Abstract

This paper analyzes the market structure of the Hungarian insurance market, which operated as a monopoly market until 1986. After the regime change this sector started to develop rapidly. But the Hungarian insurance market has a strong oligopolistic character, and thus raises an interesting question as to how close the market is to a state of perfect competition. Based on the Panzar and Rosse (J Ind Econ 35:443–456, 1987) methodology we estimate the elasticity of total revenues with respect to changes in input prices, so that we can determine the market structure. The estimation of input price elasticity is made with a static and a dynamic panel model. According to research the structure of the Hungarian insurance market significantly differs from the perfect competition case between 2010 and 2019. The market is in long-run equilibrium, and the hypothesis of the monopoly case cannot be rejected. The market structure of a sector is important for modelling phenomena and new regulations effectively, which is relevant for insurance and competition supervision in the protection of customers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Modelling a sector plays a crucial role in the preparation of new regulations and supervisor decisions. Knowledge of the market structure has a critical role in the maintenance of modelling Systematically Important Financial Institutions (SIFIs). The insurance market is a large and risky sector with many clients all over the world. When market competition rises, the situation of consumers improves as well. On the other hand, in case of a monopoly, customers are completely vulnerable. Competition supervision also seeks to curb excessive market power of each firm. Insurance is a trust transaction in which complex financial assets are sold, thus the role of customer protection and supervision are of utmost importance. Consequently, an important factor is to determine how strong competition in the insurance market is.

This paper addresses the question concerning the market structure of the Hungarian insurance sector. In studying the companies of the Hungarian insurance market, the answer is not clear, so it is worth examining the problem more thoroughly. The objective of the research is to determine whether the monopoly or the perfect competition case fits better for the balance sheet data between 2010 and 2019.

The history of Hungarian insurance dates back a long time. In the 1800s, many domestic and foreign insurance companies operated in the country. However, most of them were destroyed because of World War II. Under socialism in Hungary, as in several Eastern European countries (Tipuric et al. 2008), insurance operated as a state monopoly from 1952. In 1986, the only insurer company split into the new State Insurer and the Hungária Insurer, and it was allowed to establish new companies. The market started to develop rapidly, foreign companies appeared in the market, and in parallel the supervisor also evolved. For these reasons, after the change of regime the market underwent significant transformation.

The structure of the current Hungarian insurance market cannot be clearly defined. According to the Association of Hungarian Insurers in 2019 not less than 31 insurance companies were present in the market (MABISZ 2019). Breaking out of the monopoly position, the market has now undergone a major transformation towards perfect competition. On the other hand, in terms of premium income, the top 10 companies cover more than 80% of the market. The position of the market-leading insurers is stable, and their ranking has changed only slightly in recent years, which does not confirm the hypothesis of perfect competition.

Previous researchers have established several methods which can be used for empirical analyses of the market structure, such as the Panzar and Rosse model (Panzar and Rosse 1987) or the Iwata model (Iwata 1974). The Panzar and Rosse method uses the sum of the factor price elasticities of the reduced form revenue equation to create testable hypotheses about the market structure. Studies over the past decades have provided important information on market structures mainly in the bank industry based on this method. Results from studies of small, medium-sized and large banks around the world show monopolistic competition and stronger competition on the international market than at the local level (Bikker and Haaf 2002). Monopolistic competition is noted in Canada’s (Nathan and Neave 1989) and Italy’s (Coccorese 1998) financial markets. The Panzar–Rosse model can be used also in the insurance sector, see Kasman and Turgutlu (2008), Coccorese (2010), Murat et al. (2002), Jeng (2015), Udin et al. (2018), Alhassan and Biekpe (2017), Camino-Mogro et al. (2019), Todorov (2016).

The efficiency and concentration of the insurance market is often the focus of the research. Bikker and Leuvensteijn (2008) analyze the competition and efficiency in the Dutch life insurance market via different indicators. Knezevic et al. (2015) makes a data envelopment analysis about the efficiency of the Serbian insurance market, which shows that the market is not as developed as in neighbouring countries. Some articles examining European countries also contain results about the Hungarian market (Tipuric et al. 2008, Kramaric and Kitic 2012, Kozmenko et al. 2009). The Hungarian insurance market changed markedly after the regime change, with concentration ratios decreasing between 1998 and 2006 (Tipuric et al. 2008). Research in the sphere of the new European Union countries, including Hungary, shows that key insurance indicators are below EU averages, while concentration ratios decreased between 2000 and 2010.

The main research question in articles dealing specifically with the Hungarian insurance market does not usually concern the market structure. Szüle (2017) compares the relationship of taxation and solvency between the bank and insurance industry. The two Hungarian sectors are quite similar, but the two markets are not homogenous. Banyár and Turi (2019) give an overview of consumer protection rules in the country. In a study by Kovács (2011) the main indicators of market power are described in the insurance market by using the Herfindahl–Hirschman Index or the Markov chain model.

As the Hungarian insurance market structure is indeed rarely studied empirically, this article seeks to fill in this gap by using the Panzar–Rosse method in the case of the Hungarian insurance market. According to Goddard and Wilson (2009) the factor price elasticity should be estimated with a dynamic panel model, because the static model can cause biased and inefficient coefficients. We used a static and a dynamic panel approach and two different dependent variables to assess the robustness of the results.

The analysis shows that the structure of the Hungarian insurance market in most cases differs significantly from the perfect competition case between 2010 and 2019. But the hypothesis of the monopolistic competition case cannot be rejected. During this time period the insurance market was in long-run equilibrium according to the Panzar–Rosse methodology. The monopoly market means in this case that the insurer companies’ decisions do not depend on other companies, which suggests high market power.

The rest of the paper is organized as follows. Section 2 presents the methodology of the Panzar–Rosse model and the dynamic panel data approach. In Sect. 3 we describe the dataset on the Hungarian insurance market that we used for the analysis, and some further indicators concerning the market structure of the Hungarian sector. Section 4 focuses on the results, and finally Sect. 5 concludes.

2 Methods

The analysis of the insurance market is based on the Panzar–Rosse model, which gives testable implications of profit maximizing companies in different market structures. The great advantage of the Panzar and Rosse model is the limited data requirement, its large literature, and easy interpretability. Only revenues and factor prices of the companies are required. There is no need for explicit information about the structure of the market.

The reduced form revenue equation is the following:

where \( R\left( {y,z} \right)\) is the reduced form revenue function, \(y\) is the decision variable and \(z\) are further exogenous variables which influence the revenue function. \({\text{C}}\left( {{\text{y}},{\text{w}},{\text{t}}} \right)\) is the cost function, where \(w\) is the vector of exogenous factor prices and \(t\) is the vector of additional exogenous variables that influence cost.

This simple model assumes profit maximizing companies. The testable expression is the sum of the factor price elasticities of the reduced form revenue equation:

where * indicates the profit maximizing values.

The paper of Panzar and Rosse (1987) offers different theorems about the value of the sum of elasticities of gross revenue with respect to input prices (denoted \(H\)) for competitive and monopolistic markets to be able to distinguish these models. In the case of a neoclassical monopolist or collusive oligopolist, the elasticity is nonpositive (\(H \le 0{ }\)). It is equal to unity in the case of a competitive price-taking insurance in long-run competitive equilibrium (H = 1). For a monopolistic competitor the factor price elasticity is between 0 and 1 (0 < H < 1). An assumption is that in the case of perfect competition and monopolistic competition the companies are observed in long-run equilibrium and entry and exit are free. In long run equilibrium the return rates are not correlated with input prices. To test the long run equilibrium empirically, return on assets (ROA) can be estimated with the same independent variables used in the estimation of the factor price elasticity. In long-run competitive equilibrium, the sum of the factor price elasticities is zero (\(E = 0\)) (Table 1).

In Kasman and Turgutlu (2008) the following equation is estimated with a panel dataset:

where TR = total revenue, PL = unit price of labor, PBS = unit price of business services, PFK = unit price of financial capital, TA = total assets, ETA = the ratio of equity capital to total assets, LTA = ratio of losses paid to total assets and index i shows the insurance company, while index t denotes the time.

These values can be calculated using the financial report of the companies. To determine the market structure, we need to test the hypothesis of factor price elasticity (\(H\)), which can be calculated as the sum of the coefficients of the factor prices (\({\upbeta }_{1} + {\upbeta }_{2} + {\upbeta }_{3}\)).

The Panzar and Rosse approach is used in several studies in different countries and time periods, a summary of which is listed in Table 2. Some of the studies focus on the whole sector, but Camino-Mogro et al. (2019) and Uddin et al. (2018) distinguished the life and the non-life sector. Kasman and Turgutlu (2008) concentrated on the non-life sector, but they apply the data to three different sub-periods in their article in order to observe changes on the market. The insurance market operated in a perfect competition environment in Nigeria, Ecuador and in the case of not-fined Italian companies. In most cases where monopolistic competition or a monopoly characterizes the market structure, the hypothesis of perfect competition can be rejected. Most of the studies use the static panel data approach to estimate factor price elasticity. In Alhassan and Biekpe (2017) used the dynamic panel analyses for the estimation.

We also use two approaches of panel modelling, namely, static and dynamic. The static approach means that we do not use any autoregressive, lagged variables. The easiest way to estimate a pooled OLS model is a simple OLS for panel data. There could be one serious problem, however, which is the unobserved effect which violates the exogeneity assumption. In that case the goal of the estimation is to eliminate the unobserved effect. We can make a within transformation or fixed effects transformation in that case. It means that we take the average of cross-section observations over time and then subtract it from the original equation. In this way all the time constant effects disappear (unobserved effect and all explanatory variables which are constant over time) (Wooldridge 2012).

The dynamic approach uses an autoregressive model, the lag of the dependent variable as an explanatory variable. In that case several problems occur during estimation. When the lagged value of the dependent variable correlates with the error term, the fixed effect estimation could not solve the problem of endogeneity. Arellano and Bond (1991) use Generalized Method of Moments (GMM) estimation, in which they use first differences to eliminate individual effect. They solve the endogeneity problem by using all the lagged values of dependent variables as instruments. The method is also called one-step GMM in case of panel modelling. The hypothesis of factor price elasticity (H) could be tested in this specification because the lag of dependent variables and the instruments belong to control variables.

3 Data

To test whether the market is competitive or monopolistic we built empirical models. From the Hungarian insurance market, we chose the ten biggest companies and collected the required information about them between 2010 and 2019. In this way we had the opportunity to build a balanced panel dataset with 10 cross-section observations and 10 time periods.

Table 3 shows the number of the insurance companies in Hungary between 2011 and 2019. Insurance companies can operate under various forms of organisation, the most significant of which are formed as corporations. Our most recent analyses contain only corporations. Although there are several smaller firms on the market, their activity is difficult to review. The Hungarian Insurance Association (Mabisz) also tracks companies with different forms of operation. In total, there are more insurers in the Hungarian market than indicated in Table 2, but they are not significant in terms of revenue and size.

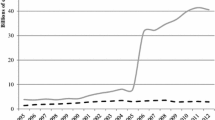

The most important indicators of market concentration are given in Table 4. The Herfindahl–Hirschman Index used to calculate gross premium income was 948 in 2011 and began to decrease until 2015 after which HHI increased to 922 by 2019. These values are below the commonly used limit of 1,500, which indicates that the market is not concentrated. The market share of the top three, five and ten companies also decreased until 2016, after which it increased. The ten highest-income companies accounted for 83% of the market in 2011, but by 2019 they already accounted for 87%. The top five insurance companies cover more than half of the market. The C3 concentration was 40% in 2019. In 2018, Aegon became the third highest-income insurer after Allianz and Generali, ahead of Groupama. The market leader in the country was Allianz throughout the whole period, with a share of around 15% (MABISZ 2019).

There is no general threshold to determine whether the market is too concentrated or not (Kovács 2011). However, in the case of a merger, the aim is to avoid excessive dominance. Therefore, the competition authorities cover the extent to which market concentration may be considered too high as a result of a merger. According to the European Union Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings, if the market share is lower than 25%, than the fusion does not ruin the competition. A merger of companies with a larger market share constitutes too much market dominance (Council Regulation 2004). According to the European Guidelines on Horizontal Mergers, there is no negative effects if the HHI is below 1000, as the market is not concentrated. Between 1000 and 2000 basis points, it is moderately concentrated, if the HHI is above 2000, then the market is highly concentrated (Csorba 2007).

4 Results

We summarise the results of the static and dynamic panel models below (see Table 5). As factor prices we used the unit price of labour (PL), business services (PBS) and capital (PFK), and as control variables the ratio of losses to total assets (LTA), the ratio of life insurance portfolio to total portfolio (Life), the ratio of equity capital to total assets (ETA), claim costs to technical provisions (PD), and outward reinsurance premiums to earned premiums (Reinsurance). According to Biker et al. (2012) only an unscaled revenue equation can give unbiased result, so the dependent variable is not scaled, and the model does not contain the total asset as a control variable. To provide positiveness in case of taking a logarithm we shifted the values of PBS, PFK and ROA with a unique constant value above zero. The parameters did not show a significant difference after this change-over. The results seem robust. This calculation is similar to the approach taken by Alhassan and Biepke (2017). The final equation contains only the significant control variables (LTA and Life) as the following equation shows.

The first model is the fixed effects panel model. The first obvious thing is that none of the variables, parameters are significant in the model (α = 5%). We checked heteroskedasticity. It could be the case that the standard errors are biased, and thus the t-tests are not consistent. So, we used heteroskedasticity and autocorrelation corrected standard errors, however, the results remained the same. It means that, the parameters of logarithm of PL, PBS and PFK are zero separately. In this way the sum of these parameters should be zero too. To test it, below the results of the model we report the two parameter tests. These are simple linear parameter restrictions, so we could implement an F test for the sum of coefficients.

In the case of monopoly, elasticity is nonpositive (H ≤ 0). In this case it means that the revenue function does not depend on the decision of the rivals. The value of the appropriate test is 1.049 with a 30.8% p-value. This means that we cannot reject the null hypothesis; we accept a monopoly market. In a monopolistic competition H ≤ 1. In long-run competitive equilibrium, the elasticity is unique (H = 1). The value of the second appropriate test is 136.349 and the p-value is near 0. This means that we reject the null hypothesis, so there is no perfect competition. The result of the two tests shows that the insurance market is a monopoly or a monopolistic competition. Goddard and Wilson (2009) found that, the estimator of H-statistics in fixed effects model could be biased towards zero, which could be a limitation here. But they also proved that the GMM estimator is more efficient in case of H statistics.

It is rational and realistic to make the model dynamic. In the one-step GMM model we use the lag of the dependent variable as an explanatory variable. This is significant and our choice seems appropriate. The model should meet some requirements. The first is the AR(2) test, which tests the number of lags and model specification. The null hypothesis states that the first lag of Y is enough. The p-value of the test is 83%, so more lags are not needed in the model. The second requirement is the Sargan over-identification test. Due to huge number of instruments over-identification could occur in the model. In our model the p-value of the test is 2.3%. This is not unambiguous; it is on the edge of acceptance and rejection. Thus, it is a limitation when we discuss the result of GMM model.

The parameter tests (H ≤ 1 and H ≤ 0) provide the same result as in the fixed effects panel model. The insurance market in Hungary, in the given time period is monopoly or monopolistic competition.

We would like to see the robustness and variability of the results if we modify the definition of the dependent variable. In the literature, the dependent variable, revenue, is defined several different ways, however, most cases focus on the technical incomes. Alhassan and Biekpe (2017) and Coccorese (2010) used the net earned premiums and investment incomes, Kasman and Turgutlu (2008) used the sum of financial and technical incomes, Murat et al. (2002) used the premium revenues and investment incomes. In the first case we used the total revenue (income from life, non-life and non-technical parts). The following table contains the results of those models, in which the dependent variable is the revenue which contains only the premiums and investment incomes from life and non-life sector without the non-technical incomes.

In the fixed effects model, we used heteroskedasticity and autocorrelation corrected standard errors again. We got more significant variables in this model compared to the previous case. The cause could be the “cleaned”, more rational dependent variable. According to the parameter tests, we can reject the monopoly and perfect competition hypothesis too, so the sum of the parameters is between 0 and 1. It means that the market is a monopolistic competition.

The specification of GMM model required the second lag of the dependent variable based on the result of AR(2) test (p-value ~ 0.000). In the GMM model there are also more significant variables compared to the former GMM case. If we see the parameter tests, we find that the H ≤ 0 hypothesis could be rejected. However, we should accept the H = 1 hypothesis on 5% significance level. According to that the market is perfect competition, but it is worth mentioning that the p-value is on the edge of acceptance and rejection here. It is also important to note that in the GMM model there is an overidentification problem according to the Sargan test.

According to the two models in Table 6 the conclusion is that the Hungarian insurance market is not monopoly or collusive oligopoly, both cases seem to support the monopolistic competition.

Panzar and Rosse assume that their estimations are acceptable under the assumption of long-run equilibrium. We can test it because in long-run equilibrium input prices are not expected to be correlated with the rate of returns in the model (Alhassan and Biepke 2017). So, we built the same models in which the logarithm of ROA is the dependent variable as the following equation shows.

From Table 7 it is clear that there are only insignificant variables. We test the sum of input parameters. If the sum is equal to zero, then long-run equilibrium exists in the Hungarian insurance market. In both models the value of the F-test for restrictions is low, which implies a high p-value. For this reason, we cannot reject the null hypothesis, so the assumption of long-run equilibrium is valid. The estimations in the previous models are acceptable. All the model diagnostics and tests are reliable. The heteroskedasticity does not affect the results of fixed effect model. There is no autocorrelation and overidentification problem in GMM model. Molyneux et al (1994) observed banking in European countries, they got similar results, there were no significant variables in the models for ROA in some countries. They drew similar conclusion, the assumption of long-run equilibrium is valid.

5 Discussion and conclusion

We examined the market structure of the Hungarian insurance sector with the help of empirical analysis. Based on the Panzar and Rosse model, we tested the input price elasticity. We accepted the long-run equilibrium assumption which enabled us to perform further estimations. Using a static and dynamic panel model with two different dependent variables we got the results that the Hungarian insurance sector is a monopolistic competition market. We reject the null hypothesis about the unit factor price elasticity in most models, the sum of the parameters of a unit price of labour, unit price of business services and unit price of financial capital is not equal to one, thus the market is not under perfect competition.

Using this model, a monopoly market means that the decision of a company does not depend on the decisions of the other participants. In some cases the hypothesis of the monopoly market can be accepted, that fact suggests large market power in the sector. Similar results in the insurance market can be seen in other countries. Methodologically it is important that the estimation of factor price elasticity was made with a static and a dynamic panel model also. Most cases seem to support monopolistic competition.

The scope of this study was limited in terms of the time period and the number of companies examined. More extensive research would be needed to work with a larger sample. The investigation of the evolution of insurance competition in time could be the topic of a future research. Greater effort is needed to divide the sector and estimate factor price elasticity for life and non-life insurance separately. A further interesting research question could examine the insurance sector at a regional or even European level. It is important to understand the market structure of Systematically Important Financial Institutions (SIFIs), so a similar study would be worthwhile undertaking for the banking sector, which would allow for a comparison of the two sectors.

References

Alhassan AL, Biekpe N (2016) Competition, and efficiency in the non-life insurance market in South Africa. J Econ Stud 43(6):882–909. https://doi.org/10.1108/JES-07-2015-0128

Alhassan AL, Biekpe N (2017) Liberalization outcomes and competitive behaviour in an emerging insurance market. Afr Dev Rev 29(2):122–138

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Banyár J, Turi P (2019) A biztosítási fogyasztóvédelmi szemlélet evolúciója Magyarországon the evolution of the insurance consumer protection approach in Hungary. Pénzügyi Szemle 2:191–209. http://real.mtak.hu/112295/1/banyar-turi-2019-2-mpdf_20190704140428_62.pdf

Bikker JA, Haaf K (2002) Competition, concentration and their relationship: an empirical analysis of the banking industry. J Bank Finance 26:2191–2214

Bikker JA, Van Leuvensteijn M (2008) Competition and efficiency in the Dutch life insurance industry. Appl Econ 40(16):2063–2084. https://doi.org/10.1080/00036840600949298

Bikker JA, Shaffer S, Spierdijk L (2012) Assessing competition with the Panzar–Rosse model: the role of scale, costs, and equilibrium. Rev Econ Stat 94(4):1025–1044

Camino-Mogro S, Armijos-Bravo G, Cornejo-Marcos G (2019) Competition in the insurance industry in ecuador: an econometric analysis in life and non-life markets. Quart Rev Econ Finance 71:291–302. https://doi.org/10.1016/j.qref.2018.10.001

Coccorese P (1998) Assessing the competitive conditions in the Italian banking system: some empirical evidence. BNL Quart Rev 205:171–191

Coccorese P (2010) Information exchange as a means of collusion: the case of the Italian car insurance market. J Ind Compet Trade 10:55–70

Council Regulation (2004) Council Regulation (EC) No 139/2004 of 20 January 2004 on the control of concentrations between undertakings (the EC Merger Regulation) (Text with EEA relevance), Official Journal L 024 , 29/01/2004 P. 0001–0022, https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:32004R0139&from=hu, download: 2022.06.25.

Csorba G (2007) A fúziókontroll módszertanáról. Dominancia- vagy versenyhatásteszt? In: Verseny és szabályozás 2007, (On the methodology of merger control. Dominance or competition test? In: Competition and Regulation 2007), http://www.econ.core.hu/kiadvany/vesz.html

Goddard J, Wilson JO (2009) Competition in banking: a disequilibrium approach. J Bank Finance 33(12):2282–2292

Iwata G (1974) Measurement of conjectural variations in oligopoly. Econometrica 42(5):947–966

Jeng VSC (2015) Competition and its variation over time: an empirical analysis of the Chinese insurance industry. Geneva Pap Risk Insur Issues Pract 40(4):632–652. https://doi.org/10.1057/gpp.2015.4

Kasman A, Turgutlu E (2008) Competitive conditions in the Turkish non-life insurance industry. Rev Middle East Econ Finance 4(1):1–16

Knezevic S, Markovic M, Brown A (2015) Measuring the efficiency of Serbian insurance companies. Acta Oecon 65(1):91–105. https://doi.org/10.1556/AOecon.65.2015.1.5

Kovács N (2011) A piaci erő közvetett mérése a biztosítási piacon (Indirect measurement of market power in the insurance market), Széchenyi István Egyetem Regionális és Gazdaságtudományi Doktori Iskola doktori értekezés.

Kozmenko O, Merenkova O, Boyko A (2009) The analysis of insurance market structure and dynamics in Ukraine, Russia and European Insurance and Reinsurance Federation the analysis of insurance market structure and dynamics in Ukraine, Russia and European Insurance and Reinsurance Federation (CEA) member states. Probl Perspect Manag 7(1):2009

Kramaric TP, Kitic M (2012) Comparative analysis of concentration in insurance markets in new EU member states, world academy of science. Eng Technol Int J Social Behav Educ Econ Bus Ind Eng 6(6):1322–1326

MABISZ (2019) Magyar Biztsoítók Évkönyve. Budapest: Magyar Biztosítók Szövetsége. Yearbook of Hungarian Insurance Companies: Hungarian Insurance Association

Madari Z, Szádoczkiné VV (2021) Empirical analysis of the Hungarian insurance market. In: Drobne S, Stirn LZ, Kljajić BM, Povh J, Žerovnik J Proceedings of the 16th International Symposium on Operational Research in Slovenia. Slovenian Society Informatika, Ljubljana, pp 125–129

Maudos J, de Guevara JF (2007) The cost of market power in banking: social welfare loss vs. cost inefficiency. J Bank Finance 31:2103–2125

Molyneux P, Lloyd-Williams DM, Thornton J (1994) Competitive conditions in European banking. J Bank Finance 18(3):445–459

Murat G, Tonkin RS, Jüttner DJ (2002) Competition in the general insurance industry. German J Risk Insur 91(3):453–481

Nathan A, Neave EH (1989) Competition and contestability in Canada’s financial system: empirical results. Can J Econ Revue Canadienne D’economique 22(3):576–594

Panzar JC, Rosse JN (1987) Testing for 'monopoly’ equilibrium. J Ind Econ 35(4):443–456

Shaffer S (1983) Non-structural measures of competition toward a synthesis of alternatives. Econ Lett 12:349–353

Simpasa AM (2013) Competition and market structure in the Zambian banking sector. African Development Bank Group, Working Paper 168

Solvency II (2009): DIRECTIVE 2009/138/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Szüle B (2017) Solvency effects of taxation: a comparison of Hungarian banks and insurance companies. Acta Oecon 67(1):63–75. https://doi.org/10.1556/032.2017.67.1.4

Tipuric D, Bach MP, Pavic T (2008) Concentration of the insurance industry in selected transition countries of Central and Eastern Europe, 1998–2006. Post Communist Econ 20(1):97–118

Todorov AB (2016) Assessing competition in the Bulgarian insurance industry: a Panzar–Rosse approach. Int J Econ Financ Issues 6(3):872–879

Uddin G, Oserei K, Oladipo O, Ajayi D (2018) Industry competitiveness using firm-level data: a case study of the Nigerian insurance sector. Adv Panel Data Anal Appl Econ Res. https://doi.org/10.1007/978-3-319-70055-7_37

Wooldridge JM (2012) Introductory Econometrics a modern approach 5th Edition

Acknowledgement

The authors would like to express their very great appreciation to Kolos Csaba Ágoston, Magdolna Gyenge, Zsombor Szádoczki and Ferenc Varga and the anonymous referees.

Funding

Open access funding provided by Corvinus University of Budapest.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Varga, V., Madari, Z. The Hungarian insurance market structure: an empirical analysis. Cent Eur J Oper Res 31, 927–940 (2023). https://doi.org/10.1007/s10100-023-00842-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-023-00842-8