Abstract

To efficiently assess the performance of investing in stocks rather than in a bank account for the long run, stochastic interest rate modelling is advocated. We introduce a correlated stochastic interest rate model that addresses this problem. We derive analytic formulas for general spectral risk measures in our setting, and apply our results to Value at Risk, Expected Shortfall and GlueVaR. We characterize the short- and long-term behaviour of these risk measures. We fit our model to financial markets, perform an empirical study and evaluate risk numbers for realistic scenarios in the future. Our results reveal sizeable sensitivities on parameter estimation, but we may conclude that holding stocks for less than a few decades bears significant risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We have recently seen a large number of papers concerning the question as to whether or not the risk of holding stocks decreases over the time horizon. For a detailed literature review on this topic we refer the reader to (Bihary et al. 2020). In essence, there have been contradicting studies published, some arguing that stocks are riskier in the long run, (Pástor and Stambaugh 2012; Avramov et al. 2017; Harlow 1991; Bodie 1995) whereas others claiming that due to time diversification the risk of holding stock does decrease on a long time horizon (Siegel 1998). Other papers (Wilkie 2001; Ferguson and Dean 1996) also claim that the conclusion of (Bodie 1995) such that stock’s risk increases monotonically with the investment horizon is incorrect. In a related work, Barberis (2000) examined buy-and-hold investors and assessed that even after incorporating uncertainty of model parameters, investors should hold a greater proportion of risky shares in their assets as time horizon increases.

Applying the methodology of (Treussard 2006) and (Nguyen et al. 2012; Bihary et al. 2020) considered a framework where spectral risk measures (Acerbi 2002) were used to investigate the riskiness of stocks relative to a money market account. They used Geometric Brownian motion and a particular exponential Lévy subclass called the Finite Moment Log Stable (FMLS) model (Carr and Wu 2003) to model the stock price movement, and the risk free interest rate was assumed to be constant for any time period. Given the very long investment horizons investigated, they pointed out that incorporating stochastic interest rates would be important to further analyze the research question.

Based on their study, we propose a modified framework where the stock price follows a Geometric Brownian Motion, while as a novelty, the risk free interest rate is also modelled as a stochastic process. As we are aiming to compare the long-term behaviour of a risk-free bank account to stock prices, we also model the correlation between the stochastic interest rate dynamics and the stock price process. The mean reverting phenomenon of short term rates has been claimed in many studies (Brace et al. 1997; Elliott and Mamon 2002; Jamshidian 1989). Short term rates appear to be pulled back to a long-term average as time goes by. In this study we use the well-known Vasicek process (Vasicek 1977) to model the short rates. The choice of the geometric Brownian motion for asset prices and Vasicek model for interest rates are popular as evidenced in recent articles (see (Baz et al. 2021; Rudin and Marr 2016; Kopa et al. 2018)).

In this framework we provide analytically tractable formulas for arbitrary spectral risk measures of a corresponding proportional loss variable. Quantile-based risk measures in the last two decades have gradually replaced the traditional variance for portfolio selection problems (see (Brandtner 2013)). Important quantile-based risk measures that have been extensively used in the literature are Value at Risk (VaR) (Jorion 2007), Expected Shortfall (ES) (Acerbi and Tasche 2002) and GlueVaR (Belles-Sampera et al. 2014). In a recent study, Nadarajah et al. (2014) provided a comprehensive review of estimation methods for ES. In Hu et al. (2021) we can see a fresh approach on the topic of optimal dynamic portfolio of cryptoassets to minimize VaR and ES. An objective of this paper is to assess how the findings of the aforementioned papers concerning long run risk translate when variance as a risk measure is changed to spectral risk measures.

We prove simple conditions that determine the short-term and long-term riskiness of the portfolio. We also perform an empirical analysis to calibrate model parameters. We use short rate and stock index price data from four major markets (USA, UK, France, Germany). As an example, we consider expected shortfall at \(90\%\) confidence. We find that our analytic formula, when properly calibrated, fits the empirical shortfall for intermediate investment horizons. We show that incorporating the stochastic interest rate component into the model yields significantly different risk values compared to assuming constant rate. Next we provide a detailed sensitivity test with respect to all parameters, and offer a range of optimistic and pessimistic estimations for the riskiness of holding stocks in the future. Although theoretically the long-term risk of holding a stock decreases for all investigated markets, this effect only sets in after decades. This implies that holding stocks for realistic investment horizons carries significant risk compared to investing in a bank account in most market situations.

The rest of the paper is organized as follows. Section 2 presents the analytical results expressing the spectral risk measure of the corresponding portfolio and proving results concerning short-term and long-term behaviour of risk. Section 3 contains a detailed empirical work, studying the robustness of the model parameter estimations using real data points from the four countries. Based on this we also provide a prediction to see how the risk of holding stocks relative to investing in a money market account would change under different scenarios for a few decades. Section 4 concludes.

2 Analytical results

We are to mathematically formulate how the spectral risk measure associated with holding stocks rather than a risk-free bank account deposit, depends on the holding period. As stated, both the stock and the risk-free deposit are modelled by stochastic processes. More precisely, we analyze the spectral risk measure of the proportional loss variable:

Equation 1 expresses how the yield on a money market bank account over a stock proportionally performs against the bank account itself. With the help of this particular Y(t) loss variable we will be able to obtain analytical expressions for different risk measures. For modelling the short term interest rate we choose a one dimensional Vasicek-model, that satisfies the following stochastic differential equation (SDE):

where \(\kappa \) denotes the speed of reversion, \(\theta \) is the long-term mean level, \(\sigma _{r}\) is the instantaneous interest rate volatility and r is the initial value of the process.

In this set-up, the money market account value at time t is given by the following formula:

For modelling the stock price movement, we use Geometric Brownian Motion (GBM) that satisfies the following SDE:

where \(\mu \) denotes the drift of the process and \(\sigma _{S}\) is the instantaneous stock price volatility.

With the aforementioned choices we have a separate SDE for the rate and for the stock model. They are both governed by a standalone Wiener process, and we also assume that these two Wiener processes are correlated with a constant level of correlation.

It is well known that the solution to the Vasicek model described in Eq. 2 reads as:

The money market account value at a future time t is given by the following formula:

Similarly, the solution of the GBM described in Eq. 4 is given as follows:

We now proceed to express the Y loss variable at time t. S(0) and B(0) both represent the initial investment amount that we henceforth without loss of generality assume to be 1.

In order to further express Y(t), we first consider the \(\ln (\frac{S(t)}{B(t)})\) process. Once we derived properties of \(\ln (\frac{S(t)}{B(t)})\), we can investigate the related Y(t) quantity.

We observe that in Eq. 10 there are two deterministic terms and two stochastic terms. Performing the integral the difference of two deterministic terms read as:

The sum of the two stochastic terms read as:

where we exchanged the two variables in the first term. With the help of Cholesky decomposition, \(dW_{S}\) can be expressed as: \(dW_{S}(t)=\rho dW_{r}(t)+\sqrt{1-\rho ^2}dW(t)\), where W(t) is a Wiener process that is independent of \(W_{r}(t)\). Applying this decomposition to Eq. 12 we obtain:

In Eq. 13 we have two Itô integrals both with deterministic integrands. We know that such integrals are normally distributed with 0 mean and variances that can be expressed as follows:

respectively.

As W(t) and \(W_{r}(t)\) are independent Wiener processes, the two integrals as random variables are also independent, therefore we get that the sum of the two stochastic terms in Eq. 12 is a normally distributed random variable as follows:

Finally we get that \(\ln (\frac{S(t)}{B(t)})\) is also of normal distribution as follows:

where the expected value is

and the variance after performing the integral in Eq. 16 reads as:

Using Itô isometry we also get for the variance of \(\ln (S(t))\) and \(\ln (B(t))\) the following:

Based on this and using Itô isometry once again we obtain:

Having established these results, we focus on expressing the spectral risk measure of Y(t).

Definition 1

Given a random loss variable X, the spectral risk measure of X, \(\rho _{\phi }(X)\) is defined as

where \(\phi \in L^{1}([0,1])\), and the following properties are true:

-

\(\phi \) is positive;

-

\(\phi \) is monotonically increasing;

-

\(\int _{0}^{1}|\phi (p)|dp=1\).

We indeed work with spectral risk measures throughout this paper, but we will use an equivalent definition derived as a special case of Choquet integrals (Choquet 1954). This formulation also appears in decision theory to model uncertainty (see for instance (Grabisch and Labreuche 2010) and (Labreuche and Grabisch 2018)). Choquet integral risk measures (see for instance (Sriboonchita et al. 2009)) are defined as follows.

Definition 2

Given a random loss variable X, the Choquet integral risk measure of X, \(\rho _{h}(X)\) is given by

where h, the so-called distortion function (Wang 1996) is non-decreasing and satisfies \(h(0)=0\) and \(h(1)=1\).

Nguyen et al. (2012) notes that for concave distortion functions h there exists a connection between Choquet integral risk measures and spectral risk measures such that if \(h'(1-p)=\phi (p)\), then \(\rho _{h}(X)=\rho _{\phi }(X)\). In this work, we will refer to spectral risk measures and Choquet integral risk measures interchangeably.

Therefore, our first goal is to express \(\rho _{h}(Y(t))\).

Theorem 1

The spectral risk measure of Y(t) with distortion function h is given by the formula:

Proof

Arguing along the lines that S(t)/B(t) is a lognormally distributed random variable and denoting by Z the standard normally distributed random variable we obtain:

We apply the substitution \(\frac{\ln (1-x)-EX_{t}}{\sqrt{VA_{t}}}=z\) \(\Leftrightarrow \) \(dx=-\sqrt{VA_{t}}e^{z \sqrt{VA_{t}}+EX_{t}} dz\) to obtain

where \(C=-EX_{t}/\sqrt{VA_{t}}\).

Note that using this definition \(Y(t)\le 1\) holds under any circumstances. Also x and z are inversely proportional thus the observed change in the integrals holds.

We can integrate by part to obtain:

Substituting the values on the boundary points using \(h(0)=0\), \(h(1)=1\) we can assert that

\(\square \)

We now consider important specific cases such as the VaR, ES and GlueVaR. Note that since the underlying distribution Y(t) is continuous for all t, therefore ES is equivalent to Tail Conditional Expectation (TCE) or Tail Value at Risk (TVaR).

For the case of Expected Shortfall at confidence level \(\alpha \) \((ES_{\alpha }(\cdot ))\), the distortion function of the loss variable (Y) is

We can express the \((ES_{\alpha }(\cdot ))\) of the loss variable (Y(t)) by substituting into Eq. 26:

As for the Value at Risk at confidence level \(\alpha \) (\(VaR_{\alpha }\)), applying the definition (\(\textit{P}(Y(t)\le \hbox {VaR}_{\alpha }(\cdot ))=\alpha \)) we argue as follows:

By definition we obtain:

Finally we get

With the help of VaR we can express ES using the defining relation between the two risk measures:

Based on this we again obtain the formula for ES:

We can see that Eqs. 27 and 32 yield the same formula.

We also illustrate the GlueVaR risk measure that has been introduced in (Belles-Sampera et al. 2014). This risk measure considers more than just one confidence interval to capture managerial and regulatory attitudes towards risk. GlueVaR is a risk measure that can be expressed as a linear combination of three risk measures: ES at confidence levels \(\beta \) and \(\alpha \) and VaR at confidence level \(\alpha \).

Given confidence levels \(\alpha \) and \(\beta \), the distortion function for GlueVaR read as:

Given a random variable X and fixed tolerance levels \(\alpha \) and \(\beta \) so that \(\alpha <\beta \), \(GlueVaR_{\beta ,\alpha }^{h_1,h_2}(X)\) can be expressed as a linear combination of \(ES_\beta (X)\), \(ES_{\alpha }(X)\) and \(VaR_{\alpha } (X)\).

That said, \(GlueVaR_{\beta ,\alpha }^{h_1,h_2}(X)\) reads as:

where

As for our loss variable for a certain time Y(t), \(GlueVaR_{\beta ,\alpha }^{h_1,h_2}(Y(t))\) can be expressed as follows:

2.1 Asymptotic behaviour of risk measures

We now investigate how the aforementioned risk measures behave when the concerned time period is infinitesimally small or infinitely large.

Theorem 2

For \(\alpha >50\%\) and \(\beta >50\%\) the following holds:

Proof

Recall Eq. 30 and examine the monotonicity of VaR at \(t \rightarrow 0^+\) by taking its first partial derivative with respect to t (we denote this partial derivative by \('\) throughout this proof):

The first partial derivatives of \(EX_{t}\) and \(\sqrt{VA_{t}}\) with respect to t are obtained as follows:

where \(VA_{t}'=\frac{\sigma _{r}^2}{\kappa ^2}-\frac{2 \sigma _{r} \sigma _{S} \rho }{\kappa }+\sigma _{S}^2-\frac{2\sigma _{r}^2}{\kappa ^2}e^{-\kappa t}+\frac{\sigma _{r}^2}{\kappa ^2}e^{-2\kappa t}+\frac{2 \sigma _{r} \sigma _{S} \rho }{\kappa }e^{-\kappa t}\) and we simply get that \(VA_{0}'=\sigma _{S}^{2}>0\)

\(VA_{0}=0\) and \(VA_{t}>0\) hold for all \(t>0\) as this is the variance of a random variable, thus \(\sqrt{VA_{0}}=0\).

Based on this, we obtain the following:

We also obtain that \(EX_{0}'=\mu -\sigma _{S}^2/2-r\) and utilizing the fact that \(\Phi ^{-1}(1-\alpha )>0\) if \(\alpha <50\%\) and \(\Phi ^{-1}(1-\alpha )<0\) if \(\alpha >50\%\), and having a look at Eq. 36 conveys the following:

As \(ES_{\alpha }(X) \ge VaR_{\alpha } (X)\) for all X and \(ES_{\alpha }(Y(0))=0\) we get that

As a positive linear combination of \(ES_\beta (Y(t))\), \(ES_{\alpha }(Y(t))\) and \(VaR_{\alpha } (Y(t))\), we also obtain that the statement of the theorem holds for \(\hbox {GlueVaR}_{\beta ,\alpha }^{h_1,h_2}(Y(t))\) as well.

\(\square \)

We can conclude that for reasonable confidence intervals (\(\alpha >50\%\)), (\(\beta >50\%\)) all three risk measures start to increase initially.

We now discuss the long-term behaviour by analysing what happens when \(t \rightarrow \infty \).

Theorem 3

For any \(0<\alpha <1\) confidence interval the following holds:

Proof

We are to examine how \(VaR_{\alpha }(Y(t))\) behaves when \(t \rightarrow \infty \).

Taking a look at Eq. 19 we get the that \(0 \le \sqrt{VA_{t}} \le \sqrt{t}\cdot (\frac{\sigma _{r}}{\kappa }+\sigma _{S})+C\) for a fixed \(C>0\) for all \(t \ge 0\).

We also obtain from Eq. 37:

Therefore when inspecting \(\lim _{t \rightarrow \infty }1-e^{\Phi ^{-1}(1-\alpha )\sqrt{VA_{t}}+EX_{t}}\), we can see from Eq. 31 that \(EX_{t}\) contains terms of linear growth of t, whereas \(\sqrt{VA_{t}}\) contains terms of sublinear growth of t, thus we can disregard the \(\Phi ^{-1}(1-\alpha )\sqrt{VA_{t}}\) term to obtain the statement of the theorem for VaR.

As for investigating \(\lim _{t \rightarrow \infty } ES_{\alpha }(t)\) we first note that \(\lim _{t \rightarrow \infty } \sqrt{VA_{t}} = \infty \) as in Eq. 19 the only terms that are either not constant or do not have a 0 limit in \(t \rightarrow \infty \) are \(t(\frac{\sigma _{r}^2}{\kappa ^2}-\frac{2 \sigma _{r} \sigma _{S} \rho }{\kappa }+\sigma _{S}^2) \ge t(\frac{\sigma _{r}}{\kappa }-\sigma _{S})^2>0.\) Thus \(\lim _{t \rightarrow \infty } \sqrt{VA_{t}} \ge \sqrt{t}|\frac{\sigma _{r}}{\kappa }-\sigma _{S}|+C_{V}=\infty \), where \(C_V\) is constant.

Besides, \(EX_{t}+\frac{VA_t}{2}\) in the limit of \(t \rightarrow \infty \) is either \(-\infty \) or \(\infty \) or constant \(C_{L}\).

We carry on by inspection of cases.

Case 1

\(\lim _{t \rightarrow \infty }EX_{t}+\frac{VA_t}{2}=-\infty \) or \(C_{L}\)

We obtain that

Case 2

\(\lim _{t \rightarrow \infty }EX_{t}+\frac{VA_t}{2}=\infty \)

We obtain that

where by the last step we applied L’Hôpital’s rule. This can be further expressed as

We know that \(\lim _{t \rightarrow \infty } VA_{t}'=C_{1}>0, \lim _{t \rightarrow \infty } EX_{t}'+\frac{VA_t'}{2}=C_{2}>0\) due to the assumptions of this case and the fact that both terms are bounded function of t. Hence \(\lim _{t \rightarrow \infty }\frac{VA_{t}'}{EX_{t}'+\frac{VA_t'}{2}}=C_{3}>0\). Therefore we can further write Eq. 44 as

And we can argue that the numerator of the last term within the lim sign is of exponential growth of t, whereas the denominator is of sublinear growth of t, to claim that the limit depends solely on \(EX_{t}\). If \(\lim _{t \rightarrow \infty }EX_{t}=-\infty \) then \(\lim _{t \rightarrow \infty } ES_{\alpha }(t)=1\). If \(\lim _{t \rightarrow \infty }EX_{t}=\infty \) then \(\lim _{t \rightarrow \infty }ES_{\alpha }(t)=-\infty \).

As \(\lim _{t \rightarrow \infty }EX_{t}=\infty \) implies that we are within Case 2., and for this subcase we have shown that \(\lim _{t \rightarrow \infty }ES_{\alpha }(t)=-\infty \), besides for cases other than this particular subcase \(\lim _{t \rightarrow \infty }ES_{\alpha }(t)=1\) we argue that we have completed the proof for ES as well. \(\square \)

Corollary 3.1

As a positive linear combination of VaR and ES we also obtain the corresponding result for GlueVaR:

3 Empirical results

In Sect. 2 we have established theoretical results for the risk of Y(t) concerning infinitesimally small or infinitely long holding periods. Now, by examining real life market data, we investigate risk behaviour when a practically reasonable (few years, few decades) investment horizon is of interest. Thus, the main goal of this section is to complement the findings of Sect. 2 by assessing the relative performance of the chosen asset when the holding period is a fixed time. In order to complete this task we both fit the parameters of the short interest rate Vasicek model and the stock index price GBM process to publicly available data from four countries: USA, Germany, France, and UK. We applied straightforward conversion from historical 3 month government bond yields to get an approximation for the short term rates. For the stock indices, we considered S &P 500, DAX Index, CAC 40 Index, FTSE 100; and we either used (Investing 2022) or (Bloomberg 2022) to get data points. For all four countries we used total return indices that represent not only profits obtained by price movements, but also include dividend earnings. All time series were collected for the 33-year period between January 1988 and November 2020 with monthly frequency.

We estimated the parameters for each country as follows. \(\mu \) and \(\sigma _{S}\) were obtained as the sample mean and sample standard deviation of monthly logarithmic returns of the particular index, scaled to a yearly basis. \(\theta \) was obtained as the sample mean of the empirical short-term rates.

Contrary to the parameters of the GBM process and the \(\theta \) long-term mean level, it is not straightforward to fit the speed of inversion \(\kappa \) and instantaneous volatility \(\sigma _{r}\) parameters. The speed of mean reversion of short term rates have been studied in (van den End 2011) for some countries, and their findings reveal that depending on the particular country the estimation for the mean reversion \(\kappa \) parameter can be quite different (0.015–0.091), moreover the estimation for all countries has a wide confidence interval. Based on these results, we chose \(\kappa =0.1\) for all four countries, and we will pay special attention to how sensitive the calculated risk values are to this somewhat arbitrary \(\kappa \) value. Once \(\kappa \) has been fixed, we fit \(\sigma _r\) by assuming that the empirical short rate series represent the stationary distribution of the Vasicek process. The stationary variance of the Vasicek process is given as \(\frac{\sigma _{r}^2}{2\kappa }\), which we estimate as the sample variance of the short rate series. The \(\sigma _{r}\) parameter can then be calculated. We chose the above described strategy because the long-term profitability of the bank account depends more on the long-term uncertainty of the rate, rather than on its instantaneous volatility.

Regarding the estimation of the \(\rho \) correlation level, we recall Eq. 21, where \(\rho \) and the correlation between \(\ln (S(t))\) and \(\ln (B(t))\) are related to each other. Using empirical monthly logarithmic returns, we obtain an estimation for \(Corr[\ln (S(t),\ln (B(t)]\) at \(t=\frac{1}{12}\). Once this estimate is obtained we calculate \(\rho \) using Eq. 21.

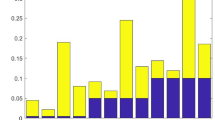

Table 1 contains all estimated parameters using the January 1988-November 2020 time frame for each of the four countries. We can see that the \(\mu -\frac{\sigma _{S}^{2}}{2}-\theta >0\) condition holds for each country, implying that all three risk measures (VaR, ES, GlueVaR) diverge to \(-\infty \) as \(t \rightarrow \infty \) for sensible (\(\alpha , \beta >50\%\)) confidence levels. We now proceed by assessing how the parameter estimations vary when considering 10 year long time ranges for estimation. In Fig. 1 we see that \(\mu -\theta \) and \(\rho \) estimations can be quite different depending on the actual 10 year long window, whereas \(\sigma _S\) is somewhat less volatile. For the rest of the analysis we stick to examining \(ES_{90\%}\). Even though in risk management practice \(\alpha =90\%\) may sound too low, it properly represents the risk tolerance of an equity fund.

In order to ascertain the calibration quality of our modelling framework, we compare empirically calculated \(ES_{90\%}\) values to the ones obtained from Eq. 27 after plugging in the estimated model parameters for the four countries from Table 1. Note that we are unable to provide an unbiased estimation for empirical Expected Shortfall due to the limited number of observations. We resort to using an estimation which involves all neighbouring monthly Y(t) observations for a fixed t value. Such sample is a time series itself and it has auto-correlation due to overlapping time periods. In order to accurately estimate empirical Expected Shortfall, we would need independent sample items. For a smaller t value we can still provide a fairly accurate empirical Expected Shortfall estimation as in these samples there are only a moderate number of items that are not independent. Due to this limitation, we can reasonably compare empirical Expected Shortfall estimations with analytical Expected Shortfall estimations up to 5 years. In Fig. 2 we can see this comparison for the four countries and we can see that the two curves are reasonably close to each other. This is reassuring of the goodness of the model of this paper and so we can extend the time frame and calculate analytical Expected Shortfall values for longer time periods, where empirical estimation is no longer viable. One possible explanation as to why the line corresponding to empirical Expected Shortfall is above the analytical one is supported by one of the stylised facts, namely the heavy tailed distribution of stock price returns. The shorter the time frame the more the returns deviate from normal distributions, and this is reflected by the lines where up to a few years for all four countries empirically calculated risks are higher than the one given by the formula assuming normally distributed returns.

This figure compares for each country the empirically estimated \(ES_{90\%}\) values to the analytical \(ES_{90\%}\) values up to 5 years. As for the analytical \(ES_{90\%}\) values, we calculated them using the parameters presented in Table 1

We check how much impact of using a stochastic Vasicek short-rate model has on the analytical \(ES_{90\%}\) values compared to the deterministic short-rate case. Figure 3 reveals that as the two curves are visibly different for all four countries, there is a significant impact of applying the stochastic short-rate model. We can also see that the analytical \(ES_{90\%}\) values with stochastic short-rates are always bigger than with constant short-rates, which translate to a more conservative estimation for the risk values.

This figure concerns the extent of the impact of using stochastic rates rather than constant rates by comparing \(ES_{90\%}\) values. As for the constant rate case, we assumed \(r(t)=r=\theta \) for all \(t \ge 0\), and \(\mu \), \(\sigma _{S}\) be equal the parameters in Table 1 for a given country, whereas for the stochastic rate case for a given country, we chose all parameters from Table 1, also assuming \(r(0)=\theta \)

Next we check the sensitivity of the analytical \(ES_{90\%}\) curves to different model parameters. In Fig. 4 we can see the sensitivity with respect to the \((\kappa , \sigma _r)\) pair by choosing three different \(\kappa \) parameters (0.05, 0.1, 0.2) and calculating the corresponding \(\sigma _r\) estimation based on the method we have previously described. As already discussed it is challenging to estimate \(\kappa \) and also the corresponding \(\sigma _r\) parameters, therefore we want to demonstrate that applying our method where we rely on the variance of the observed short-term rates we can provide accurate analytical \(ES_{90\%}\) numbers. That said, Fig. 4 indeed reveals that the curves corresponding to the different \((\kappa , \sigma _r)\) pairs are very close to each other. The only clearly visible difference appears for the USA, but the differences between the curves are still lower than what we have seen in Fig. 3. This is reassuring that using \(\kappa =0.1\) for all four countries leads to accurate results.

This figure shows how sensitive the \(ES_{90\%}\) values are with respect to the \(\kappa , \sigma _{r}\) parameter pair whilst fixing all other parameters from Table 1, also assuming \(r(0)=\theta \)

In order to complete the sensitivity analysis with respect to other parameters, we will compare the analytical \(ES_{90\%}\) with parameters coming from Table 1 to analytical \(ES_{90\%}\) with parameters using first quartile (Q1) and third quartile (Q3) estimations for the particular parameter whilst leaving all other parameters fixed coming from Table 1. As for quantifying Q1 and Q3 estimations for a certain parameter we recall the 10 year long time range estimation that we have already shown in Fig. 1. We have a number of estimations for the parameters by rolling the 10 year long window over the whole time frame to calculate Q1 and Q3.

The most important factor in the relative riskiness of the stock and the bank account is the difference between their growth rates. Indeed, \(\mu -\theta \) in our model can be identified as the stock risk premium. Therefore, we here consider the sensitivity analysis on \(\mu -\theta \). In Fig. 5 we can see that the actual size of this difference clearly has a big impact on the analytical \(ES_{90\%}\) value. With the Q1 \(\mu -\theta \) value the curves are highest, while they are lowest with the Q3 \(\mu -\theta \) value. This reflects our expectations, that the stock is less risky if its premium over the risk-free rate is greater and vice versa.

This figure shows how sensitive the \(ES_{90\%}\) values are with respect to the \(\mu -\theta \) difference whilst fixing all other parameters. As for the _Q1 and _Q3 \(ES_{90\%}\) calculation, \(\mu \) and \(\theta \) are given by taking the first and third quartile of the \(\mu -\theta \) estimates using the 10 year long rolling window technique, whilst fixing all other parameters from Table 1. As for the _Avg \(ES_{90\%}\) calculation, all parameters are given from Table 1. We also assumed \(r(0)=\theta \) for each case

This figure shows how sensitive the \(ES_{90\%}\) values are with respect to the \(\sigma _{S}\) parameter whilst fixing all other parameters. As for the _Q1 and _Q3 \(ES_{90\%}\) calculation, \(\sigma _{S}\) is given by taking the first and third quartile of the \(\sigma _{S}\) estimates using the 10 year long rolling window technique, respectively, whilst fixing all other parameters from Table 1. As for the _Avg \(ES_{90\%}\) calculation, all parameters are given from Table 1. We also assumed \(r(0)=\theta \) for each case

In Fig. 6 we can see how sensitive the analytical \(ES_{90\%}\) values are with respect to \(\sigma _S\). Although the riskiness of the stock strongly depends on its volatility, the estimated volatility range is rather narrow (see Fig. 1). For this reason, the risk curves for the \(\_Q1\), \(\_Avg\) and \(\_Q3\) are not very different. As expected, the greater the volatility the higher the risk values are. The biggest difference can be seen for Germany, where the volatility range is the widest.

In Fig. 7 we can see how sensitive the analytical \(ES_{90\%}\) values are with respect to \(\rho \). Figure 7 shows that the sensitivity with respect to \(\rho \) is small. The greater the correlation the risk values are somewhat higher.

This figure shows how sensitive the \(ES_{90\%}\) values are with respect to the \(\rho \) parameter whilst fixing all other parameters. As for the _Q1 and _Q3 \(ES_{90\%}\) calculation, \(\rho \) is given by taking the first and third quartile of the \(\rho \) estimates using the 10 year long rolling window technique, respectively, whilst fixing all other parameters from Table 1. As for the _Avg \(ES_{90\%}\) calculation, all parameters are given from Table 1. We also assumed \(r(0)=\theta \) for each case

Finally, we can make a prediction for the \(ES_{90\%}\). In order to do so we consider an investor who decides whether or not they should invest in a particular stock index or in the money market account with a unit of money in a given currency. We choose the r(0) as the short term rate at November 2020 for all four countries. As for the future stock and short-term process evolution, we consider highly optimistic and highly pessimistic scenarios. As for the optimistic scenario, we choose \(\rho =\rho _{Q3}\), \(\sigma _{S}=\sigma _{S_{Q1}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q3}\). Likewise for the pessimistic scenario, we choose \(\rho =\rho _{Q1}\), \(\sigma _{S}=\sigma _{S_{Q3}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q1}\). The curves for all four countries spread out, to state that we cannot firmly claim which investment type will be the better one. Nonetheless, we can still conclude that the stock will perform better after a while if the considered time of investment is longer, but under any scenarios to see this effect we have to wait a significant number of years. For only a few years the money market account is the less risky investment choice. Obviously the \(\alpha \) level the user chooses affects the \(ES_{\alpha }\) curves, but we expect similar results with other \(\alpha \) levels as well.

This figure shows three predictions for the \(ES_{90\%}\) risk measure for each country. Parameters to the Pessimistic \(ES_{90\%}\) line are given by choosing \(\kappa \) and \(\sigma _{r}\) from Table 1 for a given country. As for the other parameters, we chose \(\rho =\rho _{Q1}\), \(\sigma _{S}=\sigma _{S_{Q3}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q1}\). Parameters to the Optimistic \(ES_{90\%}\) line are given by choosing \(\kappa \) and \(\sigma _{r}\) from Table 1 for a given country. As for the other parameters, we chose \(\rho =\rho _{Q3}\), \(\sigma _{S}=\sigma _{S_{Q1}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q3}\). Parameters to the Neutral \(ES_{90\%}\) line are given by choosing all parameters from Table 1. We also choose r(0) as the short term rate at November 2020 for each country. That is \(r(0)=0.16\%\) for USA, \(r(0)=-0.52\%\) for France and Germany, and \(r(0)=-0.05\%\) for UK

Finally, we demonstrate the sensitivity of the results on the length of the time window, used for parameter estimations. To this end, we investigated the US market once again, where much longer data sets are available provided by (French 2022). We repeat the estimation and prediction using this dataset that covers July 1926-April 2022. With this longer data set, we could use a much longer 25 year window for parameter estimation. Related results can be seen in Fig. 9. One would expect that a longer rolling window provides more reliable estimations, making related predictions more robust. The right graph of Fig. 9 shows that lines spread out to a smaller extent compared to the USA graph in Fig. 8. Even based on a highly pessimistic scenario, the risk of holding stocks would start to decrease in comparison to money market account after around two years of time horizon. Nonetheless, even based on a highly optimistic scenario, for more than one year of time period the riskiness of stocks keep rising.

We compare the findings of this paper with the related literature. Barberis (2000) concluded that a buy-and-hold investor will optimally allocate an increasingly larger weight in stocks the longer the time horizon is by using a vector autoregressive (VAR) model and maximising utility functions. Pástor and Stambaugh (2012) concluded, that contrary to conventional wisdom claiming that stocks are safer over long horizons due to mean reversion in returns (see Siegel (2021)), long-term variance of real stock returns is higher due to a number of uncertainty factors. Motivated by economic theory, (Avramov et al. 2017) found that stocks can either be safer or riskier in the long horizon depending on whether the investor employs the long-run risk, habit formation, or prospect theory models to form prior beliefs about return dynamics. The results of this paper are in line with the papers that inferred the reduced riskiness of stocks after decades of time period. Some of the aforementioned papers provided a risk decomposition by splitting the long-horizon variance into multiple terms and associating them with current uncertainty, future uncertainty, estimation risk. etc. The figures of this study containing parameter sensitivities yield a similar kind of decomposition. The effect of changing one parameter ceteris paribus and how much difference it adds to the overall risk for a certain time horizon are given by Figs. 4, 5, 6 and 7. The risk component due to employing stochastic rates can best be observed in Fig. 3. We can clearly see that stochastic rates add significantly positive value to the risk of stocks, even though there are other uncertain parameters such as \(\mu -\theta \) that add a greater portion to the overall spectral risk.

The left of this figure shows the estimates of the three parameters for USA applying a dataset that covers July 1926-April 2022 using a 25 year long rolling window technique. The right of this figure shows the predictions for the \(ES_{90\%}\) risk measure for USA based on this longer dataset and the corresponding quantiles of the 25 year rolling window. Parameters to the Pessimistic \(ES_{90\%}\) line are given by choosing \(\rho =\rho _{Q1}\), \(\sigma _{S}=\sigma _{S_{Q3}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q1}\). Parameters to the Neutral \(ES_{90\%}\) line are given by choosing \(\rho =\rho _{Q2}\), \(\sigma _{S}=\sigma _{S_{Q2}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q2}\). Parameters to the Optimistic \(ES_{90\%}\) line are given by choosing \(\rho =\rho _{Q3}\), \(\sigma _{S}=\sigma _{S_{Q1}}\); and \(\mu \) and \(\theta \) based on \((\mu -\theta )_{Q3}\). Besides, \(\kappa =10\%\) and \(\sigma _{r}=13.48\%\) are used for all three lines, where \(\sigma _{r}=13.48\%\) corresponds to the long-term variance estimation having fixed \(\kappa \) at \(10\%\). We also choose \(r(0)=0\%\) as the short term rate at April 2022 for USA

4 Conclusion

For a passive investor, who holds a particular asset for years or even for decades, any meaningful comparison between the riskiness of stocks and money market accounts in the long run remains an essential research area. As suggested by (Bihary et al. 2020), for long investment horizons a stochastic interest rate model, correlated with the stock price, may be necessary. We considered a Geometric Brownian Motion process for the stock price and a Vasicek process for the short-term rate process, with the two Wiener processes correlated. Similarly to previous research works (Bihary et al. 2020; Nguyen et al. 2012) we analyzed spectral risk measures to express the risk of a corresponding random loss variable for each future time period with a closed formula.

We paid particular attention to popular risk measures such as Value at Risk, Expected Shortfall and GlueVaR and proved that under which conditions do the risk measures of the corresponding random variable rise or fall in the short run and in the long run. We checked that the condition to long-term fall is satisfied using parameter estimations from historical data points of four major countries. Our study reveals that the robustness of model calibration is strong, empirically estimated Expected Shortfall values are reflected by our analytical formulas. We have shown that using stochastic short-rate models we do get significantly more conservative estimations for the risk of the stock index. Based on a prediction we can state that even though over a very long time period the risk of stock will be lower than the risk of money market account, we have to wait decades to see this effect, therefore considering only a few years of investment period the money market account is the less risky investment type.

References

Acerbi C (2002) Spectral measures of risk: a coherent representation of subjective risk aversion. J Bank Financ 26:1505–1518

Acerbi C, Tasche D (2002) On the coherence of expected shortfall. J Bank Financ 26(7):1487–1503

Avramov D, Cederburg S, Lučivjanská K (2017) Are stocks riskier over the long run? Taking cues from economic theory. Rev Financ Stud 31(2):556–594

Barberis N (2000) Investing for the long run when returns are predictable. J Financ 55(1):225–264

Baz J, Sapra S, Stracke C, Zhao W (2021) Valuing a lost opportunity: an alternative perspective on the illiquidity discount. J Portf Manag 47(3):112–121

Belles-Sampera J, Guillén M, Santolino M (2014) Beyond value-at-risk: Gluevar distortion risk measures. Risk Anal 34(1):121–134

Bihary Z, Csóka P, Szabó DZ (2020) Spectral risk measure of holding stocks in the long run. Ann Oper Res 295(1):75–89

Bloomberg (2022) Bloomberg terminal. https://www.bloomberg.com/professional/solution/bloomberg-terminal

Bodie Z (1995) On the risk of stocks in the long run. Financ Anal J 51:18–22

Brace A, Gatarek D, Musiela M (1997) The market model of interest rate dynamics. Math Financ 7(2):127–155

Brandtner M (2013) Conditional value-at-risk, spectral risk measures and (non-) diversification in portfolio selection problems-a comparison with mean-variance analysis. J Bank Financ 37(12):5526–5537

Carr P, Wu L (2003) The finite moment log stable process and option pricing. J Financ 58(2):753–778

Choquet G (1954) Theory of capacities. In Annales de l’institut Fourier 5:131–295

Elliott RJ, Mamon RS (2002) An interest rate model with a Markovian mean reverting level. Quant Financ 2(6):454–458

Ferguson R, Dean L (1996) On the risk of stocks in the long run: a comment. Financ Anal J 52:67–68

French KR (2022) Data library of Kenneth R. French. https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Grabisch M, Labreuche C (2010) A decade of application of the choquet and sugeno integrals in multi-criteria decision aid. Ann Oper Res 175(1):247–286

Harlow WV (1991) Asset allocation in a downside-risk framework. Financ Anal J 47(5):28–40

Hu Y, Lindquist WB, Fabozzi FJ (2021) Modeling price dynamics, optimal portfolios, and option valuation for cryptoassets. J Altern Invest

Investing (2022) Investing 3-Month Bond Yield

Jamshidian F (1989) An exact bond option formula. J Financ 44(1):205–209

Jorion P (2007) Value at risk: the new benchmark for managing financial risk. The McGraw-Hill Companies, Inc

Kopa M, Moriggia V, Vitali S (2018) Individual optimal pension allocation under stochastic dominance constraints. Ann Oper Res 260(1):255–291

Labreuche C, Grabisch M (2018) Using multiple reference levels in multi-criteria decision aid: the generalized-additive independence model and the choquet integral approaches. Eur J Oper Res 267(2):598–611

Nadarajah S, Zhang B, Chan S (2014) Estimation methods for expected shortfall. Quant Financ 14(2):271–291

Nguyen HT, Pham UH, Tran HD (2012) On some claims related to choquet integral risk measures. Ann Oper Res 195:5–31

Pástor L, Stambaugh RF (2012) Are stocks really less volatile in the long run? J Financ 67(2):431–478

Rudin A, Marr WM (2016) Investor views, drawdown-based risk parity, and hedge fund portfolio construction. J Altern Invest 19(2):63–69

Siegel JJ (1998) Stocks for the long run. McGraw-Hill, New York

Siegel JJ (2021) Stocks for the long run: The definitive guide to financial market returns & long-term investment strategies. McGraw-Hill Education

Sriboonchita S, Wong W-K, Dhompongsa S, Nguyen HT (2009) Stochastic dominance and applications to finance, risk and economics. CRC Press

Treussard J (2006) The non-monotonicity of value-at-risk and the validity of risk measures over different horizons. http://ssrn.com/abstract=776651

van den End JW (2011) Statistical evidence on the mean reversion of interest rates. De Nederlandsche Bank Working Paper

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5(2):177–188

Wang S (1996) Premium calculation by transforming the layer premium density. ASTIN Bull: J IAA 26(1):71–92

Wilkie D (2001) On the risk of stocks in the long run: a response to zvi bodie. In: Proceedings of the 11th International AFIR Colloquium, pp 741–762

Funding

Open access funding provided by Corvinus University of Budapest.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

We have no conflicts of interest to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Dávid Zoltán Szabó thanks funding from National Research, Development and Innovation Office - NKFIH, K-138826.

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Szabó, D.Z., Bihary, Z. The riskiness of stock versus money market investment with stochastic rates. Cent Eur J Oper Res 31, 393–415 (2023). https://doi.org/10.1007/s10100-022-00814-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-022-00814-4