Abstract

I examine the welfare effects of emission permit trading in an economy where the use of energy in production generates welfare-harming emissions, there is a regulator that sets industry-specific emission permits and the industries influence the regulator by paying political contributions. I show that policy with nontraded emission permits establishes aggregate production efficiency. Emission permit trading hampers efficiency and welfare by increasing the use of emitting inputs in dirty and decreasing that in clean industries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this study, I examine endogenous environmental policy with the issue and trading of emission permits. Because there is in general no international regulator that would control emissions-based externality by efficient tax instruments, international environmental policy is commonly delegated to an authority that is subject to lobbying. Thus, it is instructive to examine how emission permit trading affects emissions and aggregate welfare.

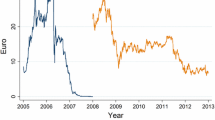

This study is motivated by the following experience. In the environmental policy of the European Union (EU), command-and-control instruments dominate over incentive-based instruments (Wråke et al. 2012), because they do not involve fiscal policy. The command-and-control policy can be implemented in three stages (Goulder 2013). First, the regulator specifies total pollution allowed for all the facilities in the regulatory program. Second, the regulator distributes the allowances. Third, the system provides for trading in the allowances. This study considers the usefulness of the third stage.

In the EU Emissions Trading System (EU-ETS), lobbying by the interest groups plays an important role. Binder and Neumayer (2005) and Fredriksson et al. (2005) examine lobbying by environmental non-governmental organizations (ENGO). In contrast, I do not make a sharp division between household and producer lobbies. I rather assume that emissions are by-products of (carbon) energy and that an industrial lobby represents households that receive income from the same industry. Then, each lobby cares about both aggregate emissions (as a consumer) and the needs for the industry. Gullberg (2008) considers whether interest groups lobby towards their friends or foes. In my approach, there is no such distinction; each industrial lobby cares about the emissions of all industries, not only those of its own.

In the EU-ETS, many emission permits are auctioned and not granted free of charge to the industries. Because the combination of lobbying and auctions would lead to a very complicated game theoretic model, I have to leave that extension for future studies.

Caplan and Silva (2005) examine emission permit trading in a federation of regions, showing that Pareto efficiency can be established with the help of inter-regional redistributive transfers. Holtsmark and Sommervoll (2012) consider emission permit trading when the (local) governments grant permits for the domestic firms. They show that the anticipation of such trading changes the governments’ behavior so that emissions actually increase, decreasing efficiency. I assume, on the contrary, that there are no redistributive transfers and that there is a regulator that grants emission permits. Hintermann (2011) and Meunier (2011) consider the imperfections in the emission permit markets, while I show that severe coordination problems appear between the regulator and the industries already with competitive markets.

To examine the problem of the usefulness of emission permit trading, I construct a game theoretic model where a self-interested regulator grants emission permits for industries, as being influenced by the lobbies that represent the income earners in those industries. I apply common agency theory, where several principals influence a single agent by offering contributions that are conditional on the latter’s behavior (cf. Grossman and Helpman 1994; Dixit et al. 1997; Aidt 1998).

The remainder of this document is organized as follows. Section 2 presents the structure of the economy. Sections 3 and 4 examine environmental policy with nontraded and traded permits, respectively, and section 5 considers the effects of emission permit trading. Section 6 summarizes the results.

2 The economy

2.1 Production

There is a “continuum” of industries \(i\in [0,1]\) that produce the same numeraire good from carbon energy \(m_i\) with decreasing returns to scale:

This is the simplest production setup for the purposes of this study and it can be motivated, e.g., as follows. Every industry \(i\in [0,1]\) produces its output \(g_i\) from carbon energy \(m_i\) and fixed inputs (e.g., labor, land) according to neoclassical technology. Because the economy is small and open, the relative prices of the industries are exogenously determined from abroad. In that case, the outputs of the industries \(i\in [0,1]\) can be aggregated into one good, the price of which can be normalized at unity in the model.

There is also an energy sector that transforms natural resources into carbon energy at a constant unit cost x in terms of the numeraire good. Then, in industry i, revenue is given by \(f_i(m_i)\doteq g_i(m_i)-xm_i\), and there is a fixed maximum \(\overline{m}_i\) for the use of input \(m_i\):

The maximum \(\overline{m}_i\) acts as an outside option in the common agency game. By (1) and (2), I can define the revenue function

I choose the units so that the use of carbon energy \(m_i\) generates emissions in one-to-one proportion. Then, aggregate emissions are given by

2.2 Utility

The representative household in industry i (hereafter called industry i, for convenience) consumes all income in that industry and acts as a lobby for that industry. To eliminate aggregation problems and distributional concerns from the model and to focus only on aggregate production efficiency, I follow Grossman and Helpman (1994) and Aidt (1998) and assume that all industries \(i\in [0,1]\) have the same marginal utility of income. Then, each industry \(i\in [0,1]\) derives utility from its consumption \(c_i\) and the emissions of all industries, \(\mathbf m \doteq \{m_k|\,\in [0,1]\}\), through the function

where \(D_i(\mathbf{m})\) is the damage of the emissions \(\mathbf m\) for industry i in terms of the numeraire good. Then, aggregate damage in the economy is given by

I take the utilitarian welfare function—i.e., the sum of the utilities (5) of all industries \(k\in [0,1]\)—to represent social welfare, for convenience [cf. (6)]:

Because all industries produce the same numeraire good, the Pareto optimum is the allocation of inputs \(\mathbf m\) that maximizes social welfare (7) when all industries \(k\in [0,1]\) consume their revenue (3), \(c_k=f_k(m_k)\):

Thus, at the Pareto optimum, the marginal product \(f_i\) of the emitting input \(m_i\) of any industry \(i\in [0,1]\) is equal to the marginal aggregate damage \(\frac{\partial D\,}{\partial m_i}\) of that input.

2.3 Regulation

Damage \(D(\mathbf{m})\) causes externality that must be controlled by environmental policy. I examine this in the setup of a common agency game (cf. Grossman and Helpman 1994; Dixit et al. 1997; Aidt 1998) as follows. There is a regulator that grants industry-specific emission permits \(\mathbf M \doteq \{M_i|i\in [0,1]\}\). If industry i joins the regulatory program, then it must accept the regulator’s policy, but if it does not join and remains as a free rider, then it pays a constant penalty \({{n}}_i>0\) to the other industries. Without the retaliation against free traders, the regulatory program could not be implemented. In a common agency game, the possibility of avoiding regulation restricts the regulator’s policy set, but in equilibrium all industries participate in the program. Thus, total emissions M are always equal to the sum of emission permits:

Because every industry \(i\in [0,1]\) attempts to influence the regulator by paying political contributions \(R_i\) to the latter, the regulator’s total income is

I assume that the regulator has no other income, for simplicity.

In line with Grossman and Helpman (1994) and Finkelstain and Kislev (1997), I assume the following. The incumbent regulator expects that high social welfare improves its likelihood to stay in power. As a result of this, it maximizes a weighted sum of social welfare (7) and private benefit (10),

where the constant z represents the preference of the regulator for political contributions R relative to social welfare W.

3 Nontraded permits

Nontraded permits \(\mathbf M\) determine emissions \(\mathbf m\) directly: \(\mathbf m =\mathbf M\). Then, each industry \(i\in [0,1]\) consumes its revenue \(f_i(m_i)=f_i(M_i)\) [cf. (3)] minus its contributions to the regulator, \(R_{iN}\),Footnote 1

and the regulator’s utility (11) can be written as follows:

Emission policy with nontraded permits is determined by the two-stage game:

-

(i)

Each industry \(i\in [0,1]\) sets its political contributions \(R_{iN}\) conditional on the regulator’s policy \(\mathbf{M}\doteq \{M_i|\, i\in [0,1]\}\).

-

(ii)

The regulator sets the emission permits \(\mathbf M\), noting aggregate emissions (9) and consumption (12) in all industries \(i\in [0,1]\).

3.1 Regulation

According to Dixit et al. (1997), a subgame perfect Nash equilibrium for the game is a set of a policy \(\mathbf M\) and contribution schedules \(R_{iN}(\mathbf M )\) for \(i\in [0,1]\) such that the following conditions (a)–(d) hold true:

-

(a)

The contributions \(R_{iN}\) of industries \(i\in [0,1]\) are non-negative but no more than the income of that industry.

-

(b)

Industry i cannot have a feasible strategy \(R_{iN}(\mathbf M )\) that yields it higher utility \(U_{iN}\) than in equilibrium (cf. \(\mathbf m =\mathbf M\)):

$$\begin{aligned} M_i&=\arg \max _{{M_i\,\,\mathrm{s.t.}\,\, {(5),(12)}}}U_{iN}=\arg \max _{{M_i\,\,\mathrm{s.t.}\,\, {(12)}}}[c_{iN}-D_i(\mathbf{M}] \nonumber \\&=\arg \max _{M_i}[f_i(M_i)-R_{iN}(\mathbf M )-D_i(\mathbf{M})]. \end{aligned}$$(14) -

(c)

The regulator cannot have a policy \(\mathbf{M}\) that yields it higher utility (13) than in equilibrium:

$$\begin{aligned} \mathbf{M}=\arg \max _{\mathbf{M}}\Omega _N=\arg \max _{\mathbf{M}}\int _0^1\bigl [f_i(M_k)+(z-1)R_{kN}(\mathbf M )\bigr ]\mathrm{d}k-D(\mathbf{M}). \end{aligned}$$(15) -

(d)

Industry i provides the regulator at least with the level of utility than in the case it offers nothing (\(R_{iN}=0\)), and the regulator responds optimally given the contribution functions of the other industries,

$$\begin{aligned} \Omega _N\ge \max _{\mathbf{M}}\Omega _N\bigl |_{R_{iN}=0}. \end{aligned}$$

3.2 Equilibrium

If industry \(i\in [0,1]\) does not join the regulatory program, then it has no contributions to pay, \(R_{iN}=0\), and it uses the maximum input \(\overline{m}_i\) [cf. (3)] and consumer revenue \(f_i(\overline{m}_i)\) minus its penalty \(n_i\):

If it joins the program, then it pays contributions \(R_{iN}(\mathbf M )\) and behaves according to (14) with the first-order conditions

Thus, in equilibrium, the change in the contributions of industry i, \(R_{iN}\), due to a change in the instrument \(M_i\) equals the effect of that instrument on the net revenue of that industry, \(f_i'(M_i)-\frac{\partial D_i}{\partial M_i}(\mathbf{M})\). These contribution schedules are locally truthful. This concept can be extended to a globally truthful contribution schedule \(R_{iN}(\mathbf M )\) that represents the preferences of industry i at all relevant policy points as follows [cf. (16), (17)]:

where the integration constant \(f_i(\overline{m}_i)-n_i\) is the opportunity income for industry i as a free rider [cf. (16)].

By (6) and (18), the equilibrium conditions (15) are equivalent to

Because this result is the same as (8), it can be rephrased as follows:

Proposition 1

The use of nontraded industry-specific emission permits establishes Pareto optimum.

This proposition is in line with the result of Grossman and Helpman (1994), Dixit et al. (1997) and Aidt (1998) on the existence of an efficient lobbying outcome: when all industries \(i\in [0,1]\) are represented by an interest group and each individual earns income only in one industry, all individuals are represented by an interest group.Footnote 2

4 Traded permits

The introduction of emission permit trading extends the extensive form game of the preceding sector to four stages by incorporating the emission permit market and individual firms as new players into the model. This is because the lobby called industry i, which represents income earners in that industry, cannot control individual firms operating in it. These firms ignore the effects of their production on aggregate emissions and take both emission permits \(M_i\) and the price for emission permits p as given. Emission policy with traded permits is then determined by the four-stage extensive form game as follows:

-

(i)

Each industry \(i\in [0,1]\) sets its political contributions \(R_{iT}(\mathbf{M})\) conditional on the regulator’s policy \(\mathbf M\).Footnote 3

-

(ii)

The regulator sets the emission permits \(\mathbf M\).

-

(iii)

The emission permit market adjusts the price p for emission permits to set aggregate demand \(\int _0^1m_k\mathrm{d}k\) equal to the aggregate supply (9):

$$\begin{aligned} \int _0^1m_k\mathrm{d}k=\int _0^1M_i\mathrm{d}i=M. \end{aligned}$$(20) -

(iv)

Firms produce using carbon energy \(m_i\).

This game is solved in reverse order in the following subsections.

4.1 Firms

The representative firm in industry i receives emission permits \(M_i\) from the regulator and faces the price p for emission permits in the market. It purchases the quantity \(m_i-M_i\) of those in the case of shortage \(m_i>M_i\) and sells the quantity \(M_i-m_i\) of those in the case of surplus \(M_i>m_i\) at the price p to produce revenue \(f_i(m_i)\). Thus, for a given price p and given permits \(M_i\), it uses carbon energy \(m_i\) to maximize its profit

This leads to the equilibrium profit and the first-order condition as follows:

4.2 The emission permit market

Inverting the profit-maximization condition in (22) defines emissions in industry i as a function of the price p for emission permits:

where \((f_i')^{-1}\) is the inverse function of \(f_i'\). Inserting the demand functions (23) into the equilibrium condition (20) yields

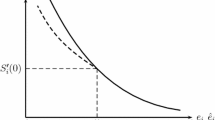

This equation defines the price for emission permits, p, as a decreasing function of aggregate emissions M:

Inserting (24) into (22) yields the profit \(\Pi _i\) of industry i as a function of emission permits \(M_i\) for that industry and aggregate emissions M:

Plugging (24) into (23) defines emissions \(m_i\) of industry \(i\in [0,1]\) as an increasing function of aggregate emissions M:

where \(m_i'\) is the proportion of aggregate emission permits M that ends up as emissions in industry i. In vector form, the result (26) is given by

Industry \(i\in [0,1]\) consumes its income (25) minus its political contributions \(R_{iT}(\mathbf M )\) to the regulator:Footnote 4

Noting consumption (28) for all industries \(i\in [0,1]\), the regulator’s utility (11) with traded permits can be written as follows [cf. (27)]:

4.3 Regulation

In contrast to the equilibrium conditions (a)–(d) in the preceding section, a subgame perfect Nash equilibrium for the game with emissions permit trading is a policy \(\mathbf{M}\) and a set of contribution schedules \(R_{iT}(\mathbf{M})\) such that condition (a) is preserved, but conditions (b’)–(d’) are revised:

- (b’):

-

Industry i cannot have a feasible strategy \(R_{iT}(\mathbf{M})\) that yields it higher utility \(U_{iT}\) than in equilibrium [cf. (27)]:

$$\begin{aligned} M_i&=\arg \max _{{M_i\,\,\mathrm{s.t. }\,\, {(20)}\text { and } {(28)}}}U_{iT} \nonumber \\&=\arg \max _{{M_i\,\,\mathrm{s.t.}\,\, M=\int _0^1M_k\mathrm{d}k}}[\Pi _i\bigl (M_i,M\bigr )-R_{iT}(\mathbf M )-D_i\bigl (\mathbf m (M)\bigr )\bigr ]_. \end{aligned}$$(30) - (c’):

-

The regulator cannot have a policy \(\mathbf{M}\) that yields it higher utility (29) than in equilibrium:

$$\begin{aligned}\mathbf{M}&=\arg \max _{\mathbf{M}}\Omega _T\nonumber \\ &=\arg \max _{\mathbf{M}}\int _0^1\bigl [\Pi _k\bigl (M_k,M\bigr )+(z-1)R_{kT}(\mathbf{M})\bigr ]\mathrm{d}k-D\bigl (\mathbf m (M)\bigr ). \end{aligned}$$(31) - (d’):

-

Industry i provides the regulator at least with the level of utility than in the case it offers nothing (\(R_{iT}=0\)), and the regulator responds optimally given the contribution functions of the other industries,

$$\begin{aligned}&\Omega _T\ge \max _{\mathbf{M}}\Omega _T\bigl |_{R_{iT}=0}. \end{aligned}$$

4.4 Equilibrium

If industry \(i\in [0,1]\) does not join the regulatory program, then it has no contributions to pay, \(R_{iT}=0\), uses the maximum input \(\overline{m}_i\) [cf. (3)] and consumes revenue \(f_i(\overline{m}_i)\) minus its penalty \(n_i\):

If it joins the program, then it pays contributions \(R_{iT}(\mathbf M )\) and consumes (28). In that case, by (20), (25) and (28), the condition (30) yields

These contribution schedules are locally truthful. This concept can be extended to a globally truthful contribution schedule that represents the preferences of industry i at all relevant policy points [cf. (20), (32) and (33)]:

where the integration constant \(f_i(\overline{m}_i)-n_i\) is the opportunity income for industry i as a free rider [cf. (32)]. By (6), (20), (22), (25), (26), (28) and (34), the equilibrium condition (31) yields

where \({m_q'}\frac{\partial D}{\partial m_q}\) is the marginal damage of industry q, \({m_q'}\) the relative weight of industry q [cf. (27)] and \(\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\) is the weighted average of the marginal damages of all industries \(q\in [0,1]\).

5 Emission permit trading

The comparison of outcomes (8), (19) and (35) yields the following result:

Proposition 2

The introduction of inter-industry emission permit trading violates the Pareto-optimality conditions (8), decreasing social welfareW.

The efficiency of industry-specific emission capping is based on the possibility to set lower caps for more damaging production. When emission permit trading lets individual firms to even out their marginal products of emitting inputs in the market (i.e., \(f_i=p\)), the regulator can effectively control only aggregate emissions M, but not the distribution of these over the industries.

The weighted average of the marginal damages of all industries,\(\int _0^1\frac{\partial D}{\partial m_q}{m_q'}\mathrm{d}q\), divides the industries into two groups:

-

I call industry i dirty, if an increase in its energy input damages more than on the average, \(\frac{\partial D\,}{\partial m_i}>\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\).

-

I call industry i clean, if an increase in its energy input damages less than on the average, \(\frac{\partial D\,}{\partial m_i}<\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\).

Assume that the economy is originally at the Pareto optimum, \(f_i'=\frac{\partial D\,}{\partial m_i}\) for \(i\in [0,1]\). Then, by \(f_i''<0\) [cf. (3)] and (35), the introduction of emission permit trading causes the following:

-

If industry i dirty, \(\frac{\partial D\,}{\partial m_i}>\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\), then marginal damage \(f_i'\) decreases from \(\frac{\partial D\,}{\partial m_i}\) to \(\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\), increasing both the input of carbon energy, \(m_i\), and output \(f_i(m_i)\) in that industry.

-

If industry i clean, \(\frac{\partial D\,}{\partial m_i}<\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\), then marginal damage \(f_i'\) increases from \(\frac{\partial D\,}{\partial m_i}\) to \(\int _0^1\frac{\partial D\,}{\partial m_q}{m_q'}\mathrm{d}q\), decreasing both the input of carbon energy, \(m_i\), and output \(f_i(m_i)\) in that industry.

This result can be rephrased as follows:

Proposition 3

Emission permit trading generates pollution by increasing the use of carbon energy in dirty and decreasing that in clean industries.

The effectiveness of emission policy is based on discrimination between dirty and clean industries. It falls, when the firms get an opportunity to equalize their marginal products of carbon energy in a competitive market.

6 Conclusions

Because aggregate emissions harm welfare, a regulator controls this externality by granting industry-specific emission permits. The regulator receives political contributions from the industries for its policy, but takes also social welfare into account to promote its survival. In this setup, emission permit trading has the following consequences.

The incumbent regulator maximizes the weighted sum of its individual income and social welfare that promotes its survival over time. An increase in emission permits increases its income, but decreases social welfare and its likelihood of survival. When emission permits are nontraded, they determine the energy inputs for all industries. In that case, in line with Grossman and Helpman (1994), Dixit et al. (1997) and Aidt (1998), there is an efficient lobbying outcome that maximizes social welfare.

Emission permit trading between the industries changes the situation fundamentally, because the lobbies representing industries have no way to control firms operating in their area. When a single firm gets an opportunity to buy and sell emission permits in a competitive market, it adjusts its marginal output of carbon energy equal to the market price. Consequently, the firms equalize the marginal products of the emitting inputs in the market. In that case, the regulator can effectively control only aggregate emissions but not the distribution of these over the industries.

While a great deal of caution should be exercised when a highly stylized game-theoretic model is used to explain international environmental policy, the following judgement seems nevertheless to be justified. If it is impossible to use incentive-based instruments, and if firms are independent of industrial lobbies, then attempts to improve the working of industry-specific emission caps by inter-industry trading opportunities can be counterproductive.

Notes

Subscript N denotes the case of no emission permit trading.

Cf. Oates and Portney (Oates and Portney 2003, p. 335). I have excluded the regulator from the social welfare function W by the assumption that it does not receive income from any of the industries \(i\in [0,1]\), for simplicity.

Subscript T denotes the case of emission permit trading.

Subscript T denotes the case of emission permit trading.

References

Aidt TS (1998) Political internalization of economic externalities and environmental policy. J Publc Econ 69:1–16

Binder S, Neumayer E (2005) Environmental pressure group strength and air pollution: an empirical analysis. Ecol Econ 55:527–538

Caplan AJ, Silva ECD (2005) An efficient mechanism to control correlated externalities: redistributive transfers and the coexistence of regional and total emissions permit markets. J Environ Econ Manag 49:68–82

Dixit A, Grossman GM, Helpman E (1997) Common agency and coordination: general theory and application to management policy making. J Polit Econ 105:752–769

Finkelstain I, Kislev Y (1997) Prices versus quantities: the political perspective. J Polit Econ 105:83–100

Fredriksson PG, Neumayer E, Damania R, Gates S (2005) Environmentalism, democracy, and pollution control. J Environ Econ Manag 49:343–365

Goulder LH (2013) Markets for pollution allowances: what are the lessons? J Econ Perspect 27:87–102

Gullberg ATh (2008) Markets for pollution allowances: what are the lessons? Energy Policy 36:29647–2972

Grossman G, Helpman E (1994) Protection for sale. Am Econ Rev 84:833–850

Hintermann B (2011) Market power, permit allocation and efficiency in emission permit markets. Environ Resour Econ 49:327–349

Holtsmark B, Sommervoll DE (2012) International emissions trading: good or bad? Econ Lett 117:362–364

Meunier G (2011) Emission permit trading between imperfectly competitive product markets. Environ Resour Econ 50:347–364

Oates WE, Portney PR (2003) The political economy of environmental policy. In: Mäler K-G, Vincent JR (eds) Handbook of environmental economics, vol I, chapter 8, pp 325–354

Wråke M, Burtraw D, Löfgren Å, Zetterberg L (2012) What have we learnt from the European Union’s emissions trading system? Ambio 41:12–22

Acknowledgements

I am grateful to the two anonymous referees for constructive comments. The author thanks IIASA (Laxenburg, Austria) for hospitality in summer 2018 when this paper was partly written. Open access funding provided by University of Helsinki including Helsinki University Central Hospital.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

This article is published under an open access license. Please check the 'Copyright Information' section either on this page or in the PDF for details of this license and what re-use is permitted. If your intended use exceeds what is permitted by the license or if you are unable to locate the licence and re-use information, please contact the Rights and Permissions team.

About this article

Cite this article

Palokangas, T. Emission permit trading with a self-interested regulator. Environ Econ Policy Stud 21, 413–426 (2019). https://doi.org/10.1007/s10018-019-00236-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-019-00236-8