Abstract

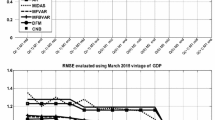

Releases of GDP data undergo a series of revisions over time. These revisions have an impact on the results of macroeconometric models documented by the growing literature on real-time data applications. Revisions of U.S. GDP data can be explained and are partly predictable according to Faust et al. (J. Money Credit Bank. 37(3):403–419, 2005) or Fixler and Grimm (J. Product. Anal. 25:213–229, 2006). This analysis proposes the inclusion of mixed frequency data for forecasting GDP revisions. Thereby, the information set available around the first data vintage can be better exploited than the pure quarterly data. In-sample and out-of-sample results suggest that forecasts of GDP revisions can be improved by using mixed frequency data.

Similar content being viewed by others

References

Bernanke, B., Boivin, J.: Monetary policy in a data-rich environment. J. Monet. Econ. 50(3), 525–546 (2003)

Breitung, J., Schumacher, C.: Real-time forecasting of GDP based on a large factor model with monthly and quarterly data. Deutsche Bundesbank, Discussion Paper, 2006/34 (2006)

Chow, G.C., Lin, A.: Best linear unbiased interpolation, distribution, and extrapolation of time series by related series. Rev. Econ. Stat. 53(4), 372–375 (1971)

Clements, M., Galvao, A.B.: Macroeconomic forecasting with mixed frequency data: forecasting US output growth. J. Bus. Econ. Stat. (2008, forthcoming)

Croushore, D., Stark, T.: A real-time data set for macroeconomists: does the data vintage matter? Rev. Econ. Stat. 85(3), 605–617 (2003)

Evans, M.: Where are we now? Real-time estimates of the macro economy. Working Paper 11064, NBER (2005)

Faust, J., Rogers, J., Wright, J.: News and noise in G-7 GDP announcements. J. Money Credit Bank. 37(3), 403–419 (2005)

Fernandez, R.B.: A methodological note on the estimation of time series. Rev. Econ. Stat. 63(3), 471–476 (1981)

Fixler, D., Grimm, B.: GDP estimates: rationality tests and turning point performance. J. Product. Anal. 25, 213–229 (2006)

Ghysels, E., Santa-Clara, P., Valkanov, R.: The MIDAS touch: mixed data sampling regression models. Scientific Series, vol. 20. CIRANO (2004)

Ghysels, E., Sinko, A., Valkanov, R.: MIDAS regressions: further results and new directions. Econom. Rev. 26(1), 53–90 (2007)

Giannone, D., Reichlin, L., Small, D.: Nowcasting GDP and inflation: real-time informational content of macroeconomic data releases. Working Paper 42, Federal Reserve Board, Washington, DC (2005)

Golinelli, R., Parigi, G.: Short-run Italian GDP forecasting and real-time data. Discussion Paper Series 5302, Centre for Economic Policy Research (2005)

Jacobs, J., Sturm, J.: Do IFO indicators help explain revisions in German industrial production? In: Sturm, J., Wollmershäuser, T. (eds.) Ifo survey data in business cycle and monetary policy analysis, pp. 93–114. Physica, Heidelberg (2004)

Kim, C.-J., Nelson, C.R.: Has the U.S. economy become more stable? A Bayesian approach based on a Markov-switching model of the business cycle. Rev. Econ. Stat. 81(4), 608–616 (1999)

Mankiw, N.G., Shapiro, M.D.: News or noise: an analysis of GDP revisions. Technical report, Survey of Current Business, pp. 20–25 (1986)

Mariano, R., Murasawa, Y.: A new coincident index of business cycles based on monthly and quarterly series. J. Appl. Econom. 18, 427–443 (2003)

Mitchell, J., Smith, R.J., Weale, M.R., Wright, S., Salazar, E.L.: An indicator of monthly GDP and an early estimate of quarterly GDP growth. Econ. J. 115, 108–129 (2005)

Muth, J.F.: Rational expectations and the theory of price movements. Econometrica 29, 315–335 (1961)

Nunes, L.: Nowcasting quarterly GDP growth in a monthly coincident indicator model. J. Forecast. 24, 575–592 (2005)

Proietti, T.: Temporal disaggregation by state space methods: dynamic regression methods revisited. Econom. J. 9, 357–372 (2006)

Stock, J.H., Watson, M.W.: Macroeconomic forecasting using diffusion indexes. J. Bus. Econ. Stat. 20, 147–162 (2002)

Swanson, N., Ghysels, E., Callan, M.: A multivariate time series analysis of the data revision process for industrial production and the composite leading indicator. In: Engle, R., White, H. (eds.) Clive W.J. Granger Festschrift, pp. 45–75. Oxford University Press, Oxford (1999)

Swanson, N., van Dijk, D.: Are statistical reporting agencies getting it right? Data rationality and business cycle asymmetry. J. Bus. Econ. Stat. 24(1), 24–42 (2006)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hogrefe, J. Forecasting data revisions of GDP: a mixed frequency approach. Adv Stat Anal 92, 271–296 (2008). https://doi.org/10.1007/s10182-008-0071-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10182-008-0071-4