Abstract

This paper analyzes the price behavior of Phase III (2013–2020) EU-ETS emission allowances of CO2 by focusing on the dynamics of daily auction equilibrium prices and on the changes of the volatility of the underlying stochastic process. The paper derives the main testable statistical hypotheses (particularly that about the determinants of the conditional variance of prices) on the results derived in a model of optimal bidders’ behavior given the ETS auction rules. Tests are conducted by estimating various versions of GARCH models for both mean and variance equations of price return. Results show that the price dynamics is affected by factors including a measure of excess demand/offer and the number of winning bidders and that, contrary to expectations, reforms of the auction rules introduced at the end of Phase III explain a great part of the increased price volatility. The increased volatility is also positively associated with the bid spread and negatively associated with the number of bidders active in each auction round.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

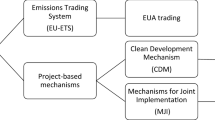

The creation in 2005 of the EU-wide CO2 GHG (greenhouse gas) emission trading system, (EU-ETS from now on) represented a novelty in European environmental policy (EU 2015; World Bank 2016). It partially replaced traditional tax and administrative forms of regulation (including grandfathering, i.e. giving polluters permits in proportion to past pollution), with a cap-and-trade mechanism in which the right to emit a certain amount of CO2 is a tradable and bankable commodity.Footnote 1 The system permits buying emissions allowances, namely permissions to emit one ton of carbon dioxide or carbon dioxide equivalent in a specified period. Allowances are assigned to participating installations and aircraft operators in the EU who bid for their acquisition. The auction cap, i.e. the maximum amount of GHG emissions allowed for allocation, operates in combination with a trading system. The latter allows participants that reduce their GHG emissions further than required, and consequently bank their unused permissions, to trade their excess allowances with other participants who have a shortage of allowances or to use them to cover their own future emissions. As borrowing is not allowed, permission to sell unused allowances is a means to increase the liquidity of the market.

The EU–ETS cap-and-trade auction system is designed as a competitive (i.e. single price) multiunit auction aiming at pursuing cost effective and economically efficient reductions of GHG emissions by producing price signals that should reflect the abatement costs as well as the scarcity of the allowances. Auction efficiency requires that allowances should go to bidders who value them most, i.e. those who have the highest marginal cost of reducing emissions. Participants with lower marginal cost and higher elasticity of substitution between polluting and non-polluting means of production would rather choose other ways to abate their emissions and comply with environmental regulation, e.g. by production optimization and investment in low carbon technology. On the contrary, buying allowances at the auction is supposed to ensure a quick, simple, and least bureaucratic way to permit those who face dissimilar technological and economic constraints to carry on profitably with polluting production and continue business as usual.

Auctioning has progressively become the default method for allocating allowances, not only in Europe.Footnote 2 Yet, according to the official EU website, EU-ETS has become the world's first major carbon market and observers estimate that it has contributed to the decrease of the overall trend in carbon emissions within the EU-ETS sectorsFootnote 3—mainly in the electricity sectorFootnote 4—although it is yet unclear to what extent. EU-ETS operates in all EU countries plus Iceland, Liechtenstein, Norway, and the UK. It limits emissions from more than 11,000 heavy energy-using installations (power stations and industrial plants) and airlines operating between these countries and covers around 45% of the EU's GHG emissions. Many sectors and gases are includedFootnote 5 and 300 million allowances are set aside in the New Entrants Reserve (NER) to fund the deployment of innovative, renewable energy technologies and carbon capture and storage through the NER 300 program.Footnote 6

Since 2005, the implementation of the EU-ETS system has gone through different trading periods (officially called Phases) and auction rules have been somehow modified from one phase to the next. In the first and second phases (2005–2007 and 2008–2012, respectively), the average ratio between allowances demanded and the total available allowances (called Cover Ratio and measured as the ratio between the bid volume and the available volume in the auction) was about 1 and 4% respectively. It indicated the realization of serious imbalances of allowances. Indeed, during the period 2009–2013, an enormous oversupply occurred, and the allowance market built up a huge “bank” of allowances having since 2008 an infinite lifetime. Note that in 2013–2014 the bank was even larger than a whole year of allowance supply (Vollebergh and Brink 2020, p. 3). The reforms of the EU-ETS rules and the launch of the third phase (2013–2020) lead to some important changes. The number of bidders increased with respect to previous periods and the Cover Ratio reduced from 4 times to just twice. This might indicate that the new rules permitted a reduction of the imbalances and generated a tendency towards long run equilibrium, a result not achieved in previous phases. With the linear reduction factor adopted in the revised EU-ETS Directive of 2018, the supply of allowances is expected to be zero in 2057. Since the decreasing cap implies that the cap will become more and more restrictive, banking helps to smooth the impact of the restrictions as it provides for intertemporal flexibility in the trade of allowances. Towards the end of phase III (January 2019), a Market Stabilizing Reserve (MSR) system was introduced to further reduce excess supply phenomena.Footnote 7 The current system is regulated by Emissions Trading System (phase IV: 2021–2030).Footnote 8

The purpose of this paper is to analyze the equilibrium price behavior of Phase III of EU-ETS auctions. It focuses first on the properties of the underlying stochastic price process generated by bidding behavior and then evaluates the effects on this dynamic of the above-mentioned measures introduced at the beginning and towards the end of Phase III to reduce excess supply and make the market more efficient. More specifically, after describing the main characteristics of the EU-ETS auction mechanism, the paper analyses in Sect. 2 the properties of the equilibrium prices realized at each auction round as they are generated by optimal bid strategies. In doing so, the paper analyses the link between equilibrium prices and bidders’ valuation of both winning and non-winning bidders. Then, in Sect. 3, the paper analyzes the stationarity property of the de-trended prices series and evaluates if their mean, variance, and covariance follow some discernible trend or if they meander without constant long-run mean or variance. Considerations derived from the properties of optimal bid functions (Sect. 2) and the results of empirical analysis of Sect. 3 suggest that the variance of the auction equilibrium price is not constant and to capture series’ characteristics like skewness, excess kurtosis and the volatility behavior the modeling of the returns of emission allowances should depart from the random walk hypothesis. Section 4 contains and comments all these estimation results. In Sect. 5, different versions of a multivariate GARCH model are tested and different variance equations are estimated to analyze what factors affect price volatility and how the estimated volatility (the estimated conditional variance) has evolved over time. It is found that the number of successful bidders as well as the total monetary amount bid affect negatively, as expected on the basis of results obtained in Sect. 2, the equilibrium price whereas the total number of bidders (winners and non-winners) and the cover ratio (interpretable as a measure of the inefficiency of the trading mechanism) reduce volatility. Results show that Phase III reforms are factors explaining the estimated conditional variance and that adjustment schemes and unlimited banking might have contributed to increase the liquidity of the market but have also increased its volatility. On the contrary, the bid spread (the difference between maximum and minimum bid in each auction round) increases equilibrium prices. Finally, predicted prices and availability of bid data permit the estimation of bidders’ surplus (difference between estimated willingness to pay and actual payment) realized during the entire Phase III (and the end of Phase II). The time path of the surplus (generated by the informational rent given by bidders’ private information on pollution technology) is shown in Sect. 6, where one can appreciate its sharp increase realized during the last part of Phase III. Conclusions are presented in Sect. 7 where I emphasize the link constructed in this paper between the results of a theoretical bidding model and the statistical properties of the time series of equilibrium prices as a key element for the interpretation of the GARCH outcomes. Interpretations of the empirical results is also offered in terms of policy issues.

2 The EU-ETS auction mechanism

The EU-ETS has concluded its third phase, which was significantly different from phases I and II.Footnote 9 In addition to the introduction of the above-mentioned linear reduction factor and MRS adjustment scheme, a single EU-wide cap on emissions replaced the previous system of national caps thereby aggregating isolated national allowance markets into a single European market. As a result, the mechanism fix with certainty the maximum quantity of GHG emissions for the period over which system caps are set. In ETS auctions, bidders submit their bids during one given bidding window/round (Day) without seeing bids submitted by other bidders complying with the following rules:

-

(i)

Bidders present Sealed Single Round Secret Bids knowing that their bids will be sorted in descending order of the price bid (price offered for ton of equivalent CO2).

-

(ii)

Bid volumes are added horizontally, starting with the highest price bid.

-

(iii)

The price component of the bid determines the position in the decreasing merit order (pseudo demand schedule) of the bidders. Clearly, since each bidder can propose more than one price bid—each specifying the price she/he is willing to pay and the amount of allowance for which she/he bids that price—a single bidder may occupy more than one position in the above merit order depending on the level of the price bids she/he has submitted.

-

(iv)

The price at which the sum of the volumes’ bids matches or exceeds the volume of allowances auctioned determines the auction-clearing price that will be paid by all successful bidders, i.e. bidders with a price bid higher than or equal to the equilibrium price. This is why I consider the mechanism as a multi-unit first price competitive auction.

-

(v)

No “Safety Valve” (ceiling instrument limiting price level) is included.

-

(vi)

Borrowing of allowances (i.e. the use of tomorrow’s allowances to cover today’s emissions) is not allowed.

-

(vii)

Tied bids will be sorted through random selection according to an algorithm.

-

(viii)

All bids with a price higher than (or equal to) the auction-clearing price are successful and receive the requested allowances at the price described under (iv).

-

(ix)

Partial execution of orders may be possible for the last successful bid matching the auction-clearing price.

Each successful bidder will pay the same auction-clearing price for each allowance regardless of the price bid she submitted. This implies that allowances are sold at a competitive price, which is to some extent equivalent to the system marginal price of bulk electricity auctions (Parisio and Bosco 2003; Bosco et al. 2010, 2016) where an equivalent rule determines the payment received by all dispatched generators in a wholesale pool.

In any auction, it is crucial to define the items being auctioned. Crampton and Kerr (2002) originally stressed that with carbon permits this is a simple matter. Each permit is for one metric ton of carbon usage and with “revenue recycling” polluters effectively buy the right to pollute from the public. Hence, each round of (Phase III) ETS auction can be modelled as a simultaneous uniform price auction for a divisible item given by the total TONs allowance of CO2 (call it QC), which can be partitioned in subunits of possible different size. This makes the auction similar to a share auction mechanism (Wilson 1979) where each bidder aims at winning a set of subunits. I assume that each bidder j receives private signals about the value of the allowances, \(v_j\). This value depends upon her/his ongoing production technology (a private information) and can be understood as the opportunity cost of the allowance, i.e. as the cost of replacing nonpolluting for polluting means of production through a costly abatement activity (Leiby and Rubin 2001). Bidders know that it is drawn from a commonly known continuous function \(F\left( v \right)\) with finite density f(v) and the support \(\left[ {\underline{v} ,\overline{v}} \right]\). I assume that while F(.) is common knowledge the realization of vi is a private information, since it depends upon the above individual opportunity cost of alternative and idiosyncratic technical innovation. This justify the assumption that v is an i.i.d. random variable and that the independent private value hypothesis applies. Adapting from Donald et al. (2006, p. 1230) I assume that a known number of potential bidders N may bid for H ≤ QC units of allowances and denote vj the vector of ordered valuations of bidder j. Under the hypothesis of diminishing marginal productivity of the allowances for each user, one may assume that \(v^j = v_1^j > v_2^j > \cdots > v_{T \le H}^j\) where the subscript indicates each unit of allowance requested by bidder j.Footnote 10 Recalling that F(v) is the cumulative distribution of valuations, the order statistics of all valuations of the all N potential bidders is

with valuation ranked in increasing order. Since the auction is not a singleton-demand auction (Milgrom 2004, p. 31) where buyers want only a single object, a bidder j can occupy more than one position in the sequence of order statistics. The reversed decreasing order forms a sort of marginal valuation function of allowances (corresponding to an unobserved total true willingness to pay for the allowances of all bidders) in which each bidder j may occupy more than one position according to her/his and other bidders’ valuation of each allowance unit.

In what follows, I focus on equilibrium bid/price and auction efficiency.

Definition 1

(Bidder gain) Two elements determine bidders’ utility. The first element is the above private valuation as it is determined by the opportunity cost of the adoption of alternative nonpolluting technologies. This is the value of each TON of CO2 per unit of produced output and it is a pure private information. In what follows this variable is denoted as \(v_i^j\)(the value assigned to unit i by bidder j) and the total volume of allowances won by bidder j is \(Q^j = \sum_{i = 1}^H {Q_i^j }\).

The second element affecting utility is the value of the banked allowances, i.e. unused TONs of CO2 bought at some previous auction price \(\overline{p}\), which the bidder expects to resell at some future equilibrium price. Calling \(Q_i^j\) each allowance i won by bidder j and Kj the stock of banked allowances already in her/his portfolio (a value which is always nonnegative because borrowing is not allowed), we can write the ex-post utility of bidder j after each auction round is concluded (i.e., once the equilibrium price p* is determined) as follows

where H is the number of allowances won by bidder i and \(\overline{p}\) is for simplicity an average of past allowances price. Then, the last term can be either positive or negative. Implicit differentiation of ex-post maximum utility shows that with \(\left( {p^* - \overline{p}} \right) > 0\) a high level of the bank negatively affects the equilibrium price.

Definition 2

(Efficiency) I assume that having observed her/his signal bidder i submits a set of Bayesian–Nash equilibrium monotonous continuous increasing bid functions, each specified as \(b_j \left( {Q_i^j ,v_i } \right):\left[ {0,Q^C } \right] \to [0,\overline{B]}\) where the upper limit is common to all bidders and may be set equal to the cap. Each function is the value bid for any unit \(Q_i \in Q^C\) the bidder j wants to acquire. Assume that the auction ends with \(I < N\) winners where N is the set of all bidders, the cap

is ex-post efficient if each subunit in which QC can be divided goes to the bidders who value them the most:

Given the competitive auction format and assuming the bid function is invertible, the market-clearing price, which corresponds to the lowest accepted bid, is:

As a result, each winner pays a total amount given by \(P_j = p^* Q_j\), which implies that the total revenue generated by each auction is \(R = p^* Q^C\) with the ratio \(c = \sum_{j = 1}^N {b_j^{ - 1} } \left\{ {p|s_j } \right\}/\sum_{j = 1}^I {b_j^{ - 1} } \left\{ {p|v_i } \right\}\) indicating the excess demand of allowances realized at the equilibrium price, conventionally called by ETS as the Cover Ratio (a value that was invariably greater than one). As a result, one can also define efficiency as

i.e. as the absence of excess demand (or as c = 1).

Definition 3

(Equilibrium price and rent) If \(b_j \left( . \right) = b_{I:N} \left( . \right)\) is the last accepted bidder (I is the marginal bidder), the equilibrium price, p* can be related to valuations as follows

In words, the equilibrium price, is fixed by the last accepted bid, and corresponds to the penultimate smallest valuation among winners, i.e. the last small valuation existing among the winners having an evaluation higher that vI when \(\sum_{i = 1}^I {Q_i } \left( {p^* } \right) = Q^C {\text{conditional}}\) to fact that \(v_{I:N} = V\). As a result, the density of the “marginal” bid in each auction round t is

The conditional expected value of the equilibrium bid determining p* (and corresponding to the valuation of the first rejected bidder I – 1 conditional upon vj being the Ith valuation) is

where 1 ≤ I – 1 ≤ N is the penultimate accepted bidder. Then, the conditional distribution of the expected equilibrium price given that v(I–1:N) = vI–1, is the same as the distribution of the (I – 1)th order statistic in a sample of size I − 1 from a population whose distribution is simply F(v) truncated on the right at vI+1. This value changes with the number of winners I in each auction round and depends upon the cap. At the same time, one can show that the conditional variance of the valuation of the first rejected bidder, corresponding in expectation to the above closing price is

Over time the price variance depends upon It – 1 where t refers to the auction round. Therefore, price variance cannot be constant from one auction round to the next even if one assumes, illogically, that \(E\left[ {v^2 } \right]\) and N remains constant over all rounds (or, equivalently, that we have the same number of participants having valuations remaining constant from one round to the next). At the same time, exploiting the properties of order statistics one can model the covariance between the equilibrium prices and the valuation of the penultimate winners as

where \(v_{I - 1:N}\) is the last highest valuation among the non-rejected bidders at that round. This implies that over the auction rounds (indicated with t in what follows)

is not constant. Equilibrium prices cannot have constant variance and constant covariance. Being the result of a multiunit auction in which bidders may win more than one object, the above results suggest that contrary to what happens with multiunit singleton auctions, the dynamics of EU-ETS equilibrium prices depends upon the number (and the changing identity) of winners and on the cap—and not only upon the number of participants and their valuations. Moreover, it should also be clear that valuations (including the expected value of the highest valuation among non-winners) depends upon the accumulated and unused bank of allowances and their regime as well as the price at which they have being bought. Since the number and the valuations of winners I change from one round to the next, time variations in price volatility seems likely. With a time-declining cap (see Sect. 1) the above conditional (on non-winners’ past valuations) variance may possibly positively depend on its history and show signs of volatility clustering. Consequently, one may argue that the variance of equilibrium prices (and returns, too) at a given auction round is proportional to the rate of information arrival as they are convoyed by number of winning bids and other market information such as bid spread and cover ratio. As a result, volatility clustering could be a reflection of the serial correlation of information arrival frequencies. Since all bidders simultaneously receive the new price signals, the shift to a new equilibrium is immediate, and there will be no intermediate (between rounds) partial equilibrium.

Equation (4) tells that ETS cap-and-trade mechanism permit bidders to maximize the informational rent on the non-observable marginal cost of adopting nonpolluting technology (v). This is made possible by the rules governing the exchange mechanism, which allow bidders to understate their valuations for some units of allowances.Footnote 11 If their lower bids close the market by fixing the equilibrium price, winners earn a greater surplus on all units bought. This is analogous to wholesale electricity markets where bidders (sellers) “reduce supply” and trade-off mark-ups on inframarginal units against revenue forgone on marginal units (Bosco et al. 2010; Crawford et al., 2007). Given the “public good” nature of the closing price in competitive auctions, this behavior generates a surplus for all winners. On the other hand, Eq. (4) tells that the amount of the surplus depends not only on the number of participants (N) but crucially on the (smaller) number of winners, and their valuations. On the other hand, the amount of the total surplus enjoyed by the entire set of winners depends on the (unobserved) valuation of the first excluded bidder. This implies that the estimation of the total surplus cannot rely on the pure difference between actual bid posted by winners and the closing price (the visible part of the informational rent) but requires an estimation of the valuation of the allowances of the first excluded bidder (bibber I + 1 < N, in the present model) as a term of comparison. Yet, given the results obtained for the variance and covariance of valuations and the actual equilibrium prices, the estimation of bidder I + 1 valuation requires careful analysis of the properties of the price series. This analysis is conducted in the next sections.

3 The data set

This paper covers the entire third phase EU–ETS (2013–2020). Data generation process has the following main characteristics.

-

A single EU-wide cap on emissions replaced the previous system of national caps. It was fixed at 2084 million Tons CO2 in 2013, which was annually reduced by a linear reduction factor (currently 1.74% roughly corresponding to 38.3 million allowances). This amounts to a cap of 1816 MtCO2e in 2020.

-

The MSR was introduced. It functions by triggering adjustments to annual auction volumes in situations where the total number of allowances in circulation is outside a certain predefined range. Allowances may be removed from auction volumes and added to the MSR if the surplus in the market is larger than a predefined threshold, or removed from the MSR and added to current auction volumes if the surplus is lower than a predefined threshold. Additionally, if the allowance price is over three times the average price of allowances during the two preceding years for six consecutive months, 100 million allowances will be released from the reserve. The MSR is intended to address the imbalance between allowance supply, which is currently fixed, and demand, which changes with a number of economic and other drivers.

-

Auctioning is the default method for allocating allowances (instead of free allocation), and harmonized allocation rules apply to the allowances still given away free.

-

More sectors and gases are included.

-

Auction rules are dictated by Commission Regulation (EU) No 1031/2010 of 12 November 2010.

Accordingly, we consider each (national) auctions as a part a European unitary auction market that takes place in successive periods (working days) in different virtual locations as part of a single allocation mechanism having common design and management. Therefore, the time series of equilibrium prices recorded in each market is regarded as a series of realizations of winning bids presented by bidders operating on the common EEE Exchange platform in the entire European market as a result of a consistent multiunit first price sealed bid strategy.

Data are described in the table below. They include the last weeks of Phase II.

The reason for choosing the selected time interval (Phase III plus a segment of Phase II) is twofold. On the one hand, it is motivated by the desire to avoid the 2008 price drop not specific to the EU ETS. Many other asset values (e.g. stocks, bonds, crude oil, and gas) experienced similar declines and their dynamics may have affected ETS prices. After recovering somewhat in early 2009, the EUA price experienced a 2-year period of stability—with a price around 15 euros—until the summer of 2011, when it fell again by around 50 percent, to a new low of 7–8 euros in 2012, before falling yet again, to around 4 euros as phase III began. During these years, the EUA price has varied considerably, even if the variations were smaller than variations recorded in late 2006 and 2007, when the prices of phase I and phase II allowances also diverged significantly. On the other hand, an examination of the price of EUAs at the end of phases I and II and the size of the allowance surplus accumulated in each phase highlights the importance of banking and its role in establishing a floor on prices. According to (Ellerman et al. 2016, p. 98), the surplus was 83 million allowances at the end of phase I and 1.8 billion allowances at the end of phase II (European Commission 2015), yet the price did not go to zero in 2012 as it did in 2007. This is because the phase I surplus allowances could not be carried over for use in phase II, whereas phase II allowances could be banked for use in phase III and later years when the cap became even lower and prices were expected to be higher. If one take into account that in Phase III a single EU-wide cap on emissions replaced the previous system of national caps (see above), it is clear (Ellerman et al. 2016, p. 98) that phase I and phase II constituted separate markets with differing degrees of expected scarcity, specific organizational forms and different data generation processes. Hence, I excluded them from the analysis.

4 Prices behavior in phase III

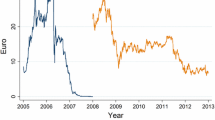

This section starts with the analysis of the main characteristics of the Price as a time series. The following plots illustrate the dynamics of Price over the entire sample period covered by this study. Figure 1 shows the prices of the next December futures contracts, which have become the main trading instruments in the EU–ETS. At first glance, one may detect a tendency of large changes to follow large changes and small changes to follow small changes, which implies volatility clustering.

More in details, the plot prompts two comments. Until the second half of 2017, the price is always lower than 10 euros and shows little variations with respect to maximum bids. The level of prices in 2012 was very small (due to general causes, e.g. the protracted effects of the economic crisis of 2008) but still greater than zero in despite that the surplus of allowances accumulated during phase I could not be carried over for use in phase II. On the contrary, phase II allowances could be banked for use in phase III and later years when the cap was expected to be even lower and prices are expected to be higher. As for this period, one might hypothesize that full bid disclosure was another reason that encouraged low bidding as bidders sought to hide their true valuations from the other market participants and pooled bids at or below the equilibrium price. Note that as stressed by Benz and Trück (2009, p. 5), aspects concerning the regulatory framework like explicit trading rules (e.g. intertemporal trading), the linkage of the EU-ETS with the market of project-based mechanisms and/or with the Kyoto Market in the future have an important impact on prices, too. From 2017, the closing price increased steadily as well as the bid spreads. Bidding became more aggressive (i.e. higher) and the bid spread shows jumps and spikes as it is made more evident by the following Fig. 2. The plot shows a further sharp increase in prices at the beginning of 2018 and this may be related to the introduction of measures affecting the supply side of the market. EU authorities enforced quantity-based interventions, such as back loadingFootnote 12 and the “Market Stability Reserve” (MSR) in 2018. The latter imposes that if the total number of allowances in circulation was less than 400 m in a year, then the MSR releases 100 m allowances into circulation in the following year. If it was between 400 and 833 m, then no release or absorption had been introduced in the market and, finally, if it was greater than 833 m, then the MSR had to reduce the volume of allowances auctioned in the subsequent year by 12% of allowances in circulation. The core impact of the MSR is its governance of the excess quantity in the bank of allowances. This measure reduced the overall supply of allowances by a substantial amount if the bank got ‘too large’. This is reflected in the higher values of the Bid Spread after 2018 and in the reduction of the Cover Ratio (Fig. 2).

When we look at the autocorrelation properties of Price, which is shown in the following plots of the ACF and PACF we notice that the decay of the autocorrelation function is very slow as it expected for integrated processes (Fig. 3).

Yet, when repeating the analysis separately for two sub periods with observations recorded over 16 weeks for 2 subsamples: January 2012–July 2016; august 2016–February 2020), the results change as it is shown in the plots below (Fig. 4).

During the first period, (2012–2016), the ACF decay is stronger and after the first 4 weeks the autocorrelation is not statistically significant as if the lags behold the first mount after each auction round were losing their relevance.

From 2016 to 2020 the ACF coefficients are not significantly different from zero for any lag with the (irrelevant) exception of the last four. The last sub sample is characterized by the introduction of the MSR reform together with the stricter LRF (see above) and which may have possibly reduced the feeble tendency towards long run equilibrium that was present during the previous sub sample. Moreover, one should recall that in February 2014 it was decided to withdraw 900 million allowances from auctioning in 2014–2016 and to add them back in to auctioning in 2019–2020. Yet, to explain why there is the above-mentioned difference on the ACF decay process more elements of the reform process should be emphasized.Footnote 13 They are anticipated here but they will be employed in the estimation of the GARCH process presented in the next section. During the first part of Phase III (2013–2015) there was no MSR. During the central part of Phase III (2015–2018) the EU-ETS operated under MSR but with no MSR-cap. In January 2019 the MSR regime changed and operated with a cap (above the cap all additional allowances absorbed by the MSR are cancelled out). This led to a reduction in the availability of allowances. Secondly, the banking regime was modified and the banking certificates (emission allowances purchased to be used in the future by the winners or to be sold on an informal secondary market) remained valid beyond the calendar year of acquisition. Then, portfolios of allowances could be created for purely speculative reasons. Moreover, as stressed by Perino et al. 2021) the MSR design adjusts the supply of allowances using an ill-suited indicator of scarcity because it refers to the total number of allowances in circulation. Banking-based short-run supply adjustment destabilizes the carbon market and TNAC-based long-run supply adjustment undermines the 2030 target. In turn, a destabilized market is prone to speculative interference, fuels stakeholder objections and impedes linking to other ETSs (including sectoral expansion). Then, the existence of different auction rules (MSR and Banking) can be illustrated graphically the construction of variables accounting for the changes introduced in the mechanism during Phase III. The plot below (Fig. 5) shows how these indicators are constructed.

Figure 5 shows the (0, 1) construction of the dummies of MSR (D1) and Banking D2 ((MSR, blue line and Banking, red line; auction rounds are on the x-axis). Hence, Fig. 5 plots the two dummies multiplied by the time trend. Both graphs show that the initial period of Phase III operated without MSR and New Banking rules; the central period had the MSR rule only; the final period operated under both rules. To avoid using the algorithm called ICSS (iterative cumulative sum of squares) to detect the sudden discrete changes in the unconditional variance of EU-ETS return series, in the estimations of section I employ the transformed dummies D1 and D2 in the variance equation, but I stress here that they have probably affected the autocorrelation process.

4.1 Price and return

Figure 6 shows a plot of the EUA log-returns Rt = ln(pt) − ln(pt −1) and the ACF for the whole sample. As it was found by Benz and Trück (2009, 8) for a period antecedent the one analyzed here (January 3, 2005–December 30, 2005), the data show heteroskedasticity and volatility clustering and both maximum positive and negative log-returns could be observed. It is interesting to compare the Return sample summary statistics of Benz and Trück (2009, p. 8) with those of this paper. The table below makes the comparison and reinforce the arguments summarized when commenting Table 1 for excluding phases I and II from the analysis.

Benz and Trück (2009) clearly show the implications of the key features of phase 1 (2005–2007): (i) the mechanism covered only CO2 emissions from power generators and energy-intensive industries; (ii) almost all allowances were given to businesses for free; (iii) the penalty for non-compliance was as low as €40 per ton. Phase 1 succeeded in establishing a price for carbon, free trade in emission allowances across the EU, and the infrastructure needed to monitor, report and verify emissions from the businesses covered. Yet Benz and Trück (2009) estimations show that in the absence of reliable emissions data, when the caps were set based on hazard and attempts, the price data were affected by the circumstance that the total amount of allowances issued exceeded emissions. This is a clear anticipation that, with supply significantly exceeding demand, in 2007 the price of allowances fell to zero (yet, recall that Phase I allowances could not be banked for use in phase 2).

Return volatility has not changed dramatically when the samples of Table 2 are compared in spite of a sharp reduction of the mean and median values. On the contrary, the shape of the distribution has. Return of Phase III exhibits an increased positive skewness and excess kurtosis. Hence, to provide a better fit to the time series analyzed in the paper estimation procedures should be designed to account for volatility structure, asymmetry and excess kurtosis.

Instead, there is a degree of autocorrelation in the riskiness of returns and clear signs of volatility clustering. As for the former we finally test for ARCH effect after running a simple OLS autoregressive model of price and return. ARCH test are reported below (Table 3).

The null of absence of ARCH effect in the Price series must be rejected at any level of significance but not for Return. Summing up, one can stress that given the objective function of bidders (which includes bank, i.e. accumulated allowances whose value depends on future prices) the accuracy of the predictions of the price model is important. Thus, the key issue is the variance of the error terms, and about what makes them small or large. The question—which is typical of financial applications where the dependent variable is the return on an asset or portfolio and the variance of the return represents the risk level of those returns—, emerges in modelling CO2 auction prices too. It advocates that errors be handled properly and the variance of the dependent variable should be modeled as a function of past values of the dependent variable and independent, or exogenous, variables. This research strategy is followed in the next section.

5 Alternative GARCH models of equilibrium prices and return

In this section, I present ARCH estimations of the price process. Yet, as AC and PAC, as well as unit root tests (not reported for brevityFootnote 14), say that the price series is I(1) I use return in the estimations.

Model | Specification 1 | Specification 2 | Specification 3 |

|---|---|---|---|

Price return at t \(= \alpha + \beta^{\prime}X_t + u_t\) \(\left. {u_t } \right|{\Omega }_t \ iid N\left( {0,h_t } \right)\) i.e. Conditional Normal error | Pure autoregressive | Regressors include a constant and other exogenous variables | As in 2 with m possible exogenous variables for the variance (symbol Y) |

Variance Equation | ||

|---|---|---|

\(h_t = \gamma_0 + \mathop \sum \limits_{i = 1}^p \delta_i h_{t - i} + \mathop \sum \limits_{j = 1}^q \gamma_\gamma u_{t - j}^2\) (p, q) to be specified | \(h_t = \gamma_0 + \mathop \sum \limits_{i = 1}^p \delta_i h_{t - i} + \mathop \sum \limits_{j = 1}^q \gamma_\gamma u_{t - j}^2\) (p, q) to be specified | \(h_t = \gamma_0 + \mathop \sum \limits_{i = 1}^p \delta_i h_{t - i} + \mathop \sum \limits_{j = 1}^q \gamma_\gamma u_{t - j}^2 + \mathop \sum \limits_{k = 1}^m \mu_k Y_k\) (p, q) to be specified |

In all specifications, I assume coefficients satisfy \(\sum_{i = 1}^p {\delta_i } + \sum_{j = 1}^q {\gamma_\gamma } < 1; \delta_i ,\gamma_\gamma \ge 0;\gamma_0 > 0\) to ensure stationarity and a strictly positive conditional variance. The intuition behind the three specifications is that the conditional heteroskedasticity process governing ETS price behavior can depend upon possible alternative relationships between prices, volatility and some exogenous variables. Specifications 2 and 3 (and their various versions employed in the estimations, see results reported below) aim to minimize errors in forecasting by accounting for errors in prior forecasting and enhancing the accuracy of ongoing predictions by including in either the mean or the variance equations, or in both, some exogenous variables of interest (among them dummies accounting for changes in the auction rules described above). One can therefore evaluate their effects on the volatility of the ETS price process and compare the results with those emerging from pure autoregressive hypothesis (Specification 1). No version adopts the variant of including the s.d. or the variance in the mean equation (ARCH-M model, where the estimated coefficient on the expected risk is a measure of the risk-return tradeoff, which would be meaningless in the present case). Neither the hypothesis of Generalized Error Distribution is adopted because the estimated coefficient would be of difficult interpretation. The first two versions are the most widely used GARCH specification and assert that the best predictor of the variance in the next period is a weighted average of the long run average variance, the variance predicted for this period and the new information belonging to this period, which is the most recent squared residual. Such an updating rule is a simple description of adaptive behavior. With version 3, I assume that bidders update the predicted variance using some exogenous regressors (other than the lagged price) representing new information affecting their bidding behavior. Note that the forecasted variances from this model are not guaranteed to be positive. Yet I introduce regressors that are always positive to minimize the possibility that a single, large negative value generates a negative forecasted value. As we shall see, the total number of bidders and the cover ratio (a measure of excess demand) will be important innovations explaining the predicted variance perfectly consistent with the theoretical findings of Sect. 2.

Results are reported in Table 4. Eight versions of the model are estimated. Below each heading there is the indication of the general specification of which they represent a variant. Within each specification, the model version is determined by the choice of the exogenous variables.

Versions 2 (specification 2) and 8 (specification 3) present the same mean equations. Both contain MA and AR processes only (i.e. they do not include explicatory variables). On the contrary, version 5 (specification 2) and version 6 (specification 2) test the hypothesis that the Bid Spread (the difference between maximum and minimum bid in each auction round which may indicate how intensive the completion is in each auction round) and the Number of Successful Bidders affect the mean return in opposite ways. Version 7 (specification 3) aims at testing the impact of the Number of Bidders independently of the intensity of rounds competition (as measured by the Bid Spread).

As for the variance equation, estimations include in different versions of the variance equation the total number of active bidders (winners and not winners) N, the Bid Spread, the Cover Ratio (interpretable as an ex-post measure of auction inefficiency) and two Dummies discussed in Sect. 4 and corresponding to the New Rules MSR and the New Banking Rules.

Versions 7 and 8 share the same variance equations but have two different mean equations.Footnote 15 All other versions include either in the mean or in variance equation exogenous variables.

Results show that the Number of Successful Bidders affect negatively the mean return whereas the Bid Spread increases it. MA and AR estimates (based on a 5-day trading period, i.e. one working week) are consistent with the previous findings of ACF and PACF study (Sect. 4) and confirm the existence of some linear dependence of return (and prices) on its previous values as well as on a stochastic (an imperfectly predictable) term. Notice that an opposite result (finding that AM and AR were not significant) would sharply contradict the results about the constancy of the price variance discussed at the end of Sect. 3.

As for the variance equations, results show that the Total number of bidders (winners and non-winners) N and the Cover Ratio) reduce volatility. On the contrary, the Bid Spread increases it.

When interpreting the resultsFootnote 16 of the two dummies one should recall that as for D1 the reference rounds/period is MSR period vs No MSR periods and as for D2 it is New Banking Rules vs pre-reform Banking Rules periods. As a result, coefficients provide a measure of the difference between the periods corresponding to active rules and periods in which the rules were not active. Hence, I may conclude that the conditional variance is higher during MSR reform periods with respect to no MSR periods. The conclusion is opposite when I evaluate the effect of Banking: the conditional variance of return is lower during New Banking Rules periods with respect to pre-reform Banking Rules periods. After controlling for the number of active bidders, one may conclude that two main EU-ETS reforms had opposite effects on volatility. As for MSR the result is in line with policy expectations: MSR was used to improve the system's resilience to major shocks by adjusting the supply of allowances to be auctioned. More difficult is to reconcile the results obtained for the New Banking Rules with the initial optimistic policy expectations.

Estimations also lead to some potentially important reflections concerning the estimated conditional variance. In the following plot, the time path of estimated conditional variance is taken from model 8, but other versions produce very similar results. Recall, moreover, that in all estimations of the variance equation the sum of the ARCH and GARCH coefficients was very close to one in all specifications of the model. This implies that in the data generation process shocks affecting the conditional variance are highly persistent. This is quite evident for the last part of the Phase III period when innovations in the auction rules were introduced (see Sect. 2 for a discussion). The plot (Fig. 7) shows the increased volatility from the end of 2017–2020 as it emerged from a model where the variance equation was predicted after controlling for some exogenous regressors (version 7; but other versions generate very similar results). Still, even after controlling for those factors the volatility shows a sharp increase due to the above innovations. Interpreting the plot, one should recall that in addition to the introduction of the already discussed linear reduction factor and the MRS adjustment scheme, in Phase III a single EU-wide cap on emissions replaced the previous system of national caps thereby aggregating isolated national allowance markets into a single European market. The number of participants increased (new entrants and small traders) as well as market liquidity. Hence, a dynamic consequence of the auction reforms introduced in the second half of Phase III and of the accelerated reduction of the total cap from one year to the next is that this new environment increased the volatility of the equilibrium prices. An increased volatility of prices during the last 2 years of Phase III generated a large amount of volatility in that and subsequent period. Yet an important implication is that GARCH(−1) is always statistically significant and this is an indication of persistent volatility clustering. In other words, price volatility clustering can be a possibly permanent feature of the future outcomes of the EU-ETS auction mechanism. At the same time the reform of Banking (D2) was not able to hamper significantly the price variations triggered by MSR and therefore failed in performing its supposedly “smoothing” role.

In Table 4, the circle indicates that the null of absence of ARCH effect must be rejected at any level of significance. This implies that versions based on estimations of the mean equations in which there are no exogenous regressors perform poorly with respect to alternative versions. The inclusion of (weekly) AR and MA corrections does not improve results even when the variance equation includes regressors (version 8). This finding accords with previous empirical results (Benz and Trück 2009, p. 11). Before commenting the above result, I stress that I reiterated the process with higher orders of ARCH processes and/or GARCH processes of different distributions (Student-t, etc.) but that the above reported structure (Table 4) produced standardized residuals that are the closest to white noise. Note that in all specifications the highly significant positive coefficient of GARCH(−1) implies persistent volatility clustering.

Yet, the effect of the variation of L(1)p* on current p* changes appreciably over time as it is show in the following plot (Fig. 8) where numerical derivatives are shown. The plot shows the numerical value of the derivatives of each regressors of the mean equation based on the estimated regression (specifically, model 8). The autoregressive effect of the lagged price is stable from Phase II to past the mid of Phase III and then drops at the beginning of 2019 to increase sharply again between 2019 and 2020. On the contrary, the number of successful bidders and the total amount bid (by all bidders) always affect negatively the equilibrium price but the values of the derivatives do not show a specific time path.

One may note that the (negative) impact on price return of the number of successful bidders (Fig. 8 left panel) as well as the total number of bids (right panel) is highly volatile. This implies that during Phase III previous price stability disappeared and competition between bidders intensified, possibly in spite of some the effect of the prolongation of the 2008 economic crisis that strongly affected industrial output and induced a “surplus” of allowances (de Perthuis and Trotignon 2014).

Estimations also lead to some reflections concerning the estimated conditional variance. In the above Fig. 7 plot, the time path of estimated conditional variance Recall, moreover, that in all estimations of the variance equation the sum of the ARCH and GARCH coefficients was very close to one in all specifications of the model. This implies that in the data generation process shocks affecting the conditional variance are highly persistent. This is quite evident for the last part of the Phase III period when innovations in the auction rules were introduced (see Sect. 2 for a discussion). The plot (Fig. 7) shows the increased volatility from the end of 2017–2020 as it emerged from a model where the variance equation was predicted after controlling for some exogenous regressors (version 7). Still, even after controlling for those factors the volatility shows a sharp increase due to the above innovations.Footnote 17 Indeed, when interpreting the above plot one should recall that in addition to the introduction of the already discussed linear reduction factor and the MRS adjustment scheme, in Phase III a single EU-wide cap on emissions replaced the previous system of national caps thereby aggregating isolated national allowance markets into a single European market. The number of participants increased (new entrants and small traders) as well as market liquidity. Hence, a dynamic consequence of the auction reforms introduced in the second half of Phase III and of the accelerated reduction of the total cap from 1 year to the next is that this new environment increased the volatility of the equilibrium prices as it was shown in Sect. 3. An increased volatility of prices during the last two years of Phase III generated a large amount of volatility in that and subsequent period.

Finally, the above estimates can be used to evaluate the surplus winners realize in each auction. A rough measure of surplus is simply \(S_t = 0.5\left( {{\text{MaxBid}}_t - \widehat{p_t^* }} \right){\text{Volume}}_t\) where the hat refers to the predicted values of the equilibrium price. The series generated according to this formula is shown in the following plot. Recall that from Definition 3 of Sect. 2 I have

Hence, I interpret the predicted price as an approximation to the predicted expected value of allowance valuation of the first excluded bidder. The first panel shows the series of the aggregated surplus of winners and the second the average surplus defined as \(S_t /I_t\) (Fig. 9).

An intuition that may explain the increased bidders’ surplus at the end of Phase III is that the new banking rules coupled with a smoothly declining cap may have led bidders to decrease current emissions beyond the constraint imposed by the cap and to accumulated allowances (banking) for trading them in next periods. When borrowing is not allowed, the calculation is only whether tomorrow discounted expected cost is higher than today cost given some discount rate. If tomorrow’s expected cost is higher than today’ cost, it is worth holding allowances, and using them to either cover some of tomorrow’s emissions or sell them later on. On the contrary, under the opposite assumption about expected cost it would be more profitable to use or sell any allowances held at today price and earn the return represented by the discount rate than to continue holding them. As one can see, Surplus is quite volatile, and this reflects the spikes and slams of price possibly brought about by the above mentioned arbitrage activity. Obviously, one wonders whether a CO2 GHG emission regulatory mechanism should be left vulnerable to purely speculative arbitrage operations.

6 Conclusions

Price volatility is one of the most important elements guiding decisions in economics. It can help to measure the risk or the error sizes obtained in modelling several price or financial series. Furthermore, it is essential for making forecasts before, as in the present context, installments’ decisions about the appropriate level of pollution-abating investments are taken. Price volatility is one of the (many) Achilles’ hells of Phase III EU-TS whose alleged weakness include over-allocation of permits, massive windfall profits (particularly for energy generator companies), and a general difficulty to meet its goals. The determinants of EU-ETS price volatility have been investigated in the present paper. Results show that the Number of Successful Bidders decreases mean return whereas the Bid Spread increases both mean return and its volatility. The latter is reduced by an increase of the Cover Ratio. Yet the most interesting findings concern the impact on EU-ETS price/return mean behavior and volatility of the institutional changes introduced in the EU-ETS market design at the end of Phase III. Banking-based short-run supply adjustments and new MSR supply rules had a destabilizing (variance unfastening) effect.Footnote 18 Evidence supports the view that adjustments based on new banking rules (or, equivalently, Total Number of Allowances in Circulation, TNAC) magnifies the price impact of anticipated changes in market fundamentals, induces multiple and unstable equilibria, and is prone to speculative attacks since the market is (and probably will be) characterized by persistent volatility clustering. Empirical analysis shows that reforms are associated to the increased price volatility of the last years and to the parallel increase in auction winners’ monetary rent. These auction outcomes are at odds with efficiency. The future gradual yearly reduction of allowances will probably be a key factor to obtain a long run deep reduction of carbonization within EU-ETS but measures to stabilize equilibrium prices (e.g. price max and particularly min levels) could help to improve efficiency. To maintain a high price the ETS and reduce volatility the mechanism should be extended to more sectors (may be with the only exclusion of the agricultural sector) and the introduction of a floor minimum price should be implemented by a mix of administrative and tax measures. The EU has expressed further pollution reduction ambitions with European Green Deal –to be implemented by further reductions of the LRF. Yet dutiful reliance on market mechanisms, such as the greatly volatile EU-ETS, might prove insufficient to curb CO2 GHG emission at least unless these mechanisms are not radically and appropriately corrected.

Notes

Vollebergh and Brink (2020) relate this European novelty to the previous US experience with the SO2 cap-and-trade scheme of the 1990s (Burtraw and Szambelan 2009). To date, the EU ETS has been the largest emissions trading scheme in the world (World Bank 2019). Revenues from the allowance auctions are distributed to member states as “auction rights” according to a formula that is inversely, but loosely, related to national per-capita income (Ellerman et al. 2015). At least 50% of revenues should be used for climate- and energy-related purposes. As for banking rules, comparisons are presented in https://www.emissions-euets.com/banking. A view of the rules is in https://icapcarbonaction.com/en/?option=com_etsmap&task=export&format=pdf&layout=list&systems%5B%5D=43.

Rode (2021) offers an analysis of the UK allocation procedure in Phase I based on a provisional allocation and an ex post post-appeal allocation.

The reduction program is the following. By 2020: 20% below 1990 GHG levels. By 2030: at least 40% below 1990 GHG levels. By 2050: EU leaders have committed to reaching climate neutrality by mid-century.

EU-ETS may also be credited to have increased the cost of carbon intensive production and contribute to a short run fuel switching from coal to natural gas (Delarue et al. 2010) not to mention a change in long-run expectations of returns on investments in carbon intensive projects.

The system covers the following sectors and gases, focusing on emissions that can be measured, reported and verified with a high level of accuracy. Carbon dioxide (CO2) from: (a) power and heat generation; (b) energy-intensive industry sectors including oil refineries, steel works and production of iron, aluminum, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids and bulk organic chemicals; commercial aviation; nitrous oxide (N2O) from production of nitric, adipic and glyoxylic acids and glyoxalin perfluorocarbons (PFCs) from aluminum production. Participation in the EU ETS is mandatory for companies operating in the above sectors but in some cases only plants above a certain size are included. Moreover, certain small installations can be excluded if governments put in place fiscal or other measures that will cut their emissions by an equivalent amount. A recent decision agreed by the German Parliament is in favor of the extension of the ETS to transport and domestic heating systems.

NER 300 is a funding program pooling together about 2 billion euros for innovative low-carbon technology, focusing on the demonstration of environmentally safe Carbon Capture and Storage (CCS) and innovative renewable energy technologies on a commercial scale within the EU.

Beck et al. (2020, p. 783) maintain that when national policies that reduce the allowance demand combine with a binding MSR cap this combination results in allowance cancellation within the MSR, and consequently it lowers the emission cap.

A description is in http://www.euromines.org/what-we-do/energy-climate-change/emissions-trading-system-phase-iv-2021-2030#:~:text=The%20EU%20ETS%20operates%20in,for%20carbon%20to%20the%20market. Recall that Phase II was characterized by (a) Lower cap on allowances (some 6.5% lower compared to 2005); (b) the presence of 3 new countries (Iceland, Liechtenstein and Norway); (c) a reduction of the proportion of free allocation that fell slightly to around 90%. Interaction with other markets are studied in Pinho and Madaleno (2011).

This assumption corresponds to the diminishing marginal utility assumed in multi-unit auctions by Ausubel et al. (2014, p. 1371).

In this context, bidders’ gain does not require political connections and patronage and does not result from lobbying effort (see Rode 2021, for rent seeking during the UK rounds of Phase I).

Back loading changes the scheduled quantities of auctioned allowances so that fewer are auctioned in the early years and more are auctioned in the later years of phase II. After some debate, the decision was made in February 2014 to withdraw 900 million allowances from auctioning in 2014–2016 and to add them back in to auctioning in 2019–2020.

Author thank a referee for remarking this aspect.

Tests are available in Bosco (2020).

With respect to the first column of Table 1, I stress that results obtained adopting other distribution hypotheses such as the Generalized Error Distribution generate similar results and are available upon request.

The goodness of the results is evaluated based on the LM test reported in the last part of the Table.

Plots obtained from different multivariate version of the GARCH model are similar.

Not surprisingly, problems plaguing the ETS since its entry into force in 2005 have led a number of countries to take unilateral steps. The UK (when still a member of the EU) introduced a price floor for carbon; Denmark, Sweden, Finland, France, Ireland, and the Netherlands have introduced a carbon tax. In Germany, the government launched a carbon price in the transport and buildings sectors as of January 2021.

References

Ausubel LM, Cramton P, Pycia M, Rostek M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 81(4):1366–1400

Beck U, Krese-Andersen PK (2020) Endogenizing the cap in a cap-and-trade system: assessing the agreement on EU ETS Phase 4. Environ Resource Econ. https://doi.org/10.1007/s10640-020-00518-w

Benz E, Trück S (2009) Modeling the price dynamics of CO2 emission allowances. Energy Economics 31:4–15

Bosco B, Parisio L, Pelagatti M, Baldi F (2010) Long-run relations in European electricity prices. J Appl Economet 25(5):805–832

Bosco B, Parisio L, Pelagatti M (2016) Price coordination in vertically integrated electricity markets: theory and empirical evidence. Energy J 37(1):181–194

Bosco B (2020) Auctioning Co2 emission allowances in Europe. A time series analysis of equilibrium prices, W. P. CefES, Dems-Bicocca, n.448

Burtraw and Szambelan (2009) U.S. Emissions Trading Markets for SO2 and NOx, Resources for the Future D.P. 09-40

Cramton P, Kerr S (2002) Tradeable carbon permit auctions: how and why to auction not grandfather. Energy Policy 30(4):333–345

Crawford GS, Crespo J, Tauchen H (2007) Bidding asymmetries in multi-unit auctions: implications of bid function equilibria in the British spot market for electricity. Int J Ind Organ 25:1233–1268

de Perthuis C, Trotignon R (2014) Governance of CO2 markets: lessons from the EU-ETS. Energy Policy 75:100–106

Delarue ED, Ellerman AD, d’Haeseleer WD (2010) Short-term CO2 abatement in the European power sector: 2005–2006. Clim Change Econ 01:113–133

Donald SG, Paarsch HJ, Robert J (2006) An empirical model of the multi-unit, sequential, clock auction. J Appl Economet 21:1221–1247

Ellerman AD, Marcantonini C, Zakla A (2016) The European Union Emissions trading system: ten years and counting. Rev Environ Econ Policy 10(1):89–107

Ellerman D, Valero V, Zaklan A (2015) An analysis of allowance banking in the EU ETS, RSCAS 2015/29 Robert Schuman Centre for Advanced Studies, Florence School of Regulation Climate

European Commission (2015) EU ETS Handbook, Brussel

Leiby L, Rubin J (2001) Intertemporal permit trading for the control of greenhouse gas emissions. Environ Resource Econ 19:229–256

Parisio L, Bosco B (2003) Market power and the power market: multi-unit bidding and (in)efficiency in electricity auctions. Int Tax Public Financ 10(4):377–401

Perino G, Pahle M, Pause F, Quemin S, Scheuing H, Willner M (2021) EU ETS stability mechanism needs new design, CEC Dauphine, February 1–2021. www.chaireeconomieduclimat.org

Pinho C, Madaleno M (2011) CO2 emission allowances and other fuel markets interaction. Environ Econ Policy Stud 13:259–281

Rode A (2021) Rent seeking over tradable emission permits. Environ Resource Econ. https://doi.org/10.1007/s10640-020-00531-z

Vollebergh HRJ, Brink C (2020) What can we learn from eu ETS? Cesifo wp, 8236

Wilson RB (1979) Auctions of shares. Quart J Econ 93:675–689

World Bank (2016) Emissions trading in practice: a handbook on design and implementation. World Bank, Washington

World Bank (2019) State and trends of carbon pricing 2019. World Bank, Washington. https://doi.org/10.1596/978-1-4648-1435-8

Acknowledgements

This paper is part of a research project on Auctions and Regulation (Partial financial support comes from University of Milan-Bicocca, Grant FAR-2019). With the usual disclaimers, I thank A. Alcay, E. Alonso-Pauli, M. Marini, Sai Bravo Melgarejo, B. Salomão Neto, B. Baigorri García and M. Pelagatti for comments and suggestions. Two anonymous reviewers have enormously contributed to the improvement of an early version.

Funding

Open access funding provided by Università degli Studi di Milano - Bicocca within the CRUI-CARE Agreement. Funding was provided by University of Milan-Bicocca.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Bosco, B. Trade, equilibrium prices and rents in European auctions for emission allowances. Environ Econ Policy Stud 25, 87–113 (2023). https://doi.org/10.1007/s10018-022-00344-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-022-00344-y