Abstract

Here we introduce an “alternative” version of the standard traditional amortization plan, where sequences of non-random time-varying periodic interest rates replace the usual constant periodic effective rate, while preserving all the other classical rules. In particular, we use two of these sequences coherently generated by two different specific hyperbolic instantaneous intensity functions. We found that the two standard amortization plans obtained through this approach match perfectly with the two main amortization plans recently proposed under the simple capitalization law. This matching provides thus a clear link between the traditional scheme and the new wave of proposals in simple regime.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Premise

All over the world it has long been peacefully accepted that mortgage amortization plans determine a financial “equivalence” (between the obligations of the lender and the borrower) in the regime of compound interest according to some specific tested rules (which we may label “traditional”)Footnote 1. However, in recent times, plans with “equilibrium” (at the beginning or at the end of the contract) in the regime of simple interest have been proposed.Footnote 2 An issue that according to some authors (especially in Italy but not onlyFootnote 3), allows to avoid the phenomenon of the so-called “anatocism”, forbidden in some legislationsFootnote 4. Nevertheless, in our contribution the question of legal legitimacy of these proposals is not explored, but the focus is on the analysis of their mathematical-financial aspects and on some important links with the compound regime.

Our purpose therefore is not merely to propose new types of amortization plans from a technical point of view. It is rather to demonstrate that, once traditional rules have been accepted (i.e. consistent with to the so-called STAPs, Standardized Traditional Amortization PlansFootnote 5), the plans proposed in the framework of simple interest law (obeying their specific rules, hence not traditional) may be obtained using sequences of non-random time-varying interest rate respecting the traditional rules in the compound regime.Footnote 6

2 Introduction

After this premise, we recall that a STAP is the result of the application of a few concise rules to a list of contractual parameters, including in particular the constant interest rate. As mentioned, we propose to use an alternative parameter to the constant interest rate, i.e. a sequence of interest rates, which vary over time in a deterministic way, within the same framework and the same logic of the STAP. In this way, we obtain an “alternative version” of such STAPs, which turn out to numerically coincide with some constant interest rate plans according to the law of simple interest.

More specifically, in the loan time horizon (0, T), we choose a pair of hyperbolic functions of instantaneous interest rates which generate two different sequences of interest rates: one of decreasing rates starting from a given initial level and, the other one of increasing rates which, at the end of the contract, reach a certain final level. By applying the same rules of the classic STAP using these sequences, two different amortization schemes are then obtained. We call them Variable Decreasing STAP (shortly VD-STAP) and Variable Increasing STAP (VI-STAP), to underline the dependence on the variable decreasing or increasing sequence of interest rates, respectively. The main result of our paper is that these schemes are able to reproduce, respectively, the Mari-Aretusi plan (MAP) and that of Annibali et al (AnnP). Here, in particular, we concentrate on the case of plans with constant instalments. In this frame, we signal that, although both MAP and AnnP are constructed in the simple interest regime, with the same set of parameters (and in particular with the same constant interest rate), they provided a different value of constant instalments and thus different plans. Our V-STAPs are able to replicate both, but by applying (non-random) floating interest rates in a continuous compound framework and thus complying with the no-arbitrage principle, helping, in our opinion, to clarify the real reason behind that difference.

The plan of the paper is as follows: in Sect. 3 we quickly recall the logic of Standardized Traditional Amortization Plans (STAP). Section 4 introduces the V-STAPs, which are STAPs where non-random time-varying interest rates enter in the rules in place of the constant one. From a technical point of view, a specific functional form of the intensity function (in a compound interest framework) has now to be chosen (Sect. 5) in order to get a sequence of interest rates to be used in the amortization plan over the time horizon of the loan. This choice has been discussed in two subsections: in 5.1 we treat the case of a given hyperbolic monotonic decreasing intensity function; within this choice, given an initial level of the interest rate, we obtain a sequence of decreasing interest rates and of corresponding discount factors; we then check that the condition of “decomposability” obviously holds; plans constructed in this framework are called intuitively V(ariable)D(ecreasing)-STAPs; after that, we apply this sequence of interest rates in order to construct plans with constant principal repayments or with constant instalments: these examples are provided in Sect. 5.2; the same approach is then followed in Sect. 5.3 where we choose another specific hyperbolic intensity function, this time monotonic increasing. In this case, we obtain a sequence of increasing interest rates up to a specific final level and it is again checked that the condition of “decomposability” clearly holds; the corresponding plans are named VI(ncreasing)-STAPs and the related examples are given in Sect. 5.4. Section 6 is then devoted to a short recall of amortization schemes in simple interest capitalization law: more precisely, Sects. 6.1 and 6.2 briefly recall the Mari-Aretusi (MAP) proposal and the Annibali et al (AnnP) one, respectively. Then, Sect. 7 is dedicated to the comparison between V-STAPs, MAP and AnnP, namely between plans with variable interest rates under compound interest law and plans with constant interest rate under simple interest law. To be more specific, in paragraph 7.1, through a comparative analysis of VD-STAP and MAP, we introduce a theorem that establishes the coincidence between these two plans; we then prove this theorem in the subsequent Sect. 7.3, by taking advantage of the characteristics of the capitalization factors in the sequence with decreasing rates (as detailed in paragraph 7.2). We follow the same logic also for the comparison between VI-STAP and AnnP in paragraph 7.4, introducing their corresponding coincidence theorem, proved in paragraph 7.6 after having studied the properties of capitalization factors in the sequence with increasing rates (as elaborated in paragraph 7.5). Paragraph 7.7 is allocated for a quick Cor1summary of our findings, as well as the presentation of a significant corollary: if the constant interest rate of MAP and AnnP is identical, then the VD and VI sequences can be viewed as twin sequences. This observation could also account for the divergence in the value of instalments between these two plans, even though both are formulated under the framework of simple interest law and with the same contractual parameters. Finally, Sect. 8 is dedicated to a quick comment on the concept of financial equivalence and its use in the amortization plans analysed here. The conclusions follow in final Sect. 9.

3 The logic of standardized traditional amortization plans (STAP)

In this section we recall the procedure to build the so-called Standardized Traditional Amortization Plans (STAP, or PAST in the original formulation; for details see Pressacco et al. (2022); Pressacco and Ziani (2020)).

In this framework, a few rules are applied to a list of contractual parameters in order to design amortizing schemes.Footnote 7

More precisely, we define the list of parameters \(L:=(D_0,k,{}_{k}i,N)\), where:

-

\(D_0\), principal amount at time \(t_0\);

-

k, frequency of instalments per year;

-

\(N=T\cdot k\), total number of instalments, given the loan term T (years);

-

\({}_{k}i\) effective interest rate referred to the frequency k, that is to the constant time interval 1/k between two consecutive payments; in particular, it is:

$$\begin{aligned} {}_{k}i=j\cdot 1/k \end{aligned}$$(1)with j constant nominal interest rate stated in the loan agreement.

Now, the rules in a STAP are, for all \(h=1,\ldots , N\):

R1 means that each instalment \(R_h\), paid by the borrower at the date \(t_h\), consists of two elements: \(C_h\), loan repayment and \(I_h\), interest accrued in the h-th interval (that is between two consecutive dates \((t_{h-1},t_h)\)) and payable in \(t_h\).

R2 states that, at each date \(t_h\), the dynamics of the outstanding balance \(D_h\) is driven only by the corresponding repayment of the loan.

R3 defines the interest accrued in the h-th interval as the product of the capital available (portion of the outstanding principal not yet reimbursed) at the beginning of the period, \(D_{h-1}\) times the effective interest rate for the period, \( {}_{k}i\).

Another particular parameter has to be chosen by the counterparties: i.e. a sequence of principal reimbursements \(\textbf{C}=(C_1,\ldots ,C_h,\ldots ,C_N)\) or, alternatively, a sequence of instalments \(\textbf{R}=(R_1,\ldots ,R_h,\ldots ,R_N)\). To any choice there corresponds a different STAP (STAP with constant repayments \(C_h=C\), STAP with constant instalments \(R_h=R\), or any other STAP with other kinds of feasible sequences).

We underline that both \(\textbf{C}\) and \(\textbf{R}\) must verify their respective feasibility conditions.

In particular, for \(\textbf{C}\) it is:

so that it is guaranteed that the principal has been completely repaid at the final dateFootnote 8.

For \(\textbf{R}\), it is:

where \(v(t_0,t_h)=\frac{1}{(1+{}_{k}i)^{h-0}}\) (assuming \(t_0=0\)) is the discount factor, under the compound interest law, of the interval \((t_0,t_h)\) with the effective constant periodic interest rate \({}_{k}i\). This condition states that the sum of the present value of instalments must be equal to the principal amount at time \(t_0\) and it is the “natural” consequence of STAP’s rules and in particular, of the idea that accrued interests are periodically payable.Footnote 9

The application of the three rules to the list of parameters draws a STAP perfectly consistent with the idea that the interest accrued in each period becomes payable at the end of the same period.Footnote 10

We stress again that the Standardization in STAP regards the fact that the interval between two consecutive payments is constant and equal to 1/k; moreover, it is Traditional because, besides following the above mentioned rules, it applies the formula (1), i.e. that the effective interest rate of the single period \({}_{k}i\) is given by the product of the constant nominal interest rate j times the length of the period 1/k.Footnote 11

Remark 1

For simplicity and unless otherwise specified, henceforth we consider \(k=1\) (one instalment per year) so that, according to (1), it is:

The time interval is then \((t_{h-1}-{t_h})=1\) (year) so that \(t_0=0,t_1=1,\ldots ,t_N=N\).

Since this scheme considers the case of a constant interest rate until the loan matures, we underline this fact by renaming it C-STAP, where C stands for Constant interest rate.

The C-STAP (but in general, any kind of amortizing plan) can be also summarized in a numerical table that reports the dynamics of the four fundamental quantities: \(C_h\), \(I_h\), \(R_h\), and \(D_h\) according to the rules introduced above (Table 1).

4 STAP with non-random time-varying interest rates

Let us now propose an “alternative” version of a STAP considering non-random time-varying interest rates in place of a constant fixed interest rate. We call this scheme V-STAP, where V stands for Variable just to distinguish from C-STAP.

In this scenario we introduce an instantaneous interest intensity that varies according to any non-negative function r(t), defined on the interval (0, T). The parameter list and the rules remain substantially the same as those of the C-STAP, except for R3 which now becomes, for all \(h=1,\ldots ,N\):

where \({}_{k}i_h= {}_{k}i(h-1,h)\) is the effective \(k-\)periodic interest rate of the h-th period generated from a given function r(t). This rule still states that the interest accrued in the h-th interval is given by the product of the capital available at the beginning of the period, \(D_{h-1}\) times, in this case, the effective interest rate for the specific h-th period, \( {}_{k}i_h\). Thus, R3-V is only formally different from R3 because it basically follows the same logic.

Remark 2

It should be noted that while \({}_{k}i\) in R3 is (\(k-\)specific) constant over time up to the final maturity, \({}_{k}i_h\) is (\(k-\)specific) constant only in the h-th period (each of length 1/k), and is variable across periods.

Remark 3

For \(k=1\) (one instalment per year), it is:

and for \(h=1,\ldots ,N\) we have the sequence of interest rates: \(i_1,i_2,\ldots ,i_h,\ldots ,i_N\).

Then, according to R3-V, for \(k=1\) it is:

In the next sections we derive two specific sequences of interest rates \({}_{k}i_h\) (for all \(h=1,\ldots , N\)), in particular focusing on the annual case (\(k=1\)).

5 The sequence of non-random time-varying interest rates

We recall that, under the condition of “decomposability”Footnote 12, the most general capitalization function \(u(T_1,T_2)\) that translates a financial equivalence relationshipFootnote 13 into a functional form is given by:

where r(t) is the instantaneous interest intensity as a non-negative, integrable function of time \(t\in [0,T]\). It corresponds to the associated discount function:

According to the well-known result of the mean value theorem for integrals, we define \(\overline{r}\) as the constant which, in the interval \((T_1,T_2)\), satisfies:

so that:

Remark 4

We underline that the product of the constant instantaneous interest intensity \(\overline{r}\) by the time \((T_2-T_1)\) assumes the dimensions of a pure number (because the instantaneous interest intensity has the dimension of the reciprocal of time) and becomes a rate of interest.

Passing to the natural logarithm of (9) it is straightforwardly:

In this context, we look now for the link with the sequence of \({}_{k}i_h\), non-random time-varying interest rates of a V-STAP.

Let \(k=1\) for simplicity. Setting \(T_1=h-1\) and \(T_2=h\), then the annual (\((T_2-T_1)=1\)) capitalization factor is \(u(T_1,T_2):=u(h-1,h)\). According to (9) it is:

where \(\overline{r}_h\) is the constant instantaneous interest intensity concerning the h-th period (\(h=1,\ldots ,N\)) which, in that period, generates an annual capitalization factor equal to that generated by the instantaneous variable intensity r(t).

The constant annual interest rate in a unitary period (in the year h) corresponding to that constant intensity \(\overline{r}_h\) is simply the rate \(i_h\):

So, for all \(h=1,\ldots ,N\) there are sequences of instantaneous intensity \(\overline{r}_h\) and, respectively, of interest rates \({}_{}i_h\), which are constant in each annual interval \((h-1, h)\), but varying across periods.

In general, to each choice of a variable instantaneous intensity function r(t) on the time interval (0, N) there correspond different sequences of \(\overline{r}_h\), of \({}_{}i_h\) and of the corresponding capitalization/discount factors which translate into a functional form the equivalence relation induced by the specific intensity function.

In the next sections we study two different functional forms of r(t): a hyperbolic monotonic decreasing and, respectively, increasing intensity function.

5.1 Hyperbolic monotonic decreasing intensity function

Let us consider the particular function r(t) of instantaneous interest rates:

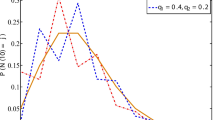

where c is a positive constant. The function is monotonic decreasing hyperbolic, with \(r(0)=c\) and \(r(T)=\frac{c}{1+c\cdot T}\), as shown in Fig. 1:

According to (6), now it is:

Let us compute a primitive R(t) of the integrand function r(t). It turns out that:

and by applying the fundamental theorem of integral calculus, it is:

and the corresponding accumulation factor is then equal to:

Let us consider now \(T_1=h-1\) and \(T_2=h\) so that the time interval \((T_1,T_2)\) is the h-th year (of a loan transaction). Then, the capitalization factor for the period \((h-1,h)\) is:

and the interest rate of this period is \(u(h-1,h)-1=i(h-1,h)\):

Now, we have directly for \(h=1\), \(i_1=c\) and so, for all \(h=2,\ldots ,N\) it is:

which gives the interest rate of h-th period as a function of the first-period interest rate, \(i_1\) (initial trigger). Furthermore, for all \(h=1,\ldots , N-1\), it is:

which gives the recursive relation holding between two consecutive periodic interest rates.

Proof

Exploiting position \(i_1=c\), and relations (17)–(18), it is:

so that

\(\square \)

Remark 5

The sequence of annual interest rates \(i_1,\ldots ,i_h,\ldots ,i_N \) according to (20) is, given the value of the trigger \(i_1\), deterministically variable and decreasing. Henceforth we refer to the amortization scheme with this sequence as VD-STAP, where D stands for Decreasing (and V for Variable).

Remark 6

It should also be noted that, for all \(h=1,\ldots , N\), the following equation is obviously verified:

as well as, in turn, for the associate discount function:

In fact, on the basis of (16) and (17), it is for all \(h=2, \ldots , N\):

thus confirming the “decomposability” property embedded in this approach. \(\square \)

Let us now give a couple of examples of VD-STAPs with, respectively, constant principal payments and constant instalments.

5.2 Examples

Example 1

Let us consider a mortgage with parameters \(L:=(D_0=1000.00,\) \(k=1,i_1=10\%,N=4)\) and \(C_h=C=\frac{1000.00}{4}=250.00\), constant.

Given the initial trigger rate \(i_1=0.10\) and according to (20), the sequence of interest rates is: \(i_1=0.10\), \(i_2=0.09\overline{09}\), \(i_3=0.08\overline{33}\), \(i_4=0.0769\).

Applying now rules R1, R2 and R3-V, we obtain Table 2 describing a VD-STAP with a sequence of constant principal reimbursements.

Example 2

Let us consider a mortgage with parameters \(L:=(D_0=1000.00,\) \(k=1,i_1=10\%,N=4)\), constant instalments \(R_h=R\) and interest rates \(i_h\) given by (20). These rates do not change with respect to Example 1, so we have: \(i_1=0.10\), \(i_2=0.09\overline{09}\), \(i_3=0.08\overline{33}\), \(i_4=0.0769\). The value of constant instalment is given by the following equation:

with \(v({h-1},{h})=\frac{1}{(1+i(h-1,h))}=\frac{1}{1+i_h}\) for \(h=1,\ldots ,4\).

Applying now rules R1,Footnote 14 R2 and R3-V, we obtain Table 3 describing a VD-STAP with a sequence of constant instalments.

Generalizing now Eq. (24) it is, for all \(h=1,\ldots ,N\):

with \(v({h-1},{h})=\frac{1}{(1+i(h-1,h))}=\frac{1}{1+i_h}\).

Remark 7

Note that relation (25) is the counterpart of the feasibility condition (3) which holds in the C-STAP with a constant sequence of instalmentsFootnote 15. In particular, relation (25) may be rewritten as:

where v(0, h) is given by (22) as the “decomposability” property holds.

5.3 Hyperbolic monotonic increasing intensity function

Let us now examine another functional form of r(t) and proceed, in analogy to the previous section, with the specification of the sequence of interest rates \(i_h\) within this new scenario. Let us then consider the function r(t) in the interval (0, N):

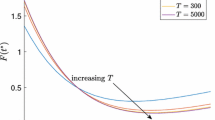

where c is a positive constant and \(N=T\cdot k\) (or, if \(k=1\), \(N=T\)). The function is monotonic increasing hyperbolic, with \(r(0)=\frac{c}{1+c\cdot N}\) and \(r(N)=c\), as shown in Fig. 2.

According to (6), now it is:

As before, let us compute a primitive R(t) of the integrand function r(t). It turns out that:

and by applying the fundamental theorem of integral calculus, it is:

and the corresponding capitalization factor is equal to:

Considering, with time measured in years, \(T_1=h-1\) and \(T_2=h\), the capitalization factor for the period \((h-1,h)\) is then:

and the associate discount factor is:

The interest rate of this period is, in turn, \(i_h=i(h-1,h)=u(h-1,h)-1\):

For \(h=N\) we have directly \(i_N=c\) (final trigger). Now, for all \(h=1,\ldots , N-1\) it is:

which gives all the periodic interest rates as a function of the final trigger, \(i_N\). Still, for \(h=1,\ldots , N-1\), a recursive relation holds as follows:

Proof

Exploiting position \(i_N=c\), and relations (32)-(33), it is:

so that

\(\square \)

Remark 8

The sequence of annual interest rates \(i_1,\ldots ,i_h,\ldots ,i_N \) according to (35) is, given the value of the trigger \(i_N\), deterministically variable and increasing. Henceforth, we refer to the amortization scheme with this sequence as VI-STAP, where I stands for Increasing (V for Variable).

Remark 9

As may be noticed from a glance to Fig. 3, given the same level of the constant c, such a sequence is perfectly inverted with respect to the one obtained with the decreasing hyperbolic function r(t) of the paragraph 5.1 (cf. formulas (20) and (35)). We will explore the features of this result in more detail in paragraph 7.7 (see Corollary 1).

Remark 10

As in the VD-STAP, note that, for all \(h=1,\ldots , N\), Eq. (21) (and (22)) is still verified by now applying capitalization factors provided by (30) (and (31)):

thus confirming the “decomposability” property. \(\square \)

Let us now discuss in this framework the same examples seen for VD-STAP.

5.4 Examples

Example 3

Let us consider a mortgage with parameters \(L:=(D_0=1000.00,\) \(k=1,i_N=10\%,N=4)\) and \(C_h=C=\frac{1000.00}{4}=250.00\), constant. Given the final trigger rate \(i_4=0.10\) and according to (35), the sequence of interest rates is: \(i_1=0.0769\), \(i_2=0.08\overline{33}\), \(i_3=0.09\overline{09}\), \(i_4=0.10\).

Applying now rules R1, R2 and R3-V, we get Table 4 which describes a VI-STAP with a sequence of constant principal reimbursements:

Compared to VD-STAP, VI-STAP features a sequence of significantly lower instalments due to decreasing interest rates applied to the same level of decreasing outstanding debt (cf. Table 2).

Example 4

Let us consider a mortgage with parameters \(L:=(D_0=1000.00,\) \(k=1,i_N=10\%,N=4)\), constant instalments \(R_h=R\) and interest rates \(i_h\) given by (35). These rates do not change with respect to Example 3, so we have:\(i_1=0.0769\), \(i_2=0.08\overline{33}\), \(i_3=0.09\overline{09}\), \(i_4=0.10\). By applying Eq. (24), now according to the increasing sequence of interest rates, we obtain the value of the constant instalment \(R=304.35\).

Applying now rules R1,Footnote 16 R2 and R3-V, we obtain Table 5 describing a VI-STAP with a sequence of constant instalments.

Remark 11

Also in this case, the constant instalment \(R_h=R\) satisfies relation (25) (or the, more compact, equivalent Eq. (26)), but with a different sequence of discount factors \(v({h-1},{h})=\frac{1}{(1+i(h-1,h))}=\frac{1}{1+i_h}\) for all \(h=1,\ldots ,N\), according to (35). We remind that relation (25) is still the counterpart of the feasibility condition (3) which holds in the C-STAP.

By comparing VD-STAP and VI-STAP (Tables 3 and 5), it can be noted that in the latter there is a double effect which explains the difference: in addition to a different sequence of interest rates, there is also a different trend in the outstanding balance, decreasing at a faster rate, which concurs to determine a significant difference in the sum of global interest (respectively 239.95 against 217.39). It is clear, of course, that this is translated to a lower instalment of the VI-STAP than in the case of the VD-STAP (respectively 304.35 against 309.99).

A final comment is in order:

Remark 12

It may be checked that, both in VD-STAP and VI-STAP with constant principal repayments, the sequence of \(R_h\) satisfies the corresponding feasibility condition (25) (and the equivalent (3)).

Furthermore, it is trivial but noteworthy to point out that, both in VD-STAP and VI-STAP with constant instalments, the sequence of principal amount repayments also satisfies the corresponding feasibility condition (2).

6 The amortization plan under simple interest law

New amortization plans in a simple capitalization regime have been recently proposed by Mari and Aretusi (2018, 2019) and by Annibali et al. (2016, 2020). The purpose of those papers is to provide amortization schemes built through relations valid in the simple capitalization regime that, in the authors’ formulation, are free of illicit anatocism. In any case, as mentioned in the introduction, we do not deal with this issue here. Instead, our aim is to show that these proposals coincide with our V-STAPs, which satisfy an equivalence relation under the law of compound interest.

For the sake of simplicity, here we focus on the specific case of constant instalments with annual frequency (\(k=1\)). This allows us to capture the essence of the point; however, it is quite simple to generalize the approach to different frequencies, especially infra-annual ones (\(k>1\)) and also to situations with non-constant instalments.

In what follows, then, we use the list of parameters that has been applied in STAP: \(L:=(D_0,k,{}_{k}i,N)\) considering the case of \(R_h=R\), annual constant (\(k=1\)). In particular, in this context the effective annual interest rate applied is also constant according to (4): \({}_{1}i=i=j\).

Let us quickly recap the rationale of the two proposals in the next sections.

6.1 Mari-Aretusi plan (MAP)

In a MAP there are the same rules as in the STAP except for R3 (accrued interest in each period), which here is actually:

where \(v(0,h-1)=(1+(h-1)\cdot i)^{-1}\) is the discount factor under simple capitalization law with \({}_{1}i=i=j\) the effective annual interest rate, constant for the entire duration of the loan agreement.

Furthermore, the constant instalment \(R_h=R\) is the (unique) solution of the following equation:

The solution R of Eq. (37) defines the value of the instalment which realizes “the equivalence” at time 0 between the lender’s obligation and the overall one of the borrower. More specifically: first member, value at the time 0 of the lender’s obligation (amount of the loan); second member, value at the time 0 of the borrower’s commitment, obtained by adding the “equivalent” value at time 0 of each amount \(R_h\) fixed (defined in the contract) at time h. The “equivalent” value is obtained by applying to the instalment the discount factor \((1+h\cdot i)^{-1}\) characteristic of the simple capitalization financial regime.

We underline that we used the quotation mark for equivalent, because, under the simple interest regime, equivalence relation in complex financial operations is not satisfied, so as it is more correct using the term “financial equilibrium”.

In order to provide their alternative plan, the authors introduce the so-called “extended” plan which involves other three columns, besides the fundamental four: we name them as \(\varDelta _h\), \(\varGamma _h\) and \(\varPsi _h\).Footnote 17 For MA, these three new quantities are instrumental in the construction of their amortization plan. The evolution of such quantities is described by the following relations,Footnote 18 for all \(h=1,\ldots ,N\):

Then, rule R3-MA may be rewritten as follows:

with \(\varDelta _0=D_0\) and, as proved by the authors, \(\varDelta _N=0\).

We now present an example of an extended plan with constant annual instalments.

Example 5

Let \(L:=(D_0=1000.00,k=1,i=10\%,N=4)\) with \(R_h=R\) solution of Eq. (37):

Then, starting from \(h=1\), according to rules R1, R2, R3-MA and formulas (38), (39), (40), it is:

and iterating the procedure (i.e. \(I_2=0.1\cdot 718.19=71.82\), \(\ldots \)), we get the extended plan as in Table 6.

Remark 13

It is straightforward to verify that the interest quotas \(I_h\) correspond to the product of the constant annual interest rate \(i=0.1\) times the quantities \(\varDelta _{h-1}\).

6.2 Annibali et al Plan (AnnP)

In their paper the authors propose specific rules for the computation of the fundamental quantities in their amortization plan.

First of all, the constant instalment \(R_h=R\) is the (unique) solution of the following equation:

where, in general, \((1+h\cdot i)=u(0,h)\) is the accumulation factor in the interval (0, h) under simple capitalization law. Note that in u(0, h) there appears \({}_{1}i=i=j\), effective annual interest rate, which is constant for the entire duration of the loan agreement.

Meaning of Eq. (42): first member, “equivalent” value at the time N of the lender’s obligation, obtained by applying to the initial principal the capitalization factor \((1+N\cdot i)\) characteristic of the regime of simple interest; second member, value at the time N of the borrower’s obligation, obtained by adding, for each \(R_h\), the corresponding “equivalent” value at time N. The “equivalent” value is obtained by applying to the instalment the capitalization factor \((1+(N-h)\cdot i)\) proper to the chosen financial regime.

It has been provedFootnote 19 that the solution of Eq. (42) is:

Now, the specific rules introduced by the authors are, for all \(h=1,\ldots , N\):

where \(C_h=D_{h-1}-D_{h}\).

In particular, R2-Ann derives from the calculation of the present value at time h, by applying discount factors of the simple interest financial regime, of an annuity with \((N-h)\) constant instalments R according to (43).

We now present an example of the AnnP with constant annual instalments.

Example 6

Let \(L:(D_0=1000.00,k=1,i=10\%,N=4)\) with \(R_h=R\) given by Eq. (43):

Let us now compute the other quantities.

As regards the first reimbursement, according to classical rule \(C_h=D_{h-1}-D_{h}\) and R2-Ann, it is:

and as for the first interest quota, according to R3-Ann, it is:

The entire plan is then given in Table 7, applying recursively rules R2-Ann and R3-Ann.

7 On the relation between STAP, MAP and AnnP

7.1 A comparison between VD-STAP and MAP

Let us compare now VD-STAP and MAP by exploiting examples briefly described in Tables 3 and 6, respectively.

First of all, let us remind that the constant instalment in VD-STAP is solution of Eq. (25), which involves periodic discount factors with a sequence of decreasing interest rates \(i_h=\frac{i_{h-1}}{1+i_{h-1}}\) and \(i_1=c\), initial trigger rate.

On the other side, the constant instalment in MAP is solution of Eq. (37), which involves discount factors under simple capitalization law with a constant interest rate \(i_h=i\) for all h.

Thus the underlying logic of the two plans is significantly different (interest rates, financial regimes and rules are not comparable), yet they produce the same result both in terms of the instalment and of all the other plan quantities (as confirmed by a glance to Tables 3 and 6).

Highlighting the fundamentally different logic that governs the two plans, we are now able to present the following:

Theorem 1

MAP coincides with VD-STAP if, given the same list of parameters, the initial trigger rate \(i_1=c\) in a VD-STAP is equal to the contractual rate i in a MAP, so that: \(i_1=c=i=j\).Footnote 20

The coincidence between the two plans emerges from the fact that each MAP discount factor of the interval (0, h) in formula (37) coincides with the corresponding one of the VD-STAP with variable interest rates in formula (26) (or in (25)).Footnote 21

Proof of Theorem 1 is given in the subsequent Sects. 7.2 and 7.3.

7.2 Properties of capitalization factors with VD interest rates

Let us summarize results given in Sect. 5.1 in order to prove Theorem 1.

Let us assume that, for any \(n=1,\ldots ,N\) (positive integer) there is a sequence of variable decreasing periodic interest rates defined by the following rule (cf. formula (19)):

Given the choice of \(i_1>0\) (trigger rate), Eq. (44) uniquely expresses each single periodic interest rate of the sequence and, thus, the whole sequence \(\{i_n\}\) as a function of the trigger \(i_1\).

Now, for any variable decreasing (VD) sequence that satisfies Eq. (44), the following Lemma holds:

Lemma 1

For any integer \(n>0\), it is:

Remark 14

Note that \(u(0,n)=u(0,1)\cdot u(1,2)\cdot \ldots \cdot u(h-1,h)\cdot \ldots \cdot u(n-1,n)=\prod _{h=1}^{n}(1+i_h)\) is the capitalization factor of the compound regime with a variable interest rate relating to the entire interval of the first n periods.

Lemma 1 states the product of the first n periodic capitalization factors of the VD sequence as a function of the trigger rate \(i_1\) and of the number of the periods.

Proof of Lemma 1

Equation (45) is obviously true for \(n=1\): \((1+i_1)=(1+1\cdot i_1)\).

Equation (45) is true for \(n=2\): \((1+i_1)\cdot (1+i_2)=(1+2\cdot i_1)\). Indeed, exploiting (44):

Assume now Eq. (45) is true for a given \((n-1)\):

If it is true for \(n-1\), exploiting the decomposability property we have:

Now according to (44), it is:

and finally:

\(\square \)

7.3 Proof of Theorem 1

The coincidence between VD-STAP and MAP is obtained if, for any \(n=1,\ldots N\), there is a coincidence between the respective discount factors of the interval (0, n). Formally, if \(v(0,n)=v(0,1)\cdot \ldots \cdot v(h-1,h)\cdot \ldots \cdot v(n-1,n)\), product of periodic discount factors in compound regime with variable decreasing interest rates \(i_h\) is equal to \(v(0,n)=(1+n\cdot i)^{-1}\), discount factor in simple regime with a constant interest rate i.

Since the coincidence between discount factors is equivalent to the coincidence between capitalization factors of the associated laws, we now set up the system of N equations to prove such a coincidence. In each equation, the left-hand side features the capitalization factor relevant to the interval in the simple regime with a constant rate i. Conversely, the right-hand side includes the capitalization factor in the compound regime with a variable rate \(i_h\), in line with the VD assumption. Formally:

Lemma 1 allows us to replace each product in the right-hand side with the corresponding expression as a function of the trigger \(i_1\). In this way, the system transforms into the system in which, for any \(n=1,\ldots ,N\), relations \((1+n\cdot i)=(1+n\cdot i_1)\) must be satisfied. The immediate solution is then \(i=i_1\).

In summary, the condition of equality between the constant contractual rate i of the plan in the simple regime and the trigger \(i_1\) of the plan in the compound regime (with sequence VD) produces the equality between the MAP at a constant rate in the simple regime and the VD-STAP in compound regime.

Theorem 1 is thus demonstrated. \(\square \)

7.4 A comparison between VI-STAP and AnnP

Let us now compare VI-STAP and AnnP by exploiting the examples briefly described in Tables 5 and 7, respectively.

First of all, let us remind that the constant instalment in VI-STAP is solution of Eq. (25), which involves periodic discount factors with a sequence of increasing interest rates \(i_{h-1}=\frac{i_{h}}{1+i_{h}}\) and \(i_N=c\) final trigger rate.

On the other side, the constant instalment in AnnP is solution of Eq. (42), which involves accumulation factors under simple capitalization law with a constant interest rate \(i_h=i\) for all h.

Also in this case, we emphasize that the two plans share the same values (they produce the same result both in terms of the instalment and of all the other plan quantities), but not the same logic, which is fully different.

We are now able to provide the following:

Theorem 2

AnnP coincides with VI-STAP if, given the same list of parameters, the final trigger rate \(i_N=c\) in the VI-STAP is equal to the contractual rate i in th AnnP, so that: \(i_N=c=i=j\).

The coincidence between the two plans emerges from the fact that each AnnP discount factor of the interval (0, h) in formula (42) coincides with the corresponding one of the VI-STAP with variable interest rates in formula (26) (or in (25)).

As concerns the proof of Theorem 2, see Sects. 7.5 and 7.6.

7.5 Properties of the capitalization factors with VI interest rates

Let us summarize results given in Sect. 5.3 in order to prove Theorem 2.

Let us assume that, for any \(n=1,\ldots ,N\) (positive integer) there is a sequence of variable increasing periodic interest rates defined by the following rule (cf. formula (34)):

Given the choice of \(i_N>0\) (trigger rate), Eq. (49) uniquely expresses each single periodic interest rate of the sequence and, thus, the whole sequence \(\{i_n\}\) as a function of the trigger \(i_N\).

Now, for any variable increasing (VI) sequence that satisfies Eq. (49), the following Lemma holds:

Lemma 2

For any integer \(n>0\), it is:

Remark 15

Note that \(u(N-n,N)=(1+i_{N-n+1})\cdot (1+i_{N-n+2})\cdot \ldots \cdot (1+i_{N-1})\cdot (1+i_N)\) is the capitalization factor of the compound regime with a variable increasing interest rate of the entire interval of the last n periods.

Note that the sequence of period indices starts at \((N-n+1)\) and ends at \(N=N-n+n\).

Lemma 2 states the product of the last n periodic capitalization factors of the VI sequence as a function of the trigger rate \(i_N\) and of the number of the periods.

Proof of Lemma 2

Equation (50) is trivially true for \(n=1\), that is \((N-n+1=N\)): \((1+i_N)=(1+1\cdot i_N)\).

Equation (50) is true for \(n=2\): \((1+i_{N-1})\cdot (1+i_N)=(1+2\cdot i_N)\). Indeed, exploiting (49):

Assume now Eq. (50) is true for a given \((n-1)\):

If it is true for \(n-1\), exploiting the decomposability property it is:

Now according to (49), it is:

and finally:

\(\square \)

7.6 Proof of Theorem 2

Given this, the coincidence between the two amortization plans (in the compound regime with a variable rate according to rule VI and in the simple regime with a constant contractual rate with equilibrium at the final maturity N) is obtained if, for each \(n=1,\ldots ,N\), there is equality between capitalization factors of the interval \((N-n,N)\) of the two regimes.

This translates into the following system of N equations: in each equation, on the left-hand side, the capitalization factor (specific to the interval) in the simple regime with a constant rate i, and on the right-hand one, the capitalization factor (for that interval) in a compound regime with an increasing variable rate according to the sequence \(i_1, i_2, \ldots ,i_h,\ldots ,i_N\).

We get the system:

Lemma 2 allows us to replace each product in the right-hand side with the corresponding expression as a function of the trigger \(i_N\). In this way, the system transforms into the system in which, for any \(n=1,\ldots ,N\), relations \((1+n\cdot i)=(1+n\cdot i_N)\) must be satisfied. The immediate solution is then \(i_N=i\).

In summary, the condition of equality between the constant contractual rate i of the plan in the simple regime and the trigger \(i_N\) of the plan in the compound regime (with sequence VI) produces the equality between the AnnP at a constant rate in the simple regime and the VI-STAP in compound regime.

Theorem 2 is thus demonstrated. \(\square \)

7.7 Summary of results and the concept of twin sequences

Summing up:

-

we have demonstrated that MAP with constant instalment repayments (which achieves financial equilibrium at the initial time) in the simple regime with constant rate i, coincides with constant instalment STAP (financial equivalence at any time) under compound regime following the VD rule and with trigger \(i_1=i\).

-

similarly, we have proven that AnnP constant instalment repayments (which reaches financial equilibrium at the final maturity) in the simple regime with a constant rate i, aligns with the constant instalment STAP under the compound regime following the VI rule, with trigger \(i_N=i\).

Remark 16

We emphasize that in the V-STAP mode, the sequences of variable rates are determined by the constant rates of their corresponding plans in the simple regime. This starts with the initial condition where the trigger rates are set equal to these constant rates. In simpler terms, the selection of the two trigger rates, and consequently the entire sequences of variable rates, is dictated by the given constant rate in the simple regime.

The analysis becomes especially noteworthy if we analysed the relationship between the two sequences, VD and VI, in scenarios where the constant contractual rates for both constant instalment amortization plans in the simple regime are identical, or more formally when i(MAP)\(=i\)(AnnP).

We are now able to provide this result:

Corollary 1

If i(MAP)\(=i\)(AnnP), then the sequences of variable rates in both VD and VI STAPs, which correspond to MAP and AnnP respectively, can be considered as twin sequences, satisfying for all \(n=1,\ldots ,N\) the following relation:

Remark 17

Observe that the sum of the indices for the rates in the twin sequences is constant with respect to n and is equal to \(N+1\). This suggests that retracing the steps in the VI sequence will yield the same sequence as advancing forward in the VD sequence.

Proof of Corollary 1

For \(n=1\), the relation is immediately verified. In fact, we have:

For \(1<n\le N\), according to formula (44) it is:

and conversely, according to formula (49):

Let \(n=N-n+1\), i.e. \(N-n=n-1\), then it is:

and also:

\(\square \)

In particular, in our sample case where \(N=4\) and given that \(i(MAP)=i(AnnP)=10\%\), we obtain the following results: according to formula (44), the VD sequence rates are: \(i_{1}(VD)=0.10\), \(i_2(VD)=0,09\overline{09}\), \(i_3(VD)=0.08\overline{33}\), \(i_4(VD)=0.0769\); similarly, based on formula (49), the VI sequence rates are: \(i_{1}(VI)=0.0769\), \(i_{2}(VI)=0.08\overline{33}\), \(i_3(VI)=0,09\overline{09}\), \(i_4(VI)=0.10\). They confirm the twin character of the variable sequences of interest rates.

8 The concept of “equivalence”

Both MAP and AnnP are built using the same financial regime and the same contractual input. Nevertheless, it can easily be verified that the two solutions (37) and (42) are different. Actually, we check numerically that R is, respectively, 309.99 in MAP and 304.35 in AnnP for the same list of parameters.

The same authors highlight this difference and underline that it is due to the different reference period of the “equivalence” between the lender’s obligation and that of the borrower; respectively \(t=0\), “initial equivalence” of current values, for Mari-Aretusi and \(t=T\), “final equivalence” of amounts, for Annibali et al. In any case, even though they agree in supporting the use of the simple versus compound interest regime in their approach, each is even more determined to argue the superiority of his particular formulation with respect to the one of the other.

In these schemes, as said before, it would be more correct to speak of “financial equilibrium” rather than “financial equivalence”: this last property in fact concerns exclusively relations holding reflexive, symmetric and transitive properties, characteristic of the compound regime. Here emerges the difference between STAPs, plans in compound interest regime, and MAP/AnnP in simple regime. In fact, the solution \(\textbf{R}\) in a STAP is invariant with respect to the time where the equivalence relation is computed. This is a well-known consequence of the equivalence property of the compound interest regime (Tables 8, 9).

Resume Finally, we resume, without comments, the core of the paper presenting the three amortization plans with the same list of contractual parameters and constant instalments, precisely: C-STAP, MAP or VD-STAP and AnnP or VI-STAP.

9 Conclusions

This paper offers a clear “bridge” of connection and an enlightening reading key between the STAP (Standardized Traditional Amortization Plan) approach and the new wave of plans proposed according to the law of simple capitalization (Simple Interest Plans, SIPs), whose two most coherent and interesting schemes came recently by Mari-Aretusi and by Annibali et al.

Building the bridge requires, in the STAP frame, a transition from constant periodic effective interest rates (C-STAP) to proper time-varying sequences of such rates (V-STAP).

The result is astonishingly straightforward: each of the two main plans of the Simple Interest Plan (SIP) approach perfectly match with the V-STAPs obtained by the time-varying sequence coherently generated by a proper hyperbolic instantaneous intensity functions defined on the time horizon (0, T) of the plan. This approach sheds light not only on the connection between STAPs and SIPs, but also offers a clear explanation of the difference between the two SIPs, beyond the usual one offered by the authors (relating to the epoch, initial or final, of financial equilibrium between the lender’s and the borrower’s payments).

Notes

Actually, some scholars of the past had already dealt with the topic. See, for instance, J. Ward, A Compendium of Algebra (1695), and A. Casano, Elementi di Algebra, Palermo, Reale Stamperia e Libreria, (1845).

In particular, according to Annibali et al. (2016), Annibali et al. (2020), and Mari and Aretusi (2018), Mari and Aretusi (2019), the purpose of alternative amortization procedures, recently proposed, is to “purify” the fundamental quantities of a classic amortization plan from the anatocistic effect.

The question of the legitimacy of STAPs has been extensively discussed in the document recently published by A.M.A.S.E.S. (Association for Mathematics Applied to Social and Economics Sciences) to which we refer (see Pressacco et al. (2022).

We are well aware that plans with deterministically variable interest rates are not usually traded on the market, but as mentioned, our goal here is to discuss the consequences of this choice in the recent new proposals. In fact, in our opinion, these new approaches become compatible with the legislation provided that the constant rate is replaced with sequences of non-random interest rates that vary over time.

These schemes are, in our opinion, consistent with Italian laws.

Here, it is also required that \(C_h\ge 0\) for all \(h=1,\ldots ,N-1\) and \(C_N>0\): the first condition, in order to avoid an increasing outstanding balance which, in turn, generates interest on interest and, therefore, an illicit “anatocism” (at least, in violation of Italian law; on the point, see Pressacco et al. (2022)); the second, in order to guarantee that the duration of the loan is not shorter of the contractual one.

The further required condition, similar to the one on \(\textbf{C}\), is that for each \(h=1,\ldots ,N-1\), both \(R_h\ge I_h\) and \(R_N>I_N\), in order to avoid the production of negative principal repayments. Also on this point, see Pressacco et al. (2022).

If this approach is accepted, the STAP is definitely lawful (for details see Pressacco et al. (2022), irrespective of the sequence \(\textbf{C}\) or \(\textbf{R}\) chosen.

Here the usual day convention 30/360 is accepted.

The condition of “decomposability” stands for “scindibilità” in Italian language.

Here we consider relations holding reflexive, symmetric and transitive properties. For details see Daboni and De Ferra (1993), pp. 41–44.

Reformulating formula R1, in order to compute \(C_h=R-I_h\) for all \(h=1,\ldots ,N\).

It holds also in a C-STAP with any feasible sequence of \(R_h\): \(\sum _{h=1}^{N} R_h\cdot v(0,h)=D_0\).

Reformulating formula R1, in order to compute \(C_h=R-I_h\) for all \(h=1,\ldots ,N\).

Here, we do not enter in details to comment the rationale of the formulas.

See Annibali et al. (2020), p. 9. The authors refer for the solution to the book written by John Ward titled A Compendium of Algebra (1724), II Part, Chapters 2 and 3.

The latter equality comes from the fact that we are specifically dealing with the annual scenario where \(k=1\).

As already mentioned, this property extends also to infra-annual instalments schemes.

References

Annibali, A., Barracchini, C., Annibali, A.: Anatocismo e ammortamento di mutui alla francese in capitalizzazione semplice. Createspace Independent Pub (2016)

Annibali, A., Annibali, A., Barracchini, C., Olivieri, F.: Ammortamento in capitalizzazione semplice di mutui alla francese: analisi e confronto dei modelli proposti o in uso, Attuariale.eu (2020)

Bortot, P., Magnani, U., Olivieri, G., Torrigiani, M.: Matematica Finanziaria, Monduzzi Ed. (1993)

Cacciafesta, F.: A proposito dell’articolo Sull’anatocismo nell’ammortamento francese. Banche Banchieri 4, 528–533 (2015)

Cacciafesta, F.: Lezioni di matematica finanziaria classica e moderna, Giappichelli Ed. (2001)

Daboni, L., De Ferra, C.: Elementi di matematica finanziaria, Lint Editoriale Associati, (1993)

Faro, C.: Debt amortization and simple interest: the case of payments in an arithmetic progression, Revista de Gestão, finanças e contabilidade 4(3) (2014)

Fersini, P., Olivieri, G.: Sull’anatocismo nell’ammortamento francese. Banche Banchieri 2, 134–171 (2015)

Marcelli, R., Pastore, A.G., Valente, A.: Sull’ammortamento alla francese, Diritto della banca e del mercato finanziario, Ed. Pacini Giuridica, 2 (2019)

Mari, C., Aretusi, G.: Sull’esistenza e unicità dell’ammortamento dei prestiti in regime lineare. Il risparmio 1, 25–45 (2018)

Mari, C., Aretusi, G.: Sull’ammortamento dei prestiti in regime composto e in regime semplice: alcune considerazioni concettuali e metodologiche. Il risparmio 1, 115–151 (2019)

Medina, M.: Anatocism, Spanish Law and Draft Common Frame of Reference. InDret Law J. 4, 1–59 (2011)

Monzeglio, O.: US APR vs EU APR, and the substitute tax on loan effects on these formulas. J. Appl. Bus. Econ. 24(3), 57–128 (2022)

Moriconi, F.: Matematica finanziaria, Il Mulino, (1994)

Pressacco, F., Ziani, L.: Matematica e diritto nell’anatocismo in piani di ammortamento progressivo. Bancaria 9, 58–78 (2020)

Pressacco, F., Beccacece, F., Cacciafesta, F., Favero, G., Fersini, P., Li Calzi, M., Nardini, F., Peccati, L., Ziani, L.: Anatocismo nei piani di ammortamento standardizzati tradizionali. Rapporto Scientifico dell’AMASES n. 2022/01 (2022)

Saccardo, Gonçalves M., Salgado, M.H., Manfrinato, J.: Analysis of the Gauss method as a substitute model for the main amortization system in the study of occurrence of Anatocim. In: Proceeding of POMS 20th Annual Conference. Orlando, Florida USA (2009)

Sinclair, P.: Compound interest and its validity (or invalidity) in the bank-customer relationship: the state-of-the-art of British common law discussed by virtue of a comparative analysis. Law Econ. Yearly Rev. 5(1), 174–200 (2016)

Funding

Open access funding provided by Università degli Studi di Udine within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that she has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ziani, L. Mortgages with non-random time-varying interest rates. Decisions Econ Finan (2024). https://doi.org/10.1007/s10203-023-00423-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10203-023-00423-z