Abstract

This study presents an overlapping-generations model with altruism towards children. We characterize a Markov-perfect political equilibrium of voting over two policy issues, public education for the young and social security for the old. The model potentially generates two types of political equilibria, one favoring public education and the other favoring social security. One equilibrium is selected by the government to maximize its objective. It is shown that (i) longevity affects equilibrium selection and relevant policy choices; and (ii) private education as an alternative to public education and a Markov-perfect political equilibrium can generate the two types of equilibria.

Similar content being viewed by others

Notes

There are two aspects of population aging: an increase in longevity, which is basically out of the control of individuals, and a decline in fertility rates, which is the outcome of individual decision-making. The current study focuses on the former aspect to examine the effect of an exogenous change in the demographic structure on education and social security policies via voting.

Given the assumption of identical individuals within a generation, we ignore intragenerational political conflict in the present study. Instead, we focus on the conflict between generations.

This assumption is unusual in the literature, but it enables us to demonstrate the intergenerational conflict over the two policy issues (i.e., public education for the young and social security for the old) in a tractable manner.

The condition \(z_{t}>0\) becomes

$$\begin{aligned} z_{t}>0\Leftrightarrow h_{t}>\left( \frac{1-\gamma }{p\theta \delta }+1\right) e_{t}+pb_{t}\Leftrightarrow 1>\frac{p(1-\theta )}{1+p\left( (1-\theta )+\delta \right) }. \end{aligned}$$The last inequality holds for any set of parameters.

Using this direct calculation, we have

$$\begin{aligned} V_{t,z>0}^{m}&\gtreqless V_{t,z=>0}^{m}\Leftrightarrow (1+p\delta )\ln \frac{1+p\delta }{1+p\theta \delta }+p\delta \ln \theta \gtreqless p\delta \ln (1-\gamma )\\&\Leftrightarrow \ln \left( \frac{1+p\delta }{1+p\theta \delta }\right) ^{(1+p\delta )}+\ln \left( \theta \right) ^{p\delta }\gtreqless \ln (1-\gamma )^{p\delta }\\&\Leftrightarrow \left( \frac{1+p\delta }{1+p\theta \delta }\right) ^{(1+p\delta )}\left( \theta \right) ^{p\delta }\gtreqless (1-\gamma )^{p\delta }\\&\Leftrightarrow \left( \frac{1+p\delta }{1+p\theta \delta }\right) ^{(1+p\delta )/p\delta }\theta \gtreqless 1-\gamma . \end{aligned}$$Using the definition of \(\phi (p)\) in the text, we obtain (9).

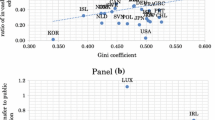

An exception is Chile with a 42.1 % share. The share is 24.2 % in Canada, which can plausibly be included in the group of Anglo-Saxon countries.

References

Acemoglu D, Robinson J (2005) Economic origins of dictatorship and democracy. Cambridge University Press, Cambridge

Bassetto M (2008) Political economy of taxation in an overlapping-generations economy. Rev Econ Dyn 11:18–43

Bearse P, Glomm G, Janeba E (2001) Composition of government budget, non-single peakedness, and majority voting. J Public Econ Theory 3:471–481

Bearse P, Glomm G, Patterson DM (2005) Endogenous public expenditures on education. J Public Econ Theory 7:561–577

Bellettini G, Berti Ceroni C (1999) Is social security really bad for growth? Rev Econ Dyn 2:796–819

Bernasconi M, Profeta P (2012) Public education and redistribution when talents are mismatched. Eur Econ Rev 56:84–96

Bethencourt C, Galasso V (2008) Political complements in the welfare state: health care and social security. J Public Econ 92:609–632

Boldrin M (2005) Public education and capital accumulation. Res Econ 59:85–109

Cardak BA (2004) Education choice, endogenous growth and income distribution. Economica 71:57–81

Casey B, Oxley H, Whitehouse ER, Antolin P, Duval R, Leibfritz W (2003) Policies for an ageing society: recent measures and areas for further reform. OECD Economics Department Working Papers, No. 369, OECD Publishing. doi:10.1787/737005512385

Castello-Climent A, Domenech R (2008) Human capital inequality, life expectancy and economic growth. Econ J 118:653–677

Cattaneo MA, Wolter SC (2009) Are the elderly a threat to educational expenditures? Eur J Polit Econ 25:225–236

Conde-Ruiz JI, Galasso V (2005) Positive arithmetic of the welfare state. J Public Econ 89:933–955

Creedy J, Li SM, Moslehi S (2011) The composition of government expenditure: economic conditions and preferences. Econ Inq 49:94–107

Creedy J, Moslehi S (2009) Modelling the composition of government expenditure in democracies. Eur J Polit Econ 25:42–55

de la Croix D, Doepke M (2004) Public versus private education when differential fertility matters. J Dev Econ 73:607–629

de la Croix D, Doepke M (2009) To segregate or to integrate: education politics and democracy. Rev Econ Stud 76:597–628

Epple D, Romano ER (1996) Public provision of private goods. J Polit Econ 104:57–84

Fernandez R, Rogerson R (2001) The determinants of public education expenditures: long-run evidence from the states. J Educ Financ 27:567–583

Glomm G (2004) Inequality, majority voting and the redistributive effects of public education funding. Pac Econ Rev 9:93–101

Glomm G, Kaganovich M (2003) Distributional effects of public education in an economy with public pensions. Int Econ Rev 44:917–937

Glomm G, Ravikumar B (1992) Public versus private investment in human capital: endogenous growth and income inequality. J Polit Econ 100:818–834

Glomm G, Ravikumar B (1995) Endogenous public policy and multiple equilibria. Eur J Polit Econ 11:653–662

Glomm G, Ravikumar B (1998) Opting out of publicly provided services: a majority voting result. Soc Choice Welf 15:187–199

Glomm G, Ravikumar B (2001) Human capital accumulation and endogenous public expenditures. Can J Econ 34:807–826

Gonzalez-Eiras M, Niepelt D (2008) The future of social security. J Monet Econ 55:197–218

Gonzalez-Eiras M, Niepelt D (2012) Aging, government budgets, retirement, and growth. Eur Econ Rev 56:97–115

Gradstein M, Justman M (1996) The political economy of mixed public and private schooling: a dynamic analysis. Int Tax Public Financ 3:297–310

Gradstein M, Justman M (1997) Democratic choice of an education system: implications for growth and income distribution. J Econ Growth 2:169–183

Gradstein M, Kaganovich M (2004) Aging population and education finance. J Public Econ 88:2469–2485

Grossman G, Helpman E (1998) Intergenerational redistribution with short-lived governments. Econ J 108:1299–1329

Harris AR, Evans WN, Schwab RM (2001) Education spending in an aging America. J Public Econ 81:449–472

Hassler J, Rodriguez Mora JV, Storesletten K, Zilibotti F (2003) The survival of the welfare state. Am Econ Rev 93:87–112

Hassler J, Krusell P, Storesletten K, Zilibotti F (2005) The dynamics of government. J Monet Econ 52:1331–1358

Hassler J, Storesletten K, Zilibotti F (2007) Democratic public good provision. J Econ Theory 133:127–151

Holtz-Eakin D, Lovely ME, Tosun MS (2004) Generational conflict, fiscal policy, and economic growth. J Macroecon 26:1–23

Hoyt WH, Lee K (1998) Educational vouchers, welfare effects, and voting. J Public Econ 69:211–228

Iturbe-Ormaetxe I, Valera G (2012) Social security reform and the support for public education. J Popul Econ 25:609–634

Kaganovich M, Meier V (2012) Social security systems, human capital, and growth in a small open economy. J Public Econ Theory 14:573–600

Kaganovich M, Zilcha I (2012) Pay-as-you-go or funded social security? A general equilibrium comparison. J Econ Dyn Control 36:455–467

Kemnitz A (2000) Social security, public education, and growth in a representative democracy. J Popul Econ 13:443–462

Konrad KA (1995) Social security and strategic inter-vivos transfers of social capital. J Popul Econ 8:315–326

Krusell P, Quadrini V, Rios-Rull J-V (1997) Politico-economic equilibrium and economic growth. J Econ Dyn Control 21:243–272

Kunze L (2014) Life expectancy and economic growth. J Macroecon 39:54–65

Lancia F, Russo A (2013) A dynamic politico-economic model of intergenerational contracts. http://econpapers.repec.org/paper/modrecent/050.htm

Levy G (2005) The politics of public provision of education. Q J Econ 120:1507–1534

Lindbeck AJ, Weibull W (1987) Balanced-budget redistribution as the outcome of political competition. Public Choice 52:273–297

Naito K (2012) Two-sided intergenerational transfer policy and economic development: a politico-economic approach. J Econ Dyn Control 36:1340–1348

OECD (2013) Education at a Glance 2013: OECD Indicators, OECD Publishing

Palivos T, Varvarigos D (2013) Intergenerational complementarities in education, endogenous public policy, and the relation between growth and volatility. J Public Econ Theory 15:249–272

Persson T, Tabellini G (2000) Political economics: explaining economic policy. MIT Press, Cambridge

Poterba JM (1997) Demographic structure and the political economy of public education. J Public Policy Manag 16:48–66

Poterba JM (1998) Demographic change, intergenerational linkages, and public education. Am Econ Rev 88:315–320

Poutvaara P (2006) On the political economy of social security and public education. J Popul Econ 19:345–365

Rangel A (2003) Forward and backward intergenerational goods: why is social security good for the environment? Am Econ Rev 93:813–834

Razin A, Sadka E, Swagel P (2002) The aging population and the size of the welfare state. J Polit Econ 110:900–918

Saint-Paul G, Verdier T (1993) Education, democracy and growth. J Dev Econ 42:399–407

Soares J (2006) A dynamic general equilibrium analysis of the political economy of public education. J Popul Econ 19:367–389

Song Z (2011) The dynamics of inequality and social security in general equilibrium. Rev Econ Dyn 14:613–635

Song Z (2012) Persistent ideology and the determination of public policy over time. Int Econ Rev 53:175–202

Song Z, Storesletten K, Zilibotti F (2012) Rotten parents and disciplined children: a politico-economic theory of public expenditure and debt. Econometrica 80:2785–2803

Stiglitz JE (1974) The demand for education in public and private school systems. J Public Econ 3:349–385

Tosun MS (2008) Endogenous fiscal policy and capital market transmissions in the presence of demographic shocks. J Econ Dyn Control 32:2031–2060

Author information

Authors and Affiliations

Corresponding author

Additional information

The author would like to thank the referee for useful comments and suggestions, and Yuki Uchida for his research assistance. This work was supported in part by a Grant-in-Aid for Scientific Research (C) from the Ministry of Education, Science, and Culture of Japan No. 24530346.

Rights and permissions

About this article

Cite this article

Ono, T. Public education and social security: a political economy approach. Econ Gov 16, 1–25 (2015). https://doi.org/10.1007/s10101-014-0149-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10101-014-0149-2