Abstract

We have developed a financial market model that incorporates the Disposition Effect, which refers to traders’ tendency to avoid realizing losses. Specifically, our model replicates several stylized facts commonly observed in financial markets, such as fat tails and volatility clustering. These market characteristics can be attributed to the Disposition Effect, especially when the trading behavior of agents aligns with the findings of Ben-David and Hirshleifer (Rev Financ Stud 25(8):2485–2532, 2012). To demonstrate this, we examine two versions of the model: one where a class of agents exhibits a high degree of Disposition Effect and another where traders are not influenced by it. By comparing the simulated time series generated by both versions, we find that the one with agents affected by the Disposition Effect better replicates the features observed in real financial markets. This holds true for both the deterministic and stochastic versions of the model.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, behavioral finance has been focused on studying the systematic biases displayed by financial actors and their impact on trading performance. For a comprehensive review of this field, refer to Shleifer (2000), Barberis and Thaler (2003), and Campbell (2006). Various trading patterns, such as the January effect (Ritter 1988), the weekend effect (Osborne 1962; Lakonishok and Maberly 1990), and the alternative "day-of-the-week effect" (Dubois and Louvet 1996; Romero-Meza et al. 2010), have drawn significant attention. However, one of the most prevalent biases is the tendency of traders to favor selling winning stocks over losing ones. This widely observed behavior is known as the Disposition Effect (DE), first introduced by Shefrin and Statman (1985).

In this paper we present a financial market model that incorporates the DE. It consists of an heterogeneous asset pricing model à la Day and Huang (1990). Similarly to other contributions on heterogeneous, boundedly rational, and interacting traders (Tramontana et al. 2013), we assume the existence of two populations of traders, fundamentalists and chartists (for an extensive survey on this stream of literature, see Hommes (2013) and Dieci and He (2018)). The second groups of traders exhibits a behavior consistent with the findings of Ben-David and Hirshleifer (2012), which include the DE. We then account for the presence of a market maker that adjusts the stock price with respect to traders’ excess demand. As a result, the dybamic of the asset is determined by a two-dimensional piece-wise nonlinear map. We are able to analytically demonstrate that the presence of non-professional traders has an important relevance on the stability of the system.

Our model also contributes to a recent stream of literature that focuses on estimating the model via matching the characteristics of simulated and real data, such as moments of the return distribution, autocorrelation functions and measures of volatility clustering, as in Franke and Westerhoff (2012, 2016). As this article aims to identify other stylized facts of financial markets that can be better explained by considering investors affected by DE, it aligns with existing literature on this subject. Furthermore, we demonstrate how the presence of this bias may facilitate price fluctuations and boom-bust dynamics, even starting from a stable scenario.

To this aim, taking into account the empirical evidence that highlights the presence of stylized empirical facts arising from statistical analysis of price variations in various types of assets in financial markets (Cont and Bouchaud 2000; Cont 2001), we demonstrate that our agent-based model is capable of reproducing some of these regularities, such as the absence of autocorrelation of returns, heavy tails, inferred volatility, and volatility clustering. Particularly, we test how the presence of different degrees of DE in our simulated time series allows us to simulate financial time series that closely resemble observed properties of real-financial market data. For a complete review of the literature on agent-based modeling of financial markets, see Chen et al. (2012). Moreover, we show that if the asset is subjected to purely Gaussian uncorrelated shocks, fat-tail distributed time series arise through the endogenous transmission mechanisms within the system.

The remainder of the paper is organized as follows: In the next section, we discuss some related literature. In Sect. 3, we present our simple discrete-time agent-based model. Section 4, by focusing on the stochastic version of the model, discusses the statistical properties of our simulated time series and the replicability of stylised facts and Sect. 5 estimates the model by using the method of moments. Sect. 6 is devoted to provide final considerations.

2 Literature review

The cause of the Disposition Effect has often been linked to the prospect theory preferences of investors (Camerer 2000; Henderson 2012; Li and Yang 2013, among others). According to Kahneman and Tversky’s (1979) findings, individuals tend to be more risk-averse in the domain of gains and more risk-seeking in the domain of losses. However, alternative explanations and criticisms have emerged. Coen-Pirani (2004) investigated the role of differences in risk aversion in affecting the long-run distribution of wealth across agents in an endowment economy and found that the long-run distribution of wealth is dominated by more risk-averse agents, contrary to results obtained from standard expected utility preferences. Kaustia (2010) analyzed data from the Finnish Central Securities Depository and showed that the propensity to sell an asset remains basically constant on losses and increases or remains constant on gains, questioning the universality of DE. Meng and Weng (2018) raised doubts about the existence of DE when the initial wealth is used as a reference point. Barberis and Xiong (2009) compared preferences defined over annual gains and losses with preferences defined over realized gains and losses, and they found that the realized gain/loss model better predicts DE. Hens and Vleck (2011) demonstrated that investors who sell winning stocks and hold losing assets might not have invested in stocks in the first place, challenging the prospect theory argument. Lehenkari (2012), using data from the Finnish stock market, suggested that the escalation of commitment explanation for DE seems to be more consistent with the data than the explanation based on prospect theory preferences. Regarding the consequences of this trading regularity, Grinblatt and Han (2005) demonstrated how DE can be the origin of both the persisting spread between a stock’s fundamental value and its market price and the tendency for rising asset prices to further increase, known as the Momentum Effect. Using individual trading data, Chang et al. (2016) found out that the disposition effect applies only to nondelegated assets like individual stocks, while delegated assets, like mutual funds, exhibit a robust reverse-disposition effect. Trejos et al. (2019) analyzed the overconfidence and its relationship with the disposition effect, confirming that investors exhibiting disposition effect are more prone to be overconfident. Dorn and Strobl (2023) showed that trading strategies as predicted by the disposition effect can arise as an optimal response to dynamic changes in the information structure if investors are asymmetrically informed.

Several theoretical models have been developed to consider investors biased with DE, including works by Barberis and Xiong (2009), Hens and Vleck (2011), Ingersoll and Jin (2013), and Polach and Kukacka (2019). Additionally, Rau (2014) analyzed gender differences in DE and loss aversion in an experimental framework, finding that female investors tend to sell a higher amount of stocks, indicating a significant degree of DE. This bias has been extensively studied in the behavioral literature using experimental approaches (e.g., Weber and Camerer 1998; Da Costa et al. 2013; Frydman and Rangel 2014; Talpsepp et al. 2014) as well as empirical frameworks (e.g., Odean 1998; Dhar and Zhu 2006; Brown and Kagel 2009; Jin and Scherbina 2011, which explored the relationship between DE and taxes; Firth 2015, among others).

Parallel to the DE, models with heterogeneous interacting agents in financial market have gained of importance in the last 30 years. The presence of different populations of investors, most commonly chartists and fundamentalists, allow to explain the complex dynamics of stock markets. The pioneering contribution of this strand of literature is the paper by Day and Huang (1990). A relevant breakthrough in these models is represented by Brock and Hommes (1998), where an asset pricing model with heterogeneous expectations is enriched with adaptive rationality. A further improvement of these models is represented by the introduction of jumps in price dynamics, given by the need to mimic regulations (Anufriev and Tuinstra 2013; Dercole and Radi 2020) or by non-smooth trading rules (see Anufriev et al. 2020; Campisi et al. 2021; Gardini et al. 2022, 2023a, b; Jungeilges et al. 2021). Our contribution enriches this stream of literature, by introducing, analyzing and calibrating a non-smooth 2D-system in a discrete-time framework. For an overview on this kind of models in economics and finance, see Anufriev et al. (2018). In the next section we present our stock market model setup.

3 The base model

In this asset market model, a market maker is responsible for adjusting the stock log-price \(P_{t}\) according to the rule:

where \(\alpha \ge 0\) represents the reactivity of the market maker to the total excess demand \(D_{t}\), which is the sum of the excess demands of all traders.Footnote 1

There are two groups of traders in this market: fundamentalists and chartists, and they interact with each other.

Fundamentalists buy the asset when its current price is lower than the exogenously given log-fundamental value F, and they sell it when the price is higher than F. Their excess demand \(D^{F}\) is described by the following formula:

where \(f>0\) represents their speed of adjustment. The cubic function in this equation captures the idea from Day and Huang (1990) that fundamentalists trade more aggressively as the market’s mispricing increases. This is due to their increasing conviction that a fundamental price correction is imminent as the misalignment grows, along with the increasing potential for gains through fundamental analysis. More recently, this nonlinear behavior for chartists has been also introduced in other frameworks. Tramontana et al. (2009), for instance, adopted this trading rule in a nonlinear dynamic model in which the stock markets of two countries are linked through the foreign exchange market.

Chartists, on the other hand, behave in the opposite manner. They buy the asset when it is overvalued (\(P_{t}>F\)) and sell it when it is undervalued (\(P_{t}<F\)), based on their belief in the persistence of the current scenario, at least in the short run. Typically, their excess demand \(D^{C}\) is determined as follows:

where \(c_{t}\) is a time-varying variable that measures the reactivity of chartists. Here, we incorporate the findings of Ben-David and Hirshleifer (2012), which suggest that the probability of buying or selling an asset for any amount of profit follows an asymmetric V-shaped function. Specifically, the function is steeper in the gain domain (right branch) than in the loss domain (left branch), resulting in an asymmetry related to the Disposition Effect (DE). In particular, as it is clear from Fig. 1, when traders deal with buying decisions, the lowest probability of buying corresponds to the scenario where the return is null. The more returns are positive or negative the higher is the probability of buying the asset. But the probability of buying increases faster when returns are negative (panel b). At the opposite, when a trader faces a selling decision, the probability of selling is still at the minimum when the return is null and it increases the more returns are positive or negative. In this case the probability of selling increases faster with positive returns (panel a). In our work, we link the DE only to the behavior of chartists, as they are typically assumed to be more prone to cognitive biases, heuristics, and rules of thumb (see, for instance, Kaizoji et al. 2015).

Figure 1 illustrates the V-shaped function representing the probability of buying/selling decisions based on the amount of profit, highlighting the asymmetry in the gain and loss domains.

V-shaped probability of selling, panel a, and of buying, panel b, an asset with respect to the comparison between current and reference price. On the horizontal axis, there are profits measured as the return since purchase, or the difference between current and purchase price, used as reference price

In our work, we utilize reactivity c as a proxy for the probability of selling/buying the asset. Instead of considering c as an exogenous parameter, we treat it as a time-varying variable that changes its value at each time step based on the findings of Ben-David and Hirshleifer (2012). Moreover, following Grinblatt and Han (2005), we define the traders’ profit at the aggregate level as the difference between the current asset price \(P_{t}\) and a weighted average of past prices \({\widetilde{P}}_{t}\), forming the reference price.

To model the reactivity of chartists at time t (\(c_{t}\)), we use the following piecewise-defined function:

where \(s_{g}, s_{l}, b_{g}\), and \(b_{l}\) are positive parameters regulating the slope of the branches of the V-shaped function. To be consistent with empirical evidence mentioned above, we assume that \(s_{g} \ge s_{l}\) and \(b_{l} \ge b_{g}\). Parameters \({\hat{c}}\) and f measure the relevance of the two groups of traders in the market. From a financial point of view, the behavior of \(c_{t}\) in (4) can be interpreted in the following way: In all cases the primary level of \(c_{t}\) is provided by the relevance of the chartists (\({\hat{c}}\)) while, the secondary components (depending on parameters \(s_{g}, s_{l}, b_{g}\) and \(b_{l}\)) direct the strategy of the chartists based on the return \((P_{t}-{\widetilde{P}}_{t})\). Specifically, when non-fundamentalist traders want to buy (i.e., when \(P_{t}>F\)), the more returns are different from zero, the more they buy, with more sensitivity to negative returns (\(b_{l} \ge b_{g}\)). Instead, when chartists decide to sell the asset (i.e., when \(P_{t}<F\)), the more returns are different from zero, the more they sell, with more sensitivity to positive returns (\(s_{g} \ge s_{l}\)). This is coherent with the results of Ben-David and Hirshleifer (2012), in fact the four equations in (4) correspond the four linear branches of Fig. 1.

The importance that professional and non-professional traders attribute to \({\widetilde{P}}_{t}\) also plays a crucial role in this adjustment dynamic. The reference price is thus updated using the following equation:

where \(\lambda \in [0,1]\) regulates the gradual fading importance of past prices.

By inserting the endogenous reactivity (4) in the chartists’ trading rule (3) and combining it with the fundamentalists’ trading rule (2) in the market maker equation (1), we derive the two-dimensional piecewise-defined nonlinear map that origins our 2-D dynamical system that governs the dynamics of the asset price and reference price:

where \(c_t\) is the piecewise-defined function defined in Eq. (4). This map captures the interactions between fundamentalists and chartists and how their trading behaviors influence the asset price and the reference price over time.

3.1 Analytical results

We denote with an asterisk (\(^{*}\)) the equilibrium values of the model’s variables. A first result concerning the equilibria and stability properties is the following:

Proposition 1

The equilibria of the dynamical system (6) are such that \(P^{*}=\) \({\widetilde{P}}^{*}\), meaning that at the equilibrium, the asset price is equal to its reference price.

Proof

By using the equilibrium conditions \(P_{t+1}=P_{t}=P^{*}\) and \({\widetilde{P}}_{t+1}={\widetilde{P}}_{t}={\widetilde{P}}^{*}\) on the dynamic equation of the reference price we immediately get \(P^{*}=\) \({\widetilde{P}}^{*}\). \(\square \)

An immediate consequence is that the parameter \(\lambda \) plays no role in the equilibrium values. At the equilibria the stock price and the reference price are equal. Moreover, given the different regimes of \(c_{t}\) in (4), we can say that equilibria are always located in a border, that is in a point of not differentiability for the map (6).

Concerning the number of the equilibria, we have the following result:

Proposition 2

The dynamical system (6) admits up to three equilibrium points. The first one is the fundamental equilibrium (\(E_{0}\)) where the asset price is equal to its fundamental value (\(P_{0}^{*} = F\)). The other two are non-fundamental equilibria (\(E_{1,2}\)), where the asset price is different from the fundamental value (\(P_{1,2}^{*} = F \pm \sqrt{\frac{{\widehat{c}}}{f}}\)). The existence of these non-fundamental equilibria depends on the relative importance of chartists and fundamentalists.

Proof

Using the equilibrium conditions \(P_{t+1}=P_{t}=P^{*}\) and \({\widetilde{P}}_{t+1}={\widetilde{P}}_{t}={\widetilde{P}}^{*}\) on the first equation of the dynamical system (6), we first get that at the equilibrium the reactivity of chartists (\(c^{*}\)) must be equal to \({\widehat{c}}\). In fact, as we know from Proposition 1, at the equilibrium the asset price is equal to the reference price, so all the four possible dynamic equations of the reactivity (4) reduce to \(c_{t}={\widehat{c}}\). Then, we get that at the equilibrium:

from which we obtain the three equilibrium values of the asset price (and of the reference price) for any positive value of parameters \({\hat{c}}\) and f, as in Tramontana et al. (2009):

In the \(E_{0}\) equilibrium there are no transactions at all because the asset price is equal to its fundamental value and both kinds of traders do not trade. Instead, at the two non-fundamental equilibria \(E_{1,2}\) the asset price is constantly above (resp. below) the fundamental value and the action of one kind of trader is perfectly compensated by the counter-action of the other kind of trader, leaving the asset price at the same value. The mispricing of the two non-fundamental fixed points thus depends on the relation of parameters f and \({\hat{c}}\). In particular, the distance between the two non-fundamental equilibria increases in line with the relevance of chartists and decreases with respect to the weight of fundamentalists. If we consider strictly positive values of \({\widehat{c}}\) and f then the three equilibria always exist. \(\square \)

The next result concerns the local stability of the equilibria.

Proposition 3

The fundamental equilibrium \(E_{0}\) is unstable. In particular, it is a saddle point.

Proof

The local stability of the equilibria must be studied by using the Jacobian matrix of (6) (see Gandolfo 2009; Puu 2013, among other contributions) calculated at the equilibria. Considering the fundamental equilibrium, we have:

where in the main diagonal there are the two eigenvalues (\(\xi _{1}=1+\alpha {\widehat{c}}\) and \(\xi _{2}=\lambda \)). Given the positivity of the parameters \(\alpha \) and \({\widehat{c}}\) we have that \(\xi _{1}>1\) so the equilibrium is unstable. Considering that \(\lambda \) is by definition positive and lower than one, we can conclude that \(E_{0}\) is a saddle \(\square \)

Concerning the local stability of the two non-fundamental equilibria we can state what follows:

Proposition 4

The non-fundamental equilibria \(E_{1,2}\) are both locally stable provided that \({\widehat{c}} < \frac{1}{\alpha }\). At \({\widehat{c}} = \frac{1}{\alpha }\) a flip bifurcation of the two non-fundamental equilibria occur.

Proof

The Jacobian matrix of (6) calculated at the two non-fundamental equilibria is the same, that is:

where in the main diagonal there are the two eigenvalues (\(\xi _{1}=1-2\alpha {\widehat{c}}\) and \(\xi _{2}=\lambda \)). Given the positivity of the parameters \(\alpha \) and \({\widehat{c}}\) we have that \(\xi _{1}\) is always lower than one. So the equilibria are locally stable provided that \(\xi _{1}>-1\), which leads to the local stability condition \({\widehat{c}} < \frac{1}{\alpha }\). At \({\widehat{c}} = \frac{1}{\alpha }\) the eigenvalue \(\xi _{1}\) is equal to \(-1\), which is a flip bifurcation value. \(\square \)

The absence of a role for the parameters related to the Disposition Effect in the equilibrium values and stability of the fundamental equilibrium is an intriguing observation. This suggests that the presence of non-professional traders, represented by chartists in the model, has a more significant impact on the stock market’s stability than the Disposition Effect itself.

The study by Gardini et al. (2022) showing that the stock market’s fundamental fixed point is always unstable in the presence of sentiment traders highlights the fragility of the market’s stability. The inclusion of non-professional traders, such as chartists, can lead to a decrease in stock market stability, making it more susceptible to instability. Moreover, very similar stability properties of the fundamental equilibrium has been observed in Tramontana et al. (2009), in whose framework the fundamental steady state is always unstable.

The presence of the two non-fundamental equilibria (i.e., \(E_{1}\), \(E_{2}\)) introduces complexities in the analytical study of their local stability. These equilibria are located on the boundary separating regions of the phase space with different dynamic equations. In these cases, the reactivity of chartists changes depending on whether the asset price is higher or lower than the reference price, leading to different dynamics.

For instance, in equilibrium \(E_{1}\) where both asset price and reference price are higher than the fundamental value, the reactivity of chartists can be expressed as \({\widehat{c}} + b_{g}(P_{t} - {\widetilde{P}}_{t})\), or \({\widehat{c}} - b_{l}(P_{t} - {\widetilde{P}}_{t})\), based on the location in the phase plane. This implies that chartists may receive buying signals that dominate the selling signals received based on the past reference price, applying different weights.

Overall, the model provides valuable insights into the interactions between fundamentalists and chartists and their effects on stock market stability. It highlights the role of sentiment traders and their potential influence on the dynamics of the stock market, especially in the presence of non-fundamental equilibria and occasional shocks.

3.2 Numerical results

To study the role of the more relevant parameters, we fix the others at \(\alpha =1\), \(f=0.6\), \(\lambda =0.9\). Moreover, in line with the experimental evidence of Ben-David and Hirshleifer (2012), we consider this relation among the DE parameters: \(s_g=b_l=2s_l=2b_g\). So by moving \(s_g\) we also move the other three DE parameters. The numerical simulations provide valuable insights into the local stability of the non-fundamental equilibria in the model. By varying the parameter \({\widehat{c}}\), which represents the exogenous component of chartists’ reactivity, the simulations reveal the emergence and stability of these equilibria.

Panel (a) of the one-dimensional bifurcation diagram in Fig. 2 illustrates the dynamics of the model as the relevance of chartists increases (by varying \({\widehat{c}}\) from 0 to 1.5). As the relevance of chartists grows, the two non-fundamental equilibria emerge and become unstable through flip bifurcation at \({\widehat{c}}=1\). All the parameters related to DE are set equal to 0. A dynamic transition from stable equilibria to period-two cycles occurs and eventually lead to unbounded and chaotic behavior for higher values of the reactivity parameter. This suggests that the trend-extrapolating behavior of chartists is a significant driver of instability and unpredictability in the asset price dynamics.

Panel (b) explores the role of the Disposition Effect by varying the parameters related to this bias (\(s_g\), \(s_l\), \(b_g\), \(b_l\)) and considering \({\widehat{c}}=0.63\).. Increasing the values of these parameters leads to the loss of stability of the two fixed points, resulting in period-doubling bifurcations and chaotic motion. The deeper the DE, the more unstable and unpredictable the asset price dynamics become, and the larger the price fluctuations. The behavioral bias of the DE amplifies the actions of traders, especially when the price differs from the reference one. Panic selling and frequent transactions induced by this bias contribute to market instability, higher volatility, and decreased predictability.

Panel (c) further demonstrates the impact of the behavioral bias on the market. The parameter setting \({\widehat{c}}=1.23\) and \(s_g=0.63\) results in regions of instability and chaos. The market experiences chaotic price fluctuations driven by the trend-following behavior of non-professional traders.

In summary, numerical simulations highlight the importance of chartists’ reactivity and the influence of the Disposition Effect in the emergence of instability, chaotic dynamics, and increased price fluctuations in the stock market. The model provides valuable insights into the complex interactions between fundamentalists and chartists, and how the behavior of sentiment traders can significantly impact the overall stability and dynamics of the market.

In the left top panel bifurcation diagram when the exogenous component \({\widehat{c}}\) of the chartists’ reactivity varies. In the right top panel bifurcation diagram with respect to the DE effect parameter \(s_{g}\) with \({\widehat{c}}=1.23\). In the bottom panel a typical chaotic timeplot obtained with \({\widehat{c}}=1.23\) and \(s_{g}=0.63\)

This result seems to be robust to changes in the combinations of parameters considered.

4 The stochastic version of the model

The bifurcation diagrams in Fig. 2 illustrate how our deterministic model can already capture some qualitative features of financial markets, such as bubbles, crashes, and some level of excess volatility, particularly in the chaotic region of the parameter space. This represents an initial contribution of the Disposition Effect (DE) in enabling the model to better replicate the dynamic evolution of financial markets. However, to gain deeper insights into the role of DE in asset price dynamics, a more comprehensive analysis is required, which involves incorporating stochastic components. In other words, we are interested in investigating whether the introduction of stochastic elements allows the DE to account for additional stylized facts observed in financial markets.

In this next step of our study, we aim to demonstrate that DE can lead to simulated returns that better reproduce important quantitative features observed in financial markets. To achieve this, we need a more sophisticated examination of the time series’ characteristics and its descriptive power. Firstly, assuming a constant, exogenously given fundamental value may not be realistic. Therefore, we now consider the fundamental value to follow a random walk, capturing unexpected or unpredictable events that may impact a financial asset. The fundamental value is modeled as a geometric Brownian motion, with its log-value described by equation:

where \(\xi _{F,t}\) is independently and identically distributed, representing the stochastic component.

Additionally, we assume that the amount of chartists (measured by the proxy \({\widehat{c}}\)) varies with time. Therefore, we consider:

where \(\xi _{{\widehat{c}},t}\) is also independently and identically distributed, accounting for the stochastic behavior of \({\widehat{c}}\).

To test the model, we use the same fixed parameter values as shown in Fig. 3c: \(\alpha =1\), \(f=0.6\), \(\lambda =0.9\), and \(\tau =0.7\). We set the initial values of \(P_{0}=0.97\) and \({\tilde{P}}_{0}=1.02\). It is worth noting that the initial values of the dynamic variables have a negligible effect on the results of the stochastic model.

To calibrate the variance of the noise, we adopt a trial and error approach, aiming to find a value that preserves the stability of the model. Specifically, we have chosen the following initial values, averages, and variances:

Then we have considered three different scenarios, which differ for different values of \(s_{g}\):

-

1.

\(s_{g}=0\) (no DE)

-

2.

\(s_{g}=0.2\) (weak DE)

-

3.

\(s_{g}=0.35\) (strong DE)

For each scenario, we conducted 1000 runs of Monte Carlo simulations, with each run consisting of 500 iterations of the dynamical system (6) with stochastic fundamental value. The Monte Carlo method involves randomly selecting sequences of F and \({\widehat{c}}\) for each simulation, and building samples based on these values. This process was repeated a thousand times to obtain the distribution of our simulated time series as the output.

Various stylized facts, which are qualitative features commonly observed in financial markets, have been extensively studied by Mantegna and Stanley (2000), Cont (2001), and Lux and Ausloos (2002).

The volatility of returns, as discussed in Shiller (2015), is measured by using the variance of simulated time series of returns. This measure indicates the average volatility.

Additionally, excess kurtosis, a measure of the peakiness of a distribution, indicates a slow decay of the probability density function, known as heavy tails (LeBaron and Samanta 2005). The presence of heavy tails suggests a non-normal decay, but determining the precise form of the tails can be challenging. To assess the presence of heavy tails, we calculate the kurtosis of the distribution using the formula:

where \(\sigma (T)^{2}\) represents the variance of log-returns. A positive value of \(\kappa \) indicates the presence of fat tails.

However, a high level of kurtosis alone is not sufficient to identify the distribution of returns. Additional tests are needed to explore the normality of the returns distribution. We perform the Jarque–Bera test and the Shapiro–Wilk test (as suggested in the comprehensive guide of Yap and Sim, 2011), and also use Q-Q plots and compare the theoretical kernel estimator with the simulated distribution.

Table 1 presents various values of kurtosis, volatility, and p-values for different degrees of \(s_{g}\). The Jarque–Bera test is used as a moment test, while the Shapiro–Wilk test is based on regression.

The results clearly indicate that scenarios with high DE are characterized by higher kurtosis and also exhibit the highest volatility. The null hypothesis of normality for the distribution of returns is consistently rejected by both the Jarque–Bera and Shapiro–Wilk tests, except in the case when DE is not present (\(s_{g}=0\)). As emphasized before, neglecting the role of the bias leads to a less accurate description of real financial indexes or time-series.

Scenario 1 (\(s_{g}=0\)). Panels a and b show the pattern of the simulated price (in red), fundamental value (in blue) and returns. They are single, representative, simulations obtained with a sequence of random realizations of the fundamental value. Panel c illustrates the theoretical kernel estimator (in blue) compared with the simulated distribution (in red). In panel d figures the relative probability plot. Average measures and statistics of 1000 Monte Carlo simulations (length 500 iterations each) (Color figure online)

Scenario 2 (\(s_{g}=0.2\)). Panels a and b show the pattern of the simulated price (in red), fundamental value (in blue) and returns. They are single, representative, simulations obtained with a sequence of random realizations of the fundamental value. Panel c illustrates the theoretical kernel estimator (in blue) compared with the simulated distribution (in red). In panel d figures the relative probability plot. Average measures and statistics of 1000 Monte Carlo simulations (length 500 iterations each) (Color figure online)

Scenario 3 (\(s_{g}=0.35\)). Panels a and b show the pattern of the simulated price (in red), fundamental value (in blue) and returns. They are single, representative, simulations obtained with a sequence of random realizations of the fundamental value. Panel c illustrates the theoretical kernel estimator (in blue) compared with the simulated distribution (in red). In panel d figures the relative probability plot. Average measures and statistics of 1000 Monte Carlo simulations (length 500 iterations each) (Color figure online)

Figures 3, 4, 5 display the simulated time-series of prices and returns for all scenarios, along with the previously discussed patterns observed in financial markets. Panels a and b of these figures show individual sequences of the evolution of price and returns for different combinations of \(s_{g}\). Panels c present the distribution of our simulated time series (in red) compared with the theoretical kernel normal distribution (in blue). Finally, panels d show the probability plot (QQ-Plot), which helps in assessing the deviation from normality.

An additional analysis is provided in Table 2, where the average values of negative and positive returns are compared. This table highlights the presence (or absence) of the gain/loss asymmetry, a stylized fact stating that financial markets generally experience "large drawdowns in stock prices and stock index values but not equally large upward movements" (Cont 2001). Notably, Scenario 3 exhibits the most pronounced difference.

In conclusion, our results suggest that considering the presence of DE in a portion of traders may contribute to a more accurate replication of the dynamics of financial markets. It is important to bear in mind that traders are influenced by various biases, and we have only considered one of them. Nevertheless, our findings indicate that the scenarios that better capture the dynamics of returns in real financial time-series are those characterized by a presence of the bias. In the following section, we will present a comprehensive empirical analysis to ascertain whether these qualitative results are corroborated by real data.

5 Empirical results

In this section, we employ the method of simulated moments as in Franke and Westerhoff (2011, 2012, 2016) to assess whether introducing the disposition effect enhances the model’s ability to replicate key stylized facts observed in financial time series. The fundamental idea behind MSM is to identify the best model specification that, through simulation, closely reproduces selected moments, aligning them with their empirical counterparts.

To this end, we analyze the Standard and Poor (S &P 500) stock market index from January 1980 to the end of May 2023, encompassing 10,944 daily observations. This benchmark time series serves as a basis for comparing the model’s performance with four essential stylized facts observed in empirical financial data: the absence of autocorrelation in raw returns, heavy tails, volatility clustering, and long memory. We quantify these characteristics through nine moments, including the mean of absolute returns (Mean abs ret), the autocorrelation function of returns (ACF ret), the autocorrelation function of absolute returns with multiple lags (ACF abs ret lag n), and the Hill tail index of absolute returns (Hill abs ret) at the top 5% level. We consider the model in (6) and we choose the following range for parameters \(\alpha \) and f:

-

\(\alpha \in [-1.5,1.5]\), with step of 0.1 and \(\alpha \ne 0\);

-

\(f\in [0.1,0.9]\);

As a starting point we set \(\hat{c_0}=1-f\) and \(F_0=P_0=4.66\); these parameter ranges allow for a comprehensive investigation of their impact on the model’s ability to capture the disposition effect and its influence on stylized facts.

We run a Monte Carlo simulation with \(M=1000\) trajectories of length \(N=10944\) for each parameters setting \(\alpha , f, {\hat{c}}\) for a total of 270 combinations. We set other parameters to \(\Delta t=1/252\) (daily time step), \(b_l=s_g\), \(b_g=s_g/2\), \(s_l = b_g\) and \(s_g=0\), \(s_g=0.2\) and \(s_g=0.35\) for the no disposition effect, weak disposition effect and strong disposition effect scenarios, respectively. This choice allows us to isolate the effects of the disposition effect from other model features, providing a clearer understanding of its specific contribution. We compute the moments of the simulated paths \((\widehat{mom_i})\) and we compare them with empirical S &P 500 moments \((mom^{emp}_i)\) in terms of root-mean- squared error(RMSE):

First, we consider all moments (\(h=9\) in (9)) to get an overview of the global RMSE, the results are shown in Table 3. It is evident that the best performance is obtained using the strong disposition effect specification.

To gain a deeper understanding of the stylized details of the financial time series, we further analyze the results by splitting them into four blocks. Specifically, we examine the mean of absolute returns, the autocorrelation function of returns, the autocorrelation function of absolute returns with multiple lags, and the Hill tail index of absolute returns individually.

The corresponding results are presented in Tables 4, 5, 6, 7. Generally, we notice that incorporating the disposition effect specification consistently enhances the results concerning RMSE across all moments, with one exception-the Hill tail index. Surprisingly, when it comes to the Hill tail index moment, the model excluding the disposition effect shows slightly better performance. This deviation could potentially be attributed to the greater impact of the disposition effect within the central part of the distribution rather than at the tails. Consequently, we witness a minor decline in the RMSE when evaluating the superior model based on the Hill tail index. However, in the other cases, incorporating the disposition effect in the model leads to better performance in replicating the empirical moments.

These findings provide further support for the relevance of the disposition effect in enhancing the model’s ability to capture important features of financial time series. The consistent improvement in performance across various moments indicates that the disposition effect plays a significant role in shaping market dynamics and price fluctuations. It reinforces the notion that behavioral biases can have a substantial impact on financial markets and may contribute to the observed stylized facts in empirical data.

To account for the variability of the moments, which could be relevant for selecting the appropriate model specification, we also consider an analysis using the following quadratic function (Pruna et al., 2020):

where W represents the inverse of an estimated variance-covariance matrix \({\hat{\Sigma }}\) of the fitted moments. The results based on this analysis are presented in Table 8. Remarkably, incorporating the disposition effect into the model significantly reduces the discrepancy between empirical and simulated data.

Considering the variability of the moments through the use of the quadratic function provides a more comprehensive evaluation of model performance. It demonstrates that the disposition effect plays a crucial role in better aligning the simulated moments with their empirical counterparts. The reduction in the distance between the two sets of data further supports the relevance of the disposition effect in enhancing the model’s accuracy and its ability to capture the key characteristics of financial time series.

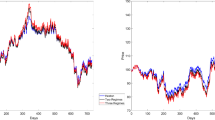

Finally, in Fig. 6, we present an illustration of simulated log-price paths for the three model specifications (no DE, weak DE, and strong DE) in comparison with the empirical S &P 500 log-price series. It is evident that the paths incorporating the disposition effect (DE) appear to closely resemble the real data, showcasing a significant improvement over the no DE specification. On the other hand, the discrepancy between the weak and strong DE specifications is not as substantial, validating the RMSE findings where the optimal model varies depending on the specific moment being considered.

Example of paths with different model specifications: S &P 500 log-price series (blue line), example of simulated log-price series without DE (red-line), example of simulated log-price series with weak DE (yellow-line) and example of simulated log-price series with strong DE (purple-line) (Color figure online)

6 Conclusions

In this paper, we explore the implications of the trading irregularity known as the Disposition Effect (DE). Our study develops a simple financial market model where heterogeneous agents coexist, and a group of traders exhibit behavior consistent with the empirical findings of Ben-David and Hirshleifer (2012), leading to the emergence of DE.

We discover that when DE is pronounced, the stock market becomes more susceptible to instability, and this bias can contribute to the appearance of bubbles and crashes. The psychological inclination of investors to strongly react to price changes collectively shapes the dynamics of stock markets. The resulting panic selling triggers sudden and frequent transactions, making the market more volatile, unstable, and less predictable.

The version of our model that most accurately replicates essential characteristics of financial time series, such as heavy tails, skewness, high volatility, and gain/loss asymmetry, is the one where traders are significant and highly affected by this bias. Notably, the impact of the behavioral parameter was observed both in the deterministic and stochastic version of the model. Furthermore, empirical analysis confirms the relevance of DE.

To the best of our knowledge, our approach is the first to explore the problem by focusing on the study of piecewise-nonlinear maps and empirically validating the model. We believe that this approach offers valuable insights into the consequences of investors’ behavioral traits on asset price dynamics and hope that our research inspires further work in this direction. In our future studies, we will continue to analyze this class of models.

References

Anufriev, M., Tuinstra, J.: The impact of short-selling constraints on financial market stability in a heterogeneous agents model. J. Econ. Dyn. Control 37(8), 1523–1543 (2013)

Anufriev, M., Radi, D., Tramontana, F.: Some reflections on past and future of nonlinear dynamics in economics and finance. Decis. Econ. Finan. 41, 91–118 (2018)

Anufriev, M., Gardini, L., Radi, D.: Chaos, border collisions and stylized empirical facts in an asset pricing model with heterogeneous agents. Nonlinear Dyn. 102(2), 993–1017 (2020)

Barberis, N., Thaler, R.: A survey of behavioral finance. In: Handbook of the Economics of Finance, vol. 1, pp. 1053–1128 (2003)

Barberis, N., Xiong, W.: What drives the disposition effect? An analysis of a long-standing preference-based explanation. J. Financ. 64(2), 751–784 (2009)

Ben-David, I., Hirshleifer, D.: Are investors really reluctant to realize their losses? Trading responses to past returns and the disposition effect. Rev Financ. Stud. 25(8), 2485–2532 (2012)

Brock, W., Hommes, C.: Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J. Econ. Dyn. Control 22, 1235–1274 (1998)

Brown, A.L., Kagel, J.H.: Behavior in a simplified stock market: the status quo bias, the disposition effect and the ostrich effect. Ann. Finance 5, 1–14 (2009)

Camerer, C.: Prospect Theory in the Wild: Evidence from the Field. In Kahneman, D., Tversky, A., Choices, Values and Frames, Cambridge University Press, Cambridge (2000)

Campbell, J.: Household finance. J. Financ. 61, 1553–1604 (2006)

Campisi, G., Muzzioli, S., Tramontana, F.: Uncertainty about fundamental, pessimistic and overconfident traders: a piecewise-linear maps approach. Decisions Econ. Finan. 44, 707–726 (2021)

Chang, T.Y., Solomon, D.H., Westerfield, M.M.: Looking for someone to blame: Delegation, cognitive dissonance, and the disposition effect. J. Financ. 71(1), 267–302 (2016)

Chen, S., Chang, C., Du, Y.: Agent-based economic models and econometrics. Knowl. Eng. Rev. 27(2), 187–219 (2012)

Coen-Pirani, D.: Effects of differences in risk aversion on the distribution of wealth. Macroecon. Dyn. 8(5), 617–632 (2004)

Cont, R., Bouchaud, J.-F.: Herd behaviour and aggregate fluctuations in financial markets Macroeconomic Dyanmics 4, 2170–196 (2000)

Cont, R.: Empirical properties of asset returns: stylized facts and statistical issues. Quant. Financ. 1, 223–236 (2001)

Da Costa Jr., N., Goulart, M., Cupertino, C., Macedo Jr., J., Da Silva, S.: The disposition effect and investor experience. J. Bank. Financ. 37, 1669–1675 (2013)

Day, R.H., Huang, W.: Bulls, bears and market sheep. J. Econ. Behav. Org. 14(3), 299–329 (1990)

Dercole, F., Radi, D.: Does the “uptick rule" stabilize the stock market? Insights from adaptive rational equilibrium dynamics. Chaos Solitons Fractals 130, 109426 (2020)

Dieci, R., He, X.: Heterogeneous agents model in finance. In: Hommes, C., LeBaron, B. (eds.) Handbook of Computational Economics: heterogeneous agents modeling, pp. 257–328. Amsterdam (2018)

Dhar, R., Zhu, N.: Up close and personal: investor sophistication and the disposition effect. Manage. Sci. 52, 726–740 (2006)

Dorn, D., Strobl, G.: Rational disposition effects: theory and evidence. J. Bank. Financ. 153, 106858 (2023)

Dubois, M., Louvet, P.: The day-of-the-week effect: the international evidence. J. Bank. Financ. 20(9), 1463–1484 (1996)

Firth, C.: The disposition effect in the absence of taxes. Econ. Lett. 136, 55–58 (2015)

Franke, R., Westerhoff, F.: Estimation of a structural stochastic volatility model of asset pricing. Comput. Econ. 38, 53–83 (2011)

Franke, R., Westerhoff, F.: Structural stochastic volatility in asset pricing dynamics: estimation and model contest. J. Econ. Dyn. Control 36(8), 1193–1211 (2012)

Franke, R., Westerhoff, F.: Why a simple herding model may generate the stylized facts of daily returns: explanation and estimation. J. Econ. Interac. Coord. 11, 1–34 (2016)

Frydman, C., Rangel, A.: Debiasing the disposition effect by reducing the saliency of information about a stock’s purchase price. J. Econ. Behav. Organ. 107, 541–552 (2014)

Gandolfo, G.: Economic Dynamics. Springer, Berlin (2009)

Gardini, L., Radi, D., Schmitt, N., Sushko, I., Westerhoff, F.: Causes of fragile stock market stability. J. Econ. Behav. Organ. 200, 483–498 (2022)

Gardini, L., Radi, D., Schmitt, N., Sushko, I., Westerhoff, F.: A 2D piecewise-linear discontinuous map arising in stock market modeling: two overlapping period-adding bifurcation structures. Chaos Solitons Fractals 176, 114143 (2023)

Gardini, L., Radi, D., Schmitt, N., Sushko, I., Westerhoff, F.: Perception of fundamental values and financial market dynamics: mathematical insights from a 2D piecewise-linear map. SIAM J. Appl. Dyn. Syst. 21, 2314–2337 (2023)

Grinblatt, M., Han, B.: Prospect theory, mental accounting, and momentum. J. Financ. Econ. 78(2), 311–339 (2005)

Henderson, V.: Prospect theory, liquidation, and the disposition effect. Manage. Sci. 58(2), 445–460 (2012)

Hens, T., Vleck, M.: Does prospect theory explain the disposition effect? J. Behav. Financ. 12(3), 141–157 (2011)

Hommes, C.: Behavioral Rationality and Heterogeneous Expectations in Complex Economic Systems. Cambridge University Press, Cambridge (2013)

Ingersoll, J., Jin, L.: Realization utility with reference-dependent preferences. Rev. Financ. Stud. 26, 723–767 (2013)

Jin, L., Scherbina, A.: Inheriting losers. Rev. Financ. Stud. 24, 786–820 (2011)

Jungeilges, J., Maklakova, E., Perevalova, T.: Asset price dynamics in a bull and bear market. Struct. Chang. Econ. Dyn. 56, 117–128 (2021)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 46, 263–291 (1979)

Kaizoji, T., Leiss, M., Saichev, A., Sornette, D.: Super-exponential endogenous bubbles in an equilibrium model of fundamentalist and chartist traders. J. Econ. Behav. Organ. 112, 289–310 (2015)

Kaustia, M.: Prospect theory and the disposition effect. J. Financ. Quant. Anal. 45(3), 791–812 (2010)

Lakonishok, J., Maberly, E.: The weekend effect: trading patterns of individual and institutional investors. J. Financ. 45(1), 231–243 (1990)

LeBaron, B., Samanta, R.: Extreme value theory and fat tails in equity markets. Available at SSRN 873656 (2005)

Lehenkari, M.: In search of the underlying mechanism of the disposition effect. J. Behav. Decis. Making 25(2), 196–209 (2012)

Li, Y., Yang, L.: Prospect theory, the disposition effect, and asset prices. J. Financ. Econ. 107(3), 715–739 (2013)

Lux, T., Ausloos, M.: Market fluctuations I: Scaling, multiscaling, and their possible origins. In: Bunde, A., Kropp, J., Schellnhuber, H. (eds.) Science of Disaster: Climate Disruptions, Heart Attacks, and Market Crashes, pp. 373–410. Springer, Berlin (2002)

Mantegna, R., Stanley, E.: An Introduction to Econophysics. Cambridge University Press, Cambridge (2000)

Meng, J., Weng, X.: Can prospect theory explain the disposition effect? A new perspective on reference points. Manage. Sci. 64(7), 3331–3351 (2018)

Odean, T.: Are investors reluctant to realize their losses? J. Financ. 53(5), 1775–1798 (1998)

Osborne, M.F.M.: Periodic structure in the Brownian motion of the stock market. Oper. Res. 10, 345–379 (1962)

Polach, J., Kukacka, J.: Prospect theory in the heterogeneous agent model. J. Econ. Interac. Coord. 14(1), 147–174 (2019)

Puu, T.: Attractors, Bifurcations and Chaos: Nonlinear Phenomena in Economics. Springer, Berlin (2013)

Rau, H.: The disposition effect and loss aversion: do gender differences matter? Econ. Lett. 123, 33–36 (2014)

Ritter, J.R.: The buying and selling behavior of individual investors at the turn of the year. J. Finance 43(3), 701–717 (1988)

Romero-Meza, R., Bonilla, C.A., Hinich, M.J., Bórquez, R.: Intraday patterns in exchange rate of return of the Chilean peso: new evidence for day-of-the-week effect. Macroecon. Dyn. 14, 42–58 (2010)

Schmitt, N., Westerhoff, F.: Trend followers, contrarians and fundamentalists: Explaining the dynamics of financial markets. J. Econ. Behav. Organ. 192, 117–136 (2021)

Shefrin, H., Statman, M.: The disposition to sell winners too early and ride losers too long: theory and evidence. J. Financ. 40(3), 777–790 (1985)

Shiller, R.: Irrational Exuberance. Princeton University Press, Princeton (2015)

Shleifer, A.: Inefficient Markets: An Introduction to Behavioral Finance. Oxford University Press, New York (2000)

Talpsepp, T., Vlcek, M., Wang, M.: Speculating in gains, waiting in losses: a closer look at the disposition effect. J. Behav. Exp. Financ. 2, 31–43 (2014)

Tramontana, F., Gardini, L., Dieci, R., Westerhoff, F.: The emergence of bull and bear dynamics in a nonlinear model of interacting markets. Discrete Dyn. Nat. Soc. 1, 310471 (2009)

Tramontana, F., Westerhoff, F., Gardini, L.: The bull and bear market model of Huang and day: some extensions and new results. J. Econ. Dyn. Control 37, 2351–2370 (2013)

Trejos, C., van Deemen, A., Rodríguez, Y.E., Gomez, J.M.: Overconfidence and disposition effect in the stock market: a micro world-based setting. J. Behav. Exp. Financ. 21, 61–69 (2019)

Weber, M., Camerer, C.F.: The disposition effect in securities trading: an experimental analysis. J. Econ. Behav. Organ. 33(2), 167–184 (1998)

Funding

Open access funding provided by Università degli Studi di Torino within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Cafferata, A., Patacca, M. & Tramontana, F. Disposition effect and its outcome on endogenous price fluctuations. Decisions Econ Finan (2024). https://doi.org/10.1007/s10203-023-00431-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10203-023-00431-z