Abstract

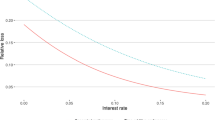

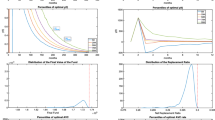

We consider the position of a member of a defined contribution (DC) pension scheme having the possibility of taking programmed withdrawals at retirement. According to this option, she can defer annuitization of her fund to a propitious future time, that can be found to be optimal according to some criteria. This option, that adds remarkable flexibility in the choice of pension benefits, is not available in many countries, where immediate annuitization is compulsory at retirement. In this paper, we address and try to answer the questions: “Is immediate annuitization optimal? If it is not, what is the cost to be paid by the retiree obliged to annuitize at retirement?”. In order to do this, we consider the model by Gerrard et al. in Quant Finance, (2011) and extend it in two different ways. In the first extension, we prove a theorem that provides necessary and sufficient conditions for immediate annuitization being always optimal. The not surprising result is that compulsory immediate annuitization turns out to be sub-optimal. We then quantify the extent of sub-optimality, by defining the sub-optimality cost as the loss of expected present value of consumption from retirement to death and measuring it in many typical situations. We find that it varies in relative terms between 6 and 40%, depending on the risk aversion of the member. In the second extension, we make extensive numerical investigations of the model and seek the optimal annuitization time. We find that the optimal annuitization time depends on personal factors such as the retiree’s risk aversion and her subjective perception of remaining lifetime. It also depends on the financial market, via the Sharpe ratio of the risky asset. Optimal annuitization should occur a few years after retirement with high risk aversion, low Sharpe ratio and/or short remaining lifetime, and many years after retirement with low risk aversion, high Sharpe ratio and/or long remaining lifetime. This paper supports the availability of programmed withdrawals as an option to retirees of DC pension schemes, by giving insight into the extent of loss in wealth suffered by a retiree who cannot choose programmed withdrawals, but is obliged to annuitize immediately on retirement.

Similar content being viewed by others

References

Albrecht P, Maurer R (2002) Self-annuitization, consumption shortfall in retirement and asset allocation: the annuity benchmark. J Pension Econ Financ 1: 269–288

Antolin P, Pugh C, Stewart F (2008) Forms of benefit payment at retirement. OECD working paper on insurance and private pensions No.26, OECD publishing. doi:10.1787/238013082545

Battocchio P, Menoncin F (2004) Optimal pension management in a stochastic framework. Insurance Math Econ 34: 79–95

Blake D, Cairns AJG, Dowd K (2001) Pensionmetrics: stochastic pension plan design and value-at-risk during the accumulation phase. Insurance Math Econ 29: 187–215

Blake D, Cairns AJG, Dowd K (2003) PensionMetrics 2: stochastic pension plan design during the distribution phase. Insurance Math Econ 33: 29–47

Cairns AJG, Blake D, Dowd K (2006) Stochastic lifestyling: optimal dynamic asset allocation for defined contribution pension plans. J Econ Dyn Control 30: 843–877

Charupat N, Milevsky MA (2002) Optimal asset allocation in life annuities: a note. Insurance Math Econ 30

Deelstra G, Grasselli M, Koehl P-F (2003) Optimal investment strategies in the presence of a minimum guarantee. Insurance Math Econ 33: 189–207

Di Giacinto M, Federico S, Gozzi F (2011) Pension funds with a minimum guarantee: a stochastic control approach. Financ Stochast 15: 297–342

Gerrard R, Haberman S, Vigna E (2004) Optimal investment choices post retirement in a defined contribution pension scheme. Insurance Math Econ 35: 321–342

Gerrard R, Haberman S, Vigna E (2006) The management of de-cumulation risks in a defined contribution pension scheme. NAAJ 10(1): 84–110

Gerrard R, Højgaard B, Vigna E (2011) Choosing the optimal annuitization time post retirement. Quant Financ (to appear)

Haberman S, Vigna E (2002) Optimal investment strategies and risk measures in defined contribution pension schemes. Insurance Math Econ 31: 35–69

Kapur S, Orszag JM (1999) A portfolio approach to investment and annuitization during retirement. In: Proceedings of the third international congress on insurance: mathematics and economics, London

Khorasanee MZ (1996) Annuity choices for pensioners. J Actuarial Pract 4: 229–255

Merton RC (1971) Optimum consumption and portfolio rules in a continuous time model. J Econ Theory 3: 373–413

Milevsky MA (1998) Optimal asset allocation towards the end of the life cycle: to annuitize or not to annuitize?. J Risk Insurance 65: 401–426

Milevsky MA, Moore KS, Young VR (2006) Asset allocation and annuity-purchase strategies to minimize the probability of financial ruin. Math Financ 16: 647–671

Milevsky MA, Robinson C (2000) Self-annuitization and ruin in retirement. NAAJ 4: 112–129

Milevsky MA, Young VR (2007) Annuitization and asset allocation. J Econ Dyn Control 31: 3138–3177

Mitchell OS, Poterba JM, Warshawsky MJ, Brown JR (1999) New evidence on the money’s worht of individual. Am Econ Rev 89: 1299–1318

Øksendal B (1998) Stochastic differential equations. Springer, Berlin

Peskir G, Shiryaev AN (2006) Optimal stopping and free-boundary problems. Springer, Berlin

Stabile G (2006) Optimal timing of the annuity purchase: combined stochastic control and optimal stopping problem. Int J Theor Appl Financ 9: 151–170

Wadsworth M, Findlater A, Boardman T (2001) Reinventing annuities. Presented to the Staple Inn Actuarial Society, London

Yaari ME (1965) Uncertain lifetime, life insurance, and the theory of the consumer. Rev Econ Stud 32: 137–150

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors gratefully acknowledge financial support from Carefin—Bocconi Centre for Applied Research in Finance. We also thank Bjarne Højgaard and Raouf Boucekkine for fruitful discussions, and two anonymous referees, whose comments have improved the paper.

Rights and permissions

About this article

Cite this article

Di Giacinto, M., Vigna, E. On the sub-optimality cost of immediate annuitization in DC pension funds. Cent Eur J Oper Res 20, 497–527 (2012). https://doi.org/10.1007/s10100-011-0221-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-011-0221-8