Abstract

Climate change is a global issue that is driving up commodity prices such as food, energy and fertiliser. In this light, this study examines the effects of climate change on international commodity prices (food, energy, and fertilisers) from 1961 to 2020. The study employs a Bayesian Vector Autoregression (BVAR) model identified with sign restrictions. First, this study finds that climate change causes an increase in commodity prices, with the effect being greatest for energy, followed by fertilisers, and least for food prices. Second, this study also finds that climate change may have amplified the short-run impact of fertiliser and energy prices on food prices. Third, the estimates suggest that climate change may have a negative impact on global real GDP. Overall, this study’s findings of global climate change’s positive effects on commodity prices and a negative impact on global real GDP, suggests that monetary authorities may face higher inflation-output trade-off. Hence, this study argues that climate change may be a new challenge to monetary policy strategy, particularly in countries that are net importers of staple foods and have a large share of food items in their consumer price index.

Similar content being viewed by others

Data availability

The data that supports the findings of this study are available in United Nations Food and Agriculture Organization (FAOSTAT), World Bank Commodity Price Statistics (The Pink Sheet), and United States Environmental Protection Agency (EPA) Repositories.

Notes

These include measures like regulating carbon emissions through a carbon tax, emission trading system (ETS), subsidies, tax credits, guarantees, and provision of infrastructure or technology regulation.

Rising temperatures, altered precipitation, decreased oxygen, rising sea levels, extreme events, flooding, drought, increased storms and cyclones, heat waves, acidification and air pollution, and so on.

Among the many measures taken to combat climate change and decarbonise the economy are the following: a carbon tax; subsidies; emission trading system, guarantees; technology regulation; targets and infrastructure; tax credits for renewable energy investment; renewable electricity portfolio standards; and tax credits for residential solar systems, electric vehicles, and weatherisation of both homes and business buildings.

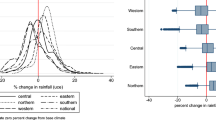

Also, as a result of changes in rainfall patterns or longer growing seasons, some climes can experience positive supply shocks from physical risks.

An increase in the carbon tax or price increases the cost of generating fossil fuels, causing their prices to rise. Because oil is used in the manufacturing and distribution of the vast majority of commodities, an increase in its price raises production costs. Profit margins are stretched when production costs grow, and firms seek to boost prices to maintain markups (Garganas 2006).

The net inflation benefit would be the difference between the inflationary effects of unchecked climate change and mitigation measures.

Climate change is defined in this study as a significant change in the average global average temperatures and precipitation over a long period of time. Four factors influenced the selection of this definition. First, key institutions (EPA, NASA, FAO, NOAA) often report key indicators of climate change, such as temperature and precipitation anomalies. Second, even the Paris Agreement target was set on temperature anomalies. Third, Hansen and Lebede (1987) demonstrate that temperature anomalies, rather than absolute temperatures, are the most appropriate measure of climate change. Fourth, Dell et al. (2012), Acevedo et al. (2018), Mukherjee and Ouattara (2021), Faccia et al. (2021), and Iliyasu et al. (2023) used temperature and precipitation anomalies to proxy climate change in their studies. Thus, using this definition, this study can measure climate change using temperature and precipitation anomalies.

Evidence suggests that climate change raises energy prices (Golombek et al. 2012; Wade and Jennings 2015), and an increase in energy prices affects the cost of nitrogen fertilisers (urea & ammonium nitrate), which are produced primarily from natural gas (FAO 2022). Also, the direct impact of climate change on fertiliser prices may stem from damages to physical capital.

Biofuel and fertiliser productions, for example, are emission-intensive and climate-sensitive; hence, climate change or the implementation of a carbon tax can push up energy, fertiliser, and food prices differently.

The natural question is how much of the pass-through of energy and fertiliser prices to food prices may be attributed to climate change shock.

This is known as conditional or shock-dependent pass-through and it is defined as the ratio of the total (cumulative) effect of shock j on price p over the total (cumulative) effect of the same shock on the inputs prices s (ECB 2020, p. 10). For consistency, we replace the exchange rate with input cost in the ECB’s definition. The conditional pass-through is computed using the formula: \(PT_{{n,s}}^{\tau }=\frac{{\sum\nolimits_{{j=0}}^{\tau } {\partial {\pi _{t+j}}/\partial \varepsilon _{t}^{s}} }}{{\sum\nolimits_{{j=0}}^{\tau } {\partial \Delta {e_{t+j}}/\partial \varepsilon _{t}^{s}} }}\), (see; An et al. 2020, p. 18). This metric measures the pass-through of input costs to food price when movements in energy and fertiliser prices are induced by climate change rather than exogenous movements in input price itself.

References

Abidoye BO, Odusola AA (2015) Climate change and economic growth in Africa: an econometric analysis. J Afr Econ 277–301. https://doi.org/10.1093/jae/eju033

Acevedo S, Mrkaic M, Novta N, Pugacheva E, Topalova P (2018) The effects of weather shocks on economic activity: what are the channels of impact. IMF Working Paper No WP/18/144, International Monetary Fund

An L, Wynne MA, Zhang R (2020) Shock-dependent exchange rate pass-through: evidence based on a narrative sign approach. Globalization Institute Working Paper 379, Federal Reserve Bank of Dallas. https://doi.org/10.24149/gwp379

Batten S, Sowerbutts R, Tanaka M (2016) Let’s talk about the weather: the impact of climate change on central banks. Bank of England Staff Working Paper No. 603. http://www.bankofengland.co.uk/research/Pages/workingpapers/default.aspx

Bofinger P, Reischle J, Schachter A (2006) Monetary Policy: goals, institutions, strategies, and Instruments. Oxford University Press, Oxford

Breitenfellner A, Pointner W, Schuberth H (2019) The potential contribution of central banks to green finance. Vierteljahrshefte zur Wirtschaftsforschung, ISSN 1861 – 1559, vol 88. Duncker & Humblot, Berlin, pp 55–71. https://doi.org/10.3790/vjh.88.2.55

Cachia F (2014) Regional food price inflation transmission. Food and Agriculture Organization of the United Nations (FAO) Statistics Division ESS Working Paper No. 14 – 01, April 2014

Ciccarelli M, Mojon B (2010) Global inflation. Rev Econ Stat 92(3):524–535

Coelho R, Restoy F (2022) The regulatory response to climate risks: some challenges. Financial Stability Institute (FSI) FSI Briefs No 16, Bank for International Settlements (BIS). http://www.bis.org

Comunale M, Kunovac D (2017) Exchange rate pass-through in the euro area. European Central Bank Working Paper Series No 2003/January 2017

Dell M, Jones BF, Olken BA (2012) Temperature shocks and economic growth: evidence from the last half-century. Am Econ J Macroecon 4(3):66–95

ECB (2020) Exchange rate pass-through in the euro area and EU countries. (E. Ortega, and C. Osbat, Eds.) European Central Bank (ECB) Occasional Paper Series No 241 / April 2020

Economides G, Xepapadeas A (2018) Monetary policy under climate change. Category 7: Monetary Policy and International Finance, CESifo Working Paper No. 7021

Evans CL (2011) What are the implications of rising commodity prices for inflation and monetary policy? Chicago Fed Letter 286

Faccia D, Parker M, Stracca L (2021) Feeling the heat: extreme temperatures and price stability. European Central Bank (ECB) Working Paper Series No 2626 / December 2021

Fankhauser S, Tol RS (2005) On climate change and economic growth. Resour Energy Econ 27(2005):1–17

FAO (2021) Temperature change statistics 1961–2020: Global, regional and country trends. FAOSTAT Analytical Brief 19

FAO (2022) 2022 Food Outlook – Biannual Report on Global Food Markets. Food and Agricultural Organisation, Rome. https://doi.org/10.4060/cb9427en

Forbes K, Hjortsoe I, Nenova T (2020) International evidence on shock-dependent exchange rate passthrough. IMF Econ Rev 68(2020):721–763

Furceri D, Loungani P, Simon J, Wachter SM (2016) Global food prices and domestic inflation: some cross-country evidence. Oxf Econ Pap 68(3):665–687

Garganas NC (2006) Macroeconomic management in an environment of aggregate supply shocks – lessons from recent experience. Background paper to a speech by Mr Nicholas C Garganas, Governor of the Bank of Greece, at the SEANZA Symposium, Bank Negara Malaysia, Kuala Lumpur, 25 November 2006

Golombek R, Kittelsen SA, Haddeland I (2012) Climate change: impacts on electricity markets in Western Europe. Clim Change 113(2012):357–370. https://doi.org/10.1007/s10584-011-0348-6

Hagos BG (2018) Climate change driven food inflation in Ethiopia? Asian J Empir Res 8(1):13–22

Hansen J, Lebede S (1987) Global trends of measured surface air temperature. J Phys Res 92(D11):13345–13372

Heinen A, Khadan J, Strobl E (2018) The price impact of extreme weather in developing countries. Econ J 129(619):1327–1342. https://doi.org/10.1111/ecoj.12581

Iliyasu J, Mamman SO, Ahmed UA (2023) Impact of climate change on output and inflation in Africa’s largest economies. Climate Dev. https://doi.org/10.1080/17565529.2023.2172315

Jain A, O’Sullivan R, Taraz V (2020) Temperature and economic activity: evidence from India. J Environ Econ Policy. https://doi.org/10.1080/21606544.2020.1727776

Kahn ME, Mohaddes K, Pesaran RN, Raissi M, Yang J-C (2019) Long-term macroeconomic e¤ects of climate change: a cross-country analysis. USC Dornsife Institute for New Economic Thinking Working Paper No. 19 – 13

Kamber G, Nodari G, Wong B (2016) The impact of commodity price movements on the New Zealand Economy. Reserve Bank of New Zealand Analytical Note Series (AN2016/05). http://www.rbnz.govt.nz

Kjellstrom T, Kovats R, Lloyd SJ, Holt T, Tol RS (2009) The direct impact of climate change on regional labor productivity. Arch Environ Occup Health 64(4):217–227

Kling G, Volz U, Murinde V, Ayas S (2021) The impact of climate vulnerability on firms’ cost of capital and access to finance. World Development 137(2021):1–11

Konradt M, Mauro BW (2022) Carbon taxation and greenflation: evidence from Europe and Canada. Graduate Institute of International and Development Studies International Economics Department Working Paper No. HEIDWP17-2021

Kramer J, Solveen R (2021) How climate protection adds to inflation. SUERF Policy Brief, No 121: SUERF-European Money and Finance Forum, Commerzbank Research on 18 Jun 2021

Lee H-H, Park C-Y (2013) International transmission of food prices and volatilities: a panel analysis. Asian Development Bank Working Paper No. 373

Mawejje J (2016) Food prices, energy and climate shocks in Uganda. Agric Food Econ 4. https://doi.org/10.1186/s40100-016-0049-6

McKibbin W, Morris A, Panton AJ, Wilcoxen PJ (2017) Climate change and monetary policy: Dealing with disruption. Centre for Applied Macroeconomic Analysis (CAMA) Working Paper 77/2017 December 2017, Crawford School of Public Policy

Moessner R (2022) Effects of carbon pricing on inflation. CESifo Working Paper No. 9563, The international platform of Ludwigs-Maximilians University’s Center for Economic Studies and the ifo Institute (CESifo)

Mukherjee K, Ouattara B (2021) Climate and monetary policy: do temperature shocks lead to inflationary pressures? Climatic Change 167:32. https://doi.org/10.1007/s10584-021-03149-2

Nahoussé D (2019) Climate change and inflation in WAEMU. Am J Econ 9(3):128–132

Nelson GC, Rosegrant MW, Koo J, Robertson R, Sulser T, Zhu T, Lee D (2009) Climate change: impact on agriculture and costs of adaptation. Int Food Policy Res Inst Food Policy Rep. https://doi.org/10.2499/0896295354

Nelson GC, Rosegrant MW, Palazzo A, Gray I, Ingersoll C, Robertson R, You L (2010) Food security, farming, and climate change to 2050: scenarios, results, policy options. Int Food Policy Res Inst (IFPRI)Research Monogr. https://doi.org/10.2499/9780896291867,www.ifpri.org

Parker M (2016) The impact of disasters on inflation. European Central Bank (ECB) Working Paper 1982, November 2016

Parker M (2018) How global is global inflation? J Macroecon. https://doi.org/10.1016/j.jmacro.2018.09.003

Rosengren ES (2011) A look inside a key economic debate: how should monetary policy respond to price increases driven by supply shocks? Remarks to the Massachusetts Chapter of NAIOP, the Commercial Real Estate Development Association, May 4, 2011

SARB (2020) Research themes and objectives: February 2020. South African Reserve Bank

SF (2019) Food price shocks: channels and implications. Special Focus: Commodity Markets Outlook. World Bank

Sheng Y, Xu X (2018) The productivity impact of climate change: Evidence from Australia’s Millennium drought. Econ Model 1–10

UC DAVIS (2022) March 18 Climate Change Terms and Definitions. Retrieved from UCDAVIS: https://climatechange.ucdavis.edu/climate/definitions

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monet Econ 52(2005):381–419

Wade K, Jennings M (2015) Climate change & the global economy: growth and inflation. Schroder Invest Manage North Am Inc. (https://www.schroderscapital.com/en/site/home/)

Wijeratne M, Anandacoomaraswamy A, Amarathunga M, Ratnasiri J (2007) Assessment of impact of climate change on productivity of tea (Camellia sinensis L.) plantations in Sri Lanka. J Natl Sci Foundation Sri Lanka 35(2):119–126

Author information

Authors and Affiliations

Contributions

Aliyu Rafindadi Sanusi conceptualised the approach, interpreted and discussed the empirical findings, reviewed the text in its entirety, and contributed to the writing of the introduction. Jamilu Iliyasu conducted the estimation and wrote the initial drafts of the introduction, literature review, identification of the VAR model, and the conclusion section.

Corresponding author

Ethics declarations

Competing interests

We have no conflict of interest to declare.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1. VAR Model Lag Selection Results

VAR Lag Order Selection Criteria

Endogenous variables: GTA_C GPA_INCH ENERGY FERTILIZERS RGDP FOOD

Exogenous variables: C

Date: 04/04/23 Time: 15:04

Sample: 1961 2020

Included observations: 57

Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

0 | -86.46569 | NA | 1.03e-06 | 3.244410 | 3.459468 | 3.327989 |

1 | 240.8738 | 574.2798 | 3.78e-11 | -6.978028 | -5.472621* | -6.392975* |

2 | 280.2355 | 60.76900* | 3.50e-11* | -7.095983* | -4.300229 | -6.009458 |

3 | 302.7128 | 29.96975 | 6.29e-11 | -6.621503 | -2.535400 | -5.033504 |

Appendix 2. VAR Model Stability Results

Roots of Characteristic Polynomial

Endogenous variables: GTA_C GPA_INCH

ENERGY FERTILISERS RGDP FOOD

Exogenous variables: C

Lag specification: 1 2

Date: 04/04/23 Time: 15:03

Root | Modulus |

|---|---|

0.986579 | 0.986579 |

0.776757–0.019825i | 0.777010 |

0.776757 + 0.019825i | 0.777010 |

0.660536–0.261053i | 0.710251 |

0.660536 + 0.261053i | 0.710251 |

0.600075 | 0.600075 |

0.199654–0.543936i | 0.579421 |

0.199654 + 0.543936i | 0.579421 |

-0.232399–0.509161i | 0.559691 |

-0.232399 + 0.509161i | 0.559691 |

-0.121174–0.231209i | 0.261038 |

-0.121174 + 0.231209i | 0.261038 |

Appendix 3. VAR Residual Serial Correlation LM Tests Results

VAR Residual Serial Correlation LM Tests

Date: 04/04/23 Time: 15:04

Sample: 1961 2020

Included observations: 58

Null hypothesis: No serial correlation at lag h | ||||||

|---|---|---|---|---|---|---|

Lag | LRE* stat | df | Prob. | Rao F-stat | df | Prob. |

1 | 27.71792 | 36 | 0.8371 | 0.752525 | (36, 152.1) | 0.8402 |

2 | 37.25727 | 36 | 0.4110 | 1.041396 | (36, 152.1) | 0.4173 |

3 | 24.68876 | 36 | 0.9229 | 0.664154 | (36, 152.1) | 0.9246 |

Null hypothesis: No serial correlation at lags 1 to h | ||||||

|---|---|---|---|---|---|---|

Lag | LRE* stat | df | Prob. | Rao F-stat | df | Prob. |

1 | 27.71792 | 36 | 0.8371 | 0.752525 | (36, 152.1) | 0.8402 |

2 | 70.22028 | 72 | 0.5374 | 0.963025 | (72, 158.1) | 0.5641 |

3 | 111.8822 | 108 | 0.3797 | 1.015927 | (108, 133.3) | 0.4631 |

About this article

Cite this article

Iliyasu, J., Sanusi, A.R. Climate change’s impact on commodity prices: a new challenge for monetary policy. Port Econ J 23, 187–212 (2024). https://doi.org/10.1007/s10258-023-00237-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-023-00237-2