Abstract

This paper examines the production and hedging decisions of the competitive firm under price uncertainty when the firm is not only risk averse but also regret averse. Regret-averse preferences are characterized by a modified utility function that includes disutility from having chosen ex post suboptimal alternatives. The extent of regret depends on the difference between the actual profit and the maximum profit attained by making the optimal production, and hedging decisions had the firm observed the true realization of the random output price. While the separation theorem holds under regret aversion, the prevalence of hedging opportunities may have perverse effect on the firm’s optimal output level, particularly when the firm is sufficiently regret averse. The full-hedging theorem, however, does not hold. We derive sufficient conditions under which the regret-averse firm’s optimal futures position is an under-hedge (over-hedge). We further show that the firm optimally increases (decreases) its futures position when the price risk possesses more positive (negative) skewness.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The seminal work of Sandmo (1971) has inspired a large body of research on the theory of the competitive firm under price uncertainty. One important strand of this literature examines the behavior of the firm when a futures market exists for hedging purposes, from which two celebrated theorems emanate (see, e.g., Broll and Zilcha (1992); Danthine (1978); Feder et al. (1980); Holthausen (1979) to name just a few). First, the separation theorem states that the firm’s optimal output level depends neither on the risk attitude of the firm nor on the incidence of the underlying uncertainty. Second, the full-hedging theorem asserts that the firm should fully hedge its exposure to the price risk if the futures market is unbiased.Footnote 1

Most of the extant models in the literature assume that the firm’s preferences admit the standard von Neumann–Morgenstern expected utility representation. Such a modeling approach rules out the possibility that the firm may have desires to avoid consequences wherein ex post suboptimal decisions appear to have been made even though these decisions are ex ante optimal based on the information available at that time. To account for this consideration, Bell (1982, 1983) and Loomes and Sugden (1982) propose regret theory that defines regret as the disutility arising from not having chosen the ex post optimal alternative, which is later axiomatized by Quiggin (1994) and Sugden (1993). Regret theory is supported by a large body of experimental literature that documents regret-averse preferences among individuals (see, e.g., Loomes (1988); Loomes et al. (1992); Loomes and Sugden (1987); Starmer and Sugden (1993)).

Steil (1993) conducts a survey of 26 multinational firms in the USA regarding their foreign exchange risk management. Most respondents in his survey strongly object to the hedging strategies as suggested by expected utility maximization. Objection is found to be driven by a perception that the extant hedging strategies are always ‘wrong’ ex post, consistent with regret theory. Treasury performance evaluation systems that ignore ex ante risk in favor of an exclusive focus on ex post results further reinforce the natural cognitive bias toward decision making colored by regret consideration.

There are two plausible motivations for the prevalence of regret in the corporate context, both of which are driven by the conflict of interest between owners and managers.Footnote 2 First, a corporate risk manager might be required to justify his/her chosen derivatives position ex post to the owners of the corporation. Even though such a motivation is more related to communication risk than to regret, the resulting structure and effects are similar to those of regret. Second, a corporate risk manager might receive a bonus that is linked to the performance of the corporation. If market prices turn out to be very high, the manager is likely to feel regret with a fully hedged position toward his foregone bonus. This motivation is closer to the interpretation of regret commonly used in the extant literature.

In this paper, we incorporate regret theory into the competitive firm that is allowed to hedge the price risk by trading futures contracts. Specifically, we characterize the firm’s regret-averse preferences by a modified utility function (Braun and Muermann 2004) that includes disutility from having chosen ex post suboptimal alternatives.Footnote 3 The extent of regret depends on the difference between the actual profit and the maximum profit attained by making the optimal production, and hedging decisions had the firm observed the true realization of the random output price. We are particularly interested in examining the robustness of the separation and full-hedging theorems when regret aversion prevails.

We show that the separation theorem holds in that the firm can sell its output forward by trading futures so as to lock in the marginal revenue at the predetermined futures price. However, the prevalence of hedging opportunities may not have the usual output-enhancing effect under regret aversion, contrary to what the conventional wisdom suggests. We show that the regret-averse firm optimally produces more when it is banned from trading futures for hedging purposes if regret aversion plays a sufficiently more important role than risk aversion in determining the firm’s production decision. The full-hedging theorem does not hold. We derive sufficient conditions under which the regret-averse firm optimally opts for an under-hedge (over-hedge). Finally, we show that the firm optimally increases (decreases) its futures position when the price risk possesses more positive (negative) skewness.

Michenaud and Solnik (2008) and Guo et al. (2015) examine similar hedging problems under regret aversion, using the same modified utility function as proposed by Braun and Muermann (2004). They show that the optimal futures position when the futures contracts are unbiased is an under-hedge, which is in stark contrast to our results. In the model of Michenaud and Solnik (2008), they assume that the firm can opt for neither a long futures position nor an over-hedge. We relax their restriction by imposing a more realistic assumption that there are position limits for long and short futures positions due to margin requirements and other liquidity reasons, which accounts for the more general findings in our setting. In the model of Guo et al. (2015), they assume that the firm cannot trade futures had the firm observed the true output price. This assumption renders the possibility that the firm’s actual profit can exceed its maximum profit should the firm observed the true output price. This is particularly true when the output price is low so that the firm has rejoice rather than regret in this case. As shown by Braun and Muermann (2004, pp. 740–741), the modified utility function used by Guo et al. (2015) is inconsistent with a setting wherein regret and rejoice coexist. When the firm adopts a full-hedge so that its actual profit is certain, the maximum profit, and thereby the magnitude of regret (rejoice), is increasing in the output price given that the firm cannot trade futures had the firm observed the true output price. As such, the firm is induced to optimally opt for an under-hedge in the model of Guo et al. (2015) so as to minimize the variation of regret (rejoice).

The rest of this paper is organized as follows. Section 2 delineates the model of the competitive firm under price uncertainty when the firm’s preferences exhibit not only risk aversion but also regret aversion. Section 3 examines the firm’s optimal production decision. Section 4 examines the firm’s optimal hedging decision. The final section concludes.

2 The model

Consider the competitive firm under price uncertainty à laSandmo (1971). There is one period with two dates: 0 and 1. To begin, the firm produces a single commodity according to a deterministic cost function, C(Q), where \(Q\ge 0\) is the output level, and C(Q) is compounded to date 1 with the properties that \(C(0)=C'(0)=0\), and \(C'(Q)>0\) and \(C''(Q)>0\) for all \(Q>0\).Footnote 4 The firm sells its entire output, Q, at the per-unit price, \({\tilde{P}}\), at date 1.Footnote 5 The firm regards \({\tilde{P}}\) as a positive random variable that is distributed according to a known cumulative distribution function, F(P), over support \([{\underline{P}},{\overline{P}}]\), where \(0<{\underline{P}}<{\overline{P}}\).

To hedge the price risk, \({\tilde{P}}\), the firm can trade infinitely divisible futures contracts at date 0. Each futures contract calls for delivery of one unit of the commodity at date 1 at the predetermined futures price, \(P^f\in ({\underline{P}},{\overline{P}})\). Let H be the number of the futures contracts sold (purchased if negative) by the firm at date 0. The firm is subject to position limits in that its short futures position cannot exceed S and its long futures position cannot exceed L due to margin requirements and other liquidity reasons, where \(S>0\) and \(L>0\) are exogenously given short and long position limits, respectively.Footnote 6 The futures position, H, is said to be an under-hedge, a full-hedge or an over-hedge, depending on whether H is smaller than, equal to, or greater than the output level, Q, respectively. We assume that the position limits, S and L, are large enough that the firm can opt for an under-hedge, a full-hedge or an over-hedge at the optimum.Footnote 7 The firm’s profit at date 1 is, therefore, given by

for all \(P\in [{\underline{P}},{\overline{P}}]\), subject to the constraint that the short and long position limits do not bind, i.e., \(-L<H<S\).

Following (Braun and Muermann 2004) and Wong (2014), we assume that the firm’s preferences are represented by the following bivariate utility function (Paroush and Venezia 1979):

where \(\beta >0\) is a constant regret coefficient, \(U(\Pi )\) is a von Neumann–Morgenstern utility function with \(U'(\Pi )>0\) and \(U''(\Pi )<0\) for all \(\Pi >0\), and G(R) is a regret function defined over the magnitude of regret, R, such that \(G(0)=0\), and \(G'(R)>0\) and \(G''(R)>0\) for all \(R>0\).Footnote 8 The magnitude of regret, \(R=\Pi ^{\max }-\Pi \), is gauged by the difference between the actual profit, \(\Pi \), and the maximum profit, \(\Pi ^{\max }\), that the firm could have earned at date 1 should the firm have made the optimal production and hedging decisions based on knowing the true per-unit price, P.Footnote 9 Since \(\Pi \) cannot exceed \(\Pi ^{\max }\), the firm experiences disutility from forgoing the possibility of undertaking the ex post optimal production and hedging decisions. As the constant regret coefficient, \(\beta \), increases, regret aversion becomes increasingly more important in representing the firm’s preferences as compared to risk aversion.

To characterize the regret-averse firm’s optimal production and hedging decisions, we have to first determine the maximum profit, \(\Pi ^{\max }\). If the firm could have observed the realized per-unit price, P, the maximum profit would be achieved by choosing Q(P) that solves \(C'\Big (Q(P)\Big )=P\) and \(H=S\) if \(P<P^f\) and \(H=-L\) if \(P>P^f\). Note that \(Q'(P)=1/C''\Big (Q(P)\Big )>0\). The maximum profit as a function of P is given by

for all \(P\in [{\underline{P}},{\overline{P}}]\). The magnitude of regret, R(P), is given by

for all \(P\in [{\underline{P}},{\overline{P}}]\), where \(\Pi (P)\) and \(\Pi ^{\max }(P)\) are given by Eqs. (1) and (3), respectively.

We can now state the regret-averse firm’s ex ante decision problem. At date 0, the firm chooses an output level, Q, and a futures position, H, so as to maximize the expected value of its regret-theoretical utility function:

where R(P) is given by Eq. (4), and \(\textrm{E}[\cdot ]\) is the expectation operator with respect to F(P). The first-order conditions for an interior solution to program (5) are given by

and

where an asterisk \((^*)\) indicates an optimal level.Footnote 10

3 Optimal production decision

In this section, we examine the firm’s optimal production decision. To this end, we add Eqs. (6)–(7) to yield

Given that \(U'(\Pi )>0\), Eq. (8) reduces to \(C'(Q^*)=P^f\), thereby invoking our first proposition.

Proposition 1

Given that the regret-averse competitive firm can trade the futures contracts for hedging purposes, the firm’s optimal output level, \(Q^*\), is the one at which the marginal cost of production, \(C'(Q^*)\), is equated to the predetermined futures price, \(P^f\).

The intuition for Proposition 1 is as follows. By producing one more unit of the commodity, the firm receives the marginal revenue, \({\tilde{P}}\), which is stochastic. The firm can sell this additional unit forward via trading one futures contract to lock in the marginal revenue at \(P^f\). At the optimum, the firm equates the marginal revenue, \(P^f\), to the marginal cost, \(C'(Q^*)\). This then gives rise to the usual optimality condition, \(C'(Q^*)=P^f\), that determines the optimal output level, \(Q^*=Q(P^f)\).

An immediate implication of Proposition 1 is that the firm’s optimal production decision depends neither on its attitude toward risk and regret, nor on the underlying uncertainty. Proposition 1 as such extends the separation theorem to the case in which the firm is regret averse.

While Proposition 1 shows that the separation theorem holds under regret aversion, it is completely silent on how the prevalence of hedging opportunities affects the regret-averse firm’s optimal output level. To address this issue, we consider a benchmark case wherein the firm is banned from trading the futures contracts for hedging purposes. In this benchmark case without hedging, the firm’s optimal output level, \(Q^{\circ }\), is the solution to the following first-order condition:

where \(\Pi _0^{\circ }(P)=PQ^{\circ }-C(Q^{\circ })\) and \(R_0^{\circ }(P)=PQ(P)-C\Big (Q(P)\Big )-\Pi _0^{\circ }(P)\) for all \(P\in [{\underline{P}},{\overline{P}}]\).

To have a fair comparison, we assume that the predetermined futures price, \(P^f\), is set equal to the expected value of \({\tilde{P}}\), i.e., \(P^f=\textrm{E}[{\tilde{P}}]\). To compare \(Q^*\) with \(Q^{\circ }\), we evaluate the left-hand side of Eq. (9) at \(Q=Q^*\) to yield

where \(\Pi _0^{*}(P)=PQ^{*}-C(Q^{*})\) and \(R_0^{*}(P)=PQ(P)-C\Big (Q(P)\Big )-\Pi _0^{*}(P)\) for all \(P\in [{\underline{P}},{\overline{P}}]\), \(\textrm{Cov}[\cdot ,\cdot ]\) is the covariance operator with respect to F(P), and the equality follows from the property of the covariance operator and Proposition 1.Footnote 11 It then follows from Eqs. (9) and (10) that \(Q^*>(<)\ Q^{\circ }\) if and only if the right-hand side of Eq. (10) is negative (positive). We refer to the first term on the right-hand side of Eq. (10) as the risk aversion incentive and the second term as the regret aversion incentive.

Differentiating \(U'\Big (\Pi _0^{*}(P)\Big )\) with respect to P yields

for all \(P\in [{\underline{P}},{\overline{P}}]\), which implies that \(\textrm{Cov}\Big [U'\Big (\Pi _0^*({\tilde{P}})\Big ),{\tilde{P}}\Big ]<0\). The firm, being risk averse, finds it optimal to reduce its output level below \(Q^*\) so as to limit its exposure to the price uncertainty (Sandmo 1971). The risk aversion incentive as such adversely affects the firm’s optimal output level.

Differentiating \(G'\Big (R_0^{*}(P)\Big )\) with respect to P yields

for all \(P<(>)\ P^f\). Hence, \(G'\Big (R_0^{*}(P)\Big )\) is U-shaped and reaches a unique minimum at \(P=P^f\). Consider first the case that \(\textrm{E}\Big [G'\Big (R_0^*({\tilde{P}})\Big )\Big ]\ge G'\Big (R_0^*({\overline{P}})\Big )\). There must exist a unique point, \(P^{\circ } \in ({\underline{P}},P^f)\), such that \(G'\Big (R_0^{*}(P^{\circ })\Big )=\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\). Hence, we have \(G'\Big (R_0^{*}(P)\Big )>\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\) for all \(P\in [{\underline{P}},P^{\circ })\) and \(G'\Big (R_0^{*}(P)\Big )<\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\) for all \(P\in (P^{\circ },{\overline{P}})\), which imply that

The firm, being regret averse, raises more concerns about the disutility from the discrepancy of its output level, \(Q(P)-Q^{*}\), when low realizations of \({\tilde{P}}\) are revealed. To minimize regret, the firm optimally adjusts its output level downward from \(Q^{*}\). Hence, the regret aversion effect reinforces the risk aversion incentive, rendering the firm to optimally produce less when it is banned from trading the futures contracts for hedging purposes. We as such establish the following proposition.

Proposition 2

If \(\textrm{E}\Big [G'\Big (R_0^*({\tilde{P}})\Big )\Big ]\ge G'\Big (R_0^*({\overline{P}})\Big )\), the regret-averse competitive firm optimally produces less when it is banned from trading the unbiased futures contracts for hedging purposes, i.e., \(Q^{\circ }<Q^*\).

Consider now the case that \(\textrm{E}\Big [G'\Big (R_0^*({\tilde{P}})\Big )\Big ]\ge G'\Big (R_0^*({\underline{P}})\Big )\). There must exist a unique point, \(P^{\circ } \in ({\underline{P}},P^f)\), such that \(G'\Big (R_0^{*}(P^{\circ })\Big )=\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\). Hence, we have \(G'\Big (R_0^{*}(P)\Big )<\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\) for all \(P\in ({\underline{P}},P^{\circ })\) and \(G'\Big (R_0^{*}(P)\Big )>\textrm{E}\Big [G'\Big (R_0^{*}({\tilde{P}})\Big )\Big ]\) for all \(P\in (P^{\circ },{\overline{P}}]\), which imply that

The regret-averse firm as such raises more concerns about the disutility from the discrepancy of its output level, \(Q(P)-Q^{*}\), when high realizations of \({\tilde{P}}\) are revealed. To minimize regret, the firm optimally adjusts its output level upward from \(Q^{*}\). Hence, the regret aversion incentive counteracts the risk aversion incentive. The firm optimally produces less (more) when it is banned from trading the futures contracts for hedging purposes if and only if the risk aversion incentive dominates (is dominated by) the regret aversion incentive, thereby invoking the following proposition.

Proposition 3

If \(\textrm{E}\Big [G'\Big (R_0^*({\tilde{P}})\Big )\Big ]\ge G'\Big (R_0^*({\underline{P}})\Big )\), the regret-averse competitive firm optimally produces less (more) when it is banned from trading the futures contracts for hedging purposes, i.e., \(Q^{\circ }<(>) \ Q^*\), whenever the constant regret coefficient, \(\beta \), satisfies the following condition:

Proposition 3 shows that the conventional wisdom under which the prevalence of hedging opportunities is output enhancing may not hold under regret aversion when the regret aversion incentive is positive. The right-hand side of condition (11) is a positive constant if \(\textrm{E}\Big [G'\Big (R_0^*({\tilde{P}})\Big )\Big ]>G'\Big (R_0^*({\underline{P}})\Big )\), and is independent of the constant regret coefficient, \(\beta \). Hence, the prevalence of hedging opportunities gives rise to a perverse output effect when \(\beta \) is sufficiently large such that the positive regret aversion incentive dominates the negative risk aversion incentive.

4 Optimal hedging decision

In this section, we examine the firm’s optimal hedging decision. To focus on the firm’s hedging motive, we assume that the futures contracts are unbiased in that the predetermined futures price, \(P^f\), is set equal to the expected value of \({\tilde{P}}\), i.e., \(P^f=\textrm{E}[{\tilde{P}}]\). In this case, Eq. (7) becomes

Since covariances can be interpreted as marginal variances, Eq. (12) simply says that the optimal futures position, \(H^*\), is the one at which the variability of the firm’s marginal utility under regret aversion is minimized.

Evaluating the left-hand side of Eq. (12) at \(H=Q^*\) yields

It then follows from Eq. (7) and the second-order conditions for program (5) that \(H^*<(>)\ Q^{*}\) if and only if the covariance term on the right-hand side of Eq. (13) is positive (negative). We state and prove the following proposition.

Proposition 4

The competitive firm, being regret averse, optimally opts for an under-hedge, i.e., \(H^*<Q^*\), or an over-hedge, i.e., \(H^*>Q^*\), depending on whether

or

respectively.

Proof

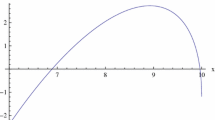

Differentiating \(G'\Big (\Pi ^{\max }(P)-\Pi ^*(P^f)\Big )\) with respect to P yields

where \(I_{\{A\}}\) is an indicator function that takes on a value equal to unity if event A occurs and zero otherwise. Since \(S\ge Q^*>Q(P)\) for all \(P\in [{\underline{P}},P^f)\) and \(G''(\Pi ^{\max }-\Pi )>0\), it follows from Eq. (16) that \(G'\Big (\Pi ^{\max }(P)-\Pi ^*(P^f)\Big )\) is decreasing (increasing) in P for all \(P<(>)\ P^f\). Hence, \(G'\Big (\Pi ^{\max }(P)-\Pi ^*(P^f)\Big )\) is U-shaped and reaches a unique minimum at \(P=P^f\). If condition (14) holds, there must exist a unique per-unit price, \(P^{\circ } \in (P^f,{\overline{P}})\), such that

Then, we have

Given that \(G'\Big (\Pi ^{\max }(P)-\Pi ^*(P^f)\Big )\) is U-shaped, condition (14) and Eq. (17) imply that the right-hand side of Eq. (18) is positive, thereby rendering that \(H^*<Q^{*}\). The proof that \(H^*>Q^{*}\) given condition (15) can be done analogously and thus is omitted. \(\square \)

The intuition for Proposition 4 is as follows. If condition (14) holds, it follows from Eq. (18) that \(G'\Big (\Pi ^{\max }({\tilde{P}})-\Pi ^*(P^f)\Big )\) is positively correlated with \({\tilde{P}}\), thereby inducing the regret-averse firm to raise more concerns about the disutility from the discrepancy of its futures position, \(Q^*\), from the long position limit, L, when high realizations of \({\tilde{P}}\) are revealed. To minimize regret, the firm optimally adjusts its futures position downward from \(Q^{*}\) so that \(H^*<Q^{*}\). On the other hand, if condition (15) holds, then \(G'\Big (\Pi ^{\max }({\tilde{P}})-\Pi ^*(P^f)\Big )\) is negatively correlated with \({\tilde{P}}\). The regret-averse firm as such raises more concerns about the disutility from the discrepancy of its futures position, \(Q^{*}\), from the short position limit, S, when low realizations of \({\tilde{P}}\) are revealed. To minimize regret, the firm optimally adjusts its futures position upward from \(Q^{*}\) so that \(H^*>Q^{*}\).

Finally, we examine the marginal effect of price risk on the firm’s optimal hedging decision. To this end, we let \({\hat{F}}(P)\) be a new CDF of \({\tilde{P}}\). The following definition is adopted from the definition of downside risk à la Menezes et al. (1980).Footnote 12

Definition 1

The CDF, \({\hat{F}}(P)\), is said to have more simple positive (negative) skewness than the CDF, F(P), if and only if

and

Equation (19) ensures that \({\tilde{P}}\) has the same mean under F(P) and \({\hat{F}}(P)\). Equation (20) ensures that \({\tilde{P}}\) has the same variance, denoted by \(\sigma ^2\), under F(P) and \({\hat{F}}(P)\). Equation (23) ensures that \({\tilde{P}}\) has more positive (negative) skewness under \({\hat{F}}(P)\) than under F(P), while Eqs. (21) and (22) ensure a single-crossing property. To see this, we compare the central third moment under \({\hat{F}}(P)\) and that under F(P):

where the first equality follows from integration by parts and Eq. (19), and the second equality follows from integration by parts and Eq. (20). If \({\hat{F}}(P)\) has more simple positive (negative) skewness than F(P), the right-hand side of Eq. (24) is positive (negative) so that the third central moment under \({\hat{F}}(P)\) is indeed larger (smaller) than that under F(P).

Since \({\tilde{P}}\) has the same mean under F(P) and \({\hat{F}}(P)\) from Eq. (19), the firm’s optimal output level remains \(Q^*\) when the original CDF, F(P), is replaced by the new CDF, \({\hat{F}}(P)\). The firm’s optimal futures position, \(H^{\dagger }\), is the solution to the following first-order condition:

where \(\Pi ^{\dagger }(P)=PQ^*-C(Q^*)+(P^f-P)H^{\dagger }\). To compare \(H^{\dagger }\) with \(H^{*}\), we evaluate the left-hand side of Eq. (25) at \(H^*\) to yield

where the equality follows from Eq. (7). It then follows from Eq. (25) that \(H^{\dagger }> ({<}) H^{*}\) if and only if the right-hand side of Eq. (26) is positive (negative). We state and prove the following proposition.

Proposition 5

If \(U'''(\Pi )\ge 0\) and \(G'''(R)\ge 0\), the regret-averse competitive firm increases (decreases) its optimal futures position, i.e., \(H^{\dagger }>(<)\ H^{*}\), when the CDF of the uncertain per-unit price, \({\tilde{P}}\), shifts from F(P) to \({\hat{F}}(P)\), where \({\hat{F}}(P)\) has more simple positive (negative) skewness than F(P).

Proof

Let \(\Phi (P)=\Big [U'\Big (\Pi ^{*}({P})\Big )+\beta G'\Big (R^{*}({P})\Big )\Big ](P^f-P)\). Then, we have \(\Phi ''(P)=\Psi (P)-2U''\Big (\Pi ^*(P)\Big )(Q^{*}-H^*)\), where

Since \(Q(P)<(>)\ Q^{*}\) whenever \(P<(>) \ P^f\) and \(Q'(P)>0\), Eq. (27) implies that \(\Psi (P)>(<)\ 0\) whenever \(P<(>) \ P^*\). Using \(\Phi (P)\), we can write the right-hand side of Eq. (26) as

where the first equality follows from integration by parts and Eq. (19), and the second equality follows from integration by parts and Eq. (20). Since \(\Psi (P)>(<)\ 0\) whenever \(P<(>) \ P^f\), Eqs. (21) and (22) imply that the first term on the right-hand side of Eq. (28) is negative (positive). Equation (23) implies that the second term on the right-hand side of Eq. (28) is also negative (positive). Hence, we conclude that \(H^{\dagger }<(>)\ H^*\) if \({\hat{F}}(P)\) has more simple positive (negative) skewness than F(P). \(\square \)

The intuition for Proposition 5 is as follows. When \({\hat{F}}(P)\) has more simple positive skewness than F(P), realizations of \({\tilde{P}}\) close to \({\underline{P}}\) are much less likely to be seen than those close to \({\overline{P}}\). The regret-averse firm as such raises more concerns about the disutility from the discrepancy of its futures position, \(H^{*}\), from the long position limit, L, when high realizations of \({\tilde{P}}\) are revealed. To minimize regret, the regret-averse firm optimally adjusts its futures position downward from \(H^{*}\). Prudence in risk, i.e., \(U'''(\Pi )\ge 0\), and prudence in regret, i.e., \(G'''(R)\ge 0\), further reinforce the firm’s preferences for positive skewness and thus \(H^{\dagger }<H^*\). On the other hand, when \({\hat{F}}(P)\) has more simple negative skewness than F(P), realizations of \({\tilde{P}}\) close to \({\underline{P}}\) are much more likely to be seen than those close to \({\overline{P}}\). The regret-averse firm as such optimally adjusts its futures positive upward from \(H^{*}\) to reduce the discrepancy of its futures position, \(H^*\), from the short position limit, S, when low per-unit prices are revealed. Prudence in risk and prudence in regret imply that the firm would like to minimize its exposure to negative skewness and thus \(H^{\dagger }>H^*\).

5 Conclusion

In this paper, we incorporate regret theory into Sandmo’s (1971) model of the competitive firm under price uncertainty. Regret-averse preferences are characterized by a modified utility function that includes disutility from having chosen ex post suboptimal alternatives. The extent of regret depends on the difference between the actual profit and the maximum profit attained by making the optimal production and hedging decisions had the firm observed the true realization of the random output price. While the separation theorem holds under regret aversion, the prevalence of hedging opportunities may have perverse effect on the firm’s optimal output level, contrary to what the conventional wisdom would suggest. We show that the regret-averse firm optimally produces more when it is banned from trading futures for hedging purposes if regret aversion plays a sufficiently more important role than risk aversion in determining the firm’s production decision. We derive sufficient conditions under which the regret-averse firm optimally opts for an under-hedge (over-hedge). We further show that the firm optimally increases (decreases) its futures position when the price risk possesses more positive (negative) skewness. Regret aversion as such plays a distinctive role, vis-à-vis risk aversion, in shaping the production and hedging decisions of the competitive firm under price uncertainty.

One interesting extension is to examine whether nonlinear contracts, such as option contracts or even straddles and butterflies, are preferred over linear futures contracts for hedging purposes under regret aversion or not.Footnote 13 In this paper, we assume that the regret-averse firm can only trade futures contracts subject to bounded short and long positions. As we model regret in a way that the marginal disutility from regret is increasing in the difference between the value under the foregone best alternative and the value under the chosen hedging strategy, the firm either regrets not having taken the maximal short or long futures position. Trading in a nonlinear contract (e.g., a butterfly) is likely to reduce the maximal disutility from regret incurred with a futures position. This is also likely to provide a rationale for why the regret-averse firm optimally puts limits on its position in the derivatives market as, otherwise, the disutility from regret is infinite. We leave this interesting extension for future research.

Notes

The full-hedging theorem is analogous to a well-known result in the insurance literature that a risk-averse individual fully insures at an actuarially fair price (Mossin 1968).

We thank an anonymous referee for suggesting these two alternative motivations.

For other applications of regret aversion using a similar modified utility function, see Braun and Muermann (2004) and Wong (2012) in the case of demand for insurance, Muermann et al. (2006) in a portfolio choice problem, Tsai (2012) and Wong (2011) in the banking context, Broll et al. (2015, 2016) in the decision to export and Wong (2020) in a principal agent model.

The strict convexity of the cost function reflects the fact that the firm’s production technology exhibits decreasing returns to scale.

Throughout the paper, random variables have a tilde \((^{\sim })\) while their realizations do not.

The short and long position limits are not only realistic features of a futures market, but also necessary for prohibiting the firm from taking an infinite short (long) futures position should the firm be perfectly informed that the true realization of the random output price is below (above) the predetermined futures price. Michenaud and Solnik (2008) impose similar restrictions on hedge ratios in their Appendix D.

This assumption requires that \(S>Q^*\), where \(Q^*\) solves \(C'(Q^*)=P^f\). See Proposition 1.

Bleichrodt et al. (2010) provide empirical evidence that regret functions are indeed convex.

Braun and Muermann (2004); Muermann et al. (2006), and Wong (2011, 2012) model regret as a utility loss, i.e., \(R=U(\Pi ^{\max })-U(\Pi )\). Since \(\Pi ^{\max }\) is optimally determined, a change in \(G(U(\Pi ^{\max })-U(\Pi ))\) when the firm changes its choice, \(X=Q\) or H, is governed by \(-G'(U(\Pi ^{\max })-U(\Pi ))U'(\Pi )\partial \Pi /\partial X\), which is simply a monotonic transformation of \(-G'(\Pi ^{\max }-\Pi )\partial \Pi /\partial X\). Hence, none of the qualitative results are affected if we adopt this alternative approach.

For any two random variables, \({\tilde{X}}\) and \({\tilde{Y}}\), we have \(\textrm{Cov}[{\tilde{X}},{\tilde{Y}}]=\textrm{E}[{\tilde{X}}{\tilde{Y}}]-\textrm{E}[{\tilde{X}}]\textrm{E}[{\tilde{Y}}]\). Proposition 1 implies that \(C'(Q^*)=P^f=\textrm{E}[{\tilde{P}}]\).

An increase in downside risk in the sense of Menezes et al. (1980) is simply a third-degree increase in risk in the sense of Ekern (1980).

We thank an anonymous referee for suggesting this interesting extension.

References

Bell, D.E.: Regret in decision making under uncertainty. Oper. Res. 30, 961–981 (1982)

Bell, D.E.: Risk premiums for decision regret. Manage. Sci. 29, 1156–1166 (1983)

Bleichrodt, H., Cillo, A., Diecidue, E.: A quantitative measurement of regret theory. Manage. Sci. 56, 161–175 (2010)

Braun, M., Muermann, A.: The impact of regret on the demand for insurance. J. Risk Insur. 71, 737–767 (2004)

Broll, U., Zilcha, I.: Exchange rate uncertainty, futures markets and the multinational firm. Eur. Econ. Rev. 36, 815–826 (1992)

Broll, U., Welzel, P., Wong, K.P.: Exchange rate risk and the impact of regret on trade. Open Econ. Rev. 26, 109–119 (2015)

Broll, U., Welzel, P., Wong, K.P.: The impact of regret on exports. Ger. Econ. Rev. 17, 192–205 (2016)

Danthine, J.-P.: Information, futures prices, and stabilizing speculation. J. Econ. Theory 17, 79–98 (1978)

Ekern, S.: Increasing \(N\)th degree risk. Econ. Lett. 6, 329–333 (1980)

Feder, G., Just, R.E., Schmitz, A.: Futures markets and the theory of the firm under price uncertainty. Q. J. Econ. 94, 317–328 (1980)

Guo, X., Wong, W.-K., Xu, Q., Zhu, X.: Production and hedging decisions under regret aversion. Econ. Model. 51, 153–158 (2015)

Holthausen, D.M.: Hedging and the competitive firm under price uncertainty. Am. Econ. Rev. 69, 989–995 (1979)

Loomes, G.: Further evidence of the impact of regret and disappointment in choice under uncertainty. Economica 55, 47–62 (1988)

Loomes, G., Starmer, C., Sugden, R.: Are preferences monotonic–testing some predictions of regret theory. Economica 59, 17–33 (1992)

Loomes, G., Sugden, R.: Regret theory: an alternative theory of rational choice under uncertainty. Econ. J. 92, 805–824 (1982)

Loomes, G., Sugden, R.: Testing for regret and disappointment in choice under uncertainty. Econ. J. 97, 118–129 (1987)

Menezes, C.F., Geiss, C., Tressler, J.: Increasing downside risk. Am. Econ. Rev. 70, 921–932 (1980)

Michenaud, S., Solnik, B.: Applying regret theory to investment choices: currency hedging decisions. J. Int. Money Financ. 27, 677–694 (2008)

Mossin, J.: Aspects of rational insurance purchasing. J. Polit. Econ. 76, 553–568 (1968)

Muermann, A., Mitchell, O., Volkman, J.: Regret, portfolio choice and guarantee in defined contribution schemes. Insur. Math. Econ. 39, 219–229 (2006)

Paroush, J., Venezia, I.: On the theory of the competitive firm with a utility function defined on profits and regret. Eur. Econ. Rev. 12, 193–202 (1979)

Quiggin, J.: Regret theory with general choice sets. J. Risk Uncertain. 8, 153–165 (1994)

Sandmo, A.: On the theory of the competitive firm under price uncertainty. Am. Econ. Rev. 61, 65–73 (1971)

Starmer, C., Sugden, R.: Testing for juxtaposition and event-splitting effects. J. Risk Uncertain. 6, 235–254 (1993)

Steil, B.: Corporate foreign exchange risk management: a study in decision making under uncertainty. J. Behav. Decis. Mak. 6, 1–31 (1993)

Sugden, R.: An axiomatic foundation of regret. J. Econ. Theory 60, 159–180 (1993)

Tsai, J.-Y.: Risk and regret aversion on optimal bank interest margin under capital regulation. Econ. Model. 29, 2190–2197 (2012)

Wong, K.P.: Regret theory and the banking firm: the optimal bank interest margin. Econ. Model. 28, 2483–2487 (2011)

Wong, K.P.: Production and insurance under regret aversion. Econ. Model. 29, 1154–1160 (2012)

Wong, K.P.: Regret theory and the competitive firm. Econ. Model. 36, 172–175 (2014)

Wong, K.P.: Optimal nonlinear pricing by a regret-averse monopoly. Manag. Decis. Econ. 41, 1156–1161 (2020)

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank an anonymous referee for his/her helpful comments and suggestions. The usual disclaimer applies.

Appendix A. Second-order conditions for program (5)

Appendix A. Second-order conditions for program (5)

Let \({\hat{V}}(Q,H)=\textrm{E}\Big [U\Big (\Pi ({\tilde{P}})\Big )-\beta G\Big (R({\tilde{P}})\Big )\Big ]\). Then, we have

and

where we have used \(C'(Q^*)=P^f\) from Proposition 1. Hence, we have

We as such conclude that the second-order conditions for program (5) are satisfied.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Broll, U., Welzel, P. & Wong, K.P. Hedging and the regret theory of the firm. Decisions Econ Finan 47, 259–273 (2024). https://doi.org/10.1007/s10203-023-00395-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-023-00395-0