Abstract

In this paper, we address the problem of optimal dividend payout strategies from a surplus process governed by Brownian motion with drift under a drawdown constraint, i.e., the dividend rate can never decrease below a given fraction \(a\) of its historical maximum. We solve the resulting two-dimensional optimal control problem and identify the value function as the unique viscosity solution of the corresponding Hamilton–Jacobi–Bellman equation. We then derive sufficient conditions under which a two-curve strategy is optimal, and we show how to determine its concrete form using calculus of variations. We establish a smooth-pasting principle and show how it can be used to prove the optimality of two-curve strategies for sufficiently large initial and maximum dividend rates. We also give a number of numerical illustrations in which the optimality of the two-curve strategy can be established for instances with smaller values of the maximum dividend rate and the concrete form of the curves can be determined. One observes that the resulting drawdown strategies nicely interpolate between the solution for the classical unconstrained dividend problem and that for a ratcheting constraint as recently studied in Albrecher et al. (SIAM J. Financial Math. 13:657–701, 2022). When the maximum allowed dividend rate tends to infinity, we show a surprisingly simple and somewhat intriguing limit result in terms of the parameter \(a\) for the surplus level above which, for a sufficiently large current dividend rate, a take-the-money-and-run strategy is optimal in the presence of the drawdown constraint.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and model

Assume that the surplus process of a company is given by a Brownian motion with drift,

where \(W\) is a standard Brownian motion, and \(\mu > 0\), \(\sigma >0\) are given constants. Let \((\Omega ,\mathcal{F}, ( \mathcal{F}_{t} ) _{t\geq 0},\mathbb{P})\) be the complete probability space generated by the Brownian motion \((W_{t})_{t\geq 0}\). Assume further that the company uses part of the surplus to pay dividends to the shareholders with rates in a set \([0,\overline{c}]\), where \(\overline{c}>0\) is the maximum dividend rate possible. Let \(D_{t}\) denote the rate at which the company pays dividends at time \(t\); then the controlled surplus process can be written as

We assume that the process \((D_{t})_{t\geq 0} \) is progressively measurable. Thus \(\int _{0}^{\cdot }D_{s}ds\) and correspondingly \(X^{D}\) are continuous adapted processes. Note that since \(\mathcal{F}_{t}=\mathcal{F}_{t{-}}\), any adapted process is predictable.

It is a classical problem in risk theory to find a dividend strategy \(D=\left ( D_{t}\right ) _{t\geq 0}\) that maximises the reward function given by the expected sum of discounted dividend payments,

over a set of admissible candidate strategies. Here \(q>0\) is a discount factor and \(\tau = \inf \{ t\geq 0:X_{t}^{D}<0 \} = \tau _{x}\) is the ruin time of the controlled process. De Finetti [15] was the first to consider a problem of this kind for a simple random walk, and Gerber [19, 20] considered extensions, including the diffusion setup (1.1) given above; see also Shreve et al. [29]. For a finite maximum dividend rate \(\overline{c}\), this problem was then further investigated by Jeanblanc and Shiryaev [23], Radner and Shepp [27], Asmussen and Taksar [7] and Gerber and Shiu [21]. Since then, a lot of variants of this problem for the process (1.1) and more general underlying risk processes have been considered; see e.g. the surveys Albrecher and Thonhauser [4] and Avanzi [8]. For the diffusion model (1.1), we recently studied in Albrecher et al. [1] this optimal dividend problem under a ratcheting constraint, i.e., under the assumption that the dividend rate can never be decreased over the lifetime of the process, which renders the respective control problem two-dimensional, where the first dimension is the current surplus and the second dimension is the currently employed dividend rate. One motivation to consider that constraint was that it may be psychologically preferable for shareholders to not experience a decrease of dividend payments, and it is interesting to see to what extent such a constraint leads to an overall performance loss.

In this paper, we go one step further and allow reductions of the dividend rate over time, but only up to a certain percentage \(a\) of the largest already exercised dividend rate (“drawdown”). More formally, a dividend drawdown strategy \(D= ( D_{t} ) _{t\geq 0}\) with drawdown constraint \(a\in [ 0,1]\) is one that satisfies \(D_{t}\in [ aR_{t},\overline{c}]\), where \(R_{t}\) is the running maximum of the dividend rate, that is,

here we denote the initial dividend rate by \(R_{0{-}}=c\). A dividend drawdown strategy is called admissible if it is progressive with respect to the filtration \(\left ( \mathcal{F}_{t}\right ) _{t\geq 0}\).

Define \(\Pi _{x,c,a}^{[0,\overline{c}]}\) as the set of all admissible dividend drawdown strategies with initial surplus \(x\geq 0\), initial running maximum dividend rate \(c\in [ 0,\overline{c}]\) and drawdown constraint \(a\in [ 0,1]\). Given \(D\in \Pi _{x,c,a}^{[0,\overline{c}]}\), the reward function of this strategy is given by (1.2). Hence, for any triple \((x,c,a)\), our aim in this paper is to maximise

Note that the limit case \(a=1\) corresponds to the ratcheting case (considered previously in Albrecher et al. [1]), and the limit case \(a=0\) corresponds to the optimisation of bounded dividend rates without any drawdown constraint.

Drawdown phenomena have been studied in various contexts in the literature. On the one hand, drawdown times and properties of uncontrolled stochastic processes were investigated in quite some generality (see for instance Landriault et al. [25] for the case of Lévy processes). In the context of control problems, drawdown constraints on the wealth have been considered in portfolio problems in the mathematical finance literature; see for instance Elie and Touzi [18], Chen et al. [14] and Kardaras et al. [24]. For a minimisation of drawdown times of a risk process through dynamic reinsurance, see Brinker [11] and Brinker and Schmidli [12]. Our context, however, is different, as we are interested in implementing a drawdown constraint on the payment structure of the dividend rates, i.e., as a constraint on the admissible dividend policies. In that sense, our approach is more closely related to problems of lifetime consumption in the mathematical finance literature; see Angoshtari et al. [5] who extend Dusenberry’s ratcheting problem of consumption studied by Dybvig [16] to drawdown constraints. However, the concrete model setup and embedding, and also the involved techniques there, are very different from dividend problems of the De Finetti type as studied in this paper.

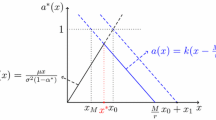

After deriving some basic analytic properties of the value function \(V_{a}^{\overline{c}}(x,c)\) of our drawdown problem in Sect. 3, we derive a Hamilton–Jacobi–Bellman equation for \(V_{a}^{\overline{c}}(x,c)\) in Sect. 4 and show that \(V_{a}^{\overline{c}}(x,c)\) is its unique viscosity solution with suitable boundary conditions. We then, in Sect. 5, briefly study in more detail the value function when one already starts at the maximal dividend rate \(\overline{c}\), which serves as a crucial ingredient for the analysis of \(V_{a}^{\overline{c}}(x,c)\) in Sect. 6. Sufficient conditions are given under which the optimal strategy for bounded dividend rates is a two-curve strategy in the space \((0,\infty )\times [ 0,\overline{c}]\) for \((x,c)\), which is partitioned by two curves \(\gamma ^{\overline{c}}(c)\) and \(\zeta ^{\overline{c}}(c)\) with \(\gamma ^{\overline{c}}(c)<\zeta ^{\overline{c}}(c)\) for all \(c\in [ 0,\overline{c}]\). If for a given \(c\), we have \(x<\gamma ^{\overline{c}}(c)\), then dividends are paid at rate \(ac\); if \(\gamma ^{\overline{c}}(c)\leq x\leq \zeta ^{\overline{c}}(c)\), then dividends are paid at rate \(c\); finally, if \(x>\zeta ^{\overline{c}}(c)\), then the dividend rate \(c\) is increased immediately until \(x=\zeta ^{\overline{c}}(c_{1})\) for some \(c_{1}\in (c,\overline{c})\) (or \(c=\overline{c}\), whichever happens first) is reached. We furthermore establish a smooth-pasting principle for these optimal curves. In Sect. 7, it is shown that the limits of \(\gamma ^{\overline{c}}(\overline{c})\) and \(\zeta ^{\overline{c}}(\overline{c})\) as \(\overline{c}\rightarrow \infty \) are finite and given by the surprisingly explicit formulas

This nicely extends the respective limit \(2\mu /q\) of the ratcheting curve that was identified for pure ratcheting (\(a=1\)) in [1, Lemma 5.21]. In Sect. 8, we then look further into the limiting case and show that for sufficiently large \(\overline{c}\), one has \(\gamma ^{\overline{c}}(c)\nearrow \gamma ^{\overline{c}}( \overline{c})\) and \(\zeta ^{\overline{c}}(c)\searrow \zeta ^{\overline{c}}(\overline{c})\) as \(c\rightarrow \overline{c}\). This enables us to establish the general optimality of two-curve strategies whenever the current dividend rate \(c\) and the maximal dividend rate \(\overline{c}\) are sufficiently large. At the same time, the negative derivative of \(\zeta ^{\overline{c}}(c)\) close to (sufficiently large) \(\overline{c}\) is notably different from the pure ratcheting case (\(a=1\)), for which it was shown in [1] that the corresponding derivative is positive for all \(c\) close to \(\overline{c}\) (and indeed the leading term in the asymptotics of \(0< a<1\) breaks down for \(a=1\) so that some sort of phase transition happens). The simplicity of the right-hand limit in (1.4) and in particular the appearance of the square-root of the drawdown coefficient \(a\) in the right-hand limit are somewhat intriguing. In the absence of an upper limit for the dividend rate, it identifies the minimum surplus level \(x\) above which, for sufficiently large current dividend rate, it is preferable to pay out all the surplus \(x\) immediately and generate ruin by doing so (a so-called “take-the-money-and-run” strategy, see e.g. Loeffen and Renaud [26]), and that value does not depend on the size of the volatility \(\sigma \). Consequently, one can get some intuition on this result in the much simpler deterministic model with \(\sigma =0\), which we therefore consider in Sect. 2 before approaching the general case \(\sigma >0\) in the rest of the paper. We give numerical illustrations in Sect. 9, where we establish the optimality of two-curve strategies also for smaller magnitudes of \(c\) and \(\overline{c}\) by numerically showing that the sufficient conditions from Sect. 6 are satisfied. We obtain the optimal curves by calculus of variation techniques and discuss the properties of the value functions of the drawdown dividend problem and their comparison to classical and ratcheting solutions for various parameter combinations. Finally, Sect. 10 concludes. Appendix A contains the proofs of the results of Sect. 6 together with some auxiliary lemmas, and Appendix B collects some longer formulas appearing in Sects. 7 and 8 in compact form.

2 Some intuition from the deterministic case

Assume in this section for simplicity a completely deterministic model

with a positive drift \(\mu >0\) (for the study of such a model in another context in the dividend literature, see e.g. Eisenberg et al. [17]). Then a constant dividend rate \(\overline{c}=\mu \) throughout time keeps the surplus at level \(x\) for all \(t\geq 0\) and correspondingly

for any \(x>0\). Consequently, whenever the initial surplus \(x\) is larger than \(\mu /q\), paying out all the surplus at the beginning (causing immediate ruin) is preferable to any other dividend strategy subject to the constraint \(\overline{c}\leq \mu \). At the same time, if a constant dividend rate \(\overline{c}>\mu \) is applied, the controlled process leads to ruin at the time \(t= x/(\overline{c}-\mu )\) and we obtain instead

The latter shows that whenever \(x>2\mu /q\), if allowed to do so, paying out all the surplus \(x\) immediately (and causing immediate ruin) is preferable to any other constant dividend strategy with large \(\overline{c}\). In other words, the potential gain from later ruin and therefore more dividend income (by exploiting the positive drift, without any risk) is outweighed by the discounting of such later dividend payments. This can also be seen as an intuitive explanation of the limit \(2\mu /q\) in Albrecher et al. [1, Lemma 5.21].

Let us now proceed to the case with drawdown. Assume that we start with initial capital \(x>b\) for some \(b\) to be determined and that we pay dividends at rate \(\overline{c}>\mu \) until we reach that lower level \(b\) at time \(t=(x-b)/(\overline{c}-\mu )\), from which time on we reduce the dividend payments to level \(a \overline{c}\) according to our drawdown constraint. In the deterministic model of this section, this then leads to

Taking the derivative with respect to \(b\) and setting it to zero gives, after simple calculations, for large \(\overline{c}\) the optimal level

But if one substitutes that value of \(b\) into (2.1), an expansion at \(\overline{c}=\infty \) gives

The numerator in the second term is negative exactly when

so that in those cases, it is preferable to immediately pay \(x\) as a lump sum dividend and go to ruin immediately (if that is allowed) rather than following the above refracting strategy, as the value \(x\) cannot be realised at any later point in time in view of the discounting, despite the continuing deterministic income with drift \(\mu \). One may expect that the size of the volatility does not matter when \(\overline{c}\to \infty \), and indeed, as a by-product of the results of this paper, it is shown in Sect. 7 that the same result can be established for the general case \(\sigma >0\); cf. Proposition 7.3. Another way to state this is the following: If one defines \(x^{*}(\overline{c})\) as the surplus value for which, when already currently paying the maximum dividend rate \(\overline{c}\), one is indifferent whether to further increase \(\overline{c}\) or not, the above result establishes that \(\lim _{\overline{c}\to \infty}x^{*}(\overline{c})=\frac{\mu}{q}(1+{1}/ \sqrt{a})\), and it is in terms of that notation that the more general result is proved in Sect. 7.

3 Basic results

Recall the definition (1.3) of our value function \(V_{a}^{\overline{c}}(x,c)\) and denote by \(V_{a}^{\infty}(x,c)\) the corresponding function when there is no ceiling on dividend rates, i.e., \(\overline{c}=\infty \). It is immediate to see that \(V_{a}^{\overline{c}}(0,c)=0\) for all \(c\in [ 0,\overline{c}]\) and \(a\in [ 0,1]\).

Remark 3.1

As mentioned in the introduction, the dividend optimisation problem without drawdown constraint has a long history; see e.g. Schmidli [28, Sect. 2.4]. Unlike the drawdown optimisation problem, the problem without the drawdown constraint is one-dimensional. If we denote its value function by \(\overline {V}^{\overline{c}}(x)\), then clearly \(V_{0}^{\overline{c}}(x,c)=\overline {V}^{\overline{c}}(x)\) and \(V_{a}^{\overline{c}}(x,c)\leq \overline {V}^{\overline{c}}(x)\) for all \(x\geq 0\), \(a\in [ 0,1]\) and \(c\in [ 0,\overline{c}]\). The function \(\overline{V}^{\overline{c}}\) is increasing, concave, twice continuously differentiable with \(\overline {V}^{\overline{c}}(0)=0\) and \(\lim _{x\rightarrow \infty}\overline{V}^{\overline{c}}(x)=\overline{c}/q\); so it is Lipschitz with Lipschitz constant \(( \overline{V}^{\overline{c}} ) ^{\prime}(0)\).

Remark 3.2

The dividend optimisation problem without any constraint was addressed by Gerber and Shiu [21] and Schmidli [28, Sect. 2.4]. If \(\overline {V}(x)\) denotes its value function, we have \(\overline{V}(x)=V_{0}^{\infty}(x,c)\) for any \(c>0\). Clearly, \(V_{a}^{\infty}(x,c)\leq \overline{V}(x)\) for all \(a\in [ 0,1]\). The function \(\overline{V}\) is increasing, concave, twice continuously differentiable with \(\overline {V}(0)=0\) and \(x\leq \overline{V}(x)\leq x+\mu /q\); so it is Lipschitz with Lipschitz constant \(\overline {V}{}^{\prime }(0)\).

Proposition 3.3

It holds that \(V_{a}^{\overline{c}}(x,c)\nearrow V_{a}^{\infty}(x,c)\) as \(\overline{c}\rightarrow \infty \).

Proof

It is straightforward that for any \(\overline{c}_{1}\leq \) \(\overline{c}_{2}\), \(V_{a}^{\overline{c}_{1}}(x,c)\leq V_{a}^{\overline{c}_{2}}(x,c)\) \(\leq V_{a}^{\infty}(x,c)\) for \(0\leq c\leq \overline{c}_{1}\). For any \(\varepsilon >0\), take a strategy \(D=(D_{t})_{t\geq 0}\in \Pi _{x,c,a}^{[0,\infty )}\) with ruin time \(\tau \) such that \(V_{a}^{\infty}(x,c)\leq J(x;D)+\varepsilon \). For an increasing sequence \(c_{n}\rightarrow \infty \) with \(c_{1}>c\), consider \(D^{n}=(D_{t}\wedge c_{n})_{t\geq 0}\in \Pi _{x,c,a}^{[0,c_{n}]}\) and let \(\tau ^{n}\geq \tau \) be the ruin time of \(D^{n}\). Then by monotone convergence,

and so we have the result. □

We now state a straightforward result regarding the boundedness and monotonicity of the value functions.

Proposition 3.4

In the case \(\overline{c}<\infty \), the value function \(V_{a}^{\overline{c}}(x,c)\) is bounded by \(\overline {c}/q\) with \(\lim _{x\rightarrow \infty}V_{a}^{\overline{c}}(x)=\overline{c}/q\), nondecreasing in \(x\) and nonincreasing in \(c\).

Proof

By Remark 3.1 and Albrecher et al. [1, Theorem 3.3], we have

with \(\lim _{x\rightarrow \infty}V_{1}^{\overline{c}}(x,c)=\lim _{x \rightarrow \infty}\overline{V}^{\overline{c}}(x)=\overline{c}/q\). So \(V_{a}^{\overline {c}}\) is bounded by \(\overline{c}/q\) with \(\lim _{x\rightarrow \infty}V_{a}^{\overline{c}}(x,c)=\overline{c}/q\).

On the one hand, \(V_{a}^{\overline{c}}(x,c)\) is nonincreasing in \(c\) because given \(c_{1}< c_{2}\leq \overline{c}\), we have \(\Pi _{x,c_{2},a}^{[0,\overline {c}]}\subseteq \Pi _{x,c_{1,a}}^{[0, \overline{c}]}\) for any \(x\geq 0\). On the other hand, given \(0\leq x_{1}< x_{2}\) and an admissible strategy \(D_{1}\in \Pi _{x_{1},c,a}^{[0,\overline{c}]}\) for any \(c\in [ 0,\overline{c}]\), define \(D_{2}\in \Pi _{x_{2},c,a}^{[0,\overline{c}]}\) as \(D_{2,t}= D_{1.t}\) until the ruin time of the controlled process \(X^{D^{1}}\) with \(X_{0}^{D^{1}}=x_{1}\), and pay the maximum rate \(\overline{c}\) afterwards. Thus \(J(x_{1};D_{1})\leq J(x_{2};D_{2})\) and we have the result. □

Proposition 3.5

The function \(V_{a}^{\infty}(x,c)\) is nondecreasing in \(x\) and nonincreasing in \(c\). For the case \(a>0 \), we have \(\lim _{c\rightarrow \infty}V_{a}^{\infty}(x,c)=x\). Moreover, \(x\leq V_{a}^{\infty}(x,c)\leq x+ \mu /q\).

Proof

By Propositions 3.3 and 3.4, \(V_{a}^{\infty}(x,c)\) is nondecreasing in \(x\) and nonincreasing in \(c\). Let us now show that \(V_{a}^{\infty}(x,c)\geq x\). The function \(V_{a}^{\infty}(x,c)\) is bounded from below by the reward function resulting from the strategy of paying a constant rate \(n\) up to ruin. Defining \({\tau}_{n}=\inf \{t:x+(\mu -n)t+\sigma W_{t}=0\}\), one gets

where the last equality follows from Borodin and Salminen [10, Equation 2.0.1].

Finally, let us argue that \(\lim _{c\rightarrow \infty}V_{a}^{\infty}(x,c)\leq x\). For any \(\varepsilon >0\) and for each \(c\), take \(D^{c}=(D_{t}^{c})_{t\geq 0}\in \Pi _{x,c,a}^{[0,\infty )}\) such that

Then \(D^{c}\geq ac\) and the corresponding ruin time is given by

so that

hence

This yields for \(c>\mu /a\) that \(\tau ^{c}<\infty \) a.s. and \(\mathbb{E} [ \tau ^{c} ] \rightarrow 0\) as \(c\rightarrow \infty \). Therefore,

and so we have the result. □

The Lipschitz property of the function \(\overline{V}\) can now be used to prove a global Lipschitz result on the regularity of the value function.

Proposition 3.6

In both the restricted case \(\overline{c}<\infty \) and the unrestricted case \(\overline{c}=\infty \), we have

for all \(0\leq x_{1}\leq x_{2}\) and \(c_{1},c_{2}\in [ 0,\overline{c}]\) with \(c_{1}\leq c_{2}\), with \(K=\max \{\frac{e^{-1}}{q}a,1\} \overline {V}{}^{\prime }(0)\).

Proof

In the case \(\overline{c}<\infty \), by Proposition 3.4, we have

for all \(0\leq x_{1}\leq x_{2}\) and \(c_{1},c_{2}\in [ 0,\overline{c}]\) with \(c_{1}\leq c_{2}\). Let us now show that there exists \(K_{1}>0\) such that

for all \(0\leq x_{1}\leq x_{2}\). Take \(\varepsilon >0\) and \(D\in \Pi _{x_{2},c,a}^{[0,\overline{c}]}\) such that

The associated control process is given by

Let \(\tau \) be the ruin time of the process \(X^{D}\). Define \(\widetilde {D}\in \Pi _{x_{1},c,a}^{[0,\overline{c}]}\) as \(\widetilde{D}_{t}=D_{t}\) and the associated control process

Let \(\widetilde{\tau}\leq \tau \) be the ruin time of the process \(X^{\widetilde{D}}\); then \(X_{t}^{D}-X_{t}^{\widetilde{D}}=x_{2}-x_{1}\) for \(t\leq \widetilde{\tau}\). We can write

The last inequality of (3.3) involves a shift of stopping times and follows from Claisse et al. [13, Theorem 2]. Indeed, the assumptions of this theorem are satisfied because we can write our controlled process as

where \(b(s,x,d)=\mu -d\), \(\sigma (s,x,d)\equiv \sigma \) and \(W\) is a standard Brownian motion. Hence we have

So by Remark 3.2, we have (3.2) with \(K_{1}=\overline {V}{}^{\prime }(0)\).

Let us now show that given \(c_{1},c_{2}\in [ 0,\overline{c}]\) with \(c_{1}\leq c_{2}\), there exists \(K_{2}>0\) with

Take \(\varepsilon >0\) and \(D\in \Pi _{x,c_{1,a}}^{[0,\overline{c}]}\) such that

and denote by \(\tau \) the ruin time of the process \(X^{D}\). Let us consider \(\widetilde{D}\in \Pi _{x,c_{2},a}^{[0,\overline{c}]} \) as \(\widetilde{D}_{t}=\max \{D_{t},ac_{2}\}\), denote by \(X^{\widetilde{D}}\) the associated controlled surplus process and by \(\overline{\tau}\leq \tau \) the corresponding ruin time. We have \(\widetilde{D}_{s}-D_{s}\leq ac_{2}-ac_{1}\) and so \(X_{\overline{\tau}}^{D}= X_{\overline{\tau}}^{D}- X_{\overline{\tau}}^{\widetilde{D}}\leq a(c_{2}-c_{1}) \overline{\tau}\). By Remark 3.2, we have

As before, the last inequality involves a shift of stopping times and follows from Claisse et al. [13, Theorem 2]. Then

Hence we can write

So we get (3.4) with \(K_{2}=K_{1}\max _{t\geq 0}(e^{-qt}ta)=K_{1}\frac{e^{-1}}{q}a \), \(K=K_{1}\max \{\frac{e^{-1}}{q}a,1\}\). We conclude the result from (3.1), (3.2) and (3.4).

In the case \(\overline{c}=\infty \), the result follows from Proposition 3.3. □

The following lemma states the dynamic programming principle. Its proof is similar to the one of Azcue and Muler [9, Lemma 1.2].

Lemma 3.7

Given any stopping time \(\widetilde{\tau}\), we can write in both the restricted case \(\overline{c}<\infty \) and the unrestricted case \(\overline{c}=\infty \) that

We now show a Lipschitz property of \(h(a)=V_{a}^{\overline{c}}(x,c)\) in the drawdown constant \(a\in [ 0,1]\), for fixed \(x\), \(c\) and finite \(\overline{c}\).

Proposition 3.8

Given \(\overline{c}<\infty \) and \(a_{1},a_{2}\in [ 0,1]\) with \(a_{1}< a_{2}\), there exists \(K_{3}>0\) such that

with \(K_{3}=\overline {V}{}^{\prime }(0)\frac{e^{-1}}{q}\overline{c}\) only depending on \(\overline{c}\). In the case \(\overline{c}=\infty \), \(V_{a}^{\infty}(x,c)\) is continuous in \(a\in [ 0,1]\).

Proof

Consider first the case \(\overline{c}<\infty \). Take \(\varepsilon >0\) and \(D\in \Pi _{x,c,a_{1}}^{[0,\overline{c}]}\) such that

Consider \(\widetilde{D}\in \Pi _{x,c,a_{2}}^{[0,\overline{c}]} \) defined as \(\widetilde{D}_{t}=\max \{D_{t},a_{2}R_{t}\}\). Denote by \(X^{\widetilde{D}}\) the associated controlled surplus process and by \(\overline{\tau}\leq \tau \) the corresponding ruin time. We have \(0\leq \widetilde{D}_{s}-D_{s}\leq (a_{2}-a_{1})R_{s}\) and so

We can write

and we obtain the result with \(K_{3}=\overline {V}{}^{\prime }(0)\frac{e^{-1}}{q}\overline{c}\).

In the case \(\overline{c}=\infty \), we want to show that given \(\varepsilon >0\) and \(a_{1}\geq 0\), there exists \(\delta >0\) such that if \(0< a_{2}-a_{1}<\delta \), then \(V_{a_{1}}^{\infty}(x,c)-V_{a_{2}}^{\infty}(x,c)<\varepsilon \). Take \(\overline{c}_{0}\) large enough such that \(V_{a_{1}}^{\infty}(x,c)-V_{a_{1}}^{\overline{c}_{0}}(x,c)<\varepsilon /2\) and \(\delta =\varepsilon /(2\overline {V}{}^{\prime }(0)\frac{e^{-1}}{q}\overline{c}_{0})\). Given any \(a_{2}\in (a_{1},a_{1}+\delta )\), we have

□

Remark 3.9

For \(a=0\), Proposition 3.5 does not hold. Indeed, \(V_{0}^{\infty}(x,c)=\overline{V}(x)\) so that \(\lim _{c\rightarrow \infty}V_{0}^{\infty}(x,c)=\overline{V}(x)>x\). Although \(\lim _{c\rightarrow \infty }V_{a}^{\infty}(x,c)=x\) for \(a\in (0,1]\) and \(\lim _{a\rightarrow 0{+}}V_{a}^{\infty}(x,c)=V_{0}^{\infty}(x,c)\) by Proposition 3.8, the lack of the Lipschitz property of \(V_{a}^{\infty}(x,c)\) at \(a=0\) makes it possible that the iterated limits

do not coincide.

In the next result, we study the continuity of \(V_{a}^{\overline{c}}(x,c)\) with respect to \(\overline{c}\).

Proposition 3.10

Given \(\overline{c}_{1},\overline{c}_{2}\in [ 0,\infty )\) with \(\overline{c}_{1}<\overline{c}_{2}\), there exists \(K_{2}>0\) such that

for \(c\leq \overline{c}_{1}\).

Proof

Take \(\varepsilon >0\) and \(D\in \Pi _{x,c,a}^{[0,\overline{c}_{2}]}\) such that

and denote the ruin time of the process \(X^{D}\) by \(\tau \). Let us consider \(\widetilde{D}\in \Pi _{x,c,a}^{[0,\overline{c}_{1}]} \) as \(\widetilde{D}_{t}=\min \{D_{t},\overline{c}_{1}\}=\overline{c}_{1}I_{\{D_{t}> \overline{c}_{1}\}}+D_{t}I_{\{D_{t}\leq \overline{c}_{1}\}}\) for \(t\leq \tau \) and \(\widetilde{D}_{t}=\overline{c}_{1}\) for \(t>\tau \), denote by \(X^{\widetilde{D}}\) the associated controlled surplus process and by \(\overline{\tau}\geq \tau \) the corresponding ruin time. We then have \(D_{s}-\widetilde{D}_{s}\leq \overline {c}_{2}-\overline{c}_{1}\) and can deduce

□

4 The Hamilton–Jacobi–Bellman equation

In this section, we introduce the Hamilton–Jacobi–Bellman (HJB) equation for the drawdown problem. We show that the value function \(V\) defined in (1.3) is the unique viscosity solution of the corresponding HJB equation with suitable boundary conditions.

As stated in the previous section, the limit case \(a=0\) (no drawdown restriction) has been studied for both \(\overline{c}<\infty \) and \(\overline {c}=\infty \), and the case \(a=1\) (ratcheting) for \(\overline{c}< \infty \).

Define

The HJB equation associated to (1.3) for both \(\overline{c}<\infty \) and \(\overline{c}=\infty \) is given by

The inequality \(\max _{\kappa \in [ ac,c]}\mathcal{L}^{\kappa} (u)(x,c)\leq 0\) comes from the dynamic programming principle in Lemma 3.7, considering the strategies of paying dividends at a constant rate \(\kappa \in [ ac,c]\). For these strategies, the running maximum is \(c\). The inequality \(\partial _{c}u(x,c)\leq 0\) comes from the fact that the value function is nonincreasing in \(c\), and it takes into account the strategies of paying dividends at a constant rate \(\kappa \in (c,\overline{c}]\), where the running maximum increases instantaneously from \(c\) to \(\kappa \).

Note that because the operator \(\mathcal{L}^{k}\) is linear in \(k\), an alternative equivalent formulation of (4.1) is

For the ratcheting case \(a=1\), the HJB equation correspondingly simplifies to

Let us introduce the usual notion of viscosity solution for the HJB equation in both cases \(0<\overline{c}<\infty \) or \(\overline{c}=\infty \).

Definition 4.1

(a) A locally Lipschitz function \(\overline{u}:[0,\infty )\times [ 0,\overline{c})\rightarrow{ \mathbb{R}}\) is a viscosity supersolution of (4.2) at \((x,c)\in (0,\infty )\times [ 0,\overline{c})\) if any \((2,1)\)-differentiable function \(\varphi :[0,\infty )\times [ 0,\overline{c})\rightarrow{ \mathbb{R}} \) with \(\varphi (x,c)=\overline{u}(x,c)\) such that \(\overline{u}-\varphi \) reaches the minimum at \(\left ( x,c\right ) \) satisfies

The function \(\varphi \) is called a test function for a supersolution at \((x,c)\).

(b) Similarly, a locally Lipschitz function \(\underline{u}: [0,\infty )\times [ 0,\overline {c})\rightarrow{\mathbb{R}} \) is a viscosity subsolution of (4.2) at \((x,c)\in (0,\infty )\times [ 0,\overline{c})\) if any \((2,1)\)-differentiable function \(\psi :[0,\infty )\times [ 0,\overline {c}) \rightarrow{\mathbb{R}} \) with \(\psi (x,c)=\underline{u}(x,c)\) such that \(\underline{u}-\psi \) reaches the maximum at \(\left ( x,c\right ) \) satisfies

The function \(\psi \) is called a test function for a subsolution at \((x,c)\).

(c) A locally Lipschitz function \(u:[0,\infty )\times [ 0,\overline{c})\rightarrow {\mathbb{R}}\) is a viscosity solution of (4.2) at \((x,c) \in [ 0,\infty )\times [ 0,\overline{c})\) if it is both a supersolution and a subsolution at \((x,c)\).

4.1 HJB equation with bounded dividend rates

Given \(a\in (0,1]\) and \(\overline{c}<\infty \), we define in the sequel, for simplicity of exposition,

Here the state variables are the current surplus and the running maximum dividend rate. The results of this subsection for the case \(a=1\) (ratcheting dividend constraint) were already proved in Albrecher et al. [1].

The next result states that \(V\) is a viscosity solution of the HJB equation.

Proposition 4.2

The function \(V\) is a viscosity solution of (4.2) in \((0,\infty )\times [ 0,\overline{c})\).

Proof

Let us show first that \(V\) is a viscosity supersolution in \((0,\infty )\times [ 0,\overline{c})\). By Proposition 3.4, \(\partial _{c}V\leq 0\) in \((0,\infty )\times [ 0,\overline{c})\) in the viscosity sense.

Consider now \((x,c)\in (0,\infty )\times [ 0,\overline{c})\) and the admissible strategy \(D\in \Pi _{x,c}\) which pays dividends at a constant rate \(\kappa \in [ ac,c]\) up to the ruin time \(\tau \). Let \(X^{D}\) be the corresponding controlled surplus process and suppose that there exists a test function \(\varphi \) for a supersolution of (4.2) at \((x,c)\); then \(\varphi \leq V\) and \(\varphi (x,c)=V(x,c)\). We want to prove that \(\mathcal{L}^{\kappa}\mathcal{(}\varphi )(x,c)\leq 0\). For that purpose, we consider an auxiliary test function for the supersolution \(\tilde{\varphi}\) in such a way that \(\tilde{\varphi}\leq \varphi \leq V\) in \([0,\infty )\times [ 0,\overline{c}]\), \(\tilde{\varphi}=\varphi \) in \([0,2x]\) (so \(\mathcal{L}^{\kappa}\mathcal{(}\varphi )(x,c)=\mathcal{L}^{\kappa}\mathcal{(}\tilde{\varphi})(x,c)\)) and \(\mathcal{L}^{\kappa} \mathcal{(}{\tilde{\varphi}})(\,\cdot \,,c)\) is bounded in \([0,\infty )\). We introduce \(\tilde{\varphi}\) because \(\mathcal{L}^{\kappa}\mathcal{(}\varphi )( \,\cdot \,,c)\) may be unbounded in \([0,\infty )\). We construct \(\tilde{\varphi}\) as follows: take \(g:[0,\infty )\rightarrow [ 0,1]\) twice continuously differentiable with \(g=0\) in \([2x+1,\infty )\) and \(g=1\) in \([0,2x]\), and define \(\tilde {\varphi}(y,\kappa )=\) \(\varphi (y,\kappa )g(y)\). Using Lemma 3.7, we obtain for \(h>0\),

Hence using Itô’s formula gives

Since \(\tau >0\) a.s.,

and

We conclude via dominated convergence that \(\mathcal{L}^{\kappa } (\varphi )(x,c)=\mathcal{L}^{\kappa}( \tilde{\varphi })(x,c)\leq 0\) for any \(\kappa \in [ ac,c]\); so \(V\) is a viscosity supersolution at \((x,c)\).

We skip the proof that \(V\) is a viscosity subsolution in \((0,\infty )\times [ 0,\overline{c})\), because it is similar to that of [1, Proposition 3.1]. □

Let us consider the function

The next proposition gives a comparison result for the viscosity solutions of (4.2) for \(\overline{c}>0\). The proof is similar to that of [1, Lemma 3.2].

Lemma 4.3

Assume that

(i) \(\underline{u}\) is a viscosity subsolution and \(\overline{u}\) is a viscosity supersolution of the HJB equation (4.2) for all \(x>0\) and all \(c\in [ 0,\overline{c})\);

(ii) \(\underline{u}\) and \(\overline{u}\) are nondecreasing in the variable \(x\) and Lipschitz in \([0,\infty )\times [ 0,\overline{c}]\);

(iii) \(\underline{u}(0,c)=\overline{u}(0,c)=0\), \(\lim _{x\rightarrow \infty }\underline{u}(x,c)\leq \overline{c}/q \leq \lim _{x\rightarrow \infty}\overline {u}(x,c)\);

(iv) \(\underline{u}(x,\overline{c})\leq v^{\overline{c}}(x)\leq \overline{u}(x,\overline{c})\) for \(x\geq 0\).

Then \(\underline{u}\leq \overline{u}\) in \([0,\infty )\times [ 0,\overline{c})\).

The following characterisation theorem is a direct consequence of the previous lemma and Propositions 3.4 and 4.2.

Theorem 4.4

The value function \(V\) is the unique function which is nondecreasing in \(x\) and a viscosity solution of (4.2) in \((0,\infty )\times [ 0,\overline{c})\) with \(V(0,c)=0\), \(V(x, \overline{c})=v^{\overline{c}}(x)\) and \(\lim _{x\rightarrow \infty}\) \(V(x,c)=\overline{c}/q\) for \(c\in [ 0,\overline{c})\).

From Definition 1.3, Lemma 4.3 and Proposition 3.4 together with Proposition 4.2, we also get the following verification theorem.

Theorem 4.5

Let \(\{ C_{x,c}\in \Pi _{x,c}:(x,c)\in [ 0,\infty )\times [ 0, \overline{c}] \} \) be a family of strategies. If the function \(W(x,c):=J(x;C_{x,c})\) is a viscosity supersolution of the HJB equation (4.2) in \((0,\infty )\times [ 0,\overline{c})\) with \(\lim _{x\rightarrow \infty}W(x,c)=\) \(\overline{c}/q\), then \(W\) is the value function \(V\). Also, if for each \(k\geq 1\), there exists a family \(\{ C_{x,c}^{k}\in \Pi _{x,c}:(x,c)\in [ 0,\infty )\times [ 0,\overline{c}] \} \) of strategies such that \(W(x,c):=\lim _{k\rightarrow \infty}J(x;C_{x,c}^{k})\) is a viscosity supersolution of the HJB equation (4.2) in \((0,\infty )\times [ 0,\overline{c})\) with \(\lim _{x \rightarrow \infty}W(x,c)=\overline{c}/q\), then \(W\) is the value function \(V\).

4.2 HJB equation with unbounded dividend rates

Let us now consider the case \(\overline{c}=\infty \) with \(a\in (0,1]\). Since \(a\) is fixed, we denote \(V^{\infty}= V_{a}^{\infty}\). The proof of the following result is similar to that of the case with bounded dividend rate.

Proposition 4.6

The function \(V^{\infty}\) is a viscosity solution of (4.2) for any \((x,c)\in (0,\infty )\times [ 0,\infty )\).

We now state a comparison result for the unbounded case.

Lemma 4.7

Assume that

(i) \(\underline{u}\) is a viscosity subsolution and \(\overline{u}\) is a viscosity supersolution of the HJB equation (4.2) for all \(x>0\) and for all \(c\in [ 0,\infty )\);

(ii) \(\underline{u}\) and \(\overline{u}\) are nondecreasing in the variable \(x\) and Lipschitz in \([0,\infty )\times [ 0,\infty )\);

(iii) \(\underline{u}(0,c)=\overline{u}(0,c)=0\);

(iv) \(~\underline{u}(x,c)\leq x+{\mu}/{q}\), \(x\leq \overline{u}(x,c)\);

(v) \(\lim _{c\rightarrow \infty }\underline{u}(x,c)\leq x \leq \lim _{c\rightarrow \infty}\overline{u}(x,c)\) for \(x\geq 0\).

Then \(\underline{u}\leq \overline{u}\) in \([0,\infty )\times [ 0,\infty )\).

Proof

Suppose there is \((x_{0},c_{0})\in (0,\infty )\times (0,\infty )\) with \(\underline{u}(x_{0},c_{0})-\overline{u}(x_{0},c_{0})>0\). Let us define

for any \(s>1\). We have

for \(s\in (1,2)\).

Let us now show that \(\overline{u}^{s}\) is a strict supersolution. We have that \(\varphi \) is a test function for the supersolution \(\overline{u}\) at \((x,c)\) if and only if \(\varphi ^{s}:=s\,h(c)\,\varphi \) is a test function for the supersolution \(\overline{u}^{s}\) at \((x,c)\). Moreover,

for \(\kappa \in [ ac,c]\), and

since \(\varphi (x,c)=\overline{u}(x,c)\geq x>0\).

Take \(s_{0}>1\) such that \(\underline{u}(x_{0},c_{0})-\overline{u}^{s_{0}}(x_{0},c_{0})>0\). We define

Let us show that

for some positive \(b\) and \(c_{1}\). Since \(\underline{u}(x,c)\leq x+ \frac{\mu }{q}\) and \(x\leq \overline{u}(x,c)\),

for \(x\) large enough; so there exists \(b>x_{0}\) such that

Besides, the function

satisfies lim sup \(_{c\rightarrow \infty}\) \(g(c)\leq 0\) because \(\lim _{c\rightarrow \infty}\underline{u}(x,c)\leq x\leq \lim _{c \rightarrow \infty}\overline{u}(x,c)\) for \(x\geq 0\). So there exists \(c_{1}>0\) with \(g(c)\leq \frac{M}{2}\) for \(c\geq c_{1}\) and we deduce (4.5). Hence the maximum is attained in a bounded set, that is,

This yields a contradiction by following the arguments of the proof of [1, Lemma 3.2]. □

As for bounded dividend rates, the following result is a direct consequence of the previous lemma, Remark 3.5 and Proposition 4.6.

Theorem 4.8

The value function \(V^{\infty}\) is the unique function which is nondecreasing in \(x\) and a viscosity solution of (4.2) in \((0,\infty )\times [ 0,\infty )\) with \(V^{\infty}(0,c)=0\), \(V^{\infty}(x,\overline{c})-x \) bounded and \(\lim _{c\rightarrow \infty}\) \(V^{\infty}(x,c)=x\).

From Definition 1.3, Lemma 4.7 and Remark 3.5 together with Proposition 4.6, we also get the following verification theorem.

Theorem 4.9

Consider a family \(\{ C_{x,c}\in \Pi _{x,c}:(x,c)\in [ 0, \infty )\times [ 0,\infty ) \}\) of strategies. If the function \(W(x,c):=J(x;C_{x,c})\) is a viscosity supersolution of the HJB equation (4.2) in \((0,\infty )\times [ 0,\infty )\) with \(W(x,c)\geq x\), then \(W\) is the value function \(V^{\infty}\). Also, if for each \(k\geq 1\), there exists a family \(\{ C_{x,c}^{k}\in \Pi _{x,c}:(x,c)\in [ 0,\infty )\times [ 0,\infty )\}\) of strategies such that \(W(x,c):=\lim _{k\rightarrow \infty}J(x;C_{x,c}^{k})\) is a viscosity supersolution of the HJB equation (4.2) in \((0,\infty )\times [ 0,\infty )\) with \(W(x,c)\geq x\), then \(W\) is the value function \(V^{\infty}\).

5 Refracting dividend strategies and \(v^{\overline{c}}\)

In the case \(0<\overline{c}<\infty \) and \(a\in (0,1)\), we now want to investigate further the function \(v^{\overline{c}}\) (defined in (4.4)) of paying dividends with rates \(\kappa \in [ a\overline{c},\overline{c}]\) in an optimal way. The following characterisation is the one-dimensional version of Theorem 4.4.

Proposition 5.1

The function \(v^{\overline{c}}:[0,\infty )\rightarrow {\mathbb{R}}\) is the unique viscosity solution of

with boundary conditions \(W(0)=0\) and \(\lim _{x\rightarrow \infty}W(x)=\overline{c}/q\).

We present in this section a formula for \(v^{\overline{c}}\), which turns out to be the reward function of the optimal refracting strategy as derived in Albrecher et al. [3].

The functions \(W\) that satisfy \(\mathcal{L}^{\kappa}(W)=0\) are given by

where \(\theta _{1}(\kappa )>0\) and \(\theta _{2}(\kappa )<0\) are the roots of the characteristic equation

associated to the operator \(\mathcal{L}^{\kappa}\), that is,

Basic properties of \(\theta _{1}(\kappa )\) and \(\theta _{2}(\kappa )\) are that

-

1)

\(\theta _{1}(\kappa )=-\theta _{2}(\kappa )\) if \(\kappa =\mu \), and \(\theta _{1}^{2}(\kappa )\geq \theta _{2}^{2}( \kappa )\) if and only if \(\kappa -\mu \geq 0\);

-

2)

\(\theta _{1}^{\prime}(\kappa )=\frac{1}{\sigma ^{2}}(1+ \frac{\kappa -\mu }{\sqrt{(\kappa -\mu )^{2}+2q\sigma ^{2}}})\) and \(\theta _{2}^{\prime}(\kappa )=\frac{1}{\sigma ^{2}}(1- \frac{\kappa -\mu}{\sqrt{(\kappa -\mu )^{2}+2q\sigma ^{2}}})\) so that \(\theta _{1}^{\prime}(\kappa ),\theta _{2}^{\prime }(\kappa )\in (0, \frac{2}{\sigma ^{2}})\).

The solutions of \(\mathcal{L}^{\kappa}(W)=0\) with boundary condition \(W(0)=0\) are of the more specific form

Finally, the unique solution of \(\mathcal{L}^{\kappa}(W)=0\) with boundary conditions \(W(0)=0\) and \(\lim _{x\rightarrow \infty}\) \(W(x)=\kappa /q \) corresponds to \(A=0\), so that

Note that this function is increasing and concave in \([0,\infty )\). In [3, Theorem 3.1], the reward function of a ‘refracting strategy’ that pays \(a\overline{c}\) when the current surplus is below a refracting threshold \(b\) and pays \(\overline{c}\) when the current surplus is above \(b\) was shown to be

where

The optimal threshold \(b^{\ast}(\overline{c})\) is given by

(note that since the underlying process \(X\) has no upward jumps, that value does not depend on \(x\)). In case (5.6) is positive, then by (5.4) the value of \(b\) satisfies

From [3], we know that the threshold can be characterised as the unique \(b\) such that \(v(x,\overline{c},b)\) is twice continuously differentiable in \(x=b\). Since \(v(x,\overline{c},b^{\ast}(\overline{c}))\) is twice continuously differentiable with \(v(0,\overline {c},b^{\ast}(\overline{c}))=0\), we therefore obtain \(\lim _{x\rightarrow \infty}v(x,\overline {c},b^{\ast}( \overline{c}))=\overline{c}/q\) and \(v(x,\overline{c},b^{*}(\overline{c}))\) is also a solution of

By Proposition 5.1, we have

that is, the strategy achieving \(v^{\overline{c}}\) has a ‘refracting’ threshold structure with optimal threshold \(b^{\ast}(\overline{c})\). Note also that since \(v^{\overline{c}}\) is twice continuously differentiable at \(b^{\ast}(\overline{c})\) and \(\mathcal{L}(v^{\overline{c}})(b^{\ast }(\overline{c}))=\mathcal{L}^{a \overline{c}}(v^{\overline{c}})(b^{\ast }(\overline{c}))=0\), we have \(\partial _{x}v^{\overline{c}}(b^{\ast}(\overline {c}))=1\). Also, since

we obtain

6 Curve strategies and the optimal two-curve strategy for bounded dividend rates

Using the formulas of the previous section, we can find the value function defined in (4.3). The proofs of all the results of this section together with the auxiliary lemmas used in these proofs are deferred to Appendix A. We also include in that appendix some explicit formulas.

Remark 6.1

Before proceeding, note that this optimisation problem is only interesting for \(\overline{c}>q\sigma ^{2}/(2\mu )\) as for smaller values of \(\overline{c}\), we know from Asmussen and Taksar [7, Eq. (1.8)] (translated to our notation) that even without a drawdown constraint, it is optimal to pay dividends at the maximal rate \(\overline{c}\) until the time of ruin. This is then also the optimal strategy in our situation, as the drawdown constraint does not affect its applicability. Indeed, and as a self-contained derivation of this result in the present context, the reward function of that strategy fulfils

for both \(\kappa =ac\) and \(\kappa =c\). So by Proposition 5.1, \(v^{\overline{c}}(x)=\frac{\overline{c}}{q} ( 1-e^{\theta _{2}(\overline{c})x} ) =: U(x,c) \) and \(b^{\ast}(\overline{c})=0\). By Theorem 4.4, it is then sufficient to prove that

for any \(c\in [ 0,\overline{c})\); but this follows from (6.1).

In the rest of this paper, we therefore assume that \(\overline{c}>\frac{q\sigma ^{2}}{2\mu}\).

Since \(V(x,c)\) solves the HJB equation (4.2), it satisfies either \(\mathcal{L}^{ac}(V)(x,c)=0\) or \(\mathcal{L}^{c}(V)(x,c)=0\) or \(\partial _{c}V(x,c)=0\). This suggests that the state space \([0,\infty )\times [ 0,\overline{c}]\) is partitioned into two regions: a non-change running maximum dividend region \(\mathcal{NC}^{ \ast}\) in which the running maximum dividend rate \(c\) does not change, and a change dividend region \(\mathcal{CH}^{\ast}\) in which the dividend rate exceeds \(c\) (so that the running maximum dividend rate increases). Moreover, the region \(\mathcal{NC}^{\ast}\) splits into two connected subregions: \(\mathcal{NC}_{ac}^{\ast}\) in which the dividends are paid at the constant rate \(ac\), and \(\mathcal{NC}_{c}^{\ast}\) in which the dividends are paid at the constant rate \(c\).

Roughly speaking, the interior of the region \(\mathcal{NC}_{ac}^{\ast}\) consists of the points \((x,c)\) in the state space where \(\mathcal{L}^{ac}(V)(x,c)=0\), \(\mathcal{L}^{c}(V)(x,c)<0\) and \(\partial _{c}V (x,c)<0\); the interior of the region \(\mathcal{NC}_{c}^{\ast}\) consists of the points where \(\mathcal{L}^{c}(V)(x,c)=0\), \(\mathcal{L}^{ac}(V)(x,c)<0\) and \(\partial _{c}V (x,c)<0\); and the interior of \(\mathcal{CH}^{\ast}\) consists of the points where \(\partial _{c}V (x,c)=0\), \(\mathcal{L}^{c}(V)(x,c)<0\) and \(\mathcal{L}^{ac}(V)(x,c)<0\). We introduce a family of two-curve strategies (or limits of two-curve strategies) where the different dividend payment regions are connected and are defined by two free boundary curves.

Consider a function \(\gamma :[0,\overline{c}]\rightarrow (0,\infty )\) which is continuously differentiable, and a function \(\zeta :[0,\overline{c}]\rightarrow (0,\infty )\) which is bounded, Riemann-integrable and càdlàg. Define the set

In the first part of this section, we define a function \(W^{\gamma ,\zeta}:[0,\infty )\times [ 0,\overline{c}] \rightarrow [ 0,\infty )\) for each \((\gamma ,\zeta )\in \) ℬ. We shall see that in some sense, \(W^{\gamma ,\zeta}(x,c)\) is the reward function of the two-curve strategy which pays dividends at the constant rate \(ac\) for the points to the left of the curve \(\mathcal{R}(\gamma )\), pays dividends at the constant rate \(c\) between the curves \(\mathcal{R}(\gamma )\) and \(\mathcal{R}(\zeta )\), and pays more than \(c\) as dividend rate otherwise, where

Hence the curves \(\mathcal{R}(\gamma )\) and \(\mathcal{R}(\zeta )\) split the state space \([0,\infty )\times [ 0,\overline{c})\) into three connected regions, namely

where dividends are paid with the constant rate \(ac\),

where dividends are paid with the constant rate \(c\), and

cf. Fig. 1. We set \(\mathcal{NC(\gamma},\mathcal{\zeta )=NC}_{ac}\mathcal{(\gamma}, \mathcal{\zeta )\cup NC}_{c}\mathcal{(\gamma },\mathcal{\zeta )}\).

In the second part of this section, we use calculus of variations to look for a pair \(( \mathcal{\gamma}^{0},\zeta ^{0} ) \in \mathcal{B}\) which maximises the reward function \(W^{\mathcal{\mathcal{\gamma}},\mathcal{\mathcal{\zeta}}}\) among all \(( \mathcal{\gamma},\zeta ) \in \) ℬ.

In order to define \(W^{\mathcal{\mathcal{\gamma}},\mathcal{\mathcal{\zeta}}}\) in the non-change regions \(\mathcal{NC}_{ac}\mathcal{(\gamma},\mathcal{\zeta )}\) and \(\mathcal{NC}_{c}\mathcal{(\mathcal{\mathcal{\gamma}}},\mathcal{\mathcal{\mathcal{\zeta}})}\), we need to introduce some auxiliary functions. Let us consider the set

and the functions \(b_{0}\), \(b_{1}:T\times [ 0,\infty )\times [ 0,\overline {c}] \rightarrow{\mathbb{R}}\) defined by

where the functions \(d\) and \(b_{00},b_{01},b_{10},b_{11}\) are defined in (A.1) and (A.2) below. In Lemma A.1 below, we show that the function \(d\) is positive so that \(b_{0}\) and \(b_{1}\) are well defined.

In the next result, we define and study the functions \(H^{\mathcal{\mathcal{\gamma}},\mathcal{\mathcal{\zeta}}}\) and \(A^{\mathcal{\mathcal{\gamma}},\mathcal{\mathcal{\zeta}}}\) that will be used to define \(W^{\gamma ,\zeta}\).

Proposition 6.2

For any given \((\gamma ,\mathcal{\mathcal{\zeta}})\in \mathcal{B}\), there exists a unique continuous function \(H^{\gamma ,\zeta}:[0, \infty )\times [ 0,\overline{c}]\rightarrow [ 0,\infty )\) with \(H^{\gamma ,\zeta}(\,\cdot \,,c)\) continuously differentiable which satisfies for any \(c\in [ 0,\overline{c})\) that

with the boundary conditions \(H^{\gamma ,\zeta}(0,c)=0\), \(H^{\gamma ,\zeta }(x,\overline{c})=v(x,\overline{c},\gamma ( \overline{c}))\) and \(\partial _{c}H^{\gamma ,\zeta}(\zeta (c),c)=0 \) at the points of continuity of \(\zeta \). It is given by

where \(f_{10}\), \(f_{11},f_{20},f_{21}\) are defined in (A.3)–(A.6) below,

and

where the function \(B\) is defined in (5.5) and the functions \(b_{0}\) and \(b_{1}\) are defined in (6.2). Moreover, \(A^{\mathcal{\mathcal{\gamma}},\mathcal{\mathcal{\zeta}}}\) is differentiable and satisfies

at the points where \(\zeta \) is continuous. Moreover, it satisfies the boundary condition (6.5).

Given \((\gamma ,\zeta )\in \mathcal{B}\), we define

where \(H^{\gamma ,\zeta}\) is defined in Proposition 6.2 and

for \(x\geq \zeta (c)\) and \(c\in [ 0,\overline{c})\); cf. Fig. 2.

In Appendix A, we show by using a Feynman–Kac argument that \(W^{\gamma ,\zeta}(x,c)\) is a uniform limit of reward functions of admissible strategies by constructing a sequence of step functions \(\zeta _{k}\) converging to \(\zeta \). See Definition A.2 and Lemmas A.3 and A.4.

Remark 6.3

Given a \((\gamma ,\zeta )\in \mathcal{B}\) where \(\zeta \) is not a step function, we say that \(W^{\gamma ,\zeta}\) is the reward function of the two-curve strategy \(\mathbf{\pi}^{(\gamma ,\zeta )}\) which starts with an initial surplus \(x\) and initial running maximum dividend rate \(c\). Then

(1) in the case \(0\leq x<\zeta (c)\), it follows the refracting strategy which pays \(ac\) when the current surplus is below a refracting threshold \(\gamma (c)\), and pays \(c\) when the current surplus is above \(\gamma (c)\), until either reaching the curve \(\mathcal{R(\zeta )}\) or ruin (whichever comes first);

(2) in the case \(x>\zeta (c)\), it increases immediately the dividend rate from \(c\) to \(\ell (x,c)\);

(3) in the case \(x=\zeta (c)\), it can be seen as the limit of admissible strategies \(\mathbf{\pi}_{x,c}^{(\gamma ,\zeta _{k})}\in \Pi _{x,c}\) arising from Lemma A.4 in Appendix A.

We now look for the maximum of \(W^{\gamma ,\zeta}\) among \((\gamma ,\zeta )\in \mathcal{B}\). Let us see that if there exists a pair \((\gamma _{0},\zeta _{0})\in \mathcal{B}\) such that

then \(W^{\gamma _{0},\zeta _{0}}(x,c)\geq W^{\gamma ,\zeta}(x,c)\) for all \((x,c)\in [ 0,\infty )\times [ 0,\overline{c}] \) and \((\gamma ,\zeta )\in \mathcal{B}\).

From Lemma A.1 and \(\theta _{2}>0>\theta _{1}\), we obtain that \(f_{11}\) and \(f_{21}\) defined in (A.4) and (A.6) are positive, and so by (6.3) and (6.6),

This implies that \(\operatorname*{arg\,max}_{(\gamma ,\zeta )\in \mathcal{B}}W^{\gamma ,\zeta }(x,c)\) does not depend on the initial capital \(x\). In addition, it also does not depend on the initial value \(c\); this follows from Lemma A.5, where we prove that the pair of functions \((\gamma _{0},\zeta _{0})\) which maximises (6.7) also maximises \(A^{\gamma ,\zeta}(c)\) for any \(c\in [ 0,\overline{c})\). Let us now find the implicit equation for the function \(A^{\gamma _{0},\zeta _{0}}\) for \((\gamma _{0},\zeta _{0})\) satisfying (6.7).

Proposition 6.4

If a pair \((\gamma _{0},\zeta _{0})\) as in (6.7) exists, then \(A^{\gamma _{0},\zeta _{0}}(c)\) satisfies

where for \(i=0,1\),

Moreover, \(\gamma _{0}(\overline{c})=b^{\ast}(\overline{c})\) is the optimal threshold defined in (5.6) and

Proposition 6.5

Consider the functions \(C_{0}\) and \(C_{ij}\) for \(i=1,2\) and \(j=0,1,2\) defined in (A.8)–(A.11). If \((\gamma _{0},\zeta _{0})\in \mathcal{B} \) defined in (6.7) satisfies that \(\zeta _{0}\) is continuous and

for \(c\in [ 0,\overline{c}]\), then \(\gamma _{0} \) and \(\zeta _{0}\) are infinitely differentiable and \((\gamma _{0},\zeta _{0})\) is a solution of the system of ODEs

with boundary conditions

where \(b^{\ast}(\overline{c})\) is the optimal threshold defined in (5.6).

Let us study the uniqueness of the solution of (6.12) with boundary condition (6.13). We know that if \(\left ( \gamma ,\zeta \right ) \in \mathcal{B}\) is a solution, then \(\gamma (\overline {c})=b^{\ast}(\overline{c})\), the optimal threshold defined in (5.6). In order to obtain \(\zeta (\overline{c})\), we have to find a zero of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\). Let us assume that there exists a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\). In the next result, we show that under this assumption, the existence of a solution \(( \gamma ,\zeta ) \) of (6.12) implies its uniqueness.

In Sect. 7, we show that there is a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\) for \(\overline{c}\) large enough. Also, we check this assumption in the numerical examples for each set of parameters.

Proposition 6.6

Assume that there exists a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\). If \(( \gamma _{1},\zeta _{1} ) \in \mathcal{B} \) and \(( \gamma _{2},\zeta _{2} ) \in \mathcal{B}\) are two solutions of the system (6.12) of differential equations with boundary conditions (6.13), then \(( \gamma _{1},\zeta _{1} ) = ( \gamma _{2},\zeta _{2} ) \).

Let us now introduce a lower bound \(\underline{c}\) for the dividend rate (to be specified later), and denote by \(( \overline{\gamma},\overline{\zeta } ) \) a solution of (6.12) in \([\underline {c},\overline{c}]\) with boundary conditions (6.13).

Remark 6.7

Since the functions \(C_{ij}\) defined in (A.10) and (A.11) are infinitely differentiable, a recursive argument establishes that \(\overline{\gamma}\) and \(\overline{\zeta}\) are also infinitely differentiable.

The next result says that the reward function \(W^{\overline {\gamma},\overline{\zeta}}\) satisfies a smooth-pasting property on the two free-boundary curves. Note that this extends Albrecher et al. [1, Prop. 5.13] from the ratcheting case with one free boundary to our present drawdown case. For a general account on conditions for smooth-pasting when the value function is not necessarily smooth, see e.g. Guo and Tomecek [22].

Proposition 6.8

If a pair of infinitely differentiable functions \((\gamma ,\zeta )\in \mathcal{B}\) satisfies

then \((\gamma ,\zeta ) \) is a solution of both (6.8) and (6.9) in \([\underline{c},\overline{c}]\) with boundary conditions (6.13). Moreover, \(\partial _{x}(W^{\gamma ,\zeta})(\gamma (c),c)=1\) for \(c\in [ \underline{c} ,\overline{c}]\). Conversely, let \((\bar{\gamma},\bar{\zeta}) \) be a solution of (6.12) in \([\underline{c},\overline{c}]\) with boundary conditions (6.13). Then \(W^{\bar {\gamma},\bar{\zeta}}\) satisfies the smooth-pasting properties

The next result shows more regularity for \(W^{\overline{\gamma },\overline{\zeta}}\) if \(\overline{\zeta}\) is strictly monotone.

Proposition 6.9

If \((\overline{\gamma},\overline{\zeta}) \) is a solution of (6.12) in \([\underline{c},\overline{c}]\) with boundary conditions (6.13) and \(\overline {\zeta}{}^{\prime}(c)\neq 0\) in \([\underline{c},\overline{c}]\), then \(W^{\overline{\gamma},\overline{\zeta}}\) is \((2,1)\)-differentiable.

The next theorem is the main result of this section.

Theorem 6.10

Let \((\overline{\gamma},\overline{\zeta}) \) be a solution of (6.12) in \([\underline{c},\overline{c}]\) with boundary conditions (6.13) such that the function \(W^{\overline{\gamma},\overline{\zeta}}\) is \((2,1)\)-differentiable and satisfies

for \(c\in [ \underline{c},\overline{c})\). Then \(W^{\overline{\gamma},\bar{\zeta}}=V\).

Remark 6.11

We conjecture that there is always a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\) for \(\overline {c}>\) \(q\sigma ^{2}/(2\mu )\), that there exists a solution \(( \overline{\gamma},\overline{\zeta} ) \in \mathcal{B}\) of the system of differential equations (6.12) satisfying the boundary conditions (6.13), and that the reward function \(W^{\overline{\gamma},\overline{\zeta}}\) is a viscosity supersolution of the HJB equation (4.2). If that holds, \((\overline{\gamma },\overline{\zeta})=(\gamma _{0},\zeta _{0})\) and \(W^{\overline{\gamma },\overline{\zeta}}\) is the value function \(V\). Moreover, the optimal strategy is then a two-curve strategy. In Sect. 8, we show that that this conjecture always holds in \([ \underline{c},\overline{c} ] \) for \(\overline{c}\) large enough and some suitable \(\underline{c}<\overline{c}\), and in Sect. 9, we also show numerically that it is true for further instances.

7 Asymptotic values as \(\overline{c}\rightarrow \infty \)

The symbolic computations of this section are highly involved; so we use the Wolfram Mathematica software to obtain Taylor expansions. Note that all results of this section are derived for \(0< a<1\), and the resulting expressions need not necessarily be applicable for the limit to \(a=1\), as dominant terms in the asymptotics may change.

Recall the boundary condition \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline {c})=0\) of the differential equation (6.12); cf. (6.13). Note that for \(\overline{c}>\frac{q\sigma ^{2}}{2\mu}\), we have from Remark 6.1 that \(b^{\ast}(\overline{c})\) is the unique positive \(b\) satisfying (5.7). In this section, we show that there is a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline {c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\) for \(\overline{c}\) large enough and that

We also show ↘-\(\lim _{\overline{c}\rightarrow \infty}V_{a}^{ \overline{c}}(x,\overline{c}) = x\) for \(0< x<\lim _{\overline{c}\rightarrow \infty }z^{\ast}(\overline{c})=\frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\) and ↗-\(\lim _{\overline{c}\rightarrow \infty}V_{a}^{ \overline{c}}(x,\overline {c})= x\) for \(x>\lim _{\overline{c}\rightarrow \infty}z^{\ast}(\overline{c})=\frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\).

In the rest of the section, we denote \(V_{a}^{\overline{c}}\) by \(V^{\overline {c}}\).

Proposition 7.1

It holds that \(\lim _{\overline {c}\rightarrow \infty}b^{\ast}(\overline{c})=\mu /q\). More precisely, the Taylor expansion of \(b^{\ast}(\overline{c})\) at \(\overline{c}=\infty \) is given by

Proof

We have from (5.6) that

But

where

Let us define \(F_{0}(\overline{c},b):=E(\overline{c},b)/e^{\theta _{1}(a \overline{c})b}\). The Taylor expansions of \(\theta _{1}(c)\) and \(\theta _{2}(c)\) in (5.2) at \(c=\infty \) are given by

Let us prove first that there is no sequence \(b^{\ast}(c_{n})\rightarrow \infty \) with \(c_{n}\rightarrow \infty \). Using (7.4), we obtain

First, let us assume that \(b^{\ast}(c_{n})=c_{n} \alpha _{n} \) with \(\alpha _{n}\rightarrow \overline{\alpha}\in (0,\infty )\). Then since \(1-e^{-\frac{q\overline{\alpha}}{a}} >0\) and \(a<1\),

which is a contradiction. Secondly, let us assume that \(b^{\ast}(c_{n})=c_{n} \alpha _{n} \) with \(\alpha _{n}\rightarrow \infty \). Then since \(e^{-\frac{qb^{\ast}(c_{n})}{ac_{n}}}\rightarrow 0\), we have \(0=\lim _{n\rightarrow \infty}F_{0}(c_{n},b^{\ast}(c_{n}))=-\infty \) which is also a contradiction. Finally, let us assume that \(b^{\ast}(c_{n})=c_{n} \alpha _{n} \) with \(\alpha _{n}\rightarrow 0{+}\). Then

gives again a contradiction. Hence \(\lim \sup _{\overline{c}\rightarrow \infty}b^{\ast}(\overline{c})< \infty \).

Let us define the function \(H_{0}:[0,\infty )\times (0,\infty )\rightarrow \mathbb{R}\) as

Then \(H_{0}(u,b)\) is infinitely continuously differentiable because it is infinitely continuously differentiable for \(u>0\) and \(\lim _{u\rightarrow 0{+}}F_{0}(\frac{1}{u},b)=4(a-1)aq(qb-\mu )/\sigma ^{4}<\infty \). Moreover, its first-order Taylor expansion at \(u = 0\) is given by

From (7.2), we obtain \(H_{0}(u,b^{\ast}(1/u))=0~\) for \(u>0\). Let us show that we have \(\lim _{u\rightarrow 0{+}}b^{ \ast}(1/u)=\mu /q\). We have already seen that \(b^{\ast}(1/u) \) is bounded for \(u\) \(\in [ 0,\varepsilon )\) for some \(\varepsilon >0\). Take any sequence \(u_{n}\rightarrow 0{+}\) with \(\lim _{n\rightarrow \infty}b^{\ast}(1/u_{n})=b_{0}<\infty \); then

and so \(b_{0}=\mu /q\). Using that \(\partial _{b}H_{0}(0,b)=\frac{4(a-1)aq^{2}}{\sigma ^{4}}\neq 0\), we conclude by the implicit function theorem that the function \(h:[0,\infty )\rightarrow \mathbb{R}\) defined as \(h(0)=\frac{\mu}{q}\) and \(h(u)= b^{\ast}(\frac{1}{u})\) for \(u>0\) is infinitely continuously differentiable, and the result follows. □

Proposition 7.2

There exists a unique zero \(z^{\ast }(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot ,\overline{c})\) in \((b^{\ast}(\overline{c}),\infty )\) for \(\overline{c}\) large enough with \(\lim _{\overline{c}\rightarrow \infty}z^{\ast}(\overline{c})= \frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\). More precisely, \(z^{\ast}(\overline{c})\) is infinitely continuously differentiable for \(\overline{c}\) large enough, and its first-order Taylor expansion at \(\overline{c}=\infty \) is given by

Proof

Considering the functions \(C_{0}(y,z,c)\) defined in (A.8) and \(E(c,y)\) defined in (7.3), we define

Since \(E(\overline{c},b^{\ast}(\overline{c}))=0\), \(\theta _{2}(c)- \theta _{1}(c)<0\) and \(d(y,z,c)>0\), we see that the property \(C_{0}(b^{ \ast}(\overline {c}),z^{\ast}(\overline{c}),\overline{c})=0\) is equivalent to \(\tilde{C}_{0}(b^{\ast}(\overline{c}),z^{\ast}(\overline{c}),\overline{c})=0\). We can write

where the \(m_{i}(y,z,c)\) are of the form

and \(m_{i0}(y,c)\), \(m_{i1}(y,c)\) are polynomials in \(\theta _{1}(c)\), \(\theta _{2}(c)\), \(\theta _{1}(ac)\), \(\theta _{2}(ac)\), \(\theta _{1}^{\prime}(c)\), \(\theta _{2}^{\prime}(c)\), \(\theta _{1}^{\prime}(ac)\), \(\theta _{2}^{\prime}(ac)\), \(y\), \(c\), \(a\). The functions \(g_{i}(y,z,c)\) in (7.6) are positive linear combinations of \((z-y)\theta _{1}(c)\), \((z-y)\theta _{2}(c)\), \(y\theta _{1}(ac)\) and \(y\theta _{2}(ac)\), with the concrete form given in Appendix B. Define

Let us show first that there is no sequence \((z_{n},c_{n})\) with \(z_{n}>b^{\ast}(c_{n})\) such that \(C_{0}(b^{\ast}(c_{n}),z_{n},c_{n})=0\), \(c_{n}\rightarrow \infty \) and \(z_{n}\rightarrow \infty \). From the definitions of the exponents \(g_{i}\) given in Appendix B and the expressions (7.4), we have that

because the other terms are negligible. We can write

and

If \(z_{n}\rightarrow \infty \), \(c_{n}\rightarrow \infty \) with \(b^{\ast}(c_{n})\rightarrow \frac{\mu}{q}\), we deduce that

First, assume that \(z_{n}=c_{n} \alpha _{n} \) with \(\alpha _{n}\rightarrow \overline{\alpha}\in (0,\infty )\). Then \(e^{-q \overline {\alpha}}(e^{q\overline{\alpha}}-1-q\overline{\alpha})>0\) and \(a<1\) yield

which is a contradiction. Secondly, assume that \(z_{n}=c_{n}\alpha _{n} \) with \(\alpha _{n}\rightarrow \infty \). Then since

we have

which is also a contradiction. Finally, assume that \(z_{n}=c_{n}\alpha _{n} \) with \(\alpha _{n}\rightarrow 0{+}\). Then

which is also a contradiction. Hence there is no such sequence \((z_{n},c_{n})\).

Using the Taylor expansions of \(\theta _{1}(\overline{c})\), \(\theta _{2}(\overline{c}) \) and \(b^{\ast}(\overline{c})\) at \(\overline{c}=\infty \) given in (7.4) and Proposition 7.1, we find that the function

is infinitely continuously differentiable, because it is infinitely continuously differentiable for \(u>0\) and

Moreover, its first-order power series expansion is given by

Since the only zero of \(H_{1}(z,0)\) in \([\frac{\mu}{q},\infty )\) is \(\frac {\mu}{q}(1+\frac{1}{\sqrt{a}})\) and

for \(z\geq \frac{\mu}{q}\), we conclude by the implicit function theorem that there exist \(\varepsilon >0\) and a unique infinitely continuously differentiable function \(g:[0,\varepsilon )\rightarrow \mathbb{R}\) with \(g(0)= \frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\) and \(H_{1}(g(u),u)=0\) for \(u\in [ 0,\varepsilon )\). In addition, \(g(u)\) is the unique zero of \(H_{1}(\,\cdot \,,u)\) in a neighbourhood \(U\) of \((\frac{\mu}{q}(1+\frac{1}{\sqrt{a}}),0)\). Moreover, the first-order Taylor expansion of \(g\) at \(u=0\) is given by

Let us now show that \(g(u)\) is the only zero of \(H_{1}(\,\cdot \,,u)\) in \((b^{\ast }(1/u),\infty )\) for \(u\) small enough. If this were not the case, there would be a sequence \((z_{n},u_{n})_{n\geq 1}\) with \(z_{n}>b^{\ast}(1/u_{n})\), \(z_{n}\neq g(u_{n})\) such that \(u_{n}\searrow 0\) and \(H_{1}(z_{n},u_{n})=0\). If there exists a convergent subsequence \((z_{n_{k}})\) with \(z_{n_{k}}\rightarrow z_{0}\in [ \frac{\mu}{q},\infty )\), then \(H_{1}(z_{0},0)=0\) by continuity and so \(z_{0}=g(0)=\frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\) which is a contradiction because \((z_{n_{k}},u_{n_{k}})\notin U\) for \(k\) large enough. So \(z_{n}\rightarrow \infty \) and this is also a contradiction. So from (7.7), we get the result. □

Proposition 7.3

There exists a unique zero \(x^{\ast} (\overline{c})\) of \(\partial _{\overline{c}}V^{\overline{c}}(x,\overline{c})\) in \((0,\infty )\) for \(\overline{c}\) large enough with \(x^{\ast}(\overline {c})>b^{\ast}(\overline{c})\) and \(\lim _{\overline{c}\rightarrow \infty}x^{\ast }(\overline{c})= \frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\). More precisely, \(x^{\ast}(\overline{c})\) is infinitely continuously differentiable for \(\overline{c}\) large enough and its first-order Taylor expansion at \(\overline{c}=\infty \) is given by

Moreover, we have

Proof

From (5.4), we have that

and from Proposition 7.1, we know that ↗-\(\lim _{\overline{c}\rightarrow \infty}b^{\ast}( \overline{c}) = \mu /q\).

Take \(x<\mu /q\). Then \(x< b^{\ast}(\overline{c})\) for \(\overline{c}\) large enough; so we have

and so

where

and

Here \(\ell _{i}(x,b,c)\) are polynomials in \(\theta _{1}(c)\), \(\theta _{2}(c)\), \(\theta _{1}(ac)\), \(\theta _{2}(ac)\), \(\theta _{1}^{\prime}(c)\), \(\theta _{2}^{\prime}(c)\), \(\theta _{1}^{\prime}(ac)\), \(\theta _{2}^{\prime}(ac)\), \(x\), \(b\), \(c\), \(a\), and \(h_{i}(x,b,c)\), \(i=1,\dots ,11\), are positive linear combinations of \(b\theta _{1}(ac)\), \(x\theta _{1}(ac)\), \(b\theta _{2}(ac)\) and \(x\theta _{2}(ac)\) stated in detail in Appendix B. Since \(\lim _{\overline{c}\rightarrow \infty}b^{\ast}(\overline{c})=\mu /q\), the Taylor expansion of \(F_{2}(x,\overline{c})/\overline{c}^{2}\) at \(\overline {c}=\infty \) is given by

Since \(xq-2\mu <\) 0, we have \(\partial _{\overline{c}}V^{\overline{c}}(x,\overline{c})<0\) for \(\overline{c}\) large enough, and so we obtain \(\lim _{\overline{c}\rightarrow \infty}V^{\overline{c}}(x, \overline{c})=x^{+}\) for \(x<\frac{\mu}{q}\).

Take now \(x\geq \mu /q>b^{\ast}(\overline{c})\). Then

and so

where

\(\ell _{0}(b,\overline{c})\) is defined in (7.9), \(\bar{\ell}_{i}(x,b,c)\) are polynomials in \(\theta _{1}(c)\), \(\theta _{2}(c)\), \(\theta _{1}(ac)\), \(\theta _{2}(ac)\), \(\theta _{1}^{\prime}(c)\), \(\theta _{2}^{\prime}(c)\), \(\theta _{1}^{\prime}(ac)\), \(\theta _{2}^{\prime}(ac)\), \(x\), \(b\), \(c\), \(a\), and \(k_{i}(x,b,c)\), \(i=1,\dots ,8\), are positive linear combinations of \(b\theta _{1}(ac)\), \(b\theta _{2}(ac)\) and \((x-b)\theta _{2}(c)\) as detailed in Appendix B. Since \(\lim _{\overline{c}\rightarrow \infty }b^{\ast}(\overline{c})=\mu /q\), the Taylor expansion of \(F_{3}(x,\overline {c})/\) \(\overline{c}^{2}\) at \(\overline{c}=\infty \) is given by

So \(F_{3}(x^{\ast}(\overline{c}),\overline{c})=0\) yields that the Taylor expansion of \(x^{\ast}(\overline{c})\) is given by (7.8).

Finally, for \(\overline{c}\) large enough, we get \(\partial _{\overline{c}}V^{\overline{c}}(x,\overline{c})<0\) for \(x\in [ \frac{\mu }{q},\frac{\mu}{q}(1+\frac{1}{\sqrt{a}}))\) and \(\partial _{\overline{c}}V^{\overline{c}}(x,\overline{c})>0\) for \(x>\frac{\mu}{q}(1+\frac{1}{\sqrt{a}})\). So the result follows. □

Remark 7.4

Note that

So \(z^{\ast}(\overline{c})>x^{\ast}(\overline{c})\) for \(\overline{c}\) large enough, and we have asymptotic equivalence for these two quantities when \(\overline {c}\to \infty \). At the same time, the inequality \(z^{\ast}(\overline{c})\geq x^{\ast}(\overline{c})\) can easily be seen to hold for any \(\overline{c}\) from the following argument: We have

since \(V^{\overline{c}}(x,c)\) is nondecreasing in \(\overline{c}\) by Proposition 3.10. Dividing by \(h\) and taking the limit as \(h\) goes to zero, we get

Hence \(\partial _{\overline{c}}V^{\overline{c}}(z^{\ast}(\overline {c}), \overline{c})\geq V_{c}^{\overline{c}}(z^{\ast}(\overline {c}),c) \big\vert _{c=\overline{c}}=0\), and then the value \(x^{\ast}(\overline{c})\) where \(\partial _{\overline{c}}V^{\overline{c}}(\,\cdot \, ,\overline{c})\) changes from negative to positive satisfies \(x^{\ast }(\overline{c})\leq z^{\ast}(\overline{c})\).

Remark 7.5

One observes from (7.5) that for very small values of \(a\), the coefficient of \(1/\overline{c}\) in the asymptotic expansion is positive so that the limit \(\mu (1+1/\sqrt{a})/q\) is approached from the right, whereas for larger values of \(a\), that coefficient is negative and the limit is approached from the left as \(\overline{c}\) becomes large; see also the numerical illustrations in Sect. 9. It may also be instructive to derive the higher-order limiting behaviour of \(x^{\ast}(\overline{c})\) established in Proposition 7.3 in a direct way for the deterministic case discussed in Sect. 2. Concretely, including one more term in the expansion (2.2) gives

and substituting \(x=\frac{\mu}{q}(1+\frac{1}{\sqrt{a}})+\frac{a_{0}}{\overline{c}}\) (for an \(a_{0}\in{\mathbb{R}}\) to be identified) into this expression gives

This fraction equals zero for \(a_{0}=\frac{(1-2\sqrt{a}-3a)\mu ^{2}}{3\sqrt{a^{3}}q}\) so that we obtain

which exactly corresponds to (7.8) for \(\sigma =0\). This formula shows that in the deterministic case, indeed the limit \(\mu (1+1/\sqrt{a})/q\) is approached from the right for \(a<1/9\) and from the left for \(a>1/9\) as \(\overline{c}\rightarrow \infty \).

8 Optimal strategies for \(\overline{c}\) large

In the next result, we show that for \(\overline{c}\) large enough, there exists a unique solution of (6.12) with boundary conditions (6.13) and that \(\overline{\zeta }{}^{\prime}<0\) and \(\overline{\gamma}{}^{\prime}>0\) in a neighbourhood of \(\overline{c}\). We emphasise again that for all results in this section, we assume \(a<1\).

Proposition 8.1

For \(\overline{c}\) large enough, we can find \(\underline{c}\in [ 0,\overline{c})\) such that there exists a unique solution \((\overline{\gamma}(c),\overline{\zeta}(c))\) of (6.12) with boundary conditions (6.13) in \([\underline{c},\overline{c}]\), and \(\overline{\gamma}\) is strictly increasing and \(\overline{\zeta}\) is strictly decreasing in \([\underline{c},\overline{c}]\), respectively.

Proof

In order to prove that there exists a unique solution \((\overline{\gamma}(c),\overline{\zeta}(c))\) of (6.12) in \([\underline{c},\overline{c}]\) for some \(\underline{c}<\overline{c}\), it suffices to show that

for \(\overline{c}\) large enough. Combining (7.1) and (7.5) with the formulas of \(C_{11}(y,z,c)\) and \(C_{22}(y,z,c)\) given in (A.9) and (A.11), we obtain that

and so

for \(\overline{c}\) large enough.

In order to prove that \(\overline{\gamma}(c)\) is increasing and \(\overline {\zeta}(c)\) is decreasing in \([\underline{c},\overline{c}]\) for \(\overline{c}\) large enough and some \(\underline{c}<\overline{c}\), we use the differential equations (6.12) at \(c=\overline{c}\) and the power series expansion of \(C_{ij}\) to show that

for \(\overline{c}\) large enough; so we have the result. □

In the following result, we show that the reward function \(W^{\overline{\gamma},\overline{\zeta}}\) of the two-curve strategy given by the solutions of \((\overline{\gamma},\overline{\zeta})\) of (6.12) with boundary conditions (6.13) is the value function in \([0,\infty )\times [ \underline{c},\overline{c}]\) for \(\overline{c}\) large enough and some \(\underline{c}<\overline{c}\). So the optimal strategy is a two-curve strategy.

Theorem 8.2

There exist a large \(\overline{c}> q\sigma ^{2}/(2\mu )\) and some \(\underline{c}<\overline{c}\) such that \(W^{\overline{\gamma},\overline{\zeta}}=V\) in \([0,\infty )\times [ \underline{c},\overline{c}]\).

Proof

By Proposition 8.1, there exist \(\overline{c}\) large enough and some \(\underline{c}<\overline{c}\) such that \(\overline{\zeta}{}^{\prime}(c)\neq 0\), and so by Proposition 6.9, \(W^{\overline{\gamma},\overline{\zeta}}\) is \((2,1)\)-differentiable in \([0,\infty )\times [ \underline{c},\overline{c}]\). Using Theorem 6.10, in order to prove the result, it is sufficient to show that

for \(c\in [ \underline{c},\overline{c})\). We have from Proposition 6.8 that \(\partial _{x}(W^{\overline{\gamma},\overline{\zeta}})( \overline{\gamma}(c),c)=1\) for \(c\in [ \underline{c},\overline{c}]\), and the Taylor expansion of \(\partial _{xx}v^{\overline{c}}(x)\) at \(\overline{c}=\infty \) is given by

which is negative so that \(\partial _{xx}v^{\overline{c}}(x)<0\) for \(\overline{c}\) large enough. Since \(\partial _{xx}(W^{\overline{\gamma},\overline{\zeta}})(x,c)\) is continuous, there exists \(\underline{c}<\overline{c}\) such that \(\partial _{xx}(W^{\overline{\gamma},\overline{\zeta}})(x,c)<0\) in \((x,c)\) for \(c\in [ \underline{c},\overline{c}]\) and \(x\in [ 0,\overline{\zeta }(c)]\). We conclude that (8.1) holds for \(c\in [ \underline{c},\overline{c}]\) and \(\overline{c}\) large enough.

Let us show that for \(\overline{c}\) large enough and some \(\underline{c}<\) \(\overline{c}\), we have \(\partial _{c}W^{ \overline{\gamma},\overline {\zeta}}(x,c)\leq 0\) for \(c\in [ \underline{c},\overline{c}]\) and \(0\leq x\leq \overline{\zeta}(c)\). We prove first that \(\partial _{c}W^{\overline {\gamma},\overline{\zeta}}(x,c)\leq 0\) for \(x\in [ \overline{\gamma }(c),\overline{\zeta}(c)]\). We have

and by Lemma A.1, \(f_{21}(y,x,c)>0\) for \(x>y\). So we should prove that

for \(x\in [ \overline{\gamma}(c),\overline{\zeta}(c)]\). By Proposition 6.8, \(0=\partial _{c}H^{\overline{\gamma}, \overline{\zeta}}(x,\overline{c})=\partial _{cx}H^{\overline{\gamma}, \overline{\zeta}}(x,\overline{c})\), and so we have \(G(\overline{\zeta}(\overline {c}),\overline{c})=\partial _{x}G( \overline{\zeta}(\overline{c}),\overline {c})=0\). Then it is sufficient to prove that \(\partial _{xx}G(x,c)<0\) for \(x\in [ \overline{\gamma}(c),\overline{\zeta}(c)]\). We first show that \(\partial _{xx}G(x,\overline{c})<0\) for \(x\in [ \overline{\gamma }(\overline{c}),\overline{\zeta}( \overline{c})] \) for \(\overline{c}\) large enough, and then the result follows for \(c\in [ \underline{c},\overline {c}]\) for some \(\underline{c}<\overline{c}\) by continuity arguments in a compact set. Using \(\overline{\gamma}(\overline{c})=b^{\ast}(\overline {c}),~\overline{\zeta}(\overline{c})=z^{\ast}(\overline{c})\), (7.1) and (7.5), we obtain that the Taylor expansion at \(\overline{c}=\infty \) of

is given by

and the Taylor expansion of \(h(z^{\ast}(\overline{c}),\overline{c})\) at \(\overline{c}=\infty \) is given by

Since

is positive and \(h(z^{\ast}(\overline{c}),\overline{c})<0\) for \(\overline{c}\) large enough, we conclude that \(\partial _{xx}G(x,\overline{c})<0 \) for \(x\in [ \overline{\gamma}(\overline{c}),\overline{\zeta}( \overline{c})]\). Let us show that for \(\overline{c}\) large enough and some \(\underline{c}<\) \(\overline{c}\), it holds that \(\partial _{c}W^{\overline{\gamma},\overline {\zeta}}(x,c)\leq 0\) for \(x\in [ 0,\overline{\gamma}(c)]\) and \(c\in [ \underline{c},\overline{c}]\). We can write

where \(f_{11}(x,c)>0\); so we should prove that

for \(x\in [ 0,\overline{\gamma}(c)]\). We have shown that \(\partial _{c}W^{\overline{\gamma},\overline{\zeta}}( \overline{\gamma}(c),c)<0\) so that \(G_{1}(\overline{\gamma}(c), \overline{c})<0\); then it suffices to prove that \(\partial _{x}G_{1}(x,c)>0\) for \(x\in [ 0,\overline{\gamma}(c)]\). We show first that \(\partial _{x}G_{1}(x,\overline{c})>0\) for \(x\in [ 0,\overline{\gamma}(\overline{c})] \) for \(\overline{c}\) large enough; then the result follows for \(c\in [ \underline{c},\overline{c}]\) with some \(\underline{c}<\overline{c}\) by continuity arguments in a compact set. Using \(\overline{\gamma}(\overline{c})=b^{\ast}(\overline{c})\), (7.1) and (7.5), we obtain that the Taylor expansion at \(\overline{c}=\infty \) of

is given by

which is positive for \(\overline{c}\) large enough and \(x\leq b^{\ast }(\overline{c})<\frac{\mu}{q}<\frac{2\mu}{q}\). □

9 Numerical examples

In this section, we consider some numerical illustrations for the case \(q=0.1\), \(\mu =4\) and \(\sigma =2\).

9.1 Bounded case

Let us first consider the case with an upper bound \(\overline{c}=3\) for the dividend rate. In this case, we are able to derive the value function and the optimal strategies for the problem with drawdown constraints \(a=0.2\), \(a=0.5\) and \(a=0.8\). Indeed, they are of two-curve type as conjectured in Remark 6.11. The obtained reward function and optimal dividend strategies then also allow us to compare them with those for the (already previously known) extreme cases \(a=0\) (classical dividend problem without any constraint) and \(a=1\) (dividend problem with ratcheting constraint). To obtain the value functions \(V_{a}^{\overline{c}}\) for each set of parameters, we proceed as follows:

-

1)

We check that there exists a unique zero \(z^{\ast}(\overline{c})\) of \(C_{0}(b^{\ast}(\overline{c}),\cdot \,,\overline{c})\) in \((b^{\ast}(\overline {c}),\infty )\).

-

2)

We obtain the curves \(\overline{\gamma}\) and \(\overline{\zeta}\) by solving numerically, by the Euler method, the system (6.12) of ordinary differential equations with boundary conditions (6.13).

-

3)

We check numerically that the pair \((\overline{\gamma},\overline{\zeta })\) satisfies (6.11) for \(c\in [ 0,\overline{c}]\). So by Proposition 6.6, we are approximating the unique solution \((\overline{\gamma},\overline{\zeta})\). We also verify that \(\overline{\zeta}\) is nondecreasing.

-

4)

We check that the function \(W^{\overline{\gamma},\overline{\zeta}}\) defined in (6.6) satisfies the conditions of Theorem 4.4. Hence \(W^{\overline{\gamma},\overline{\zeta}}\) is the value function \(V_{a}^{\overline{c}}\), and the optimal strategy is indeed a two-curve strategy given by \((\overline{\gamma},\overline{\zeta} )\in \mathcal{B}\).

Figure 3 depicts the graphs of \(V_{a}^{\overline{c}}(x,0)\) with \(\overline{c}=3\) for \(a=0\) (no restrictions, gray solid), \(a=0.5\) (dashed) and \(a=1\) (ratcheting, black solid) as a function of \(x\). One can nicely see how the drawdown case is – in terms of performance – a compromise between the unconstrained case and the stronger constraint of ratcheting.