Abstract

We consider the set-up of a Japanese–English auction with exogenously fixed discrete bid levels for a specific game (the wallet game with two bidders, following Gonçalves and Ray in Econ Lett 159:177–179, 2017). We show that in this auction, partition equilibria exist that may be separating or pooling. We illustrate separating and pooling equilibria in games with two and three discrete bid levels and compare the revenues of the seller from these equilibria to find the optimal bid levels for these cases.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Discrete bidding in (English) auctions has been the norm in the real world, although substantial variations in the exact design and characteristics of these auctions are observed in practice. In auctions at Sotheby’s or Christie’s, bidding usually advances between 5 and 10% of the current price level (Rothkopf and Harstad 1994). Cassady (1967) gives examples of auctions in which the bid levels are exogenously given, such as tobacco and livestock auctions in the USA. In wholesale fish markets, ascending or English (Graham 1999, p. 181) and descending or Dutch (Guillotreau and Jiménez-Toribio 2011) electronic auctions are commonly used, where the former (electronically) replicates the traditional oral ascending auctions; known discrete bid increments are a common feature in both these auction types (Carleton 2000, pp. 10–11).Footnote 1 Various online auction sites, such as eBay, have implemented a proxy bidding mechanism, whereby the price level increases automatically (up to the bidder’s stated maximum bid) in known discrete bid increments that depend on the price level (Bajari and Hortaçsu 2004).

This discreteness in bids contrasts with a particular version of the English auction, the so-called Japanese–English Auction (henceforth JEA, commonly known as the clock auction), in which the price of the object increases continuously whilst interested bidders depress a button, and, upon observing the price level, bidders decide to stay (by continuing to press the button) or drop out by releasing the button (Milgrom and Weber 1982). Rothkopf and Harstad (1994) were the first to point out that discrete (rather than continuous) bid levels could affect English auction strategies and outcomes.Footnote 2 Recently, Tukiainen (2017) provided empirical evidence from online English auctions (using a field experiment) supporting this view.

We propose to incorporate this feature of real world English auctions in a common value JEA. The set-up in this paper (as originally presented in Gonçalves and Ray 2017) is the same as the usual JEA except that the price goes up in discrete commonly known bid levels. In our game, as in the usual JEA, if a bidder wants to drop out, all he has to do is release the button. The final auction price is equal to the highest bid level at which at least one bidder was active.

There are real-life examples that (sort of) fit the above set-up. Bidding at the online auction site QXL was quite similar to our model: the price went up in predetermined increments and if bids were not a multiple of that increment, then the bid was rounded down to the closest multiple of the increment. QXL bidding increments depended on the bid value; for example, for bids in the \(\pounds 2.50{-}\pounds 9.99\) range, the bid increment was \( \pounds 0.10\) while for bids in the \(\pounds 10{-}\pounds 99.99\), it was \( \pounds 1.00\) and so on.

In the recent past, English auctions with predefined discrete bid levels have been analyzed in different contexts (Rothkopf and Harstad 1994; Yu 1999; Harstad and Rothkopf 2000; Sinha and Greenleaf 2000; Cheng 2004; David et al. 2007; Rogers et al. 2007; Isaac et al. 2007). For example, Yu (1999), in a private value setting with discrete bid increments, found multiple equilibria: depending on whether bidders’ valuations are above (or below) certain thresholds, bidders choose different (equilibrium) strategies. Several other authors have looked into the role of discrete bids in other auction types: Li et al (2011, 2013, 2018) for Dutch auctions; Mathews and Sengupta (2008) and Sandoval (2014) for second-price sealed bid auctions and Rasooly and Gavidia-Calderon (2021) for first- and second-price sealed bid auctions as well as all-pay auctions. However, we note that the existing (above-mentioned) literature on discrete bids for single object auctions has focused entirely on private value environments; virtually nothing has been done for the common value model. There is a vast literature on both multi-object and multi-unit auctions, some of which considers discrete bidding (see, for example, Brusco and Lopomo 2002; Ausubel 2004; Engelbrecht-Wiggans and Kahn 2005). However, this literature also mainly refers to private values; for example, Ausubel (2004) modeled the auction increments through a price clock with either integer (steps) or continuous increases. Interestingly, and of relevance to our paper, Ausubel (2004) used discrete increments only in the private values case while the proposed (novel) ascending auction under an interdependent value formulation (a generalization of both the private and common value models) is analyzed under continuous bid increments.

We use the so-called “wallet game” with two bidders (in which the common value of the good is simply the sum of two private signals, the amounts in the “wallets” of each bidder), introduced by Klemperer (1998), as our background common value model to theoretically analyze a JEA with discrete bid levels. Klemperer (1998) illustrated that bidding twice the individual (private) signal forms the unique symmetric (Bayesian-Nash) equilibrium in this game. However, with discrete bid levels, Gonçalves and Ray (2017) proved that one cannot construct a symmetric equilibrium using strategies analogous (in a discrete bids’ environment) to bidding twice the private signal. Moreover, following the seminal experiment by Avery and Kagel (1997) on a continuous-bid JEA based on the wallet game, Gonçalves and Hey (2011) experimentally looked at the role of discrete bids in such an environment; however, there has been no attempt to theoretically analyze the equilibria for this game apart from the recent contribution by Gonçalves and Ray (2017). Following their work, we are now taking the first step to theoretically characterize the set of equilibria for the wallet game in a JEA with exogenously specified discrete bid levels.

In this paper, we show that (symmetric) partition equilibria, involving weakly increasing strategies based on elements of a partition of the signal space, exist for the wallet game in a JEA with discrete bid levels. Such partition equilibria may be pooling or separating (depending on the number of partitions). We illustrate several such equilibria with only two or three discrete bid levels and find the necessary conditions that support them. These equilibria, however, yield a lower expected revenue for the seller than in the case of a continuous JEA. Despite this, we further show that a revenue-maximizing second-best solution for this set-up exists; that is, the seller may choose these bid levels optimally to maximize the revenue, although it can never achieve the expected revenue of a continuous JEA (first-best).

These results are, in our opinion, interesting and novel from a theoretical viewpoint, but are also of practical interest for real world auctions. First, our partition equilibria with discrete bid levels suggest that (expected) seller’s revenue may be lower than in a continuous JEA—a result which is similar to that obtained by Rothkopf and Harstad (1994) in a private values environment. However, by adequately choosing both the number and the values of discrete bid levels, the seller may minimize this loss. Moreover, we find that expected revenue is higher in a separating equilibrium than in any of the pooling equilibria (although lower in both cases than expected revenue in the continuous JEA), suggesting that auctioneers would prefer the former to be played, as it minimizes the loss vis-a-vis the continuous JEA. Naturally, the seller also benefits from discrete bid levels in ways that our model does not capture. For instance, the auction speed may be higher, and this is an important variable to consider when auctioning certain goods. In addition, by definition, JEA preclude the possibility of jump-bidding equilibria, which could hurt the auctioneer (Avery 1998; Isaac et al. 2007).

Second, the (symmetric) partition equilibria that we find may appear to be complex in the way they are calculated, but they do point to very simple rule-of-thumb strategies that bidders may resort to: for example, with two discrete bid levels, a bidder would bid high if the signal is higher than a threshold; otherwise bid low. The experimental literature on ascending auctions presents multiple (similar in nature) examples of simple strategies that are actually played (for instance, see Kagel 1995; Kagel and Levin 2016). Although in most of those cases, such strategies are not equilibrium strategies, our partition equilibria strategies would be. In that context, our results may, in a way, bridge the divide between the theoretical and the experimental work on ascending auctions.

In summary, from an auction design viewpoint, our research points out what the implications are of using a specific set of bid levels and how a seller should optimally manipulate it, although the multiplicity of equilibria (especially when pooling and separating equilibria coexist) may hinder those efforts. In addition, one may be interested in finding the optimal number of bid levels for such an auction. Our simulation on three bid levels suggests that the optimal number of bid levels (to maximize the seller’s revenue) is perhaps small.

2 Model

We consider the wallet gameFootnote 3 with two symmetric risk-neutral bidders, \(i\in \left\{ 1,2\right\} \), bidding for one single good with common value, \(\tilde{V}\). Each of the two bidders receives an independent and uniformlyFootnote 4 distributed private signal \(x_{i}\sim U\left( 0,1\right) \), \(i=1,2\). The (ex ante) unknown common value of the good is the sum of the two signals: \(\tilde{V} =x_{1}+x_{2}\).

We analyze a JEA for this game, with some exogenously fixed discrete bids that are the elements of the set \(A=\left\{ a_{1},\ldots ,a_{k}\right\} \), with \( 0<a_{1}<\cdots<a_{k}<2\), \(k\ge 2\) a finite integer; A is common knowledge to the bidders. We denote a typical bid level by \(a_{j}\), for \(j=1,\ldots ,k\), with the implicit assumption that \(a_{0}=0\) and \(a_{k+1}=2\), for notational convenience. The price in the JEA goes up in levels in the set A, starting from \(a_{1}\) and ending at \(a_{k}\). The final price is equal to the highest bid level at which at least one bidder was active. Therefore, for any \( j=1,\ldots ,k-1\), if one bidder is active at \(a_{j}\) but not at \(a_{j+1}\) while his opponent is active at \(a_{j+1}\), then the latter wins the auction and pays a price equal to \(a_{j+1}\); if both bidders are active at \(a_{j}\), but not at \(a_{j+1}\), then the auction winner is decided at random with equal probabilities and the final price is \(a_{j}\); finally, if both bidders are active at the last bid level \(a_{k}\), the winner will be chosen at random with equal probabilities and will pay the price \(a_{k}\).

The net payoff to the winner is the realized value of \(x_{1}+x_{2}\) minus the price to pay while the payoff to the loser is 0. If no bidder is active at \(a_{1}\), then the auction ends immediately with zero payoff to each bidder. This JEA for the wallet game with k bid levels (\( a_{1},..,a_{k}\)) will henceforth be called \(G_{k}\).

In this paper, we restrict attention to dynamic strategies that are history independent. In particular, players choose a drop-out bid level as a function of the signal. Given a signal \(x\in \left( 0,1\right) \), a bidding strategy for a player in \(G_{k}\) is to choose either 0 (which implies that the bidder is not active even at \(a_{1}\)) or a bid level \(a_{j}\) so that the bidder will be active at \(a_{j}\) but not at \(a_{j+1}\), where \(j=1,\ldots ,k\) (with \(a_{k+1}=2\)). A typical strategy thus can be denoted by \(\sigma =b(x)\), where, \(b(x)\in \{0,a_{1},\ldots ,a_{k}\}\) implying that the player with signal x is active until b(x). We focus on a specific subset of the strategy sets in \(G_{k}\) using the following assumption.

Assumption 0 Bidder’s strategy set is restricted to a set of drop-out functions that are weakly increasing step functions b(x), where \(b(x)\in \{0,a_{1},\ldots ,a_{k}\}\).

Our strategies thus divide the domain of signals, \(\left( 0,1\right) \), into \((l+1)\) subintervals or elements of a partition using l (\(\ge 1\)) many cutoff signals. The JEA for the wallet game with k bid levels (\( a_{1},..,a_{k}\)), with weakly increasing partitionFootnote 5 strategies only, is our baseline game, called \(G_{k}^{0}\).

3 Results

We focus on the strategies under Assumption 0 in \(G_{k}^{0}\), with \(k\ge 2 \).

Definition 1

For any \(k\ge 2\), \(l\le k-1\), a strategy with l many cutoffs is called separating if \(l=k-1\). For \(k>2\), a strategy with l many cutoffs is called poolingFootnote 6 if \(1\le l<k-1\).

In \(G_{k}^{0}\), where \(k>2\), a separating strategy uses \(k-1\) cutoffs (\( x_{1}^{*},\ldots ,x_{k-1}^{*}\)) and thereby k partitions; it can be writtenFootnote 7 as:

In \(G_{2}^{0}\), with 2 bid levels (\(a_{1},a_{2}\)) and one cutoff \(x^{*} \), a separating strategy \(\sigma \) can be written as: \(\sigma =\) \(a_{1}\) if \(x\le x^{*}\) and \(a_{2}\) otherwise. Similarly, one may formally express any pooling strategy, with \(k>2\), using l (\(<k-1\)) cutoffs.

We analyze symmetric equilibria (in which both bidders play the same partition strategy) only, for the game \(G_{k}^{0}\), with \(k\ge 2\), in the rest of our paper.

Definition 2

A symmetric partition strategy profile for any game \(G_{k}^{0}\), with \( k\ge 2\), is called a symmetric partition equilibrium if it is a Bayesian-Nash Equilibrium (BNE) of the game, i.e., each bidder is playing optimally given the strategy of the other player.

We first characterize our separating equilibria. Clearly, one has to use the expression for the expected payoff for a bidder i, \(u_{i}\left( \sigma _{1},\sigma _{2}\right) \), in such a characterization. In what follows, in the rest of the paper, we abuse notations slightly for all these expected payoffs and write it in terms of the bid level a player is active until, given the signal x. For example, the expected payoff of bidder 1, \( u_{i}\left( \sigma _{1},\sigma _{2}\right) \), when bidder 1’s strategy \( \sigma _{1}=b(x_{1})=a_{1}\), is denoted by \(u_{1}\left( a_{1},\sigma _{2}\right) \).

Lemma 0. In \(G_{k}^{0}\), a symmetric separating strategy profile \(\left( \sigma _{1},\sigma _{2}\right) \) each with \(k-1\) cutoffs (\(x_{1}^{*},\ldots ,x_{k-1}^{*}\)) is a symmetric separating equilibrium if and only if all of the following conditions are satisfied.

(i) \(\left. u_{1}\left( a_{j},\sigma _{2}\right) \right| _{x_{1}=x_{j}^{*}}=\left. u_{1}\left( a_{j+1},\sigma _{2}\right) \right| _{x_{1}=x_{j}^{*}},\) \(j=1,\ldots ,k-1\).

(ii) \(u_{1}\left( a_{1},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \(x_{1}\le x_{1}^{*},\) \(h>1\).

\((iii)\ u_{1}\left( a_{k},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \(x_{1}>x_{k-1}^{*},\) \(h<k\).

(iv) \(u_{1}\left( a_{j},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \(x_{j-1}^{*}<x_{1}\le x_{j}^{*},\) \(j=2,\ldots ,k-1,\) \( h\ne {j}\), only for \(k>2\).

\((v)\ u_{1}\left( a_{1},\sigma _{2}\right) \ge u_{1}\left( 0,\sigma _{2}\right) =0\) if \(x_{1}\le x_{1}^{*}\).

(vi) \(0<x_{1}^{*}<\cdots<x_{k-1}^{*}<1\).

The proof of Lemma 0 just uses standard BNE conditions: participation constraint, incentive constraints and indifference conditions at all the cutoffs.Footnote 8 The explicit proof can be found in the Appendix.

Unfortunately, it is extremely difficult to analytically solve the set of constraints in Lemma 0 and thereby find all partition equilibria for \(G_{k}^{0}\), particularly when k is not small. The analysis is understandably easier for \(G_{2}^{0}\) or \(G_{3}^{0}\); the case of \(G_{2}^{0}\) is presented in the next subsection.

Following Lemma 0, one may also characterize a (symmetric) pooling equilibrium for any specific values of k and l. We do so, later in this paper, for \(G_{3}^{0}\) with \(l=1\), and provide new lemmata for such equilibria.

3.1 Equilibrium in \(G_{2}^{0}\)

Consider any given \(G_{2}^{0}\). Let us denote the bid levels by L (low) and H (high); that is, \(k=2\) with \(a_{1}=L\) and \(a_{2}=H\). A separating strategy for this game can be written in terms of a cutoff signal \(x^{*}\), \(0<x^{*}<1\):

We use the superscript ‘2S’ to identify the number of discrete bid levels in the game (‘2’) and ‘S’ to denote a separating strategy. The proof of the following proposition is in the Appendix.Footnote 9

Proposition 0. (i) For any L and H, satisfying \(L<\frac{1}{2}\) and \(L+\frac{1}{2}<H<\frac{3}{4}+\frac{L}{2}\), the separating strategy \( \sigma ^{2\,S}\), with \(x^{*}=\frac{2H-1}{2\left( 1+L-H\right) }\), is the unique symmetric (Bayesian-Nash) equilibrium of \(G_{2}^{0}\); seller’s expected revenue is maximized when \(L^{*}=1/4\) and \(H^{*}=3/4\), with \(x^{*}=1/2\) and \(R^{2S^{*}}=5/8\).

(ii) When \(H<1/2,\) the unique symmetric equilibrium is for both players to play H regardless of their signal.

(iii) For L and H such that \(H>\frac{3}{4}+\frac{L}{2}\), the unique symmetric equilibrium is for both players to play L regardless of their signal.

Note that in (i) of Proposition 0, \(L<\frac{1}{2}\) and \(L+\frac{1}{2}<H<\frac{3}{4}+\frac{L}{2}\) together implies \(H<1\). As noted in the proof of Proposition 0, whenever the symmetric separating equilibrium \(\sigma ^{2S}\) is played, the seller’s expected revenue is \(R^{2\,S}=\frac{L+4LH-4LH^{2}+3H-4H^{2}+4HL^{2}}{4\left( 1+L-H\right) ^{2}}\). We observe that \(R^{2\,S}\) is lower than the revenue in a JEA with continuous bids, where each bidder stays active up to twice her signal (that is, \(b^{*}\left( x_{i}\right) =2x_{i}),\) given by \(E\left[ P^{JEA}\right] =2/3\) (see Avery and Kagel 1997).

Figure 1 displays this result, which is similar to that obtained by Rothkopf and Harstad (1994, Proposition, p. 575) in a private values setting (insofar as the revenue from a discrete bid auction is lower than in its continuous counterpart). Although \(G_{2}^{0}\) yields ‘lost revenue’ compared to the continuous case, Proposition 0 provides the second-best solution for which \(R^{2S^{*}}=5/8\). In this second best solution, “the loss of revenue” compared to the JEA with continuous bids is approximately 6.3%. It is, although significantly higher than zero, not very high in percentage terms.

3.2 Pooling equilibria in \(G_{3}^{0}\)

In the rest of the paper, we find results for \(G_{3}^{0}\) to be a good illustration of the type of equilibria that may emerge in \(G_{k}^{0}\), with \( k>3.\) In the game with three bid levels, one may test three strategy profiles that are obvious possible candidates to pooling equilibria, by checking whether they satisfy the equilibrium conditions. We denote each of them with superscript ‘3P’ as ‘3’ refers to the number of discrete bid levels in the game and ‘P’ denotes pooling equilibrium.

Below, we state and prove that all three candidate strategy profiles constitute an equilibrium for this game under certain conditions on the bid levels, each as a proposition. Moreover, we find the best possible bid levels that maximize the seller’s revenue in each case.

Each of these propositions relies on the characterization of a pooling equilibrium in this set-up; we state the corresponding characterization result as a lemma in each case. The proofs of the three lemmata follow steps similar to those used in the proof of Lemma 0 and are thus omitted. The proofs of the propositions have been relegated to the Appendix.

Let us start with the following partition strategy:

Clearly the above strategy is a pooling strategy. Intuitively, this strategy may emerge naturally if one bidder believes the other bidder will not use H (and these beliefs would be consistent in equilibrium). For instance, M could be significantly distant from H, leading one player to believe that H may not be used in equilibrium.

Lemma 1

In \(G_{3}^{0}\), the partition strategy \(\sigma ^{3P_{1}}\) (with some \( x^{*}\)) is a symmetric pooling equilibrium if and only if all of the following conditions are satisfied:

It is now easy to state and prove our first proposition of this subsection, using the above lemma.

Proposition 1

For any L, M and H satisfying (i) \(L<\frac{1}{2},\) (ii) \(L+\frac{1}{2}\le M<\frac{3}{4}+\frac{L}{2}\), and (iii) \(H\ge \frac{3}{4}+ \frac{M}{2}+\frac{2M-1}{8\left( 1+L-M\right) },\) the partition strategy \( \sigma ^{3P_{1}}\), with \(x^{*}=\frac{2M-1}{2\left( 1+L-M\right) }\), constitutes a symmetric pooling equilibrium of \(G_{3}^{0}\); seller’s expected revenue from such an equilibrium is maximized when \(L^{*}=1/4\), \(M^{*}=3/4\) and \(H^{*}\ge 5/4\), with \(x^{*}=1/2\) and \( R^{3P_{1}^{*}}=5/8\).

Consider our second pooling partition strategy profile \((\sigma ^{3P_{2}},\sigma ^{3P_{2}})\), where,

In this partition strategy, the bid level M is not used. Such (consistent in equilibrium) beliefs could emerge naturally if M and H are sufficiently close to one another, thus rendering dropping out at M rather useless (in terms of expected payoffs) compared to the alternative of dropping out at H (and ending the auction); or when L and M are sufficiently close, again rendering dropping out at M ineffective (in terms of expected payoffs) vis-a-vis L.

Lemma 2

In \(G_{3}^{0}\), the partition strategy \(\sigma ^{3P_{2}}\) (with some \( x^{*}\)) is a symmetric pooling equilibrium if and only if all of the following conditions are satisfied:

Proposition 2

For any L, M and H satisfying (i) \(L<1/2,\) (ii) \(H>1/2,\) (iii) \(\frac{1-2H+4L^{2}+4L+4LH}{8L}\le M<\frac{3}{4}+\frac{L}{2},\) and (iv) \(M\ge \frac{2L+2H-1}{4},\) the partition strategy \(\sigma ^{3P_{2}}\), with \(x^{*}=\frac{2H-1}{2\left( 1+L+H-2M\right) }\), constitutes a symmetric pooling equilibrium of \(G_{3}^{0}\); seller’s expected revenue from such an equilibrium is maximized when \(L^{*}=1/4\) and \(M^{*}=9/8-H^{*}/2\), yielding \(x^{*}=1/2\) and \(R^{3P_{2}^{*}}=5/8\).

Finally, we consider the following pooling partition strategy:

In this pooling strategy the bid level L is not used. This could be portrayed as a belief (which is consistent in equilibrium) that dropping out at L is unlikely to occur because the next best alternative—M—is better from an expected payoff viewpoint. For instance, this may occur when L and M are fairly close to one another or when L is particularly low and M is somewhat distant from it.

Lemma 3

In \(G_{3}^{0}\), the partition strategy \(\sigma ^{3P_{3}}\) (with some \( x^{*}\)) is a symmetric pooling equilibrium if and only if all of the following conditions are satisfied:

Proposition 3

For any L, M and H satisfying (i) \(1/2<H<1\) and (ii) \( 2H-3/2<M\le H-1/2,\) the partition strategy \(\sigma ^{3P_{3}}\), with \( x^{*}=\frac{2H-1}{2\left( 1+M-H\right) }\), constitutes a symmetric pooling partition equilibrium of \(G_{3}^{0}\); seller’s expected revenue from such an equilibrium is maximized when \(M^{*}=1/4\) and \(H^{*}=3/4 \), with any \(L<1/4\), yielding \(x^{*}=1/2\) and \(R^{3P_{3}^{*}}=5/8\).

These multiple equilibria emerge because of the interplay between beliefs and the bid levels themselves. Observe that \(R^{3P_{1}^{*}}=R^{3P_{2}^{*}}=R^{3P_{3}^{*}}=R^{2\,S^{*}}\). Also, note that pooling equilibria \(3P_{1}\) and \(3P_{3}\) are analogous to equilibrium 2S in the two bid level case (Sect. 3.1): in either of those two equilibria, one of the ‘extreme’ bid levels (either the highest bid level in equilibrium \(3P_{1}\) or the lowest bid level in equilibrium \( 3P_{3}\)) is not played in equilibrium. Therefore, notice that the expression for \(x^{*}\) in both those equilibria is very similar to that obtained for equilibrium 2S (with two bid levels).

One may illustrate the above three propositions using a graphical analysis. A closer look at the pooling equilibrium conditions of Propositions 1, 2 and 3 allows us to identify, graphically, parameter regions for these equilibria to hold. Figure 2 displays, for three values of L—\(L=1/10,\) \(L=1/4\) and \(L=2/5\)—the boundaries of the range of values for M and H that support each pooling equilibrium. In the first panel, we identify the expressions in Propositions 1, 2 and 3 that correspond to each boundary.

Given the results of this subsection, note that the revenue-maximizing bid levels may not coincide with the values of L we have considered in each plot and, naturally, will not appear in all the plots of Fig. 2. Pooling equilibrium 1 \((\sigma ^{3P_{1}})\) holds for values of M and H in the area bounded by the green/light brown lines in Fig. 2; the light brown line is the revenue maximizing bid level choice for this equilibrium which, as Proposition 1 points out, involves having \(L=1/4.\) For this reason, the revenue-maximizing choice of pooling equilibrium 1 only appears in the second panel (where \(L=1/4),\) and not in the other two panels. Pooling equilibrium 2 \((\sigma ^{3P_{2}})\) holds in the area bounded by the black/red lines; the red line is the revenue maximizing bid level choice for this equilibrium. As Proposition 2 shows, this revenue-maximizing choice occurs when \(L=1/4;\) therefore, it only appears in the second panel, with \(L=1/4.\) Finally, pooling equilibrium 3 (\(\sigma ^{3P_{3}}\)) holds in the area inside the blue triangle; the brown point is the revenue maximizing bid level choice of this equilibrium and, as Proposition 3 demonstrates, this requires \(L<1/4.\) Out of the three values of L for which we have plotted the equilibria regions in Fig. 2, only \(L=1/10\) satisfies this condition and, therefore, this revenue-maximizing bid level choice only appears in the first panel (where \(L=1/10)\).

Analytically, it is possible to find values of the bid levels such that both pooling equilibria \(\sigma ^{3P_{1}}\) and \(\sigma ^{3P_{2}}\) exist simultaneously, as well as \(\sigma ^{3P_{2}}\) and \(\sigma ^{3P_{3}},\) as inspection of Fig. 2 confirms. Consider the first case: suppose \(L=0.1,\) \(M=0.7\) and \(H=1.5.\) On the one hand, these bid levels may induce beliefs consistent with \(\sigma ^{3P_{1}},\) because H is very distant from M, thus making it plausible to believe that H may not be played in equilibrium (and this belief is indeed consistent with \(\sigma ^{3P_{1}}).\) On the other hand, M is closer to L than it is to H, thus making it plausible that bidders believe dropping out at M to be less appealing (in terms of expected payoffs) than dropping out at either L or H. We close this subsection with the following example in which two pooling equilibria exist.

Example 1

Take a \(G_{3}^{0}\) with \(L=1/4\), \(M=4/5\) and \(H=3/2\), satisfying the conditions of Proposition 1 as well as of Proposition 2. In this game, we have two different pooling equilibria, \(\sigma ^{3P_{1}}\) and \(\sigma ^{3P_{2}}\), characterized by two different cutoffs, respectively, 2/3 and 20/23. First, in the symmetric pooling partition equilibria \(\sigma ^{3P_{1}}\), each bidder is active at L (but not at M or H) when the signal is less than or equal to 2/3 and active at M when the signal is larger than 2/3. Bidder i’s payoff, \(u_{i}\), from this equilibrium strategy profile is given by \(u_{i}=\frac{1}{3}x_{i}+\frac{1 }{36}\) if \(x_{i}\le 2/3\) (in which case bidder i plays L) and \(u_{i}= \frac{5}{6}x_{i}-\frac{1}{36}\) if \(x_{i}>2/3\) (in which case bidder i plays M). Second, in the symmetric pooling partition equilibria \(\sigma ^{3P_{2}},\) each bidder is active at L (but not at M or H) when the signal is less than or equal to 20/23 and active at H when the signal is larger than 20/23. Bidder i’s payoff, \(u_{i}\), from this equilibrium strategy profile is given by by \(u_{i}=\frac{10}{23}x_{i}+\frac{85}{1058}\) if \(x_{i}\le 20/23\) (in which case bidder i plays L) and \(u_{i}=\frac{43 }{46}x_{i}-\frac{375}{1058}\) if \(x_{i}>20/23\) (in which case bidder i plays H). One may compare these two equilibria by their ex-ante expected payoffs (for each bidder i) that are respectively \(\frac{2}{9}\) (\(=0.222\)) for \(\sigma ^{3P_{1}}\) and \(\frac{639}{2116}\) (\(=0.302\)) for \(\sigma ^{3P_{2}}\); hence, the equilibrium \(\sigma ^{3P_{2}}\) is better for the bidders.

3.3 Separating equilibria in \(G_{3}^{0}\)

One may be interested in constructing a separating equilibrium for any given \(G_{3}^{0}\). Following Definition 1 and Lemma 0, a separating strategy for \(G_{3}^{0}\) with three bid levels, L, M and H can be written using two cutoffs \( x^{*}\) (\(=x_{1}^{*}\)) and \(y^{*}\) (\(=x_{2}^{*}\)) as (we use the superscript ‘3 S’ to identify the number of discrete bid levels in the game—‘3’—and ‘S’ to denote separating equilibrium):

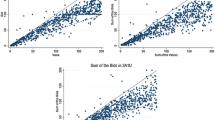

From Lemma 0, we can construct a symmetric separating equilibrium using the above strategy. However, this computation needs to be carried out numerically, as no analytical solution can be found. We proceed in the following way. For given values of L, M and H, we simulate, numerically, the equilibrium values of \(x^{*}\) and \(y^{*}\), for three levels of L: \(L=1/10,\) \(L=1/4\) and \(L=2/5.\) For a given level of L, we then (iteratively) assume values for the other two bid levels, such that \( L<M<H\), and find the equilibrium values of \(x^{*}\) and \(y^{*}\). The simulation is carried out in 0.025 increments for values of M and H above L and below 2 such that \(L<M<H\). Figure 3 displays the parameter region for a separating equilibrium to exist. This is given by the shaded area. In other words, when we fix the level of L and then vary M and H (in such a way that \(L<M<H)\), the shaded area depicts the bid level combinations that satisfy all equilibrium conditions.

An interesting special case is that of ‘equally distanced bids’. This may have two different meanings: (i) three equally distanced bid levels that partition the [0, 2] interval in 4 equally sized segments; or (ii) three equally spaced bid levels that partition the [0,2] interval in less than 4 equally sized segments. The only possible bid levels that satisfy (i) are \( L=1/2\), \(M=1\) and \(H=3/2\). Several bid level combinations satisfy (ii): for example, \(L=1/3\), \(M=2/3\) and \(H=1\) (which generates 3 equally sized segments in the [0, 2] interval) or \(L=2/5\), \(M=3/5\) and \(H=4/5\) (which generates 2 equally sized segments in the [0, 2] interval). With respect to (i), it is straightforward to confirm that these bid levels do not generate a pooling equilibrium, as they do not satisfy the conditions put forward by Propositions 1, 2 and 3. Inspection of Fig. 3 shows that a separating equilibrium does not exist for these bid levels either.

Consider case (ii) now. Suppose the difference between all bid levels is a constant \(\delta \), that is, \(H-M=M-L=\delta .\) We have plotted these bid levels in Fig. 3 as a straight line segment which we define as ‘equally distanced bids’. Note that for all three cases in Fig. 3, a range of values for \(\delta \) supports a separating equilibrium. In fact, we found that whenever \(1/2<\delta <3/4,\) there always exists a range of values of L which supports a separating equilibrium. For instance, when \(\delta =0.6,\) we found that any \(L<3/10\) supports a separating equilibrium; therefore, the ‘equally distanced bids’ line crosses the shaded area in the first and second panels of Fig. 3 (\(L=1/10\) and \(L=1/4),\) but not in the third panel (where \(L=4/10,\) in which case \(M=1\) and \(H=1.6\) would be the bid levels consistent with \(\delta =0.6).\)

Note that the separating equilibrium is supported by bid levels that also support pooling equilibria 1 and 2 (intersection of the shaded area, the area bounded by the green/light brown lines and the area bounded by the black/red lines) or only pooling equilibrium 2. For low values of L (e.g., \(L=1/10\)), the separating equilibrium support region also overlaps partially with that of pooling equilibrium 3. In other words, whenever the separating equilibrium exists, it coexists with at least one pooling equilibrium. The reverse, however, is not true: there exist bid levels which support at least one pooling equilibrium, but not a separating equilibrium.

It is not possible to analytically find the revenue maximizing choice of bid levels for the auctioneer. However, through our simulations, we uncover a novel result. First, assume that the auctioneer cannot freely choose one of the bid levels. For simplicity, assume that L is, for some reason, fixed. Under those circumstances, one can obtain the revenue maximizing choices of M and H for each of the (three) pooling and (multiple) separating equilibria, that is, the choice of M and H (for a given L) that satisfies all equilibrium conditions and that yields the maximum revenue. Figure 4 displays the maximum revenue levels that can be obtained in each of the three pooling equilibria as well as among the multiple separating equilibria for a given L.

Interestingly, note that for a given L (that by our assumption the auctioneer cannot freely change), the separating equilibrium generates a higher revenue than any of the pooling equilibria. In other words, although restricted in his choice (because L cannot be freely chosen), the auctioneer strictly prefers to choose bid levels for M and H that elicit a separating equilibrium. It is also important to note, however, that these revenue-maximizing bid levels in the separating equilibrium are located in a region in Fig. 3 where both pooling equilibrium 2 and the separating equilibrium can coexist (as well as pooling equilibrium 3 for relatively low values of L). Therefore, a “multiple-equilibria” problem arises and actual revenue will depend on which equilibrium will be played.

If the auctioneer had no such restrictions on the choice of bid levels, then Fig. 4 also shows the absolute maximum revenue that can be attained in the separating equilibrium, which, naturally, is higher than the maximum revenue attainable in any of the pooling equilibria. This is achieved when \(L\simeq 0.16665,\) \(M\simeq 0.499975\) and \(H\simeq 1.055525\). Revenue is approximately 0.648. This value can be compared with the maximum possible revenue under any of the pooling equilibria with three bid levels or the separating equilibrium with two bid levels (0.625) and the maximum revenue under a JEA with continuous bid increments (\(2/3\simeq 0.667\); see Avery and Kagel 1997). Therefore, the highest possible revenue is obtained through a JEA with continuous bid increments, followed by a separating equilibrium with three bid levels and the lowest revenue is obtained through any of the pooling equilibria with three bid levels or the separating equilibrium with two bid levels. In a nutshell, we obtain a result that is similar to that of Rothkopf and Harstad (1994, Proposition, p. 575) in a private values setting, insofar as the revenue from a discrete bid level auction is lower than its continuous counterpart. However, the ‘lost revenue’ compared to the continuous case JEA is significantly lower if the auctioneer can elicit a separating equilibrium.

It is perhaps intuitive that a separating equilibrium generates the highest expected revenue, as it is consistent with the ideas that, in equilibrium, (i) more information is better (no information is disregarded) and (ii) a bidder’s (consistent) belief is that their opponent is using all the available information. In the face of this, we conjecture that more discrete bid levels (and therefore a finer partition) may lead to even higher expected revenues in a separating equilibrium, thus approaching the continuous JEA.

4 Conclusion

In a JEA for the wallet game with continuous bid levels, we have shown that a partition equilibrium based on cutoffs in signals exists where the bidders use only weakly increasing partition strategies. We have characterized these equilibria that can be pooling or separating. We illustrated a few such equilibria with two and three discrete bid levels. Under our partition equilibrium, seller’s expected revenue is strictly lower than that of the continuous JEA; the seller can, however, optimally choose the bid levels to maximize the expected revenue. In this second best solution, the ‘loss of revenue’ compared to the JEA with continuous bid increments is not very high in percentage terms and it is the lowest under a separating equilibrium. Our paper thus provides some understanding of how bid levels could be optimally chosen by the seller, having fixed the number of bid levels.

The rationale behind our result is relatively straightforward: given discrete bid levels, the partition equilibrium leads the players to bid up to the lowest discrete bid level ‘too’ often, and that reduces the expected revenue compared to the continuous bidding JEA. With continuous bid levels, the players can easily infer (from the equilibrium strategies) their opponent’s signal and thus accurately calculate their payoff. However, with discrete bid levels, such an accurate inference is no longer possible and bidding up to the low bid level more often provides a ‘safety net’ under such “uncertainty”.

Our construction of equilibrium is somewhat similar to the recent work by Ettinger and Michelucci (2016a) and Hernando-Veciana and Michelucci (2018) in a different environment: these results are all related to a type of bunching which is endogenously determined (in their papers, by jump bids or by the choice of a 2-stage mechanism while in our work by the choice of the bid levels). Also, Ettinger and Michelucci (2016b) analyze a simple example in which partitions can be induced by jump bidding (Proposition 4 in their paper).

Needless to add, it is certainly an interesting question whether a general result for the set of equilibria can be obtained in the games analyzed in this paper for more than three bid levels. Future research could characterize the set of all such partition equilibria for any number of discrete bids and other (non-partition) equilibria, if any. However, our framework suggests that this is inherently a rather complex task and the nature of the results that could emerge from such an endeavor could be well captured by our model with three exogenous and discrete bid levels.

JEA with discrete bids may present other advantages to the auctioneer or to the bidders, such as reducing the duration or an easier understanding of the rules, issues that are particularly important in online auctions. Thus, it may very well be the case that it becomes an even more attractive auction format in the future, in which case more analysis should be devoted to this format than its continuous bid counterpart.

Whether our partition equilibria are played is also a question well-suited for experimental testing. In a very simple set-up, with two or three discrete bid levels, although multiple (separating or pooling) equilibria exist, our analysis provides helpful indications regarding equilibrium selection.

Finally, our discrete JEA setup diverges to a significant extent from the concept of a second-price auction: whilst in a continuous JEA, the final auction price would be approximately equal to the drop-out price of the second highest bidder, that is not the case in our discrete JEA. Therefore, an interesting research question is whether in a common value discrete bid second-price sealed bid auction we can also find equilibria, pooling or separating, that are similar in nature to those we obtain for the discrete JEA.Footnote 10 This line of research would extend to a common value environment the work of Mathews and Sengupta (2008) and Sandoval (2014) in a private values setting. These are likely to be the next steps in our future research.

Notes

For example, in the Looe wholesale fish auction (UK), the increments are anywhere from 1p to 5p or 10p and sometimes different increments are used for different species during the same auction session.

To the best of our knowledge, the seminal reference for discrete bids is Chwe (1989), who looked at its role in first-price auctions.

Details of this game can be found in Gonçalves and Ray (2017).

We take the uniform distribution as it is easier to analyze; however, any other specific distribution could have been considered.

In the rest of the paper, we (ab)use the word “partition” to mean “elements of a partition”.

We do understand that our use of the word “pooling” is not standard in this literature.

We have used, without any loss of generality, the weak inequality on the left-hand side of the cutoff (as the signal is generated using a continuous distribution). One may consider a partition strategy with the weak inequality on the right-hand side of the cutoff in which case the following equilibrium analysis needs to be modified accordingly.

The unconventional numbering—Lemma 0—was adopted for expositional clarity, so as to align the numbering of the (three) lemmas in Sect. 3.2 with that of the respective Propositions’ numbering.

The unconventional numbering of this result—Proposition 0—has been adopted for expositional clarity, so as to align the numbering of the (three) equilibria and Propositions in Sect. 3.2.

We thank Marek Weretka (Associate Editor) for this suggestion.

If this restriction does not bind, all multipliers are equal to 0 and there are no values positive values of L, M and H that satisfy \(\frac{\partial Z}{\partial L}=0,\) \(\frac{\partial Z}{\partial M}=0\) and \(\frac{ \partial Z}{\partial H}=0.\) Therefore, optimality requires this constraint to bind.

When this condition binds, we obtain a unique solution: \(L^{*}=1/4\), \( M^{*}=1/2\) and \(H^{*}=5/4.\) Note, however, that this solution is consistent with the bid levels obtained when the condition does not bind: \( L^{*}=1/4\) and \(M^{*}=9/8-1/2H^{*}.\)

If this restriction does not bind, all multipliers are equal to 0 and there are no values positive values of L, M and H that satisfy \(\frac{ \partial Z}{\partial L}=0,\) \(\frac{\partial Z}{\partial M}=0\) and \(\frac{ \partial Z}{\partial H}=0.\) Therefore, optimality requires this constraint to bind.

If this restriction does not bind, all multipliers are equal to 0 and there are no values positive values of L, M and H that satisfy \(\frac{ \partial Z}{\partial L}=0,\) \(\frac{\partial Z}{\partial M}=0\) and \(\frac{ \partial Z}{\partial H}=0.\) Therefore, optimality requires this constraint to bind.

References

Ausubel LM (2004) An efficient ascending-bid auction for multiple objects. Am Econ Rev 94(5):1452–1475

Avery C (1998) Strategic jump bidding in English auctions. Rev Econ Stud 65(2):185–210

Avery C, Kagel J (1997) Second-price auctions with asymmetric payoffs: an experimental investigation. J Econ Manag Strategy 6(3):573–603

Bajari P, Hortaçsu A (2004) Economic insights from internet auctions. J Econ Lit 42(2):457–486

Brusco S, Lopomo G (2002) Collusion via signalling in simultaneous ascending bid auctions with heterogeneous objects, with and without complementarities. Rev Econ Stud 69(2):407–436

Carleton C (2000) Electronic fish auctions: strategies for securing and maintaining comparative advantage in the seafood trade, Background Paper, Nautilus Consultants Limited, Edinburgh. Retrieved from http://www.nautilus-consultants.co.uk/sites/default/files/final-1b.pdf

Cassady R Jr (1967) Auctions and auctioneering. University of California Press, Berkeley

Cheng H (2004) Optimal auction design with discrete bidding, Mimeo

Chwe M (1989) The discrete bid first auction. Econ Lett 31:303–306

David E, Rogers A, Jennings NR, Schiff J, Kraus S, Rothkopf MH (2007) Optimal design of English auctions with discrete bid levels. ACM Trans Internet Technol 7(2):Article 12

Engelbrecht-Wiggans R, Kahn CM (2005) Low-revenue equilibria in simultaneous ascending-bid auctions. Manag Sci 51(3):508–518

Ettinger D, Michelucci F (2016a) Hiding information in open auctions with jump bids. Econ J 126(594):1484–1502

Ettinger D, Michelucci F (2016b) Creating a winner’s curse via jump bids. Rev Econ Design 20(3):173–186

Gonçalves R, Hey J (2011) Experimental evidence on English auctions: oral outcry vs. clock. Bull Econ Res 63(4):313–352

Gonçalves R, Ray I (2017) A note on the wallet game with discrete bid levels. Econ Lett 159:177–179

Graham I (1999) The construction of electronic markets, PhD Thesis, Edinburgh

Guillotreau P, Jiménez-Toribio R (2011) The price effect of expanding fish auction markets. J Econ Behav Organ 79(3):211–225

Harstad R, Rothkopf M (2000) An alternating recognition model of English auctions. Manag Sci 46(1):1–12

Hernando-Veciana A, Michelucci F (2018) Inefficient rushes in auctions. Theor Econ 13(1):273–306

Isaac M, Salmon T, Zillante A (2007) A theory of jump bidding in ascending auctions. J Econ Behav Organ 62(1):144–164

Kagel J (1995) Auctions: a survey of experimental research. In: Kagel J, Roth A (eds) The handbook of experimental economics. Princeton University Press, Princeton, pp 501–586

Kagel J, Levin D (2016) Auctions: a survey of experimental research. In: Kagel J, Roth A (eds) The handbook of experimental economics, vol 2. Princeton University Press, Princeton, pp 563–637

Klemperer P (1998) Auctions with almost common values: the ‘Wallet Game’ and its applications. Eur Econ Rev 42(3–5):757–769

Li Z, Kuo C-C (2011) Revenue-maximizing Dutch auctions with discrete bid levels. Eur J Oper Res 215(3):721–729

Li Z, Kuo C-C (2013) Design of discrete Dutch auctions with an uncertain number of bidders. Ann Oper Res 211:255–272

Li Z, Yue J, Kuo C-C (2018) Design of discrete Dutch auctions with consideration of time. Eur J Oper Res 265(3):1159–1171

Mathews T, Sengupta A (2008) Sealed bid second price auctions with discrete bidding. Appl Econ Res Bull 1(1):31–52

Milgrom P, Weber R (1982) A theory of auctions and competitive bidding. Econometrica 50(5):1089–1122

Rasooly I, Gavidia-Calderon C (2021) The importance of being discrete: on the (in-)accuracy of continuous approximations in auction theory, mimeo

Rogers A, David E, Jennings N, Schiff J (2007) The effects of proxy bidding and minimum bid increments within eBay auctions. ACM Trans Web 1(2):Article 9

Rothkopf M, Harstad R (1994) On the role of discrete bid levels in oral auctions. Eur J Oper Res 74(3):572–581

Sandoval JAO (2014) The discrete Vickrey auction and the role of ties, MSc thesis, Institute for Advanced Studies, Vienna

Sinha A, Greenleaf E (2000) The impact of discrete bidding and bidder aggressiveness on seller’s strategies in open English auctions: reserves and covert shilling. Mark Sci 19(3):244–265

Tukiainen J (2017) Effects of minimum bid increments in Internet auctions: evidence from a field experiment. J Ind Econ 65(3):597–622

Yu J (1999) Discrete approximation of continuous allocation mechanisms, Ph.D. thesis, California Institute of Technology, Division of Humanities and Social Science

Funding

Open access funding provided by FCT|FCCN (b-on).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This supersedes a previously circulated working paper titled “Partition Equilibria in a Japanese–English Auction with Discrete Bid Levels for the Wallet Game” by us. We wish to thank seminar and conference participants at Aveiro, Birmingham, Bristol, Coimbra, Dibrugarh, Glasgow, Jadavpur, Lisbon, New Delhi, Warwick, York and in particular, Bhaskar Dutta, Françoise Forges, Peter Hammond, Ron Harstad, Paul Klemperer, Fabio Michelucci and Stephen Morris for many helpful comments, as well as Steve Farrar (Looe Fish Selling) for invaluable insights. We also thank an associate editor and two anonymous referees for their useful comments and suggestions. Financial support from Fundação para a Ciência e Tecnologia (through Project UID/GES/00731/2013) and the British Academy/Leverhulme small research Grant (SG153381) is gratefully acknowledged.

Appendix (Proofs)

Appendix (Proofs)

We collect the proofs of our results in this section.

Proof of Lemma 0

As the game is symmetric and we are considering symmetric strategy profiles only, it is enough to show the equilibrium conditions (for BNE) for one of the players (bidders). We thus consider bidder 1 and prove that for each signal (type), the corresponding separating bidding strategy is indeed the best response, against the given \( \sigma _{2}\), if and only if the conditions in the Lemma 0 are met. These conditions are: i. indifference at the cutoffs, ii. incentive constraints for each partition, iii. activation constraint (active at \( a_{1}\)) which implies the participation constraint (at the beginning of the auction) and iv. feasibility constraints for the cutoff points.

(i) \(\left. u_{1}\left( a_{j},\sigma _{2}\right) \right| _{x_{1}=x_{j}^{*}}=\left. u_{1}\left( a_{j+1},\sigma _{2}\right) \right| _{x_{1}=x_{j}^{*}},\) \(j=1,\ldots ,k-1\): this is the indifference condition at any cutoff point \(x_{j}^{*}\); when the signal (type) of bidder 1 is \(x_{j}^{*}\), bidder 1 must be indifferent between choosing \(a_{j}\) and \(a_{j+1}\).

(ii) \(u_{1}\left( a_{1},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \(x_{1}\le x_{1}^{*},\) \(h>1\) is the incentive constraint for the first partition, below \(x_{1}^{*}\); when the signal (type) of bidder 1 is any \(x_{1}\le x_{1}^{*}\), bidder 1 prefers \( a_{1}\) to any other \(a_{h}\), \(h>1\). Similarly, (iii) \(u_{1}\left( a_{k},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \( x_{1}>x_{k-1}^{*},\) \(h<k\), is the incentive constraint for the last partition, above \(x_{k-1}^{*}\); when the signal (type) of bidder 1 is any \(x_{1}>x_{k-1}^{*}\), bidder 1 prefers \(a_{k}\) to any other \(a_{h}\), \(h<k\). We also need (iv) \(u_{1}\left( a_{j},\sigma _{2}\right) >u_{1}\left( a_{h},\sigma _{2}\right) \) if \(x_{j-1}^{*}<x_{1}\le x_{j}^{*},\) \(j=2,\ldots ,k-1,\) \(h\ne j\) which is the incentive constraint for any other partitions and, obviously, it’s needed only for \(k>2\).

(v) \(u_{1}\left( a_{1},\sigma _{2}\right) \ge u_{1}\left( 0,\sigma _{2}\right) =0\) if \(x_{1}\le x_{1}^{*}\) is simply the activation constraint, implying \(\left. u_{1}\left( a_{1},\sigma _{2}\right) \right| _{x_{1}=0}\ge 0\) which is the participation constraint. Finally, \((vi)\ 0<x_{1}^{*}<\cdots<x_{k-1}^{*}<1\) provide the feasibility constraints. Hence the lemma.

Proof of Proposition 0

First note that there are only two potential candidate profiles which are based on two signal-independent strategies of staying active until L or H regardless of the signal. We denote these profiles by (L, L) and (H, H).

Suppose \(H<1/2.\) The condition \(x_{1}>H-1/2\) is required in order for \( u_{1}(H,H)-u_{1}(L,H)>0.\) This implies that for any \(H<1/2\), playing H is a best response to H for any \(x_{1}\). Therefore, whenever \(H<1/2\), playing H is a signal-independent equilibrium of the auction game.

Now suppose \(H>\frac{3}{4}+\frac{L}{2}.\) In particular, suppose that \( H=3/4+L/2+\varepsilon \), with \(\varepsilon >0\). In this case, L is a best response when \(x_{1}<1-2(3/4+L/2-H)\), which is equivalent to \( x_{1}<1+2\varepsilon \). As \(\varepsilon >0\), this is always true, which means that for any \(x_{1}\), L is a signal-independent equilibrium for both players.

Consider now L and H, satisfying \(L<\frac{1}{2}\) and \(L+\frac{1}{2}<H< \frac{3}{4}+\frac{L}{2}.\) In this case, to prove that (L, L) cannot be an equilibrium, we note that there are realizations of \(x_{1}\) for bidder 1 for which bidding L is not a best response against L. To see this, take \( 1>x_{1}>\) \(1-2(\frac{3}{4}+\frac{L}{2}-H)\). In this case, \(u_{1}\left( H,L\right) -u_{1}\left( L,L\right) =(x_{1}+\frac{1}{2}-H)-\frac{1}{2}(x_{1}+ \frac{1}{2}-L)>0\) (as, under the assumed bid level restrictions, \(1-2(\frac{3 }{4}+\frac{L}{2}-H)<\ 1\)). Similarly, we prove that (H, H) cannot be an equilibrium by showing that there are realizations of \(x_{1}\) for bidder 1 for which bidding H is not a best response against H. To see this, take \( 0<x_{1}<H-1/2\). Here, \(u_{1}\left( L,H\right) -u_{1}\left( H,H\right) =\frac{ 1}{2}(H-\frac{1}{2}-x_{1})>0\).

Now we show that \(\sigma ^{2S}\) constitutes an equilibrium. We first compute the (expected) payoffs for a bidder from the partition strategy profile; without loss of generality, we consider bidder 1. When bidder 2 has a signal \(x_{2}\le x^{*}\) and bids L, using the uniform distribution, bidder 1 expects bidder 2 to have a signal realization equal to \(x^{*}/2\); similarly, when bidder 2 has a signal \(x_{2}>x^{*}\) and bids H, bidder 1 expects bidder 2 to have a signal realization equal to \( \left( 1+x^{*}\right) /2\). Bidder 1’s expected payoffs thus are given by: \(u_{1}\left( L,\sigma ^{2\,S}\right) =x^{*}.\frac{1}{2}(x_{1}+\frac{ x^{*}}{2}-L)+(1-x^{*}).0\) and \(u_{1}\left( H,\sigma ^{2\,S}\right) =x^{*}.(x_{1}+\frac{x^{*}}{2}-H)+\left( 1-x^{*}\right) .\frac{1}{ 2}.(x_{1}+\frac{1+x^{*}}{2}-H)\). Setting the indifference condition (as in Lemma 0) \(u_{1}\left( L,\sigma ^{2\,S}\right) =u_{1}\left( H,\sigma ^{2\,S}\right) \), we get \(x^{*}=\frac{2x_{1}+1-2H}{2\left( H-L\right) }\), which implies that when \(x_{1}=x^{*}\), \(u_{1}\left( L,\sigma ^{2\,S}\right) =u_{1}\left( H,\sigma ^{2\,S}\right) \) provided \(x^{*}=\frac{2H-1}{2\left( 1+L-H\right) }\). Substituting this cutoff \(x^{*}\) in the expected payoffs, we obtain \(u_{1}\left( L,\sigma ^{2\,S}\right) -u_{1}\left( H,\sigma ^{2\,S}\right) =\frac{1}{4}\frac{2H-1-2x_{1}\left( 1+L-H\right) }{1+L-H}=\frac{1}{2}\left( x^{*}-x_{1}\right) \).

Hence, for bidder 1, if \(x_{1}>x^{*}\), we have \(u_{1}\left( H,\sigma ^{2\,S}\right) >u_{1}\left( L,\sigma ^{2\,S}\right) \), that is, with a high signal realization (above \(x^{*})\), bidder 1 prefers to bid H, and when \(x_{1}\le x^{*}\), we have \(u_{1}\left( L,\sigma ^{2\,S}\right) >u_{1}\left( H,\sigma ^{2\,S}\right) \), that is, with a low signal realization (below \(x^{*})\), bidder 1 prefers to bid L, which confirms the desired equilibrium condition (incentive constraint as in Lemma 0).

We now have to confirm the feasibility constraint that \(x^{*}\in \left( 0,1\right) \); this is guaranteed because \(x^{*}>0\Leftrightarrow H>1/2\) and \(x^{*}<1\Leftrightarrow H<\frac{3}{4}+\frac{L}{2}\).

Finally, we need to check the activation (and thus the participation) constraint that the payoffs cannot be negative (otherwise bidders would prefer not to be active) at L. As \(u_{1}\left( L,\sigma ^{2S}\right) \) is increasing in \(x_{1}\), we just need to ensure that \(\left. u_{1}\left( L,\sigma ^{2\,S}\right) \right| _{x_{1}=0}=\frac{\left( 1-2H\right) \left( 1+2L\right) \left( 2L+1-H\right) }{16\left( H-L-1\right) ^{2}}>0\). The above is indeed true; the denominator is always positive and for the numerator to be positive we must have either \(H<1/2\) and \(H<L+1/2\), which we disregard because it would not yield a positive cutoff \(x^{*}\), or we must have \( H>1/2\) and \(H>L+1/2\), which is guaranteed by the parameter range.

The expected revenue for the seller from this equilibrium comes from L when both players play L (occurs with probability \(\left( x^{*}\right) ^{2})\) and H in all other cases (i.e., when at least one bidder bids H). Thus the seller’s expected revenue (\(R^{2S}\)) is: \(R^{2\,S}=\left( x^{*}\right) \left( x^{*}\right) L+\left( x^{*}\right) \left( 1-x^{*}\right) H+\left( 1-x^{*}\right) \left( x^{*}\right) H+\left( 1-x^{*}\right) \left( 1-x^{*}\right) H=\frac{ L+4LH-4LH^{2}+3H-4H^{2}+4HL^{2}}{4\left( 1+L-H\right) ^{2}}\). Now, to obtain the revenue-maximizing values of L and H, we need to solve the following optimization problem (rearranging the inequality restrictions):

\(\max _{L,H}R^{2\,S}=\frac{L+4LH-4LH^{2}+3H-4H^{2}+4HL^{2}}{4\left( 1+L-H\right) ^{2}}\) subject to \(1/2-L\ge 0\), \(H-L-1/2\ge 0\), \( 3/4+L/2-H\ge 0\), \(L\ge 0\) and \(H\ge 0\).

We now set up the Lagrangian: \(Z=\frac{L+4LH-4LH^{2}+3H-4H^{2}+4HL^{2}}{ 4\left( 1+L-H\right) ^{2}}+y_{1}\left( 1/2-L\right) +y_{2}\left( H-L-1/2\right) +y_{3}\left( 3/4+L/2-H\right) \), with \(y_{i}\)’s as the multipliers. We then use the Kuhn-Tucker conditions for the above Lagrangian. First, as we are looking for \(L^{*}>0\) and \(H^{*}>0\), we have \(\frac{\partial Z}{\partial L}=0\) and \(\frac{\partial Z}{\partial H}=0\). Now, when \(\frac{\partial Z}{\partial y_{2}}=H-L-1/2=0\) (that is, when \( H=L+1/2)\), we have \(y_{2}>0\) and the expected revenue is a concave function of L. This implies \(\frac{\partial Z}{\partial y_{1}}=1/2-L>0\) and also \( \frac{\partial Z}{\partial y_{3}}=3/4+L/2-H>0\), thereby \(y_{1}=0\) and \( y_{3}=0\). Thus we have three equations, namely, \(\frac{\partial Z}{\partial L }=0\), \(\frac{\partial Z}{\partial H}=0\) and \(\frac{\partial Z}{\partial y_{2} }=0\) that we can solve with respect to L, H and \(y_{2}\). Solving these, we get \(L^{*}=1/4\) and \(H^{*}=3/4\) (with \(y_{2}^{*}=3/4).\) Finally, substituting these values into \(x^{*}=\frac{2H-1}{2\left( 1+L-H\right) }\) and into \(R^{2S}\) we obtain \(x^{*}=1/2\) and \(R^{2S^{*}}=5/8\), proving Proposition 0.

Proof of Proposition 1

Start with Eq. (1). Bidder 1’s expected payoff under the cutoff strategy profile is:

Setting \(u_{1}\left( L;\sigma _{2}\right) =u_{1}\left( M;\sigma _{2}\right) \), we obtain \(x^{*}=\frac{2x_{1}+1-2M}{2\left( M-L\right) }\), that is, when \(x_{1}=x^{*},\) the two payoffs are equal provided \(x^{*}=\frac{ 2M-1}{2\left( 1+L-M\right) }\).

In order to have \(x^{*}\in \left( 0,1\right) \) (Eq. (3)), we must have:

The second condition on M (\(M<\frac{3}{4}+\frac{L}{2})\) is more stringent than the first one (\(M<L+1)\), that is, the first condition is always satisfied when the second one holds. In addition, payoffs cannot be negative (otherwise bidder 1 would prefer not to bid), that is, the participation constraint must be satisfied (Eq. (2)). Because \(u_{1}\left( L;\sigma _{2}\right) \) is increasing in \(x_{1},\) we need to ensure that:

The denominator is always positive. For the numerator to be positive we must have \(M<1/2\) and \(M<L+1/2.\) The former is more stringent and would need to hold for the participation constraint to be satisfied, but in that case (\( M<1/2),\) the cutoff \(x^{*}\) would be negative. Therefore, we disregard this condition. Alternatively, we must have \(M>1/2\) and \(M>L+1/2\), with this latter condition being more stringent than the former. Combining this condition with the earlier restrictions, we must have \(L+1/2\le M<\frac{3}{4 }+\frac{L}{2}.\) In addition, in order for this range to be positive, \(L<1/2.\)

Using this cutoff \(x^{*},\) we thus obtain:

If, for bidder 1, \(x_{1}>x^{*},\) we have \(u_{1}\left( L;\sigma _{2}\right) -u_{1}\left( M;\sigma _{2}\right) <0,\) that is, with a high signal realization (above \(x^{*})\), bidder 1 prefers to bid M, and when \(x_{1}\le x^{*},\) we have \(u_{1}\left( L;\sigma _{2}\right) \ge u_{1}\left( M;\sigma _{2}\right) ,\) that is, with a low signal realization (below \(x^{*})\), bidder 1 prefers to bid L. Therefore, Eqs. (4) and (6) are satisfied.

Also, bidder 1 cannot prefer to deviate and play H when bidder 2 plays \(\sigma _{2}\) (Eq. (7)). That is, the following must hold: \( u_{1}\left( M;\sigma _{2}\right) -u_{1}\left( H;\sigma _{2}\right) \ge 0\), or equivalently \(\frac{1}{4}\left( 1-x^{*}\right) \left( 4H-x^{*}-2M-1-2x_{1}\right) \ge 0\). This expression is decreasing with \(x_{1},\) which means that it must be positive when \(x_{1}=1\) (the highest possible signal). Setting \(x_{1}=1\) and substituting \(x^{*}=\frac{2M-1}{2\left( 1+L-M\right) }\) we obtain:

From Eq. (5), we obtain:

This expression is decreasing in \(x_{1},\) which means that it must be positive when \(x_{1}=x^{*}\) in order for Eq. (5) to be satisfied. The necessary condition is:

This condition, in Eq. (30), is less stringent than Eq. (28) and, therefore, it is always satisfied when Eq. (28) holds.

The seller’s revenue from the equilibrium \((\sigma ^{3P_{1}},\sigma ^{3P_{1}})\) is given by:

\(R^{3P_{1}}=x^{*}x^{*}L+2x^{*}(1-x^{*})M+(1-x^{*})(1-x^{*})M=\frac{L+4LM-4LM^{2}+3M-4M^{2}+4ML^{2}}{4\left( 1+L-M\right) ^{2}}\). Recall that in this symmetric pooling equilibrium, each player stays active until L with probability \(x^{*}\) and active until M with probability \((1-x^{*}).\) To obtain the revenue-maximizing values of L, M and H, we therefore need to solve the following optimization problem (rearranging the equilibrium inequality restrictions):

subject to \(1/2-L\ge 0\), \(3/4+L/2-M\ge 0\), \(M-L-1/2\ge 0,\) \(H-\frac{3}{4}- \frac{M}{2}-\frac{2M-1}{8\left( 1+L-M\right) }\ge 0\), \(M-L\ge 0\) and \( H-M\ge 0\).

We set up the Lagrangian as below, where \(y_{i}\)’s are the multipliers:

We are now going to use the Kuhn-Tucker conditions for the above Lagrangian. First, note that as we are looking for \(L^{*}>0,\) \(M^{*}>0\) and \( H^{*}>0\), we must have \(\frac{\partial Z}{\partial L}=0,\) \(\frac{ \partial Z}{\partial M}=0\) and \(\frac{\partial Z}{\partial H}=0\). These expressions are lengthy and we omit them from the proof.

Recall from Proposition 1 that in equilibrium we must have \( L<1/2 \) and \(M<\frac{3}{4}+\frac{L}{2}.\) This implies that \(y_{1}=y_{2}=0.\) Also, by definition, \(M>L\) and \(H>M,\) which implies that \(y_{5}=y_{6}=0.\) Assume for now that the condition \(H-\frac{3}{4}-\frac{M}{2}-\frac{2M-1}{ 8\left( 1+L-M\right) }\ge 0\) does not bind, that is, that \(H-\frac{3}{4}- \frac{M}{2}-\frac{2M-1}{8\left( 1+L-M\right) }>0,\) in which case we have \( y_{4}=0.\) Also assume that the third restriction binds, which implies that \( y_{3}>0\) and \(\frac{\partial Z}{\partial y_{3}}=M-L-1/2=0,\) which is equivalent to \(M=L+1/2.\)Footnote 11 This also implies that \(\frac{\partial Z}{\partial H}=0.\) Substituting \(M=L+1/2\) in the remaining two first-order conditions (which we had omitted thus far)—\(\partial Z/\partial L\ \)and \(\partial Z/\partial M\)—, we obtain:

From these two equations we obtain \(L^{*}=1/4.\) Substituting into \( M=L+1/2\) we obtain \(M^{*}=3/4.\) Condition \(H-\frac{3}{4}-\frac{M}{2}- \frac{2M-1}{8\left( 1+L-M\right) }\) was assumed not to bind, which implies that \(H^{*}>5/4.\)

When \(H-\frac{3}{4}-\frac{M}{2}-\frac{2M-1}{8\left( 1+L-M\right) }\) is assumed to bind, we obtain a unique solution: \(L^{*}=1/4\), \(M^{*}=3/4 \) and \(H^{*}=5/4.\) Therefore, revenue is maximized when \(L^{*}=1/4\), \(M^{*}=3/4\) and \(H^{*}\ge 5/4\). Finally, substituting these values into \(x^{*}=\frac{2M-1}{2\left( 1+L-M\right) }\) and into \( R^{3P_{1}}\) we obtain \(x^{*}=1/2\) and \(R^{3P_{1}}=5/8\).

Proof of Proposition 2

Start with Eq. (8). Setting \(\left. u_{1}\left( L,\sigma _{2}\right) \right| _{x_{1}=x^{*}}=\left. u_{1}\left( H,\sigma _{2}\right) \right| _{x_{1}=x^{*}}\) we obtain \(x^{*}=\frac{2H-1}{2\left( 1+L+H-2M\right) }\).

In order to have \(x^{*}\in \left( 0,1\right) \) (Eq. (10)), we must have:

The second condition on M (\(M<\frac{3}{4}+\frac{L}{2})\) is more stringent than the first one (\(M<\frac{1+L+H}{2})\) when \(H>1/2,\) that is, provided \( H>1/2,\) the first condition is always satisfied when the second one holds. In addition, payoffs cannot be negative (otherwise bidder 1 would prefer not to bid), that is, the participation constraint must be satisfied (Eq. (9)). Because \(u_{1}\left( L;\sigma _{2}\right) \) is increasing in \( x_{1},\) we need to ensure that:

The denominator is always positive. For the numerator to be positive we must have \(H>1/2\) and \(\frac{1-2H+4L^{2}+4L+4LH}{8L}\le M\). In addition, in order for the range \(\frac{1-2H+4L^{2}+4L+4LH}{8L}\le M<\frac{3}{4}+\frac{L }{2}\) to be positive, \(L<1/2\). When \(x^{*}=\frac{2H-1}{2\left( 1+L+H-2M\right) }\), it is straightforward to show that Eqs. (12) and (13) are satisfied, because:

Turning our attention to Eq. (11), we obtain:

This expression is decreasing in \(x_{1},\) which means that in order for Eq. (11) to be satisfied, it must be positive when \(x_{1}=x^{*}.\) Substituting \(x^{*}=\frac{2H-1}{2\left( 1+L+H-2M\right) },\) this implies that, in addition to other necessary constraints (namely \(H>1/2\) and \(M<\frac{3}{4}+\frac{L}{2})\), \(M\ge \frac{2L+2H-1}{4}.\) Whenever this inequality holds, Eq. (14) is also satisfied.

The seller’s revenue from the equilibrium \((\sigma ^{3P_{2}},\sigma ^{3P_{2}})\) is given by:

\(R^{3P_{2}}=x^{*}x^{*}L+2x^{*}(1-x^{*})M+(1-x^{*})(1-x^{*})H=\frac{L+8LH+4LH^{2}-6M-4LM+8M^{2}-12MH-8HLM+9H+4HL^{2}}{ 4\left( 1+L+H-2M\right) ^{2}}\). Recall that in this symmetric pooling equilibrium, each player stays active until L with probability \(x^{*}\) and active until H with probability \((1-x^{*}).\) Therefore, with probability \(2x^{*}(1-x^{*}),\) one player will drop out at M whilst the other is still active, leading the auction to end at that price. In order to obtain the revenue-maximizing values of L, M and H, we need to solve the following optimization problem (rearranging the equilibrium inequality restrictions):

subject to \(1/2-L\ge 0\), \(3/4+L/2-M\ge 0\), \(M-\frac{1-2H+4L^{2}+4L+4LH}{8L} \ge 0,\) \(H-1/2\ge 0\), \(M-\frac{2L+2H-1}{4}\ge 0,\) \(M-L\ge 0\) and \( H-M\ge 0\).

We set up the Lagrangian as below, where \(y_{i}\)’s are the multipliers:

We are now going to use the Kuhn-Tucker conditions for the above Lagrangian. First, note that as we are looking for \(L^{*}>0,\) \(M^{*}>0\) and \( H^{*}>0\), we must have \(\frac{\partial Z}{\partial L}=0,\) \(\frac{ \partial Z}{\partial M}=0\) and \(\frac{\partial Z}{\partial H}=0\). These expressions are lengthy and we omit them from the proof.

Recall from Proposition 2 that in equilibrium we must have \( L<1/2,\) \(M<\frac{3}{4}+\frac{L}{2}\) and \(H>1/2.\) This implies that \( y_{1}=y_{2}=y_{4}=0.\) Also, by definition, \(M>L\) and \(H>M,\) which implies that \(y_{6}=y_{7}=0.\) Assume for now that the condition \(M-\frac{2L+2H-1}{4} \ge 0\) does not bind, that is, that \(M-\frac{2L+2H-1}{4}>0,\) in which case we have \(y_{5}=0\).Footnote 12 Also assume the third restriction binds, which implies that \(y_{3}>0\) and \(\frac{\partial Z}{ \partial y_{3}}=M-\frac{1-2H+4L^{2}+4L+4LH}{8L}=0\) which is equivalent to \(M= \frac{1-2H+4L^{2}+4L+4LH}{8L}\).Footnote 13 Substituting this expression in the remaining three first-order conditions (which we had omitted thus far)—\(\partial Z/\partial L,\) \( \partial Z/\partial M\) and \(\partial Z/\partial H\)—, we obtain:

Looking at Eqs. (41) and (42), we find that they are satisfied provided \(y_{3}=\frac{8L^{2}\left( 6L-1\right) }{2H-1}.\) Substituting this expression in Eq. (40), we obtain \(L^{*}=1/4.\) Then substituting this in \(\frac{\partial Z}{\partial y_{3}}=M-\frac{ 1-2H+4L^{2}+4L+4LH}{8L}=0,\) we obtain \(M^{*}=9/8-H^{*}/2\). Finally, substituting these values into \(x^{*}=\frac{2H-1}{2\left( 1+L+H-2M\right) }\) and into \(R^{3P_{2}}\) we obtain \(x^{*}=1/2\) and \( R^{3P_{2}}=5/8\).

Proof of Proposition 3

Start with Eq. (15). Setting \(\left. u_{1}\left( M,\sigma _{2}\right) \right| _{x_{1}=x^{*}}=\left. u_{1}\left( H,\sigma _{2}\right) \right| _{x_{1}=x^{*}}\) we obtain \(x^{*}=\frac{2H-1}{2\left( 1+M-H\right) }\).

In order to have \(x^{*}\in \left( 0,1\right) \) (Eq. (17)), we must have:

The second condition on M (\(M>2H-3/2)\) is more stringent than the first one (\(M>H-1),\) that is, the first condition is always satisfied when the second one holds. In addition, payoffs cannot be negative (otherwise bidder 1 would prefer not to bid), that is, the participation constraint must be satisfied (Eq. (16)). Because \(u_{1}\left( M;\sigma _{2}\right) \) is increasing in \(x_{1},\) we need to ensure that:

The denominator is always positive. For the numerator to be positive we have \(H>1/2\) and \(M\le H-1/2.\) In addition, in order for the range \( 2H-3/2<M<H-1/2\) to be positive, \(H<1\). When \(x^{*}=\frac{2H-1}{2\left( 1+M-H\right) },\) it is straightforward to show that Eqs. (18) and (20) are satisfied:

Also, provided \(M\le H-1/2,\) Eq. (19) is also satisfied. Turning our attention to Eq. (21), we obtain:

This expression is increasing with \(x_{1},\) which means that in order for Eq. (21) to be satisfied, it must be (weakly) positive when \( x_{1}=x^{*}.\) Substituting \(x^{*}=\frac{2H-1}{2\left( 1+M-H\right) }, \) this implies that \(H\ge \frac{3+4M+4M^{2}}{6+4M}\). Whenever \(M\le H-1/2 \) or, equivalently, when \(H\ge M+1/2,\) this condition is always satisfied.

The seller’s revenue from the equilibrium \((\sigma ^{3P_{3}},\sigma ^{3P_{3}})\) is given by:

\(R^{3P_{3}}=x^{*}x^{*}M+2x^{*}(1-x^{*})H+(1-x^{*})(1-x^{*})H=\frac{M+4MH-4MH^{2}-4H^{2}+3H+4M^{2}H}{4\left( 1+M-H\right) ^{2}}\). Recall that in this symmetric pooling equilibrium, each player stays active until M with probability \(x^{*}\) and active until H with probability \((1-x^{*}).\) In order to obtain the revenue-maximizing values of L, M and H, we need to solve the following optimization problem (rearranging the equilibrium inequality restrictions):

subject to \(H-1/2\ge 0\), \(1-H\ge 0\), \(M-2H+3/2\ge 0,\) \(H-1/2-M\ge 0\), \( M-L\ge 0\) and \(H-M\ge 0\).

We set up the Lagrangian as below, where \(y_{i}\)’s are the multipliers:

We are now going to use the Kuhn-Tucker conditions for the above Lagrangian. First, note that as we are looking for \(L^{*}>0,\) \(M^{*}>0\) and \( H^{*}>0\), we must have \(\frac{\partial Z}{\partial L}=0,\) \(\frac{ \partial Z}{\partial M}=0\) and \(\frac{\partial Z}{\partial H}=0\). These expressions are lengthy and we omit them from the proof.

Recall from Proposition 3 that in equilibrium we must have \( 1/2<H<1\) and \(2H-3/2<M.\) This implies that \(y_{1}=y_{2}=y_{3}=0.\) Also, by definition, \(M>L\) and \(H>M,\) which implies that \(y_{5}=y_{6}=0.\) Assume the fourth restriction binds, which implies that \(y_{4}>0\) and \(\frac{\partial Z }{\partial y_{4}}=H-1/2-M=0,\) which is equivalent to \(H=M+1/2\).Footnote 14 This also implies that \(\frac{\partial Z}{\partial L}=0.\) Substituting \(H=M+1/2\) in the remaining two first-order conditions (which we had omitted thus far)—\(\partial Z/\partial M\) and \(\partial Z/\partial H\)—, we obtain:

From these two equations we obtain \(M^{*}=1/4.\) Substituting into \( H=M+1/2\) we obtain \(H^{*}=3/4.\) Because, by definition, \(M>L\), we have that \(L^{*}<1/4\). Finally, substituting these values into \(x^{*}= \frac{2H-1}{2\left( 1+M-H\right) }\) and into \(R^{3P_{3}}\) we obtain \(x^{*}=1/2\) and \(R^{3P_{3}}=5/8\), proving this proposition.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gonçalves, R., Ray, I. Revenue implications of choosing discrete bid levels in a Japanese–English auction. Rev Econ Design 28, 125–150 (2024). https://doi.org/10.1007/s10058-023-00337-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-023-00337-7

Keywords

- Japanese–English auctions

- Wallet game

- Discrete bids

- Partitions

- Pooling equilibrium

- Separating equilibrium

- Seller’s revenue