Abstract

In this paper we analyze competition between firms with uncertain demand functions. A duopoly model is considered in which two identical firms producing homogeneous commodities compete in quantities. They face uncertain market demand in a context in which two different future scenarios are possible, and no information about the probability distribution of occurrence of the scenarios is available. This decision-making situation is formalized as a normal-form game with vector-valued utility functions for which the notion of Pareto equilibrium is adopted as a natural extension of that of Cournot equilibrium. Under standard assumptions about the demand functions, we characterize the complete set of Pareto equilibria. In the second part of the paper, we analyse the equilibria to which the agents will arrive depending on their attitude to risk. We find that equilibria always exist if both agents are simultaneously pessimistic or optimistic. In the non-trivial cases, for pessimistic firms, infinitely many equilibria exist, whereas when firms act optimistically, only those pairs of strategies corresponding to the Cournot equilibria in each scenario can be equilibria.

Similar content being viewed by others

Notes

The convex hull of \(S\subseteq \mathbb {R}^2\), is \(\textit{conv}(S)=\{z\in \mathbb {R}^2: z=\alpha x+(1-\alpha )y, \, x,y\in S,\, \alpha \in [0,1] \, \}.\)

We call a set \(S\subseteq \mathbb {R}^2\) symmetric if for all \((x_1,x_2)\in S\) then \((x_2, x_1)\in S\).

References

Asplund M (2002) Risk-averse firms in oligopoly. Int J Ind Organ 20:995–1012

Bade S (2005) Nash equilibrium in games with incomplete preferences. Econ Theory 26:309–332

Cournot AA (1838) Recherches sur les principles mathematiques de la theorie des richesses. Hachette, Paris

Fontini F (2005) Cournot oligopoly under strategic uncertainty with optimistic and pessimistic firms. Metroeconomica 56:318–333

Gilboa I, Schmeidler D (1989) Maxmin expected utility with non-unique prior. J Math Econ 18:141–153

Grimm V (2008) Cournot Competition under Uncertainty, University of Cologne, working paper

Lagerlöf JMN (2007) Insisting on a non-negative price: oligopoly, uncertainty, welfafre, and multiple equilibria. Int J Ind Organ 25:861–875

Savage LJ (1954) The foundations of statistics. Wiley, New York

Shapley LS (1959) Equilibrium points in games with vector payoffs. Navl Res Logist Q 6:57–61

Vives X (1984) Duopoly information equilibrium: Cournot and Bertrand. J Econ Theory 34:71–94

Acknowledgments

The research of the authors is partially supported by the Andalusian Ministry of Economics, Innovation and Science, Project P09-SEJ-4903 and by the Spanish Ministry of Science and Innovation, Project ECO2011-29801-C02-01.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs

Appendix: Proofs

Proof of Theorem 2.2

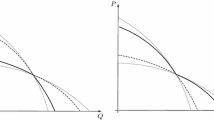

First note that since \(\frac{\alpha _1}{\gamma _1}<\frac{\alpha _2}{\gamma _2}\), then \(r^i_1(q^j)<r^i_2(q^j)\) for all \(q^j\in A_j\).

Consider a point \((\bar{q}^1, \bar{q}^2)\) such that \(\bar{q}^1<r_1^1(\bar{q}^2)\). Since each firm’s objective function, \(\Pi _k^i\), is strictly concave in the firm’s own quantity, both \(\Pi _1^1(q^1, \bar{q}^2)\) and \(\Pi _2^1(q^1, \bar{q}^2)\) are increasing for \(q^1\le r_1^1(\bar{q}^2)\), therefore, it follows that if agent \(1\) moves to \(\bar{q}^1+\varepsilon \) then his benefit will increase in both scenarios. Hence, \((\bar{q}^1, \bar{q}^2)\not \in \textit{PE}(G^{\textit{UC}})\). Analogously, this holds for \(\bar{q}^1> r_2^1(\bar{q}^2)\).

On the other hand, if \(r_1^1(\bar{q}^2)\le \bar{q}^1\le r_2^1(\bar{q}^2), \, r_1^2(\bar{q}^1)\le \bar{q}^2\le r_2^2(\bar{q}^1)\), then any individual movement of one of the agents produces an increase of the benefit in one of the scenarios and a decrease in the other, and therefore \((\bar{q}^1, \bar{q}^2) \in \textit{PE}(G^{\textit{UC}})\).

Proof of Theorem 2.4

The first inclusion (\(\subseteq \)) follows from the definition of Pareto equilibrium.

The other inclusion is a consequence of the strict concavity of the benefit functions. To proof it, consider \( q^*= ( q^{*1}, q^{*2})\in \textit{PE}(G^{\textit{UC}}_+)\). We will distinguish the following cases:

-

(a)

\(q^{*1}, q^{*2}>0\). Suppose that the contrary is true: \(q^* \not \in \textit{PE}\left( G^{\textit{UC}}\right) \). It follows that for an agent, say agent 1, there exists an alternative, \(q^1<0\) such that \(u^1_1\left( q^1, q^{*2}\right) \ge u^1_1\left( q^{*1}, q^{*2}\right) \) and \(u^1_2\left( q^1, q^{*2}\right) \ge u^1_2\left( q^{*1}, q^{*2}\right) \) (with a strict inequality). Let \(\bar{q}=\left( 0,q^{*2}\right) \), \(0=\lambda q^1+\left( 1-\lambda \right) q^{*1}\) with \(\lambda \in \left( 0,1\right) \). It follows from the strict concavity of \(u^1_k\) that \(u^1_k\left( \bar{q}\right) >\lambda u^1_k\left( q^1, q^{*2}\right) +\left( 1-\lambda \right) u^1_k\left( q^{*1}, q^{*2}\right) \ge u^1_k\left( q^{*1}, q^{*2}\right) \). This contradicts \(q^* \in \textit{PE}\left( G^{\textit{UC}}_+\right) \).

-

(b)

\(q^{*1}>0,\, q^{*2}=0\) (or \(q^{*1}=0,\, q^{*2}>0\)). Suppose that the contrary is true: \(q^* \not \in \textit{PE}(G^{\textit{UC}})\). Hence \(q^{1*}< \frac{\alpha _1}{\gamma _1}\) or \(q^{1*}> \frac{\alpha _2}{2\gamma _2}\). If \(q^{1*}< \frac{\alpha _1}{\gamma _1}\), then for a fixed \(q^{1*}\), the benefit of agent 2, \(\Pi _k^2\left( q^{1*},q^2\right) \), is strictly increasing for both \(k=1,2\) at \(q^2=0\), and therefore, a strategy of agent 2 exists, \(q^2=\varepsilon \) with \(\varepsilon >0\) such that \(\Pi _k^2\left( q^{1*}, \varepsilon \right) >\Pi _k^2\left( q^{1*}, 0\right) \) for \(k=1,2\). This contradicts \(q^* \in \textit{PE}\left( G^{\textit{UC}}_+\right) \). If \(q^{1*}> \frac{\alpha _2}{2\gamma _2}\), then the benefit of agent 1 when \(q^2\) fixed at \(0\), \(\Pi _k^1\left( q^1, 0\right) \) is strictly decreasing for both \(k=1,2\), and therefore, \(\varepsilon > 0\) exists, such that, for \(q^1=q^{1*}-\varepsilon >0\), \(\Pi _k^2\left( q^{1*}-\varepsilon , 0\right) >\Pi _k^2\left( q^{1*}, 0\right) \) holds for \(k=1,2\). This contradicts \(q^* \in \textit{PE}\left( G^{\textit{UC}}_+\right) \).

-

(c)

\(q^{*1}=0,\, q^{*2}=0\). The reasoning is analogous to that above.

Proof of Proposition 3.3

Let \(\left( q^{*1}, q^{*2}\right) \) be a conservative equilibrium for the Cournot game \(G_+^{\textit{UC}}\), and suppose to the contrary that it is not a Pareto equilibrium. It follows that, for a firm \(i\), a strategy \(q^i\in \mathbb {R}_+\) exists such that \(\Pi ^i_k\left( q^i, q^{*j}\right) \ge \Pi ^i_k \left( q^{*i}, q^{*j}\right) \) for \(k=1,2\) (with a strict inequality).

Therefore, since \(\Pi ^i_k\left( q^{*i}, q^{*j}\right) \ge \Pi ^i_c \left( q^{*i}, q^{*j}\right) \) for \(k=1,2\), then \(\Pi ^i_k\left( q^i, q^{*j}\right) \ge \Pi ^i_c \left( q^{*i}, q^{*j}\right) \) for \(k=1,2\) and \(\Pi ^i_c\left( q^i, q^{*j}\right) \ge \Pi ^i_c \left( q^{*i}, q^{*j}\right) \). Thus \(q^i\in R_+\) exists such that \(\Pi _c^i\left( q^i, q^{*j}\right) \ge \Pi _c^i \left( q^{*i}, q^{*j}\right) \), which is a contradiction with \(\left( q^{*1}, q^{*2}\right) \) being a conservative equilibrium.

Proof of Theorem 3.4

To prove our result we consider several cases which depend on the relative positions of the demand functions in the two scenarios. Recall that \(\frac{\alpha _1}{\gamma _1}<\frac{\alpha _2}{\gamma _2}\), and note that the conservative utility function, \(\Pi ^i_c\) coincides with \(\Pi ^i_1\) for \(\left( q^1,q^2\right) \) such that \(\left( \gamma _1-\gamma _2\right) \left( q^1+q^2\right) \ge \alpha _1-\alpha _2\), and coincides with \(\Pi ^i_2\) otherwise.

-

(a1)

\(\alpha _1\le \alpha _2\) and \(\gamma _1>\gamma _2\). It is easy to see that in this case \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_1\left( q^1,q^2\right) \) if and only if \(q^1+q^2\ge \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). However, since \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\le 0\), it follows that \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_1\left( q^1,q^2\right) \) for all \(q^1, q^2\ge 0\) and therefore the conservative equilibria coincide with that of scenario 1, \(E^c\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \right\} \).

-

(a2)

\(\alpha _1\le \alpha _2\) and \(\gamma _1<\gamma _2\). Here \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_1\left( q^1,q^2\right) \) if and only if \(q^1+q^2\le \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), and \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_2\left( q^1,q^2\right) \) if and only if \(q^1+q^2\ge \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). Since, by Lemma 3.1, \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}>\frac{\alpha _2}{\gamma _2}\), then the whole set of Pareto Equilibria lies in the region where the conservative function coincides with the benefit in scenario 1. It is easy to prove that in this case the conservative equilibrium also coincides with that of scenario 1, \(E^c\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \right\} \).

-

(a3)

\(\alpha _1\le \alpha _2\) and \(\gamma _1=\gamma _2\). It is straightforward that in this case \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_1\left( q^1,q^2\right) \) for all \(\left( q^1, q^2\right) \), and hence \(E^c\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \right\} \).

We will now analyse the cases in which \(\alpha _1>\alpha _2\).

For these values, \(\gamma _1>\gamma _2\), by Lemma 3.1 \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}<\frac{\alpha _1}{\gamma _1}\) holds, and

Several subcases are now determined:

-

(b)

\(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\le \frac{2\alpha _1}{3\gamma _1}\). For these values of the parameters, the whole set of Pareto equilibria lies in the region where the conservative function coincides with the benefit in scenario 1, and the conservative equilibria coincide with that of scenario 1, \(E^c\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \right\} \).

-

(c)

\(\frac{2\alpha _1}{3\gamma _1}<\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}<\frac{2\alpha _2}{3\gamma _2}\). To prove that a point \(\left( q^{1*}, q^{2*}\right) \in \textit{PE}\left( G_+^{\textit{UC}} \right) \) with \( q^{1*}+q^{2*}=\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\) is a conservative equilibrium, we rely on the strict concavity of \(\Pi _k^i\left( q^i, q^{j*}\right) \). Suppose that agent \(1\) deviates from \(\left( q^{1*}, q^{2*}\right) \) by adopting strategy \(q^1\). If \(q^1>q^{1*}\), then since \(\Pi _1^1\left( q^1, q^{2*}\right) \) is decreasing, then her utility decreases since \(\Pi _c^1\left( q^1, q^{2*}\right) =\Pi _1^1\left( q^1, q^{2*}\right) < \Pi _1^1\left( q^{1*}, q^{2*}\right) =\Pi _c^1\left( q^{1*}, q^{2*}\right) \). If \(q^1<q^{1*}\) then \(\Pi _c^1\left( q^1, q^{2*}\right) =\Pi _2^i\left( q^1, q^{j*}\right) \). However, in this region, \(\Pi _2^1\left( q^1, q^{2*}\right) \) is increasing and therefore \(\Pi _2^1\left( q^1, q^{2*}\right) < \Pi _2^1\left( q^{1*}, q^{2*}\right) =\Pi _c^1\left( q^{1*}, q^{2*}\right) \). Analogous reasoning with the deviations of agent 2, leads us to the result. Consider now a point \(\left( q^{1*},q^{2*}\right) \in \textit{PE}\left( G_+^{\textit{UC}}\right) \) with \(q^{1*}+q^{2*} < \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). In this region, \(\Pi _c^i\left( q^1, q^2\right) =\Pi _2^1\left( q^1, q^2\right) \) and given the action of one of the firms, the benefit at scenario \(2\) is strictly increasing in its own action. Therefore, any of the firms will improve its utility by increasing its quantity, and the point is not a conservative equilibrium.

-

(d)

\(\frac{2\alpha _2}{3\gamma _2}\le \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}.\) In this case, the set of Pareto equilibria lies in the region where the conservative utility coincides with the benefit at scenario 2 and the conservative equilibria coincides with that of scenario 2.

Proof of Proposition 3.6

Let \(\left( q^{*1}, q^{*2}\right) \) be an optimistic equilibrium for the Cournot game \(G_+^{\textit{UC}}\), and suppose to the contrary that it is not a Pareto equilibrium. It follows that, for a firm \(i\), a strategy \(q^i\in \mathbb {R}_+\) exists such that \(\Pi ^i_k\left( q^i, q^{*j}\right) \ge \Pi ^i_k \left( q^{*i}, q^{*j}\right) \) for \(k=1,2\) (with a strict inequality). As a consequence, since \(\Pi ^i_{op}\left( q^{i}, q^{*j}\right) \ge \Pi ^i_k\left( q^{i}, q^{*j}\right) \) for \(i=1,2\), then \(\Pi ^i_{op}\left( q^i, q^{*j}\right) \ge \Pi ^i_k \left( q^{*i}, q^{*j}\right) \) for \(k=1,2\), and therefore \(\Pi ^i_{op}\left( q^i, q^{*j}\right) \ge \Pi ^i_{op} \left( q^{*i}, q^{*j}\right) \). This contradicts \(\left( q^{*1}, q^{*2}\right) \) being an optimistic equilibrium.

Proof of Theorem 3.7

Recall that \(\frac{\alpha _1}{\gamma _1}<\frac{\alpha _2}{\gamma _2}\), and note that the optimistic utility function \(\Pi ^i_{op}\) coincides with \(\Pi ^i_1\) for those \(\left( q^1,q^2\right) \) such that \(\left( \gamma _1-\gamma _2\right) \left( q^1+q^2\right) \le \alpha _1-\alpha _2\), and coincides with \(\Pi ^i_2\) otherwise. Several subcases can be determined:

-

(a1)

\(\alpha _1\le \alpha _2\) and \(\gamma _1>\gamma _2\). In this case, \(\Pi _{op}^i\left( q^1, q^2\right) =\Pi ^i_2\left( q^1,q^2\right) \) if and only if \(q^1+q^2\ge \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). However, since \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\le 0\), it follows that \(\Pi _{op}^i\left( q^1, q^2\right) =\Pi ^i_2\left( q^1,q^2\right) \) for all \(q^1, q^2\ge 0\) and therefore the optimistic equilibria coincides with that of scenario 2, \(E^{op}\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \right\} \).

-

(a2)

\(\alpha _1\le \alpha _2\) and \(\gamma _1<\gamma _2\). In this case \(\Pi _{op}^i\left( q^1, q^2\right) =\Pi ^i_2\left( q^1,q^2\right) \) if and only if \(q^1+q^2\le \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), and \(\Pi _{op}^i\left( q^1, q^2\right) =\Pi ^i_1\left( q^1,q^2\right) \) if and only if \(q^1+q^2\ge \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). Since, by Lemma 3.1, \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}>\frac{\alpha _2}{\gamma _2}\) holds, then the whole set of Pareto Equilibria lies in the region where the optimistic function coincides with the benefit in scenario 2 and the optimistic equilibria coincide with that of scenario 2, \(E^{op}\left( G_+^{\textit{UC}}\right) =\left\{ \left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \right\} \).

-

(a3)

\(\alpha _1\le \alpha _2\) and \(\gamma _1=\gamma _2\). It is straightforward that in this case \(\Pi _c^i\left( q^1, q^2\right) =\Pi ^i_2\left( q^1,q^2\right) \) for all \(\left( q^1, q^2\right) \), and hence \(E^c\left( G_+^{\textit{UC}}\right) =\{\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \}\).

We now analyse the cases in which \(\alpha _1>\alpha _2\).

For these values, \(\gamma _1>\gamma _2\). By Lemma 3.1, \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}<\frac{\alpha _1}{\gamma _1}\) holds and

We distinguish several sub-cases.

-

(b)

\(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}<\frac{2\alpha _1}{3\gamma _1}\). It is easy to see that since the whole set of Pareto equilibria lies in the region where \(\Pi _{op}\) coincides with \(\Pi _2\), then the only candidate to be an optimistic equilibria is \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \). To prove that this point is the optimistic equilibrium, consider the possible deviations of firm 1 from \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \). If, by deviating, \(\left( q^1,\frac{\alpha _2}{3\gamma _2} \right) \) remains in the region where \(\Pi _{op}\) coincides with \(\Pi _2\), then its benefit decreases. On the other hand, if a negative deviation takes \(\left( q^1,\frac{\alpha _2}{3\gamma _2}\right) \) outside this region then \(\Pi _{op}\left( q^1,\frac{\alpha _2}{3\gamma _2}\right) = \Pi _1\left( q^1,\frac{\alpha _2}{3\gamma _2}\right) \). Note that, since \(\Pi _1\) is strictly increasing in \(q^1\), then \(\Pi _1\left( q^1,\frac{\alpha _2}{3\gamma _2}\right) < \Pi _1\left( \bar{q}^1,\frac{\alpha _2}{3\gamma _2}\right) = \Pi _2\left( \bar{q}^1,\frac{\alpha _2}{3\gamma _2}\right) \), where \(\bar{q}^1\) is such that \(\bar{q}^1+\frac{\alpha _2}{3\gamma _2}=\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). Now note that \(\Pi _2\left( \bar{q}^1,\frac{\alpha _2}{3\gamma _2}\right) < \Pi _2\left( \frac{\alpha _2}{3\gamma _2},\frac{\alpha _2}{3\gamma _2}\right) =\Pi _{op}\left( \frac{\alpha _2}{3\gamma _2},\frac{\alpha _2}{3\gamma _2}\right) \). Therefore, any deviation from \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) yields a strict decrease of the firm’s optimistic utility. As a consequence \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) is the optimistic equilibrium.

-

(c)

\(\frac{2\alpha _1}{3\gamma _1}<\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}<\frac{2\alpha _2}{3\gamma _2}\). We will prove that only \(\left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \) and \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) can be optimistic equilibria.

-

1.

Given a point \((q^1, q^2) \in \textit{PE}(G_+^{\textit{UC}})\) in the interior of \(\textit{PE}(G_+^{\textit{UC}})\), any of the agents can deviate to his best response corresponding to the scenario in which the optimistic function coincides with the benefit.

-

2.

Consider now \((q^1, q^2)\in \textit{PE}(G_+^{\textit{UC}}){\setminus } \{(\frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}), \, (\frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2})\}\) which lies on some of the best response lines. Assume without loss of generality that \(q^2=r^2_1\big (q^1\big )\) or \(q^2=r^2_2\big (q^1\big )\):

-

If \(q^2=r^2_1\big (q^1\big )\) and \(q^{1}+q^{2}\le \dfrac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), then, since \(q^1\) is not the best response of agent 1 to this \(q^2\), then agent 1 will improve his benefit by moving to his best response line in scenario 1.

-

If \(q^2=r^2_1\big (q^1\big )\) and \(q^{1}+q^{2}\ge \dfrac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), then agent 2 will improve its benefit by moving to his best response line in scenario 2.

-

If \(q^2=r^2_2\big (q^1\big )\) and \(q^{1}+q^{2}\le \dfrac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), then agent 2 will improve his benefit by moving to his best response line in scenario 1.

-

If \(q^2=r^2_2\big (q^1\big )\) and \(q^{1}+q^{2}\ge \dfrac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), then agent 1 will improve his benefit by moving to his best response line in scenario 2.

-

-

3.

If \((q^1, q^2)\in \textit{PE}\left( G_+^{\textit{UC}}\right) \) with \(q^2=0\) and lies on the boundary of \( \textit{PE}(G_+^{\textit{UC}})\), then \(q^1\ge \frac{\alpha _1}{\gamma _1}\). As a consequence of Lemma 3.1, \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\le \frac{\alpha _1}{\gamma _1}\) holds and it follows that at this point the optimistic utility coincides with the benefit in scenario 2. In this situation, firm 2 can improve its optimistic utility by adopting a strategy \(\bar{q}^2>0\). Therefore, \((q^1, 0)\) is not an optimistic equilibrium. Analogous reasoning is valid if If \(\left( q^1, q^2\right) \in \textit{PE}\left( G_+^{\textit{UC}}\right) \) with \(q^1=0\) and lies on the boundary of \({\textit{PE}}\left( G_+^{\textit{UC}}\right) \).

-

1.

-

(d)

\(\frac{2\alpha _2}{3\gamma _2}<\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\). The reasoning is analogous to that of sub-case (a3).

Proof of Lemma 3.8

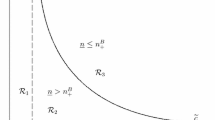

When the strategy of agent 1 is \(q^1\le \frac{\alpha _1}{\gamma _1}\), agent 2 has the possibility of adopting the best response function corresponding to the first scenario or to the second scenario. If agent 2 is optimistic, then he only considers the maximum of the benefits he obtains with these best responses, that is, the maximum of the following two quantities:

In other words, for \(q^1\le \frac{\alpha _1}{\gamma _1}\), the best response of agent 2 is \(r_{op}^2\big (q^1\big )=r_k^2\big (q^1\big )\) where for each \(q^1\), \(k\) is such that

On the other hand, when \(q^1\ge \frac{\alpha _1}{\gamma _1}\), then the best response of agent 2 at scenario 1 is \(r^2_1\big (q^1\big )=0\) and therefore \(r_{op}^2\big (q^1\big )=r_2^2\big (q^1\big )\).

Note that, as a consequence of the symmetry of our model, for each \(q\le \frac{\alpha _1}{\gamma _1}\), \(\Pi _1^2\left( q, r^2_1(q)\right) = \Pi _1^1\left( r_1^1(q), q\right) \) and \(\Pi _2^2\left( q, r^2_1(q)\right) = \Pi _2^1\left( r_2^1(q), q\right) \). Hence, for \(q\le \frac{\alpha _1}{\gamma _1}\), the best response of agent 1, \(r_{op}^1(q)\), is attained for the same scenario as the best response for agent 2, \(r_{op}^2(q)\). On the other hand if \(q\ge \frac{\alpha _1}{\gamma _1}\), then \(r_{op}^1(q)=r_2^1(q)\).

It is important to identify at which values of the strategy of his opponent, an optimistic agent switches from reacting with the best response at one scenario to reacting with the best response at the other scenario. The values of \(q\) for which the benefit obtained in scenario 1 with the best response in scenario 1 coincides with the benefit in scenario 2 with the best response in scenario 2 are the values for which agent 2 will change from one of the best responses to the other. These values are obtained by solving the equation

Denote these quantities as \(q_m\) and \(q_M\):

A first remarkable fact is that one and only one of these switching points is below \(\frac{\alpha _1}{\gamma _1}\). That is, \( q_m< \frac{\alpha _1}{\gamma _1}<q_M\): Clearly \(q_m< \frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\), and it follows from Lemma 3.1 that \(\frac{\alpha _1-\alpha _2}{\gamma _1-\gamma _2}\le \frac{\alpha _1}{\gamma _1}\), therefore the first inequality holds. The second inequality is obtained by taking into account that in this case \(\gamma _2<\gamma _1\), and by performing algebraic operations.

Now note that both \(\Pi _1^2\left( q, r^2_1(q)\right) = \frac{\left( \alpha _1-\gamma _1q\right) ^2}{4\gamma _1}\) and \(\Pi _2^2\left( q, r^2_2(q)\right) = \frac{\left( \alpha _2-\gamma _2q\right) ^2}{4\gamma _2}\) are convex parabolic functions attaining their minima at \(\frac{\alpha _1}{\gamma _1}\) and \(\frac{\alpha _2}{\gamma _2}\) respectively. Hence, for \(q<\frac{\alpha _1}{\gamma _1}\) they are both decreasing. Since for \(q= \frac{\alpha _1}{\gamma _1}\), \(\Pi _2^2\left( q, r^2_2(q)\right) >\Pi _1^2\left( q, r^2_1(q)\right) \), it follows that \(\Pi _2^2\left( q, r^2_2(q)\right) >\Pi _1^2\left( q, r^2_1(q)\right) \) for those \(q\) such that \(q_m<q<\frac{\alpha _1}{\gamma _1}\). It also follows that \(\Pi _1^2\left( q, r^2_1(q)\right) > \Pi _2^2\left( q, r^2_2(q)\right) \) for all \(q<q_m\).

As a consequence, given an action of one of the agents \(q\ge 0\), the best response of the optimistic opponent is: For \(q<q_m\), \(r_{op}^2(q)=r_1^2(q)=r_{op}^1(q)=r_1^1(q)\). For all \(q>q_m\), \(r_{op}^2(q)=r_2^2(q)=r_{op}^1(q)=r_2^1(q)\).

Proof of Proposition 3.9

From Theorem 3.7 it is known that the only points which can be optimistic equilibria are the Cournot equilibria of the two scenarios. We will analyse whether they are or not:

-

(a)

\(q_m<\frac{\alpha _1}{3\gamma _1}\). In this case, \(r_{op}^2\left( \frac{\alpha _1}{3\gamma _1}\right) =r_2^2\left( \frac{\alpha _1}{3\gamma _1}\right) \ne \frac{\alpha _1}{3\gamma _1}\) and therefore \(\left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \) is not an optimistic equilibria. On the other hand, since \(q_m<\frac{\alpha _2}{3\gamma _2}\) also holds, then \(r_{op}^2\left( \frac{\alpha _2}{3\gamma _2}\right) =r_2^2\left( \frac{\alpha _2}{3\gamma _2}\right) = \frac{\alpha _2}{3\gamma _2}\). Symmetrically, \(r_{op}^1\left( \frac{\alpha _2}{3\gamma _2}\right) =r_2^1\left( \frac{\alpha _2}{3\gamma _2}\right) = \frac{\alpha _2}{3\gamma _2}\). It follows that \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) is the unique optimistic equilibrium in this case.

-

(b)

\(\frac{\alpha _1}{3\gamma _1}\le q_m\le \frac{\alpha _2}{3\gamma _2}\). In this case, \(r_{op}^2\left( \frac{\alpha _1}{3\gamma _1}\right) =r_1^2\left( \frac{\alpha _1}{3\gamma _1}\right) = \frac{\alpha _1}{3\gamma _1}\) and symmetrically \(r_{op}^1\left( \frac{\alpha _1}{3\gamma _1}\right) = \frac{\alpha _1}{3\gamma _1}\). Therefore \(\left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \) is an optimistic equilibria. Analogous reasoning leads us to conclude that \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) is also an optimistic equilibrium.

-

(c)

\(q_m>\frac{\alpha _2}{3\gamma _2}\). By using an identical argument as in case (b), we conclude that \(\left( \frac{\alpha _1}{3\gamma _1}, \frac{\alpha _1}{3\gamma _1}\right) \) is an optimistic equilibrium. By a reasoning to that of case (a), it can be proven that \(\left( \frac{\alpha _2}{3\gamma _2}, \frac{\alpha _2}{3\gamma _2}\right) \) is not an optimistic equilibrium.

Rights and permissions

About this article

Cite this article

Caraballo, M.A., Mármol, A.M., Monroy, L. et al. Cournot competition under uncertainty: conservative and optimistic equilibria. Rev Econ Design 19, 145–165 (2015). https://doi.org/10.1007/s10058-015-0171-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10058-015-0171-z