Abstract

The platform economy has generated various new and highly successful business models. However, certain models facilitate tax evasion for service providers on their income earned on these platforms. While tax evasion contradicts the pro-social claim of many sharing platforms, it is unclear whether a provider’s tax honesty constitutes a value for consumers at all. This study investigates the role of tax compliance for platform users by employing an online experiment (\(n=286\)). The results indicate that consumers perceive providers’ tax compliance and consider it as a trust-enhancing signal. In further analysis, we find that consumers’ moral norms moderate both the signal’s trust-building effect as well as the relation between trust and transaction intention. In light of recent policy debates around taxing the platform economy, this study provides valuable practical insights for tax legislators.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last two decades, we have witnessed a massive digitalization of our economy and society. As part of this development, we have seen the birth and rise of the so-called “sharing economy” (Sundararajan 2016; Teubner and Hawlitschek 2018), in which idle resources are efficiently shared among different user groups. Peer-to-Peer (P2P) platforms are considered particularly interesting in terms of user uptake, revenues, and firm value (Zijm et al. 2019).Footnote 1 These platforms facilitate the exchange of goods and services between mostly private providers and consumers in various segments (e.g., accommodation, retail, mobility, Resnick and Zeckhauser 2002; Ma et al. 2017; Teubner and Flath 2015). One of these key sectors is P2P accommodation sharing (European Commission 2016). Airbnb, the most prominent player within this domain, provides listings from over 220 countries and regions and estimates to have facilitated over 500 million stays since its founding in 2008.Footnote 2

Besides their increasing economic relevance, platform businesses are blamed for causing several economic and societal problems. For the prominent example of P2P accommodation sharing, the most pressing concerns include local side effects such as over-touristification (Oskam and Boswijk 2016), ever-increasing rent prices (Gurran and Phibbs 2017), and illegal hospitality operations (Schäfer and Braun 2016).

Furthermore, P2P sharing platforms are criticized for facilitating illegal tax evasion by service providers (e.g., hosts) who are suspected of under-reporting their income earned via such platforms (Bologna 2020; Shotter and Hancock 2020). Tax authorities, on the other hand, lack the proper resources to monitor the plethora of online transactions realized on the platforms effectively, thereby rendering tax enforcement costly and inefficient (Elliot 2018). In light of the volume of tax revenues at stake, ensuring tax complianceFootnote 3 is one of the most salient public interests in the platform economy (Frenken et al. 2019) and has been identified as one of the major regulatory challenges policymakers are concerned with (OECD 2019).

Prior research has mainly focused on quantifying the extent of non-compliance on P2P platforms (Bibler et al. 2021; Wilking 2020). Tax losses stemming from tax evasion are substantial. In the US, for instance, less than 25% of all Airbnb providers are assumed to meet local tax obligations (Bibler et al. 2021). While tax evasion appears to be widespread among service providers on P2P platforms, it is unclear whether providers’ tax behavior constitutes a relevant factor for platform consumers and influences their overall intention to enter transactions.

Against this backdrop, we provide insights from an experimental study on whether consumers actually value tax compliance on sharing platforms. More precisely, our research question is whether publicly communicated tax compliance increases consumers’ trust towards the service provider and, in turn, their intentions to book at the tax-compliant provider. Understanding consumer reactions to tax behavior on sharing platforms is essential for two reasons. First, providers may face mistrust from prospective customers if they are suspected of engaging in tax evasion. This threat is particularly pronounced for the platform economy, where both market sides (i.e., hosts and guests) critically hinge on each other’s activity and trust (McAfee and Brynjolfsson 2017). Second, beyond the scope of sharing economy platforms, the idea of holding taxpayers publicly accountable has gained considerable momentum in recent years, as evidenced by the discussions around public tax transparency measures (Lagarden et al. 2020; Oxfam, 2020).

We address our research question by means of a scenario-based online experiment (\(n=286\)). Participants take the role of consumers on an accommodation sharing platform, evaluate a set of available listings and thus, implicitly, the associated providers. To make the providers’ tax behavior salient to consumers, we introduce a visual label that is granted to tax compliant providers (tax compliance label) in the experiment. This tax compliance label allows us to directly examine consumers’ reactions to publicly assured tax honesty.

In the domain of P2P sharing, platform operators implement several reputation mechanisms to address trust-related aspects (for a thorough review on the role of trust on platforms, see Soleimani , 2021). Visual labels (often referred to as “badges”) aim to propagate specific qualifications or service quality standards that are otherwise unobservable for consumers (Hesse et al. 2020; Dann et al. 2019). From a theoretical perspective, labels function as a signal to bridge information asymmetries between providers and consumers (Spence 1973). Studies document that the information inherent to these labels translates into increased levels of trust in providers (Teubner and Hawlitschek 2018), increased willingness to pay for offers from such providers (Abramova et al. 2017; Liang et al. 2017), as well as the resulting number of actually ensuing transactions (Ke 2017). We hypothesize that tax compliance signals advantageous qualities such as integrity and honesty, strengthening a provider’s trustworthiness in the eyes of prospective consumers and their willingness to book at tax-compliant providers.

In addition, the public commitment to tax honesty allows consumers to draw inferences on the providers’ moral values and beliefs. Tax evasion is a controversial topic and generally perceived as “immoral” or “unethical” (Kirchler et al. 2003). Importantly, it contradicts the claim of the sharing economy to foster a fair and sustainable economy (Martin 2016). Tax compliance, in contrast, relates to socially-oriented values that emphasize cooperative and supportive behavior within society (Schwartz 2012). Personal values and moral beliefs are important determinants for individuals’ behavior (Bergquist et al. 2019) and influence their economic decision-making (Frey and Torgler 2007; Antonetti and Anesa 2017). Therefore, we expect that consumers’ moral norms moderate the effect of the tax compliance label to the extent that the perceived values of the provider match with consumers’ own preferences.

The results of our analysis indicate that consumers do indeed embrace providers’ tax behavior in the process of selecting listings. In particular, we find that a visual tax compliance label positively influences participants’ trust in a provider. In line with prior research (Teubner and Hawlitschek 2018), this positive effect also translates into increased booking intentions with regard to such tax-compliant providers. Moreover, consumers’ moral norms take a moderating role in both the trust-fostering effect of the tax compliance label and the positive impact of trust on consumers’ willingness to enter a transaction. We supplement our findings with qualitative insights into participants’ perceptions of tax-compliant providers based on open-ended (textual) responses.

With our study, we contribute to two major streams of the literature. A nascent but growing body of research focuses on quantifying and explaining tax evasion on income earned via digital platforms (Bibler et al. 2021; Wilking 2020; Berger et al. 2020). We build on this research by adding the consumer perspective. To the best of our knowledge, this study represents the first to examine consumers’ reactions to an indication of the tax behavior/honesty of P2P accommodation sharing providers. Our results suggest that providers may actually benefit from signaling tax honesty. Moreover, the outlined research question also resonates with prior studies on consumer reactions to aggressive (but legal) corporate tax planning (Asay et al. 2018; Gallemore et al. 2014; Hardeck et al. 2021). However, we assess consumer reactions to tax behavior in the sharing economy, where the consumers interact with real peers (i.e., individuals) rather than companies.

Second, our results address the broader public debate on tax justice and taxing the emerging digital business models. Tax transparency is gaining ground with legislators responding to the growing demand to hold taxpayers publicly accountable for their tax contribution (KPMG 2021). Our findings provide support to the notion that consumers may reward publicly communicated tax honesty on P2P platforms. Thus, increasing tax transparency on sharing platforms may constitute a cost-efficient regulatory mechanism for policymakers. We, therefore, discuss how the label may be awarded to ensure high credibility and to keep administrative efforts at a minimum. In particular, a voluntary information sharing system with tax authorities as used in Estonia could be implemented to certify tax compliant service providers (Ogembo and Lehdonvirta 2020). Under this scenario, service providers have the free choice to signal their tax honesty on sharing platforms.

2 Related work and research model

2.1 Tax evasion in the platform economy

The recent scandals about secret offshore activities (e.g., Lux Leaks, Panama Papers) have increased public awareness for tax-related misconduct. Despite legislators’ efforts to ensure tax compliance, certain areas still provide opportunities to evade taxes at low detection risks. Regarding the sharing economy, the key tax challenge consists of taxing service providers’ income. On virtually all sharing platforms, service providers are represented by individuals rather than companies. In the case of Airbnb, for instance, the income from letting an apartment or room is treated as rental income from immovable property, which is taxed at the personal income tax rate. Notably, providers are responsible for filing and reporting their income together with related expenses in their tax returns (Beretta 2017).Footnote 4

However, self-reported income is susceptible to manipulation (Alm et al. 2009; Kleven et al. 2011). Taxpayers may either report low or no income from renting activities at all. The traditional economic model predicts that the level of tax compliance depends on perceived detection probabilities and penalties (Allingham and Sandmo 1972). In the sharing economy, tax authorities typically lack information on the numerous online transactions between private providers and consumers. Monitoring providers through audits requires substantial resources and renders tax enforcement particularly burdensome (Elliot 2018). As a result, the overall detection probability of misreporting is relatively low. Besides anecdotal evidence on dishonest tax reporting covered by the media (Bologna 2020; Shotter and Hancock 2020; Ramthun 2018), two recent empirical studies provide evidence that Airbnb providers do not report their total income in the absence of additional compliance mechanisms (Bibler et al. 2021; Wilking 2020).

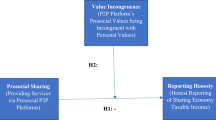

Moreover, the issue of misreporting appears to be rooted in the design of sharing platforms. Sharing platforms are often characterized as a pathway to a more sustainable and equitable economy (Martin 2016). Berger et al. (2020) argue that the pro-social benefits associated with sharing activities liberate service providers to dishonestly report their earned income. According to their findings, tax evasion rates are higher among service providers whose personal values are not in line with the values of the platform.

However, dishonest tax reporting leads to several undesirable outcomes. First, non-compliant providers gain an unfair competitive advantage over honest providers as they can afford to demand lower prices. Similarly, such behavior distorts competition with traditional service providers such as the hotel industry, which is more regulated than sharing platforms (OECD 2019). Second, tax evasion results in a substantial reduction of tax revenues. Foregone tax revenues narrow the scope of governments to finance public goods and services. Thus, tax evasion contradicts the sharing economy’s sustainability narrative (Palgan et al. 2017).

2.2 Consumers’ perception of providers’ behavior: trust, labels, and moral norms

Demonstrating trustworthiness is essential for successful participation on P2P platforms (Loebbecke 2003; Tussyadiah and Park 2018). Studies have shown that trust in a prospective transaction partner is a crucial factor and that a lack of trust is likely to hinder the realization of any transaction (Hawlitschek et al. 2016; Soleimani 2021). Unsurprisingly, major platforms explicitly state to “design for trust” (Gebbia 2016) and give providers the opportunity to establish a reputation on the platform and thus to showcase their trustworthiness. This reputation is of vital importance for providers as they have to market themselves via the platform to generate demand (Tussyadiah 2016). To this end, platform operators make use of a variety of mechanisms such as star ratings or text review systems (Hesse et al. 2020; Dann et al. 2020).

Among the most successful trust-building artifacts are platform-specific visual labels. Typically, these labels are granted by platforms themselves and are intended to certify a user’s superiority in terms of one or more value dimensions. The separating component of superiority may relate to different aspects. It may, for instance, indicate that the provider has demonstrated an exceptionally high level of service quality in the past (e.g., consistently high evaluations), has achieved a particular proficiency or achievement on the platform (e.g., long-term membership), or has been verified in some form (e.g., by means of an ID card).

Indeed, scholars show that consumers are willing to pay more for offers from such providers (Abramova et al. 2017; Liang et al. 2017). On Airbnb, for instance, the Superhost label attests that a provider fulfills excellent standards in the dimensions communication, commitment, guest satisfaction, and experience (Airbnb 2014). The effectiveness of such labels is undisputed and users state to perceive providers with the Superhost label as high-quality and to be willing to pay a price premium (Liang et al. 2017). Further empirical evidence reflects this pattern where quality labels appear to be a significant driver of prices (Teubner et al. 2016; Wang and Nicolau 2017; Kakar et al. 2018; Teubner et al. 2017; Gibbs et al. 2018; Ert and Fleischer 2019; Neumann and Gutt 2017) and the amount of realized transactions (Ke 2017).

Given that, as of today, no official nor otherwise visible verification of tax-compliant behavior is available, consumers cannot differentiate tax-compliant (i.e., honest) providers from non-compliant providers. Since, at the same time, individual tax evasion is perceived as immoral behavior (Kirchler et al. 2003; Frey and Torgler 2007), a non-compliant tax behavior on P2P sharing platforms poses a risk to their general reputation—and hence to the sharing economy as a whole.

2.2.1 Signaling theory

To provide a theoretical frame for the role of tax compliance labels in our study, we draw on signaling theory (Spence 1973). The theory assumes markets with information asymmetry, for instance, between job seekers and employers or online vendors and customers. According to signaling theory, the more informed side (i.e., job seekers, sellers) can use signaling (or signals) to demonstrate their otherwise unobservable quality (e.g., talent, skill, intelligence, product quality Basoglu and Hess , 2014).

One of the fundamental principles of signals is that they are inherently costly. Individual signaling costs depend on the underlying trait that the signal is intended to represent, that is, higher quality is associated with lower signaling costs for quality. This cost differentiation for high- and low-quality sellers causes a separating equilibrium in which it is only worthwhile for high-quality sellers to acquire the costly signal. The signal itself, therefore, becomes a separating factor.

Within the context of platforms and accommodation sharing in particular, similar informational asymmetries between providers and consumers exist. This aspect becomes particularly aggravated considering that most offers are run by private individuals rather than corporate hospitality providers (Ke 2017). Traditional hotel chains typically build strong reputation and brand awareness, which reduces uncertainty associated with the quality of the accommodation service. Public information on private service providers is, however, limited to the content published on the platforms.

In this sense, tax compliance labels constitute a signal of honesty, integrity, and a sincere interest in societal well-being and the common good through paying taxes (as credibly documented by the signal). The underlying premise here is that for honest and sincere providers, paying taxes represents a matter of course. For them, in the sense of the theory, providing this signal does not incur any additional costs since they would pay taxes in any case. For dishonest providers who would rather refrain from paying taxes on their rental revenues, in contrast, providing the signal (i.e., the tax compliance label) comes at a much higher cost, that is, the cost of actually paying the taxes.

To understand how signals of tax compliance manifest themselves in consumers’ perceptions of providers and how this perception ultimately affects their willingness to enter into a transaction with them, our research model (Fig. 1) incorporates the dimensions of trust and moral norms. We argue that observing the signal increases providers’ trustworthiness in the eyes of prospective customers. Assuming that tax-honesty is linked to honesty and benevolence in general, the observed tax-compliance signal is likely to serve as a proxy for other characteristics such as reliability and reasonable pricing. We approximate the transaction intention by means of customers’ intention to book an offer on a P2P sharing platform. Since the positive association of trust and booking intentions has already and repeatedly been demonstrated by various studies (e.g., Teubner and Hawlitschek 2018; Teubner et al. 2014; Hawlitschek et al. 2016; Liang et al. 2018; Mittendorf and Ostermann 2017), we consider this positive relationship as given.

Existing literature shows that labels such as Airbnb’s Superhost label can imply quality (Liang et al. 2017) and establish trust (Teubner and Hawlitschek 2018). Providers seem to be well-aware of the effectiveness of these labels and claim to use them strategically (Neumann and Gutt 2017; Liang et al. 2017). Signaling theory in the context of tax compliance hence implies that labels are a necessary means to establish a separating equilibrium in which only the actual tax-compliant providers will bear the cost of acquiring the label. Hence, we hypothesize that a label for tax-compliant behavior constitutes a relevant signal that can promote consumers’ perceptions of provider trustworthiness. Formally, our hypothesis states:

H 1

The presence of a tax compliance label has a positive effect on consumers’ trust in the provider.

2.2.2 The moderating role of moral norms

Our first hypothesis establishes a link between providers’ assurance of tax compliance and their trustworthiness in the eyes of prospective consumers. To better understand the relationship between the tax compliance label and consumers’ responses, we next turn to a potential moderator of this effect. In particular, we examine whether consumers’ moral norms on tax compliance influence their decision-making. Scholars have pointed out that “personal moral norms” are a relevant predictor for human behavior (Ajzen 1991; Schwartz 2012). Moral norms explain, to some extent, specific behavior that cannot be traced back to merely rational, cost-benefit considerations (Botetzagias et al. 2015; Wenzel 2004; Frey and Torgler 2007). Moreover, moral norms reflect the personal feelings of moral obligation or responsibility to perform a particular behavior (Ajzen 1991). In this regard, Schwartz (2012) postulates that a person’s evaluation of moral norms is based on its individual values. Consequently, personal values affect how inclined we are to accept or reject a particular norm.

Moral norms, however, do not only prescribe desirable behavior for oneself. Ethical expectations are also used to assess the observed behavior of others. For instance, several studies conclude that consumers’ reactions to corporate social responsibility (CSR) activities depend on the extent to which consumers identify with the company (Sen and Bhattacharya 2001; Bhattacharya and Sen 2004). Sen and Bhattacharya (2001) suggest that individual factors influence the perceived overlap between their own and the company’s character (as indicated by CSR activities). These individual factors relate to personality traits such as norms and values. The authors conclude that the perceived (value) congruence determines how consumers evaluate CSR activities (Sen and Bhattacharya 2001).

In the context of tax compliance, tax morale may constitute an essential determinant of the level of congruence. Hardeck and Hertl (2014), for instance, provide evidence that consumers’ individual moral norms moderate the relationship between corporate tax behavior and corporate reputation. Consumers who disapprove tax evasion evaluate tax minimizing companies more negatively. Moreover, consumers’ evaluation of a company’s tax behavior is strongly linked to their personal attitudes towards taxation (Antonetti and Anesa 2017). These findings suggest that consumers reflect on the observed tax behavior based on their own moral standards and adjust their evaluation of the company accordingly.

We build on the congruence argument to conceptualize the interaction of moral norms with the tax compliance label. While we acknowledge that findings on consumer reactions to corporate behavior do not necessarily apply to a setting in which consumers interact with peers rather than companies, the same mechanism may—to some extent—govern consumer behavior on P2P platforms. Two factors support this assertion. First, information about a person’s tax compliance does affect the overall perception of that person. Confronted with different types of tax behavior (e.g., tax honesty, tax flight, and tax evasion), people consider tax evasion immoral and unfair toward society (Kirchler et al. 2003). Kasper et al. (2018) document that people attribute positive characteristics to honest taxpayers whereas tax evaders are judged least favorable and described as “aggressive” and “uncooperative”. Second, participants in the sharing economy place a higher weight on socially-oriented values than the overall population (Piscicelli et al. 2015, 2018). Therefore, they are likely to be more concerned about irresponsible, anti-social behavior such as tax evasion.

Applying Schwartz’s theory of basic values (Schwartz et al. 2012; Schwartz 2012) to our setting, the tax compliance label signals two socially-oriented values: conformity to rules and universalism. People who consider tax compliance as a moral obligation are likely to share a preference for conforming to rules. The second value refers to the protection and appreciation of the societal welfare and of nature and is in accordance with the general promise of the sharing economy of building a more sustainable and fairer economy.

For the context of this study, where non-compliance is virtually equivalent to tax evasion, we therefore expect that consumers considering tax compliance as a moral obligation towards society perceive strong congruence with providers holding a signal of tax-compliant behavior:

H 2

The effect of the tax compliance label on trust in the provider is stronger if tax compliance is in line with consumers’ moral norms.

Apart from reputational aspects, moral norms also frame actual behavior. For instance, studies on pro-environmental behavior show that norms may help to address environmental problems (e.g., Bergquist et al. 2019). Beyond pro-environmental behavior, moral norms also affect economic decision-making. A large body of literature confirms the positive effect of tax morale (i.e., the perceived moral obligation to pay taxes) on personal tax compliance decisions (Wenzel 2004; Alm and Torgler 2006; Frey and Torgler 2007).

Moreover, moral norms seem to moderate consumers’ willingness to enter into economic transactions with companies (Antonetti and Anesa 2017). Participants with a negative attitude toward legal tax planning exhibit both lower purchase intentions and a reduced willingness to pay for a product of a company that was associated with corporate tax planning (Hardeck and Hertl 2014). These findings are in line with the results of Asay et al. (2018)—participants that are aware of specific incidents of dubious corporate tax practices claim to have declined to purchase from those companies.

To summarize, consumers prefer providers whose presumably observable behavior (i.e., tax compliance) is in line with their moral norms and what they think is the right thing to do (Klöckner 2013). We thus hypothesize:

H 3

The effect of trust in the provider on intention to book is stronger if tax compliance is in line with consumers’ moral norms.

3 Method

We evaluate our research model by means of a scenario-based online experiment. Participants act as consumers on a P2P accommodation sharing platform and consider a set of listings from different providers. Employing a treatment-based experiment allows for a high degree of control and, at the same time, for making causal claims on the exogenous treatment variables’ effects (i.e., presence of tax compliance labels) (Friedman and Cassar 2004).

3.1 Scenario and treatment design

Participants face the following scenario. They are looking for a place to stay in a foreign city for two nights for themselves and a friend. For this trip, they are looking for a suitable accommodation on a P2P sharing platform. Their friend has already pre-selected one of five available listings of different configurations (Table 1), and they are now in charge of evaluating this pre-selected listing in terms of how likely they would be to actually book it. The treatment design manipulates the configuration of the pre-selected accommodation such that the listing either has a tax compliance label or not (binary treatment design). Each participant is assigned to either one or the other treatment condition (between-subjects design). To ensure a high degree of comparability between treatments, two out of the five listings have the tax compliance label, while the other three do not. Depending on the treatment condition, the pre-selected listing is either one of the two with the label, or one of the three without.

3.2 Stimulus material

To create an engaging scenario and to mimic an actual search/booking process as realistically as possible, we visually align the stimulus material with that of popular accommodation sharing platforms such as Airbnb (see Fig. 2; right). After being welcomed and having read the scenario description, participants are forwarded to the overview page, showing the five listings, including their friend’s pre-selection. Each listing’s rating is randomly set to either 4.5 or 5.0 stars, and the number of ratings is randomly chosen between 14 and 17.Footnote 5 In order to prevent any inferences about the merits or drawbacks of individual listings (e.g., information about location or amenities), titles, descriptions, pictures, and the location markers are blurred.

3.2.1 Tax compliance label

Since tax compliance labels are not (yet) used by any major platform, we created such a label based on the following considerations (Fig. 2; left). Given the scenario is set in Germany and also the sample is recruited from Germany, the label uses typical design elements associated with German Federal Ministries (i.e., the federal eagle). Regarding color, the design is mainly kept in blue tones, following Sundar and Kellaris’ (2016) emphasis of color symbolism. During the experiment, participants were able to mouse over the label to see an explanation about its meaning, stating: “This provider is verified according to FAIRTAX and pays income tax for all bookings. The price shown includes all taxes.”

3.2.2 Prices

For prices, we select five different price levels, derived from the 25-, 50-, and 75-percentiles of comparable listings on Airbnb (Teubner et al. 2017). Rounded to the nearest integer, we thereby generate the following set of prices: (1) 25-percentile -5%: €90, (2) 25-percentile: €95, (3) 50-percentile: €124, (4) 75-percentile: €165, and (5) 75-percentile +5%: €173. These five prices are allocated to the five listings at random, whereby we ensured that the pre-selected listing is either associated with 25- (low) or 75-percentile (high) price (i.e., not with any of the “extremes”).

3.3 Measures

All measurement instruments of this study are based on validated scales. We adapt the operationalization of intention to book (ITB) from Gefen and Straub (2003), moral norms (MN) from Botetzagias et al. (2015), and trust in provider (TIP) from Pavlou and Gefen (2004). All items were measured on 7-point Likert scales. Beyond these constructs, we survey demographic traits as control variables. These included age, gender, individual risk propensity (Dohmen et al. 2011), general trusting disposition (DTT) (Gefen and Straub 2004), familiarity with P2P platforms (Gefen and Straub 2004), and tax experience. All measurement instruments are listed in Table 9.

3.4 Procedure and sample

Participants were recruited from the student subject pool at a large German university using the software hroot (Bock et al. 2014). We incentivize participation by monetary rewards (€10.26 per hour and person on average). The median time spent in the experiment was 9.1 minutes, and 362 participants started the experiment. From those, 286 participants passed all attention checks and finished the experiment completely. The resulting sample size is well above the threshold of samples needed for most applications (Hair et al. 2017; Cohen 1992).

We summarize all sample characteristics in Table 2. Within the sample, 34.3% are female, average age is 23.57 years (SD = 3.91) with a minimum of 18 and a maximum of 59 years. Average risk affinity (scale from 0 to 10) is 4.96 (SD = 1.85). Overall, 55.2% of participants state to have experience declaring (their own or someone else’s) taxes.

4 Results

First, we analyze the tax compliance label’s overall effects on intention to book (see Fig. 3). A 2 (label: yes, no) \(\times\) 2 (price: high, low) ANOVA reveals significant effects for both the tax compliance label (\(F(1,283)=7.88\), \(p=.005\)), and price (\(F(1,283)=94.82\), \(p<\).001), and no significant second-order interaction effects. Subsequent post-hoc analysis (TukeyHSD) confirms the significant differences for both tax compliance label (\(D_{LAB{\text {-}}NO\_LAB}=.391\), \(p=.005\)) and price (\(D_{LOW{\text {-}}HIGH} = -1.36\), \(p<\).001). Table 3 summarizes these main effects.

4.1 Measurement model

To initially explore the underlying structure of the measurement instrument, we conduct an Exploratory Factor Analysis (EFA) (Reio and Shuck 2015). The EFA uses the Maximum Likelihood procedure and Promax Rotation resulting in an acceptable four-factor model with all factor loadings greater than .50. Table 4 lists the adequacy measures. Table 5 provides the corresponding pattern matrix. Item-level descriptives are provided in Table 6. We summarize construct descriptives, correlations, and reliability measures in Table 7.

We ensure internal consistency by confirming that all constructs fulfill the thresholds of .70 for Cronbach’s \(\alpha\) and composite reliability (Bagozzi and Yi 1988). Next, we confirm convergent validity by validating that all Average Variance Extracted (AVE) values exceed the .50 threshold (Hair et al. 2011). Regarding discriminant validity, the Fornell-Larcker criterion (Fornell and Larcker 1981) is met, and we observe no influential cross-loading values in the pattern matrix (Table 5).

4.2 Confirmatory factor analysis

We proceed with the Confirmatory Factor Analysis (CFA) using AMOS 26 (IBM 2019). We follow the guidelines of Hair et al. (2017) to determine the factor structure within our data and to test our hypotheses. To assess assumptions of multivariate normality, we confirm values within the range of \(\pm 2.2\) for both skewness and kurtosis (Table 6; Skarpness 1983). For all models, we compare model fit by means of five fit indices, following the guidelines and thresholds of Hu and Bentler (1999).Footnote 6 For our initial model, we observe \(\chi ^2 = 161.7\), \(p<.001\), \(\chi ^2\)/df = 2.61, CFI = .941, SRMR = .052, RMSEA = .075, PClose = .002, indicating an insufficient model fit (particularly regarding the PClose value). Based on the standardized residual covariances, we decided to drop DTT3 for the subsequent analysis. The resulting model achieves good model fit regarding all fit measures: \(\chi ^2\) = 145.4, \(p <.001\), \(\chi ^2\)/df = 1.73, CFI = .965, SRMR = .054, RMSEA = .051, PClose = .452.

4.2.1 Measurement model invariance

To ensure that the observed factor structure and loadings are equal across groups, we run invariance tests using a gender-based participant split. The model shows good fit, when assessed with both groups unconstrained (\(\chi ^2\) = 332.2, df = 196, \(\chi ^2\)/df = 1.695, CFI = .934, SRMR = .061, RMSEA = .049, PClose = .527), confirming configural invariance. Next, comparing the measurement model to the unconstrained model, we observe no significant difference (\(\chi ^2\) = 19.6, df = 16, p = .237), meeting the requirements for metric invariance (Schmitt and Kuljanin 2008).

4.2.2 Common method bias

To account for potential Common Method Bias (CMB), we conduct a test of a unmeasured method factor (using a common latent factor) (Podsakoff et al. 2003; Gaskin and Lim 2017). We find that the unconstrained model is invariant from the constraint to zero model (unconstrained model: \(\chi ^2\) = 53.0, df = 98; zero constrained model: \(\chi ^2\) = 90.0, df = 98; delta: \(\chi ^2\) = 37.0, df = 588, \(p>.999\)). We conclude to observe no CMB and remove the unmeasured method factor for creating our factor scores.

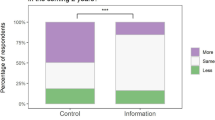

4.2.3 Manipulation check

To ensure that our externally manipulated treatment conditions are perceived as such by the participants, we included two manipulation checks in our survey (Table 10). Figure 4 depicts the manipulation’s effect on the respective items. The visual impression of a discernible difference in the means across the groups is supported by separate two-sided Mann-Whitney U tests showing significant difference for both the tax compliance label (\(U=3418.5, p<.001\)) and the price conditions (\(U=1287.0, p<.001\)). Consequently, we conclude that the manipulation was successful.

4.3 Structural model and hypotheses testing

We build our structural model using the composites imputed from the previously validated measurement model’s factor scores. We validate the multivariate assumptions of the generated composites by evaluating Cook’s distance values. We observe no values larger than .008 indicating no multivariate influential outliers (Aguinis et al. 2013). Regarding multicollinearity, all observed variance inflation factors are below the 3.0, and tolerance values above the .10 threshold, indicating no multicollinearity issues (O’Brien 2007). The final model (Fig. 5) shows good model fit (\(\chi ^2\) = 6.62, df = 5.00, \(\chi ^2\)/df = 1.32, CFI = .994, SRMR = .020, RMSEA = .034, PClose = .595), allowing us to interpret the estimated path coefficients.

The model explains 44.2% of the variance in consumers’ intention to book and confirms all hypothesized relations. We observe a positive and significant effect of the tax compliance label on trust in provider (\(H_{1}, \beta =.197, p<.001\)). Further, this effect is stronger for consumers for which tax compliance is in accordance with their moral norms (\(H_{2}, \beta =.109, p=.026\)). While the expected positive relationship between trust in provider and intention to book is also reflected in the model (\(\beta =.435, p<.001\)), it further shows that, consistent with our hypothesis, this effect is stronger for consumers for whom tax compliance is in accordance with their moral norms (\(H_{3}, \beta =.094, p=.035\)). Figure 6 depicts the moderation effects.

4.4 Control variable analysis

Next, we analyze the influence of the secondary variables on our structural model and hypotheses (Table 10). Control variable analysis shows three significant effects. First, participants’ overall trusting disposition positively affects trust in provider (\(\beta =.504, p<.001\)). Second, male participants show a lower level of trust in the provider (\(\beta =-.132, p=.007\)). Third, the listing’s price negatively influences booking intentions (\(\beta =-.441, p<.001\)). Importantly, none of the control variables alters our findings in terms of magnitude, sign, or significance.

4.5 Monetary equivalent of the tax compliance label

The two employed price levels (see Table 1) allow us to calculate a monetary equivalent that participants assign to listings with the tax compliance label. Note that a price increase of €10 is associated with an average decrease of .194 on intention to book (7-point Likert scale). Contrasting this to the difference in booking intention induced by the tax compliance label yields a first proxy for its monetary equivalent, which amounts to €23.12 (\(\Delta =.450\)).

4.6 Qualitative assessment

To better understand participants’ perception of the tax compliance label, we collected qualitative feedback from the experiment participants in the form of short free texts. Specifically, we asked participants to “please describe in your own words how the aspect of assuring tax compliance (i.e., the FAIRTAX label) has affected your evaluation of the selected listing.” This inquiry yielded 286 responses, which we classify on three levels. First, we assess whether the tax compliance label was stated to have a general influence on participants’ booking decisions or not. Second, provided that there was an influence, we classify whether a stated influence is perceived to be large or small. Third, we classify each response according to a set of 11 topic-based categories (Table 8).

To create the set of categories, three researchers independently screened all responses and generated initial category sets. Subsequently, categories were discussed, refined, and synthesized. Regarding inter-rater reliability, the final classification yields an average Fleiss’ Kappa score of .660, indicating substantial agreement among raters (Landis and Koch 1977).

Overall, we observe a distribution of themes as depicted in Fig. 7. The majority (69.2%) of the respondents state to perceive an influence of the tax compliance label (37.5% large; 31.7% small). Among those who stated to perceive a large influence, participants predominantly highlight the labels trust-, competence-, and transparency-fostering effect (31.8%) and regard it as a signal with differentiating character (31.3%). Further, participants describe the label as a signal that justifies a small surcharge (23.5%) and as a marker of social responsibility (13.4%). Statements referring to a small influence mainly consider the tax compliance label as a further criterion if the competing listings are otherwise equal (47.7%), but consider other things more important (27.3%). Some participants expressed uncertainty regarding the label’s credibility (25.0%). Participants that do not observe a general influence are characterized as strictly price-oriented decision-makers (23.4%), have a strict understanding of tax responsibility as a matter for the provider exclusively (13.4%), or question the usefulness of labels in general (10.0%).

5 Discussion

We study the effects of tax compliance labels on consumers’ booking intentions in the context of P2P sharing platforms. While platforms such as Airbnb have established systems that allow for an assessment of providers’ trustworthiness and service quality (e.g., text reviews, star rating scores, or number of reviews), providers’ tax compliance behavior is, as of today, not subject to any signaling device. Providers’ tax compliance, however, is of utmost importance from an economic and societal perspective. This holds specifically true given the substantial tax revenue associated with peer-based accommodation sharing and the competitive dynamics in such markets where maintaining “a level playing field” represents an important goal (European Commission 2016, p. 13).

5.1 Theoretical implications

Much of the P2P platform literature examines how different design artifacts influence the (mutual) perceptions of prospective transaction partners. To the best of our knowledge, this study is the first to examine the effects of tax compliance by means of an online experiment. Thus far, existing literature mainly considered visual labels as signals of various quality dimensions directly related to the associated service or product (e.g., Airbnb’s Superhost label; Teubner et al. 2017; Ke 2017; Liang et al. 2017). Given that tax compliance is at the host’s discretion, we applied the theoretical lens of signaling and showed that there is in fact value in signals that refer to more indirect information such as behavioral morality. Thereby, tax compliance labels may be beneficial in a threefold way. First, they may increase tax honesty and the volume of tax payments to authorities that would otherwise not have been declared. Second, they may benefit platform users in that they represent a valuable signal that allows them to attract additional demand and/or enforce price premiums. As such, the tax compliance label may serve to distinguish between tax-honest and non-honest users in a meaningful way (separating equilibrium). Third, also platform operators may benefit by providing the infrastructure for tax compliance labels in that they a) may be able to generate additional bookings and b) may have a positive effect on the public and political narratives on their business models. The responses to our open-ended question corroborate these conclusions. Specifically, participants stated that:

“I would filter out the listings without the tax compliance label” (Participant 203, 26, male).

“I would use a tax compliance label filter” (Participant 96, 19, male).

While providers’ tax compliance is not directly linked to their service’s quality per se (e.g., amenities or hospitality), it does affect consumers’ evaluation and is associated with an increased willingness to pay. Thereby, we show that signaling tax compliance seems to represent a way of cross-context signaling, which helps providers to establish the image of a trustworthy transaction partner (i.e., \(H_1\))—ultimately reflected in booking intentions. We emphasize the instrumental role of platforms in designing, creating, and maintaining an environment that allows for and stimulates trust-building (Kim et al. 2015). Our findings suggest that credibly demonstrating one’s tax compliance represents a powerful lever in this regard.

“The tax compliance label shows that the provider pays their taxes and, therefore, should be more trustworthy” (Participant 146, 27, female).

“I would trust the provider [with the tax compliance label] more” (Participant 288, 20, female).

Building on signaling theory, we contribute by showing how individual normative concepts influence the effects of this label. We extend existing findings describing the influence of consumers’ moral standards on the relationship of tax-compliant behavior and corporate reputation (e.g., Hardeck and Hertl 2014; Hoopes et al. 2018) to a setting where individuals interact with peers. The effect of signaling tax compliance on trust in provider is stronger for participants who consider tax compliance as a moral obligation toward society (i.e., \(H_2\)). In addition, conformity of moral norms affects consumers’ booking intentions and intensifies the (positive) relationship between trust and booking intentions (i.e., \(H_3\)).

“I would limit the variety of the available listings to my price budget and then choose from those that have such a tax compliance label to meet my moral standards and to ease my conscience” (Participant 261, 22, female).

Our assessment of the drivers behind participants’ intentions allows for a deeper understanding of how participants evaluate providers and how, within this process, moral norms guide their thinking. Previous literature primarily argued with the mere bridging of information asymmetry (e.g., with regard to product/service quality). Our results indicate that the consideration of consumers’ moral norms constitutes one necessary piece of the puzzle in understanding the signal-trust relationship. In addition, moral norms seem to gain in importance since the 1980s (Wheeler et al. 2019), and their relevance should not be neglected. This insight is of vital importance for studies in the context of P2P sharing platforms since virtually all of these are associated with societal changes and, thereby, do not constitute ordinary (or neutral) markets. Particularly the case of P2P accommodation sharing is value-laden and inherently associated with many conflicts such as over-touristification, increasing rents, illegal hospitality operations, and—eventually—tax evasion (Frenken et al. 2019; Dann et al. 2019).

5.2 Practical implications

Our study has implications for platform users, operators, and policymakers. First, providers should be aware that consumers actually care about tax behavior, rendering it a key driver of trustworthiness. Signaling tax compliance thereby helps to generate an overall honest and trustworthy appearance.

“I would consider the provider holding a tax compliance label to be more trustworthy, as he/she tries to behave correctly. I would also be under the impression that he/she is trying to act as honestly as possible” (Participant 318, 28, female).

Second, platform operators should consider implementing tax compliance labels. While the concept of tax labels is still novel to the platform economy, the “Fair Tax Mark” that is granted by a UK-based non-governmental organization to firms with transparent tax practices may serve as a best practice example.Footnote 7 Such labels not only strengthen consumers’ willingness to enter transactions with “tax-certified” providers, they also allow for charging price premiums for the associated offers. Our results indicate a feasible price markup of up to 18%. Some users even categorically refuse transactions with non-certified providers—an attitude, which may threaten the ongoing realization of transactions, and, thereby, the continued existence of a platform (Hodapp et al. 2019). Besides, it can be assumed that a proactive step towards tax compliance will undoubtedly improve the platform’s reputation.

“I would also be willing to pay more for an apartment that has the tax compliance label” (Participant 362, 24, male).

Third, policymakers should actively engage platforms to employ artifacts for signaling tax compliance. Considering the flexibility in the design of digital platforms, integrating such a tax compliance label seems to be an acceptable effort for platform operators and an effective means to take the first step towards transparent taxation of transactions. Furthermore, implementing a tax compliance label would keep administrative efforts at a reasonable level for tax authorities, platform operators, and providers (Fetzer et al. 2020). At the same time, it may increase compliance regarding self-reported income. This notion is supported by Slemrod et al. (2022) who conclude that the social recognition associated with the public disclosure of tax payments induces tax compliance. Basically, there are two options for how such a tax compliance label may be granted to the provider.

The first option and one of the most direct ways is having the platform deduct and transfer the tax component directly to the tax authority. Banks have a very similar practice for security portfolios (Endres and Christoph 2015). Several countries and municipalities have already come to agreements with Airbnb and implemented a taxation at the source, for instance for occupancy taxes (Airbnb 2022). Beyond that, some countries implemented unilateral measures to ensure the taxation of platform-related income. Belgium, for instance, has implemented a tax at source of 10% on certain types of sharing economy income. With this approach, the platform operator becomes liable for the collection and transfer of tax payments in every jurisdiction. Given that the platform operator disposes over all necessary information, granting the tax compliance label within this system of direct tax deduction becomes technically efficient.

Policymakers worldwide are currently also debating on standardized rules for platform operators to share information on the realized transactions with national tax authorities (OECD 2020). The exchange of information would enable tax authorities to identify and track cases of potential tax evasion. Moreover, a unified reporting format would reduce complexity and keep the administrative burden for the platform operators at a reasonable level. Airbnb, for instance, has begun to show cooperativeness in this regard (Airbnb 2020).

The second option for the certification procedure of the tax-compliant providers could follow three steps. (1): Providers give consent that the platform shares their transaction data with tax authorities, including name, address, tax ID, and details on realized transactions. A comparable voluntary income reporting system has been adopted by the Estonian government for all P2P platforms operating in Estonia (Ogembo and Lehdonvirta 2020). (2): Tax authorities assess the information and compare it with income declared through the tax return. (3): The provider receives the tax compliance label if the tax authority confirms the correct and truthful declaration of income over the previous year(s). Obviously, providers may still decide not to declare their total income in future periods, but then at a higher risk of detection and prosecution. As a side effect of this procedure, the verification of tax compliance by local tax authorities would substantiate the label’s credibility, which we identified as a concrete requirement mentioned by consumers.

In light of our findings, policymakers might explore novel forms of cooperation that include, for instance, the official certification of tax-compliant providers as outlined above. Such interaction with taxpayers would meet frequently raised calls by scholars for more service-oriented tax authorities and may improve intrinsic motivation for tax compliance (Pickhardt and Prinz 2014; Ogembo and Lehdonvirta 2020). Overall, by ensuring tax compliance among providers, policymakers would create equal and fair competitive conditions among market participants and, thereby, might increase the platform economy’s overall societal acceptance.

5.3 Limitations and future work

We are aware of several limitations of our study. First, our experiment’s scenario is inherently hypothetical without monetary incentives. Hence, participants’ statements may not fully reflect their behavior when using sharing platforms as consumers. To mitigate this concern, all used stimulus materials were closely aligned to the look and feel of actual platforms. Moreover, individuals participating on sharing platforms might be less sensitive to prices due to (some degree of) idealistic motivation (Piscicelli et al. 2015; Jung and Lee 2017). Still, other study designs (e.g., field experiments) might yield higher external validity.

Second, our sample consists mostly of students within their 20’s. However, while our sample represents the target and most active user group of P2P platforms (Mittendorf et al. 2019; Godelnik 2017; European Union 2017), it also lessens our results’ generalizability to the entire population or society as a whole. To ensure that our results are not driven by the most apparent covariates, we control for a broad set of variables, including age, gender, tax experience, disposition to trust, familiarity with P2P platforms, and general risk affinity. We explain 44.2% of the variance of consumers’ transaction intention, which indicates potential for future research to investigate further drivers. Despite our controls, we are unable to disentangle the effect of having a tax compliance label from having a label of any other type, for instance, the Superhost label. Studying possible interactions and the relative weights of both labels may constitute an interesting path for future research.

Finally, our study considers only the perspective of consumers. Aspects of what would motivate or deter providers from acquiring a tax compliance label remain unanswered at present. Moreover, future research should investigate potential spillover effects for platforms themselves, which may improve their reputation just by offering a tax compliance label in the first place.

6 Concluding note

As the emergence of Airbnb and Uber has shown, the platform economy poses new challenges for regulatory bodies along several dimensions (Fitzsimmons 2018). Taxation and tax compliance in platform-mediated work and service delivery is one such aspect. For the case of accommodation sharing, we demonstrate that tax compliance can function as a reputational signal with tangible economic value for service providers (i.e., hosts)—particularly when it is in line with consumers’ moral norms. Implementing tax compliance labels is beneficial for all involved actors and constitutes an essential lever to establish a level playing field in the platform economy. If incumbent and/or entrant platform operators will not do so proactively, policy makers should seize the opportunity to address the matter of tax compliance and taxation. Doing so, they may fall back on options such as direct tax deduction via the platforms or establishing agreements with providers to share their transaction data.

Notes

The worldwide gross volume generated by the platform-driven gig and sharing economy is estimated to grow to USD 455 billion by 2023, doubling the gross volume of USD 204 billion in 2018 (Mastercard & Kaiser Associates 2019).

In addition to income taxes, most jurisdictions also levy consumption taxes (e.g., the value-added tax, VAT, in the European Union) on the monetary consideration paid by the consumer to the provider for the provision of goods and services. If the annual turnover of the provider exceeds a certain threshold, the provider is obliged to register with national tax authorities and to account for VAT (Beretta 2018).

The recommended thresholds are: \(\chi ^2\)/df > .95, CFI > 95, SRMR < .09, RMSEA < .05, and PClose > .05.

See, https://fairtaxmark.net.

References

Abramova O, Krasnova H, Tan C-W (2017) How much will you pay? Understanding the value of information cues in the sharing economy. In: ECIS 2017 Proceedings, pp 1011–1028

Aguinis H, Gottfredson RK, Joo H (2013) Best-practice recommendations for defining, identifying, and handling outliers. Organ Res Methods 16(2):270–301

Airbnb (2014) Superhost. http://blog.airbnb.com/superhost/. Accessed 10 May 2020

Airbnb (2020) Airbnb submission OECD public consultation on model rules for reporting by platform operators with respect to sellers in the sharing and Gig economy. Technical report, Airbnb

Airbnb (2022) In what areas is occupancy tax collection and remittance by Airbnb available? https://www.airbnb.com/help/article/2509/in-what-areas-is-occupancy-tax-collection-and-remittance-by-airbnb-available?locale=en&_set_bev_on_new_domain=1589550872_NTdlMTlmZDYzZmNh. Accessed 2 Feb 2020

Ajzen I (1991) The theory of planned behavior. Organ Behav Hum Decis Process 50(2):179–211

Allingham MG, Sandmo A (1972) Income tax evasion: a theoretical analysis. J Public Econ 1(3–4):323–338

Alm J, Deskins J, McKee M (2009) Do individuals comply on income not reported by their employer? Public Finance Review 37(2):120–141

Alm J, Torgler B (2006) Culture differences and tax morale in the United States and in Europe. J Econ Psychol 27(2):224–246

Antonetti P, Anesa M (2017) Consumer reactions to corporate tax strategies: the role of political ideology. J Bus Res 74(1):1–10

Asay HS, Hoopes JL, Thornock J, Wilde JH (2018) Consumer responses to corporate tax planning. Working paper

Bagozzi RP, Yi Y (1988) On the evaluation of structural equation models. J Acad Mark Sci 16(1):74–94

Basoglu KA, Hess TJ (2014) Online business reporting: a signaling theory perspective. J Inf Syst 28(2):67–101

Beretta G (2017) Taxation of individuals in the sharing economy. Intertax 45(1):2–11

Beretta G (2018) VAT and the sharing economy. World Tax J 10(3):381–425

Berger L, Guo L, King T (2020) Selfish sharing? The impact of the sharing economy on tax reporting honesty. J Bus Ethics 167(2):181–205

Bergquist M, Nilsson A, Schultz WP (2019) A meta-analysis of field-experiments using social norms to promote pro-environmental behaviors. Glob Environ Chang 59(1):1–8

Bhattacharya CB, Sen S (2004) Doing better at doing good: when, why, and how consumers respond to corporate social initiatives. Calif Manage Rev 47(1):9–24

Bibler AJ, Teltser KF, Tremblay MJ (2021) Inferring tax compliance from pass-through: evidence from airbnb tax enforcement agreements. Rev Econ Stat 103(October):1–16

Bock O, Baetge I, Nicklisch A (2014) hroot: Hamburg registration and organization online tool. Eur Econ Rev 71(1):117–120

Bologna M (2020) Airbnb targeted by states suspecting tax-collection shortfalls. https://news.bloombergtax.com/daily-tax-report-state/airbnb-targeted-by-states-suspecting-tax-collection-shortfallsl. Accessed 24 Mar 2021

Botetzagias I, Dima A-FF, Malesios C (2015) Extending the theory of planned behavior in the context of recycling: the role of moral norms and of demographic predictors. Resour Conserv Recycl 95(1):58–67

Cohen J (1992) A power primer. Psychol Bull 112(1):155–159

Cox M (2019) Inside Airbnb: adding data to the debate. http://insideairbnb.com/. Accessed 15 Feb 2020

Dann D, Teubner T, Adam MTP, Weinhardt C (2020) Where the host is part of the deal: social and economic value in the platform economy. Electron Commer Res Appl 40(1):1–12

Dann D, Teubner T, Weinhardt C (2019) Poster child and guinea pig-Insights from a structured literature review on Airbnb. Int J Contemp Hosp Manag 31(1):427–473

Dohmen T, Falk A, Huffman D, Sunde U, Schupp J, Wagner GG (2011) Individual risk attitudes: measurement, determinants, and behavioral consequences. J Eur Econ Assoc 9(3):522–550

Elliot CB (2018) Taxation of the sharing economy: recurring issues. Bull Int Taxation 72(4):1–4

Endres D, Christoph S (2015) International company taxation and tax planning. Kluwer Law International

Ert E, Fleischer A (2019) The evolution of trust in Airbnb: a case of home rental. Ann Tour Res 75(1):279–287

European Commission (2016) A European agenda for the collaborative economy. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions

European Union (2017) Exploratory study of consumer issues in online peer-to-peer platform markets

Fetzer T, Spengel C, Dinger B, Werner A-C (2020) Besteuerungkonzepte für die Sharing Economy. Steuer und Wirtschaft 97(2):106–120

Fitzsimmons EG (2018) Uber hit with cap as New York City takes lead in crackdown. https://www.nytimes.com/2018/08/08/nyregion/uber-vote-city-council-cap.html. Accessed 14 Feb 2020

Fornell C, Larcker DF (1981) Evaluating structural equation models with unobservable variables and measurement error. J Mark Res 18(1):39–50

Frenken K, Waes A, Pelzer P, Smink M, Est R (2019) Safeguarding public interests in the platform economy. Policy Internet 12(3):1–26

Frey BS, Torgler B (2007) Tax morale and conditional cooperation. J Comp Econ 35(1):136–159

Friedman D, Cassar A (2004) Economics lab: an intensive course in experimental economics. Routledge, Vasa

Gallemore J, Maydew EL, Thornock JR (2014) The reputational costs of tax avoidance. Contemp Account Res 31(4):1103–1133

Gaskin J, Lim J (2017) CFA tool. AMOS plugin. http://statwiki.kolobkreations.com. Accessed 20 May 2020

Gebbia J (2016) How Airbnb designs for trust. TED.com

Gefen D, Straub DW (2003) Managing user trust in B2C e-services. E-service J 2(2):7–24

Gefen D, Straub DW (2004) Consumer trust in B2C e-commerce and the importance of social presence: experiments in e-products and e-services. Omega 32(6):407–424

Gibbs C, Guttentag D, Gretzel U, Morton J, Goodwill A (2018) Pricing in the sharing economy: a hedonic pricing model applied to Airbnb listings. J Travel Tour Mark 35(1):46–51

Godelnik R (2017) Millennials and the sharing economy: lessons from a ‘buy nothing new, share everything month’ project. Environ Innov Soc Trans 23(1):40–52

Gurran N, Phibbs P (2017) When tourists move in: how should urban planners respond to Airbnb? J Am Plann Assoc 83(1):80–92

Hair JF, Babin BJ, Krey N (2017) Covariance-based structural equation modeling in the journal of advertising: review and recommendations. J Advert 46(1):163–177

Hair JF, Ringle CM, Sarstedt M (2011) PLS-SEM: indeed a silver bullet. J Market Theory Pract 19(2):139–152

Hardeck I, Harden WJ, Upton DR (2021) Consumer reactions to tax avoidance: evidence from the United States and Germany. J Bus Ethics 170(1):75–96

Hardeck I, Hertl R (2014) Consumer reactions to corporate tax strategies: effects on corporate reputation and purchasing behavior. J Bus Ethics 123(2):309–326

Hawlitschek F, Teubner T, Gimpel H (2016) Understanding the sharing-drivers and impediments for participation in peer-to-peer rental. In: HICSS 2016 proceedings, vol 4801. IEEE, pp 4782–4791

Hesse M, Dann D, Brasesemann F, Teubner T (2020) Understanding the platform economy: signals, trust, and social interaction. In: HICSS 2020 proceedings, pp 1–10

Hodapp D, Hawlitschek F, Kramer D (2019) Value co-creation in nascent platform ecosystems: a delphi study in the context of the internet of things. In: ICIS 2019 proceedings, pp 1–17

Hoopes JL, Robinson L, Slemrod J (2018) Public tax-return disclosure. J Account Econ 66(1):142–162

Hu LT, Bentler PM (1999) Cutoff criteria for fit indexes in covariance structure analysis: conventional criteria versus new alternatives. Struct Equ Model 6(1):1–55

IBM (2019) IBM SPSS Amos. https://www.ibm.com/marketplace/structural-equation-modeling-sem. Accessed 20 May 2020

Jung J, Lee K (2017) Curiosity or certainty? A qualitative, comparative analysis of couchsurfing and airbnb user behaviors. In: CHI 2017 proceedings, pp 1740–1747

Kakar V, Voelz J, Wu J, Franco J (2018) The visible host: does race guide airbnb rental rates in San Francisco? J Hous Econ 40(1):25–40

Kasper M, Olsen J, Kogler C, Stark J, Kirchler E (2018) Individual attitudes and social representations of taxation, tax avoidance and tax evasion. In: Hashimzade N, Epifantseva Y (eds) The Routledge companion to tax avoidance research, chap 19. Routledge, pp 289–303

Ke Q (2017) Sharing means renting?: An entire-marketplace analysis of Airbnb. In: Proceedings of the 2017 ACM on web science conference. WebSci ’17, pp 131–139

Kim J, Youngseog Y, Hangjung Z (2015) Why people participate in the sharing economy: a social exchange perspective. In: PACIS 2015 proceedings, pp 1–6

Kirchler E, Maciejovsky B, Schneider F (2003) Everyday representations of tax avoidance, tax evasion, and tax flight: Do legal differences matter? J Econ Psychol 24(4):535–553

Kleven HJ, Knudsen MB, Kreiner CT, Pedersen S, Saez E (2011) Unwilling or unable to cheat? evidence from a tax audit experiment in Denmark. Econometrica 79(3):651–692

Klöckner CA (2013) A comprehensive model of the psychology of environmental behaviour—a meta-analysis. Glob Environ Chang 23(5):1028–1038

KPMG (2021) Country-by-country reporting: the latest information on the EU’s initiatives on public and non-public CBCR

Lagarden M, Schreiber U, Simons D, Sureth-Sloane C (2020) Country-by-country reporting goes public—Cui Bono? Int Transf Pricing J 27(2):91–97

Landis JR, Koch GG (1977) The measurement of observer agreement for categorical data. Biometrics 33(1):159–174

Liang LJ, Choi HC, Joppe M (2018) Exploring the relationship between satisfaction, trust and switching intention, repurchase intention in the context of Airbnb. Int J Hosp Manag 69(1):41–48

Liang S, Schuckert M, Law R, Chen C-C (2017) Be a “Superhost”: the importance of badge systems for peer-to-peer rental accommodations. Tourism Manage 60(1):454–465

Loebbecke C (2003) e-Business trust concepts based on seals and insurance solutions. IseB 1(1):55–72

Ma X, Hancock JT, Mingjie K-L, Mor N (2017) Self-disclosure and perceived trustworthiness of Airbnb host profiles. In: CSCW 2017 proceedings, pp 1–13

Martin CJ (2016) The sharing economy: a pathway to sustainability or a nightmarish form of neoliberal capitalism? Ecol Econ 121:149–159

Mascagni G (2018) From the lab to the field: a review of tax experiments. J Econ Surv 32(2):273–301

Mastercard, & Kaiser Associates (2019) The global Gig economy: capitalizing on a 500B opportunity. Technical report, Mastercard

McAfee A, Brynjolfsson E (2017) Machine, platform, crowd—harnessing our digital future. W. W. Norton & Company

Mittendorf C, Berente N, Holten R (2019) Trust in sharing encounters among millennials. Inf Syst J 29(5):1083–1119

Mittendorf C, Ostermann U (2017) Private vs. business customers in the sharing economy-the implications of trust, perceived risk, and social motives on Airbnb. In: HICSS 2017 proceedings, pp 5827–5836

Neumann J, Gutt D (2017) A homeowner’s guide to Airbnb: theory and empirical evidence for optimal pricing conditional on online ratings. In: ECIS 2017 proceedings, pp 997–1010

O’Brien RM (2007) A caution regarding rules of thumb for variance inflation factors. Qual Quant 41(5):673–690

OECD (2019) The sharing and Gig economy—effective taxation of platform sellers. OECD Publishing, Paris

OECD (2020) Public consultation document—model rules for reporting by platform operators with respect to sellers in the sharing and Gig economy. OECD, Technical Report February

Ogembo D, Lehdonvirta V (2020) Taxing earnings from the platform economy: an EU digital single window for income data? Br Tax Rev 1:82–102

Oskam J, Boswijk A (2016) Airbnb: the future of networked hospitality businesses. J Tourism Fut 2(1):22–42

Oxfam (2020) OECD public consultation on transfer pricing—Oxfam comments. OECD, Technical report

Pavlou PA, Gefen D (2004) Building effective online marketplaces with institution-based trust. Inf Syst Res 15(1):37–59

Pickhardt M, Prinz A (2014) Behavioral dynamics of tax evasion—a survey. J Econ Psychol 40(1):1–19

Piscicelli L, Cooper T, Fisher T (2015) The role of values in collaborative consumption: insights from a product-service system for lending and borrowing in the UK. J Clean Prod 97:21–29

Piscicelli L, Ludden GDS, Cooper T (2018) What makes a sustainable business model successful? An empirical comparison of two peer-to-peer goods-sharing platforms. J Clean Prod 172:4580–4591

Podsakoff PM, MacKenzie SB, Lee J-YY, Podsakoff NP (2003) Common method biases in behavioral research: a critical review of the literature and recommended remedies. J Appl Psychol 88(5):879–903

Ramthun C (2018) Fiskus prüft Steuerhinterziehung bei Airbnb-Vermietern. https://www.wiwo.de/finanzen/steuern-recht/unterkunft-vermittler-fiskus-prueft-steuerhinterziehung-bei-airbnb-vermietern/21244518.html. Accessed 25 May 2020

Reio TG, Brad S (2015) Exploratory factor analysis: implications for theory, research, and practice. Adv Dev Human Resour

Resnick P, Zeckhauser R (2002) Trust among strangers in internet transactions: empirical analysis of eBay’s reputation system. Econ Int E-commerce 11(2):1–26

Schäfer P, Braun N (2016) Misuse through short-term rentals on the Berlin housing market. Int J Housing Mark Anal 9(2):287–311

Schmitt N, Kuljanin G (2008) Measurement invariance: review of practice and implications. Hum Resour Manag Rev 18(4):210–222

Schwartz SH (2012) An overview of the Schwartz theory of basic values. Online Read Psychol Culture 2(1):1–20

Schwartz SH, Cieciuch J, Vecchione M, Davidov E, Fischer R, Beierlein C, Ramos A, Verkasalo M, Lönnqvist J-E, Demirutku K, Dirilen-Gumus O, Konty M (2012) Refining the theory of basic individual values. J Pers Soc Psychol 103(4):663–688

Sen S, Bhattacharya CB (2001) Does doing good always lead to doing better? Consumer reactions to corporate social responsibility. J Mark Res 38(2):225–243

Shotter J, Hancock A (2020) Poland’s finance minister set for tax battle with Airbnb. https://www.ft.com/content/3aacd4b0-3a09-11ea-b232-000f4477fbca. Accessed 24 Mar 2021

Skarpness B (1983) On the efficiency of using the sample kurtosis in selecting optimal LP estimators. Commun Stat Simul Comput 12(3):265–272

Slemrod J (2019) Tax compliance and enforcement. J Econ Lit 57(4):904–954

Slemrod J, Rehman OU, Waseem M (2022) How do taxpayers respond to public disclosure and social recognition programs? Evidence from Pakistan. Rev Econ Stat 104(1):116–132

Soleimani M (2021) Buyers’ trust and mistrust in e-commerce platforms: a synthesizing literature review. Inf Syst e-Bus Manag

Spence M (1973) Job market signaling. Q J Econ 87(3):355–374

Sundar A, Kellaris JJ (2016) Blue-washing the green halo: how colors color ethical judgments. In: The psychology of design: creating consumer appeal. Routledge/Taylor & Francis Group, pp 63–74

Sundararajan A (2016) The sharing economy: the end of employment and the rise of crowd-based capitalism. MIT Press

Teubner T, Adam MTP, Camacho S, Hassanein K (2014) Understanding resource sharing in C2C platforms: the role of picture humanization. In: ACIS 2014 Proceedings, pp 1–10

Teubner T, Flath CM (2015) The economics of multi-hop ride sharing: creating new mobility networks through is. Bus Inf Syst Eng 57(5):311–324

Teubner T, Hawlitschek F (2018) The economics of peer-to-peer online sharing. In: The rise of the sharing economy: exploring the challenges and opportunities of collaborative consumption. ABC-CLIO, pp 129–156

Teubner T, Hawlitschek F, Dann D (2017) Price determinants on airbnb: how reputation pays off in the sharing economy. J Self Govern Manage Econ 5(4):53–80

Teubner T, Norman S, Hawlitschek F, Weinhardt C (2016) It’s only pixels, badges, and stars: on the economic value of reputation on Airbnb. In: ACIS 2016 proceedings, pp 1–11

Tussyadiah IP (2016) Strategic self-presentation in the sharing economy: implications for host branding. In: Information and communication technologies in tourism. Springer, pp 695–708

Tussyadiah IP, Park S (2018) When guests trust hosts for their words: Host description and trust in sharing economy. Tour Manage 67(1):261–272

Voytenko Palgan Y, Zvolska L, Mont O (2017) Sustainability framings of accommodation sharing. Environ Innov Soc Trans 23:70–83

Wang D, Nicolau JL (2017) Price determinants of sharing economy based accommodation rental: a study of listings from 33 cities on Airbnb.com. Int J Hosp Manag 62(1):120–131

Wenzel M (2004) The social side of sanctions: personal and social norms as moderators of deterrence. Law Hum Behav 28(5):547–567

Wheeler MA, McGrath MJ, Haslam N (2019) Twentieth century morality: the rise and fall of moral concepts from 1900 to 2007. PLoS ONE 14(2):1–12

Wilking E (2020) Why does it matter who remits? Evidence from a natural experiment involving Airbnb and hotel taxes. Working Paper, pp 1–39

Zijm H, Sunderesh H, Klumpp M, Regattieri A (2019) Perspectives on operations management developments and research. Springer International Publishing, pp 15–25

Acknowledgements

We thank two anonymous reviewers as well as Florian Hawlitschek and Philipp Dörrenberg for helpful comments and suggestions.

Funding

Open Access funding enabled and organized by Projekt DEAL. This work was partially supported by the research alliance ForDigital (fordigital.org), an initiative encouraged and funded by the Federal State of Baden-Württemberg, Germany.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Ethics approval

This study was conducted in accordance with the ethical standards of the Institute of Information Systems and Marketing (IISM).

Consent to participate

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dann, D., Müller, R., Werner, AC. et al. How do tax compliance labels impact sharing platform consumers? An empirical study on the interplay of trust, moral, and intention to book. Inf Syst E-Bus Manage 20, 409–439 (2022). https://doi.org/10.1007/s10257-022-00554-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10257-022-00554-7