Abstract

This paper studies the effect of trade opportunities on a seller’s incentive to acquire information through experimentation. I characterize the unique equilibrium outcome and discuss the effects of variations in the information structure on the probability of trade. The main result is that more accurate information for the buyer can reduce social welfare. Efficiency requires that the buyer offers a price that the seller always accepts and that the seller experiments when it is socially optimal to do so. When the buyer receives very informative signals about positive experimentation outcomes, the absence of such a signal can induce the buyer to purchase the good only with low but known quality at a low price. If the buyer receives an informative signal about negative experimentation outcomes, the seller might prefer to not experiment so as to avoid the risk of generating a negative outcome that could trigger the buyer to reduce her offer.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

In Akerlof’s classic lemons problem (Akerlof 1970), sellers enter the market with superior information about the quality of their goods. In many real-life instances, the acquisition of information requires substantial investments involving significant risks and those decisions should therefore be viewed as a strategic choice for the seller prior to sale. For example, consider an owner and CEO of a startup who hopes to sell his firm quickly to a large competitor. If the CEO decides to invest heavily in marketing his product, the investment may generate revenue as well as positive information about the demand for his company’s product that can increase the sales value of his company. However, the marketing campaign may also fail and not only generate a financial loss, but also potentially harm the company’s reputation. This raises the question of how the informational value of the manager’s marketing decision affects trade and, conversely, how the option to trade affects the seller’s decision to invest.

I study this question in a simple one-armed bandit model in which the seller may acquire information about a risky asset through experimentation. In the first period, the seller decides whether to choose a risky option for which the payoff depends on an uncertain state of the world or a safe option that yields a known payoff. Experimenting with the risky option may result in either a success or a failure. The buyer, who arrives in the second period, cannot observe the seller’s choice directly but may observe a verifiable signal whether the experiment was a success or a failure. Importantly, I assume that successes are not always verifiable and failures cannot always be hidden. In the marketing campaign example above, a success of the campaign may become unverifiable due to economic shocks and volatile market conditions. Similarly, the seller may try to hide a failed investment in financial disclosure statements, but an attentive buyer may nevertheless be able to detect this. I derive the unique perfect Bayesian equilibrium outcome and investigate how the efficiency of trade varies with changes in the informativeness of the buyer’s signal.

A main result is that providing the buyer with more accurate information about the outcome of the seller’s experiment can reduce social welfare. Efficiency requires that the buyer is willing to offer a price that the seller is willing to accept even after a successful experiment. However, when the buyer receives very informative signals about positive experimentation outcomes, the absence of such a signal is a strong indication of a bad outcome, in which case the buyer would prefer to purchase the good only with low but known quality at a low price. Alternatively, if the buyer receives a very informative signal about negative experimentation outcomes, then the seller would prefer not to experiment so as to avoid the risk of generating a negative outcome that could trigger the buyer to reduce her offer.

There is only a small number of papers that investigate the effects of seller learning on bilateral trade environments. Shavell (1994) studies a seller’s incentive to acquire information prior to sale. He is concerned with the efficiency of information acquisition, differentiating between socially valuable information (information about the good that creates a positive externality for the buyer) and socially useless information (information that resolves uncertainty but does not affect the buyer’s payoff). The valuations of the buyer and seller are such that trade always occurs so that the lemons problem does not arise. Dang (2008) studies a model in which both the seller and the buyer have the option to acquire information prior to sale. He shows that the option to acquire information is sufficient for trade to break down. A similar result holds here as well (see Theorem 1). The present paper generalizes the models of information acquisition proposed in Dang (2008) and Shavell (1994) and adds to their findings an investigation of how changes in the information structure affect trade.

The effects of information on trade have been studied in a number of papers. Kessler (2001) investigates how changes in information structure affect the efficiency of trade. More specifically, she compares a competitive market for lemons à la Akerlof with a market in which only a fraction of sellers is informed about the quality of their good. She shows that more information on the sellers’ side can decrease social welfare. In a related paper, Levin (2001) finds the same effect, but extends this result by showing that providing buyers with more information unambiguously increases social welfare as long as demand is downward sloping. The present paper shows that this result may no longer hold when buyers obtain their information from the seller’s experimentation. In this case, sellers have a disincentive to become informed, as a negative outcome might spill over to the buyer who would respond by paying a low price. The result is that sellers may not acquire information when it would be socially optimal to do so.

The present paper is also related to a body of literature on dynamic signaling in which a seller, who already knows the value to the buyer, chooses an observable action, typically the time of sale. (among others, see Janssen and Roy 2002; Kim 2017; Fuchs and Skrzypacz 2019; Cho and Matsui 2012; Hörner and Vieille 2009; Lauermann and Wolinsky 2016; Kaya and Kim 2018). Relatively few papers consider the effects of information acquisition before trade takes place. Daley and Green (2012) studies a setting in which the buyers continually receive an exogenously arriving stream of information about the quality of the seller’s good. Dilmé (2019a, 2019b) extend this model, by allowing the seller to influence the publicly available information through a hidden action. In all of these papers, however, the buyers are the ones who receive information about their valuation of the good, while the seller is perfectly informed. Competition between buyers allows the seller to extract rent, while the knowledge of her own type gives her an incentive to wait to signal her type. In the current paper, in contrast, the buyer and the seller are ex-ante symmetrically informed, but the seller faces the option to acquire information through experimentation while waiting for an offer from the buyer. The equilibrium behavior and the timing of sale is not primarily driven by signalling incentives. The focus here lies on how the seller’s incentives to engage in socially valuable experimentation depend on the observability of the experimentation outcomes.

1 Model

Consider the following two-period game. In the first period, the seller of an object (“he”) faces the option of experimenting with it. If the seller decides to experiment, the probability of success depends on the type of the object, which is either “good” or “bad”. If the object is good, then the seller’s experiment is successful with probability \(\lambda _g\), and if the object is bad, then experimentation is successful with probability \(\lambda _b\), where \(\lambda _g>\lambda _b\). When the experiment is successful, the seller receives a flow-payoff \(y_S\ge 0\). If the experimentation fails, the seller incurs a loss of \(c_S> 0\). The seller’s flow-payoff from experimenting if his belief that the object is good is \(\pi \in [0,1]\), is given by

If the seller does not experiment, his flow-payoff is zero. We assume that the seller has a positive valuation for a good object and a negative valuation for a bad object.

Assumption 1

\(\lambda _gy_S+(1-\lambda _g)c_S>0>\lambda _by_S+(1-\lambda _b)c_S\).

In the second period, a potential buyer (“she”) observes a signal regarding the experimentation outcome in the first period and makes a take-it-or-leave-it offer to the seller. If the seller accepts, she pays the seller, and ownership is transferred to the buyer who subsequently has the option to experiment with the object. We assume that the buyer has a higher valuation for the good: if her experiment is successful, the buyer’s payoff is \(y_B\ge y_S\), and if it is a failure, the buyer has a loss \(c_B\le c_S\). If the seller rejects, no payment is made and the seller retains the option to experiment with the object a second time. For the buyer, the flow-payoff from experimenting when her belief is \(\pi \) is denoted by

If the buyer does not experiment, her flow-payoff is normalized to zero.

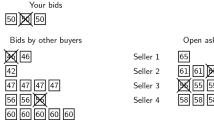

The exact timing of the game is as follows. First, the unobservable type \(\lambda \in \{\lambda _g,\lambda _b\}\) of the object is realized, then the seller decides whether to experiment. In the next step, the outcome \(\theta _S\in \{s,f,0\}\) is realized, where \(\theta _S=s\) represents a success and \(\theta _S=f\) a failure in the event that the seller experiments, and \(\theta _S=0\) represents the event when the seller does not experiment. We assume that the signal that the seller receives about the experimentation outcome is unverifiable.Footnote 1 Subsequently, the buyer observes a signal \(\theta _B\in \{s,f,0\}\) about the true experimentation outcome. The distribution over the buyer’s signal \(\theta _B\) conditional on the experimentation outcome \(\theta _S\) is depicted in Fig. 1, where \(\alpha ^s,\alpha ^f\in (0,1)\). Based on the realization of her signal, she makes an offer to the seller which the seller either accepts or rejects. If the seller accepts the offer, the buyer makes a payment equal to her offer to the seller and then has the option to experiment in the second period. If the seller rejects, the buyer makes no payment, and the seller retains the option to experiment in the second period.

The flow-value derived from experimenting with the object depends on the experimenter’s belief. The common prior belief that the object is good is \(\pi _0\). If the seller experiments and the experimentation is successful (\(\theta _S=s\)), then his updated belief in the second period is

If the seller experiments and the experiment fails (\(\theta _S=f\)), then his updated belief in the second period is

If the seller does not experiment (\(\theta _S=0\)), then his belief in the second period is identical to his prior belief. For future reference, we denote by \(\sigma =\pi _0\lambda _g+(1-\pi _0)\lambda _b\) the probability of success if the seller experiments.

The seller’s flow-value of experimenting in the first period is \(u=u(\pi _0)\). After updating his belief, the seller’s valuation of owning the good in the second period is \(u^s=\max \{u(\pi ^s),0\}\) if he experiments successfully in the first period, \(u^f=\max \{u(\pi ^f),0\}\) if he experiments in the first period and the experiment fails, and \(u^0=\max \{u(\pi _0),0\}\) if he does not experiment.

The buyer’s posterior belief about \(\theta _S\) conditional on the realization of her own signal is obtained via Bayes’ rule. If the buyer observes a success (\(\theta _B=s\)), she assigns probability one to \(\theta _S=s\), and hence her belief that the object is good is \(\pi ^s\). Similarly, if she observes a failure (\(\theta _B=f\)), she assigns probability one to the event \(\theta _S=f\) and hence her belief that the object is good is \(\pi ^f\). The buyer’s valuation of owning the good in the second period is therefore \(v^s=\max \{v(\pi ^s),0\} \) if she observes a success \((\theta _B=s)\) and \(v^f=\max \{v(\pi ^f),0\}\) if she observes a failure (\(\theta _B=f\)). If the buyer does not observe the experimentation outcome \((\theta _B=0)\) her posterior belief depends on the probability she assigns to the event that the seller experimented. In the special case in which she assigns probability one to this event, her valuation of the good is \(v^0=\max \{\sigma ^0v^s+(1-\sigma ^0)v^f,0\}\), where

is the probability that a success occurred when the buyer observes \(\theta _B=0\).

A strategy for the buyer is a (possibly random) offer for every signal \(\theta _B\in \{s,f,0\}\), represented by a triple \(p=(p^{s},p^f,p^0)\), where \(p^{\theta _B}\) is the buyer’s offer when observing signal \(\theta _B\). A strategy for the seller is an experimentation decision, represented by the (possibly random) variable \(e\in \{0,1\}\) that indicates whether the seller experiments (\(e=1\)) or not (\(e=0\)), together with an acceptance rule a that specifies for every history \((\theta _S,p')\) consisting of an experimentation outcome \(\theta _S\in \{s,f,0\}\) and offer \(p'\ge 0\) an acceptance decision \(a(\theta _S,p')\in \{0,1\}\), where \(a(\theta _S,p')=1\) if the seller accepts and \(a(\theta _S,p')=0\) if he rejects. The acceptance rule is independent of the seller’s experimentation decision without loss of generality, because \(\theta _S\) is a sufficient statistic for e.

The net present values for the seller and the buyer at the beginning of the game are, respectively,

A strategy pair (p, (e, a)) is a weak perfect Bayesian equilibrium if, given the players’ beliefs, (i) \(U_S(p,(e,a))\ge U_S(p,(e',a'))\) for \((e',a')\ne (e,a)\), (ii) \(U_B(p,(e,a))\ge U_B(p',(e,a))\) for \(p'\ne p\) and (iii) beliefs at each history are determined via Bayes’ rule when possible. I define an equilibrium to be a weak perfect Bayesian equilibrium that has the property that the buyer’s belief assigns probability one to the event \(\{\theta _S=\theta '\}\) when \(\theta _B=\theta '\) for each \(\theta '\in \{s,f\}\) at every history. This additional assumption merely ensures that informative signals remain informative, even when they are unexpected.

2 Optimal experimentation without trade

For the following analysis, it will be useful to start by discussing the case of optimal experimentation when the seller does not have the option to trade the good at a later time. Suppose therefore that there is no buyer in the second period. The owner’s value of experimenting in the first period is

Note that the flow-payoff u increases in \(\pi _0\) and is positive if and only if \(\pi _0>{\bar{\pi }}\), where

Since u, \(u^s\), \(u^f\) and \(\sigma \) are non-decreasing and continuous in \(\pi _0\), so is U. Moreover, when \(u=0,\) then \(u^f=0\) and \(u^s>0\), which implies that there is a critical threshold \({\underline{\pi }}<{\bar{\pi }}\) so that \(U>0\) if and only if \(\pi _0>{\underline{\pi }}\). Noting that \(u^f=0\) if \(\pi _0={\underline{\pi }}\), we can calculate the threshold explicitly:

We can distinguish between three different regions of prior beliefs, based on the relation to the thresholds \({\bar{\pi }}\) and \({\underline{\pi }}\). In the first region, where \(\pi _0<{\underline{\pi }}\), the seller’s valuation of the good is zero, the seller chooses not to experiment and his continuation value in the second period is zero. In the second region we have \({\underline{\pi }}\le \pi _0<{\bar{\pi }}\). The flow-payoff for the seller is negative, but the value of information through experimentation in the first period renders the seller’s total valuation of the good positive. In the third region with \(\pi _0\ge {\bar{\pi }}\), the seller’s flow payoff is positive, so that the value of the information acquired through the experiment is irrelevant for his decision to experiment.

3 Partial observability

Consider now the case with a buyer who can partially observe successes and failures. The equilibrium definition pins down the seller’s acceptance rule in the second period: the seller accepts any offer greater than his reservation price \(u^{\theta _S}\) and rejects any offer below it. When the offer is equal to his reservation price, the seller is indifferent between accepting and rejecting the buyer’s offer. If the seller rejects an offer when he is indifferent between accepting and rejecting, then there may not be a best response for the buyer. Therefore, there is no loss in generality in focussing on equilibria in which the seller uses the acceptance rule

Now consider the buyer’s strategy. When the buyer observes \(\theta _B\in \{s,f\}\), she knows the experimentation outcome and optimally offers the seller’s reservation price. More specifically, if the buyer observes \(\theta _B=s\) it is optimal for her to offer \(p^s=u^{s}\), and if she observes \(\theta _B=f\) it is optimal for her to offer \(p^f=u^f\). Hence, we have the following result.

Lemma 1

In every equilibrium, \(p^{s}=u^{s}\) and \(p^f=u^f\).

Since the seller’s acceptance rule and the buyer’s offers after observed experimentation outcomes are already determined, the strategic interaction reduces to the seller’s experimentation decision and the buyer’s choice of \(p^0\). This interaction can be modeled as a strategic game. The corresponding payoff matrix is depicted in Fig. 2. For future reference, denote this game by \(\Gamma \). For the seller, the payoff is the expected flow-payoff from experimenting today, if he does, plus the expected flow-payoff in the next period derived either from the option of experimenting a second time or from the buyer’s payment depending on whether he accepts or rejects the buyer’s offer. For the buyer, the payoff is the expected valuation of owning the good, conditional on receiving the signal \(\theta _B=0\), minus the offered price, all multiplied by the probability that the seller accepts the buyer’s offer.

Lemma 2

The strategy pair \(((u^s,u^f,p^0) ,(e, a^*))\) is a perfect Bayesian equilibrium in the extensive game if and only if \((p_0,e)\) is a Nash-equilibrium of \(\Gamma \).

What are the equilibria of the strategic game \(\Gamma \)? If \(\pi _0\le {\underline{\pi }}\) then the seller’s valuation of the object is zero. It is clear that in the unique equilibrium the seller does not experiment and the buyer offers \(p^0=u^0=0\). Hence, let \(\pi _0>{\underline{\pi }}\) so that the seller’s valuation of the object is positive. If the seller does not experiment, his reservation price in the second period is \(u^0\). In equilibrium, the buyer anticipates the seller’s action, and hence her best offer is \(p^0=u^0\). If the seller does experiment, his reservation price depends on the outcome of the experiment. Suppose the buyer, when not observing the outcome of the experiment, offers \(p^0=u^{s}\). Then the seller accepts with certainty, and the buyer’s valuation of owning the good is \(v^0\). The payoff for the buyer of obtaining the object at price \(u^{s}\) is, therefore, \(v^0-u^{s}\). If the buyer offers \(p^0=u^f\), the seller accepts only after a failure. The buyer’s expected value of obtaining the good is then \((1-\sigma ^0)(v^f-u^f)\). Hence, a necessary condition for the existence of an equilibrium in which the seller experiments and the buyer offers the high price \(u^s\) is

Now consider the seller. Suppose the buyer’s offer is \(p^0=u^s\). The seller’s expected payoff when he experiments is

If the seller does not experiment, then his expected payoff is \( u^{s}\). Therefore, a necessary condition for the existence of an equilibrium in which the buyer offers the high price \(u^s\) and seller experiments is

The right hand side is non-negative so that the inequality is equivalent to

If conditions B and S hold simultaneously, then there is a unique equilibrium in the strategic game in Fig. 2 in which the seller experiments (\(e=1\)) and the buyer offers the highest price (\(p^0=u^s\)).

If condition B is not satisfied, then the buyer prefers to offer \(p^0=u^f\) and obtain the object only if the seller’s experiment failed. The seller prefers to experiment in this case. This follows from the fact that the seller faces the same trade-off as in the case without trade, and from the hypothesis \(\pi >{\underline{\pi }}\) which implies that it is optimal for the buyer to experiment.

Finally, if condition S does not hold, but condition B does, then there does not exist an equilibrium in pure strategies. If the buyer offers \(p^0=u^s\) the seller prefers not to experiment since S is violated. If the seller does not experiment, the unique best response is \(p^0=u^0 \). If the buyer offers \(p^0=u^0\), the seller prefers to experiment, since \(\pi >{\underline{\pi }}\). Finally, if the seller experiments, the buyer prefers to offer \(p^0=u^s\) since B holds. The mixed strategy equilibrium is unique because \(p^0=u^f\) is never a best response.

Theorem 1

The game \(\Gamma \) has a unique equilibrium outcome. In every such equilibrium, the seller’s experimentation decision e and the buyer’s offer \(p^0\) are as follows.

-

1.

If \(\pi _0<{\underline{\pi }}\), then \(e=0\) and \(p^0=0\).

-

2.

If \(\pi _0\ge {\underline{\pi }}\) and B is violated, then \(e=1\) and \(p^0=u^f\).

-

3.

If \(\pi _0\ge {\underline{\pi }}\), B holds and S is violated, then \(e=1\) with probability

$$\begin{aligned} \begin{aligned} q^*=\frac{u^{s}-u^0}{(1-\alpha ^{s}) \sigma (v^{s}-u^{s})+(\sigma +\alpha ^f (1-\sigma )) (u^{s}-u^0)} \end{aligned} \end{aligned}$$and \(e=0\) with probability \(1-q^*\), and \(p^0=u^{s}\) with probability

$$\begin{aligned} \begin{aligned} \beta ^*=\frac{u+ \sigma \left( u^{s}-u^0\right) -\alpha ^f (1-\sigma )\left( u^0-u^f\right) }{ \left( \sigma +\alpha ^f(1-\sigma \right) )\left( u^{s}-u^0\right) } \end{aligned} \end{aligned}$$and \(p^0=u^0\) with probability \(1-\beta ^*\).

-

4.

If \(\pi _0\ge {\underline{\pi }}\) and B and S hold, then \(e=1\) and \(p^0=u^{s}\).

Part 1 of the theorem shows that the opportunity to trade never increases the seller’s incentive to experiment. Intuitively, one might expect that the presence of a buyer encourages the seller to experiment because by selling the good after a failure the seller should be able to externalize the cost of experimentation to some extent. To see why this is not the case, consider a prior belief \(\pi \) that is lower than the threshold \({\underline{\pi }}\) at which experimenting is optimal for the seller when no buyer is present. From \(\pi <{\underline{\pi }}\), it follows that the flow payoff at \(\pi \) is negative, i.e., \(u<0\). If \(u^s\le 0\), then it is certainly never optimal for the seller to experiment, hence assume that \(u^{s}>0\). If the buyer offers the reservation value \(u^{s}\) when observing neither success nor failure, then the seller clearly has a lower incentive to experiment, since his flow-payoff from experimenting is negative, and because experimentation carries the risk of producing an observed failure which would induce the buyer to offer the lowest price. If the buyer were to offer the reservation price 0, then the seller’s payoff after each history would be the same as in the case without a buyer, so that her incentive to experiment would be the same as in the case without a buyer. As a result, it is optimal not to experiment.

That the seller does not experiment excessively at low beliefs is a positive result from an efficiency point-of-view: equilibria are efficient for every prior belief below \({\underline{\pi }}\). Part 4 of the theorem characterizes the efficient equilibrium when \(\pi >{\underline{\pi }}\). Trade is efficient only if the buyer is willing to buy the good of uncertain quality at the reservation price of the highest seller type, and if the seller is willing to experiment, even if experimentation may generate an observed failure and trigger the buyer to offer the lowest price. Efficiency, therefore, requires two incentive constraints to be satisfied and if either of these constraints is violated, trade fails with positive probability.

If the buyer’s incentive constraint B is violated, then in the unique equilibrium for \(\pi >{\underline{\pi }}\) the buyer’s expected payoff from purchasing the good from either seller type is not high enough to justify the higher price. Therefore, the buyer offers the lowest price and accepts the loss from the possibility that trade may fail. Note that the failure of trade does not only depend on the difference in the seller’s and the buyer’s valuations but also on the information the buyer obtains about the experimentation outcome. When the buyer observes successes with a much higher probability than failures, then she won’t be willing to pay the high price when she does not observe the experimentation outcome, since this event suggests that the experiment failed. This is true even if the buyer’s valuation of the good is much greater than the seller’s.

If the buyer’s incentive constraint B is satisfied, but the seller’s incentive constraint S is violated, then the unique equilibrium is one in mixed strategies. If the buyer offers the high price when observing neither success nor failure, the seller prefers not to experiment. But then the buyer optimally pays the seller \(p^0=u^0\), i.e., the seller’s reservation price when he does not experiment. On the other hand, if the buyer offers \(p^0\le u^0\), then the seller’s expected payoff from experimenting is higher than without a buyer, while his expected payoff from not experimenting is the same as in the case without a buyer. Hence, it is optimal for the seller to experiment.

4 Comparative statics

This section discusses the comparative statics of the equilibrium presented in Theorem 1. The analysis focuses on how the observability of experimentation outcomes affects the seller’s decision to experiment and the buyer’s offers to the seller. We know from Theorem 1 that when the prior belief about the project is below the threshold \({\underline{\pi }}\), the buyer purchases the good at price zero. This is the somewhat less interesting case since the presence of the buyer does not create any friction. Therefore, I maintain the following assumption for the remaining analysis.

Assumption 2

\(\pi >{\underline{\pi }}\).

The first step in the analysis is to identify a condition on the observability parameters \(\alpha ^f\) and \(\alpha ^s\) that guarantees efficiency of trade under Assumption 2. From Theorem 1 we know that trade is efficient only if the incentive constraints B and S hold simultaneously. For condition B, note that observability enters in two ways: through \(\sigma ^0\), the probability of success conditional on observing \(\theta _B=0\) and through \(v^0\), the seller’s valuation, conditional on observing \(\theta _B=0\). The following result shows that B can be written explicitly as a constraint on the observability parameters \(\alpha ^f\) and \(\alpha ^s\).

Lemma 3

B holds if and only if

Proof

Note that \(v^0=\sigma ^0 v^s+(1-\sigma ^0)v^f\). Substitute this into B and simplify to obtain

Since \(\pi ^s>\pi _0>{\underline{\pi }}\), we have \(v^s>0\) and \(u^s>0\). Further, by the definition of \(\sigma ^0\)

and therefore

Isolating \(\alpha ^f \) on the left-hand side yields the result. \(\square \)

The Lemma states that for B to be satisfied, \(\alpha ^f\) cannot be too small. The intuition behind this is that offering the highest price becomes less attractive when the probability of observed failures becomes too large, since the conditional probability that the seller had an unobserved failure increases with \(\alpha ^f\), and therefore the expected value of the good decreases. Hence the buyer’s valuations of the good after observing \(\theta _B=0\) and \(\alpha ^f \) are inversely related. From the seller’s constraint S it is straightforward to see that S holds only if \(\alpha ^f\) is not too large. The reason is that for the seller, experimentation becomes less attractive when the buyer is more likely to observe failures, since the buyer offers the lowest price in this case. Combining these two constraints, we obtain the following chain of inequalities which gives the range of \(\alpha ^f\) for which the unique equilibrium outcome is efficient:

Denote the lower threshold for \(\alpha ^f\) in E by \(\alpha ^{f*}(\alpha ^s)\) and the upper threshold by \(\alpha ^{f**}\). Denote further by \({\underline{\alpha }}^{f*}(\alpha ^s)=\alpha ^{f*}(0)\) the lowest value for \(\alpha ^{f*}(\alpha ^s)\) when \(\alpha ^s=0\). For later reference, we shall write \(\alpha ^{s*}(\alpha ^f)\) to denote the inverse to \(\alpha ^{f*}(\alpha ^s)\), that is, the solution to \(\alpha ^{f*}(\alpha ^s)=\alpha ^f\) for a given \(\alpha ^f\). In each case, we shall omit the argument whenever it is treated as a constant.

By inspection of E we can draw several conclusions regarding the effects of variations in \(\alpha ^{s}\) and \(\alpha ^f\). First, trade must fail with positive probability in equilibrium for any values of \(\alpha ^f\) and \(\alpha ^s\) when \(\pi \in ({\underline{\pi }},{\bar{\pi }})\). The reason is that for \(\pi <{\bar{\pi }}\) , the seller’s flow-payoff is negative, i.e., \(u^0=0\). Therefore, the right-hand side is negative, so the second inequality is necessarily violated. Second, trade must also fail with positive probability in equilibrium when \(\alpha ^{s}\) is close enough to 1. More accurately, there exists a critical value for \(\alpha ^{s}\) so that trade fails with positive probability in equilibrium for all values of \(\alpha ^{s}\) above this threshold. This follows because the threshold \(\alpha ^{f*}(\alpha ^s)\) goes to one as \(\alpha ^s\) approaches one. Intuitively, if the buyer observes successes with a much higher probability than failures, she assigns a low probability to the event that the seller generated an unobserved success, and therefore her willingness to pay the high price for the good is too low to support an efficient equilibrium.

Finally, efficient equilibria may fail to exist when the seller’s valuation for the object is close to the seller’s. The smaller the gains from trade, the lower the buyer’s incentive to pay the high price for the object when she does not observe the experimentation outcome. As a result, the efficient equilibrium can be supported only if the conditional probability of an unobserved experimentation outcome being a success is sufficiently high, which in turn requires \(\alpha ^f\) to be sufficiently close to one. The next result gives a condition for the buyer’s valuation so that for some values of \(\alpha ^s\) and \(\alpha ^f\), there exists an equilibrium in which trade occurs with probability one.

Theorem 2

Suppose \(\pi \ge {\bar{\pi }}\) and

where \(\sigma ^s=\pi ^s\lambda _g+(1-\pi ^s)\lambda _b\). Then there exist values \(\alpha ^f,\alpha ^s\in (0,1)\) so that in equilibrium, trade occurs with probability one.

Figure 3 shows a representation of the set of equilibria when the conditions in Theorem 2 are satisfied. The diagonal line in the figure represents the threshold \(\alpha ^{f*}(\alpha ^s)\) as a function of \(\alpha ^s\). Region I corresponds to equilibria in which the seller experiments and the buyer offers the lowest price. Region II corresponds to mixed strategy equilibria. The shaded region, Region III, corresponds to equilibria in which the seller experiments and the buyer offers the highest price. Both of the inefficient regions I and II can be associated with a different mechanism causing the inefficiency. In Region I, the seller prefers not to experiment at a high price resulting in inefficient experimentation. In Region II experimentation is efficient, but trade occurs only at a low price that drives a successful seller out of the market.

The next two results relate to the local effect of variations in the observability parameter \(\alpha ^f\) and \(\alpha ^s\) on social welfare.

Theorem 3

The probability of trade is constant in \(\alpha ^f\) for \(\alpha ^f<\alpha ^{f*}(\alpha ^s)\) and equal to one if \(\alpha ^{f*}<\alpha ^f<\alpha ^{f**}\). For \(\alpha ^f>\max \{\alpha ^{f*},\alpha ^{f**}\}\) the probability of trade is locally increasing if \(\alpha ^f<\alpha ^f_0\) and locally decreasing if \(\alpha ^f>\alpha ^f_0\) where

The probability of trade increases discontinuously at \(\alpha ^{f*}\).

For the case \(\alpha ^f<\alpha ^{f*}\) in which condition B is violated, the claim follows trivially: the probability of trade is equal to \(1-\sigma (1-\alpha ^{s})\), which is clearly independent of \(\alpha ^f\). For \(\alpha ^f>\alpha ^{f**}\), when B is satisfied and S is violated, the probability of trade depends on \(q^*\) and \(\beta ^*\), the equilibrium probabilities of the seller experimenting and the buyer offering the seller his highest reservation price, respectively. The reason that \(\alpha ^f\) has a non-monotone effect on the probability of trade results from the fact that \(\alpha ^f\) affects the incentives of the buyer and the seller in opposing ways.

For the buyer, an increase in \(\alpha ^f\) makes it more likely that an unobserved experimentation outcome is a success. This effect increases the buyer’s incentive to offer the seller’s highest reservation price. To keep the buyer indifferent between offering the high and low price, the seller has to decrease the probability of experimenting. For the seller, on the other hand, an increase in \(\alpha ^f\) results in a higher probability that a failed experiment is observed so that the seller has a lower incentive to experiment. To keep the seller indifferent, the buyer must offer the highest reservation price with a higher probability.

The total welfare effect of a change in \(\alpha ^f\) depends on the relative effects on the incentive constraints. Intuitively, recall that for the seller the incremental cost from a marginal increase in \(\alpha ^f\) is \((1-\sigma )(u^s-u^f)\), i.e., the loss in value due to the higher probability that the buyer observes a failure. A change in \(\alpha ^f\) has the largest proportional effect on the seller’s incentive when \(\alpha ^f\) is small. For the buyer, the added cost depends on \(\alpha ^f\) through the probability \(1-\sigma ^0\), the probability that an unobserved experimentation outcome is a failure. The proportional change in this probability is greater for large values of \(\sigma ^0\), i.e. when \(\alpha ^f\) is sufficiently larger than \(\alpha ^f\), which implies that the effect of a marginal change in \(\alpha ^f\) is largest for the buyer when \(\alpha ^f\) is close to 1. Therefore, when \(\alpha ^f\) is small, a small increase in \(\alpha ^f\) must compensate primarily the seller, which means that the primary change in trading probability is due to an increase in \(\beta ^*\). Since trade fails only when the buyer offers the low price, this increase in \(\beta ^*\) increases the probability of trade. On the other hand, when \(\alpha ^f\) is close to 1, then a small increase in \(\alpha ^f\) must primarily compensate the buyer, which means that the change in trading probability is primarily due to the increase in \(q^*\). Since trade fails with a positive probability when the seller experiments, the probability of trade decreases.

The important observation here is that an increase in the observability of the experimentation outcome can move an equilibrium from an efficient equilibrium to an inefficient one. In other words, providing the buyer with more or better information about the seller’s experimentation outcome may be harmful to market efficiency.

Theorem 4

Define \(\alpha ^{s*}=1-(1-\alpha ^f)\left( \frac{1-\sigma }{\sigma } \right) \left( \frac{u^s-u^f}{v^s-u^s}\right) \). In the unique equilibirum, the probability of trade changes in \(\alpha ^s\) as follows:

-

(i)

If \(\alpha ^f>\alpha ^{f**}\) or \(\alpha ^s>\alpha ^{s*}\), then the probability of trade is locally increasing in \(\alpha ^s\).

-

(ii)

If \(\alpha ^f\in ({\underline{\alpha }}^{f*},\alpha ^{f**})\) and \(\alpha ^s<\alpha ^{s*}\), then the probability of trade is constant equal to 1.

-

(iii)

At \(\alpha ^s=\alpha ^{s^*}\), the probability of trade has a downwards jump.

That this result is indeed true is easy to see for the case \(\alpha ^s>\alpha ^{s*}\) in which the buyer’s incentive constraint inequality B is violated. In the corresponding equilibrium, the seller experiments and the buyer purchases the good when she observes the experimentation outcome, or when the seller’s experiment generates an unobserved failure. The only event in which trade does not occur is when the seller generates an unobserved success. Since the probability that the seller generates an unobserved success is \(\sigma (1-\alpha ^{s})\), the total probability of trade is \(1-\sigma (1-\alpha ^{s})\), which is clearly increasing in \(\alpha ^{s}\).

For the case \(\alpha ^f>\alpha ^{f**}\) and \(\alpha ^s<\alpha ^{s*}\) in which only the seller’s constraint S is violated, the claim follows from the fact that an increase in \(\alpha ^{s}\) reduces the buyer’s incentive to offer the high price. Note that in the corresponding equilibrium, both the seller and the buyer use mixed strategies. To ensure that the buyer is still willing to offer the higher price, the probability that the experimentation outcome is positive has to be higher, and therefore the seller has to experiment with a higher probability. On the other hand, since the seller’s payoff is not affected by a change in \(\alpha ^{s}\) (recall that the seller only cares about the cost of generating observed failures) the probability that the buyer offers the high price remains unchanged when \(\alpha ^{s} \) increases.

The downward jump at \(\alpha ^s=\alpha ^{s*}\) shows that additional information can harm efficiency. Intuitively, the jump occurs because when the buyer is more likely to observe successes, his valuation of the good when not observing a success is lower, and when \(\alpha ^s\) exceeds the threshold \(\alpha ^{s*}\), the buyer won’t be willing to offer the highest price and the good is not traded after an unobserved success. The phenomenon that additional information can exacerbate the lemon’s problem and thus harm trade has already been pointed out by Levin (2001). The basic mechanism in this particular instance in indeed the same: by releasing additional information about positive outcomes, the remaining uncertainty can lead to unraveling and prevent some types from being traded. Finally, it is worthwhile to discuss how the welfare results are affected when we allow trade in the first period. Since at the outset, the buyer and seller are symmetrically informed, there is an equilibrium in which all gains from trade are realized immediately: the buyer offers the seller a price equal to the expected payoff that the seller would achieve in the second period and the seller accepts. The seller is then as well off as from rejecting the offer. The buyer receives a larger payoff than without trade in the first period, because his flow value of experimentation is higher than for the seller, and because all gains from trade are realized.

Inefficiencies arise, because of the seller’s incentive to engage in experimentation when the good cannot be traded immediately. The inefficiencies can be mitigated, however, if the buyer is able to commit to a menu of prices. Specifically, commitment may be beneficial for the buyer for parameters in Region I of Fig. 3. By offering a price higher than the seller’s reservation price after observing a failure, the buyer can induce the seller to experiment efficiently, in which case it is optimal for the buyer to offer the highest price when observing no failure, thus restoring market efficiency. The following example demonstrates this point.

Example 1

Consider the case in which the buyer observes no successes, but failures with certainty, i.e., \(\alpha ^f=1\) and \(\alpha ^s=0\). Suppose the buyer’s and the seller’s valuations are

and let \(\sigma <\textstyle 0.5\). Under these assumptions, it is easy to see that condition B holds and condition S is violated. Hence, the unique equilibrium is in mixed strategies described in Item 3 of Theorem 1. Substituting the buyer’s and the seller’s valuations in the expression for the seller’s probability of experimenting we obtain \(q^*=1-\sigma \). The seller’s equilibrium payoff is therefore

Suppose now the buyer can commit to the following menu of prices: when \(\theta _B=0\) she offers \(p^0=u^s\), and when \(\theta _B=f\) she offers a price \(p^f\ge u^f\). For such a scheme, it is optimal for the seller to experiment in the first period if

When the seller does not experiment her payoff is \(u^s=1\). If the seller experiments, he is successful with probability \(\sigma \), and then receives payoff \(u^s=1\) in both periods. If he is not successful, he receives 0 in the first period and \(p^f\) in the second period. The lowest price for which it is optimal for the seller to experiment is

If the buyer’s offer this price, and the seller experiments, the buyer’s payoff is

Committing to this scheme gives the buyer a greater payoff when \(2\sigma >\sigma +(1-\sigma ^2)\), or equivalently if \(\sigma >\frac{1}{2} \left( 3-\sqrt{5}\right) \approx 0.38\)2. Hence, when \(0.382<\sigma <0.5\) the buyer can increase her payoff by committing to a higher price after a low signal, thus inducing the seller to experiment, and purchase the good with certainty.

Note that for equilibria in Region II of Fig. 3 the buyer does not benefit by committing to a pricing scheme, because such a commitment would not affect the seller’s decision to experiment.

5 Conclusion

This paper studies how trade opportunities affect a seller’s decision to acquire information through experimentation when the experimentation outcome is partially observable to the buyer. Trade is efficient when the object is worthless to the seller or when the buyer is willing to offer the seller the highest reservation price and the seller is willing to experiment regardless of the buyer’s offer. To reach efficiency, it may be necessary to limit the information that is available to the buyer. Increasing the observability of successes increases realized gains from trade, except at a critical threshold at which the probability of trade jumps down due to the lemon’s problem. In contrast, increasing the observability of failures increases the probability of trade only up to some critical value above which social welfare decreases.

Notes

If the seller was to receive a signal that he could verifiably reveal to the buyer, there would be unravelling in equilibrium: the seller would always reveal the the highest signal. This case is equivalent to the case \(\alpha ^s=1\).

References

Akerlof GA (1970) The market for “lemons’’: quality uncertainty and the market mechanism. Q J Econ 84(3):488–500

Cho IK, Matsui A (2012). Dynamic lemons problem. Unpublished Manuscript

Daley B, Green B (2012) Waiting for news in the market for lemons. Econometrica 80(4):1433–1504

Dang TV (2008) Bargaining with endogenous information. J Econ Theory 140(1):339–354

Dilmé F (2019) Dynamic quality signaling with hidden actions. Games Econom Behav 113:116–136

Dilmé F (2019) Pre-trade private investments. Games Econom Behav 117:98–119

Fuchs W, Skrzypacz A (2019) Costs and benefits of dynamic trading in a lemons market. Rev Econ Dyn 33:105–127

Hörner J, Vieille N (2009) Public vs. Private Offers in the Market for Lemons. Econometrica 77(1):29–69

Janssen MC, Roy S (2002) Dynamic Trading in a durable good market with asymmetric information. Int Econ Rev 43(1):257–282

Kaya A, Kim K (2018) Trading dynamics with private buyer signals in the market for lemons. Rev Econ Stud 85(4):2318–2352

Kessler A (2001) Revisiting the lemons market. Int Econ Rev 42(1):25–41

Kim K (2017) Information about sellers’ past behavior in the market for lemons. J Econ Theory 169:365–399

Lauermann S, Wolinsky A (2016) Search with adverse selection. Econometrica 84(1):243–315

Levin J (2001) Information and the Market for Lemons. Rand J Econ 32(4):657

Shavell, S. (1994). Acquisition and disclosure of information prior to sale. RAND J Econ

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Proofs for Section 3 (Partial Observability)

Proof of Theorem 1

It remains to derive the strategies for the seller and the buyer in the mixed strategy equilibrium when B holds and S is violated. (i) Suppose the seller experiments with probability q. The buyer observes \(\theta _B=0\) with probability \(\rho =1-q+q\sigma (1-\alpha ^{s})+q(1-\sigma )(1-\alpha ^f).\) Suppose the buyer offers \(p=u^0\). The seller accepts if he did not experiment or if he experimented unsuccessfully. The buyer’s expected payoff is therefore

On the other hand, if the buyer offers \(p^0=u(\phi ^{s}(\pi ))\), her expected payoff is

The buyer is indifferent between either offer if

(ii) If the buyer offers \(u^s\) with probability \(\beta \) and \(u^0\) with probability \(1-\beta \), the seller’s expected payoff from experimenting is

He receives flow-payoff u in the first period. In the second period, his payoff is \(u^s\) if he has a success in the first period, or if the buyer observes \(\theta _B=0\) and offers \(u^s\). The seller receives payoff \(u^0\) if he has a failure, the buyer does not observe it but offers \(p^0=u^0\). Finally, if the seller has a failure and the buyer observes it, the seller’s payoff is \(u^f\). The seller’s payoff if he does not experiment is

The seller is indifferent if

\(\square \)

Proofs for Section 4 (Comparative statics)

Proof of Theorem 2

By (E), the equilibrium outcome is efficient if

An equilibrium in which trade occurs with probability one exists only if

which is equivalent to

Now \(\alpha ^s>0\) by assumption, so that no equilibrium exists in which trade occurs with probability one if

Substitute \(v^s=\sigma ^sy_B+(1-\sigma ^s)c_B\), and isolate \(y_B\) on the left-hand side, to obtain

\(\square \)

Proof of Theorem 3

If \(\alpha ^f<\alpha ^{f*}\) condition B is violated. The probability of trade in this case is \(1-\sigma (1-\alpha ^s)\) which is independent of \(\alpha ^f\) so that the claim follows trivially. If \(\alpha ^f\in (\alpha ^{f*},\alpha ^{f**})\) then the probability of trade is equal to one, by the construction of \(\alpha ^{f*}\) and \(\alpha ^{f**}\). To show that the probability of trade increases discontinuously at \(\alpha ^{f*}\), note that \(1-(1-\beta ^*)(1-\alpha ^{s})\sigma q^*>1-(1-\alpha ^s)\sigma \), since \(\beta ^*,q^*\in (0,1)\). Suppose that \(\alpha ^f>\alpha ^{f**}\). The unique equilibrium outcome is then in mixed strategies. Trade occurs unless the seller generates an unobserved success, and the buyer offers the low price. The probability of trade is therefore \(1-(1-\beta ^*)(1-\alpha ^{s})\sigma q^*\). The randomization probabilities \(\beta ^*\) and \(q^*\) from Theorem 1 are

and

Define \(z=\sigma +\alpha ^f (1-\sigma )\) with the domain \([\sigma ,1]\). Then \(\beta ^*\) is a function of z of the form \(a/z-b\) and \(q^*\) is of the form \(1/(z+e)\) where

Note that \(a,b,e>0\). The probability of trade can be written as \(1-\lambda (1-a/z+b)/(z+e)\). The derivative of this probability with respect to z is

The denominator is positive. Denote by n(z) the numerator. Note that n(z) is a polynomial of degree 2. Since its leading coefficient is positive, n(z) is convex and has a unique minimum in \({\mathbb {R}}\). Note that \(a,e >0\) implies \(n(0)<0\), and hence \(\min _z n(z)<0\). As a result, n must have a unique positive root \(z_0\). If \(z_0>1\) then the probability of trade assumes its minimum at \(z=1\). If \(z_0<\sigma +(1-\sigma )\max \{\alpha ^{f*},\alpha ^{f**}\},\) then the probability of trade assumes its minimum at \(z=\sigma +(1-\sigma )\max \{\alpha ^{f*},\alpha ^{f**}\}\). Otherwise, the probability of trade assumes its minimum at \(z_0\). The root \(z_0\) is obtained by setting

and solving for z (ignoring the negative root of n)

Substituting the expressions for a, b and e, and simplifying the result gives the following expression:

Replacing z with \(\sigma +\alpha ^f (1-\sigma )\) and solving for \(\alpha ^f\), gives the critical value \(\alpha ^f_0\) in the theorem. \(\square \)

Proof of Theorem 4

-

(i)

Consider first the case in which condition B holds and condition S is violated. Then trade fails if and only if the seller generates an unobserved success and the buyer offers the low price. This event has probability \(q^*\sigma (1-\alpha ^{s})(1-\beta ^*)\). Note that \(\beta ^*\) is independent of \(\alpha ^{s}\) and \(q^*\) is decreasing in \(\alpha ^{s}\). Hence, the probability of trade is increasing in \(\alpha ^{s}\).

-

(ii)

Next, consider the case in which condition B does not hold. Then the seller experiments with certainty and the buyer buys the object only after a failed experiment. Hence, the probability of trade is \(\sigma \alpha ^{s}+(1-\sigma )\). This value is clearly increasing in \(\alpha ^{s}\) and independent of \(\alpha ^f\). Therefore the probability of trade is again increasing in \(\alpha ^{s}\). \(\square \)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Wagner, P. Seller experimentation and trade. Rev Econ Design 27, 337–357 (2023). https://doi.org/10.1007/s10058-022-00294-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-022-00294-7