Abstract

Investing on behalf of a firm, a trader can feign personal skill by committing fraud that with high probability remains undetected and generates small gains, but with low probability bankrupts the firm, offsetting ostensible gains. Honesty requires enough skin in the game: if two traders with isoelastic preferences operate in continuous time and one of them is honest, the other is honest as long as the respective fraction of capital is above an endogenous fraud threshold that depends on the trader’s preferences and skill. If both traders can cheat, they reach a Nash equilibrium in which the fraud threshold of each of them is lower than if the other one were honest. More skill, higher risk aversion, longer horizons and higher volatility all lead to honesty on a wider range of capital allocations between the traders.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The expression “rogue trader” entered popular culture in 1995 when Nicholas W. Leeson, a trader of an overseas office of Barings Bank in Singapore, made unauthorised bullish bets on the Japanese stock market, concealing his losses in an error account. At first, losses were recovered with a profit, but in the aftermath of the Kobe earthquake, they reached $1.4 billion (Brown and Steenbeek [7]), forcing the 233 years old bank into bankruptcy. Earlier episodes of rogue trading ante litteram include the losses of Robert Citron in 1994 for Orange County ($1.7 billion, Jorion [27]) and of Toshihide Iguchi in 1983–1995 for Daiwa Bank ($1.1 billion, Iguchi [22, Prologue’]). The earliest case is possibly that involving the law firm of Grant & Ward in 1884, which embarrassed former president Ulysses S. Grant, one of the firm’s partners (Krawiec [32]).

Since the demise of Barings Bank, rogue trading episodes have increased in frequency and magnitude. In 2008, Jerome Kerviel, a junior trader at Société Générale who had been exceeding position limits through fictitious trades to avoid detection, eventually lost $7.6 billion, the largest rogue trading loss in history. In his defense, he claimed that colleagues also engaged in unauthorised trading (The New York Times [41] and Reuters [39]). Most recently, in September 2021, Keith A. Wakefield, the former head of the fixed income trading desk at the broker–dealer IFS Securities, was charged by the U.S. Securities and Exchange Commission with unauthorised speculative trading and creating fictitious trading profits, leading to the closure of IFS Securities and substantial losses to both IFS Securities and one dozen counter-parties to the trades (U.S. Securities and Exchange and Commission [42]).

The rise in rogue trading and its threat to both financial institutions and financial stability is recognised by the Basel Committee as operational risk, defined as “the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events” (BCBS [3, Clause 10 of Sect. “Principles for the management of operational risk”]). The Capital Accord of Basel II – and Basel III, to be enacted in 2023 – includes provisions for protection from operational losses: while insurance can cover high-frequency, low-impact events, rogue trading falls squarely in the low-frequency, high-impact category of uninsurable risks, which incur capital charges. Such charges are in turn based on standardised approaches or statistical models, due in part to the absence of consensus on the origin of rogue trading, which is the focus of this paper.

Our starting point is that “The continued existence of rogue trading […] presents a mystery for many scholars and industry observers.” (Krawiec [32]). “Operational risk is unlike market and credit risk; by assuming more of it, a financial firm cannot expect to generate higher returns.” (Crouhy et al. [11]). In other words, prima facie it is hard to reconcile rogue traders’ actions with the optimising behaviour of sophisticated rational agents.

We propose a model in which rational, self-interested, risk-averse traders deliberately engage in fraudulent activity that has zero risk premium. While undetected, fraud allows a trader to feign superior returns, ostensibly without additional risk. In reality, higher returns are exactly offset by a higher probability of bankruptcy, thereby creating no value for the firm. Yet, under some circumstances, fraud may be optimal for a trader because while its benefits are personal, potential bankruptcy costs are shared with other traders. Furthermore, a trader who understands the circumstances leading to others’ fraud can anticipate them and act accordingly, leading to a dynamic Nash equilibrium.

In equilibrium, each trader abstains from fraud as long as the respective share of wealth under management exceeds an endogenous fraud threshold that depends on both traders’ preferences (risk aversions and average horizon) and investment characteristics (expected returns and volatilities). Thus a trader must have enough skin in the game to remain honest: when the share of managed assets drops below the fraud threshold, the marginal utility of fraudulent trades becomes positive, and a trader cheats as little and as quickly as possible to restore the wealth share to the honesty region. Importantly, such fraudulent activity does not generate extra volatility; so it cannot be detected by monitoring wealth before bankruptcy occurs.

These results bring several insights. First, our model suggests that rogue trading has an important social component: A sole trader investing all the firm’s capital would not engage in fraud because such a trader would bear in full both the costs and the benefits of fraudulent activity (Proposition 2.1). Furthermore, the fraud threshold is higher if a trader knows that nobody else is cheating (Lemma 3.8 and Theorem 3.10).

Second, the model emphasises the risk that traders with relatively small amounts of capital can pose to a financial institution, due to their insufficient stakes in the firm. This concern is confirmed by the cases of the junior traders Jerome Kerviel and Nick Leeson. By reviewing Mr. Leeson’s trading record and the investigation reports from Singaporean authorities, Brown and Steenbeek [7] suggest that he had excluded the error account (meant for traders to settle minor trading mismatches) from the market reports to headquarters and had built up unauthorised speculative positions since taking the post at Baring’s office in Singapore in 1992.

Third, our comparative statics offer some clues for assessing and mitigating rogue trading risk. The incidence of fraud is higher in less skilled traders, which means that emphasis on performance evaluation has the indirect benefit of fraud reduction. Fraud also declines significantly as risk aversion increases, suggesting that, ceteris paribus, the most fearless traders are also the ones most tempted by fraud, and that the most dangerous combination is found in a trader with high risk tolerance and low share of managed assets. In addition, fraud declines when the horizon is long enough.

Fourth, our model hints at a subtle trade-off between investment performance and operational risk. Classical portfolio theory implies that diversification can only increase performance; hence the addition of a trader with expertise in a new asset class always improves the risk–return trade-off. Yet, our results caution that a higher number of traders, each with a lower share of assets under management, may also increase the appeal of fraud for each of them, potentially worsening the firm’s risk profile. (The quantitative analysis of the trade-off between diversification and fraud requires very different technical tools, hence is deferred to future research.)

This paper offers the first structural model of rogue trading, in which fraud arises from agency issues between traders and their firms. A priori, it is traders’ hidden action that enables fraudulent activity. A posteriori, the traders’ optimal strategies imply that fraud is both continuous and of finite variation, which makes it hard to detect even for a hypothetical observer who could continuously monitor traders’ wealth.

In the interest of both simplicity and relevance, the model assumes that each trader is compensated with a fraction of trading profits, i.e., contracts are linear. As a result, the fraudulent activity that arises in the model does not stem from nonlinear incentives that may encourage risk-taking (Carpenter [9]), but merely from the asymmetric opportunity of taking personal credit from fraudulent gains while sharing bankruptcy costs. In this sense, each trader’s fraud represents an externality for other traders and the firm, whence the overall demand for fraud is socially suboptimal (i.e., nonzero).

At the technical level, this paper contributes to the theory of nonzero-sum stochastic differential games with singular controls. A distinctive feature of our model is that both players are free to perform simultaneous discontinuous actions, a possibility that is often excluded in the literature for technical convenience. We also provide a continuous-time formulation of Nash equilibrium with singular controls and construct an equilibrium explicitly through Skorokhod reflection.

The results in the paper also bear a curious analogy with portfolio choice with proportional transaction costs in that, similar to Davis and Norman [12], the solution to the present model leads to an inaction region, surrounded by two regions in which actions are performed as little as necessary to return to the inaction region. Although the mechanisms underlying the two models are very different, it is worth pointing out the common feature that leads to the common structure. In both cases (and in many other singular control problems), an action is performed only in a positive amount (fraud of either trader in this paper, buying or selling in portfolio choice). As a result, the inaction region arises when each action is counterproductive for its agent, while the action regions are visited at their boundaries because costs are linear in the action performed (bankruptcy probability in this paper, trading costs in portfolio choice).

In the present model, a trader’s marginal value of fraud depends on that trader’s share of the firm’s wealth. When the wealth share is large enough (skin in the game is high), the marginal value is negative, hence the optimal amount of fraud is zero. Vice versa, the marginal value of fraud is positive when the share is low: since fraud yields a reward proportional to its amount, the optimal amount would be infinite. However, as fraud (before causing bankruptcy) increases wealth, it occurs in equilibrium only as the wealth share is at that level for which its marginal value is exactly zero, and only in the infinitesimal amounts necessary to keep the wealth share at such a level.

The literature on rogue trading is relatively sparse. Most existing works explore the legal (Krawiec [32, 33]), regulatory (Moodie [36]) and social-psychological (Wexler [43]) aspects of rogue trading, and offer a number of hypotheses for mechanisms that may foster malfeasance in trading. Armstrong and Brigo [2] find that common risk measures are ineffective in preventing excessive risk-taking by traders with tail-risk-seeking preferences. In a similar vein, Gwilym and Ebrahim [20] argue that position limits are inadequate in restraining rogue trading. Taking the perspective of a firm’s management, Xu et al. [38] use stochastic control to minimise operational risk through preventative and corrective policies, while Kim and Xu [31] design inspection policies to manage operational risk losses. Xu et al. [37] review the recent literature on operational risk.

In contrast to single-agent singular stochastic control problems, which date back to the finite-fuel problem of Bather and Chernoff [4], research on singular stochastic differential games is relatively recent. Guo and Xu [19] generalise the finite-fuel problem to an \({n}\)-player stochastic game and a mean-field game, in which each player minimises the distance of an object to the center of \({N}\) objects, while minimising the total amount of control applied. Guo et al. [18] extend this analysis to a larger class of games with potentially moving reflecting boundaries in Nash equilibria. Kwon [34] analyses the game of contribution to the common good and discovers Nash equilibria of mixed type, i.e., the strategies in equilibrium consist of both absolutely continuous and singular components. De Angelis and Ferrari [13] establish a connection between a class of stochastic games with singular controls and a certain optimal stopping game, where the underlying state processes differ but the reflecting and exit boundaries coincide. Kwon and Zhang [35] and Ekström et al. [16] study optimal stopping games in which all or one of the players control an exit time that terminates the game. Note that the fraud in Ekström et al. [16] differs from that considered here in that their model entails an agent stealing from another one, who seeks to detect fraud and can terminate the game. In these papers, players are forbidden to execute discontinuous actions simultaneously, whereas our model does not impose such a restriction. In addition, the present work provides a structural formulation of Nash equilibrium in the presence of singular controls. Adopting BSDE techniques, Karatzas and Li [28] investigate existence and uniqueness of Nash equilibrium in games of control and stopping, while Hamadène and Mu [21] establish existence for games without exit but with unbounded drift. Dianetti and Ferrari [14] employ fixed-point methods for the monotone-follower games with submodular costs.

The rest of this paper is organised as follows. Section 2 describes our model of rogue trading and its rationale. Section 3 constructs a Nash equilibrium with two traders and states the main result. Section 4 discusses the interpretation of the results and their implications. Concluding remarks are in Sect. 5, and all proofs are in the Appendix.

2 A model of rogue trading

Krawiec [32] offers the following definition: “A rogue trader is a market professional who engages in unauthorised purchases or sales of securities, commodities or derivatives, often for a financial institution’s proprietary trading account.”

Most episodes of fraudulent trading share some distinctive features. First, they involve violations of a firm’s internal rules or external regulations. Second, fraud often remains concealed and results in modest (relative to the firm’s size) gains that are ascribed to the skill of the perpetrator. Third, fraud generates substantial risk without expected return for the firm, and is revealed only when catastrophic losses eventually materialise.

To reproduce these features, it is useful to think of a small fraud as a (forbidden) bet that a trader wagers on the whole firm’s capital. With a small chance (say \(\varepsilon \)), the bet bankrupts the firm (a return of \(-100\%\)), but most of the time (with probability \(1-\varepsilon \)), it results in a return of \(1/(1-\varepsilon )-1\approx \varepsilon \) for which the trader can take credit. Of course, the bet’s overall return for the firm is zero as \((1-\varepsilon )\cdot (1/(1-\varepsilon )-1)-1\cdot \varepsilon =0\). Such asymmetric outcomes (likely small gains against unlikely large losses) are in fact common in both illicit and licit trading strategies (for example, selling deep out-of-the-money options), and have attracted the label of “picking up nickels in front of a steamroller” (Duarte et al. [15]).

Thus the dilemma of an unscrupulous but profit-driven and risk-averse trader is to what degree to engage in fraud, as cheating too little may forego some easy profits, but cheating too much may result in likely bankruptcy. If one imagines the small fraud above as the outcome of a (heavily biased) coin-toss, the trader essentially ponders how many coins to toss. For example, tossing two coins would generate a likely payoff of \({(1-\varepsilon )^{-2}}\), but may also lead to bankruptcy with probability \({2\varepsilon -\varepsilon ^{2}}\).

If the trader is the firm’s sole owner, it is not hard to see that fraud does not pay: when one bears both gains and losses in full, wagering fair bets on one’s capital merely replaces a payoff with another one, more uncertain but with the same mean – an inferior choice by risk aversion.

In this sense, fraud arises from social interactions, both through the incentives implied by traders’ compensation contracts or by each trader’s ability to take risks with other people’s money (Kay [30, Chap. 2]), with the awareness that colleagues may also engage in fraud. The present model focuses on the latter motive by assuming that each trader receives a fixed fraction of individual profits and losses, which is a common arrangement for bonuses with clawback provisions. The model envisages multiple traders; each of them has the mandate to invest a share of the firm’s capital in some risky asset with a positive risk premium and is paid with a fraction of the terminal payoff. Thus except for fraudulent behaviour, each trader’s objective is aligned with the firm’s. For the sake of tractability and clarity, the paper focuses on the case of two traders.

The moral hazard stems from the asymmetric effects of fraud on a trader’s reward: as long as the fraudulent activity is successful, the trader can disguise its revenues as the fruit of personal skill in performing the investment mandate. In reality, such additional revenues merely compensate for the fraudulent bets that the trader wagers on the capital of the whole firm, rather than personal capital (e.g. exceeding risk limits by either collateralising the firm’s asset or assuming excess liabilities). Of course, such bets are possible exactly because they are fraudulent, and are explicitly forbidden by the firm’s regulations; they nonetheless exist, due to “inadequate or failed internal processes, people and systems” embodied in the definition of operational risk (BCBS [3, Clause 10 of Sect. “Principles for the management of operational risk”]).

The appeal of fraud – privatising gains while socialising losses – thus varies with a trader’s share of the firm’s capital: intuitively, the temptation of fraudulently enriching oneself is much stronger for a small trader, who has little to lose and much to gain from gambling with others’ wealth, than for a large trader who has significant skin in the game. For this reason, in the present continuous-time model, each trader can cheat with varying intensity in response to changes in one’s and others’ wealth.

After this informal description, the precise definition of the model follows.

2.1 Investment and fraud in continuous time

We fix a stochastic basis \({(\Omega ,\mathcal{F},\mathbb{P})}\) equipped with the natural filtration \({\mathbb{F}=(\mathcal{F}_{t})_{t\geq 0}}\) of an \({N}\)-dimensional (\({N \geq 1}\)) Brownian motion \({B=(B_{t})_{t\geq 0}}\), satisfying the usual hypotheses of right-continuity and completeness, and set \({\mathcal{F}_{\infty}:=\sigma (\bigcup _{t\geq 0}\mathcal{F}_{t}) \subseteq \mathcal{F}}\). As all processes considered here are at least right-continuous and ℙ is fixed, we write “a.s. for all \(t \geq 0\)” for the equivalent properties “for all \(t \geq 0\), ℙ-a.s.” and “ℙ-a.s., for each \(t \geq 0\)”.

Assuming a zero safe rate to ease notation, in the absence of fraud, the capital \({Y^{i}}\) of the \({i}\)th trader (\({1\le i\le N}\)) evolves as

reflecting the trader’s average ability \({\mu _{i}>0}\) to deliver excess returns with the volatility \({\sigma _{i}>0}\) that the firm’s risk management is willing to accept. For simplicity, assume that \({B^{i}}\) and \({B^{j}}\) are independent for \({i\ne j}\), which means that traders take uncorrelated risks (for example, one invests in stocks and the other in bonds).

To describe how each trader may engage in fraud by endangering the firm’s capital, define the class of processes

For \({A\in \mathcal {A}}\), \({A_{t}}\) represents the cumulative amount of “bets” wagered by a trader on the firm’s capital up to time \({t}\). To understand this representation, suppose that \({A_{t}=\int _{0}^{t} \lambda _{s} ds}\), which means that in the interval \({[s,s+ds]}\), the trader wagers a fair bet that has the probability \({\lambda _{s} ds}\) of bankrupting the firm. Because the fraud is illicitly wagered on the firm’s capital (thereby exceeding the capital \({Y^{i,x}}\) that the trader has been assigned), if bankruptcy does not occur, that fraud yields a profit of \({Y^{S}_{s} \lambda _{s} ds}\), where \({Y^{S,x}:=\sum _{k=1}^{N}Y^{k,x}}\) is the total capital of the firm.

Although this description is intuitive, it has two limitations. First, it encompasses only the case of fraud with a finite rate \({\lambda _{s}}\), excluding bursts of rogue trades at any instant. Second, the bankruptcy probability cannot incorporate the impact of fraud over an arbitrary time interval as the value of \({\int _{s}^{t}\lambda _{u}du}\) can exceed 1. For these reasons, a more careful but also more technical description is necessary.

To make precise the intuition that \({dA_{s}}\) drives the bankruptcy rate, note first that any \({A\in \mathcal{A}}\) is right-continuous and of finite variation. Therefore, it has the representation \({A_{t}=A_{t}^{c}+\sum _{0\leq s\leq t}\Delta A_{s}}\) for any \({t\geq 0}\), where \({\Delta A_{s}=A_{s}-A_{s-}}\) and \({A^{c}}\) is the continuous part of the process \({A}\) with \({A^{c}_{0}=0}\). For a set of \(N\) traders’ fraud processes \({(A^{1},\dots ,A^{N})\in \mathcal{A}^{N}}\), denote the total fraud process by \({A^{S}=\sum _{k=1}^{N}A^{k}}\). The bankruptcy time is then defined as

where \({\theta}\) is an ℱ-measurable exponential random variable with rate 1, independent of the filtration \({\mathbb{F}}\). (Recall the convention that \(\inf \emptyset = \infty \).) Lemma A.3 below shows that the survival probability satisfies \({\mathbb{P}[\tau _{A}>t|\mathcal{F}_{t}]=e^{-A^{S}_{t}}}\) for all \({t\geq 0}\). At time \({\tau _{A}}\), the wealth of all agents becomes zero.

Before bankruptcy occurs, the wealth of each trader follows the dynamics

where the integral with respect to \({\tilde{A}^{i}}\) in (2.2) is understood in the Lebesgue–Stieltjes sense, and \({\tilde{A}^{i}_{t}:=A^{i,c}_{t}+\sum _{0\leq s\leq t}(e^{\Delta A^{i}_{s}}-1)}\) reflects the fact that the simple return of a jump in fraud is not \({\Delta}\) itself but rather \({e^{\Delta}-1}\). Such a distinction is immaterial with continuous fraud because \({e^{\Delta}-1\approx \Delta}\) for \({\Delta}\) close to zero. The final expression for wealth, which includes the effect of bankruptcy at \({\tau _{A}}\), is

Lemma A.2 in Appendix A.1 formally verifies that the pre-bankruptcy wealth in (2.2) is well defined by showing that \({Y^{x}=(Y^{1,x},\dots ,Y^{N,x})}\) is the unique strong solution to the \(N\)-dimensional linear stochastic differential equation (SDE) in (2.2). Upon bankruptcy on the event \({\{t\ge \tau _{A}\}}\), the wealth of all traders vanishes and remains null thereafter; hence the dynamics of the fraud processes beyond \({\tau _{A}}\) is irrelevant for the model. Effectively, fraud is described by the stopped process \({(A^{i}_{t\wedge \tau _{A}})_{t\geq 0}}\).

Note that the bankruptcy time \({\tau _{A}}\) is not an \({\mathbb{F}}\)-stopping time. Thus to accommodate the wealth process \({X^{x}=(X^{1,x},\dots ,X^{N,x})}\), it is necessary to make the minimal enlargement of the filtration \({\mathbb{F}}\) that makes \({\tau _{A}}\) a stopping time. To this end, let \({\mathbb{H}^{A}=(\mathcal{H}_{t}^{A})_{t\geq 0}}\) be the natural filtration of the indicator process \(({\mathbf{1}}_{\{t \geq \tau _{A}\}})_{t\geq 0}\) and define the enlarged filtration \({\mathbb{G}^{A}=(\mathcal{G}_{t}^{A})_{t\geq 0}}\) as \({\mathcal{G}^{A}_{t}=\bigcap _{s>t}(\mathcal{F}_{s}\vee \mathcal{H}^{A}_{s})}\), which is the smallest right-continuous filtration containing \({\mathbb{F}}\) such that \({\tau _{A}}\) is a stopping time. Such an extension is known as ‘progressive filtration enlargement’ (cf. Jeanblanc and Le Cam [25] and Jeulin [26, Chap. IV]). Moreover, the bankruptcy time \({\tau _{A}}\) is \(\mathbb{G}^{A}\)-predictable if and only if fraud does not occur after time 0 (Lemma A.6).

As wagering bets on one’s own wealth means bearing their risks in full, thereby earning a zero risk premium, a trader who owns the whole firm (\({N=1}\)) has a wealth process that is a \(\mathbb{G}^{A}\)-martingale in the absence of investment skill.Footnote 1 (See Proposition A.4, which additionally justifies the choice of the return from jump fraud.)

The goal of each trader is to maximise expected utility over a random horizon \({\tau}\), which is an ℱ-measurable exponential random variable with rate \({\lambda >0}\), independent of both \({\mathcal{F}_{\infty}}\) and \({\theta}\) (and hence of the bankruptcy time \({\tau _{A}}\)). This random horizon models a trader with an open-ended contract, whose mandate is to maximise profits in the long term. The arrival rate \({\lambda}\) captures the likelihood that business may end for exogenous reasons (that is, independently of traders’ performance).

A trader’s attitude to risk is represented by a utility function of power type

In particular, the relative risk aversion parameter \({\gamma _{i}}\) is below one so that the utility is finite also upon bankruptcy (\({x_{i} =0}\)), and the problem is nontrivial. If \({\gamma _{i}}\) were greater or equal to one, then zero wealth would be completely unacceptable (\({U^{i}(0)=- \infty}\)) and fraud would disappear. In fact, as shown below (Remark 3.11), fraud does vanish as \({\gamma _{i}}\) converges to one.

As anticipated in the description, an important implication of this model is that a rational and strictly risk-averse trader abstains from fraud if no other trader is present. Its significance is to confirm that in this model, fraud stems from the ability to share losses but not gains, and hence disappears when such sharing disappears.

Proposition 2.1

Let \({N=1}\), \({\kappa \geq 0}\) and \({\tau}\) be an ℱ-measurable, a.s. finite random horizon independent of \({\mathcal{F}_{\infty}}\) and \({\theta}\) such that

If the sole trader maximises

over all fraud processes \({A^{1}\in \mathcal{A}}\), then \({A^{1,\star}}\) is optimal if and only if \({A^{1,\star}_{t}=0}\) a.s. for all \({t\geq 0}\) such that \({\mathbb{P}[\tau \geq t]>0}\). In particular:

(i) If \({\tau}\) is unbounded, then \({A^{1,\star}_{t}=0}\) a.s. for all \({t\geq 0}\).

(ii) If \({\tau \le T^{1}}\) a.s. for some \({T^{1}>0}\), then \({A^{1,\star}_{T^{1}-}=0}\). If \({\mathbb{P}[\tau =T^{1}]>0}\), then also \({A^{1,\star}_{T^{1}}=0}\) a.s.

Note that for this result, the assumption of an exponential horizon made in the rest of the paper can be dropped. Note also that Proposition 2.1 fails if \({N\geq 2}\) because the coupling term \({Y^{S,x}_{t-}}\) in (2.2) rescinds the martingale property (Proposition A.4) for each trader’s wealth in the absence of drift (\({\mu _{i}=0}\)). For example, if all but the \({i}\)th trader abstain from fraud, then \({X^{i,x}}\) can become a submartingale if the \({i}\)th trader cheats; in this case, the wealth processes of other traders become supermartingales as they share the bankruptcy risk from the \({i}\)th trader’s actions. As shown in Sect. 3, engaging in fraud may be optimal, depending on traders’ shares of capital, risk aversions, drifts and volatilities.

3 Main result

While the presentation in the previous section considered an arbitrary number \({N}\) of traders, the main result in this section focuses on two traders to simplify both the exposition and the proofs. (A model with \({N}\) traders implies that relative wealth shares follow an \((N-1)\)-dimensional diffusion, which reduces to a scalar diffusion for two traders.) Thus henceforth \({N=2}\), and for clarity, the indices \({\{a,b\}}\) replace \({\{1,2\}}\) to identify traders. The wealth processes are denoted by either \({X^{x}(A^{a},A^{b})}\) or \({X^{x}}\) (respectively, \({Y^{x}(A^{a},A^{b})}\) or \({Y^{x}}\)), depending on the need to specify the fraud process \({(A^{a},A^{b})}\) in context.

3.1 Definition of Nash equilibrium

For any \(i\), \(j\) in \({\{a,b\}}\) with \({i\neq j}\) (henceforth abbreviated as ‘for any \({i\neq j\in \{a,b\}}\)’), the goal of trader \({i}\) is to maximise expected utility over a random horizon \({\tau}\) as the other trader \({j}\) chooses the respective fraud process \({A^{j}}\), i.e.,

over \({A^{i}\in \mathcal{A}}\). Here \({\kappa \geq 0}\) is the discount rate and the random horizon \({\tau}\) is independent of \({\mathbb{F}}\) and \({\theta}\) and exponentially distributed with rate \({\lambda}\) (meaning that \({\frac{1}{\lambda}}\) represents traders’ average horizon). Let thus

be the value function for the \({i}\)th trader for trader \({j}\)’s fraud process \({A^{j}}\) and initial wealth \({x\in \mathbb{R}_{++}^{2}}\). The next assumption concerning minimum risk aversion and maximum skill stands throughout the paper and ensures that the optimisation problem is well posed.

Assumption 3.1

Let \({\lambda ^{\kappa}=\kappa +\lambda}\) and assume that \({\lambda ^{\kappa}>(1-\gamma _{a}\wedge \gamma _{b})(\mu _{a}\vee \mu _{b})}\).

The value function \({V^{i}}\) satisfies the following basic properties.

Lemma 3.2

For any \({i\neq j\in \{a,b\}}\), \({x\in \mathbb{R}_{++}^{2}}\) and \({(A^{i},A^{j})\in \mathcal{A}^{2}}\), we have:

(i) \(0< V^{i} (x;A^{j} )\leq \displaystyle \frac{ \lambda U^{i}(x_{a}+x_{b})}{\lambda ^{\kappa}-(1-\gamma _{i})(\mu _{a}\vee \mu _{b})} \).

(ii) \(J^{i} (x;A^{i},A^{j} )=\displaystyle \lambda \,\mathbb{E}\bigg [ { \int _{0}^{\infty}e^{-\lambda ^{\kappa }t-A^{S}_{t}}U^{i} \big(Y_{t}^{i,x}(A^{i},A^{j}) \big)dt} \bigg] \).

(iii) \(\textit{For any $c>0$, $J^{i} (cx;A^{i},A^{j} )=c^{1-\gamma _{i}}J^{i} (x;A^{i},A^{j} )$} \).

Most importantly, Lemma 3.2 (i) ensures that under Assumption 3.1, the value function (3.1) is finite, rendering a well-posed optimisation problem. Furthermore, (ii) reveals that we only need to use the pre-bankruptcy wealth \({Y^{x}}\) as the state processes of the optimisation problem, as the random horizon \({\tau}\) is exponentially distributed. Finally, (iii) reveals the scale-invariance of the value function, which allows reducing the resulting Hamilton–Jacobi–Bellman (HJB) equations to ordinary differential equations (see Appendix B).

At time \({t}\), the \({i}\)th trader observes the history of personal wealth \({(Y^{i,x}_{s})_{s\in [0,t)}}\) and personal fraud \({(A^{i}_{s})_{s\in [0,t)}}\), as well as the wealth history of the other trader \({j}\), i.e., \({(Y^{j,x}_{s})_{s\in [0,t]}}\), so that trader \({i}\) can respond to trader \({j}\)’s instant wealth change \({\Delta Y^{j,x}_{t}}\). Formally, for \({t\ge 0}\), let \({\mathcal{D}_{+}([0,t])}\) denote the set of \({\mathbb{R}_{++}}\)-valued càdlàg functions on \({[0,t]}\) with a left limit at \({t=0}\). Let \({\mathcal{D}^{\uparrow}([0,t])}\) be the set of \({\mathbb{R}_{+}}\)-valued nondecreasing, right-continuous functions on \({[0,t]}\) with zero left limit at \({t=0}\). The sets \({\mathcal{D}_{+}([0,t))}\) and \({\mathcal{D}^{\uparrow}([0,t))}\) are defined analogously. For any process \({(Z_{t})_{t\geq 0}}\) with left limit at 0, \({Z_{[0,t)}}\) (resp. \({Z_{[0,t]}}\)) denotes the restrictions of the paths of \({Z}\) to the interval \({[0,t)}\) (resp. \({[0,t]}\)). Denote by \({\mathcal{H}^{+}_{t}}\), \({\mathcal{H}^{+}_{t-}}\) and \({\mathcal{H}^{\uparrow}_{t-}}\) the smallest \({\sigma}\)-algebras generated by all \(\mathbb{F}\)-adapted processes with trajectories in \({\mathcal{D}_{+}([0,t])}\), \({\mathcal{D}_{+}([0,t))}\) and \({\mathcal{D}^{\uparrow}([0,t))}\), respectively.

To construct a Nash equilibrium of closed-loop form, we consider a special class of fraud strategies that constitute a trader’s possible responses to the fraudulent activities of the other trader, but depend on the latter only through the wealth of both traders and one’s own strategy.

Definition 3.3

Let \({i\neq j\in \{a,b\}}\). The set \({\Lambda ^{i}}\) is the collection of maps \({\Psi =(\Psi _{t})_{t\geq 0}}\) which are for any \({t\geq 0}\) of the form

such that for any \({x=(x_{i},x_{j})\in \mathbb{R}_{++}^{2}}\) and any \({A^{j}\in \mathcal{A}}\), there exists a unique \({A^{i}\in \mathcal {A}}\) satisfying

where \({(Y^{i,x},Y^{j,x})}\) is the pre-bankruptcy wealth associated with \({(A^{i}, A^{j})}\).

Lemma A.2 (i) yields a unique strong solution \({(Y^{i,x},Y^{j,x})}\) to the SDE (2.2) for a given pair of fraud processes \({(A^{a},A^{b})}\) and initial wealth \({x\in \mathbb{R}_{++}^{2}}\).

We are now ready to define Nash equilibria in the context of this paper. See Carmona [8, Sect. III.5] for an overview of Nash equilibria in stochastic settings with absolute continuous controls.

Definition 3.4

A pair \({(\Psi ^{\star ,a},\Psi ^{\star ,b})\in (\Lambda ^{a},\Lambda ^{b})}\) is a Nash equilibrium if for any initial capital \({{x\in \mathbb{R}_{++}^{2}}}\), there exists a unique pair \({(A^{a,\star},A^{b,\star})\in \mathcal {A}^{2}}\) such that for any \({{i\neq j\in \{a,b\}}}\),

-

1.

\({A^{i,\star}_{t}=\Psi ^{\star , i}_{t}(Y^{i,x,\star}_{[0,t)},Y^{j,x, \star}_{[0,t]},A^{i,\star}_{[0,t)})}\) a.s. for all \({t\geq 0}\), where \({(Y^{a,x,\star}, Y^{b,x,\star})}\) denotes the wealth associated with \({(A^{a,\star},A^{b,\star})}\);

-

2.

non-cooperative optimality holds, that is, for any \({A^{i}\in \mathcal{A}}\), the response \({A^{j}}\) satisfying (3.2) with \({\Psi ^{j}=\Psi ^{\star , j}}\) makes \({A^{i}}\) sub-optimal, i.e.,

$$\begin{aligned} J^{i} (x;A^{i},A^{j} )\leq J^{i} (x;A^{i,\star},A^{j,\star} ). \end{aligned}$$

The pair \({(A^{a,\star},A^{b,\star})}\) is referred to as equilibrium fraud processes.

Remark 3.5

A Nash equilibrium \({(\Psi ^{\star , a},\Psi ^{\star ,b})\in (\Lambda ^{a},\Lambda ^{b})}\) does not necessarily yield best-response maps: It is not necessarily true that for any \({{i\neq j \in \{a,b\}}}\) and \({A^{i}\in \mathcal {A}}\),

with the response map \({A^{j,'}_{t}=\Psi ^{\star , j}_{t}(Y^{j,x}_{[0,t)},Y^{i,x}_{[0,t]},A^{j,'}_{[0,t)})}\) for all \({t\geq 0}\) satisfying (3.2). In other words, the response \({\Psi ^{\star ,j}}\) of trader \({j}\) need not be optimal for any fraud process of trader \(i\), but merely sufficient to deter the other trader from deviating from \({A^{i,\star}}\). For the specific equilibrium fraud process \({A^{i,\star}}\) of trader \(i\), (3.3) holds true in view of Definition 3.4, condition (ii).

3.2 Construction of Nash equilibrium

In the Nash equilibrium described below, each trader cheats as little as necessary to keep the personal share of wealth above a certain threshold. To rigorously define this behaviour, it is necessary to recall the notion of Skorokhod reflection. For any \({x=(x_{a},x_{b})\in \mathbb{R}_{++}^{2}}\) and any \({i\in \{a,b\}}\), define \({r_{i}(x)=\frac{x_{i}}{x_{a}+x_{b}}}\). Then \({r_{i}(Y^{x}_{t})}\) is trader \({i}\)’s share of the firm’s capital at time \({t}\). (See Lemma A.9 for the SDE identification of \({r_{i}(Y^{x})}\).) Define by \({W^{i,w_{i}}_{t}(A^{i},A^{j})=r_{i}(Y^{x}_{t}(A^{i},A^{j}))}\) for any \({t\geq 0}\) with the initial wealth share \({W^{i,w_{i}}_{0-}(A^{i},A^{j})=r_{i}(x)=w_{i}}\).

Definition 3.6

Let \({i\neq j\in \{a,b\}}\) and \({m_{i}\in (0,1)}\). A function \({\Psi ^{i,m_{i}}\in \Lambda ^{i}}\) solves the (one-sided) Skorokhod reflection problem (henceforth \({\text{SP}^{i}_{m_{i}+}}\)) if for any \({A^{j}\in \mathcal{A}}\) and any \({x\in \mathbb{R}_{++}^{2}}\), the pair \({(A^{i},Y^{x})}\) associated to \({\Psi ^{i,m_{i}}}\) is the unique pair satisfying

-

1.

\({m_{i}\leq W_{t}^{i,w_{i}}(A^{i},A^{j})<1}\) a.s. for all \({t\geq 0}\);

-

2.

\(\int _{\mathbb{R}_{+}}{\mathbf{1}}_{\{W_{t}^{i,w_{i}}(A^{i},A^{j})>m_{i}\}}dA^{i}_{t}=0 \text{ a.s.} \)

By (i), \({W_{t}^{i,w_{i}}(A^{i},A^{j})\ge m_{i}}\) a.s. for all \({t\geq 0}\), while (ii) means that as \({A^{i}}\) increases, \({W^{i,w_{i}}(A^{i},A^{j})}\) can reach \({m_{i}}\) but without spending any positive amount of time at this point. Because \({W^{i,w_{i}} = 1-W^{j,1-w_{i}}}\) for any \({i\neq j\in \{a,b\}}\), \({W^{i,w_{i}}}\) is reflected upward at \({m_{i}}\) if and only if the other trader’s fraction of wealth \({W^{j,1-w_{i}}}\) is reflected downward at \({1-m_{i}}\). Moreover, the solution to \({\text{SP}^{i}_{m_{i}+}}\) is unique in that it identifies a unique pair \({(A^{i},Y^{x})}\).

For any \({i\neq j\in \{a,b\}}\), let \({m_{i}\in (0,1)}\) and define \({\Psi ^{i,m_{i}}\in \Lambda ^{i}}\) as follows. For all \({t\geq 0}\) and \({(y^{i}_{[0,t)},y^{j}_{[0,t]},a^{i}_{[0,t)})\in \mathcal{D}_{+}([0,t)) \times \mathcal{D}_{+}([0,t])\times \mathcal{D}^{\uparrow}([0,t))}\), set

where \({w^{i-}_{t}:=r_{i}(y^{i}_{t-},y^{j}_{t})}\) for \({t\geq 0}\) and \({a^{i,c}}\) denotes the continuous part of \({a^{i}}\). The first and second term on the right-hand side of (3.3) govern the continuous and discontinuous components of the path \({{t\mapsto \Psi _{t}^{i,m_{i}}(y^{i}_{[0,t)},y^{j}_{[0,t]},a^{i}_{[0,t)})}}\), respectively. Proposition A.10 in Appendix A.5 proves that \({\Psi ^{i,m_{i}}}\) is the solution to \({\text{SP}^{i}_{m_{i}+}}\). It also establishes conditions under which the separate Skorokhod reflections can be combined to form a two-sided Skorokhod reflection, which ultimately yields a Nash equilibrium.

At this point, it is necessary to introduce some notation.

Definition 3.7

For any \({i\neq j\in \{a,b\}}\), define the threshold

where

Furthermore, set

Let \({\Delta :=\{(w_{a},w_{b})\in (0,1)^{2}:w_{a}+w_{b}<1\}}\) and for any \({i\neq j\in \{a,b\}}\), define the map \({F^{i}:\Delta \rightarrow \mathbb{R}}\) by

Note that \({F^{i}}\) implicitly depends on the rate \({\lambda}\) of the exponentially distributed random horizon (through \({\alpha _{i}}\) and \({\beta _{i}}\)) and on the parameters of both traders’, except trader \(j\)’s risk aversion \({\gamma _{j}}\). The next result identifies the fraud thresholds used in Theorem 3.9 below to construct the Nash equilibrium.

Lemma 3.8

There exists \({(\tilde{w}_{a},\tilde{w}_{b})\in \Delta}\) such that

Moreover, any such pair \({(\tilde{w}_{a},\tilde{w}_{b})}\) satisfies \({\tilde{w}_{k}<\hat{w}_{k}}\) for all \({k\in \{a,b\}}\).

Theorem 3.9

For \({(\tilde{w}_{a},\tilde{w}_{b})}\) as in Lemma 3.8, the pair \({(\Psi ^{a,\tilde{w}_{a}},\Psi ^{b,\tilde{w}_{b}})}\) is a Nash equilibrium. In particular, for any \({i\neq j\in \{a,b\}}\), trader \({i}\) cheats, if necessary, at time 0 so as to bring the wealth share instantly to \({\tilde{w}_{i}}\). Thereafter, the trader minimally cheats to keep that share above \({\tilde{w}_{i}}\) (the no-fraud region). The corresponding game values satisfy, for any \({i\neq j\in \{a,b\}}\) and \({x\in \mathbb{R}_{++}^{2}}\),

where \({(A^{a,\star}, A^{b,\star})}\) is the equilibrium fraud process and

with the constants

For the purpose of comparative statics, it is also useful to consider the case when only one trader can commit fraud. Indeed, depending on circumstances, access to fraud may be uneven. For instance, Nick Leeson was able to conceal his unauthorised trades because he was allowed to settle his own trades (controlling both the front- and the back-office), a privilege that other traders of the firm did not share. In this regard, assuming that one of the two traders cannot cheat, the other trader maximises expected utility by cheating in a similar way, but with a different fraud threshold.

Theorem 3.10

For any \({i\neq j\in \{a,b\}}\), if \({A^{j}\equiv 0}\), the optimal fraud process for trader \({i}\) is \({A^{i,\star}_{t}=\Psi ^{i,\hat{w}_{i}}_{t}(Y^{i,x}_{[0,t)},Y^{j,x}_{[0,t)},A^{i, \star}_{[0,t)})}\) for all \({t\geq 0}\), and the corresponding value function satisfies

for any \({x\in \mathbb{R}_{++}^{2}}\), where

with

Remark 3.11

Because \({\hat{w}_{i}>\tilde{w}_{i}}\) (Lemma 3.8), a rogue trader who knows that the other is honest has a higher cheating threshold than one who knows that the other can also cheat. The fraud region of trader \({i}\) is indeed smaller in the Nash equilibrium, where both cheat as little as necessary (Theorem 3.9) to keep their proportion of wealth above \({\tilde{w}_{i}}\). Furthermore, \({\lim _{\gamma _{i}\uparrow 1}\hat{w}_{i}=0}\) follows by (3.4), and then \({\lim _{\gamma _{i}\uparrow 1}\tilde{w}_{i}=0}\) due to \({\hat{w}_{i}>\tilde{w}_{i}}\), which shows that fraud disappears with log-utility for both solo and dual rogue traders, as bankruptcy becomes unacceptable.

4 Discussion

This section brings to life the theoretical results in Sect. 3.2 by examining the properties of the Nash equilibrium for concrete parameter values.

4.1 Comparative statics

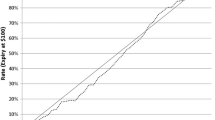

A trader’s fraud threshold is relatively insensitive to the profitability of personal investments (Fig. 1, upper left), even as that profitability increases from 10% to 60%. The flatness of the threshold, however, does not imply the flatness of average fraud, which instead declines rapidly as profitability increases (Fig. 2, upper left). The explanation of this phenomenon lies in the dynamics of relative wealth shares: when one trader’s profitability is high, that trader’s wealth share tends to increase over time, thereby reaching the fraud threshold less often, hence generating lower fraud.

Fraud thresholds for trader \({a}\) (blue) and \({b}\) (red), in view of trader \(a\)’s share of wealth (vertical axis), in Nash equilibrium (solid line), and when the other trader is honest (dashed line), against trader \(a\)’s expected return (upper left, \({0\%\leq \mu _{a}\leq 60\%}\)), volatility (upper right, \({0\%< \sigma _{a}\leq 100\%}\)), risk aversion (bottom left, \({0<\gamma _{a}<1}\)) and average horizon (bottom right, \({0<1/\lambda \leq 20}\)). Other parameters are \({\mu _{a} = \mu _{b} = 10\%}\), \({\sigma _{a} = \sigma _{b} = 20\%}\), \({\gamma _{a} = \gamma _{b} = 0.5}\), \({\lambda = 1/3}\), \({\kappa =10\%}\)

Equilibrium average fraud, up to horizon or bankruptcy, of traders \({a}\) (blue) and \({b}\) (red), and bankruptcy probability (orange) against trader \({a}\)’s expected return (upper left, \({0\%\leq \mu _{a}\leq 60\%}\)), volatility (upper right, \({0\%< \sigma _{a}\leq 100\%}\)), risk aversion (bottom left, \({0.1<\gamma _{a}<0.9}\)) and average horizon (bottom right, \({0<1/\lambda \leq 20}\)). Results obtained from the simulation of \({10^{4}}\) paths, each with step size \({5 \cdot 10^{-4}}\). Other parameters are \({\mu _{a} = \mu _{b} = 10\%}\), \({\sigma _{a} = \sigma _{b} = 20\%}\), \({\gamma _{a} = \gamma _{b} = 0.5}\), \({w_{a}=w_{b} = 0.5}\), \({\lambda = 1/3}\), \({\kappa =10\%}\)

By contrast, the fraud threshold of the other trader (whose profitability remains constant) rapidly shifts upwards; hence this trader cheats when the respective wealth share falls below a lower threshold. Again, this does not imply a decline in the amount of personal fraud, because that trader’s typical wealth share also tends to decline. In fact, Fig. 2 shows that the amount of fraud first increases up to \({\mu _{a} \approx 40\%}\), at which insolvency risk peaks, and then decreases: The initial rise is understood as a short-term appropriation, whereby the less skilled trader’s higher fraud pilfers the other’s profits. The subsequent decline is more akin to a long-term appropriation: the less skilled trader recognises that the other’s skill is so high that it is overall more profitable to limit the amount of fraud per unit of time so as to let the other’s wealth grow faster, and that future fraud can be even more profitable. Put differently, the less skilled trader establishes a sort of parasite–host relationship with the more skilled trader, thereby avoiding excessive cheating, lest the host perish. Note also that the threshold of the more skilled trader is more sensitive to the honesty (or lack thereof) of the other trader, while the less skilled trader becomes indifferent to the other’s honesty when the profitability is sufficiently high. Furthermore, the equality of traders’ skills corresponds to a local minimum for bankruptcy risk, but the global minimum (approximately \({2\%}\)) is achieved when one trader markedly outperforms the other one (\({\mu _{a}=80\%}\) versus \({\mu _{b}=10\%}\)).

As the volatility of a trader’s investments increases (upper right, Figs. 1 and 2), that trader’s fraud threshold recedes aggressively, but total fraud and hence the probability of bankruptcy increase significantly. Increased volatility is qualitatively similar to lower skill, which makes the trader more reliant on fraud to generate profits. Vice versa, the other trader can still rely on a personal payoff with lower volatility, which would be significantly degraded by the additional asymmetry generated by more fraud.

Risk aversion (lower left, Figs. 1 and 2) has a major impact on the propensity to fraud. Holding the opponent’s risk aversion constant at 0.5, as a trader’s risk aversion increases from zero to one, the fraud threshold declines very rapidly from one (incessant fraud) to zero (no fraud). Note that as one fraud threshold declines, the other threshold also declines, not to zero, but to the threshold that assumes the other’s honesty. Put differently, a fearless trader’s propensity to fraud forces the other, more prudent trader to withdraw from fraud as the overall risk is already too high. The implication is that when the two traders have very different risk aversions but similar investment opportunities, it is the least risk-averse (in particular, if it is below 0.5) that has the most potential for fraud. Vice versa, when risk aversions are similar, the overall potential for fraud is evenly distributed between traders. Note that the insolvency probability is insensitive to the risk aversion when it is above 0.5 because the reduction of fraud from the more risk-averse trader is offset completely by the increase of fraud from the other trader with risk aversion 0.5.

Fraud completely disappears with unit risk aversion (i.e., logarithmic preferences). In this case, the dread of bankruptcy is so high that traders abstain from fraud regardless of its potential rewards. Note that this phenomenon stems from the fraud’s inherent discontinuity, which always implies a probability, however small, that wealth may vanish. Put differently, for the logarithmic investor, the marginal utility of any amount of fraud is infinitely negative, regardless of expected profits.

The average horizon is also an important determinant of fraud (lower right, Figs. 1 and 2). Fraud thresholds recede as the horizon increases (\({\lambda}\) decreases) and with it the expected reward for delaying fraud. In fact, the average amount of fraud increases sharply, up to a horizon of about five years, climbing steadily thereafter and eventually stabilising. The implication is that while a longer horizon helps in reducing fraud per unit of time, it does not reduce overall fraud, which in fact increases the most in the medium term – the typical turnover of traders in financial institutions.

4.2 Bankruptcy

Figures 1 and 2 demonstrate the dependence of the fraud thresholds on model parameters, the average amount of fraud of each trader and the bankruptcy probability. A direct application of the Doob–Meyer decomposition (Lemma A.5) reveals that in the Nash equilibrium, the bankruptcy probability satisfies

showing that the bankruptcy probability is the sum of the (stopped) fraud processes and an extra term if the initial share of wealth is in the fraud region. In Fig. 2, the initial share of wealth is \({50\%}\), which lies in the fraud-free region \({[\tilde{w}_{a}, 1-\tilde{w}_{b}]}\), except for falling into the personal fraud region \({(0,\tilde{w}_{a}]}\) when trader \({a}\)’s risk aversion is below 0.26.

Figure 3 depicts the distribution of the bankruptcy time \({\tau _{A}}\) conditionally on the event that bankruptcy occurs before the random horizon \({\tau _{A}}\), assuming the traders are identical in risk aversion, skill and initial wealth. The distribution is skewed to the right: more than half of the insolvencies occur within the first 3 years (coinciding with the average time horizon \({\mathbb{E}[\tau ]=\frac{1}{\lambda}=3}\) years), reaching the peak of approximately \({30\%}\) in the second year and quickly decreasing below \({2\%}\) after the sixth year. The survival probability (red bar) is approximately \({95\%}\).

Distribution of the bankruptcy time \({\tau _{A}}\) in Nash equilibrium, conditionally on bankruptcy occurring before the terminal horizon \({\tau}\) against time (\({0\leq t\leq 20}\)) with a bin size of half a year (blue). The probability of survival (red) \(\text{$\mathbb{P}[\tau _{A}>\tau ]$ is $\approx 95\%$}\). Results are obtained from the simulation of \({10^{5}}\) paths, each with step size \({5 \cdot 10^{-4}}\). Other parameters are \({\mu _{a} = \mu _{b} = 10\%}\), \({\sigma _{a} = \sigma _{b} = 20\%}\), \({\gamma _{a} = \gamma _{b} = 0.5}\), \({w_{a} = w_{b}= 0.5}\), \({\lambda = 1/3}\), \({\kappa =10\%}\)

4.3 Welfare

Figure 4 compares trader \({a}\)’s expected utility in three scenarios: (i) both traders abstain from fraud, (ii) only trader \({a}\) commits fraud, and (iii) both commit fraud in a Nash equilibrium. Once becoming the solo rogue trader, trader \({a}\)’s utility increases dramatically when the share of wealth is low; in contrast, that increment is insignificant when the share is high. The presence of the additional rogue trader \({b}\) reduces the value function of the sole cheater across the span of the initial wealth share. This reduction is most significant when trader \({a}\) has the most skin in the game (which coincides in this example with the fraud zone of trader \({b}\)). Near the \({50\%}\) wealth share, both traders are better off abstaining completely from fraud and even the prospect of solitary fraud yields little benefit. Thus in the case of two traders with similar ability, an equal allocation of managed wealth mitigates the potential for fraud.

Value functions of trader \({a}\) in the absence of fraud (black), when trader \({a}\) is the sole cheater (red) with fraud threshold \({\hat{w}_{a}}\) (dashed line in green) as in Theorem 3.10, and in the Nash equilibrium (blue) with fraud threshold \({\tilde{w}_{a}}\) (dashed line in cyan) and trader \({b}\)’s fraud threshold in view of trader \({a}\)’s wealth share \({1-\tilde{w}_{b}}\) (dashed line in purple) as in Theorem 3.9, against the initial share of the wealth of trader \({a}\) (\({0\%< w_{a}<100\%}\)). Other parameters are \({\mu _{a} = \mu _{b} = 10\%}\), \({\sigma _{a} = \sigma _{b} = 20\%}\), \({\gamma _{a} = \gamma _{b} = 0.5}\), \({\lambda = 1/3}\), \({\kappa =10\%}\), \({x_{a}+x_{b}=\lambda ^{-(1-\gamma _{a})^{-1}}}\)

4.4 Uncertain opponent’s skill

In practice, a trader may not have perfect information about the other’s investment skill and portfolio risk, but may be able to estimate them. Volatility can be determined rather precisely from frequent (say daily) observations of wealth history; indeed, in the model, volatility follows directly from the quadratic variation of the logarithmic wealth process, which is insensitive to fraud (which is a finite-variation process).

The situation is more delicate for the skill \({\mu _{j}}\). As Theorem 3.9 proves that a rational trader cheats only when the respective wealth share drops below some boundary (and spends approximately zero time at that boundary), the cumulative return of the opponent satisfies

where the continuous, nondecreasing process \({(U_{t})_{t\geq 0}}\) (reflecting the contribution of fraud to returns) increases only on the set \({\{(t,\omega ): r_{j}(Y^{x}_{t}(\omega )) = w_{j}\}}\), where \({w_{j}}\) is the fraud threshold. Thus the opponent’s return includes the contributions of both skill and fraud, but the latter can be removed by excluding the returns that take place near the minimum of \({r_{j}}\). In practice, if the discrete-time observations are \({(Y^{j}_{t_{k}})_{0\le k\le n}}\), the trader calculates the minimum \({\underline{r} = \min _{1\le k\le n}r_{j}(Y^{x}_{t_{k-1}})}\) and then estimates the opponent’s skill \({\mu _{j}}\) from the returns as

and the parameter \({\varepsilon}\) is chosen so that the probability that \({r_{j}(Y^{x})}\) reaches \({\underline{r}}\) between \({r_{j}(Y_{t_{k-1}}^{x})}\) and \({r_{j}(Y^{x}_{t_{k}})}\) is negligible; therefore the estimator of \({\mu _{j}}\) is approximately unbiased. Indeed, the probability that an Itô process with diffusion coefficient \({\sigma}\) moves from \({x>y}\) to \({z>y}\) in time \({\Delta t}\) without reaching \({y}\) is approximately \({e^{-2(x-y)(z-y)/(\sigma ^{2} \Delta t)}}\) (cf. Borodin and Salminen [6, 1.2.8 in Part II, Sect. 2.1]). Thus choosing \({x-y, z-y \approx 2\sigma \sqrt{\Delta t}}\), this probability is about \({e^{-8}\approx 0.03\%}\), which corresponds for daily observations to a frequency of less than one day in ten years (\({0.03\%\cdot 252\cdot 10 \approx 0.8}\)). Hence a reasonable choice for \({\varepsilon}\) is two standard deviations of the daily change in wealth share.

The large-sample distribution of \({\hat{\mu}_{j}}\) is close to normal, but the trader recognises that the exact normal distribution is ill-suited to estimate the skill \({\mu _{j}}\) which is assumed to be positive and to satisfy Assumption 3.1. Instead, a viable alternative distribution that is close to normal while preserving positivity is the binomial distribution, so that trader \({i}\) can more plausibly posit that

where the parameters \({n_{j}}\) and \({p_{j}}\) are identified by the first two moments \({n_{j} p_{j} = \hat{\mu}_{j}}\) and \({n_{j} p_{j}(1-p_{j}) = \hat{v}_{j}}\), and \({\hat{v}_{j}}\) is the variance associated to the opponent’s skill. (A frequentist trader who estimates the variance only from returns would choose \({\hat{v}_{j}}\) to be their sample variance, i.e., \({\frac{1}{m-1} \sum _{r_{j}(Y_{t_{k-1}}) > \underline{r}+\varepsilon}({Y^{j}_{t_{k}}}/{Y^{j}_{t_{k-1}}}-1 -\hat{\mu}^{j})^{2}}\). A Bayesian trader may use different estimators for \({\hat{\mu}_{j}}\) and \({\hat{v}_{j}}\), depending on the relative weight of the prior on the opponent’s skill.) Then the trader can choose a personal cheating threshold that maximises the expected utility for an uncertain opponent’s skill with the prescribed distribution.

Figure 5 highlights the impact of uncertainty on the opponent’s skill on fraud. The left panel displays the probability mass function of the drift estimator, while the right panel displays the dependence of the average amount of fraud of each trader on the estimation error, holding the opponent’s estimator of the trader’s drift constant with mean \({10\%}\) and error \({5\%}\). As a trader’s estimation error of the opponent’s skill increases from \({1\%}\) to \({10\%}\) (horizontal axis), fraud reduces significantly (approximately 10% with the chosen parameters), while the opponent’s behaviour remains nearly constant.

(Left) Probability mass function of trader \({a}\)’s estimator \({\hat{\mu}^{a}_{b}}\) with mean \({10\%}\) and standard deviation \({\varepsilon _{b}^{a}}\) (\({3\%}\), \({5\%}\) and \({7\%}\), from top to bottom). (Right) Equilibrium average fraud (vertical axis) with estimated drifts, up to horizon or bankruptcy, of traders \({a}\) (blue) and \({b}\) (red) against trader \({a}\)’s estimation error (\({1\%\leq \varepsilon _{b}^{a} \leq 10 \%}\)). Results obtained from the simulation of \({10^{4}}\) paths, each with step size \({5 \cdot 10^{-4}}\). Other parameters are \({\mu _{a} = \mu _{b} = 10\%}\), \({\sigma _{a} = \sigma _{b} = 20\%}\), \({\gamma _{a} = \gamma _{b} = 0.5}\), \({w_{a}=w_{b} = 0.5}\), \({\lambda = 1/3}\), \({\kappa =10\%}\) and \({\hat{\mu}^{b}_{a}}\) has mean \({10\%}\) and standard deviation \({\varepsilon ^{b}_{a}=5\%}\)

This phenomenon arises because when the opponent’s skill is uncertain, a hypothetical high skill implies a significant reduction in fraud, while a hypothetical low skill has little effect on fraud (cf. upper left panels in Figs. 1 and 2). This asymmetry implies that uncertainty on the opponent’s skill is akin to its overestimation and partially mitigates fraud: traders who are unsure of each other’s abilities behave as if their peers were more skilled than they actually are on average.

4.5 The shareholders’ problem

Suppose that if no bankruptcy occurs, each trader receives at the terminal horizon \({\tau}\) a fixed portion \({p\in (0,1)}\) of wealth, with the remainder \({1-p}\) distributed to shareholders. (Up to subtracting the initial wealth, this formulation is equivalent to (more realistically) rewarding traders with a fraction of gains rather than wealth. As an additive constant does not change the optimisation problem but complicates the notation, we do not discuss this variant.) For traders, the individual objective function is

The Nash equilibrium strategies of Theorem 3.9 remain unchanged under such constant scaling, while the game values are obtained by multiplying \({V^{i}}\) (as in Theorem 3.9) with the constant \({\frac{p^{1-\gamma _{i}}}{1-\gamma _{i}}}\).

If shareholders are risk-neutral (as is customary in the corporate finance literature, in view of their ability to diversify investments across a multitude of assets), their objective is to maximise

over all \({(A^{a},A^{b})\in \mathcal{A}^{2}}\). Denote by \({J^{S}(x;A^{a}):=\mathbb{E}[e^{-\kappa \tau}(1-p)X^{a,x}_{\tau}(A^{a})]}\) the value of a sole trader’s cheating strategy \({A^{a}}\).

Proposition 4.1

Let \({\lambda ^{\kappa}>\mu _{a} \geq \mu _{b}}\).

(i) If \({\mu _{a}=\mu _{b}}\), then a pair \({(A^{a},A^{b})\in \mathcal{A}^{2}}\) maximises the value in (4.1) if and only if it satisfies \({\Delta A^{a}_{t}\Delta A^{b}_{t}=0}\) a.s. for all \({t\geq 0}\).

(ii) If \({\mu _{a}>\mu _{b}}\), then for any \({(x_{a},x_{b})\in \mathbb{R}_{++}^{2}}\) and \({A^{a}\in \mathcal {A}\setminus \{0\}}\), we have

with the inequality reversing if \({\mu _{a}<\mu _{b}}\). Moreover, the value function coincides with the value of a sole trader’s cheating strategy, that is, for any \({(x_{a},x_{b})\in \mathbb{R}_{++}^{2}}\),

However, the value function is unattainable in \({\mathcal {A}^{2}}\).

In Proposition 4.1, (i) states that unless there are simultaneous jumps of the fraud processes, shareholders are indifferent to any fraud. This is in particular the case for the Nash equilibrium in Theorem 3.9, where the only jumps may arise at inception, albeit not simultaneously.

By (ii), for shareholders, fraud of the more skilled trader is preferable to no fraud at all, which is in turn preferable to fraud by the less skilled trader. Prima facie, such a result is counterintuitive as fraud risk does not carry any premium. However, the fraud of the more highly skilled, accidentally rewarded as skill, helps in reducing the wealth share managed by the less skilled trader, thereby increasing the return on the firm’s capital.

However, due to the final statement of (ii), the optimisation problem is ill posed. Nevertheless, the above intuition can be strengthened by including an additional control, which represents the initial share of assets under the management of trader \({a}\), to make the problem well posed. Let this control be \({w_{a}\in [0,1]}\), where the firm recruits only trader \({a}\) whenever \({w_{a}=1}\) and only trader \({b}\) whenever \({w_{a}=0}\). Then by choosing \({w_{a}=1}\), the supremum of \({J((x_{a},x_{b});A^{a},A^{b})}\) is indeed attained. Note that if the firm employs only a sole trader (say trader \({a}\)), risk-neutral shareholders are indifferent to fraud as wagering bets with one’s own capital has zero (rather than negative) risk premium, because wealth from only rogue trading (i.e., without legitimate investment) \({X_{t}^{a}={\mathbf{1}}_{\{t<\tau _{A}\}}e^{A_{t}^{a}}}\), \(t \geq 0\), is a \(\mathbb{G}^{A}\)-martingale. However, shareholders would be averse to fraud if it carried a negative risk premium because wealth would be a true supermartingale. To see this, modify the bankruptcy time (2.1) as

for some constant \({\epsilon \geq 0}\) representing the unit cost of fraud. Then fraud is indeed undesirable for risk-neutral shareholders because \(({\mathbf{1}}_{\{t<\tau _{A}\}}e^{A^{a}_{t}})\) is a true supermartingale for \({\epsilon >0}\). Indeed, by viewing \({(1+\epsilon )A^{a}}\) as the fraud process, Proposition A.4 (i) implies that \(({\mathbf{1}}_{\{t<\tau _{A}^{\epsilon}\}}e^{(1+\epsilon )A^{a}_{t}})\) is a \(\mathbb{G}^{A}\)-martingale, whence

for any \({{0\leq s< t<\infty}}\), where the inequality is strict if and only if \({{\mathbb{P}[A^{a}_{t}>A^{a}_{s}]>0}}\).

Denoting by \({J^{S,\epsilon}}\) the reward function corresponding to the modified bankruptcy time and with only trader \({a}\), it follows that for \({\epsilon >0}\),

and for any \({A^{a}\neq 0}\) in \({\mathcal {A}}\),

Since the survival processes satisfy \({{\mathbf{1}}_{\{t<\tau _{A}^{\epsilon}\}}\leq {\mathbf{1}}_{\{t<\tau _{A}\}}}\) a.s. for all \({t\geq 0}\) with equality if and only if \({A^{S}\equiv 0}\), then \({{J^{\epsilon}((x_{a},x_{b});A^{a},A^{b})\leq J((x_{a},x_{b});A^{a},A^{b})}}\) for any \({(A^{a},A^{b})\in \mathcal{A}^{2}}\) and \({J^{S}(x_{a}+x_{b};0)=J^{S,\epsilon}(x_{a}+x_{b};0)}\). By (ii), it follows that

Therefore, using the model modification (4.3), the optimal policy for risk-neutral shareholders is to recruit only the more skilled trader \({a}\) who, being alone, will then abstain from fraud (Proposition 2.1).

5 Conclusion

This paper develops a structural model of rational rogue trading. Self-interested, risk-averse traders can deliberately engage in fraudulent trading activity that can be concealed as superior performance while successful, but may lead to a firm’s bankruptcy if unsuccessful. Traders abstain from fraud when they have sufficient skin in the game, suggesting that effective mitigation of rogue trading episodes should not focus on large traders alone.

Notes

In principle, one could consider the case of fraud with a negative risk premium. Our model focuses on the parsimonious case of zero risk premium, which maximises the propensity for a trader to cheat. If the risk premium were positive, the bet would be a legitimate investment opportunity, for which the label of “fraud” may not be justified.

References

Aksamit, A., Jeanblanc, M.: Enlargement of Filtration with Finance in View. Springer, Berlin (2017)

Armstrong, J., Brigo, D.: Risk managing tail-risk seekers: VaR and expected shortfall vs S-shaped utility. J. Bank. Finance 101, 122–135 (2019)

Basel Committee on Banking Supervision: Principles for the sound management of operational risk. Bank for International Settlements Communications, Basel, Switzerland (2011). https://www.bis.org/publ/bcbs195.pdf

Bather, J., Chernoff, H.: Sequential decisions in the control of a spaceship. In: Le Cam, L., Neyman, J. (eds.) Fifth Berkeley Symposium on Mathematical Statistics and Probability, vol. 3, pp. 181–207. University of California Press, Berkeley (1967)

Bielecki, T.R., Rutkowski, M.: Credit Risk: Modeling, Valuation and Hedging. Springer, Berlin (2004)

Borodin, A.N., Salminen, P.: Handbook of Brownian Motion – Facts and Formulae, 2nd edn. Springer, Berlin (2002)

Brown, S.J., Doubling, S.O.W.: Nick Leeson’s trading strategy. Pac.-Basin Finance J. 9, 83–99 (2001)

Carmona, R.: Lectures on BSDEs, Stochastic Control, and Stochastic Differential Games with Financial Applications. SIAM, Philadelphia (2016)

Carpenter, J.N.: Does option compensation increase managerial risk appetite? J. Finance 55, 2311–2331 (2000)

Cohen, S.N., Elliott, R.J.: Stochastic Calculus and Applications. Springer, Berlin (2015)

Crouhy, M.G., Galai, D., Mark, R.: Insuring versus self-insuring operational risk: viewpoints of depositors and shareholders. J. Deriv. 12(2), 51–55 (2004)

Davis, M.H., Norman, A.R.: Portfolio selection with transaction costs. Math. Oper. Res. 15, 676–713 (1990)

De Angelis, T., Ferrari, G.: Stochastic nonzero-sum games: a new connection between singular control and optimal stopping. Adv. Appl. Probab. 50, 347–372 (2018)

Dianetti, J., Ferrari, G.: Nonzero-sum submodular monotone-follower games: existence and approximation of Nash equilibria. SIAM J. Control Optim. 58, 1257–1288 (2020)

Duarte, J., Longstaff, F.A., Yu, F.: Risk and return in fixed-income arbitrage: nickels in front of a steamroller? Rev. Financ. Stud. 20, 769–811 (2006)

Ekström, E., Lindensjö, K., Olofsson, M.: How to detect a salami slicer: a stochastic controller-and-stopper game with unknown competition. SIAM J. Control Optim. 60, 545–574 (2022)

Fleming, W.H., Soner, H.M.: Controlled Markov Processes and Viscosity Solutions. Springer, Berlin (2006)

Guo, X., Tang, W., Xu, R.: A class of stochastic games and moving free boundary problems. SIAM J. Control Optim. 60, 758–785 (2022)

Guo, X., Xu, R.: Stochastic games for fuel follower problem: \(N\) versus mean field game. SIAM J. Control Optim. 57, 659–692 (2019)

Gwilym, R., Ebrahim, M.S.: Can position limits restrain ‘rogue’ trading? J. Bank. Finance 37, 824–836 (2013)

Hamadène, S., Mu, R.: Existence of Nash equilibrium points for Markovian non-zero-sum stochastic differential games with unbounded coefficients. Stochastics 87, 85–111 (2015)

Iguchi, T.: My Billion Dollar Education: Inside the Mind of a Rogue Trader. Toshihide Iguchi (2014)

Jacod, J.: Calcul Stochastique et Problèmes de Martingales. Lecture Notes in Mathematics, vol. 714. Springer, Berlin (1979)

Jacod, J., Shiryaev, A.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, Berlin (2003)

Jeanblanc, M., Le Cam, Y.: Progressive enlargement of filtrations with initial times. Stoch. Process. Appl. 119, 2523–2543 (2009)

Jeulin, T.: Semi-Martingales et Grossissement d’une Filtration. Lecture Notes in Mathematics, vol. 833. Springer, Berlin (1980)

Jorion, P.: Big Bets Gone Bad: Derivatives and Bankruptcy in Orange County. Academic Press, San Diego (1995)

Karatzas, I., Li, Q.: BSDE approach to non-zero-sum stochastic differential games of control and stopping. In: Cohen, S.N., et al. (eds.) Stochastic Processes, Finance and Control: A Festschrift in Honor of Robert J. Elliott, pp. 105–153. World Scientific, Singapore (2012)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus, 2nd edn. Springer, New York (1998)

Kay, J.: Other People’s Money. Profile Books, London (2016)

Kim, Y., Xu, Y.: Operational risk management: optimal inspection policy. Preprint (2019). https://doi.org/10.2139/ssrn.3491006

Krawiec, K.D.: Accounting for greed: unraveling the rogue trader mystery. Oregon Law Rev. 79, 301–338 (2000)

Krawiec, K.D.: The return of the rogue. Ariz. Law Rev. 51, 127–174 (2009)

Kwon, H.D.: Game of variable contributions to the common good under uncertainty. Oper. Res. 70, 1359–1370 (2022)

Kwon, H.D., Zhang, H.: Game of singular stochastic control and strategic exit. Math. Oper. Res. 40, 869–887 (2015)

Moodie, J.: Internal systems and controls that help to prevent rogue trading. J. Secur. Oper. Custody 2, 169–180 (2009)

Pinedo, M., Xu, Y., Xue, M.: Operational risk in financial services: a review and new research opportunities. Prod. Oper. Manag. 26, 426–445 (2017)

Pinedo, M., Xu, Y., Zhu, L.: Operational risk management: a stochastic control framework with preventive and corrective controls. Oper. Res. 68, 1804–1825 (2020)

Reuters: Timeline of events in SOCGEN rogue trader case (2008). https://www.reuters.com/article/uk-socgen-kerviel-events-timeline-idUKL1885652420080318

Tanaka, H.: Stochastic differential equations with reflecting boundary condition in convex regions. In: Maejima, M., Shiga, T. (eds.) Stochastic Processes: Selected Papers of Hiroshi Tanaka, pp. 157–171. World Scientific, Singapore (2002)

The New York Times: Bank outlines how trader hid his activities (2008). https://www.nytimes.com/2008/01/28/business/worldbusiness/28bank.html

US Securities and Exchange and Commission: Sec charges rogue trader who bankrupted his firm (2021). https://www.sec.gov/news/press-release/2021-205

Wexler, M.N.: Financial edgework and the persistence of rogue traders. Bus. Soc. Rev. 115, 1–25 (2010)

Acknowledgements

For helpful comments, we thank Agostino Capponi, Umut Çetin, Albina Danilova, Jodi Dinetti, Tiziano De Angelis, Giorgio Ferrari, Martin Herdegen, Gur Huberman, Patrice Kiener, Kostas Kardaras, David Itkin, Johannes Muhle-Karbe, Sergey Nadtochiy, Marcel Nutz, Philip Protter, Frank Riedel, Johannes Ruf, Yoav Tamir, Kwok Chuen Wong and seminar participants at Bielefeld University, Columbia University, London School of Economics, National University of Singapore, Bachelier Colloquium 2023 and the AMaMeF 2021 conference. We are also grateful to the anonymous Associate Editor and referees for their stimulating criticism which enhanced the paper, and to the Editor Martin Schweizer for an exceptionally careful reading which led to numerous improvements of the manuscript.

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Dong is supported by the NUS grant WBS A-0004587-00-00. Guasoni is partially supported by SFI (16/IA/4443, 16/SPP/3347).

Appendices

Appendix A

1.1 A.1 Wealth of rogue traders

Recall the definition of the stochastic exponential (Jacod and Shiryaev [24, Eq. I.4.62]) of a general semimartingale.

Definition A.1

For any ℝ-valued semimartingale \({S}\) with \(S_{0-}\in \mathbb{R}\), the stochastic exponential of \({S}\) is the process

where \({\mathcal{E}(S)_{0-}=1}\) and \({S^{c}}\) denotes the continuous local martingale part of \({S}\).

All stochastic exponentials in this article are a.s. strictly positive because the jump sizes are bounded away from −1 (cf. [24, Theorem I.4.61 (c)]. If the total variation of the jumps of \(S\) is finite, recall that

a.s. for all \({t\geq 0}\). Therefore the stochastic exponential then simplifies to

for \(S_{0-}=0\). The following result shows that the pre-bankruptcy wealth (2.2) is well defined and provides an expression in terms of a stochastic exponential.

Lemma A.2

For any \({k\in \{1,\dots ,N\}}\), let \({r_{k}(x)=\frac{x_{k}}{\sum _{i=1}^{N}x_{i}}}\) for any \({x\in \mathbb{R}_{++}^{N}}\). Then:

(i) There exists a unique strong solution \({Y^{x}=(Y^{1,x},\dots ,Y^{N,x})}\) of (2.2), and for all \({{1\le i\le N}}\), \({ \mathbb{P}[Y^{i,x}_{t}>0 \textit{ for all }t\geq 0]=1.}\)

(ii) For all \({1\le i\le N}\) and any \({t\geq 0}\), we have a.s. with \({\tilde{A}^{S}=\sum _{k=1}^{N}\tilde{A}^{k}}\) that

Proof

Denote by \({I_{N}}\) the \({N\times N}\) identity matrix. The SDE (2.2) can be written in vector form as

where we define the process \({R=(R^{1},\dots ,R^{N})}\) by \({R^{i}_{t}=\mu _{i}t+\sigma _{i}B^{i}_{t}}\) for \({1\le i\le N}\) and set \({{\tilde{A}=(\tilde{A}^{1},\dots ,\tilde{A}^{N})}}\). The linearity of the coefficients of (A.2) implies uniform Lipschitz-continuity, hence the existence and uniqueness of a strong solution (cf. Cohen and Elliott [10, Theorem 16.3.11]).

For any \({1\le i\le N}\), let \({Z^{i}_{t}=R^{i}_{t}+\tilde{A}^{i}_{t}}\) and \({H^{i}_{t}=x_{i}+\int _{[0,t]}\sum _{j\neq i}^{N}Y^{j}_{s-}d \tilde{A}^{i}_{s}}\) for all \({t\geq 0}\), with \({Z^{i}_{0-}=0}\) and \({H^{i}_{0-}=x_{i}}\). Rewriting (2.2) yields

By Jacod [23, Theorem 6.8], it follows that

where

and \({\bar{A}_{t}^{i}=A^{i,c}_{t}+\sum _{0\leq s\leq t} \frac{\Delta \tilde{A}_{s}^{i}}{1+\Delta \tilde{A}_{s}^{i} }}\) with \({\bar{A}^{i}_{0-}=0}\). Substituting (A.4) into (A.3) yields

Define the exit time \({\tau _{0}=\inf \{t\geq 0: \min _{1\le k\le N}Y^{k}_{t}\leq 0\}}\). Suppose for a contradiction that \({\mathbb{P}[0\leq \tau _{0}<\infty ]>0}\). Then for any \({{\omega \in \{\omega \in \Omega :0\leq \tau _{0}(\omega )<\infty \}}}\), there exists \({{1\le q\le N}}\) such that \({{Y^{q}_{\tau _{0}(\omega )}(\omega )\leq 0}}\) and \({{Y^{q}_{\tau _{0}(\omega )-}(\omega )\geq 0}}\) because \({Y^{q}}\) is a càdlàg process. Since \({x_{q}>0}\), (A.5) implies that \({\sum _{j\neq q}^{N}Y^{j}_{s}(\omega )<0}\) for some \({s<\tau _{0}(\omega )}\) which contradicts the definition of \({\tau _{0}}\), thereby completing the proof of (i).

Thus rewrite (2.2) and the firm’s total pre-bankruptcy wealth \({Y^{S}}\) as

An application of [23, Theorem 6.8] yields (ii). □

The following lemma characterises the conditional probability of bankruptcy in relation to total fraud.

Lemma A.3

The following hold a.s. for all \({t\geq 0}\):

Proof

First, we show that

On the one hand, \({\{t<\tau _{A}\}\subseteq \{A^{S}_{t}<\theta \}}\) by the definition of \({\tau _{A}}\). On the other hand, let \({\omega \in \Omega}\) be such that \({A^{S}_{t}(\omega )<\theta (\omega )}\). If \({\tau _{A}(\omega )<\infty}\), then \({\theta (\omega )\leq A_{\tau _{A}(\omega )}^{S}(\omega )}\). Hence \({t<\tau _{A}(\omega )}\) because \({A^{S}_{t}(\omega )< A_{\tau _{A}(\omega )}^{S}(\omega )}\) and \({A^{S}}\) is nondecreasing. If we have instead \({\tau _{A}(\omega )=\infty}\), then trivially \({t<\tau _{A}(\omega )}\).

As \({\theta}\) is independent of \({\mathcal{F}_{\infty}}\), and exponentially distributed with unit mean, (A.8) implies that

Because \({A^{S}}\) is \(\mathbb{F}\)-adapted and by the tower property of conditional expectations, (A.6) and (A.7) follow. □

We next show that the treatment of jumps in the definition of \({\tilde{A}}\) is the only one consistent with the martingale property for wealth in the absence of skill.

Proposition A.4

Let \({N=1}\), \({\mu _{1}=0}\) and \({A^{g}_{t}:=A^{1,c}_{t}+\sum _{0\leq s\leq t}g(\Delta A^{1}_{s})}\), where the function \({{g:\mathbb{R}_{+}\rightarrow \mathbb{R}_{+}}}\) is measurable with \({g(0)=0}\). Let \(\bar{Y}\) be the solution of the SDE

and

Then:

(i) If \({A^{1}_{t}=A^{1,c}_{t}}\) a.s. for all \({t\geq 0}\) or if \({g(a)=e^{a}-1}\), then \({\bar{X}^{1,x_{1}}}\) is a \(\mathbb{G}^{A}\)-martingale.

(ii) If \({\bar{X}^{1,x_{1}}}\)is a \(\mathbb{G}^{A}\)-martingale for any \({A^{1}\in \mathcal{A}}\), then \({g(a)=e^{a}-1}\) for any \({a\geq 0}\).

Proof

(i) By Aksamit and Jeanblanc [1, Lemma 3.8], (A.7) implies the immersion property, i.e., any \(\mathbb{F}\)-martingale remains a martingale in the enlarged filtration \(\mathbb{G}^{A}\). It then follows by Lévy’s characterisation theorem that \({B^{1}}\) remains a Brownian motion in \(\mathbb{G}^{A}\). Lemma A.2 (ii) and Cohen and Elliott [10, Corollary 15.1.9] yield that

a.s. for all \({t\geq 0}\). If \({A^{1}}\) has a.s. continuous paths or \({g(a)=e^{a}-1}\), then \({\mathcal{E}({A}^{g})_{t}=e^{A^{1}_{t}}}\), and \(({\mathbf{1}}_{\{t<\tau _{A}\}}e^{A^{1}_{t}})\) is a \(\mathbb{G}^{A}\)-martingale by Bielecki and Rutkowski [5, Lemma 5.1.7]. Because the covariation between \(({\mathbf{1}}_{\{t<\tau _{A}\}}e^{A^{1}_{t}})\) and \({\mathcal{E}(\sigma _{1}B^{1})}\) is zero and \({X^{1,x_{1}}_{t}=X^{1,x_{1}}_{t\wedge \tau _{A}}}\) a.s. for all \({t\geq 0}\), it follows that \({X^{i,x}}\) is a \(\mathbb{G}^{A}\)-martingale.

(ii) Consider the family \({A^{\xi}}\) of strategies indexed by \({\xi \geq 0}\), defined for \({t\geq 0}\) by \({A^{\xi}_{t}=1_{\{t\geq 1\}}\xi}\). By construction, \({A^{\xi}\in \mathcal {A}}\) for all \({\xi \geq 0}\). Denote the corresponding wealth by \(\bar{X}^{1,x_{1},\xi}\). By assumption, this is a \(\mathbb{G}^{A}\)-martingale for any \({\xi \geq 0}\). One can factorise it as \(\bar{X}^{1,x_{1},\xi}=M U\), where for any \({t\geq 0}\),

Note that \({M}\) is a \(\mathbb{G}^{A}\)-martingale and by Lemma A.5, the finite-variation process \({U}\) is \(\mathbb{G}^{A}\)-predictable. Integration by parts (cf. [1, Proposition 1.16]) yields

The process \({(\int _{0}^{t}U_{s}dM_{s})_{t\geq 0}}\) is a \(\mathbb{G}^{A}\)-local martingale. By Jacod and Shiryaev [24, Proposition I.3.5], the process \({(\int _{0}^{t}M_{s-}dU_{s})_{t\geq 0}}\) inherits the \(\mathbb{G}^{A}\)-predictability and the finite-variation property from its integrator \({U}\). Because \({ \bar{X}^{1,x_{1},\xi}}\) is a \(\mathbb{G}^{A}\)-martingale, \({(\int _{0}^{t}M_{s-}dU_{s})_{t\geq 0}}\) is a \(\mathbb{G}^{A}\)-local martingale. Then by [10, Lemma 10.3.9], the process \({(\int _{0}^{t}M_{s-}dU_{s})_{t\geq 0}}\) is constant. Since \({M_{1-}>0}\) with positive probability and

it follows that \({e^{-\xi}(1+g(\xi ))=1}\) for all \({\xi \geq 0}\). Note that in (A.9), all quantities except for the indicator function are strictly positive and \({\mathbb{P}[\tau _{A}\ge 1]>0}\) because in view of (A.8), \({0<\mathbb{P}[A_{1}^{\xi}<\theta ]\leq \mathbb{P}[\bigcap _{ \varepsilon \in (0,1)}\{A_{1-\varepsilon}<\theta \}]=\mathbb{P}[ \bigcap _{\varepsilon \in (0,1)} \{\tau _{A}>1-\varepsilon \}]}\). □

1.2 A.2 Proof of Proposition 2.1

By Lemma A.2, trader 1’s wealth is of the form

Hence by Lemma A.3,

Therefore, by the tower property of conditional expectations,

and

Let \({\mathbb{P}_{\tau}}\) be the law of \({\tau}\), i.e., \({\mathbb{P}_{\tau}[U]=\mathbb{P}[\tau \in U]}\) for any Borel-measurable set \({U\subseteq \mathbb{R}_{+}}\). Then by the law of total probability and the independence of \({\tau}\) from \({B}\) and \({\theta}\),

Thus (A.10) implies that

if and only if \({\mathbb{P}[A_{t}^{1}=0]=1}\) for all \({t>0}\) for which \({\mathbb{P}[\tau \geq t]>0}\). In fact, suppose that on the contrary, there exists some \({t_{0}\geq 0}\) for which \({\mathbb{P}[\tau \geq t_{0}]>0}\), but \({\mathbb{P}[A_{t_{0}}^{1}>0]>0}\). Because \({A^{1}}\) is nondecreasing a.s., we have \(\mathbb{P}[A^{1}_{t}\ge A^{1}_{t_{0}}>0] = \mathbb{P}[A^{1}_{t_{0}}>0] > 0\) for \({t\geq t_{0}}\) and so (A.11) implies that