.

In order to compute MPCs, we multiply the figures in the table by the ratio - equal to 0.83 - of average consumption to average income of Portuguese households in euro.Footnote 14 In the period 2011-2012 there are negative shocks only. The responses to them are clearly significant, with the average cumulative MPC estimates standing at 69 cents on impact, 47 cents after six months and 31 cents after eighteen months. In contrast, negative shocks in the years 2013-2017 produce no impact. Positive wage changes trigger an increase in consumption in this latter subsample, but such an increase is significant only up to six months and of a smaller magnitude, the average response remaining around 15 to 20 cents, per euro of change in income. In order to put these figures into perspective, simulations of a life cycle model with constant risk aversion in Jappelli and Pistaferri (2010) generate MPCs out of permanent shocks of 0.77 and 0.93, respectively, depending on whether agents could borrow or not. The corresponding figures for transitory shocks were 0.05 and 0.18.

The absence of a response to the wage cuts in 2013-2017 suggests that the affected households (mostly belonging to the upper brackets of the wage distribution) may have regarded them as transitory and smoothed them out. Specifically, agents could be expecting from the start the Constitutional Court to overturn the 2014 wage cut. Similarly, the lifting of the original 2011 wage cut in the months following that same Court decision was known in advance to be temporary and could have been disregarded by agents, along with the negative shock associated with the ensuing reintroduction. This contrasts with the cuts in the initial years that agents are likely to have regarded as long-lasting.

A second piece of evidence following from Table 4 is the more pronounced impact of negative shocks in the period 2011-2012 vis-a-vis that of positive shocks in the subsequent years. This is in line with previous work separating out the impacts of income declines and increases which has often found a stronger impact of the former. For instance, Bunn et al. (2018), on the basis of questions included in a household survey for the UK, reported MPCs of 64 and 14 pence per pound of change in income, over an annual horizon, respectively, for negative and positive shocks. In the same vein, Sahm et al. (2015) found that a sizeable segment of households in the US used the 2011 payroll tax cut mostly to rebuild their balance sheets (rather than spend more) and then, when the payroll tax cut expired in 2013, reacted by spending less (rather than drawing down their balance sheets).

In our context such an evidence could square with agents’ becoming gradually to expect the wage reinstatements that occurred in the post-2013 period,Footnote 15 which could have diluted in time their reaction. It is worth noting that such an asymmetry continues to hold in the announcement approach (see the next section), in which such reinstatements were lumped into one large shock rather than recorded as a sequence of smaller shocks.

8.2 Announcement approach

We now analyse the impact on consumption in the announcement approach, for which shocks span between January 2011 and January 2016.

The results for the announcement approach (Table 5) are generally much in line with those in the preceding section. Responses to negative shocks in the first subsample are statistically significant throughout the full horizon. The point estimates are slightly stronger and the response more persistent than in the payment approach. The average cumulative MPC estimates now stands at 77 cents on impact, 61 cents after six months and 51 cents after eighteen months. Nevertheless, the point estimates in both approaches, for a given horizon, are not different in statistical terms. It worth noting that particularly in 2011-20112 it is difficult to disentangle the impacts of shocks in each of the two approaches, as they overlap to a reasonable extent.Footnote 16

Literature studying effects of income shocks on consumption, notably, Shea (1995), Shapiro and Slemrod (1995), Parker (1999) and Souleles (1999), did not find much evidence of anticipation, as agents reacted to predictable income changes. Browning and Collado (2001) is an exception in this respect.Footnote 17 We read our evidence as indicating a response both at the time of announcement (which for these early shocks means the date of legislation approval) and at the time of payment, as one does not preclude the other. Indeed, there might have been some differentiation in the behaviour of agents in this respect. Below we show some evidence that workers at the upper wage cohorts reacted essentially at the time of announcement, while workers at the lower cohorts reacted at both dates.

A further issue arising is that agents could have anticipated the 2011-2012 shocks to the date of the discussion of the State Budget in parliament (given also the high likelihood of approval). We constructed an «enhanced» anticipation measure to encompass this possibility, which dates those shocks to November instead of January of the year after (see Table 3). However, for this measure the response on impact was not significant, becoming so around three months out. Therefore, such an earlier reaction apparently did not take place.

In the period 2013-2017 responses are non-significant for negative shocks as before. In the announcement approach there is just one such shock (see Fig. 2b), the 2014 wage cut which, as argued above, agents may have disregarded as temporary. As far as positive shocks are concerned, responses are slightly stronger but shorter-lived than in the payment approach. These are significant on impact and up to three months only (the average cumulative MPC standing, respectively, at 42 and 51 cents). The asymmetry between a stronger impact of negative shocks in 2011-2012 vis-a-vis that of positive shocks in the subsequent years continues to hold. Among such positive shocks, only the ones reinstating the pre-2011 level had a permanent nature. In contrast, the reversion of the 2011 cut, encompassed in the broader reversion of the 2014 cut, was certainly regarded as temporary by households. We experimented with the exclusion of this reversion, but the strength of the response remained approximately unchanged, confirming that the reinstatement of pre-2011 wages had a weaker effect than the initial cut.

9 Heterogeneity in the response of consumption by wages of workers affected

9.1 Payment approach

Table 6 shows the impacts of wage shocks on consumption in the payment approach, for the model interacting the shocks with the mean rank in the wage distribution of the concerned workers, by municipality.Footnote 18 As shown in Figure 3b, the mean rank - normalized to the interval (0,1) - lies above 0.6 for most shocks. We present results for interaction with the values 0.7, 0.8 and 0.9, which comprise most of the distribution of that mean rank across shocks (percentiles 15 to 90). The estimates shown are the overall marginal effect of the shocks when the interaction variable takes on the indicated values.

In the period 2011-2012, the average cumulative impacts (where statistically significant) go down, in absolute terms, as affected workers move up the wage distribution. Such a pattern becomes even more evident, converting the percentage responses in the table into euro-for-euro impacts on the basis of differentiated ratios of average consumption to average income, which tend to be lower at the upper income brackets.Footnote 19 Negative shocks in 2011-2012 trigger a decrease in consumption of 94 cents per euro of change in income, on impact, for the 0.7 mean rank. Over time, the average cumulative effect weakens somewhat, to 78 cents after one year and further to 73 cents half a year later, but it remains statistically significant throughout. For the 0.8 mean rank, the MPC is 73 cents on impact and remains statistically significant up to one year (31 cents, on average) only, while for the 0.9 mean rank, the response of consumption becomes just barely significant on impact (56 cents).

A decreasing profile of MPCs as one moves up the wage distribution is the one to expect on the assumption that ability to smooth out consumption is positively related to income. Several previous contributions came to analogous profiles of MPCs across income or wealth levels. For instance, Souleles et al. (2006) show that low-income or low-liquid-wealth households consumed a larger proportion of the 2001 tax rebate in the US, and Jappelli and Pistaferri (2014) document a negative correlation between MPC out of an income windfall and cash-on-handFootnote 20 for Italian households. This literature has often ascribed such an evidence to liquidity constraints and financial wealth holdings, an explanation less appealing in our case, as civil servants affected by the shocks generally ranked high in the wage distribution. Presumably, other factors such as differentiated income risk perceptions or precautionary behaviour could have been at play.

Negative shocks in 2013-2017 had no impact on consumption, even in the lower ranks. This evidence also plays down the importance of liquidity constraints. Presumably shocks would have to have an impact further down the wage distribution to produce a response of consumption.Footnote 21

The impact of positive shocks in the later years is suggestive of a negative relationship between the MPCs and the rank in the income distribution, as for negative shocks in 2011-2012. Nevertheless, responses are now significant only for the 0.7 mean rank, indicating for higher ranks a more marked dilution over time of the impact of pre-2011 wages’ reinstatement.

9.2 Announcement approach

Table 7 shows heterogeneity in consumption responses for the announcement approach. The average impacts of the large negative shocks in 2011-2012 are statistically significant across all the interaction values of the mean rank of the affected workers by municipality - albeit at the 10 percent level only for shorter horizons for the 0.9 mean rank. In this case, the MPCs range between 37 cents, on impact, to 69 cents, eighteen months out, on average (a decreasing trend being absent over the horizon considered). The fact that there is now a significant response, in contrast to the payment approach, indicates that a reaction at time of announcement was more prevalent among the higher-income workers. It is however noteworthy that responses are likewise significant and quite sizeable for the lower- income workers. The MPCs stand at around 2.5 euros, on impact, remaining at 1 euro and 20 cents, on average, after one year and half.

These point estimates are very large in absolute terms and much larger than those for the payment approach but should be seen with caution given that values of the mean rank lower than 0.80 are not represented in the sample for all shocks (in particular, not for the 2011 cut). Moreover, the uncertainty surrounding the estimates is large as well, so that the two standard-errors interval around the point estimates intersect in both approaches. Nevertheless, this points to an overreaction of the relatively less well-off households to the initial shocks, which could be consistent with these being felt through a precautionary behaviour effect.

In the announcement approach, the positive shocks in 2013-2017 trigger more marked responses than in the payment approach, in particular effects are significant for both the 0.7 and 0.8 mean ranks (the average MPCs being, respectively, 85 and 36 cents). This may indicate that the announcement approach captures slightly better (albeit still much imperfectly) the expectation of wage reinstatements which gradually emerged in later years.

10 Heterogeneity in the response of consumption by age of workers affected

We now turn to the impacts on consumption when shocks are interacted with the mean age of the workers affected by the shock. Table 8 presents the interactions with mean age equal to 41, 43 and 45, values which range approximately from percentile 10 to 90 of the variable.

In spite of the limited variability of mean age of the affected workers across municipalities, point estimates indicate a decreasing pattern of MPCs with age, both for negative shocks in 2011-2012 and for positive ones in 2013-2017. In the second subsample, this profile is more marked for the announcement approach. An issue that may be raised is to what extent the positive correlation between income and age of workers accounts for this result, given the similar pattern of decrease in the MPCs as income goes up, documented in the previous section. Correlation between income and age across shocks is indeed positive but not large - around 30 percent. Nevertheless, in order to control for it, we also estimated a model interacting the shocks with both variables, income and age, and the decreasing profile of MPC with age still mostly holds.Footnote 22

A stability of the MPC by age is to be expected when agents are still far from retirement (Christelis et al. 2019). In this vein, Souleles et al. (2006) report that MPCs out of the 2011 tax rebates in the US remain essentially unchanged across ages. Jappelli and Pistaferri (2014) documented a decreasing pattern of MPC out an income windfall with age, but mainly for persons at retirement. Our results, however, suggest a greater ability to smooth out consumption for elderly households in their active years. This could be due, for instance, to larger holdings of wealth (after controlling for income).

11 Responses of financial variables

Table 9 shows the average cumulative responses of change in deposits and in consumer debt, in percentage points in the payment approach. These responses may be transformed into euro-for-euro impacts, similarly to the calculations of MPCs, by multiplying them by the ratio of each financial variable (stock) to income.Footnote 23

In the period 2011-2012, for the 0.7 mean rank the change in deposits decreases by 47 cents per euro of reduction in income, on impact, by 15 cents three months out and by 8 cents eighteen months out, on average. This indicates that the relatively less well-off households smoothed out consumption to some extent by drawing deposits down. The responses for the workers further up the wage distribution are statistically significant on impact only (smaller variation of deposits of 46 cents, per euro of decrease in income). This does not fully match the hypothesis of an increased use of deposits to finance consumption as one moves up the wage distribution, in the wake of the initial negative income shocks, which one would expect from the results above. However, we are not looking at the full balance sheet. It could be that households in upper income cohorts were rather de- cumulating other types of financial assets, riskier than deposits, given the added uncertainty of economic environment in Portugal in the period.

It is worth noting that irrespective of a reaction at the time of announcement or at the time of payment, a smaller net accumulation of assets is always to be expected when income actually falls, if there is consumption smoothing to some extent. However, when the reaction occurs at the time of announcement, households will cut consumption already when they learn about the future income reduction, and assets will go up temporarily, while income remains unchanged. At the time income falls, such an increase is more than fully reversed. The response of deposits for the announcement approach in the period 2011-2012 does not indicate, however, a pattern of sign reversion.Footnote 24 For the 0.7 mean rank, there is a larger change in deposits on impact, as one would expect, but the responses for the remaining horizons are not significant. For the higher ranks, responses are similar to the ones in the payment approach.

In the period 2013-2017, a negative response of deposits to negative shocks is consistently significant for the 0.7 rank (smaller variation of 27 cents eighteen months out, on average, per euro of decrease in income). As in 2010-2011, this squares with some degree of consumption financing through a reduction in deposits. Again, no similar result is observed for the upper ranks.

In the wake of positive shocks in the later year, deposits do not go up. Actually, for the 0.8 and 0.9 mean ranks, the opposite occurs, albeit over a relative short horizon (change in deposits decreasing, respectively, by 10 and 17 cents after six months, on average). This suggests that there may have been a re-composition of financial assets portfolio, away from deposits and towards riskier assets.

Consumer debt goes down after the shocks in 2011-2012, indicating that this variable did not accommodate the income reduction, nor helped sustain consumption, to any extent. This holds across the different segments of the wage distribution that are being interacted with the shock, although the persistence of responses differs a bit across them. Negative shocks appear to have triggered debt repayment instead, possibly reflecting the enhanced restrictiveness of credit conditions during this period. Converting into euro-for-euro the respective magnitudes are, however, rather small: for example, change in debt falls on average by 2 cents or less after three months. The responses of consumer debt are generally not significant in the post-2012 period, but there is evidence of a decrease after positive shocks for shorter horizons, which continues to suggest debt repayment.

12 Conclusions

This paper focuses on the transmission of shocks in public wages to consumption decisions in Portugal in the framework of the sovereign debt crisis. The MPC depends on the nature and characteristics of the income shock. Our estimates point to a strong and persistent consumption response to the large negative shocks in 2011-2012. We estimate in this period MPCs of 0.7-0.8 on impact and 0.5- 0.7, on average, after one year. These results suggest that such shocks, besides unanticipated, have been perceived as rather persistent. Nevertheless, households smoothed to some extent their impact on consumption, partly through a reduction of deposits. The financial constraints predominant in this period hampered the smoothing of consumption through the credit mechanism. Indeed, those negative shocks triggered deleveraging by households.

From 2013 onwards, consumption responses to wage shocks were weaker, suggesting a more important role for consumption smoothing than before. Negative changes in wages in this period appear to have had no impact on consumption, being partly accommodated by a decrease in deposits. Agents likely perceived these changes as temporary, as they replaced measures previously overturned by the Constitutional Court. The positive shocks in these later years, including particularly a gradual reversion of previous wage cuts, had a significant positive effect on consumption. The magnitude and persistence of responses were nevertheless weaker relative to negative shocks in the first period. Such an evidence possibly reflects anticipation by agents that all wage cuts would be reversed, before actual implementation.

The response of consumption was generally larger, the lower the wages of those experiencing the shock. However, looking at the financial side, the decrease in deposits was much more evident for the relatively less well-off households, which is surprising. The interpretation of the effects on financial variables requires some caution though, as their evolution - in particular that of deposits - reflects not only income and consumption changes but also decisions about the financial asset portfolio.

Data availability

The data on the wage shocks underlying the findings of this study can be obtained from the corresponding author, Manuel Coutinho Pereira, upon request. The data on cash withdrawals at automated teller machines and payments at point of sale terminals should be requested from SIBS - Sociedade Interbancária de Serviços (https://www.sibs.com/). Data on deposits and consumer credit should be requested from Banco de Portugal (https://www.bportugal.pt/).

Notes

Card transactions approximate well consumption of non-durables and durables excluding cars (cars make up about half of purchases of durables). This is the actual aggregate we are studying throughout the paper, but for simplicity we refer to private consumption without this qualification.

In the framework of the program, there were important tax shocks as well. As explained in Section 5, this is dealt with by the inclusion of a wide set of controls and the use of data on a monthly frequency when measuring the effects of the shocks.

Figure 1 shows evidence on how workers were affected by the shocks depending on salaries earned.

In the two previous instances, the assessment by the Constitutional Court had been requested by Members of Parliament of the opposition parties.

As described above, this characteristic changed to a certain extent as part of the legislated changes we are studying.

Approximated by the publication date; when publication occurs until the mid of the month, the shock is allocated to that month, otherwise it is allocated to the following one.

Data for Azores Regional Government were not available and, for this reason, the municipalities in Azores were altogether excluded from the exercise.

Career progression was suspended in August 2005 until new legislation was approved in the course of 2008. However, due to delays in the coming into force of this new legislation, and the rules themselves governing workers’ progression, relatively few employees managed to get advancements until the freezing was re-introduced from January 2011 on and kept throughout the crisis.

The fact that we are relying on fixed income weights to derive the municipality-level shocks makes our setting resemble that of Bartik instruments. This is however accidental and our identification of shocks does not rely on a shift-share design.

In the analogous context of the presentation of fiscal multipliers, several authors such as Ramey (2016), have argued for the presentation of impulse-response functions as the ratio between the cumulative changes in the response-variable and the shock-variable.

Given the accounting identity between consumption,income and changes in house hold assets and liabilities.

Only transactions made with domestic cards were considered, given that it is intended to estimate the response of consumption of residents. The payments made through online banking were not included, because their breakdown by municipality is not available.

The phasing out of the 2011 cut was completed in October 2016, but this impacted the second bonus to be paid in the following year only in June, corresponding to the final shock in this approach.

Figures taken from the Household Expenditure Survey (Inquérito às despesas das famílias) 2010-2011. We considered all consumption classes, except car purchases and imputed rents, to approximate the type of purchases normally made with cards (see Sect. 7), and took all households. We could have as well taken only the households in the upper income brackets, say, in the three upper quintiles, to which affected workers mostly belong. As it turns out, the ratio of averages for the households in these quintiles is almost identical to the overall ratio.

Given the improvement in the macroeconomic situation and the stance taken by the Constitutional Court, from the time it decided to overturn the cut in the bonuses.

Clearly a way to investigate this issue is to include both shocks in the same regression, but results arenot clear-cut. Considering the full sample and the overall shock, to have more degrees of freedom given the overlapping of the two series, only the time of payment shocks appear significant; if we confine the estimation to the years 2011–2012, then only the shocks in the announcement approach appear significant.

One could as well have considered the interaction with the median almost without changing the results, because the correlation between me an and median is around 0.95.

Specifically, we now consider the average propensities to consume within percentiles 60 to 80, 70 to 90 and 80 to 100 of the income distribution, respectively equal to 0.88, 0.77 and 0.66 (figures computed on the basis of the Household Expenditure Survey).

Defined as the sum of disposable income and financial wealth net of consumer debt.

The MPC evaluated at a mean rank of 0.6 (not shown), a value already at the bottom of the distribution in our data, still indicates no effect.

The exception being for the payment approach in the second sub sample, where the estimates are not statistically significant anymore.

This is done on the basis of information from the Household Finance and Consumption Survey 2013. Specifically, we consider the ratio of the mean stock to mean income within percentiles 60 to 80, 70 to 90 and 80 to 100 of the income distribution. Such ratios are, respectively, equal to 0.70, 0.63 and 0.58, in the case of deposits, and 0.11, 0.08 and 0.06, in the case of consumer debt.

Results for the announcement approach are not shown in order not to overburden the text, but available upon request.

References

Agarwal S, Liu C, Souleles NS (2007) The reaction of consumer spending and debt to tax rebates—evidence from consumer credit data. J Polit Econ 115(6):986–1019

Agarwal S, Qian W (2014) Consumption and debt response to unanticipated income shocks: Evidence from a natural experiment in Singapore. Am Econ Rev 104(12):4205–30

Auerbach AJ, Gorodnichenko Y (2013) Output spillovers from fiscal policy. Am Econ Rev Papers Proc 103(3):141–146

Browning M, Collado MD (2001) The response of expenditures to anticipated income changes: Panel data estimates. Am Econ Rev 91(3):681–692

Bunn P, Le Roux J, Reinold K, Surico P (2018) The consumption response to positive and negative income shocks. J Monetary Econ 96(C):1–15

Chodorow-Reich G (2019) Geographic cross-sectional fiscal spending multipliers: What have we learned? Am Econ J Econ Policy 11(3):1–34

Christelis D, Georgarakos D, Jappelli T, Pistaferri L, van Rooij M (2019) Asymmetric consumption effects of transitory income shocks. Econ J 129(622):2322–2341

Cloyne J (2013) Discretionary tax changes and the macroeconomy: New narrative evidence from the United Kingdom. Am Econ Rev 103(4):1507–1528

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Dupor B, Karabarbounis M, Kudlyak M, Saif Mehkari M (2023) Regional consumption responses and the aggregate fiscal multiplier. Rev Econ Stud 90(6):2982–3021

Fagereng A, Holm MB, Natvik GJ (2021) MPC heterogeneity and household balance sheets. Am Econ Rev Macroecon 13(4):1–54

Fieldhouse A, Mertens K, Ravn MO (2017) The macroeconomic effects of government asset purchases: Evidence from postwar US housing credit policy. Am Econ Rev 133(3):1503–1560

Gelman M (2021) What drives heterogeneity in the marginal propensity to consume? Temporary shocks vs persistent characteristics. J Monet Econ 117(C):521–542

Gross DB, Souleles NS (2002) Do liquidity constraints and interest rates matter for consumer behavior? Evidence from credit card data. Quart J Econ 7(1):149–185

Jappelli T, Pistaferri L (2010) Fiscal policy and MPC heterogeneity. Ann Rev Econ 2(1):479–506

Jappelli T, Pistaferri L (2014) Fiscal policy and MPC heterogeneity. Am Econ J Macroecon 6(4):107–136

Jappelli T, Pistaferri L (2017) The economics of consumption: theory and evidence. Oxford University Press, New York

Kueng L (2018) Excess sensitivity of high-income consumers. Quarterly J Econ 133(4):1693–1751

Leduc S, Wilson D (2013) Roads to prosperity or bridges to nowhere? Theory and evidence on the impact of public infrastructure investment. In: Acemoglu D, Parker J, Woodford M (eds) NBER macroeconomics annual, vol 27. University of Chicago Press, Chicago, pp 89–142

Lewis DJ, Melcangi D, Pilossoph L (2021) Latent heterogeneity in the marginal propensity to consume. FRB of New York Staff Report 902, New York. https://www.newyorkfed.org/research/staff_reports/sr902

Mertens K, Ravn M (2013) The dynamic effects of personal and corporate income tax changes in the United States. Am Econ Rev 103(4):1212–47

Mian A, Rao K, Sufi A (2013) Household balance sheets, consumption, and the economic slump. Quart J Econ 128(4):1687–1726

Misra K, Surico P (2014) Consumption, income changes, and heterogeneity: Evidence from two fiscal stimulus programs. Am Econ J Macroecon 6(4):84–106

Parker J (1999) The reaction of household consumption to predictable changes in social security taxes. Am Econ Rev 89(4):959–973

Parker JA, Souleles NS, Johnson DS, McClelland R (2013) Consumer spending and the economic stimulus payments of 2008. Am Econ Rev 103(6):2530–53

Pereira MC, Wemans L (2015) Output effects of a measure of tax shocks based on changes in legislation for portugal. Hacienda Pública Española 215(4):27–62

Ramey VA (2011) Identifying government spending shocks: it’s all in the timing. Quart J Econ 126(1):1–50

Ramey VA (2016) Macroeconomic shocks and their propagation. In: Taylor J, Uhlig H (eds) Handbook of macroeconomics, vol 2, Ch. 2. Elsevier, Amsterdam, pp 71–162

Ramey VA, Zubairy S (2018) Government spending multipliers in good times and in bad: Evidence from US historical data. J Polit Econ 126(2):850–901

Romer C, Romer D (2010) The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks. Am Econ Rev 100(3):763–801

Romer C, Romer D (2017) New evidence on the aftermath of financial crises in advanced countries. Am Econ Rev 107(10):3072–3118

Sahm CR, Shapiro MD, Slemrod J (2015) Balance- sheet households and fiscal stimulus: Lessons from the payroll tax cut and its expiration. Working Paper 21220 National Bureau of Economic Research, Cambridge. https://www.nber.org/papers/w21220

Shapiro MD, Slemrod J (1995) Consumer response to the timing of income: Evidence from a change in tax withholding. Am Econ Rev 85(1):274–283

Shea J (1995) Union contracts and the life-cycle/permanent-income hypothesis. Am Econ Rev 85(1):186–200

Souleles NS (1999) The response of household consumption to income tax refunds. Am Econ Rev 89(4):947–958

Souleles NS, Parker JA, Johnson DS (2006) Household expenditure and the income tax rebates of 2001. Am Econ Rev 96(5):1589–1610

Jordà Ó (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Acknowledgements

We would like to thank João Amador, António Antunes, Lara Wemans, anonymous referees and participants in an internal seminar for valuable comments. The views expressed are those of the authors and do not necessarily coincide with those of Banco de Portugal or the Eurosystem. All errors are ours.

Funding

Open access funding provided by FCT|FCCN (b-on).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Alves, N., Cardoso, F. & Pereira, M.C. Response of consumers to wage shocks in the framework of the Portuguese assistance program. Port Econ J (2024). https://doi.org/10.1007/s10258-024-00254-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10258-024-00254-9