Abstract

This article examines the properties of the optimal fiscal policy in an economy with warm-glow altruism (utility interdependence) and heterogeneous individuals. We propose a new efficiency concept, D-efficiency, that considers an implicit constraint in the act of giving: Donors cannot bequeath to donees more than their existing resources. Considering this constraint, we show that the market equilibrium is not socially efficient. The efficient level of bequest transfers can be implemented by the market with estate and labor-income subsidies and a capital-income tax. In the absence of lump-sum taxation, the government faces a trade-off between minimizing distortions and eliminating external effects. The implied tax policy differs from Pigovian taxation since the government’s ability to correct the external effects is limited. Finally, we show that the efficiency-equity trade-off does not affect the qualitative features of the optimal distortionary fiscal policy.

Similar content being viewed by others

Notes

In the analysis we use a two-period economy for two reasons. The first reason is to provide comparable results with previous work in the literature. Second, models with more than two periods impose some constraints in the set of fiscal instruments if age-specific taxes are not allowed (see Escolano 1992; Garriga 2000; Erosa and Gervais 2002). These restrictions usually imply capital-income taxes different from zero. Therefore, given that we want to study the pure effects of altruism, the driving forces of the main results should not depend on exogenous restrictions on the set of instruments that the government can use.

Quadrini and Ríos-Rull (1997) find that the standard models with dynastic altruism cannot account for the observed wealth and income distribution. Nevertheless, de Nardi (2004) shows that warm-glow linkages are important to explain the emergence of large estates that characterize the upper tail of the wealth distribution observed in the data for the United States and Sweden, whereas a model with accidental bequests does not generate the observed wealth concentration.

When bequests are accidental, a confiscatory estate tax is optimal. However, in the presence of dynastic altruism Cremer and Pestieau (2006) show that wealth transfers should not be taxed in the long run.

Another alternative has been to use the standard infinite horizon model à la Barro-Becker and avoid double-counting by considering only the welfare of the first generation.

If the donee is taxed, then we should assume that the donor is interested in the net bequest received by the donee.

Because the government may condition the taxes to the individual type θ i, then it may condition the net return on government debt to the type, too.

This is not an important challenge for the definition of second-best allocations because they explicitly deal with the individual budget constraint. However, it can create some important problems in defining first-best or Pareto efficient allocations.

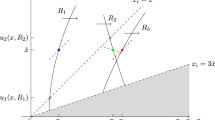

This concept is similar to the efficiency concept proposed by Dávila et al. (2007), where the income distribution becomes a state variable of the social planner’s problem.

Note that Eq. 22 crucially depends on the weights assigned to each individual type by the social planner.

Throughout the article we assume that the government can commit to the optimal policy, and thus time-consistency issues are ignored.

This approach is based on characterizing the set of allocations that the government can implement for a given fiscal policy π. The set of implementable allocations is described by a sequence of resource and implementability constraints. The implementability constraints are the households’ present value budget constraints, after substituting in the first-order conditions of the consumers’ and the firms’ problems. These constraints capture the direct effect of fiscal policy on agents’ decisions and an indirect effect on prices. Thus, the government problem amounts to maximizing a social welfare function over the set of implementable allocations. From the optimal allocations we can decentralize the economy, finding the prices and the optimal fiscal policy. The implementability constraint can be easily derived combining the first-order conditions of the consumer problem with the intertemporal budget constraint (see Chari and Kehoe 1999, for a detailed derivation).

The presence of debt allows the government to redistribute resources across generations and attain the modified golden rule. We assume that the initial capital-income tax, \(\left\{ \tau _{0}^{k^{i}}\right\} _{i=1}^{n}\), is inherited by the government. For economies in which agents live a finite number of periods, this assumption is not very important because taxes at t = 0 cannot be used to mimic lump sum and obtain a first-best assignment.

It is important to note that, given the nature of this problem, the first-order conditions together with the transversality condition might not be sufficient to characterize a solution; that depends on the properties of the implementability constraint, which might fail to be convex. A detailed discussion of this problem can be found in Lucas and Stokey (1983).

Formally,

$$ \begin{array}{rcl} W_{\!c_{1t}} &=& U_{\!c_{1t}}+\eta _{t}\left[ U_{\!c_{1t}}+\left( c_{1t}-b_{\!t}\right) U_{\!c_{1t}c_{1t}}+l_{t}U_{\!l_{t}c_{1t}}\right] , \\ W_{l_{t}}&=&U_{\!l_{t}}+\eta _{t}\left[ U_{\!l_{t}}+l_{t}U_{\!l_{t}l_{t}}+\left( c_{1t}-b_{\!t}\right) U_{\!c_{1t}l_{t}}\right] , \\ W_{\!c_{2t}}&=&V_{\!c_{2t}}+\eta _{t-1}\left[V_{\!c_{2t}}+c_{2t}V_{\!c_{2t}c_{2t}}+b_{\!t}V_{\!b_{\!t}c_{2t}}\right], \\ W_{\!b_{\!t}}&=&V_{\!b_{\!t}}+\eta _{t-1}\left[V_{\!b_{\!t}}+b_{\!t}V_{\!b_{\!t}b_{\!t}}+c_{2t}V_{\!c_{2t}b_{\!t}}\right]. \end{array} $$The additional terms on the marginal utilities capture the efficient distortion, in terms of allocations, chosen by the government. At t = 0, these expressions include additional terms that account for the initial income distribution.

Formally,

$$ \begin{array}{c} Z_{1t}=(c_{1t}-b_{\!t})U_{\!c_{1t}c_{1t}}+l_{t}U_{\!l_{t}c_{1t}},\\ Z_{2t}=V_{\!b_{\!t}}+b_{\!t}V_{\!b_{\!t}b_{\!t}}+(c_{2t}-b_{\!t})V_{\!c_{2}b_{\!t}}-V_{\!c_{2t}}-c_{2t}V_{\!c_{2t}c_{2t}}. \end{array} $$Formally,

$$ Q_{t+1}=\frac{V_{\!c_{2t+1}c_{2t+1}}-V_{\!c_{2t+1}b_{\!t+1}}}{ V_{\!b_{\!t+1}b_{\!t+1}}-V_{\!c_{2t+1}b_{\!t+1}}}\left(\rho W_{\!b_{\!t+1}}-\beta \eta _{t+1}U_{\!c_{1t+1}}\right). $$This solution could be interpreted as a pooling equilibrium in which individual skills and effort are not observable. In a separating equilibrium the government would offer a menu of contracts that satisfies the incentive compatibility constraint of each type. We do not explore this possibility in this paper because we want to avoid the effect of informational frictions and focus only on efficiency considerations.

We assume that the sequence of government expenditure converges in the long-run to a constant level G. In an infinitely lived consumer model, the initial level of debt affects the tightness of the implementability constraint and therefore the optimal fiscal policy. In this economy, the steady state is independent of the initial conditions, because the level of debt at t = 0 only appears in the implementability constraint of the initial old, but not in the newborn generations. Hence, we can study the optimal fiscal policy regardless of the initial conditions.

In the numerical simulations, the parameters δ, β, and ρ have been adjusted to consider that one period in the model consists of 30 years.

We have approximated a continuous distribution of individual types \(\theta ^{i}\in [0.8,1.8]\) using a discrete number of types and then interpolating on the decision rules.

References

Atkinson AB, Stiglitz B (1980) Lectures on public economics. McGraw-Hill, New York

Blumkin T, Sadka E (2003) Estate taxation with intended and accidental bequests. J Public Econ 88:1–21

Chari VV, Kehoe PJ (1999) Optimal fiscal and monetary policy. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics, vol Ic. North-Holland, Amsterdam, pp 1671–1743

Cremer H, Pestieau P (2006) Wealth transfer taxation: a survey of the theoretical literature. In: Kolm S-C, Ythier JM (eds) Handbook on the economics of giving: altruism and reciprocity, vol 2. North-Holland, Amsterdam, pp 1107–1134

Davies JB, Shorrocks AF (2000) The distribution of wealth. In: Atkinson AB, Bourguignon F (eds) Handbook of income distribution, vol 1. North-Holland, Amsterdam, pp 605–676

Dávila J, Hong JH, Krusell P, Ríos-Rull JV (2007) Constrained efficiency in the neoclassical growth model with uninsurable idiosyncratic shocks. Mimeo, University of Pennsylvania

de Nardi C (2004) Wealth inequality and intergenerational links. Rev Econ Stud 71:743–768

Erosa A, Gervais M (2002) Optimal taxation in life-cycle economies. J Econ Theory 105:338–369

Escolano J (1992) Essays on fiscal policy, intergenerational transfers and distribution of wealth. PhD Dissertation, University of Minnesota

Gale WG, Scholz JK (1994) Intergenerational transfers and the accumulation of wealth. J Econ Perspect 8:145–160

Garriga C (2000) Optimal fiscal policy in overlapping generations models. Working Paper N. 0105, Centre de Recerca en Economia del Benestar (CREB)

Kotlikoff LJ, Summers LH (1981) The contribution of intergenerational transfers in aggregate capital accumulation. J Polit Econ 89:706–732

Kotlikoff LJ, Summers LH (1986) The contribution of intergenerational transfers to total wealth. NBER Working Paper 1827

Laitner J (1997) Intergenerational and interhousehold economic links. In: Rosenzweig MR, Stark O (eds) Handbook of population and family economics, vol 1a, 5. North-Holland, Amsterdam, pp 189–238

Lucas RE Jr, Stokey NL (1983) Optimal fiscal and monetary policy in an economy without capital. J Monet Econ 12:55–93

McGarry K, Schoeni RF (1995) Transfer behavior: measurement and the redistribution of resources within the family. J Hum Resour 30:S184–S226

Michel P, Pestieau P (1999) Fiscal policy when individuals differ regarding altruism and labor supply. J Public Econ Theory 1:187–203

Michel P, Pestieau P (2004) Fiscal policy in an overlapping generations model with bequest-as-consumption. J Public Econ Theory 6:397–407

Quadrini V, Ríos-Rull JV (1997) Understanding the U.S. distribution of wealth. Q Rev Fed Reserve Bank Minneap 21:22–36

Yaari ME (1965) Uncertain lifetime, life insurance, and the life of consumer. Rev Econ Stud 32:137–150

Acknowledgements

We acknowledge the useful comments from the workshop participants at Centre de Recerca en Economia del Benestar (CREB) and especially Emmanuel Saez, Kyslaya Prasad, Pat Kehoe, and V.V. Chari. Judith A. Ahlers provided great editorial comments. Carlos Garriga is grateful for the financial support of the National Science Foundation for grant No. SES-0649374 and the Spanish Ministerio de Ciencia y Tecnología through grant No. SEJ2006-02879. Fernando Sánchez-Losada is grateful for the financial support of Generalitat de Catalunya through grant No. 2005SGR00984 and Ministerio de Ciencia y Tecnología through grant No. SEJ2006-05441.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed are those of the individual authors and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis, the Federal Reserve System, or the Board of Governors.

About this article

Cite this article

Garriga, C., Sánchez-Losada, F. Estate taxation with warm-glow altruism. Port Econ J 8, 99–118 (2009). https://doi.org/10.1007/s10258-009-0040-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-009-0040-1