Abstract

Under incomplete environmental enforcement, the high-cost (less efficient) firm may strategically violate the environmental standard, causing the low-cost (more efficient) firm to exit the market—a phenomenon similar to Gresham’s law in which bad money drives out good money. Tightening environmental regulation without increasing probability and penalties helps the high-cost firm to drive the low-cost firm out of the market. This explains why serious pollution and inefficient production co-exist in developing economies.

Similar content being viewed by others

Notes

Gresham’s law is originally the law of “bad money drives out good money.”

Cohen (2000) reviews state-of-the-art techniques for estimating the costs and benefits of criminal justice and prevention programs.

The reason why a duopoly model is adopted here is because we want to study the impacts of both the production efficiency (cost asymmetry) and the compliance behavior of the competing firms on the market structure. It is necessary to use such a simplified model to make the model workable. If the current model is replaced by an n-oligopoly model, then the qualitative results and intuitions are still the same, but the computation is more complicated.

The authors also interviewed an official in the Environmental Protection Bureau of Tainan City in south Taiwan for its inspection practice in August 2011. Local governments in Taiwan also follow the same rule for environmental enforcement.

This game structure is like that of Markusen et al. (1993) which contains a two-stage game model allowing firms to enter or exit. To change the number and location of their plants in response to environmental policies, the game structure (referred to in the third paragraph in p. 73) is that, in stage one, x and y producers make a choice among three options: no production, a plant only in their home region, or a plant in each region of their home region. In stage two, x and y play a one-shot Cournot game, and moves in each stage are assumed to be simultaneous.

Horiuchi and Ishikawa (2009) also take the oligopoly as a benchmark market structure to study the behavior of the North firm. They find that the import tariff rate and the licensing strategy of the North firm jointly determine whether the import market structure is a duopoly or a monopoly.

A firm will adopt the strategy of exit, if given the strategy of its rival, the equilibrium output of compliance being negative and the expected profit of non-compliance being negative must both hold.

The first (second) strategy on the superscript of expected profit is the one adopted by firm x(y), where C denotes a compliance strategy, N denotes a violation strategy, and O represents an exit strategy.

Horstmann and Markusen (1992) develop a simple model that generates alternative market structures as Nash equilibrium for different parameterizations of the basic model. They find that small tax-policy changes can produce large welfare effects as the equilibrium market structure shifts. Markusen et al. (1993) discuss the location choice of two firms from two countries. They point out that any small policy changes may cause a shift in the equilibrium regime, hence making a drastic welfare change. Motta and Norman (1996) build up a three-country, three-firm model. They study how a free trade zone formed by two countries affects the foreign direct investment behavior of the third country’s firm.

The marginal cost of the two firms cannot be greater than a (\( c_{i} + s < a \)) when they comply with the environmental standard, and so \( s < 4 - c_{i} \) if \( a = 4 \). The variation of \( a \) by keeping the other parameters constant is the reverse of the variation of the other parameters while keeping \( a \) constant.

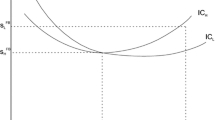

Other things being equal, if \( b \ne 1 \), then the denominator of the expected payoff, except the expected penalty (\( \theta f \)), of all the outcomes should be multiplied by \( b \). For example, by Appendix 1, we know that when \( s = 1 \) and \( c_{x} = 1 \), for (C, C) to be an SPNE, \( c_{y} \le 2,\,\theta f \ge \frac{{20 - 8c_{y} }}{9b} \), and \( \theta f \ge \frac{{8 + 4c_{y} }}{9b} \) must hold, and for (C, N) to be an SPNE, both \( \frac{{4 + 4c_{y} }}{9b} \le \theta f \le \frac{{20 - 8c_{y} }}{9b} \) and \( 0 \le c_{y} \le \frac{4}{3} \) must be satisfied. This tells us that for any given \( c_{y} \), all the boundaries of an SPNE pertaining to the expected fine (\( \theta f \)) should be inflated (deflated) by \( b \) if \( b > ( < )1 \). Thus, all the boundaries pertaining to \( \theta f \) in Figs. 1 and 2 will shift rightward (leftward) if \( b > ( < )1 \), but the relative position of the boundary of all SPNEs will not be altered. To sum up, a proportional expansion or contraction in b will not change at all the relative positions of the equilibrium regimes in Figs. 1 and 2.

As Appendix 1 shows, for (N, C) to be an SPNE, both \( E\pi_{x}^{\text{NC}} \ge E\pi_{x}^{\text{CC}} \) and \( E\pi_{x}^{\text{NC}} \ge E\pi_{x}^{OC} = 0 \) must hold. Because \( E\pi_{x}^{\text{CC}} = \frac{{(1 + c_{y} )^{2} }}{9} \) is always greater than 0, it implies the latter condition automatically holds, and so we need not indicate \( E\pi_{x}^{\text{NC}} = 0 \) in Fig. 1. For (N, O) to be an SPNE, both \( E\pi_{x}^{\text{NO}} > E\pi_{x}^{\text{CO}} \) and \( E\pi_{x}^{\text{NO}} > E\pi_{x}^{\text{OO}} = 0 \) must hold. Because the former implies the latter, the line \( E\pi_{x}^{\text{NO}} = 0 \) is not needed to show in Fig. 2. By the same reason as the above, for (C, N) to be an SPNE, \( E\pi_{y}^{\text{CN}} > E\pi_{y}^{CC} ,\,E\pi_{y}^{\text{CN}} > E\pi_{y}^{\text{CO}} = 0,\,E\pi_{x}^{\text{CN}} > E\pi_{x}^{\text{NN}} \), and \( E\pi_{x}^{\text{CN}} > E\pi_{x}^{\text{ON}} = 0 \). By the first and the last two conditions, we can obtain \( \frac{{4 + 4c_{y} }}{9} \le \theta f \le \frac{{20 - 8c_{y} }}{9} \) and \( 0 \le c_{y} \le \frac{4}{3} \), implying that \( E\pi_{y}^{\text{CN}} > E\pi_{y}^{\text{CO}} = 0 \) must hold and hence the line \( E\pi_{y}^{\text{CN}} = 0 \) is not needed in Fig. 1.

To save space, we only construct more interesting cases of the switch of SPNE, especially cases of switch from one of the multiple SPNEs to a unique SPNE. From another viewpoint, we should not neglect the possibility that the switch of SPNE that we have analyzed may happen. Motta (Motta and Norman 1996) makes use of the same method (referred to in the last two paragraph of p. 766) to analyze the more interesting cases of switching one of the multiple SPNEs to a new unique SPNE.

Because \( E\pi_{y}^{\text{CC}} = \frac{{(a - 2c_{y} + c_{x} - s)^{2} }}{9b} = \frac{{(4 - 2c_{y} - s)^{2} }}{9} \) and \( E\pi_{y}^{\text{NC}} = \frac{{(4 - 2c_{y} + 1 - 2s)^{2} }}{9} \), the higher the value of \( s \) is, the more likely the equilibrium output level of firm y will be negative if \( c_{y} \) is high.

References

Andrea M, Giordano M (2006) Advertising and endogenous exit in a differentiated duopoly. Louvain Econ Rev 72:19–47

Bayer C (2007) Investment timing and predatory behavior in a duopoly with endogenous exit. J Eco Dyn Control 31:3069–3101

China Economic Net (2008) China has an annual plastic waste amount more than 300 million tons: promoting recycling plastic bags is extremely difficult (in Chinese). http://big5.ce.cn/xwzx/gnsz/gdxw/200801/14/t20080114_14220686.shtml

Chiou JR, Hu JL (2001) Environmental research joint ventures under emission taxes. Environ Resour Econ 20:129–146

Chua DH, Kennedy PW, Laplante B (1992) Industry structure and compliance with environmental standards. Econ Lett 40:241–246

Cohen MA (2000) Measuring the costs and benefits of crime and justice. In: Criminal Justice, vol 4. Office of Justice Programs, U.S. Department of Justice, Washington DC, pp 263–315

Department for Environment, Food, and Rural Affairs, UK (DEFRA) (2011) Local environmental enforcement—guidance on the use of fixed penalty notices. http://www.defra.gov.uk/publications/2011/03/28/fixed-penalty-guidance-pb12414/

Farzin YH, Akao KI (2007) Environmental quality in a differentiated duopoly. Fondazione Eni Enrico Mattei Working Paper. http://www.bepress.com/feem/paper110

Garvie D, Keeler A (1994) Incomplete enforcement with endogenous regulatory choice. J Public Econ 55:141–162

Harford JD (1978) Firm behavior under imperfectly enforceable standards and taxes. J Environ Econ Manag 5:26–43

Harford JD (1991) Measurement error and state-dependent pollution control enforcement. J Environ Econ Manag 21:67–81

Harrington W (1988) Enforcement leverage when penalties are restricted. J Public Econ 37:29–53

Helder V (2005) Tacit collusion, cost asymmetries, and mergers. Rand J Econ 36:39–62

Heyes A (2000) Implementing environmental regulation: enforcement and compliance. J Regul Econ 17:107–129

Horiuchi E, Ishikawa J (2009) Tariffs and technology transfer through an intermediate product. Rev Int Econ 17:310–326

Horstmann IJ, Markusen JR (1992) Endogenous market structures in international trade. J Int Econ 32:109–129

Hu JL, Huang CH, Chu WK (2004) Hierarchical government, bribery, and incomplete environmental enforcement. Environ Econ Policy Stud 6:177–196

Huang CH (1996) Effectiveness of environmental regulations under imperfect enforcement and firm avoidance. Environ Resour Econ 8:183–204

Jones CA (1989) Standard setting with incomplete enforcement revisited. J Policy Anal Manag 8:72–87

Kambhu J (1989) Regulatory standards, noncompliance, and enforcement. J Regul Econ 1:103–114

Keeler AG (1991) Noncompliant firms in transferable discharge permit markets: some extensions. J Environ Econ Manag 21:180–189

Lear KK, Maxwell JW (1998) The impact of industry structure and penalty policies on incentive for compliance and regulatory enforcement. J Regul Econ 14:127–148

Malik AS (1990) Markets for pollution control when firms are noncompliant. J Environ Econ Manag 18:97–106

Malik AS (1993) Self-reporting and the design of policies for regulating stochastic pollution. J Environ Econ Manag 24:241–257

Markusen JR, Morey ER, Olewiler ND (1993) Environmental policy when market structure and plant locations are endogenous. J Environ Econ Manag 24:69–86

Montero JB (2002) Prices versus quantities with incomplete enforcement. J Public Econ Manag 85:435–454

Motta M, Norman G (1996) Does economic integration cause foreign direct investment? Int Econ Rev 37:757–783

People (2007) Institution is the guarantee to promote energy-saving bulbs (in Chinese). http://energy.people.com.cn/BIG5/71894/6199710.html

Piercarlo Z (2006) Differentiated duopoly with asymmetric costs. J Econ Manag Strateg 15:999–1015

Polinsky AM, Shavell S (2000) The economic theory of public enforcement of law. J Econ Lit 38:45–76

Segerson K, Tietenberg T (1992) The structure of penalties in environmental enforcement: an economic analysis. J Environ Econ Manag 23:179–200

Shaffer S (1990) Regulatory compliance with nonlinear penalties. J Regul Econ 2:99–103

Swierzbsinski JE (1994) Guilty until proven innocent—regulation with costly and limited enforcement. J Environ Econ Manag 27:127–146

Viscusi WK, Zeckhauser R (1979) Optimal standards with incomplete enforcement. Public Policy 27:437–456

Xepapadeas AP (1991) Environmental policy under imperfect information: Incentive and moral hazard. J Environ Econ Manag 20:113–126

Zejian On Line (2005) Dismantling used stuffs: recycling or environment-exhausting? (in Chinese). http://www.zjol.com.cn/system/2005/07/27/0_20050727.shtml

Acknowledgments

Authors are grateful to an editor and two anonymous referees of this journal for helpful comments. Financial support from the National Science Council in Taiwan (NSC-99-2410-H-390-010 and NSC-99-2410-H-009-063) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Substituting \( a = 4,b = 1,c_{x} = 1,s = 1 \) into the expected profit function in Table 1, we obtain the following expected (second-stage equilibrium) profits of all outcomes: \( \begin{gathered} E\pi_{x}^{\text{CC}} = \frac{{(1 + c_{y} )^{2} }}{9},\,\,E\pi_{y}^{\text{CC}} = \frac{{(4 - 2c_{y} )^{2} }}{9},\,\,E\pi_{x}^{\text{CN}} = \frac{{c_{y}^{2} }}{9},\,\,E\pi_{y}^{\text{CN}} = \frac{{(6 + 2c_{y} )^{2} }}{9} - \,\theta f,\, \hfill \\ E\pi_{x}^{\text{NC}} = \frac{{(3 + c_{y} )^{2} }}{9} - \,\theta f,\,\,E\pi_{y}^{\text{NC}} = \frac{{(3 - 2c_{y} )^{2} }}{9},\,\,E\pi_{x}^{\text{NN}} = \frac{{(2 + c_{y} )^{2} }}{9} - \,\theta f,\, \hfill \\ E\pi_{y}^{\text{NN}} = \frac{{(5 - 2c_{y} )^{2} }}{9} - \,\theta f,\,E\pi_{x}^{\text{CO}} = \frac{4}{4},\,\,E\pi_{x}^{\text{NO}} = \frac{9}{4} - \,\theta f,\,\,E\pi_{y}^{\text{OC}} = \frac{{(3 - c_{y} )^{2} }}{4},\, {\text{and}}\, \hfill \\ E\pi_{y}^{\text{ON}} = \frac{{(4 - c_{y} )^{2} }}{4} - \,\theta f. \hfill \\ \end{gathered} \)

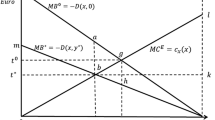

According to the above expected profit, we find out the conditions for an outcome to be an SPNE and depict them in Fig. 1 as follows.

1.1 (C, C) as an SPNE

For (C, C) to be an SPNE, (1) and (2) must hold.

(1) Given firm x adopts C, firm y’s best response is adopting C.

\( E\pi_{y}^{\text{CC}} = \frac{{(4 - 2c_{y} )^{2} }}{9} > E\pi_{y}^{\text{CN}} = \frac{{(6 - 2c_{y} )^{2} }}{9} - \theta f \) and \( E\pi_{y}^{\text{CC}} = \frac{{(4 - 2c_{y} )^{2} }}{9} > E\pi_{y}^{\text{CO}} = 0 \) must hold. By rearranging the former condition, we have \( \theta f \ge \frac{{(6 - 2c_{y} )^{2} }}{9} - \frac{{(4 - 2c_{y} )^{2} }}{9} = \frac{{20 - 8c_{y} }}{9} \), such that the function of line \( E\pi_{y}^{\text{CC}} = E\pi_{y}^{\text{CN}} \) in Fig. 1 is \( \theta f = \frac{{20 - 8c_{y} }}{9} \) and the points on the right (left) side of it represent \( \theta f > {(<)}\frac{{20 - 8c_{y} }}{9} \) and \( E\pi_{y}^{\text{CC}} > {(<)}E\pi_{y}^{\text{CN}} \). Rearranging the latter condition, we get \( c_{y} \le 2 \), and so the function of line \( E\pi_{y}^{CC} = 0 \) is \( c_{y} \le 2 \) and the points above (under) it represent \( c_{y} > {(<)}2 \) and \( E\pi_{y}^{CC} < {(>)}0 \).

(2) Given firm y adopts C, firm x’s best response is adopting C.

\( E\pi_{x}^{\text{CC}} = \frac{{(1 + c_{y} )^{2} }}{9} \ge E\pi_{x}^{\text{NC}} = \frac{{(3 + c_{y} )^{2} }}{9} - \theta f \) and \( E\pi_{x}^{\text{CC}} = \frac{{(1 + c_{y} )^{2} }}{9} \ge E\pi_{x}^{\text{OC}} = 0. \) By rearranging the former condition, we have \( \theta f \ge \frac{{8 + 4c_{y} }}{9} \), such that the function of line \( E\pi_{x}^{\text{CC}} = E\pi_{x}^{\text{NC}} \) is \( \theta f \ge \frac{{8 + 4c_{y} }}{9} \), and the points on the right (left) side of it represent \( \theta f > ( < )\frac{{8 + 4c_{y} }}{9} \) and \( E\pi_{x}^{\text{CC}} > ( < )E\pi_{x}^{\text{NC}} \). Moreover, the latter condition always holds.

To sum up, for (C, C) to be an SPNE, (1) and (2) must hold simultaneously, such that area (C, C) in Fig. 1 is surrounded by \( c_{y} \le 2,\,\theta f \ge \frac{{20 - 8c_{y} }}{9} \), and \( \theta f \ge \frac{{8 + 4c_{y} }}{9} \).

By the same way with (C, C), we also get the conditions for the other outcomes to be SPNE and depict them in Fig. 1.

1.2 (C, N) as an SPNE

All \( \begin{gathered} E\pi_{y}^{\text{CN}} = \frac{{(6 - 2c_{y} )^{2} }}{9} - \theta f \ge E\pi_{y}^{\text{CC}} = \frac{{(4 - 2c_{y} )^{2} }}{9},\quad E\pi_{y}^{\text{CN}} = \frac{{(6 - 2c_{y} )^{2} }}{9} - \theta f \ge 0, \hfill \\ E\pi_{y}^{\text{CN}} = \frac{{c_{y}^{2} }}{9} \ge E\pi_{x}^{\text{NN}} = \frac{{(2 + c_{y} )^{2} }}{9} - \theta f, \hfill \\ \end{gathered} \) and \( E\pi_{y}^{\text{CN}} = \frac{{c_{y}^{2} }}{9} \ge 0 \) must hold. Rearranging them, we get \( \frac{{4 + 4c_{y} }}{9} \le \theta f \le \frac{{20 - 8c_{y} }}{9} \) and \( 0 \le c_{y} \le \frac{4}{3} \). This is the area surrounded by line \( E\pi_{y}^{\text{CC}} = E\pi_{y}^{\text{CN}} \) and line \( E\pi_{x}^{\text{CN}} = E\pi_{x}^{\text{NN}} \) and the horizontal axis.

1.3 (N, C) as an SPNE

All \( \begin{gathered} E\pi_{x}^{\text{NC}} = \frac{{(3 + c_{y} )^{2} }}{9} - \theta f \ge E\pi_{x}^{\text{CC}} = \frac{{(1 + c_{y} )^{2} }}{9},E\pi_{x}^{\text{CN}} = \frac{{c_{y}^{2} }}{9} \ge E\pi_{x}^{\text{NN}} = \frac{{(2 + c_{y} )^{2} }}{9} - \theta f, \hfill \\ E\pi_{y}^{\text{NC}} = \frac{{(3 - 2c_{y} )^{2} }}{9} \ge E\pi_{y}^{\text{NN}} = \frac{{(5 - 2c_{y} )^{2} }}{9} - \theta f, \hfill \\ \end{gathered} \) and \( E\pi_{y}^{\text{NC}} \ge 0 \)must hold. By simplifying them, we have \( \frac{{16 - 8c_{y} }}{9} \le \theta f \le \frac{{8 + 4c_{y} }}{9} \) and \( \frac{2}{3} \le c_{y} \le \frac{3}{2} \). This is the area surrounded by line \( E\pi_{x}^{\text{NC}} = E\pi_{x}^{\text{CC}} , \) line \( E\pi_{y}^{\text{NC}} = E\pi_{y}^{\text{NN}} , \) and line \( E\pi_{y}^{\text{NC}} = 0. \)

1.4 (N, N) as an SPNE

All \( \begin{gathered} E\pi_{x}^{\text{NN}} = \frac{{(2 + c_{y} )^{2} }}{9} - \theta f \ge E\pi_{x}^{\text{CN}} = \frac{{c_{y}^{2} }}{9},E\pi_{x}^{\text{NN}} = \frac{{(2 + c_{y} )^{2} }}{9} - \theta f \ge 0, \hfill \\ E\pi_{y}^{\text{NN}} = \frac{{(5 - 2c_{y} )^{2} }}{9} - \theta f \ge E\pi_{y}^{\text{NC}} = \frac{{(3 - 2c_{y} )^{2} }}{9},{\text{ and }}E\pi_{y}^{\text{NN}} = \frac{{(5 - 2c_{y} )^{2} }}{9} - \theta f \ge 0 \hfill \\ \end{gathered} \) must hold. By simplifying the above, we have: when \( 0 \le c_{y} \le 1,\,\theta f \le \frac{{4 + 4c_{y} }}{9} \); when \( 1 \le c_{y} \le \frac{3}{2},\,\theta f \le \frac{{16 - 8c_{y} }}{9} \); when \( \frac{3}{2} \le c_{y} \le \frac{5}{2},\,\theta f \le \frac{{(5 - 2c_{y} )^{2} }}{9} \). This is the area surrounded by lines \( E\pi_{x}^{\text{NN}} = E\pi_{x}^{\text{CN}} ,\,E\pi_{y}^{\text{NN}} = E\pi_{y}^{\text{NC}} ,E\pi_{y}^{\text{NN}} = 0, \) the vertical axis, and the horizontal axis.

1.5 (C, O) as an SPNE

All \( E\pi_{y}^{\text{CC}} = \frac{{(4 - 2c_{y} )^{2} }}{9} \le 0,\,E\pi_{y}^{\text{CN}} = \frac{{(6 - 2c_{y} )^{2} }}{9} - \theta f \le 0 \) and \( E\pi_{x}^{\text{CO}} = \frac{4}{4} \le E\pi_{x}^{\text{NO}} = \frac{9}{4} - \theta f \) must hold. Simplifying them, we get \( c_{y} \ge 2 \) and \( \theta f \ge \frac{5}{4} \). This is the area on the top right side of lines \( E\pi_{x}^{\text{CO}} = E\pi_{x}^{\text{NO}} \) and \( E\pi_{y}^{\text{CC}} = 0. \)

1.6 (N, O) as an SPNE

All \( E\pi_{y}^{\text{NC}} = \frac{{(3 - 2c_{y} )^{2} }}{9} < 0,\,E\pi_{y}^{\text{NN}} = \frac{{(5 - 2c_{y} )^{2} }}{9} - \theta f \le 0, \) and \( E\pi_{x}^{\text{CO}} = \frac{4}{4} \ge \,E\pi_{x}^{\text{NO}} = \frac{9}{4} - \theta f \) must hold. By simplifying the above, we have \( 3 - 2c_{y} \le 0 \); when \( \frac{3}{2} \le c_{y} \le \frac{5}{2} \), \( \frac{{(5 - 2c_{y} )^{2} }}{9} \le \theta f \le \frac{5}{4} \); and when \( c_{y} \ge \frac{5}{2},\,\theta f \le \frac{5}{4}. \) This is the area surrounded by lines \( E\pi_{y}^{\text{NC}} = 0,\,E\pi_{y}^{\text{NN}} = 0,\, \) and \( E\pi_{x}^{\text{CO}} = E\pi_{x}^{\text{NO}} . \)

1.7 (O, N) as an SPNE

All \( E\pi_{x}^{\text{CN}} = \frac{{c_{y}^{2} }}{9} \le 0,E\pi_{x}^{\text{NN}} = \frac{{\left( {2 + c_{y} } \right)^{2} }}{9} - \theta f < 0, \) and \( E\pi_{y}^{\text{ON}} = \frac{{\left( {4 - c_{y} } \right)^{2} }}{4} - \theta f \ge \,\,E\pi_{y}^{\text{OC}} = \frac{{\left( {3 - c_{y} } \right)^{2} }}{4} \) must hold. By simplifying the above, we have \( c_{y} = 0 \) and \( \frac{4}{9} \le \theta f \le \frac{7}{4} \). This is the thick line on the horizontal axis. Furthermore, (O, C) as an SPNE is the dotted line on the horizontal axis, and (O, O) will not be an SPNE under these given parameters.

Appendix 2

By Table 1, when \( s = 1.7 \), for (O,N) to be a SPNE, the following conditions must hold: \( E\pi_{x}^{ON} = 0 \ge E\pi_{x}^{NN} = \frac{{(4 - 2 \cdot 1 + c_{y} )^{2} }}{9} = \frac{{(2 + c_{y} )^{2} }}{9} - \theta f \) \( E\pi_{x}^{ON} = 0 \ge E\pi_{x}^{CN} = \frac{{(4 - 2 \cdot (1 + 1.7) + c_{y} )^{2} }}{9} = \frac{{(c_{y} - 1.4)^{2} }}{9} \) \( E\pi_{y}^{ON} = \frac{{(4 - c_{y} )^{2} }}{4} - \theta f \ge E\pi_{y}^{OC} = \frac{{(4 - c_{y} - 1.7)^{2} }}{4} \) and \( E\pi_{y}^{ON} = \frac{{(4 - c_{y} )^{2} }}{4} - \theta f \ge E\pi_{y}^{OO} = 0 \).

Rearranging them, we have \( c_{y} \le 1.4,\,\theta f \ge \frac{{(2 + c_{y} )^{2} }}{9},\,\theta f \le \frac{{(4 - c_{y} )^{2} }}{4}, \) and \( \theta f \le \frac{{(6.3 - 2c_{y} ) \cdot 1.7}}{4} \). Because \( c_{y} \le 1.4 \) and \( \theta f \le \frac{{(6.3 - 2c_{y} ) \cdot 1.7}}{4} \) imply \( \theta f \le \frac{{(4 - c_{y} )^{2} }}{4} \), they are simplified to be \( c_{y} \le 1.4,\,\theta f \ge \frac{{(2 + c_{y} )^{2} }}{9}, \) and \( \theta f \le \frac{{(6.3 - 2c_{y} ) \cdot 1.7}}{4} \). Moreover, according to Appendix 1, for (O, N) to be an SPNE when \( s = 1 \), both \( \frac{{4 + 4c_{y} }}{9} \le \theta f \le \frac{{20 - 8c_{y} }}{9} \) and \( 0 \le c_{y} \le \frac{4}{3} \) must hold.

Based on the above, we overlap the area of (C, N) as an SPNE when \( s = 1 \) and that of (O, N) as an SPNE when \( s = 1.7 \) in Fig. 3. In Fig. 3, \( tuv \) is the area of (C, N) as an SPNE when \( s = 1 \), whereas \( qrst \) is the area of (O, N) as an SPNE when \( s = 1.7 \), and \( lmn \) is their overlapping area. By the aforementioned conditions, we also find the equations of the lines surrounding \( lmn \) are \( \theta f = \frac{{(2 + c_{y} )^{2} }}{9},\,\theta f = \frac{{20 - 8c_{y} }}{9}, \) and \( c_{y} = 1 \).

About this article

Cite this article

Yang, YP., Hu, JL. Gresham’s law in environmental protection. Environ Econ Policy Stud 14, 103–122 (2012). https://doi.org/10.1007/s10018-011-0025-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-011-0025-z