Abstract

While hundreds of papers study the strategic interactions of oligopolists facing sticky prices only very few treat the in my opinion more important and opposite case of sticky or sluggish demand and supply, e.g., for energy. This point was taken up in Wirl (Int J Ind Organ 28:220–229, 2010) but unfortunately, the computation of the linear Markov perfect equilibrium is wrong. The situation in energy markets following Russia’s invasion of Ukraine adds a topical element to the theoretical analysis. Application to the oil market suggests that the difference between collusion and oligopolistic competition among few (symmetric) players is small for Markov perfect linear eqilibria. This is in stark contrast to the outcome in open loop strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many papers study Cournot strategies of oligopolists facing sticky prices, i.e., when the price adapts dynamically, more precisely, sluggishly to changes in an industry’s aggregate output. Indeed, sticky prices are one of the most studied cases in the differential games literature and a few examples follow: First in Fershtman and Kamien (1987), extended in Dockner (1988), Tsutsui and Mino (1990) use it to show the existence of multiple nonlinear Markov perfect equilibria and in Cellini and Lambertini (2004). It is discussed in the reference text books of Dockner et al. (2000) and in Lambertini (2018) and in the survey of Jun and Vives (2004).

However, many prices are anything but sticky. Indeed, important markets, in particular the energy markets, have the opposite characteristic: drastic price changes, spikes and collapses, due to comparatively small changes in supply or demand. Examples on the supply side are: the Arab oil embargo in 1973 following the Yom-Kipur war and the reduction of Iranian oil supplies in 1979 after the Iranian revolution led in both instances to a quadrupling of world oil prices, the oil price collapse in 1986 after Saudi Arabia increased its supply, the minor shortages in California in 2000 led to a quadrupling of electricity prices (from $100 per MW in October to $400 in December), and the effect of the hurricane Katrina on oil prices. A very recent example is the shortfall in Europe’s energy supplies due to Russia’s invasion of Ukraine. The shortfall, or only the perceived shortfall for the coming winter, sent natural gas prices to astronomical levels during summer and autumn 2022 and as a consequence also electricity prices since the marginal power stations in Europe use natural gas. Sluggish reactions explain this price volatility. Demand is sluggish because adjustments require behavioral changes (not always easy since we know from Shakespeare that "use breeds a habit", which is often hard to break) and investments, e.g., in the case of energy demand: retrofitting a house and buying new, presumably more efficient, equipment (refrigerators, cars, etc.) have long lasting implications on demand (around ten years for a car, many decades for buildings). This demand sluggishness leads to price volatility, first shown in Wirl et al. (1985) and applied to OPEC and the oil market in Caban and Wirl (2014) and Wirl (2015) in stochastic settings. Sluggishness and changes in demand explain the puzzle of oil prices reaching $140 per barrel during June 2008 but falling to below $40 after the Lehman bankruptcy in autumn 2008 (which Hamilton 2009 finds, wrongly in my opinion, incompatible with market fundamentals). Similarly on the supply side. A supplier’s decision to either expand or to reduce output takes time and requires costly investments. Using again examples from the energy market, expanding oil production, natural gas distribution networks, and adding power plants require time, e.g., more than a decade for large hydro power stations and nuclear power plants; or as Kilian (2009) puts it ‘that taking a well offline as well as bringing one online incurs costs’ and, I would add, takes time.

An explanation of the sticky price model’s dominance in the literature is that its analysis can rely on a single state (the price) and that it permits multiple nonlinear Markov perfect equilibria, Tsutsui and Mino (1990). In contrast, the dimension of the state space cannot be reduced in a model of an oligopoly facing demand and supply sluggishness even if imposing symmetry (which, however, reduces the number of coefficients that must be computed). Indeed Wirl (2010) made this error of reducing the state space from n, the supply of each firm represents one state of the system, to 2 and this paper corrects this error and discusses the different economic outcomes by examples including an application to the world oil market.

2 Model (Wirl 2010)

2.1 Dynamic demand

Many goods in particular fuels (oil, but also gas, coal and electricity) are characterized by sluggish demand, i.e., small short run but larger long run price elasticities. The reason is that current demand (for energy and many other nondurables) depends on appliances (durables) and on habits, their number, size and technical efficiency, so that adjustment is costly and proceeds slowly. Therefore, the following reduced form model of dynamic demand is proposed,

\(x\left( t\right) \) is the demand in period t, \(D\left( p\right) \) is the target (or equilibrium or long run) demand given the price p, \(\tau \) is the time constant that measures the sluggishness of demand, more precisely, the time that it takes until \(63\%\) from the convergence to the equilibrium demand (for a constant price level) are reached. The feedback rule in (1) describes the optimal intertemporal adjustment of myopic consumers facing quadratic costs for deviating from their target demand and for adjustment, Eisner and Strotz (1963). Similar dynamic relations have been used in Wirl (1985), Rauscher (1992), Roy and Richardson (2003) and in many other papers. Furthermore, (1) is the continuous time version of the often estimated discrete time relation for modeling dynamic demand, \( x_{t}=\left( 1-\lambda \right) D\left( p_{t}\right) +\lambda x_{t-1}\), in particular energy and oil demand, e.g., Pindyck (1978, 1979), Hogan (1989), Engsted and Bentzen (1993) and Dargay et al. (2007), Cuddington and Leila (2015) survey dynamic energy demand relations concerning their implicit restrictions on price and income elasticities. In order to arrive at a linear-quadratic game, demand is assumed to be linear and is in addition normalized (without loss in generality),

2.2 Intertemporal supply

As on the demand side, a supplier’s decision to expand or to reduce output is costly. Therefore, each non-competitive supplier, \(i=1,\ldots ,n\), decides about expanding, \(u_{i}\) (or respectively reducing if \(u_{i}<0\)), its supply, \(y_{i}\),

at the costs C (negative if selling equipment). The costs include adjustment costs and are linear-quadratic as in the corresponding literature starting with Reynolds (1987, 1991) for the known reason of analytical tractability,

The aggregate investment costs in (4) would increase if the same volume were split among a smaller number of firms due to the implicit decreasing returns to scale of C. Hence increasing n would have two effects: a reduction of the costs of an industry-wide expansion and an increase in competition. These two different effects of changing n are often ignored (e.g. in Reynolds 1991; Karp Larry and Jeffrey 1993 and others). Therefore, I assume that the total cost for the aggregate expansion of an industry,

is independent whether one, two or many (symmetric) firms expand by the aggregate amount U, i.e., \(C\left( U\right) =nC\left( U/n\right) \) for all n. That is an increase in n measures indeed increased competition and not a cost decline. This assumption implies that the adjustment parameter a in (4) must increase linearly in n,

in which the parameter \(a_{1}\) refers to the adjustment cost of a single firm. Another rationalization of (5) is that a competitive sector supplies the equipment at the marginal costs \(k+AU\) where \(U=nu\) is the total investment demand, because these marginal costs must be independent whether the total demand U results from one, two or more firms. Therefore, \(A=a_{1}\), and the normalization (5) must hold at the level of a firm in a symmetric oligopoly with n firms; otherwise the cartel outcome would change with respect to the number of its members.

Assuming perfect competition, the stationary price is equal to kr (= the interest costs for an infinitesimally small adjustment), which must be less than the choke price. Therefore, I make the

Assumption

In addition to the normalization of the adjustment costs according to (5), the interest costs for an infinitesimally small adjustment must be less than the choke price,

2.3 Market clearing price

Equating demand and supply at each period of time,

determines the market clearing price from (1),

Hence, the effect of any change in output is magnified by \(\tau \) so that large time constants translate even small output changes into large price changes.

2.4 Objectives

Each firm maximizes its net present value (using the constant discount rate \( r>0\)) of profits (ignoring variable production costs),

subject to the n dynamic constraints (3), accounting for the market clearing price (8) and taking the data of all other players \(j\ne i\) as given.

3 Collusive and open loop equilibria

The outcomes under cooperation (i.e., of a cartel) and in an open loop Nash equilibrium can be taken from Wirl (2010) and are here amended for a few comparative static properties.

Proposition 1

If all n symmetric firms collude (identified by the superscript c, the subscript \(\infty \) refers to the steady states), their optimal individual adjustment strategy can be written in the following feedback form,

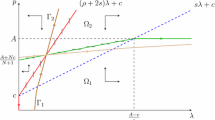

Of course, the aggregates of adjustments \(\left( nu^{c}\right) \) and of supplies \(\left( ny\right) \) are independent of n if the adjustment cost parameter is normalized according to (5) and thus both are identical to those of a monopoly \(\left( n=1\right) \). The longrun supply \( \left( y_{\infty }^{c}\right) \) is positive given the assumption ( 6), stable (since \(\alpha ^{c}>0\)), below the static solution (on the right hand side in (11) which is the limiting case for either \(r\rightarrow 0\) or \(\tau \rightarrow 0\)), declining with respect to costs, discounting and sluggishness, i.e., k, r and \(\tau \) but independent of the adjustment cost parameter \( \left( a\right) \). This parameter affects only the speed of convergence \(\left( \alpha ^{c}\right) \) negatively so that the time constant of convergence to \(y_{\infty }^{c}\), i.e., \(1/\alpha ^{c}\), increases with a higher value of a. A more sluggish demand, i.e., a larger value of \(\tau \), increases \(\alpha ^{c}\) and thus, surprisingly, reduces the time constant of the controlled process \(\left( 1/\alpha ^{c}\right) \). However, how discounting affects \(\left( 1/\alpha ^{c}\right) \) depends on \(\tau \) and a, more precisely, it increases for \( \tau <\sqrt{2a_{1}}\) but decreases for larger values of \(\tau \), see Fig. 1.

Proposition 2

If all n firms compete and specify their strategies as functions of time, \( \left\{ u_{i}\left( t\right) ,\;t\in [0,\infty )\right\} \), then the corresponding symmetric open loop equilibrium strategy, which is identified by the superscript o, can be expressed in a feedback form,

The open loop equilibrium exists given the assumption (6), is unique and is independent of the competitors’ strategies. The implied long run supply \(\left( y_{\infty }^{o}\right) \) is positive, is above the collusive but below the static Cournot equilibrium \(\left( y^{s}\right) \) = the limiting case for either \(r\rightarrow 0\) or \( \tau \rightarrow 0\), is declining with respect to \(c,r,\tau \) and n, but the aggregate, \(ny_{\infty }^{o}\) is increasing with respect to n for the normalization (5). The limit of the open loop solution equals the competitive outcome,

The strategy (12)–(14) is stable (since \(\alpha ^{c}>0\) ). The long run supply is independent of the adjustment cost parameter a, which, however, lowers the speed of convergence \(\left( \alpha ^{c}\right) \)so that the time constant, \(1/\alpha ^{c}\), of approaching the steady state \(y_{\infty }^{o}\) is increased; this applies to n as well (using the normalization (5). However, whether the adjustment speed \( \alpha ^{o}\) is in- or decreasing with respect to the parameters r and \(\tau \) depends on the parameter values (see the examples in Fig. 1).

4 Linear Markov perfect equilibrium (LMPE)

In a Markov perfect equilibrium, the n players’ value functions must satisfy simultaneously the following n partial differential equations,

for \(i=1,\ldots ,n\). The maximizations on the right hand sides of (16) imply,

Linear-quadratic value functions,

solve the n functional equations in (16). As for the open loop solution, symmetry is assumed not only for the parameters but also of the outcomesFootnote 1 for all players and in particular for the competitors of player i, thus \( y_{j}=y\) (and subsequently equal to \(y_{i}\)) and \(u_{j}=u\). Therefore, we can drop the index i of the value function V. Focusing on the first player, \(i=1\), implies the following coefficient matrix of the quadratic form,

The expressions on the right hand side of (19) follow for all mixed and symmetric terms,

because then \(y_{i}y_{j}=y^{2}\) for \(i>1,\;j>1\). Similarly, symmetry implies for the linear terms,

The sums on the right hand sides of (16) can be separated into the own terms \(\left( u_{i},y_{i}\right) \) and the sums over all the competitors \(j\ne i\). This suggests that one could reduce the n-dimensions of the state space to 2. Unfortunately, this is not possible. More precisely, although symmetry allows to reduce the calculations to the determination of a single linear-quadratic value function of the type (18)–(20) with the coefficients

one cannot reduce the state space to two for \(n>2\). The reason is that the sum of controls appears in the objectives and thus on the right hand sides of (16). This error was made in Wirl (2010). The price for this correction is that no closed form solution can be given that is valid for all values of n. Although we can assume symmetry (proven at least for all the numerical examples), we CANNOT assume the identity \( y_{i}=y_{j}=y\) given the requirement of a subgame perfect equilibrium. That is, we cannot reduce the dimension of the state space although in the end we have to solve only for one of the symmetric value functions of the type (18)–(20).

The reason is explained in the following: The observation—only the sums over all the competitors \(j\ne i\) matter for controls, states and value functions—suggests wrongly that one could reduce the n-dimensions to 2, i.e., solving

instead of (16). As a consequence, the value function of player \( i=1 \) is,

Analogous for another second player j as the representative for all of \( i=1 \)’s competitors (and who takes i as representative for his competitors),

Combining this reduction to two states \(\left( y_{i},y\right) \) for \(n=3\) with the guess of the value function (24) yields

Using instead the original HJB-equation (16), assuming symmetry and accounting for each player’s strategy and state, the individual strategies are,

And indeed, accounting for symmetry, \(y_{2}=y_{3}=y\), and setting \(i=1\), the outcomes in (28)–(30) seem identical to (26)–(27). Unfortunately, the implied equations for the determination of the value function coefficients differ and thus the derived value functions. The reason is that the sum of the controls differ in spite of the above similarity. More precisely, setting, \(y=y_{j}\), \(j\ne i\), we get for the sum of the controls, first if accounting for all controls, i.e., (28)–(30),

Using the simplification of two states and controls, i.e., for (26)–(27), the sum over the controls is,

with K also from (32). However, the two sums (31) and (33) differ by

The difference \(\Delta \) vanishes along a symmetric equilibrium, but this is insufficient for the HJB-equation setup and responsible for the error that this shortcut introduces. Similarly for \(n>3\). Therefore, the dimension of the state space cannot be reduced to 2 as in (26) and (27) above and in Wirl (2010).

5 A duopoly

Even a complete derivation for \(n=2\) requires numerical means, more precisely, in order to compute the coefficient \(v_{12}\); all the other coefficients can be given in a closed form conditional on the value of \( v_{12}\). Moreover the uniqueness of the linear Markov perfect equilibrium can be shown, at least for duopolies. This sounds superfluous since almost no paper cares about this issue of uniqueness. However, Eigruber and Wirl (2022) show that a higher dimensional state space allows for multiple and symmetric LMPEs in meaningful economic models (even from the field of industrial organization), a characterization that the so far known few examples of multiple LMPEs—Engwerda in a series of papers in particular and most recently in Engwerda (2016) and Lockwood (1996)—are lacking.

Substitution of the strategies

into the functional equation (16), using the guess (18) and comparing the coefficients leads to the following system of five equations,

that determines the coefficients of the value function guess (18); the equation for the intercept is dropped since \(v_{0}\) is not relevant for the strategies in (34).

Given multiple roots of the equation system (35)–(39) only those can characterize an LMPE that imply stability for (3). Therefore, the Jacobian of the dynamic system, \({\dot{y}}_{1}\) and \({\dot{y}} _{2} \) after substituting the corresponding strategies (34), must have two negative eigenvalues, so that,

and

That is, the value of \(v_{12}\), which classifies the strategies either as complements (if \(v_{12}>0\)) or as substitutes (if \(v_{12}<0\)) following Jun and Vives (2004), must be not too large in absolute terms in order to characterize an LMPE.

The first two equations are linear in \(v_{1}\) and \(v_{2}\) and therefore these coefficients can be computed (but conditional on the other coefficients); their solution is suppressed because they are not relevant for the selection of stable strategies. The third equation is quadratic and independent of \(v_{1}\) and \(v_{2}\) and has the roots,

First of all, the root A defined in (42) must be real. Hence, the term under the square root in (42) must be positive, which constrains the admissible values of \(v_{12}\) to,

Second, the negative root from (42), more precisely,

is the solution, because the stability condition (40) rules out the other root and requires moreover that

This leads to the bounds,

which ensure that \(v_{11}\) is real because the root in (42) includes in addition \(\frac{1}{2}a^{2}r^{2}>0\) so that \(v_{12}^{-}>v_{12\text {real}}\) and \(v_{12}^{+}<v_{12}^{\text {real}}\). The bounds in (45) as well as those already in (43) are symmetric around \(\tau /2\) with negative lower and positive upper values.

Substituting the solution (44) of \(v_{11}\) into the fourth equation (38) determines

uniquely.

Substituting \(v_{11}\ \)and \(v_{22}\) from above into the last equation (39) allows (after some calculations) to define the function

The roots of \(\phi \) determine first \(v_{12}\) and then by backward substitution all the other coefficients and thus all the candidates for an LMPE. This function \(\phi \) is real valued for all values of \(v_{12}\in \left[ v_{12\text {real}},v_{12}^{\text {real}}\right] \). It does not depend on the linear cost term k, which determines the costs if the adjustments were spread out very thinly and which determines the longrun outcomes under competition (15), collusion (11) and for the open loop strategies (see (14)).

Focussing on the numerator of the above ratio (of course only in the interval \(\left[ v_{12\text {real}},v_{12}^{\text {real}}\right] \)), we get the roots of \(\phi \) from solving the equation

The left hand side (lhs) is a cubic polynomial. It is defined for all \( v_{12}\in \Re \), diverges to \(-\infty \) on the left and to \(+\infty \) on the right due to a positive cubic coefficient of 18. Differentiating and equating to zero determines the local extrema at of the function defined on the left hand side of (47),

with the local maximum followed by the local minimum. The right hand side (rhs) of (47) defines a parabola that is zero at \(v_{12\text {real}}\) and \(v_{12}^{\text {real}}\), is positive in between and not existing outside this interval.

Figure 2 shows the typical features of the left hand and right hand sides of the equation (47), in particular, the possibility of three roots in the interval \(\left( v_{12\text {real}},v_{12}^{\text {real}}\right) \). However, not each of the three roots determines an LMPE, because of the stability criteria: First (40) so that \(v_{12}\in \left( v_{12}^{-},v_{12}^{+}\right) \) from (45) and second the additional stability criterion (41) that restricts the set of solutions of \(v_{12}\) further. Loosely speaking, \(\mid v_{12}\mid \) must not be too large and within the bounds established in (45). Applying this stability condition (41) requires to study separately both cases of a positive or negative coefficient \(v_{12}\).

If \(v_{12}<0\),

then

of which the equality determines the lower bound for the roots \(v_{12}\) that can lead to an LMPE,

so that \(v_{12}^{\min }<0\) yet to the right of the above two bounds on the left, i.e., \(v_{12\text {real}}\) and \(v_{12}^{-}\).

Analogously, any root \(v_{12}>0\) must satisfy,

Therefore, we get the upper bound,

so that \(v_{12}^{\max }>0\) and to the left of \(v_{12}^{+}\). Therefore the domains \(v_{12}<v_{12}^{\min }\) and \(v_{12}>v_{12}^{\max }\) are irrelevant for an LMPE and only the roots within the open interval \(\left( v_{12}^{\min },v_{12}^{\max }\right) \) can support an LMPE.

Although I cannot establish a criterion for uniqueness of, or respectively, for multiple equilibria for an arbitrary n, I can show analytically that neither the first root of \(\phi \) in the interval \(\left( v_{12}^{-},v_{12}^{+}\right) \) nor the largest root can provide an LMPE for a duopoly. As mentioned, no one seems to care about the possible non-uniqueness of the LMPE; Reynolds (1991) is an exception that checks the uniqueness at least locally for small discount rates. And yes, there are very few examples, actually only two: Lockwood (1996) and Engwerda (2016) have two LMPEs in a single state game but both examples require assumptions that are at odds with economic models: either the "tail wags the dog" or such a strong convexity in the state that rules out a cooperative solution of the game, see Eigruber and Wirl (2022). Yet recently, Eigruber and Wirl (2022) find multiple LMPE in the economic setting of learning by doing, which is related to this game in its irreducibility of the state space. Therefore, the issue of uniqueness is here addressed explicitly, at least for \(n=2\).

The first root, the left hand side in (47) cuts the rhs from below, can only support an LMPE if this root is in the feasible domain, \(v_{12}\in \left( v_{12}^{\min },v_{12}^{\max }\right) \). This is only possible if the lhs in (47) were smaller than the right hand side at \(v_{12}^{\min } \). First, the left hand side

is already positive at \(v_{12}^{\min }\) since the root in the bracket, C from (50), exceeds \(2\tau \). Since the left hand side is positive at \( v_{12}^{\min }\), the relation between the left and right hand sides is maintained after squaring. Yet the difference between the left hand and right hand side, after squaring, yields,

which is positive. Hence, the first of the three roots (if existingFootnote 2) is to the left of \(v_{12}^{\min }\) and thus cannot qualify for an LMPE.

The third and largest root results if the left hand side of equation (47) cuts the parabola on the right hand side from below. This root can only characterize an LMPE if the left hand side would exceed the right hand side at the upper bound of the feasible domain, i.e., at \(v_{12}^{\max }\). This requires first of all that the left hand side is positive at \( v_{12}^{\max }\), yet it is negative,

Therefore, only the root in the middle qualifies for an LMPE and is marked in Fig. 2.

Of course, one can find parameters for which no LMPE exists (even the root A need not exist), but if it exists, then the LMPE is unique at least for a duopoly.

6 Examples

6.1 Numerical examples

I draw on examples to sketch a few comparative static properties of the game using the reference parameters

so that the stationary total supplies are: for a cartel = 1/6 (from (11)) and for an open loop duopoly = 1/4 (from (14)) for competition =1/2 (as the limit of (14) for \(n\rightarrow \infty \)). Figure 3 shows the strategies for \(n=\) 2, 3 and 4 at the individual level in the state space (assuming symmetric and identical output for the competitors, in particular, if \(n=\) 3 and 4) and the aggregates along the symmetric outcomes. This example, which assumes high costs for additional supply at half the choke price, reveals a substantial impact of competition, at least in the open loop setting: aggregate supply increases from 0.25 for \( n=2\) to 0.33 for \(n=4\)). However, an outcome in Markov strategies leads to substantially less long run supply compared with the open loop equilibrium. The result is fairly similar for a much lower cost parameter, e.g., \(k=1\), so that stationary competitive supply is 0.90 for competition and thus close to the saturation level of 1 and 0.30 for the monopoly; of course, supply vanishes at \(k=\) 10.

Figures 4, 5, 6 trace the consequences of the adjustment cost parameter \(\left( a_{1}\right) \). Adjustment costs do not affect the long run supply of either a monopoly, or of the open loop oligopoly or of competition, see Fig. 4. The reason is that any targeted level of supply can be achieved by small expansions over time (at unit costs k) minimizing the diseconomies associated with large adjustments. However, the adjustment cost, i.e., the penalty for large adjustments, affects the outcome if the firms employ Markov strategies and, very surprisingly, higher adjustment costs increase the long run oligopolistic supply up to the point that it exceeds its open loop counterpart at very high costs, e.g., at \(a_{1}>50\) and \(n=4\) in Fig. 4! Moreover, the Markov strategies are fairly close to the cartel outcome and much lower than the open loop counterpart if the adjustment costs are small. The reason is explained in Fig. 6: Higher adjustment costs lower the degree of complementarity between the strategies and turn them into substitutes at very high adjustment costs, which alters the relation with the open loop equilibrium strategy that is independent of the competitors’ states.

Adjustment costs affect the time constants of all the dynamic processes of \( y_{i}\) governed by the players’ strategies and of course, higher adjustment costs slow down this process, see Fig. 5. Given the steep reactions of the cartel shown in Fig. 3, it is no surprise, that the cartel approaches its stationary supply quickest. Applying this intuition from the steepness of the strategies, the LMPE converges faster (i.e., the time constant \(1/\alpha \) is smaller) but this relation is reversed at very high adjustment costs as for the steady states (and only for \(n=3\) in the example in Fig. 5). The explanation is as above: high adjustment costs change the nature of the strategies from compliments to substitutes. According to the first order condition (17) and the linear-quadratic value function (18) with the coefficients (21), the strategies are

and are therefore complements, if \(v_{12}>0\) but otherwise substitutes. Figure 6 plots the coefficients of the LMPE strategies along symmetric outcomes for a duopoly and for \(n=3\). The coefficient of \(y_{i}\) is always negative (which follows from stability) while the cross effect and thus \(v_{12}\) is positive but turns negative at very high adjustment costs and \(n=3\). If \( v_{12}<0\), then the strategies are substitutes, which creates an incentive to preempt and to deter the competitors’ supply expansions. This leads to supply in excess of the open loop strategy that do not take the rivals’ supplies into account. And this explains also the above puzzle that higher adjustment costs increase the supply in the linear Markov perfect equilibrium—the degree of complementarity between the strategies is first reduced and then the strategies are even turned into substitutes.

6.2 Application to OPEC

I apply now the above game to OPEC. The purpose is not to give another, let alone detailed, account of the much discussed OPEC decision making—cartelized versus different degrees of internal competitionFootnote 3—but to present results that can be interpreted in particular in the light of the topical events during 2022 in the energy markets. Considering as in Wirl (2015) the following demand-price relation (demand in million barrels per day (mb/d) and the price in dollars per barrel ($/b)),

so that \(\$100/b\) imply an equilibrium export demand for OPEC oil of the order of 30 mb/d and that 40 mb/d would maximize OPEC’s export revenues if demand were static. Gately (2006) arrived at this number but for a different set of OPEC countries than today. This seems not crucial given the coarse representation of the market and the objective of evaluating different forms of competition—cartelized versus oligopolistic in open loop or feedback strategies. The dynamic intertemporal optimization will lead to lower OPEC exports according to the results in this paper, in particular Propositions 1 and 2 and presumably for the LMPE too according to the previous section.

This demand relation (52) must first be transformed into the normalized one (2) in order to apply the framework introduced in Sect. 2 and must then be transferred back into the units used in the relation (52). This transformation must also be applied to the cost parameters in (4). According to IHS-markit (https://ihsmarkit.com/research-analysis/global-crude-oil-curve-shows-projects-break-even-through-2040.html visited on the 20th of August 2022) the costs for the expansion by an incremental barrel in the Middle East range on average from $20/b for the first barrel to $35/b for an expansion by 10 mb/d with $5/b (at 0) and $50/b (at 10 mb/d expansion) at the lower and respectively upper bound. Using these numbers to determine the marginal expansion costs at 0 and at 10 mb/d for both cost assumptions and applying the transformation for the normalized framework yields the following parameters for the cost function (4)

for the first assumption (using the average) and

for the 5–50 $/b range implying a larger value of \(a_{1}\).

Figure 7 compares the OPEC strategies for different degrees of competition—cartel, duopoly and a group of \(n=\) 4 on the left hand side—and for the above two different cost assumptions comparing a cartel with a duopoly on the right hand side. A puzzling observation in the light of Fig. 3 is that the LMPE is very close to the cartel outcome even for \(n=\) 4; this applies even to the not shown second and steeper assumption about costs. Furthermore, while going from 2 to 4 players within OPEC adds 10mb/d of supply (or 1/3) in the open loop equilibrium (and close to Gately’s number of 40 mb/d) but only above 1 mb/d for the LMPE; similarly for the different cost assumptions shown on the right hand side of Fig. 7. The reason is that the LMPE strategies are characterized by a large degree of complementarity. Already Fig. 6 shows that low adjustment costs imply a substantial complementarity for the players’ strategies and Fig. 8 shows this for the application to OPEC. More precisely, Fig. 8 documents this steepness of the LMPE strategies with respect to the own (strongly negative) and the competitor’s (positive and large) supply for a duopoly and the smaller cost range; similar observations hold for the other cost assumptions and a larger division of OPEC. However, a crucial caveat is that the above interpretation is based on the assumption of symmetric cartel members yet OPEC members are highly asymmetric: they include the dominant global oil supplier Saudi Arabia producing above 10 m/d now for more than a decade as well as countries like Congo, Equatorial Guinea and Gabon all producing below 0.2 mb/d (according to BP 2022).

Nevertheless, the examples and in particular the application to OPEC highlight that sluggish demand and supply lead to a linear Markov perfect equilibrium that diminishes competition substantially even if firms compete unless adjustment costs are very high. This contrasts oligopolistic supply behavior facing static demand that leads to preemptive and thus to extensive investments and outputs according to Reynolds (1987, 1991) and many follow ups. This finding—the difference between the behavior of a monolithic OPEC cartel or of an OPEC consisting of two or three crucial players is minor - corrects the wrong impression in Wirl (2015) of a "benevolent" OPEC, albeit under the assumption of symmetric players. Asymmetry between the players, as it applies to OPEC with or without Russia consenting, may change this conclusion, yet this question, is left for future research.

7 Final remarks

This paper addresses the issue of sluggish demand and supply relations using a differential game. Such a setup is highly relevant for many and in particular for very important markets like the energy markets. The first contribution is to correct an error in Wirl (2010), which affects the results and the interpretations significantly. Second, to highlight that the common assumption of symmetry does not allow to reduce the state space to 2 for \(n>2\), as made in Wirl (2010) and in other papers; this is a warning for other differential games with a larger state space. Third, the examples and in particular the application to OPEC highlight that sluggish demand and supply can lead to a linear Markov perfect equilibrium that diminishes competition substantially even if firms compete unless adjustment costs are very high. The economic explanation of weak oligopolistic competition in an equilibrium in Markov strategies is that the strategies are complements unless for very high adjustment costs. And they are potentially strong complements if the adjustment costs are relatively small as applies to OPEC (more precisely, to expanding oil production in the Middle East). Complementarity means that expanding output will induce the competitor to expand output too. Therefore, each player internalizes output expansion mimicking cartelization implicitly and tacitly. In contrast if the strategies were substitutes, then expanding the output will deter the competitor’s expansion, which leads to more output due to stronger competition. However, this requires very high adjustment costs that are implausible for the oil market.

Notes

Although the assumption of symmetry of the strategies and of the value function is common in the differential games literature for a symmetric setup, it cannot be taken for granted. E.g., Engwerda (2005) gives an example in which only an asymmetric LMPE exist. However, no asymmetric solutions were found (numerically) in the game investigated in this paper.

Given the steepness of the right hand side at \(v_{12\text {real}}\), actually \( \infty \), more than one root could exist to the left of \(v_{12}^{min}\) but none of them could qualify for an LMPE. Numerically only one or no root to left of \(v_{12\text {real}}\) was found.

Empirical investigations of OPEC as a cartel start with Griffin (1985), followed by 4, and Mason and Polasky (2005), all indicating that OPEC fits neither the competitive nor the cartel description neatly; John (2005) stresses the ambiguity of such tests and finds OPEC as in between a cartel and an oligopoly.

References

BP (2022) bp Statistical Review of World Energy 2022. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf

Caban S, Wirl F (2014) A rationalization of ups & downs of oil prices by sluggish demand uncertainty non-concavity. Natl Resour Model 27(2):178–196

Cellini R, Lambertini L (2004) Dynamic oligopoly with sticky prices: closed-loop, feedback and open-loop solutions. J Dyn Control Syst 10:303–314

Cuddington JT, Leila D (2015) Estimating short and long-run demand elasticities: a primer with energy-sector applications. Energy J 36(1):185–209

Dargay JM, Gately D, Huntington HG (2007) Price and income responsiveness of world oil demand by product. MIMEO, Huntington

Dockner EJ (1988) On the relation between dynamic oligopolistic competition and long-run competitive equilibrium. Eur J Polit Econ 4:47–64

Dockner EJ, Jorgensen S, Ngo van Long N, Sorger G (2000) Differential games in economics and management science. Cambridge University Press, Cambridge

Eigruber M, Wirl F (2022) On uniqueness and nonuniqueness of linear Markov perfect equilibria in differential games. MIMEO, University of Vienna

Eisner R, Strotz R (1963) Determinants of business investment. Prentice Hall, Impacts on Monetary Policy

Engsted T, Bentzen J (1993) Expectations, adjustment costs, and energy demand. Resour Energy Econ 15:371–385

Engwerda J (2005) LQ dynamic optimization and differential games. Wiley

Engwerda J (2016) Properties of feedback Nash equilibria in scalar LQ differential games. Automatica 69:364–374

Fershtman C, Kamien M (1987) Dynamic duopolistic competition with sticky prices. Econometrica 55:1151–1164

Gately D (2006) What oil export levels should we expect from OPEC? Energy J 28(2):151–173

Griffin JM (1985) OPEC behavior: a test of alternative hypotheses. Am Econ Rev 75:954–963

Hamilton JD (2009) Understanding crude oil prices. Energy J 30(2):179–206

Hogan WW (1989) A dynamic putty-semi-putty model of aggregate energy demand. Energy Econ 11:53–69

Jun B, Vives X (2004) Strategic incentives in dynamic duopoly. J Econ Theory 116:249–281

Karp Larry S, Jeffrey M (1993) Perloff, open-loop and feedback models of dynamic oligopoly. Int J Ind Organ 11:369–389

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069

Lambertini L (2018) Differential games in industrial economics. Cambridge University Press, Cambridge

Lockwood B (1996) Uniqueness infinite-time of Markov-perfect equilibrium in affine-quadratic differential games. J Econ Dyn Control 20:751–765

Mason CF, Polasky S (2005) What motivates membership in non-renewable resource cartels? The case of OPEC. Resour Energy Econ 27:321–342

Pindyck RS (1978) Gains to producers from the cartelization of exhaustible resources. Rev Econ Stat 62:238–251

Pindyck RS (1979) The structure of world energy demand. MIT Press, Cambridge

Roy R, Richardson TJ (2003) Monopolists and viscous demand. Games Econ Behav 45:442–464

Rauscher M (1992) Cartel instability and periodic price shocks. J Econ 55:209–219

Reynolds SS (1987) Capacity investment, preemption and commitment in an infinite horizon model. Int Econ Rev 28:69–88

Reynolds SS (1991) Dynamic oligopoly with capacity adjustment costs. J Econ Dyn Control 15:491–514

Smith J (2005) Inscrutable OPEC? Behavioral tests of the Cartel hypothesis. Energy J 26(1):51–81

Tsutsui S, Mino K (1990) Nonlinear strategies in dynamic competition with sticky prices. J Econ Theory 52:136–161

Wirl F (1985) Stable, volatile prices: an explanation by dynamic demand. In: Feichtinger G (eds), Optimal control theory and economic analysis 2, 263–277 North Holland

Wirl F (2010) Dynamic demand and noncompetitive intertemporal output adjustments. Int J Ind Organ 28:220–229

Wirl F (2015) Output adjusting cartels facing dynamic, convex demand under uncertainty: the case of OPEC. Econ Model 44:307–316

Acknowledgements

I thank the editors, Herbert Dawid, Karl Dörner, Gustav Feichtinger, Margaretha Gansterer, Peter M. Kort, and Andrea Seidl, for this invitation. This gives me the opportunity to correct for an error in one of my papers that addresses the important and topical issue of sluggish demand and supply relations (characteristic for energy markets), which IJIO (the journal where I published the original version) declined even to consider refereeing it. Last but not least, I thank two referees for their helpful comments Of course, more important is that it offers the opportunity to express my best wishes (among the usual ones, I wish many interesting travels although he will find it difficult to find new spots on earth) to my long time colleague Richard F. Hartl joining me as an emeritus. If there is something to regret, and it is most probably my fault, then that we wrote only very few papers together despite proximity in space and research agenda.

Funding

Open access funding provided by University of Vienna.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

There is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Calculations

1.1.1 Cartel

1.1.2 Open loop

Adjustment speed (\(\alpha ^{o}\) and respectively the opposite for the time constant \(1/\alpha ^{o}\))

1.1.3 Comparing coefficients for \(n=3\)

Carrying out the comparison of the coefficients for \(n=3\) yields the following equations,

which is different from the setup that is obtained using the shortcut (26) and (27).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wirl, F. Dynamic demand and noncompetitive intertemporal output adjustments: correction and extension. Cent Eur J Oper Res 32, 483–505 (2024). https://doi.org/10.1007/s10100-023-00860-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-023-00860-6