Abstract

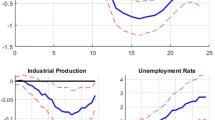

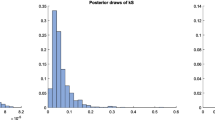

This study aims to analyze the time-varying effects of global economic policy uncertainty (GEPU) shocks on macroeconomic activity in Turkey over the quarterly period of 1999q1 to 2020q4. To this end, the study uses the GEPU index developed by Davis (Working paper 22740, National Bureau of Economic Research, 2016) and employs the time-varying parameter vector autoregression (TVP-VAR) model. Empirical evidence shows that the GEPU shocks have adverse effects on the macroeconomic activity as they result in declines in share prices, investment, employment, consumption, and GDP growth. It is also evident that these effects vary over time, with the highest impact observed following the crises periods such as the 9/11 attacks, the Iraq invasion, the global financial crisis (GFC), and the Covid-19 pandemic. The time-varying impacts typically reach the maximum in the first and second lag periods, and the most severe impacts of uncertainty are observed on share prices and investment. The study also examines three substantial events (the 9/11 attacks, the GFC, and the Brexit referendum) and finds that the responses of the underlying variables to GEPU shocks vary both in magnitude and signs over the sample period. The responses of the variables are mainly more severe during the periods when geopolitical and economic concerns are high compared to periods of political crises. Overall, the findings from the analyses indicate that the Turkish economy still maintains its fragile structure and suggest that the adverse macroeconomic effects of foreign uncertainty shocks do not remain the same over time.

Similar content being viewed by others

Notes

The reason for using this period is that the data of the macroeconomic variables can be obtained from the databases without interruption.

The United States, the United Kingdom, Australia, France, Germany, Spain, Ireland, Italy, the Netherlands Sweden, Greece, Canada, China, Japan, Russia, South Korea, Mexico, Chile, Colombia, Brazil, and India.

All the growth rates are computed as a percentage change from same quarter of previous year.

The causality between the variables is also checked for different lags and found that there is unilateral causality running from GEPU to all other macroeconomic variables at lags from 2 to 5. The study also checked the causal relationship between the variables using the leveraged bootstrap approach developed by Hacker and Hatemi-J (2006) since this approach overcomes problems of non-normality and ARCH effects in the data. The method points to the same result as the Granger causality test.

References

Al-Thaqeb SA, Algharabali BG (2019) Economic policy uncertainty: a literature review. J Econ Asymmetries 20:e00133

Baker SR, Bloom N, Davis SJ (2013) Measuring economic uncertainty. Working paper 21633. National Bureau of Economic Research

Bansal R, Yaron A (2004) Risks for the Long Run: A Potential Resolution of Asset Pricing Puzzles. J Financ 59(4):1481–1509

Bernanke BS (1983) Irreversibility, Uncertainty, and Cyclical Investment. Q J Econ 98(1):85–106

Bhattarai S, Chatterjee A, Park WY (2020) Global spillover effects of US uncertainty. J Monet Econ 114:71–89

Biljanovska N, Grigoli F, Hengge M (2017) Fear thy neighbor: spillovers from economic policy uncertainty. Working paper 17/240, International Monetary Fund

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–176

Bloom N (2017) Observations on Uncertainty. Aust Econ Rev 50(1):79–84

Bloom N, Bond S, Reenen JV (2007) Uncertainty and investment dynamics. Rev Econ Stud 74(2):391–415

Braun PA, Mittnik S (1993) Misspecifications in Vector Autoregressions and Their Effects on Impulse Responses and Variance Decompositions. J Econ 59(3):319–341

Byrne JP, Davis EP (2005) Investment and uncertainty in the G7. Review of World Economics/Weltwirtschaftliches Archiv 141(1):1–32

Caggiano G, Castelnuovo E, Groshenny N (2014) Uncertainty shocks and unemployment dynamics in U.S recessions. J Monet Econ 67:78–92

Caggiano G, Castelnuovo E, Figueres JM (2020) Economic Policy Uncertainty Spillovers in Booms and Busts. Oxford Bull Econ Stat 82(1):125–155

Carrière-Swallow Y, Céspedes LF (2013) The Impact of Uncertainty Shocks in Emerging Economies. J Int Econ 90(2):316–325

Chamon M, Liu K, Prasad E (2013) Income Uncertainty and Household Savings in China. J Dev Econ 105:164–177

Cheng CHJ (2017) Effects of Foreign and Domestic Economic Policy Uncertainty Shocks on South Korea. J Asian Econ 51:1–11

Choi S (2018) The Impact of US Financial Uncertainty Shocks on Emerging Market Economies: An International Credit Channel. Open Econ Rev 29(1):89–118

Choi S, Loungani P (2015) Uncertainty and unemployment: the effects of aggregate and sectoral channels. Working paper 15/36, International Monetary Fund

Christidou M, Panagiotidis T, Sharma A (2013) On the Stationarity of per Capita Carbon Dioxide Emissions over a Century. Econ Model 33:918–925

Cuestas JC, Garratt D (2011) Is real GDP per Capita a Stationary Process? Smooth Transitions, Nonlinear Trends and Unit Root Testing. Empir Econ 41:555–563

Davis SJ (2016) An index of global economic policy uncertainty. Working paper 22740, National Bureau of Economic Research

Dixit AK, Pindyck RS (1994) Investment under Uncertainty. Princeton University Press, Princeton

Ferderer JP (1993) The Impact of Uncertainty on Aggregate Investment Spending: An Empirical Analysis. J Money, Credit, Bank 25(1):30–48

Ferrara L, Lhuissier S, Tripier F (2017) Uncertainty fluctuations: measures, effects and macroeconomic policy challenges. CEPII, Policy Brief, No: 20

Ferrara L, Guérin P (2018) What are the macroeconomic effects of high-frequency uncertainty shocks? J Appl Economet 33(5):662–679

Fontaine I, Didier L, Razafindravaosolonirina J (2017) Foreign Policy Uncertainty Shocks and US Macroeconomic Activity: Evidence from China. Econ Lett 155:121–125

Fontaine I, Razafindravaosolonirina J, Didier L (2018) Chinese Policy Uncertainty Shocks and the World Macroeconomy: Evidence from STVAR. China Econ Rev 51:1–19

Gabauer D, Gupta R (2018) On the transmission mechanism of country-specific and international economic uncertainty spillovers: Evidence from a TVP-VAR connectedness decomposition approach. Econ Lett 171:63–71

Ghosal V, Ye Y (2015) Uncertainty and the employment dynamics of small and large businesses. Working paper 15/4, International Monetary Fund

Ghosal V, Laungani P (2000) The Differential Impact of Uncertainty on Investment in Small and Large Businesses. Rev Econ Stat 82(2):383–343

Giavazzi F, McMahon M (2012) Policy Uncertainty and Household Savings. Rev Econ Stat 94(2):517–531

Gilchrist S, Sim JW, Zakrajšek E (2014) Uncertainty, financial frictions, and investment dynamics. Working paper 20038, National Bureau of Economic Research

Gong Y, He Z, Xue W (2022) EPU spillovers and stock return predictability: A cross-country study. J Int Financ Mark Inst Money 78:101556

Guariglia A (2001) Saving Behaviour and Earnings Uncertainty: Evidence from the British Household Panel Survey. J Popul Econ 14(4):619–634

Gulen H, Ion M (2015) Policy uncertainty and corporate investment. Rev Financ Stud 29(3):523–564

Gupta R, Lau CKM, Wohar ME (2019) The Impact of US Uncertainty on the Euro Area in Good and Bad Times: Evidence from a Quantile Structural Vector Autoregressive Model. Empirica 46:353–368

Hacker RS, Hatemi-J A (2006) Tests for causality between integrated variables using asymptotic and bootstrap distributions: theory and application. Appl Econ 38(13):1489–1500

Haddow A, Hare C, Hooley J, Shakir T (2013) Macroeconomic Uncertainty: What Is It, How Can We Measure It and Why Does it Matter? Bank of England Quarterly Bulletin 53(2):100–109

Harvey DI, Leybourne SJ (2007) Testing for Time Series Linearity. Economet J 10(1):149–165

Harvey DI, Leybourne SJ, Xiao B (2008) A Powerful Test for Linearity When the Order of Integration is Unknown. Stud Nonlinear Dyn Econom 12(3):1–24

Hassler J (2001) Uncertainty and the Timing of Automobile Purchases. Scand J Econ 103(2):351–366

Jo S (2014) The Effects of Oil Price Uncertainty on Global Real Economic Activity. J Money, Credit, Bank 46(6):1113–1135

Julio B, Yook Y (2012) Political Uncertainty and Corporate Investment Cycles. J Financ 67(2):45–83

Kamber G, Karagedikli Ö, Ryan M, Vehbi T (2016) International spill-overs of uncertainty shocks: evidence from a FAVAR. Working paper 61/2016, Centre for Applied Macroeconomic Analysis

Kang SH, Islam F, Twari AK (2019) The Dynamic Relationships among CO2emissions, Renewable and Non-Renewable Energy Sources, and Economic Growth in India: Evidence from Time-Varying Bayesian VAR model. Struct Chang Econ Dyn 50:90–101

Kapetanious G, Shinn Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 112(2):359–379

Keynes JM (1936) The General Theory of Employment, Interest, and Money. Macmillan, Cambridge University Press

Keynes JM (1937) The General Theory of Employment. Q J Econ 51(2):209–223

Khraief N, Shahbaz M, Heshmati A, Azam M (2020) Are Unemployment Rates in OECD Countries Stationary? Evidence from Univariate and Panel Unit Root Tests. N Am J Econ Finance 51

Knight FH (1921) Risk, Uncertainty and profit. Boston and New York, Houghton Mifflin Company

Leland HE (1968) Saving and Uncertainty: The Precautionary Demand for Saving. Q J Econ 82(3):465–473

Liang CC, Troy C, Rouyer E (2020) US uncertainty and Asian stock prices: evidence from the asymmetric NARDL model. N Am J Econ Finance 51

Luk P, Cheng M, Wong K (2020) Economic Policy Uncertainty Spillovers in Small Open Economies: The Case of Hong Kong. Pasific Economic Review 25(1):21–46

Lyhagen J (2001) The Effect of Precautionary Saving on Consumption in Sweden. Appl Econ 33(5):673–681

McDonald R, Siegel D (1986) The Value of Waiting to Invest. Q J Econ 101(4):707–728

Mezhgani I, Haddad HB (2017) Energy Consumption and Economic Growth: An Empirical Study of the Electricity Consumption in Saudi Arabia. Renew Sustain Energy Rev 75:145–156

Mody A, Ohnsorge F, Sandri D (2012) Precautionary savings in the great recession. Working paper 12/42, International Monetary Fund.

Motegi K, Sadahiro A (2018) Sluggish private investment in Japan’s Lost Decade: mixed frequency vector autoregression approach. N Am J Econ Finance 43:118–128

Nakajima J (2011) Time-Varying Parameter VAR Model with Stochastic Volatility: An Overview of Methodology and Empirical Applications. Monetary Econ Stud 29:107–142

Nakajima J, Kasuya M, Watanabe T (2011) Bayesian analysis of time-varying parameter vector autoregressive model for the Japanese economy and monetary policy. J Jpn Int Econ 25(3):225–245

Nilavongse R, Rubaszek M, Uddin GS (2020) Economic policy uncertainty shocks, economic activity, and exchange rate adjustments. Econ Lett 186

Pástor L, Veronesi P (2013) Political Uncertainty and Risk Premia. J Financ Econ 110(3):520–545

Primiceri GE (2005) Time Varying Structural Vector Autoregressions and Monetary Policy. Rev Econ Stud 72(3):821–885

Romer CD (1990) The Great Crash and the Onset of the Great Depression. Q J Econ 105(3):597–624

Sandmo A (1970) The Effect of Uncertainty on Saving Decisions. Rev Econ Stud 37(3):353–360

Schaal E (2017) Uncertainty and Unemployment. Econometrica 85(6):1675–1721

Segal G, Shaliastovich I, Yaron A (2015) Good and Bad Uncertainty: Macroeconomic and Financial Market Implications. J Financ Econ 117(2):395–397

Setiastuti SA (2017) Time-Varying Macroeconomic Impacts of Global Economic Policy Uncertainty to a Small Open Economy: Evidence from Indonesia. Buletin Ekonomi Moneter Dan Perbankan 20(2):129–148

Shah SZ, Baharumshah AZ, Said R, Murdipi R (2019) The International Transmission of Volatility Shocks on an Emerging Economy: The Case of Malaysia. Malays J Econ Stud 56(2):243–265

Sialm C (2005) Stochastic Taxation and Asset Pricing in Dynamic General Equilibrium. J Econ Dyn Control 30(3):511–540

Sollis R (2009) A Simple Unit Root Test against Asymmetric STAR Nonlinearity with an Application to Real Exchange Rates in Nordic Countries. Econ Model 26(1):118–125

Stockhammar P, Österholm P (2016) Effects of US policy uncertainty on Swedish GDP growth. Empir Econ 50:443–462

Stockhammar P, Österholm P (2017) The Impact of US Uncertainty Shocks on Small Open Economies. Open Econ Rev 28(2):347–368

Sum V (2013) The ASEAN stock market performance and economic policy uncertainty in the United States. Economic Papers: A Journal of Applied Economics and Policy 32(4):512–521

Trung NB (2019) The Spillover Effect of the US Uncertainty on Emerging Economies: A Panel VAR Approach. Appl Econ Lett 26(3):210–216

Trung NB (2019) The spillover effects of US economic policy uncertainty on the global economy: a global VAR approach. N Am J Econ Finance 48:90–110

van Asselt MBA, Rotmans J (2002) Uncertainty in Integrated Assessment Modelling––from Positivism to Pluralism. Clim Change 54(1–2):75–105

Yalçınkaya Ö, Daştan M (2020) Effects of global economic, political and geopolitical uncertainties on the Turkish economy: a SVAR analysis. Rom J Econ Forecast 23(1):97–116

Yan M, Shi K (2021) The impact of high-frequency economic policy uncertainty on China’s macroeconomy: evidence from mixed-frequency VAR. Econ Res-Ekon Istraživanja 34(1):3201–3224

Yun Y, Jung HY (2020) Effects of Uncertainty Shocks on Household Consumption and Working Hours: A Fuzzy Cognitive Map-Based Approach. Mathematics 8(6):1–13

Zeldes SP (1989) Optimal Consumption with Stochastic Income: Deviations from Certainty Equivalence. Q J Econ 104(2):275–298

Zhang D, Lei L, Kutan AM (2019) Economic policy uncertainty in the US and China and their impact on the global markets. Econ Model 79:47–56

Acknowledgements

The authors thank the editor, Ana Fernandes, and anonymous referees for helpful comments and suggestions. This work was derived from Muhammet Daştan's Ph.D thesis at Atatürk University, Graduate School of Social Sciences, Erzurum, Turkey.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

About this article

Cite this article

Daştan, M., Karabulut, K. & Yalçınkaya, Ö. The time-varying impacts of global economic policy uncertainty on macroeconomic activity in a small open economy: the case of Turkey. Port Econ J 23, 275–311 (2024). https://doi.org/10.1007/s10258-023-00239-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-023-00239-0