Abstract

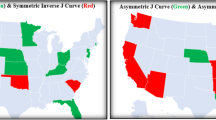

This study creates a US state-level asymmetric J‑curve hypothesis testing map with Canada. The map may visually present how a US state policymaker manages bilateral trade balances with Canada. Green-colored US states support the evidence of the asymmetric J‑curve hypothesis, while red-colored and gray-colored states do not. The main empirical finding indicates that the asymmetric J‑curve hypothesis is supported for only 15 US states and D.C., shown in green on the map. This suggests that policymakers of these US states may have more sustainable and manageable bilateral trade policies with Canada. If so, policymakers in red/grey US states should reevaluate their bilateral trade policy regulations, especially those related to taxation, budgetary frameworks, energy prices, and other relevant factors that can impact consumer-producer prices and thereby create competitive state-level real exchange rates. By doing so, they may achieve the anticipated positive outcomes of the J‑curve effect to export more.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The US total trade deficit with Canada reached $1.1 trillion from 1985 to 2021, and the USA never experienced a trade surplus during this period (CB 2021). Of course, many different factors may cause such enormous deficits. However, changing the exchange rate between the USD and Canada’s currency (CAD) may be the most important determinant. This is because the economic growth rates of the two countries were nearly the same, but the bilateral exchange rate seriously fluctuated over time. For example, from May 2020 to May 2021, the USD appreciated against the Canadian currency (CAD) by 14.9% (FED 2022). Thus, this change between the USD and CAD naturally brings to mind a well-known J‑curve hypothesis introduced by Magee (1973). According to the J‑curve hypothesis, a depreciation or devaluation in a home country’s currency against its partner country’s currency initially worsens and eventually improves the home country’s bilateral trade balance with this partner. The pattern of this economic activity is known as the J‑curve because it resembles the letter “J.” (Fig. 1).

Canada ranks first among the countries frequently used as partner countries in J‑curve analyses for the USA. The USA and Canada are member countries of the USCMA (the United States-Mexico-Canada Agreement), one of the world’s largest free trade agreements. Therefore, J‑curve analyses between these two countries can yield more accurate results, as the effect of tariffs and trade barriers, which may be determinative in the model results, will be automatically eliminated due to free trade. Empirical studies in the J‑curve, which consider the USA the major country and Canada as the partner country (the USA \(\rightarrow\) Canada), can be broadly categorized into two groups. The first group of studies is subject to aggregation bias, as they use aggregated trade volumes. In contrast, the second group of studies uses disaggregated trade volumes. However, the empirical studies in both groups have mixed results in validating the J‑curve hypothesis (Bahmani-Oskooee and Ratha 2004). While Magee’s (1973) pioneering study introduced the idea of the J‑curve hypothesis, the first paper to test this hypothesis is Bahmani-Oskooee’s 1985 publication (Bahmani-Oskooee 1985). Here are some examples of studies in the first group with their published years, methodologies, and test results of the J‑curve: Rose and Yellen (1989, the ordinary least squares (OLS) model, no evidence for the J‑curve hypothesis), Marwah and Klein (1996, the OLS model, evidence supporting the J‑curve), Shirvani and Wilbratte (1997, the Johansen and Jusilius cointegration technique, no evidence), Ongan et al. (2018, the linear and nonlinear autoregressive distributed lag (ARDL) models, no evidence), Hsing and Sergi (2010, the vector error correction model, no evidence), Bahmani-Oskooee and Fariditavana (2016, the linear and nonlinear ARDL models, evidence), Kallianiotis (2022, the vector autoregressive (VAR) model, evidence). The second group of empirical studies on the J‑curve used disaggregated trade volumes. Baek (2007, the ARDL model for forest industries, no evidence), Bahmani-Oskooee and Bolhasani (2008, the linear ARDL models to 152 industries, no evidence), Bahmani-Oskooee and Fariditavana (2020, the linear and nonlinear ARDL models for different industries, evidence for some), Bahmani-Oskooee and Karamelikli (2022, the linear and nonlinear ARDL models for finance industry, evidence), Ongan et al. (2023, the linear and nonlinear ARDL models for 91 industries, evidence for some).

In all the studies above, the J‑curve test was performed at the bilateral country level from the USA to Canada. However, our study differs from all of them by testing this hypothesis at the US state level rather than the county level. This study takes a unique approach by examining the J‑curve hypothesis at the US state level rather than the country level analyzed in prior research. There are three main reasons for this state-level analysis.

First, many US states have larger economic sizes and populations than some entire countries, including Canada. Therefore, a state-level analysis may be more appropriate for understanding the complex trade dynamics between the US and Canada.

Second, the US has collected state-level trade data accurately and regularly for a long time, which provides an advantage for a more detailed and comprehensive analysis.

Third, the results of this study can be essential for US state policymakers, who may need to manage their bilateral trade balances with Canada at an individual-state level. This is because US states policymakers can have their own economic policies and regulations, such as tax rates, energy prices, budgetary frameworks, and production costs, that can impact productivity and consumer prices, as well as real exchange rates and export-import volumes. In this context, we assume that if a U.S. state supports the evidence for the J‑curve hypothesis, in the long run, this will signify that this state’s policymaker has a long-run manageable and sustainable bilateral trade policy with Canada. It should be kept in mind that US state policymakers cannot control the nominal exchange rate, but they can influence the price index used to calculate the real exchange rate to some extent. Therefore, the US states’ above-mentioned economic and administrative policies and practices can play a crucial role in achieving the anticipated positive outcomes of the J‑curve hypothesis by changing the real exchange rate. Hence, these economic-administrative policies-practices may determine the success of this hypothesis. Moreover, the United States is a country with a range of social and economic differences between its states (Rupasingha et al. 2002; Rentfrow et al. 2009), which means that there may be a tie between the J‑curve hypothesis and state-based regional characteristics. In the same way, just as export-led economic growth for a country is determined with all the elements of that country that will contribute to the increase of that country’s exports, the same can be evaluated based on particular regions or as in our study US states referring to the importance of the regional economy or economic geography (Krugman 1998; Fujita et al. 2001).

Additionally, the study also aims to create a US state-level J‑curve hypothesis testing map for trade with Canada. This map will visually illustrate which states support the hypothesis and which do not, providing valuable information for policymakers and researchers interested in understanding the complexities of trade dynamics at the state level.

2 Empirical Model and Methodology

In the empirical model of this study, we follow Bahmani-Oskooee and Fariditavana’s (2016) nonlinear Autoregressive Distributed Lag (NARDL) framework for US states trade with Canada. Theoretically, in Rose and Yellen’s (1989) linear approach, appreciation worsens while depreciation improves bilateral trade balance (BTB). This relationship is constructed on a linear (symmetric) assumption. However, as Bahmani-Oskooee and Fariditavana (2016) argued, this relationship may be nonlinear (asymmetric). This means that depreciation may have no effect or may worsen the bilateral trade balance, appreciation may improve, or vice versa. The NARDL framework, developed by Shin et al. (2014), was constructed to explore the asymmetries in the model. However, we first present the most used reduced form bilateral trade model with its main determinants in Eq. (1):

where SX/SM is a US state’s bilateral trade balance with Canada and defined as the state’s exports to Canada over this US state’s imports from Canada (S, X, and M denote the US state, exports, and imports). SEUS and ECAN are the number of persons employed, as the proxy of real GDP, in a US given state and Canada, respectively, since US state-level monthly GDPs and Industrial Production Indexes (IPI) are not available. REXCAD−USD is the real exchange rate between the USD and the Canadian dollar (CAD). \(\mathrm{REX}_{\mathrm{CAD}-\mathrm{USD}}\)= \(\frac{\left(NEX*\mathrm{CPI}_{\mathrm{CAN}}\right)}{\mathrm{CPI}_{US}}\). NEX is the nominal exchange rate, defined as units of USD per CAD. CPICAN and CPIUS are Canada’s and USA’s country level consumer price indexes (CPIs). We wanted to calculate the US state-level real exchange rates in the model; however, there are no US states’ consumer price indexes available. Concerning the signs of independent variables with SX/SM, we expect the sign for β1 to be negative since a rise in SEUS will lead to increase of a US state’s imports from Canada, which will worsen SX/SM. The expected sign of β2 is to be positive since a rise in ECAN will lead to increase of a US state’s exports to Canada, which will improve SX/SM. Finally, we expect β3 to be positive since real depreciation in the USD (increase in REX) will increase a US state’s exports to Canada, and, thereby, SX/SM will improve. We also added the Covid-19 pandemic in the model as a game-changer independent variable that may affect US bilateral trade balance. \(\text{SCovid}19_{{US_{t}}}\) and \(\text{Covid}19_{{\mathrm{CAN}_{t}}}\) are US state-level and Canada country-level number of covid cases reported, respectively. The expected signs of β4 and β5 are to be either positive or negative. This means that this pandemic may worsen or improve a US state’s bilateral trade balance with Canada. This study uses the total value of 91 Harmonized System (HS) coded commodities. Monthly state-level export and import flow between 2008M1 and 2021M6 were obtained from the US Census Bureau (CB 2021) as the available longest sample period. Nominal exchange rates, CPIs, and numbers of persons employed for the USA and Canada were obtained from the Federal Reserve Bank of St. Louis. The number of US state level and Canada’s country level covid cases were obtained from the CDC (2022) and StatCan (2022b), respectively. The sample period of the study is between 2008M1-2021M11.

To study with monthly data, we use the monthly number of persons employed instead of real GDP for 50 US states and D.C. since no industrial production index (IPI) or GDP data are collected or published at US state level. According to the US National Bureau of Economic Research (NBER) committee, using the real GDP may involve some interpretation problems in indicating the actual state of economic activities. This is because omissions of the quality of products-services produced and different price measurement methodologies [CPI, PPI (Producer Price Index)] may change real GDP values. In recent years the committee has also used employment besides the industrial production index (Hall et al. 2003; Feldstein 2017). The rationale for using this alternative indicator (employment) goes back to the 1960s. Arthur Okun (1962) experimentally confirmed the long-run negative relationship between changes in real GDP and employment with his famous Okun’s LawFootnote 1. Therefore, we used the numbers of persons employed. Another supporting criterion making this indicator utilizable is that jobs and salaries for most of the families in both countries provide the means for spending, and, thereby, consumer spending that accounts for the biggest portion of GDP with 70% for the USA and 60% for Canada (BEA 2022; StatCan 2022a).

In the methodology of this study, we apply the linear and nonlinear ARDL models, respectively. For the linear (symmetric) analysis, the following model is formed in Eq. (2):

To verify the symmetric J‑curve hypothesis using the equation provided above, we need to take two steps. First, we must confirm the existence of a long-run cointegration relationship for a US state, which can be achieved through either an F test or ECMt−1, as suggested by Bahmani-Oskooee and Nouira (2021). Second, according to Rose and Yellen’s (1989) findings, if the estimation of the real exchange rate (RER) is negative or insignificant in the short run, we need to look for a significant and positive value of α4 in Eq. (2) for SBTB in the long run, as indicated by Bahmani-Oskooee and Durmaz (2020). On the other hand, if the coefficient of RER is insignificant or positive in the short run but negative and significant in the long run, then we would be dealing with a symmetric inverse J Curve, as discussed by Bahmani-Oskooee and Ratha (2004).

To conduct the asymmetric analysis in this study, we utilize the NARDL model. The first step in this process involves decomposing the real exchange rate (REX) into its two components: depreciation (DEP) and appreciation (APR). This can be achieved using the following partial sum process:

Following the decomposition process, we rewrite the model in Eq. (1) in the following NARDL form with the two additional variables of DEP and APR. The dependent variable SX/SM in Eq. (1) will be represented by SBTB (state bilateral trade balance) in the following model. We will test the J‑curve hypothesis for all US states using this model:

In Eq. (5), normalized long-run coefficients are obtained through \(\mathrm{DEP}_{t}=-\alpha _{4}/\alpha _{1}\) and \(\mathrm{APR}_{t}=-\alpha _{5}/\alpha _{1}.\) We determine long-run impacts of changes in incomes on \(\mathrm{SBTB}_{{US-\mathrm{CAN}_{t}}}\) by the signs and significances of normalized coefficients −α2/α1 and −α3/α1. COVID-19 was evaluated as dummy variables and added the analysis as fixed regressors. Here α11 and α12 represent the effects of COVID-19 on \(\mathrm{SBTB}_{{US-\mathrm{CAN}_{t}}}\). We apply the Wald tests (WSR and WLR) in short-run and long-run asymmetry for real exchange rate by testing\({\sum }_{k=0}^{p_{4}}\alpha _{9k}\mathrm{DEP}_{t-k}={\sum }_{k=0}^{p_{5}}\alpha _{10k}\mathrm{APR}_{t-k}\) and \(-\alpha _{4}/\alpha _{1}=-\alpha _{5}/\alpha _{1}\)(Bahmani-Oskooee et al. 2019; Bahmani-Oskooee and Karamelikli 2022; Ongan et al. 2023).

In the validation of long-run asymmetric J‑curve hypothesis, we will first ensure that a US state has a cointegration relationship, using either F test or ECMt−1. Secondly, following a negative or insignificant estimations of real exchange rate (DEP, APR) in short-run (Rose and Yellen 1989), the estimated sign of either −α4/α1 (DEP) or −α5/α1 (APR) in Eq. (5) must be significant and positive on BTB in the long-run (Bahmani-Oskooee and Fariditavana 2016). If the coefficient of the real exchange rate (POS and/or NEG) is positive or insignificant in the short run but negative and significant in the long run, this will imply the asymmetric inverse J Curve (Bahmani-Oskooee et al. 2022; Bahmani-Oskooee and Nouira 2021; Bahmani-Oskooee and Karamelikli 2022).

3 Empirical Findings

The linear model’s short-run and long-run results are presented in Tables 1 and 2, respectively. Tables 3 and 4 show the results of the nonlinear model in the short run for DEP and APR, respectively. Table 5 reports the long-run estimates and diagnostic tests of the NARDL model to determine the validity of the long-run asymmetric J‑curve hypothesis across the 50 US states and the District of Columbia (D.C.). To summarize the results of both models, Table 6 is provided. Finally, Table 7 presents the names of the US states for different test results in detail in Sections A, B, C, D, E, and F. The US states marked “a” indicate that they do not have long-run cointegration relationships and therefore we cannot test the J‑curve hypothesis for them.

Tables 1 and 2 present the test results of the linear model, which indicate that only 5 US states (AL, CA, ID, KS, and WI) support the symmetric J‑curve hypothesis. This is due to the negative or insignificant effects of the real exchange rate (RER) in the short run and positive and significant effects in the long run on the US bilateral trade balances (BTBs). On the other hand, 4 US states (MN, MS, ND, and NS) support the symmetric inverse J‑curve hypothesis, as there are positive or insignificant effects of the real exchange rate (RER) in the short run and negative and significant effects in the long run.

In terms of the effects of the number of persons employed in the linear model, which is used as a proxy for income, on US states’ BTBs, an increase in Canada’s income (ECAN) improves the BTBs for 12 US states, specifically AL, FL, IA, KS, NC, NE, NV, NY, OH, OR, SC, and SD, but worsens the BTBs for 7 US states, namely CA, DE, IL, MI, MO, NM, and VT. Conversely, an increase in US income (SEUS) improves the BTBs for 6 US states, specifically DC, DE, MD, MO, MS, and ND, but worsens the BTBs for 11 US states, namely AL, FL, GA, IA, KS, MN, NE, NV, OR, RI, and SC. Finally, with respect to the impact of COVID-19 cases in both countries, the pandemic in the US (SCovid19US) worsens BTBs for 3 US states, specifically MD, RI, and TN, while the same pandemic in Canada (Covid19CAN) only worsens BTBs for NY. The study provides detailed test results for the symmetric analysis (linear model) in Tables 6 and 7 in Sections C and D, and short-run and long-run test results of the nonlinear ARDL model in Table 3, 4 and 5.

Test results of the nonlinear model in the tables above indicate that the long-run asymmetric J‑curve hypothesis is supported only for 15 US states and D.C., namely AK, AL, CT, D.C, ID, KS, LA, MD, ME, NC, NE, NH, OR, RI, SD, and UT (shown in Section E in Table 7). This may be interpreted to mean that the policymakers of these states have more sustainable and manageable bilateral trade policies with Canada. For the remaining 35 US states, either there was no cointegrated relationship or, if there was, the asymmetric J‑curve hypothesis was not confirmed. Therefore, policymakers of 35 US states and D.C. should review their trade policies and regulations, such as tax rates, energy prices, budgets, and production costs which could change the prices of export-import goods, thereby, improving these US states’ bilateral trade balances with Canada. The following potential relationships (mentioned in the Introduction Section) have been attempted to establish-explain whether our evaluations based on the finding we obtained can be supported or explained by various economic data (characteristics) of the US states:

-

In 12 of the 15 US states and D.C. where the J‑Curve has been verified (AL, D.C., ID, LA, KS, MD, ME, NC, NE, OR, SD and UT), total industrial electricity prices are on average of $9.5Footnote 2 or lower than average Therefore, lower energy costs in production may lead to lower sales prices, which in turn may increase the foreign trade competitiveness of the relevant states.

-

The GSPs (Gross State Product) of 14 of these 15 US states and D.C. (AK, AL, CT, ID, KS, LA, ME, NE, NH, OK, RI, SD, UT, and D.C.,) are small economies with less than $357Footnote 3 billion. This low domestic demand may have led producers to export.

-

In 9 of the 15 US states and D.C where the asymmetric J‑Curve is verified (CT, D.C., ID, MD, ME, NH, NE, OR, RI, and UT), tax rates are on average of 1.5%Footnote 4 or lower than the average. Therefore, low taxes may have contributed to low domestic prices (CPI) and indirectly to the increase in foreign trade competitiveness of the relevant states through the real exchange rate.

Statistical tests were conducted to explore potential relationships between the characteristics of US states and the J‑curve hypothesis. The paired sample t‑test was employed to examine whether there was a significant difference in average tax rates between the 15 US states and DC where the J Curve Hypothesis is valid and the 35 states where it does not apply. The null hypothesis of the paired exam scores being zero was rejected based on probe values less than 0.05, indicating that the J Curve Hypothesis is applicable to the average tax rate of the 15 US states and DC but not to the other 35 states. Furthermore, significant differences were found between the average price of electricity for ultimate customers by end-use sector and the gross state product. Test results and graphs created in this direction are shown in Appendix 2.

Section A in Table 7 reports the US states that have asymmetric effects of USD appreciation and depreciation on the US states BTBs. For example, both appreciation and depreciation improve the BTB in Alabama (AL) or they both worsen it in South Carolina (SC) in Table 5.

While depreciation (DEP) in the USD against the Canadian dollar (CAD) improves bilateral trade balances (BTBs) for 14 US states, namely, AK, AL, CT, KS, LA, MD, ME, NE, NC, NH, OR, RI, SD, and UT, appreciation (APR) in this currency improves BTBs for 11 US states, namely, AL, DC, ID, KS, LA, MD, ME, NC, NE, RI, and SD. Hence, it can be interpreted that these are both CAD-depreciated-appreciated-sensitive US states. Furthermore, the improvement effects of the depreciation and appreciation of the USD on US BTBs are more pronounced than their worsening effects (14 + 11, 6 + 5). The states that have long-run asymmetric effects are AK, AZ, CA, CT, DC, KS, LA, MD, ME, NC, NH, NM, OR, RI, SC, UT, VA, WV, and WY. This means that depreciation and appreciation affect these US states’ bilateral trade balances differently (asymmetrically-unexpectedly). For instance, both depreciation and appreciation improve LA’s bilateral trade balance with Canada. Therefore, policymakers of these states should consider these exchange-rate based asymmetric effects to achieve more manageable trade balances.

Concerning the effects of US and Canada’s number of persons employed (as the proxy of real GDPs) on US state’s BTBs, while rises in the number of US employed persons (SEUS) worsen the US BTBs for 12 states, namely, AL, CA, FL, GA, NE, NV, OR, RI, SC, SD, UT, and WI, rises in the number of Canadian persons employed (ECAN) worsen US BTBs for 10 US states, namely, CT, DE, KS, LA, MD, ME, NC, NH, RI, and WY. The improving and worsening effects of increases in the US and Canada‘s income (employment) on US-Canada bilateral trade balances (BTBs) are presented in two maps in the Appendix 1. In Map A, while US states in green indicate that increases in these US states’ income (SEUS) improve the US BTBs for these states, US states in red indicate that such increases in these states’ income worsen the BTBs for those states. Similarly, in Map B, while US states in green indicate that increases in Canada’s income (ECAN) improve the US BTBs for these states, US states in red indicate that such increases worsen US BTBs for them. Gray-colored US states indicate there are no cointegration relationships between SEUS and ECAN with BTBs or the coefficients of SEUS and ECAN are insignificant for these US states in both maps. Lastly, while the number of Covid cases in the USA (SCovid19US) worsen the BTBs for CT, KS, LA, MD, SC, SD, and TN, the number of Canadian cases (Covid19CAN) worsen the BTB only for NC. On the other hand, the number of cases in Canada improves the BTBs for CT, KS, LA, MD, SC, SD, and TN. On the other hand, the number of Covid cases in the USA (SCovid19US) doesn’t improve any US state’s BTB.

4 Conclusion

This study attempts to test the J‑curve hypothesis at the US state rather than the country level. The rationale behind and need for conducting a US state-level analysis are twofold. First, US states as individual political entities may have their own state-level economic-related decisions and regulations, such as tax rates and budgetary frameworks. These decisions can directly impact the prices of export products and thus affect state-level CPI-adjusted real exchange rates, exports, imports, and bilateral trade balances with other countries.

Second, due to US states’ different economic sizes, resources, populations, and administrative-political structures, state-level analyses rather than country-based analyses may be required for the US. Therefore, policymakers of US states may play crucial roles in managing their state-level international trade policies (bilateral trade balances) with their foreign trade partners, such as Canada. This may require testing the J‑curve hypothesis for individual US states.

The empirical findings of this study reveal that the long-run asymmetric J‑curve hypothesis is supported for only 15 US states and D.C. out of 51. This may mean that these 15 US states and D.C. (or their policymakers) have more sustainable and manageable bilateral trade policies with Canada because their bilateral trade policies with Canada improve their bilateral trade balances in the long run.

Policymakers in 35 states where the J‑curve effect was not supported can consider adopting policies that may improve their bilateral trade balances. For instance, they can focus on increasing exports or reducing imports through measures such as improving trade infrastructure, enhancing competitiveness, decreasing bureaucracy and production costs, or negotiating favorable state-level trade agreements with Canada. Moreover, policymakers in these US states can increase exports and reduce imports by lowering energy prices and tax rates, making consumer and producer prices more competitive, and thus influencing the real exchange rate to some extent. Therefore, they may take advantage of achieving the anticipated positive outcomes of the J‑curve effect for exporting more. Of course, US states cannot change the nominal exchange rate between the US dollar and Canadian currency.

Furthermore, policymakers can use the information from this study to evaluate their state’s economic, political, administrative, and trade policies and identify areas where improvements can be made. This can lead to better management of state-level international trade policies and, as a result, improved state-level economic growth and job creation.

This study highlights the need for empirical analyses to be conducted geographically (regionally) at the US state-level, or province-level in other countries, rather than on an aggregated country basis, to achieve more detailed findings if regular and detailed data are available as the US provides.

Notes

Calculated from the US Energy Information Administration (EIA).

https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a.

Calculated from the webpage of the Urban Institute (UI).

Calculated from the website of The Tax Foundation (TF).

References

Baek J (2007) The J‑curve effect and the US-Canada forest products trade. J For Econ 13(4):245–258

Bahmani-Oskooee M (1985) Devaluation and the J‑curve: some evidence from LDcs. Rev Econ Stat 67(3):500–504

Bahmani-Oskooee M, Bolhasani M (2008) The J‑curve: evidence from commodity trade between Canada and the US. J Econ Finance 32(3):207–225

Bahmani-Oskooee M, Fariditavana H (2016) Nonlinear ARDL approach and the J curve phenomenon. Open Econ Rev 27(1):51–70

Bahmani-Oskooee M, Fariditavana H (2020) Asymmetric cointegration and the J‑curve: new evidence from commodity trade between the U.S. & Canada. Int Econ Econ Policy 17:427–482

Bahmani-Oskooee M, Karamelikli H (2022) Is there J‑Curve effect in the US Service Trade? Evidence from asymmetric analysis. Int J Finance Econ: 1–11. https://doi.org/10.1002/ijfe.2624

Bahmani-Oskooee M, Nouira R (2021) U.S.-German commodity trade and the J‑curve: new evidence from asymmetry analysis. Econ Syst 45(2):100779

Bahmani-Oskooee M, Ratha A (2004) Dynamics of the U.S. trade with developing countries. J Dev Areas 37(2):11–11

Bahmani-Oskooee M, Bose N, Zhang Y (2019) An asymmetric analysis of the J‑curve effect in the commodity trade between China and the US. World Econ 42(10):2854–2899

BEA (2022) Bureau of economic analysis. https://apps.bea.gov/iTable/index_nipa.cfm. Accessed 24 Feb 2022

CB (2021) U.S. Census bureau. U.S. Imports and export merchandise trade statistics. http://usatrade.census.gov/Perspective60. Accessed 22 Feb 2021

CDC (2022) US center for disease control and prevention. https://covid.cdc.gov/covid-data-tracker/#additional-covid-data. Accessed 24 Feb 2022

FED (2022) Federal Reserve Bank of St. Louis. FRED, Economic Research. https://fred.stlouisfed.org/. Accessed 24 Feb 2022

Feldstein M (2017) Underestimating the real growth of GDP, personal income, and productivity. J Econ Perspect 31(2):145–164

Fujita M, Krugman P, Venables AJ (2001) The spatial economy: cities, regions, and international trade. MIT Press (382 pages)

Hall R, Feldstein M, Frankel J, Gordon R, Romer C, Romer D, Zarnowitz V (2003) The NBER’s business-cycle dating procedure. National Bureau of Economics Research (https://web.stanford.edu/~rehall/BusCycle%204-10-03.pdf)

Hsing Y, Sergi BS (2010) Test of the bilateral trade J‑curve between the USA and Australia, Canada, New Zealand and the UK. Int J Trade Glob Mark 3(2):189–198

Kallianiotis I (2022) Trade balance and exchange rate: the J‑curve. J Appl Finance Bank 12(20):41–64

Krugman P (1998) Space: the final frontier. J Econ Perspect 12(2):161–174

Magee SP (1973) Currency contracts, pass through and devaluation. Brook Pap Econ Activity 4(1):303–325

Marwah K, Klein LR (1996) Estimation of J‑Curves: United States and Canada. Can J Econ 29:523–540

Okun AM (1962) Potential GNP: its measurement and significance. 1962 Proceedings of the Business and Economic Statistics Section American Statistical Association, pp 98–104

Ongan S, Ozdemir D, Isik C (2018) Testing the J‑curve hypothesis for the USA: applications of the nonlinear and linear ARDL models. South East Eur J Econ 16(1):21–34

Ongan S, Karamelikli H, Gocer I (2023) The alternative version of J‑curve hypothesis testing: evidence between the USA and Canada. J Int Trade Econ Dev. https://doi.org/10.1080/09638199.2022.2155689

Rentfrow PJ, Mellander C, Florid R (2009) Happy States of America: a state-level analysis of psychological, economic, and social well-being. J Res Pers 43(6):1073–1082

Rose AK, Yellen JL (1989) Is there a J-curve? J Monet Econ 24(1):53–68

Rupasingha A, Goetz SJ, Freshwater D (2002) Social and institutional factors as determinants of economic growth: evidence from the United States counties. Pap Reg Sci 81(2):139–155

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric Cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Sickels R, Horrace W (eds) Festschrift in honor of Peter Schmidt: “econometric methods and applications”, pp 281–314

Shirvani H, Wilbratte B (1997) The relation between the real exchange rate and the trade balance: an empirical reassessment. Int Econ J 11(1):39–49

StatCan (2022a) Statistical Office of Canada. https://www150.statcan.gc.ca/n1/daily-quotidien/211130/t004a-eng.htm. Accessed 24 Feb 2022

StatCan (2022b) Statistical Office of Canada. https://health-infobase.canada.ca/covid-19/epidemiological-summary-covid-19-cases.html. Accessed 24 Feb 2022

Further Reading

EIA (2022) US energy information administration (EIA). https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a. Accessed 24 Feb 2022

TF (2022) The Tax Foundation. https://taxfoundation.org/2022-sales-taxes/#combined. Accessed 24 Feb 2022

UI (2022) The Urban Institute (UI). https://www.urban.org/policy-centers/cross-center-initiatives/state-and-local-finance-initiative/state-and-local-backgrounders/state-and-local-expenditures#Question1. Accessed 24 Feb 2022

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Appendix 1

1.2 Appendix 2

Note

Test results of the Paired Sample t‑test and related graphics are reported below. The red dots in graphs show the 15 US states and D.C. where the J‑curve hypothesis is supported, while the blue colored dots show the 35 US states where the J‑curve hypothesis is not supported.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ongan, S., Gocer, I. & Karamelikli, H. The US State-Level Geographic J-curve Hypothesis Mapping with Canada. Rev Reg Res 43, 203–240 (2023). https://doi.org/10.1007/s10037-023-00186-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10037-023-00186-5