Abstract

In the automobile supplier industry companies frequently need to make bids, typically based on cost estimates for the production process, to obtain incoming orders. The production process is executed in several main stages, which are linked by intra-plant logistics. To model different scenarios, we consider two separate organizational approaches towards cost estimation. In the first one, all the main stages are optimized via a central authority. The second approach models a decentralized decision making process, as it is currently used in practice. Moreover, we analyze different coordination mechanisms to improve the decentralized approach. To capture the uncertainty during the bid process, associated with key parameters like demand, capacity consumption and cost, we formulate a stochastic version of the model, capturing different risk preferences to compare risk-neutral and risk-averse decision making. The resulting MILPs are solved with CPLEX and results for an illustrative example based on a real data set are presented.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Like many other industries, the automotive industry is characterized by a high degree of dynamism leading to frequent structural changes of the market environment. Increased outsourcing of value-adding activities to suppliers, shorter innovation cycles and growing demand have been observed for many years. Together, these trends put pressure on the suppliers to keep up with the technological progress and to offer a suitable product portfolio and a cost-efficient production environment (cf. e.g. Heigl and Rennhak 2008; Wyman 2012). On the other hand, flexibility and time-to-market are crucial parameters for suppliers in securing orders from automotive original equipment manufacturers (OEMs). In this paper, which is an extention of Borenich et al. (2014), we consider the situation, where an automotive OEM approaches an automotive supplier with the request to furnish a bid for the production of a certain car model.

Since bidding for such orders typically takes place under very limited information availability and short time-frames, cost estimates underlying the bids are highly imprecise bearing a significant risk for the supplier. Specifically, the actual capacity consumption induced by unknown model-mix information as well as the sequencing in each main stage to ensure a smooth workflow, can not be forecasted with sufficient precision. Moreover, the overall cost estimate is based on individual cost estimates independently computed by each main stage involved in the production process. These main stages are the body shop, the paint shop, the final assembly, supply chain management, and quality control. These main stages coordinate their efforts to some extent by using joint assumptions and premises, which exploit the experience from each main stage and ensure the active participation of each main stage in the cost estimation phase as well as the acceptance of the final bid by each main stage. Yet, the explicit implications of decisions taken in one main stage on cost drivers of other main stages are not considered. This may lead to the risk of understated or exaggerated overall cost estimates. Moreover, each main stage usually adds a risk premium depending on the perceived uncertainty induced by the incomplete information. Again, these risk premia will be uncoordinated between the main stages and their aggregation may lead to an over- or underestimation of the true risk associated with the project. As a result the firms face two risks. The first one is to lose against a competitor in the bidding process when the bid is too high, while the second one is to win a project but subsequently making a loss when the bid was too optimistic compared to the actual cost. Obviously, both cases put stress on a firm’s profitability and consequently strategies to reduce the mentioned bidding risks are sought.

In this paper we focus on the links between decisions taken in the different main stages to highlight the importance of coordinating the cost estimation process. In doing so, we use a simplified model focusing on three strategic variables that mimick the real situation. First, each main stage takes an intra-plant location decision, thereby influencing logistics costs. Second, the degree of automation critically influences the volume flexibility within each main stage and drives capital investment. Third, the shift model associated with the human resources employed in the process is the main driver of human resources costs.

In the model analysis we focus on two main questions. First, how should the cost estimation of the different main stages be organized to obtain an overall acceptable result? Second, how should the firm deal with the risk associated with the cost estimation under input parameter uncertainty? The first question is addressed by comparing three different approaches. The first one mimicks the current practice at our industrial partner and can be viewed as a decentralized, simultaneous approach (termed DSIM in the remainder of the paper). The second one considers a central authority (termed CA) taking all decisions and can be viewed as a benchmark yielding a global lower bound. The third one again models a decentralized setting, but adds a sequence in the main stages’ decisions thereby prioritizing certain main stages over others. This third approach will be termed DSEQ. The second question is dealt with by analyzing a deterministic approach, where all uncertainties are eliminated by using expected values of the associated input parameters. This approach is then contrasted with two stochastic approaches, where the uncertainty in the parameters is modeled through scenarios. One of these approaches assumes risk-neutrality and minimizes the expected cost, while the second approach explicitly captures risk by minimizing the Conditional-Value-at-Risk (CVaR) associated with the total cost estimate. Mathematically we formulate our models and approaches as mixed-integer linear programs and employ the standard solver CPLEX for obtaining results based on an illustrative example drawn from data of our industrial partner.

The remainder of the paper is organized as follows. The next section covers a literature review of related work. Section 3 describes the real-world problem faced by our industrial partner. This is followed by the model formulation in Sect. 4. The results for our illustrative example are presented in Sect. 5. The paper concludes with some final remarks and an outlook on further research.

2 Literature review

For supporting the bid process for a production environment, a suitable model needs to be based on an aggregate view, yet incorporate the most critical aspects of the operational business. Moreover, an appropriate model needs to incorporate uncertainty to reflect the strategic character of the problem characterized by imprecise or even missing data.

As such the literature on hierarchical production planning is closely related to our topic. The basic model of hierarchical production planning formalizes sequences of decision making that capture the different time horizons associated with these decisions. The main idea is to reduce the complexity of the overall planning task. Besides the firm’s long-term strategic decisions on the top-level, a mid-term aggregate production plan for the different product categories is determined. This serves as a tool to support capacity decisions. Then, on an intermediate level, disaggregated production lot-sizes and schedules are built, while the bottom-level finally deals with short-term production sequencing decisions (cf. Schneeweiß 2003). In acknowledging the interactions between these levels, the existing literature highlights the importance of using accurate proxies for the decisions on the lower levels (or at least their impact) when setting up decision support on the top level.

The classical papers Holt et al. (1955, 1956) concentrate on production and employee scheduling. The authors consider quadratic cost terms, e.g. hiring and layoff costs, as well as backlogging and overtime expenditures, and use linearized decision rules for the scheduling of the production rate and the workforce involved. It is also shown that the method used generates optimal solutions for certain specific data sets. Moreover, they explicitly exemplify how the numerical coefficients of the rules may be computed for any set of cost parameters.

Extending Holt et al. (1955), Hanssmann and Hess (1960) again deal with production and employment scheduling, while building upon the use of linear programming. The model independently chooses the respective unit costs of hiring and layoffs and those for the inventory and shortages. Additionally, it can be used to incorporate a more complex and realistic setting, i.e. the case of uncertainty.

Many papers deal with the focus of aggregate production planning, the determination of production level and strategy, of employment situation and the inventory planning over a finite mostly intermediate time horizon. Among these, the following ones should be highlighted. From a technical point of view, pioneering work has been done in Oliff et al. (1989). The authors describe a mixed-integer linear programming formulation, which recognizes discrete production and workforce levels in crew-loaded operations. An empirical example of a paint factory illustrates the theoretical background. In Gansterer (2015) a comprehensive hierarchical production planning framework, which is used to investigate the impact of aggregate planning in a make-to-order environment is developed.

The management of employee shift numbers is explicitly targeted in the probabilistic model of Fernandes et al. (2013). The results show efficient interrelations between said numbers and the demand pattern given, making use of the cash-flow-situation of the firm. Several strategies are developed, mainly to depict the employment situation of regular and temporary workers, respectively.

A detailed and comprehensive overview over aggregate planning models can be found in Nam and Logendran (1992). The authors discuss linear programming techniques, review the classical decision rules of Holt et al. (1955), incorporating several extensions, and discuss strengths and weaknesses of lot sizing models as well as goal programming, learning curve approaches and simulation. An extension can be found in Nam and Logendran (1995), where variants of modified production switching heuristics are presented, again applied to the paint factory case. An overview over models for production planning under uncertainty is given in Mula et al. (2006), to provide the reader with a starting point about uncertainty modeling in production planning problems aimed. Also in Peidro et al. (2009) an overview about quantitative models for supply chain planning under uncertainty can be found.

A specific stream of literature deals with robust models, which aim at supporting strategic decisions that are not very responsive with respect to uncertain events on the lower levels (see e.g. Gebhard and Kuhn 2009). For an efficient bid structure in a production environment, the authors of Albers and Krafft (2000) introduce a spread-sheet-type Maximum-Likelihood-approach, which is able to incorporate probabilistic profit aspects by means of a near-optimal decision rule. In Aouam and Brahimi (2013) a robust optimization approach for integrated production planning and order acceptance under uncertainty is introduced. A robust optimization model for agile and build-to-order supply chain planning under uncertainties is introduced in Lalmazloumian et al. (2016). There an integrated optimization approach of procurement, production and distribution costs associated with the supply chain members has been taken into account.

Based on an industrial case, Wang and Liang (2005) demonstrate the usefulness of interactive “possibilistic” linear programming. This complex aggregated production planning approach simultaneously minimizes a most possible value of imprecise total costs, maximizes the possibility of obtaining lower total costs and minimizes the risk of obtaining higher total costs. The method relies on multi-objective linear programming, in which the sophisticated base problem is converted into a number of single-goal fuzzy programming problems.

Likewise, da Silva et al. (2006) presents an interactive decision support system, a so-called learning-search-oriented concept, for an aggregate production planning model, which is again based on multiple criteria optimization and utilizes mixed integer linear programming. In dealing with a whole pool of solutions, interaction means the possibility of influencing the course of the optimization by the inclusion of new restrictions to reduce the feasible region or by changing weights in the objective function.

The following papers explicitly deal with related quantitative production models in the automotive context. For example, Meyr (2004) studies trends in the German automotive industry, especially covering the supply chain aspect. He advocates the automation and centralization of a formerly decentralized order promising in order to guarantee the efficiency and reliability, which is demanded for modern online ordering systems.

Personnel flexibility in the automotive industry is the key aspect in Sillekens (2008). The focus is on hierarchical production planning by means of linear models. Besides the classical terms considering manufacturing and holding costs, costs for changing the shift model for the workers are considered. Different variants of the problem with varying degrees of complexity in terms of the personnel modeling are analyzed. The author investigates a great variety of exact and heuristic approaches, and their hybrid forms, using classical operations research tools as well as newly developed decomposition techniques. A follow up of this Ph.D. project is the publication of Sillekens et al. (2011). It includes an illustrative case study, whose numerical results underline the applicability of the general model given, while emphasizing the main decision aspects of an integrated production and workforce planning. The topic of interest in Volling and Spengler (2011) is an improved synchronization of automotive production output with the market demand. The authors provide a simulative framework comprising separately linked quantitative models for order promising and master production scheduling.

In Aghezzaf et al. (2010) three models for robust tactical planning in multi-stage production systems with uncertain demands are introduced. A two-stage stochastic planning model, by a robust stochastic optimization planning model, an equivalent deterministic planning model which integrates the variability of the finished-product demands and a third model which uses finished-product average demands as minimal requirements to satisfy are compared in this paper.

We build on this literature and extend it in two key aspects. First, we focus on decentralized decision making and analyze different organizational structures to deal with that issue. Second, we introduce a stochastic, recourse based formulation of the problem and contrast both risk-neutral and risk-averse decision making. The interaction of these two contributions yields interesting new problem insights based on a specific real-world example from the automotive industry. Thereby we are able to provide real decision-support to our industrial partner.

3 Problem description

In this paper we consider an assembly plant of an European automotive industry supplier. The plant supports car manufacturers with R&D and custom manufacturing experience and covers a wide spectrum of specifications for individual components up to complete vehicles in both small volumes and mass production.

According to Sillekens et al. (2011), the following structure of an automotive plant is commonly observed:

-

1.

In the stamping plant metal or aluminum sheets are getting stamped for the body.

-

2.

In the body shop the body of the car is welded together.

-

3.

In the paint shop the painting and drying of the body is done.

-

4.

In the final assembly the painted body as well as engine, axles, transmission and the interior are assembled together.

These main stages are linked through buffers of inventories that allow a decoupling of the production lot sizes. The buffers and the intra-plant logistics are managed by the cross-functional main stage supply chain management (which—for brevity—we will term logistics in the following). Finally, quality control is organized in another cross-functional main stage.

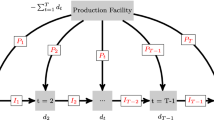

In the case of our industrial partner involved, the stamping is located in a different facility and thus it will not be included in our further considerations. Figure 1 visualizes the setup of the plant including the material flows. Note that semi-finished products and final products are stored in different locations and thus cannot share the same storage capacity.

While the body shop, the final assembly, logistics and quality control are specific to the product of interest, the paint shop handles all the products that are currently manufactured in the plant. As such, its design and setup is hardly influenced by the product considered.

The cost calculations, underlying the bid process, are done independently in each of the main stages on the basis of incomplete information and some joint assumptions and premises. Depending on the business case, these may range from rough design sketches of the car to specific data such as bills of material and construction plans, while the specific production sequences and times are typically unknown. As a consequence, the cost calculations are more or less rough estimates of the true project expenses. Specifically, interrelations of cost drivers affecting different main stages, are typically insufficiently taken into account.

Thus, we analyze different organizational structures for dealing with the coordination between the main stages. Moreover, we study risk-neutral and risk-averse approaches towards bidding under uncertainty. In the next section these approaches will be explained in more detail in the context of our model development.

4 Model characteristics

As mentioned in the problem description, the plant consists of five main stages, namely the body shop, the paint shop, the final assembly, logistics and quality control. Quality control influences the overall cost through more or less stringent requirements on the production tolerances. However, quality control does not crucially influence the interactions between the remaining main stages and thus we consider only the other four main stages in our model.

The main idea of our model is to cover as close as possible the actual practice of our industrial partner in terms of the strategic approach towards cost estimation for supporting the bid. This highlights the importance of understanding the operational implications of the essential strategic decisions. Yet, it is neither possible nor reasonable to capture all the operational complexities in our model. First, the resulting model would become very difficult to solve and the main results would be obscured by a lot of minor effects interacting in various ways. Second, and more importantly, at the time of preparing the cost estimate a lot of the information required for making operational plans, e.g. the exact configuration of the production line, will not be available.

Thus, we propose an aggregated approach for the production part of the model based on a dynamic, capacitated lotsizing model. The model is constructed for a finite time horizon of a number of periods, during which a single product, with a given demand for each period is produced. The time horizon corresponds to the anticipated production life cycle of the product which is typically three to five years. As a consequence and for the sake of the cost estimation process, the model periods realistically are years. In each period, each main stage decides its production output under two types of constraints.

First, the production output of a main stage is limited by its available capacity. For the body shop and final assembly this output is determined by the strategic decision variables to be discussed in the next subsection. For the paint shop, the situation is different. As noted, the paint shop depends on all the products that are currently manufactured in the production plant. When considering the cost estimates for the bid process for a specific product, we can assume that the design and setup of the paint shop are given and cannot be changed. The throughput of a specific product in the paint shop depends on the quantities of all the products to be handled. Since the other products and their quantities are exogenous to our model, we assume a fixed, limited capacity for our considered product in the paint shop.

The second important factor, the workflow within the factory, is driven by the main stage logistics as well as by the production sequence. In terms of the main stage logistics we assume unlimited transport capacities for moving semi-finished and finished goods between the storage and the other three main stages. Further, without loss of generality, we set transportation times equal to zero, but assume that transportation costs depend on the intra-plant locations of the other main stages. Production lead times, together with production quantity decisions, will influence the available inventory of semi-finished products, which, in turn, constrains a main stage’s production output. Since production periods in our model are quite long, we assume that the output of a certain stage in a given period is already available at the subsequent stage before the end of the same period. Only for the first main stage, the body shop, we assume that the exogenous material supply is unlimited.

In the remainder of this section we firstly specify the strategic decision variables and the associated costs. Then we discuss the uncertainties modeled as well as the operationalization of the risk preferences. Next, we introduce the different approaches for obtaining the overall cost estimate. Finally, we present the mathematical formulation of the model.

4.1 Strategic decision variables and associated costs

Our industrial partner categorizes the main costs in each main stage according to Fig. 2, which further shows how we operationalized these cost categories.

This operationalization is also motivated by the following three groups of strategic decision variables, which provide aggregate information about the factory setup for the product.

The first pair of variables models the degree of automation for the body shop and for the final assembly. These influence the investment and energy costs for the automation as well as the capacity. The degrees of automation are fixed at the beginning of the planning horizon and cannot be changed anymore.

The second pair of variables concerns the shift model, which can be chosen separately for the body shop and the final assembly. The number of shifts, ranging from 1 to 3, influences the fixed shift costs and further limits the available capacity in any given period.

The third pair of variables models the intra-plant location decision of the body shop and the final assembly. For both of these main stages a hall has to be chosen. These decisions have an influence on the total lease costs of the halls, on the capacities of these main stages and on the costs of the logistics.

The costs, induced by specific values of these decision variables, are influenced by operational processes, which link the underlying main stages. For example, as mentioned above, the degree of automation in the final assembly influences the total available capacity and consequently the maximum production quantities in this main stage. However, the actual production quantities also depend on the production decisions of the previous main stages. Thus, a high degree of automation in the final assembly, implying high volume flexibility, may be useless if the degree of automation and consequently the production output of the main stage body shop are very low. We model exactly this relationship by focusing our attention on aggregate production quantities.

4.2 Optimization under uncertainty

Clearly, the cost estimation supporting the bid process takes place under a significant level of uncertainty on both the demand as well as on the supply side. Capturing all possible uncertainties would again render our model and its analysis incomprehensible. Thus, we focus on selected types of uncertainties, which in accordance with our industrial partner, are the main drivers for the internal decision processes. Specifically, we will consider three types of uncertainties. First, we assume that the yearly demand is uncertain. While the contracts typically specify the total demand to be satisfied, the customers are given the flexibility to adjust the average yearly demand by up to 15% in both directions. Second, since it is also used by different products lines, the capacity of the paint shop is uncertain. Finally, we assume that the technology coefficients are uncertain. This is meant to reflect the changing capacity requirements on the assembly line induced by different specifications of the cars produced. In line with practice in our industrial partner, we assume that all main stages share the same information about the uncertainties.

In view of these uncertainties, the decisions modeled can be split into two categories. Clearly, the strategic decisions described in Sect. 4.1 set up the environment for honoring the contractual duties if the project is won. Thus, these decisions have to be taken before the uncertainty discussed above resolves. On the other hand, actual setup and aggregate production decisions in the dynamic, capacitated lotsizing part of our model are taken once the project execution starts, in which case we assume that the above mentioned uncertainties have resolved.

From a technical point of view, this gives rise to a 2-stage stochastic optimization model. While 2-stage stochastic optimization in a convex setting is well understood, the inclusion of integer variables (caused e.g. by setup considerations) leads to much higher complexity (see e.g. Schultz 2003). Thus, it is common practice to employ Sample Average Approximation, where the uncertain data are discretized and the optimal solution, minimizing the average cost over the finite number of resulting scenarios, is sought (cf. Ahmed and Shapiro 2002). This serves as an approximation of the true expected value of the continuous probability distribution. By using scenarios, the resulting problem can then be modeled and solved as an (integer) linear program. Therefore we generate a set of scenarios modelling the uncertain demands, capacity of the paint shop as well as technology coefficients.

Using such a scenario approach, the optimal reaction to each scenario induced by the production flexibility gives rise to scenario-dependent cost estimates. Aggregation of these cost estimates into a single number that can be used in the bid process requires the definition of the decision maker’s risk preferences. As sketched earlier, we compare two scenarios. First, a risk-neutral decision maker is mimicked by optimization of the mean cost over all scenarios. Second, a risk-averse decision maker is modeled by optimizing the CVaR of the cost.

The CVaR is an extension of the Value-at-Risk (VaR) and, other than the VaR, belongs to the class of coherent risk measures (see e.g. Artzner et al. 1999). VaR and CVaR can be formally defined as follows (see Rockafellar and Uryasev 2002). Let the random variable TC(V, s) denote the cost function of a strategy vector (values of the decision variables) \(s \in S\). The random vector  , with probability density \(f_V\), represents the future values of some stochastic variables. Let \(\hbox {VaR}_{\beta }\) denote the \(\beta \)-quantile of the induced cost distribution given by

, with probability density \(f_V\), represents the future values of some stochastic variables. Let \(\hbox {VaR}_{\beta }\) denote the \(\beta \)-quantile of the induced cost distribution given by

Then, the associated CVaR is defined by the following conditional expectation for any choice \(s \in S\)

which can be characterized by the following optimization problem:

, where \(F_{\beta }(s,\alpha )\) is given by

, where \(F_{\beta }(s,\alpha )\) is given by

In Rockafellar and Uryasev (2002) it was shown that under the assumption that V does not depend on s, and TC(V, s) is linear in s, the CVaR optimization can be approximated linearly. Particularly, given J scenarios, \(j=1,\ldots ,J\) with realizations \(v_1,\ldots ,v_{J}\) of the stochastic variable V, \(F_\beta (s,\alpha )\) can be approximated by a convex piecewise linear function in \(\alpha \):

This characteristic allows the incorporation of CVaR into a linear programming model as shown below.

In the illustrative numerical example discussed in Sect. 5 we contrast the risk-neutral and risk-averse approaches with a deterministic approach, where the uncertainty is resolved a priori by considering only the expected values of the stochastic input factors.

4.3 Centralized and decentralized optimization

We study three different settings. Our first setting is the DSIM setting as mentioned in the introduction. This can be viewed as the case mimicking the real current situation and is illustrated in Fig. 3a. All main stages first agree on a set of assumptions and premises. It is important to articulate which assumptions and premises are captured by the model. In our basic setting we consider a joint demand estimate and information sharing concerning lead times, which guide the workflow over time. Then the main stages independently and simultaneously determine their local cost estimates, which are subsequently added together to obtain the total cost estimate. Depending on the quality of the jointly agreed upon premises and assumptions, this DSIM-solution may underestimate the true project cost quite severely. For example, uncoordinated production decisions may lead to insufficient supply of semi-finished products. This, in turn, makes the planned solution infeasible and costly recourse actions during the execution of the project will be necessary in practice.

To alleviate this, we propose two alternative settings. As mentioned above, the quality of the cost estimate for the product crucially depends on the complex relationships between the different main stages. In our models these relationships are captured through the inventory processes which link the production of the different main stages. While in the strategic situation of supporting a bid, the actual production sequences cannot be determined in detail, we at least model aggregate effects arising from capacity utilization choices. In doing so, our second setting sticks with the decentralized decision making of the main stages, thereby acknowledging the organizational structure of the firm. However, we now consider the sequential approach DSEQ where one after the other main stage makes its cost estimate. In Fig. 3b one can see that the first main stage, which can be the body shop, the paint shop, the final assembly or the logistics, gets all the input parameters. With these parameters this main stage calculates the optimal costs for itself. After this calculation it passes on the calculated variable values to the next main stage and stores its costs for the calculation of the total costs. When main stages make their cost estimates sequentially, a main stage can incorporate planning information from the planning processes of its preceding main stages, so that the overall cost estimate is improved. Specifically, potential infeasibilities from uncoordinated actions are reduced. On the other hand, this planning information of preceding main stages will limit the possible decisions of a main stage thereby increasing its cost estimate locally as well as the total cost estimate. In this way the acceptance of such a process by the different main stages may be reduced. Besides, the cost estimate may be excessively high, thereby reducing the probability of a successful bid. Note, that a key question of the DSEQ-setting concerns the sequence in which main stages should make their estimates. We will look into this question by analyzing various possibilities in our illustrative numerical example below.

Finally, our third setting models the case of fully centralized decision making (CA) as shown in Fig. 3c. All the decisions of all main stages are taken jointly in view of the total cost estimate. While this cost estimate will be globally optimal, the underlying setting implies that the main stages no longer have managerial power. Thus, this setting corresponds to a radical organizational change at least in the cost estimation process, which may be difficult to implement in practice. For the sake of our analysis it serves as a reference setting to evaluate the quality of the cost estimate in the above mentioned sequential decentralized decision making.

4.4 Mathematical model

In this section we describe the mathematical models for minimizing the total cost. First of all, the parameters and the decision variables will be described. Afterwards, detailed information of the cost components will be given. With respect to the different optimization approaches described above, CA, DSEQ and DSIM, we start with the detailed model description of CA and explain afterwards how this base model differs from DSEQ and DSIM.

4.4.1 Parameters

Most of the model parameters have to be defined for every constructive main stage i, where \(i=1\) corresponds to the body shop, \(i=2\) identifies the paint shop and \(i=3\) relates to the final assembly. For the sake of convenience, all variables are given in alphabetical order:

- \(\beta \):

-

Measure of the risk preferences (\(0\le \beta <1\))

- \(C_{2,j}\):

-

Per period capacity of the paint shop for scenario \(j\in \bar{J}\)

- \(C_{h,i}\):

-

Per period unit design capacity for hall h and main stage \(i=1,3\)

- \(C_i=\max _{h \in {\bar{H_i}}} C_{h,i}\):

-

Per period unit design capacity of the biggest hall for main stage \(i=1,3\)

- \(D_{p,j}\):

-

Demand for finished products at the end of period p for scenario \(j\in \bar{J}\)

- \({\bar{H_i}}=\{1,\ldots ,H_i\}\):

-

Halls for main stage \(i=1,3\)

- \(I_{0,i}\):

-

Initial inventory of main stage \(i=1,2,3\)

- \(I_F\):

-

Maximum stock level for the finished goods inventory

- \(I_{SF}\):

-

Maximum stock level for the intermediate stock of semi-finished products

- \(\bar{J}=\{1,\ldots ,J\}\):

-

Scenarios capturing the uncertainty in the demand, the capacity of the paint shop and the technology coefficients

- \(K^{energy,fix}_{h,i}\):

-

Per-period energy costs for a degree of automation of 100% in hall h of main stage \(i=1,3\)

- \(K^{energy,var}_{h,i}\):

-

Energy costs per unit in hall h of main stage \(i=1,3\)

- \(K^{hall}_{h,i}\):

-

Lease costs for hall h per period in main stage \(i=1,3\)

- \(K^{inv}_i\):

-

One-time investment costs for a degree of automation of 100% in main stage \(i=1,3\)

- \(K^{mat}_i\):

-

Material costs per unit for main stage \(i=1,2,3\)

- \(K^{other}_i\):

-

Other costs per unit in main stage \(i=1,3\)

- \(K^{paint}\):

-

Per-unit transportation costs between the paint shop and the storage

- \(K^{pers}_i\):

-

Labor costs per period for a degree of automation of 0% in main stage \(i=1,3\)

- \(K^{shift}_i\):

-

Costs of one shift in main stage \(i=1,3\)

- \(K^{stock}_i\):

-

Warehousing costs per unit and period for the intermediate stock of semi-finished products (\(i=1,2\)) and the inventory of finished products (\(i=3\))

- \(K^{trans}_{i,h}\):

-

Per-unit transportation costs between the body shop (\(i=1\)) or the final assembly (\(i=3\)) and the storage

- \(l=1,2,3\):

-

Index corresponding to the number of shifts

- \(\lambda _i\):

-

Productivity factor of personnel resources relative to automation

- \(\bar{P}=\{1,\ldots ,P\}\):

-

Periods

- \(w_{i,j}\):

-

Capacity needed for one item, i.e. technology coefficient, in main stage \(i=1,3\) and for scenario \(j\in \bar{J}\).

4.4.2 Decision variables

As mentioned above, the decision variables are split into two categories, namely the strategic and the scenario-dependent variables.

Strategic variables are fixed once and are identical for all scenarios:

- \(y^{hall}_{h,i}\):

-

Binary variable for the selection of a hall h for main stage \(i=1,3\)

- \(y^{shift}_{i,l}\):

-

Binary variable, which indicates that l shifts are chosen in main stage \(i=1,3\)

- \(z_i\):

-

Automation degree in main stage \(i=1,3\); \(0\le z_i \le 1\)

Operational variables are scenario-dependent variables and reflect decisions that are taken after uncertainty has resolved, i.e. these variables may take different values in each scenario.

- \(I_{p,i,j}\):

-

Inventory level after main stage i at the end of period p for every scenario \(j\in \bar{J}\)

- \(t_{p,i,j}\):

-

Effective percentage of the maximum available personnel resources corresponding to the design capacity of the biggest hall within a given period p and for scenario \(j\in \bar{J}\) in main stage \(i=1,3\)

- \(x_{p,i,j}\):

-

Produced items in period p in main stage \(i=1,\ldots ,3\) and for scenario \(j\in \bar{J}\)

- \(y^{period}_{p,i,j}\):

-

Binary variable for period p and for scenario \(j\in \bar{J}\), which indicates whether in main stage \(i=1,3\) production takes place or not

4.4.3 Cost components of the objective function

Overall, the total cost \(TC_j\) in a given scenario j can be written as:

The costs are divided into the four main stages, where they occur. In the body shop and the final assembly the same types of costs occur. Since we do not consider any strategic decisions in the paint shop, the only costs modeled in this main stage are material costs which only depend on the exogenously given demand and thus making them a constant parameter. Finally, the costs for inventories and the intra-plant transportation are summarized in the main stage logistics.

-

Costs of the body shop and the final assembly

For the given main stage body shop (\(i=1\)) or for the final assembly (\(i=3\)) these identical costs consist of the following parts:

$$\begin{aligned}&\underbrace{\sum _{p\in {\bar{P}}} K_i^{pers}t_{p,i,j}y^{period}_{p,i,j}}_{\text {labor costs}}+\underbrace{\sum _{p\in {\bar{P}}} K_i^{energy,fix} y^{period}_{p,i,j}z_i+K_{i}^{energy,var} x_{p,i,j}}_{\text {energy costs}}\\&\quad +\underbrace{\sum _{p\in {\bar{P}}} K^{material}_{i}x_{p,i,j}}_{\text {material costs}}+\underbrace{\sum _{h\in {\bar{H}}_i} \sum _{p \in P} K^{hall}_{h,i}y^{hall}_{h,i}}_{\text {lease costs for the hall}}+\underbrace{\sum _{p\in {\bar{P}}} K^{other}_ix_{p,i,j}}_{\text {other costs}}\\&\quad +\underbrace{z_iK^{inv}_{i}}_{\text {investment costs for the automation}}+\underbrace{K^{shift}_{i}(y^{shift}_{i,1}+2y^{shift}_{i,2}+3y^{shift}_{i,3})}_{\text {costs of shifts}} \end{aligned}$$The labor costs just occur if production takes place in the corresponding period (\(y^{period}_{p,i}=1\)) and depend on the chosen personnel capacity. Same as above, the energy costs for automation only occur, if the production takes place in the corresponding period. They depend on the degree of automation. The total material costs depend on the amount of production. For the production, one hall out of the \(H_i\) halls must be chosen. The lease costs for the hall are fixed and occur in each period. The other costs may occur in a period and just arise if the production takes place in that period. The one-time investment costs for automation just occur once and depend on the degree of automation. The shift costs consist of fixed costs for every shift introduced.

-

Paint shop costs

The costs of the paint shop (\(i=2\)) just depend on the amount of cars to be painted:

$$\begin{aligned} Cost^{PaintShop}_j = \sum _{p\in {\bar{P}}} K^{mat}_2x_{p,2,j} \end{aligned}$$ -

Costs of the main stage logistics

The costs of the storage plus the costs of the intra-plant transportation constitute the costs of the fourth main stage, the logistics:

$$\begin{aligned} \underbrace{\sum _{p\in {\bar{P}}} K^{stock}_iI_{p,i,j}}_{\text {storage costs}}+\underbrace{\sum _{p\in {\bar{P}}} \sum _{ h\in {\bar{H}}_i} K^{trans}_{i,h}y^{hall}_{h,i}x_{p,i,j}+2\sum _{p\in {\bar{P}}} K^{paint}x_{p,2,j}}_{\text {intra-plant transportation costs}} \end{aligned}$$Per-unit and per-period storage costs for semi-finished products occur for inventories, which are output by the body shop (\(i=1\)) and by the paint shop (\(i=2\)). Per-unit and per-period storage costs for finished products waiting to be used for demand satisfaction occur after the final assembly (\(i=3\)). The intra-plant transportation costs are influenced by the locations of the body shop and the final assembly. The selection of the corresponding halls affects the distance from a hall to the storage location and moreover it includes the decision if there exists a tunnel between the main stage and the storage location, by which the costs of the transportation decrease, additionally the costs between the storage and the paint shop \(i=2\) have to be added.

4.4.4 Mathematical program for the CA approach

In the following we describe the CA approach, DSIM and DSEQ will be derived from CA in the next section.

Using the auxiliary real variable \(\alpha \), our optimization problem can be formulated with a general objective function reflecting different types of risk preferences via parameter \(\beta \). The following mathematical program for the centralized case, CA, exemplifies the overall model structure.

s.t.

The objective function (6) and constraint (26) capture different settings with respect to uncertainty as well as to risk preferences. When \(J=1\), i.e. only one scenario is considered, the problem collapses into a deterministic optimization minimizing \(TC_j\) of the chosen scenario. On the other hand, when \(J>1\) the objective function models the so-called \(\hbox {CVaR}_{\beta }\) of the total cost function and the value of \(\beta \) will determine the risk preferences. For example, in the case of risk neutrality, i.e. if \(\beta =0\), the expected value of the total cost \(TC_j\) is minimized. As \(\beta \) increases, the decision maker gets more and more risk averse. For more details about CVaR-modelling the interested reader is directed to (Rockafellar and Uryasev 2000).

In constraints (7) the hall for the body shop and the final assembly is chosen out of the \(H_1\) and \(H_3\) halls, respectively. The capacity constraints of the body shop and the final assembly are given by (8), the capacity constraint for the paint shop by (9). Equations (8) depend on all three strategic variables, namely, the chosen hall, the degree of automation and the personnel capacity. Observe first the term \(1-y^{hall}_{h,i}(1-\frac{C_{h,i}}{C_i})\). If a hall h is not selected, this term is equal to 1. On the other hand, for the selected hall this term simplifies to \(\frac{C_{h,i}}{C_i}\). This corresponds to the relative capacity of the chosen hall compared with the largest selectable hall for the main stage i. Thus, the term \(\min _{h \in \bar{H}_i}\{1-y^{hall}_{h,i}(1-\frac{C_{h,i}}{C_i})\}\) determines the relative capacity in main stage i induced by the location decision. To utilize this capacity, the firm needs to invest in automation and personnel capacity. The influence of these two variables on the available capacity is given by \(z_i+\frac{t_{p,i,j}}{\lambda _i}\). Here we assume that the two variables are imperfect substitutes for one another. Particularly, personnel capacity is less productive than automation as shown by the parameter \(\lambda _i>1\). Moreover, the right hand side of (8) models that a smaller hall limits the effectiveness of investments in both automation and personnel capacity. Finally, the left hand side of constraints (8) signifies the uncertainty in the capacity consumption for a single unit through the technology parameter \(w_{i,j}\). Contrary to that, as mentioned above and shown in constraints (9), the capacity in the paint shop cannot be influenced and is uncertain, i.e. it is a given parameter which depends on the scenario j.

In plain words, the constraints (10) and (11) first ensure that one shift model is chosen by each of the two concerned main stages. Second, depending on the chosen shift model, the actual capacity will change. The term \(\frac{\sum _{l \in \{1,2,3\}}ly^{shift}_{i,l}}{3}\) in constraints (11) reflects the fact that under a single shift (two shifts) only a third (two thirds) of the available design capacity can be effectively used when compared with the full three-shift model. Besides, as mentioned above in the discussion of constraints (8), the size of the hall will influence the utilizable personnel resources.

In the body shop and the final assembly the output of a period can only be greater than zero if production takes place during this period, which is modeled in constraints (12). Constraints (13) and (14) refer to the inventory balance in the different main stages. For the body shop the inventory level of the actual period is given by the inventory level of the former period plus the number of units produced minus the number of units used by the paint shop in the actual period. The same holds for the paint shop and, in analogy, for the succeeding final assembly, where the inventory balance equations consider the final customer demand instead of the units used by the succeeding main stage, see constraints (15). Specifically, in a given period p, the production quantity in a certain main stage is limited by the available inventory of the previous main stage at the end of period \(p-1\) plus the previous main stage’s period p production. Storage capacities for semi-finished products and finished products are limited as shown in constraints (16) and (17), respectively. Initial inventories for each main stage are defined in constraints (18).

Last but not least, the restrictions on the domains of the variables are defined in constraints (19) to (26).

For the ease of exposition, the mathematical program shown above was given in non-linear form [compare e.g. the multiplication of decision variables in Sect. 4.4.3 or the maximum formulation in the objective of (6)]. In order to run the computational experiments and exemplify the key results for our underlying industrial setting, we linearized the program to a MILP, which is equivalent to the given nonlinear formulation.Footnote 1

4.4.5 Deriving DSIM and DSEQ from CA

As mentioned, for the CA approach the above mentioned LP is used. Contrary to that, for the DSIM and the DSEQ approaches the model has to be changed in the following way.

In the case of the DSIM approach, the model has to be separated into four parts, where each component is a technically independent mathematical program, set up to optimize the respective main stage. This means that each summand of the objective (5) is used as an independent objective function. For the main stages \(i=1, \ldots , 3\), each independent program receives all sets of constraints, exactly as they are originally defined in CA for the respective i.

Note that, corresponding to the number of summands, i.e. the number of stages, DSIM involves the solution of four different mathematical programs, based on the same data set. DSEQ uses the same programs. However, in the DSEQ approach they are one by one solved in a way that, according to a pre-defined sequence, each main stage optimizes its cost and subsequently forwards the values of its optimized decision variables as input parameters to the consecutive main stage and program, respectively.

5 Computational experiments

To focus on structural insights for the decision making, we use an illustrative example based on data from our industrial partner. These data have been modified to ensure confidentiality, yet the main relationships and ratios observed in the real setting are preserved. Table 1 summarizes these data.

The remainder of this section is organized to answer the following three research questions:

-

1.

What is the benefit of using a stochastic approach over a deterministic approach in terms of the cost estimate as well as in terms of the underlying decisions?

-

2.

How are the cost estimates as well as the underlying decisions influenced by the risk preferences of the decision makers?

-

3.

What is the impact of different organizational structures underlying the strategic cost estimation process for bidding on both the quality of the cost estimate as well as the decisions taken?

5.1 Comparison of the stochastic with the deterministic optimization for the CA approach

A key aspect of our model is the consideration of uncertainty. As Table 1 shows, we consider \(J=100\) scenarios reflecting different (joint) realizations the three demands, of the paint shop capacity and of the technology coefficient. In evaluating all our solutions, we assume that the actual future will be one of these scenarios and that each scenario has the same probability of \(\frac{1}{100}\) for being the future outcome. Thus ex-post we can quantify the true cost of a solution for each scenario and consequently we can also compute the mean total cost and the CVaR of the total cost.

We start with confronting the different optimization approaches, i.e. the stochastic and the deterministic one. Exemplifying the CA approach, the corresponding results are given in column (1) of Table 2 for the stochastic case and in columns (2) and (3) of the same table for the deterministic case. In doing so, we exactly use the CA approach as given in Sect. 4.4.4 (note that such a comparison alternatively made for DSEQ and DSIM would yield the same results by tendency, since cost relations as well as decision variable relations can be justified using the same arguments). Generally in our analysis, decision variable values to be discussed are given by \(z_i\) (as defined above), by \(\tau _i\) (with \(\tau _i=l\) iff \(y^{shift}_{i,l}=1\)) and \(h_i\) (with \(h_i=h\) iff \(y^{hall}_{h,i}=1\)).

The stochastic optimization is based on the risk neutral setting operationalized by the optimization of the objective function (6) with \(\beta =0\). Remember that this approach considers all the \(J=100\) scenarios and returns the solution that minimizes the mean cost over all these scenarios. We report this optimized mean total cost as well as the associated CVaR of the total cost.

The deterministic model has two manifestations. First, using mean values (over all scenarios) of all the uncertain parameters (paint shop capacity, technology coefficient and the three demands), column (2) reflects the standard decision making process in which average data is used to generate optimal strategic decisions. This culminates in a single expected scenario, captured by \(J=1\). Note that this expected scenario will typically not coincide with any of the 100 underlying scenarios. Yet, the deterministic approach finds the optimal solution for this expected scenario (see column (2)). To know how this solution will fare when faced with the actual future realization of all the uncertain variables, and in order to fairly compare operational decisions, the resulting strategic decisions from said expected scenario, concerning the degree of automation (\(z_i\)), the shift model (\(\tau _i\)) and the choice of the hall (\(h_i\)) for each relevant main stage (\(i=1,3\)) are applied to each of the \(J=100\) scenarios and the resulting mean total cost as well as the CVaR of the total cost are evaluated (see column (3)).

Thus we can now compare three different mean total cost values that could form the basis of the bid. The first one is the mean total cost from the deterministic optimization for the expected scenario. From column (2) in Table 2 we observe a value of 2,403,985,990. If the firm were to use this mean cost for making the bid, it takes a significant risk. By applying the underlying strategic decisions, the true average total cost, computed by evaluating the decisions on the basis of the \(J=100\) scenarios, will be 2,413,725,468 as shown in column (3) of Table 2. Thus, the firm would underestimate the real expected cost of its strategy by roughly 10,000,000.

The second alternative could be to use the strategy computed with the deterministic approach, but to base the bid on the evaluation of this strategy over the \(J=100\) possible futures, i.e. the 2,413,725,468 as shown in column (3) of Table 2. Obviously in that case the firm would face a lower risk of underestimating the true cost of its strategy in the future. However, when compared with the third alternative, which is the stochastic optimization as shown in column (1) of Table 2, we find that the optimal mean total cost shown there is lower by 1,718,284. Thus, the deterministic approach evaluated over the \(J=100\) scenarios—by prescribing suboptimal decisions—overestimates the mean total cost, thereby lowering the winning chances of the bid. Finally, the table also shows that the solution returned by the deterministic approach also bears a larger risk as highlighted by the CVaR. Here the advantage of the stochastic approach is even more pronounced.

These differences in the mean total cost are driven by different strategic decisions returned by the stochastic and the deterministic approaches. In the deterministic approach, the final assembly chooses the small hall (\(h_3=1\)) but uses a rather larger degree of automation reflecting the optimal choice for the mean-demand scenario. When faced with the uncertainty in demand, which is uniformly distributed within a range of ± 15% of its mean value, these strategic choices lead to two problems. A closer investigation of the solution revealed that in scenarios where demand is small, the large degree of automation leads to a low utilization in the final assembly, thereby making the investment inefficient. In scenarios where demand is large, the capacity limitation induced by the choice of the small hall, necessitates the temporal shift of some production to earlier periods, thereby increasing inventory cost. Compared to that, in the stochastic approach the final assembly is placed in the large hall with a smaller degree of automation. First, the extra cost associated with selecting the larger hall is partly offset by reduced investment in automation. Besides, the smaller degree of automation is more efficient when demand turns out to be small. Finally, when demand is large, the larger hall necessitates less to no temporal adjustment of production.

5.2 Comparison of the results for the risk-neutral and the risk-averse settings

Now we analyze (alternatively, if wanted, change all to analyse) the results for the risk-neutral and the risk-averse settings comparing the different approaches CA, DSEQ and DSIM. These results are given in Tables 3 and 4. In both Tables, for the DSEQ approach all permutations of the body shop, final assembly and logistics (numbers 1, 3 and 4) represent the sequence in which the decision makers optimize their respective environment. Sequence-independent number 2 depicts the main stage paint shop and is added at the last position (compare Sect. 4.4.3). Note that, besides optimization objectives (first mean and then CVaR of total cost), in each case, CVaR and mean, obtained from a post-optimization-calculation, are given in the subsequent line.

A key insight in terms of the decision making is that the strategic decisions are remarkably robust under the two different risk preferences. The only structural change observed, is that under risk aversion the level of automation is generally slightly increased. The key to this result is that the degree of automation is closely related to the minimum demand that needs to be covered. Since the most costly scenarios, which form the basis of the CVaR computation, are those where demands are generally higher, this demand effect is mirrored in the level of automation. As a consequence, the investment cost associated with automation increases, but this increase is compensated for by a reduction in human resources cost due to the reduced necessity of costly personnel adjustments during the project execution.

Looking at the mean total cost and the CVaR, the above mentioned robustness is also reflected. For the CA (columns (1) and (9)), for the DSIM (columns (2) and (10)) as well as for the DSEQ approaches 4-1-3-2 and 4-3-1-2 (columns (5) and (13) and columns (6) and (14), respectively) we observe that under the different risk preferences in the objective, total costs and CVaR show only a negligible difference.

A key aspect to consider here is the cost of being risk averse. We measure it by the difference between the optimal mean total cost and the optimal CVaR as these are the basis for the bid of the risk neutral and the risk averse decision maker, respectively. As an example, consider the CA approach shown in columns (1) and (9) of Tables 3 and 4, respectively. The risk neutral decision maker would base the bid on the mean total cost evaluated at 2,412,007,183. Conversely, the risk averse decision maker would base the bid on the optimal CVaR evaluated at 2,437,945,771 in order to cover its bases when things go wrong. This difference of about 26 millions, which is robust over all the DSEQ and DSIM approaches as well, implies that in relative terms, risk aversion will increase the cost basis of the bid by about 1%.

In terms of the other DSEQ approaches (columns (3), (4), (7) and (8)) we observe an interesting and counterintuitive result: due to the sequential nature of the decision making, a risk averse perspective of each individual main stage may either increase or decrease the CVaR of the total cost. Besides, also the mean total cost may increase or decrease. Overall, these results suggest that while risk preferences play an important role for the cost estimation process, their effect is dominated by the organisational structure underlying the process. We will turn to this issue now.

5.3 Comparison of the results obtained with the different organizational structures

Let us finally consider the effect of the different organizational decision making structures induced by the DSIM, DSEQ and CA approaches. From Tables 3 and 4 we observe the interesting result that the DSIM approach generates the overall minimum cost, it produces an improvement of about 12 millions in terms of both the mean total cost as well as the CVaR when compared with the CA approach. Note that the DSIM approach mimicks the current situation in practice, so this finding looks good at first sight. However, it turns out that this minimum is achieved at the expense of feasibility (observe that a DSIM-solution, better than the global optimum of CA, means infeasibility). Note that in the DSIM-approach there are constraints missing which connect the stages. As a result an optimal solution of the DSIM-approach may be infeasible for the underlying problem. Obviously, in such a case the agreed upon assumptions and premises are not sufficient to truly coordinate the main stages. Particularly, the main stage logistics, when minimizing its cost, aims at JIT production and perfect alignment of the production quantities between the productive main stages to eliminate inventory cost. On the other hand, the productive main stages aim at a more balanced production rate over the different periods to effectively utilize an optimal level of automation. As a consequence, the true project cost is underestimated by the DSIM approach and an associated bid will bear a significant extra risk.

The second observation, which can be made, is that CA always outperforms the DSEQ results. Since the CA approach implies perfect alignment of all main stages, this result highlights the cost of decentralization. Clearly, this cost of decentralization depends on the actual sequence employed in the DSEQ approach. It turns out that it is most favorable, when the main stage logistics is allowed to take its decisions first, see columns (5) and (6) in Table 3 and columns (13) and (14) in Table 4. In these settings, the total cost increase by only 0.14% or around 3 millions in comparison to the CA approach. These results highlight the importance of the main stage logistics as a function managing the interfaces between all the productive main stages, even if its actual cost contribution may be small when compared e.g. with the cost in the main stage final assembly. When looking at the other DSEQ sequences, the model suggests to prioritize the main stage body shop over the main stage final assembly, i.e. to let the body shop take its decisions first.

To understand these results, let us compare the decisions taken in the CA approach and different sequences of the DSEQ approach in more detail. We observe some structural properties underlying the cost differences. First of all, individually, each productive main stage prefers to choose its smaller hall. Given the demand, particularly in period 3, this puts some stress on the system due to the induced capacity tightness. Specifically, as it was observed during a closer inspection of the results, the productive main stages shift production forward to an earlier slot, thereby smoothing capacity utilization and reducing capacity adjustment cost. The forward shift in production, particularly in case of the main stage final assembly, increases logistics costs quite severely, due to finished goods holding cost. To a lesser extent, different smoothing patterns between the body shop and final assembly increase logistics costs further through increased inventories of semi-finished products. In contrast, when logistics is the first main stage to take its decisions, it establishes a JIT protocol both for semi-finished and finished products thereby reducing inventory holding cost by synchronizing production between the productive main stages as well as with demand. Given demand, this requires both the body shop and the final assembly to select their larger hall. These changes in the choice of halls are always accompanied by a change in the level of automation: the productive main stages internally trade-off their local infrastructure cost with the investment cost for automation, when deciding their capacity provision. However, the body shop and the final assembly differ in the direction of this adjustment. While final assembly reduces its level of automation when placed in the larger hall, the body shop increases its level of automation in the larger hall. This is due to the structural differences in the two productive main stages. The body shop is highly automated and personnel resources are comparatively inefficient. On the contrary, final assembly is rather labour intensive and personnel resources are relatively more efficient than automation. Overall, the different sequences in the DSEQ approach emphasize the relative importance of one particular cost driver, either capacity provision cost (in terms of choice of hall, choice of level of automation) or inventory holding cost. While prioritizing logistics leads to the smallest cost increase compared with the CA approach, the results show that a more balanced view of the different cost drivers is necessary. Thus, finding the best sequence in the DSEQ approach as well as setting the joint assumptions and premises in a coordinating way, will require a solid understanding of these trade-offs as well as of interface effects between the main stages. Finally, it may also be difficult to establish a certain sequence, when this implies that some main stages have to accept limited decision making power. The analysis of possible incentives resolving this resistance is thus an interesting topic for further research.

6 Conclusion

In this paper we have presented a model for capturing and analyzing the decision making associated with cost estimation for a bid process in the automotive industry. The model variants presented in this paper have been designed to serve two purposes:

-

1.

In terms of managerial insights, they allow to analyze the effects of different decentralized decision mechanisms vis-a-vis a global optimal, centralized approach. Since all of these models induce different restrictions on the decision making process in the individual main stages, the differences in the overall cost estimates provide useful structural insights into the optimal design of the bid process. Through the explicit consideration of uncertainty, combined with the characterization of different risk preferences, the risk associated with a specific total cost estimate can be quantified.

-

2.

In terms of concrete decision support, the general structure of the models can be readily adapted to cover the relationships and cost functions on a more detailed case-specific level. Moreover, through the consideration of the CVaR optimization, mimicking risk aversion, our results provide actual insight into how the strategic decisions should be taken to reduce risk.

Summarizing the key observations made, we can state that the total costs obtained by the simultaneous, decentralized approach can be significantly lower than those returned by the sequential, decentralized approach. However, this cost reduction comes at the disadvantage of solution infeasibilities. The associated result, while appealing during the bid process, may put a significant stress on the processes during the project execution phase, when operational decisions need to be adjusted. The results of the illustrative example further show the potential of an improved coordination between the different main stages at the cost of potential acceptance problems, which may occur through strong interventions during the planning phase in the centralized model. Abstracting from that, our results also highlight the importance of logistics as a function managing the interfaces between the productive main stages. Prioritizing logistics decisions, which themselves may have a small direct influence on cost, may significantly improve the quality of the overall bid.

Notes

The MILP formulation of the problem can be obtained from the authors upon request.

References

Aghezzaf EH, Sitompul C, Najid NM (2010) Models for robust tactical planning in multi-stage production systems with uncertain demands. Comput Oper Res 37(5):880–889. https://doi.org/10.1016/j.cor.2009.03.012

Ahmed S, Shapiro A (2002) The sample average approximation method for stochastic programs with integer recourse. Technical report, Georgia Institute of Technology

Albers S, Krafft M (2000) Regeln zur Bestimmung des fast-optimalen Angebotsaufwands. Z Betr 70(10):1083–1107

Aouam T, Brahimi N (2013) Integrated production planning and order acceptance under uncertainty: a robust optimization approach. Eur J Oper Res 228(3):504–515. https://doi.org/10.1016/j.ejor.2013.02.010

Artzner P, Delbaen F, Eber JM, Heath D (1999) Coherent measures of risk. Math Finance 9:203–228

Borenich A, Greistorfer P, Reimann M, Schafler M, Unzeitig W (2014) Unterstützung des Angebotsprozesses eines Automobilzulieferers durch ein Produktionsmodell mit mehreren Gewerken. In: AKS Zsifkovits HE (ed) Logistische Modellierung. Rainer Hampp Verlag

da Silva C, Figueira J, Lisboa J, Barman S (2006) An interactive decision support system for an aggregate production planning model based on multiple criteria mixed integer linear programming. Omega 34(2):167–177. https://doi.org/10.1016/j.omega.2004.08.007

Fernandes R, Gouveia B, Pinho C (2013) A real options approach to labour shifts planning under different service level targets. Eur J Oper Res 231(1):182–189

Gansterer M (2015) Aggregate planning and forecasting in make-to-order production systems. Int J Prod Econ 170:521–528. https://doi.org/10.1016/j.ijpe.2015.06.001

Gebhard M, Kuhn P (2009) Hierarchische Produktionsplanung bei Unsicherheit, chap. 5, pp. 67–89. Produktion und Logistik. Gabler Verlag

Hanssmann F, Hess S (1960) A linear programming approach to production and employment scheduling. Manag Sci MT–1(1):46–51. https://doi.org/10.1287/mantech.1.1.46

Heigl KM, Rennhak C (2008) Zukünftige Wettbewerbsstrategien für Automobilzulieferer. Chancen und Risiken der dritten Revolution in der Automobilindustrie. ibidem-Verlag, Stuttgart, Deutschland

Holt C, Modigliani F, Simon H (1955) A linear decision rule for production and employment scheduling. Manag Sci 2(1):1–30

Holt C, Modigliani F, Muth J (1956) Derivation of a linear decision rule for production and employment. Manag Sci 2(2):159–177

Lalmazloumian M, Wong KY, Govindan K, Kannan D (2016) A robust optimization model for agile and build-to-order supply chain planning under uncertainties. Ann Oper Res 240(2):435–470. https://doi.org/10.1007/s10479-013-1421-5

Meyr H (2004) Supply chain planning in the German automotive industry. OR Spectr 26(4):447–470. https://doi.org/10.1007/s00291-004-0168-4

Mula J, Poler R, García-Sabater GS, Lario FC (2006) Models for production planning under uncertainty: a review. Int J Prod Econ 103(1):271–285. https://doi.org/10.1016/j.ijpe.2005.09.001

Nam S, Logendran R (1992) Aggregate production planning: a survey of models and methodologies. Eur J Oper Res 61(3):255–272. https://doi.org/10.1016/0377-2217(92)90356-E

Nam S, Logendran R (1995) Modified production switching heuristics for aggregate production planning. Comput Oper Res 22(5):531–541. https://doi.org/10.1016/0305-0548(94)00034-6

Oliff M, Lewis H, Markland R (1989) Aggregate planning in crew-loaded production environments. Comput Oper Res 16(1):13–25. https://doi.org/10.1016/0305-0548(89)90048-8

Peidro D, Mula J, Poler R, Lario FC (2009) Quantitative models for supply chain planning under uncertainty: a review. Int J Adv Manuf Technol 43(3–4):400–420. https://doi.org/10.1007/s00170-008-1715-y

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2(3):21–41

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Finance 26:1443–1471

Schneeweiß C (2003) Distributed decision making. Springer, Berlin

Schultz R (2003) Stochastic programming with integer variables. Math Program 97:285–309

Sillekens T (2008) Aggregierte Produktionsplanung in der Automobilindustrie unter besonderer Berücksichtigung von Personalflexibilität. Ph.D. thesis, Universitat Paderborn, Fakultat fur Wirtschaftswissenschaften, Wirtschaftsinformatik

Sillekens T, Koberstein A, Suhl L (2011) Aggregate production planning in the automotive industry with special consideration of workforce flexibility. Int J Prod Res 49(17):5055–5078. https://doi.org/10.1080/00207543.2010.524261

Volling T, Spengler T (2011) Modeling and simulation of order-driven planning policies in build-to-order automobile production. Int J Prod Econ 131(1):183–193

Wang RC, Liang TF (2005) Applying possibilistic linear programming to aggregate production planning. Int J Prod Econ 98(3):328–341. https://doi.org/10.1016/j.ijpe.2004.09.011

Wyman O (2012) FAST 2025—Massiver Wandel in der automobilen Wertschöpfungsstruktur https://docplayer.org/1744306-Fast-2025-massiver-wandel-in-derautomobilen-wertschoepfungsstruktur.html. Accessed 21 Jan 2019

Acknowledgements

Open access funding provided by University of Graz.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors would like to acknowledge the financial support of the “COMET K2 - Competence Centres for Excellent Technologies Programme” of the Austrian Federal Ministry for Transport, Innovation and Technology (bmvit), the Austrian Federal Ministry of Science, Research and Economy (bmwfw), the Austrian Research Promotion Agency (FFG), the Province of Styria and the Styrian Business Promotion Agency (SFG). We also express our thanks to our supporting industrial and scientific project partners, namely “MAGNA STEYR Fahrzeugtechnik AG & CO KG” and to the Graz University of Technology.

Rights and permissions

OpenAccess This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Borenich, A., Greistorfer, P. & Reimann, M. Model-based production cost estimation to support bid processes: an automotive case study. Cent Eur J Oper Res 28, 841–868 (2020). https://doi.org/10.1007/s10100-019-00608-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-019-00608-1