Abstract

We consider a continuous-time market with proportional transaction costs. Under appropriate assumptions, we prove the existence of optimal strategies for investors who maximise their worst-case utility over a class of possible models. We consider utility functions defined on either the positive axis or the whole real line.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, the existence of solutions to the utility maximisation problem from terminal utility is studied in the presence of model ambiguity. We assume that investors prepare for the worst-case scenario in the sense that they take the infimum of utility functionals over the class of possible models before maximising over admissible investment strategies.

The literature on robust optimisation typically assumes that uncertainty is modelled by a family of prior measures \(\mathcal{P}\) on some canonical space in which trajectories of the processes lie. Starting with Quenez [29] and Schied [34], the case in which \(\mathcal{P}\) is dominated by a reference measure \(P_{*}\) has received ample treatment. In diffusion settings, this corresponds to uncertainty in the drift. Such an approach is not completely convincing since market participants may also be uncertain about the volatilities.

More recently, the non-dominated problem has also been studied in various contexts. For instance, Tevzadze et al. [35] investigated a compact set of possible drift and volatility coefficients and tackled the robust problem by solving an associated Hamilton–Jacobi–Bellman equation. In Matoussi et al. [24], where volatility coefficients are uncertain over a compact set and the drift is known, the theory of BSDEs is applied. Existence results in a fairly general class of models are available only in discrete time; see Nutz [27], Blanchard and Carassus [8], Neufeld and Šikić [26], Bartl [2], Bartl et al. [3] and Rásonyi and Meireles-Rodrigues [31]. A minimax result was established for bounded utilities in frictionless continuous-time markets in Denis and Kervarec [14].

As far as we know, our existence results below are the first to apply in a broad class of continuous-time models. We now summarise the principal ideas underlying our arguments. First, we work under proportional transaction costs. In this setting, strategies can be identified with finite-variation processes which we endow with a suitable convergence structure. Second, instead of a family of measures, we consider a parametrised family of stochastic processes on a fixed filtered probability space. Necessarily, instead of one portfolio value, we need to consider a family of possible values corresponding to the respective parameters. Third, the latter fact forces us to take the family of strategies as our domain of optimisation (unlike most of the optimal investment literature since Kramkov and Schachermayer [21], which prefers to optimise over a set of random variables, the terminal values of possible portfolios). Fourth, we exploit that the boundedness of terminal portfolio values in an appropriate sense implies boundedness of the strategies themselves (again, in an appropriate sense); this is false in continuous-time frictionless markets, but true in our setting. Fifth, we profit from a method first developed in Rásonyi [30] that verifies the supermartingale property of a putative optimiser, based on a lemma of Delbaen and Owari [13]. Because of the fourth point above, our techniques do not seem to be applicable in the continuous-time frictionless setting. See, however, the companion paper by Rásonyi and Meireles-Rodrigues [31] which treats discrete-time frictionless markets.

The robust model in this paper, similarly to those introduced in Biagini and Pınar [6], Neufeld and Nutz [25], Lin and Riedel [22], assumes that there is a parametrisation for the uncertain dynamics of risky assets. However, as we shall see below, no specific assumption is made about the parametrisation and an arbitrary index set is permitted. From a practical point of view, this approach is particularly tractable and easily implemented when it comes to calibration. For example, when estimating drift and volatility parameters for diffusion price processes, the results only give guesses (hopefully with some confidence sets) about the true values. Thus it is reasonable to parametrise ambiguity by considering suitable ranges which contain possible values for the coefficients being estimated.

From a mathematical point of view, the treatment of robust models in the present paper simplifies technical issues, as will become apparent from the proofs. Working on the same (filtered) probability space, instead of considering a family of measures, gives us more flexibility by avoiding the canonical setting with problems concerning null events, filtration completion, etc. Measurable selection arguments, see Bouchard and Nutz [9], Biagini et al. [4] or Nutz [27], are not needed any more. Our approach can still incorporate most of the relevant model classes, and their laws on the path space do not need to be equivalent; see Sect. 2.

Compactness plays an important role in proving the existence of optimisers. Usually, the utility maximisation problem is transformed into an “abstract” version with random variables (the terminal wealth of admissible portfolios), and then convex compactness results in \(L^{0}\), in particular, Komlós-type arguments, are applied successfully; see Kramkov and Schachermayer [21]. Unfortunately, the robust setting is unlikely to be lifted to “abstract” versions, since the uncertainty produces a whole collection of wealth processes. As a result, Komlós-type arguments on the space \(L^{0}\) cannot be employed. Furthermore, the candidate dual problem in this setting does not, in general, admit a solution (see Bartl [2, Remark 2.3]) so that the usual approach of getting optimisers from solutions of dual problems seems inapplicable. Therefore, we are forced to work on the primal problem directly.

We are using two Komlós-type arguments. The first one is performed on the space of finite-variation processes (strategies), which gives a candidate for the optimiser, and the second is used in an Orlicz space context, to handle possible losses of trading when establishing the supermartingale property of the optimal wealth process, relying on Delbaen and Owari [13]. A crucial observation is that the utility of a portfolio is a sequentially upper semicontinuous function of the strategies (when the latter are equipped with a convenient convergence structure); see Guasoni [15] where the optimisation problem was viewed in a similar manner.

The paper is organised as follows. Section 2 introduces the robust market model and technical assumptions. Sections 3 and 4 study the existence of solutions for the robust utility maximisation problem when the utility functions are defined on \(\mathbb{R}_{+}\) and ℝ, respectively. Ramifications are discussed in Sect. 5. Some preliminaries on finite-variation processes and on Orlicz space theory are presented in Sect. 5.

2 The market model

Let \((\varOmega , \mathcal{F}, (\mathcal{F}_{t})_{t\in [0,T]}, P)\) be a filtered probability space, where the filtration is assumed to be right-continuous and \(\mathcal{F}_{0}\) coincides with the \(P\)-completion of the trivial sigma-algebra. We define by \(L^{0}\) the set of all a.s.-equivalence classes of random variables and its positive cone by \(L^{0}_{+}\).

Let \(\varTheta \) be a (non-empty) set, which is interpreted as the parametrisation of uncertainty. We consider a financial market consisting of a riskless asset \(S^{0}_{t} = 1\) for all \(t \in [0,T]\) and a risky asset, whose dynamics is unknown. To describe the latter, we consider a family \((S^{\theta }_{t})_{t\in [0,T]}\), \(\theta \in \varTheta \), of adapted, positive processes with continuous trajectories which represent the possible price evolutions. No condition is imposed on \(\varTheta \) nor, for the moment, on the dynamics of the risky asset.

Remark 2.1

We now comment on the difference between our concept of model ambiguity and that of most previous papers, where a family of priors is considered on a canonical space.

Working on a given probability space and filtration amounts to fixing the information structure of the problem; the information flow is normally generated by a particular driving process (such as a multidimensional Brownian motion). Possible prices are then functionals of a parameter (finite- or infinite-dimensional, see Examples 2.2 and 2.4 below) and the driving noise. Strategies are functionals adapted to the given information flow.

Considering a family of probabilities, one has greater liberty in the sense that no common driving noise is required, but the choice of strategies is limited; they must be adapted functionals on the canonical space, i.e., they are functions of the price process. In our modelling, the controls are adapted to an information flow that may be strictly bigger than the natural filtration of any possible price process.

In a strictly formal sense, none of two the approaches is more general than the other; see also examples in [31]. Intuitively, the standard setting is the more general one, while ours seems more easily tractable and fits better with a practical calibration and/or statistical inference framework.

We illustrate by the following examples that the present setting is useful and contains interesting models from previous studies.

Example 2.2

In the robust Black–Scholes market model, the risky asset satisfies the SDE

where \(\mu \), \(\sigma \) are constants and \(W\) is a standard Brownian motion. The uncertainty is modelled by

where \(\underline{\mu}\leq \overline{\mu}\), \(0<\underline{\sigma} \leq \overline{\sigma }\) are given constants. The classical Black–Scholes model corresponds to the case \(\underline{\mu} = \overline{\mu}\) and \(\underline{\sigma} = \overline{\sigma }\). It is observed that the laws of \(S^{\mu _{1},\sigma _{1}}\), \(S^{\mu _{2},\sigma _{2}}\) are singular when \(\sigma _{1} \ne \sigma _{2}\). If only volatility uncertainty is considered, the family of laws is mutually singular. See [22, 6] about treatments for similar models.

Remark 2.3

In the domain of robust finance, measurable selection techniques are often used; see e.g. [27]. This requires a certain measurability of the family of laws corresponding to various models. In our present approach, however, this is not a necessity. Let e.g. \(\varTheta '\) be a non-Borelian (or even non-analytic) subset of \(\varTheta \) in Example 2.2 above. Theorems 3.6 and 4.7 apply to the family of models \(S^{\theta }\), \(\theta \in \varTheta '\), too.

Example 2.4

In the above example, \(\varTheta \) was a subset of a finite-dimensional Euclidean space. One may easily fabricate similar examples where \(\varTheta \) is infinite-dimensional. For instance, let \(\varTheta \) consist of all pairs of predictable processes \((\mu _{t},\sigma _{t})\) such that for all \(t\in [0,T]\), \(\mu _{t}\in [\underline{\mu },\overline{\mu }]\) a.s. and \(\sigma _{t}\in [\underline{\sigma },\overline{\sigma }]\) a.s., and consider the SDEs

for each \((\mu ,\sigma )\in \varTheta \).

The following example extends the robust Black–Scholes model and allows an external economic factor.

Example 2.5

This is a factor model which is inspired by [20], but much simplified. Let \(\varTheta \subseteq \mathbb{R}^{2\times 2}\) be a set. The risky asset is governed by the SDE

and the factor process evolves according to

where \(m\), \(g\) are suitable functions, \(W=(W^{1},W^{2})\) is a two-dimensional Brownian motion and \(\rho =(\rho _{1},\rho _{2})\in \mathbb{R}^{2}\) a fixed parameter. The bracket \(\langle \cdot ,\cdot \rangle \) denotes the scalar product in \(\mathbb{R}^{2}\). Note that the original setting of [20] cannot be directly transferred to the present one as it involves a family of weak solutions of SDEs which are not necessarily realisable on our given stochastic basis.

The risky asset is traded under proportional transaction costs \(\lambda \in (0,1)\). More precisely, investors have to pay a higher (ask) price \(S^{\theta }\) when buying the risky asset, but receive a lower (bid) price \((1-\lambda )S^{\theta }\) when selling it.

Let \(\mathcal{V}\) denote the family of nondecreasing, right-continuous functions on \([0,T]\) which are 0 at time 0. Let \(\mathbf{V}\) denote the set of triplets \(H=(H^{\uparrow },H^{\downarrow },H_{0})\), where \(H^{\uparrow }_{t}\), \(H^{\downarrow }_{t}\), \(t\in [0,T]\), are optional processes such that \(H^{\uparrow }(\omega ),H^{\downarrow }(\omega ) \in \mathcal{V}\) for each \(\omega \in \varOmega \) and \(H_{0}\in \mathbb{R}\) (deterministic). The space \(\mathbf{V}\) can be equipped with a convergence structure; see Sect. A.1 below for details.

Each trading strategy corresponds to an element \(H\in \mathbf{V}\). In this formulation, \(H^{\uparrow }\) denotes the cumulative amount of transfers from the riskless asset to the risky one and \(H^{\downarrow }\) represents the transfers in the opposite direction; \(H_{0}\) encodes the amount of initial transfer from the riskless asset to the risky one. Therefore the portfolio position in the risky asset at time \(t\) equals \(\phi _{t}:=H_{0}+H^{\uparrow }_{t} - H^{\downarrow }_{t}\), \(t\in [0,T]\), \(\phi _{0-}:=0\).

For any \(x\in \mathbb{R}\), we denote \(x^{+}:=\max \{0,x\}\), \(x^{-}:=\max \{0,-x\}\). For an initial capital \(x\in \mathbb{R}\), the dynamics of the cash account of an investor following the strategy \(H\) evolves according to

for \(t\in [0,T]\). The liquidation value is defined by

We introduce the definition of consistent price systems, which play a similar role to martingale measures in frictionless markets; see [19, 17, 16].

Definition 2.6

For each \(\theta \in \varTheta \), a \(\lambda \)-consistent price system (\(\lambda \)-CPS) for the model \({\theta }\) is a pair \((\tilde{S}^{\theta }, Q^{\theta })\) of a probability measure \(Q^{\theta }\approx P\) and a (càdlàg) \(Q^{\theta }\)-local martingale \(\tilde{S}^{\theta }\) such that

A \(\lambda \)-strictly consistent price system (\(\lambda \)-SCPS) is a CPS such that the inequalities in (2.2) are strict.

We impose the existence of consistent price systems for every model \(S^{\theta }\). In Sect. 3, we need the following assumption in order to be able to use the results of [12].

Assumption 2.7

For each \(\theta \in \varTheta \) and for all \(0<\mu <\lambda \), the price process \(S^{\theta }\) admits a \(\mu \)-CPS.

This assumption is fulfilled if for every \(\theta \in \varTheta \), the process \(S^{\theta }\) satisfies the no-arbitrage condition for \(\mu \)-transaction cost for all \(\mu >0\); see [17]. See Example 4.6 for a risky asset violating Assumption 2.7.

Clearly, if \(0<\mu <\lambda \), then a \(\mu \)-CPS is also a \(\lambda \)-SCPS.

Lemma 2.8

If\((\tilde{S}^{\theta }, Q^{\theta })\)is a\(\lambda \)-strictly consistent price system, the random variable

is almost surely strictly positive and\(E^{Q^{\theta }}[\delta ( \theta )] < \infty \).

Proof

The argument follows that of [19, Lemma 3.6.4]. □

Let

For a consistent price system \((\tilde{S}^{\theta }, Q^{\theta })\), we define the process

without emphasising the dependence of \(V\) on the specific consistent price system. It is easy to check that \(W^{x,\mathrm{liq}}_{t}(H) \le V^{x}_{t}(\theta ,H)\) a.s., for each \(t \in [0,T]\).

3 Utility function on \(\mathbb{R}_{+}\)

Assumption 3.1

The utility function \(U :(0,\infty ) \to \mathbb{R}\) is nondecreasing and concave.

Define the convex conjugate of \(U\) by

Admissible strategies are defined in a natural way, thanks to the domain of the utility function.

Definition 3.2

A strategy \(H=(H^{\uparrow },H^{\downarrow },H_{0})\in \mathbf{V}\) is admissible for initial capital \(x>0\) and for the model \(\theta \in \varTheta \) if for each \(t \in [0,T]\),

Denote by \(\mathcal{A}^{\theta }(x)\) the set of all admissible strategies for \(\theta \). Set

and \(\mathcal{A}(x) = \bigcap _{\theta \in \varTheta } \mathcal{A}_{0} ^{\theta }(x)\).

Remark 3.3

For each \(H\in \mathcal{A}(x)\) and \(\theta \in \varTheta \),

due to \(\phi _{T}=0\). We also see from (2.1) that at time \(0 < t < T\), the liquidation value is neither concave nor convex in \(H\). However, the condition \(\phi _{T} = 0\) recovers concavity of the liquidation value with respect to \(H\) at time \(T\). This is crucial for finding maximisers in the subsequent analysis.

Let \(x>0\). Note that \(\mathcal{A}(x)\neq \emptyset \) since it contains the identically zero strategy. Our investors want to find the optimiser for

It is worth noting that maximising in \(H\) is a concave problem; however, minimising over \(\varTheta \) is not a convex problem.

For each \(\theta \in \varTheta \) and \(x>0\), we denote

For each \(y>0\), the set of supermartingale deflators\(\mathcal{B}^{\theta }(y)\) consists of the strictly positive processes \(Y=(Y^{0}_{t},Y^{1}_{t})_{t\in [0,T]}\), \(Y^{0}_{0} =y\), such that \(Y^{1}/Y^{0} \in [(1-\lambda )S^{\theta },S^{\theta }]\) and \(W^{x}(\theta ,H) Y^{0} + \phi Y^{1}\) is a (càdlàg) supermartingale for all \(H \in \mathcal{A}^{\theta }(x)\). Also, we define

The primal and dual value functions for the \(\theta \)-model are

The next lemma states that the sets \(\mathcal{C}^{\theta }(x)\) and \(\mathcal{D}^{\theta }(y)\) are polar to each other. It follows directly from [12, Proposition 2.9].

Lemma 3.4

Fix\(x,y>0\). Let Assumption2.7be in force. A random variable\(X\in L^{0}_{+}\)satisfies\(X\in \mathcal{C}^{\theta }(x)\)if and only if\(E[XY]\leq xy\)for all\(Y\in \mathcal{D}^{\theta }(y)\). A random variable\(Y\in L_{+}^{0}\)satisfies\(Y\in \mathcal{D}(y)\)if and only if\(E[XY]\leq xy\)for all\(X\in \mathcal{C}^{\theta }(x)\).

We impose a technical assumption.

Assumption 3.5

The dual value function \(v^{\theta }(y),y>0\), is finite for all\(\theta \in \varTheta \).

Theorem 3.6

Let\(x>0\). Under Assumptions2.7, 3.1, 3.5, the robust utility maximisation problem (3.1) admits a solution, i.e., there is\(H^{*}\in \mathcal{A}(x)\)satisfying

When\(U\)is bounded from above, the same conclusion holds assuming only that there exists (at least) one\(\tilde{\theta }\in \varTheta \)for which there exists a\(\lambda \)-SCPS.

Proof

If \(U\) is constant, there is nothing to prove. Otherwise, by adding a constant to \(U\), we may assume that \(U(\infty ) > 0 > \lim _{x \to 0} U(x)\).

Notice that \(U(\infty ) > 0\) and

imply \(\liminf _{x\to \infty }u^{\theta }(x)/x\geq 0\). From Lemma 3.4, trivially,

for all \(y>0\). Fixing \(y\), we obtain \(\limsup _{x\to \infty }u^{\theta }(x)/x \le y\), and sending \(y\) to zero gives

After these preparations, we turn to the main arguments. Assumption 3.5, (3.3) and (3.2) imply that \(u^{\theta }(x)\) is finite for each \(\theta \) and so is \(u(x)\). Let \(H^{n} \in \mathcal{A}(x)\), \(n\in \mathbb{N}\), be a maximising sequence, i.e.,

Let us fix for the moment \(\theta \in \varTheta \) and a \(\mu \)-CPS \((\tilde{S}^{\theta }, Q^{\theta })\) with \(0<\mu < \lambda \). First, we prove that the process

is a \(Q^{\theta }\)-supermartingale for all \(n\). Indeed, Itô’s formula gives

Admissibility of \(H^{n}\) implies

In particular, we obtain

for every \(t \in [0,T]\), and therefore \(\int _{0}^{t}{\phi ^{n}_{u-} d \tilde{S}^{\theta }_{u}}\), \(t\in [0,T]\), is a \(Q^{\theta }\)-supermartingale; see [1, Corollary 3.5]. It follows that \(V_{t}^{x}(\theta ,H^{n})\), \(t\in [0,T]\), is also a \(Q^{\theta }\)-supermartingale.

We claim that \(\sup _{n} (H^{n}_{0})^{-}\) is finite. If this were not the case, then along a subsequence \(n_{k}\), \(k\in \mathbb{N}\), we should have \((H^{n_{k}}_{0})^{-} \to \infty \), \(k\to \infty \), and \((H^{n_{k}}_{0})^{+}=0\), \(k\in \mathbb{N}\). Taking \(Q^{\theta }\)-expectations in (3.5), we should get

a contradiction. Hence the supremum is indeed finite.

Furthermore, from the supermartingale property of \(\int _{0}^{t}{\phi ^{n}_{u-} d\tilde{S}^{\theta }_{u}}\), \(t\in [0,T]\), and from (3.6),

follows. Using (2.3), we deduce from (3.5) that

Apply Lemma A.1 with the choice \(dQ/dQ^{\theta }:=\delta ( \theta )/E^{Q^{\theta }}[\delta (\theta )]\). It implies that there exist convex weights \(\alpha ^{n}_{j} \ge 0\), \(j=n,\ldots ,M(n)\), with \(\sum _{j=n}^{M(n)} \alpha _{j}^{n} = 1\) such that \(\tilde{H}^{n}:= \sum _{j=n}^{M(n)} H^{n} \to H^{*}\) in \(\mathbf{V}\). Since the utility function is concave, we obtain that \(\tilde{H}^{n}\), \(n \in \mathbb{N}\), is also a maximising sequence as

We now prove that the sequence \(U^{+}(W^{x,\mathrm{liq}}_{T}(\theta , \tilde{H}^{n}))\), \(n \in \mathbb{N}\), is uniformly integrable for each \(\theta \in \varTheta \). Suppose by contradiction that the sequence is not uniformly integrable for some \(\theta \). Then one can find disjoint sets \(A_{n}\in \mathcal{F}\), \(n\in \mathbb{N}\), and a constant \(\alpha > 0\) such that

Set \(w^{n} = \sum _{i=1}^{n} W^{x,\mathrm{liq}}_{T}(\theta ,\tilde{H} ^{i}) 1_{\{W^{x,\mathrm{liq}}_{T}(\theta ,\tilde{H}^{i}) \ge u_{0}\}}1_{A _{i}}\), where \(u_{0}\) is chosen such that it satisfies \(U(u_{0}) = 0\). It is immediate that

In addition, for any \(h \in \mathcal{D}^{\theta }(1)\), the supermartingale property shows that \(E[hw^{n}] \le nx\). Consequently, we obtain \(w^{n} \in C^{\theta }(nx)\) by Lemma 3.4. We compute

and passing to the limit when \(n\to \infty \) contradicts (3.4). Thus \(U^{+}(W^{x,\mathrm{liq}}_{T}(\theta ,\tilde{H}^{n}))\), \(n\in \mathbb{N}\), is indeed uniformly integrable.

Since \(\tilde{H}^{n} \to H^{*}\) in \(\mathbf{V}\), \(W^{x,\mathrm{liq}} _{T}(\theta , \tilde{H}^{n}) \to W^{x,\mathrm{liq}}_{T}(\theta , H ^{*})\) almost surely by Remark A.2. So Fatou’s lemma and uniform integrability imply

which proves that \(H^{*}\) is an optimiser. It remains to check that \(H^{*}\in \mathcal{A}(x)\). For each \(\theta \), \(W^{x,\mathrm{liq}} _{t}(\theta ,H^{*})\geq 0\) a.s., for Lebesgue-almost every \(t\), by Remark A.2; so we get admissibility of \(H^{*}\) since \(t\to W^{x, \mathrm{liq}}_{t}\) is a.s. right-continuous.

In the case where \(U\) is bounded from above, it is enough to perform the first part of the above argument for \(\tilde{\theta }\), obtain \(H^{*}\) and then simply invoke Fatou’s lemma to complete the proof. □

Remark 3.7

In the classical theory where there is no uncertainty, i.e., when \(\varTheta \) contains only one element, the existence result holds assuming the finiteness of \(u(x)\) only. This condition, however, does not suffice to find optimisers in the robust problem. Indeed, the finiteness of \(u(x)\) makes the robust problem well posed, compactness gives a candidate for the optimiser, but this is still not enough to prove that the candidate is indeed an optimiser. To complete the proof, it is necessary to have upper semicontinuity of the expected utility when considered as a function of the strategy variable. In [27], a counterexample (in which \(u(x)\) is finite, but one could not find an optimiser) is given in the nondominated case. The author’s argument exploits precisely the lack of upper semicontinuity property in one model. Furthermore, [27] gives a sufficient condition to have upper semicontinuity, namely the integrability of the positive part of the utility function under every possible model; see [27, Theorem 2.2] and also [8] for further developments. In our approach, upper semicontinuity follows from the finiteness of the dual value function for every model.

4 Utility functions on ℝ

Assumption 4.1

The utility function \(U :\mathbb{R} \to \mathbb{R}\) is bounded from above, nondecreasing, concave and \(U(0) = 0\). Define the convex conjugate of \(U\) by

We also assume that

Remark 4.2

Under (4.1), the function \(V\) takes finite values and \(V(y)>0\) for \(y\) large enough; hence (4.2) makes sense. The condition \(U(0) = 0\) is used only to simplify calculations. Condition (4.1) is mild and so is (4.2); indeed, as shown in [32, Corollary 4.2(i)], for every utility function \(U\) with reasonable asymptotic elasticity, its conjugate \(V\) satisfies (4.2). The studies [11, 23] assumed a smooth \(U\) which is strictly concave on its entire domain; we need neither smoothness nor strict concavity of \(U\).

As discussed in [7, 33], the choice of admissible trading strategies is a delicate issue in the context of utility maximisation with utility functions defined on the real line. A common approach is to consider strategies whose wealth processes are bounded uniformly from below by a constant. This choice, however, turns out to be restrictive and fails to contain optimisers. In frictionless markets, [33] proved that for a utility function having reasonable asymptotic elasticity, the optimal investment process is a supermartingale under each martingale measure \(Q\) such that \(E[V(dQ/dP)]\) is finite. We thus use the supermartingale property to define admissibility, just like in [28, 10].

To begin with, we define

the set of local martingale measures in consistent price systems for the \(\theta \)-model with finite generalised relative entropy.

Definition 4.3

We define

and set \(\mathcal{A}(x) := \bigcap _{\theta \in \varTheta } \mathcal{A} ^{\theta }(x)\).

The optimisation problem becomes

Assumption 4.4

For each \(\theta \in \varTheta \), the price process \(S^{\theta }\) admits a \(\lambda \)-SCPS \((Q^{\theta },\tilde{S}^{\theta })\) such that \(Q^{\theta }\in \mathcal{M}^{\theta }_{V}\).

Remark 4.5

Unlike in [11, 12, 23] and in Sect. 3, we do not impose in the present section the existence of consistent price systems for every transaction cost coefficient \(0 < \mu < \lambda \); we only stipulate Assumption 4.4. The following example shows that it is quite possible to have CPSs for relatively large \(\lambda \) without having them for arbitrarily small \(\mu \). In this example, there is an obvious arbitrage, in the language of [17], which persists (ceases) with sufficiently small (large) transaction costs.

Example 4.6

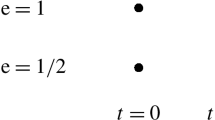

Let us consider

If \(\lambda < 3/7\), then \((1-\lambda )S_{1} > 1=S_{0}\) a.s.; therefore, there is no consistent price system. If \(\lambda \geq 2/3\), then

In other words, \((P,\tilde{S} \equiv 3/4)\) is a consistent price system.

Theorem 4.7

Under Assumptions4.1and4.4, there exists a strategy\(H^{*} \in \mathcal{A}(x)\)such that

Proof

We adapt certain techniques of [30]. Our arguments bring novelties even in the case where \(\varTheta \) is a singleton (i.e., without model uncertainty). Define \(\varPhi ^{*}(x) \!= -U(-x)\) for \(x\ge 0\). Its conjugate (in the sense of Sect. A.2 below) is

where \(\beta \) is the left derivative of \(U\) at 0; see [5]. Note that \(\varPhi \), \(\varPhi ^{*}\) are Young functions and \(\varPhi \) is of class \(\Delta _{2}\) by (4.2).

Let \(H^{n} \in \mathcal{A}(x)\), \(n\in \mathbb{N}\), be a maximising sequence, i.e.,

First, for all \(\theta \in \varTheta \), it holds that

Indeed, let us assume that there exists \(\theta \in \varTheta \) such that (4.4) does not hold, or equivalently, there exists a subsequence \(n_{k}=n^{\theta }_{k}\), \(k\in \mathbb{N}\), such that

Let us denote by \(C\) an upper bound of \(U\); then

which contradicts (4.3). Hence (4.4) indeed holds.

Consider a \(\lambda \)-strictly consistent price system \((\tilde{S} ^{\theta },Q^{\theta })\). Fenchel’s inequality gives

and therefore

From (4.4) and (4.5), we deduce that

Itô’s formula gives

This implies that

In particular,

For each \(n\), the process \(V^{x}(\theta ,H^{n})\) is a \(Q^{\theta }\)-supermartingale; so there exists a \(Q^{\theta }\)-martingale which dominates the right-hand side of (4.7) and also the left-hand side of the same expression. [1, Corollary 3.5] implies that \(\int _{0}^{t}{\phi ^{n}_{u-} d \tilde{S}^{\theta }_{u}}\), \(t\in [0,T]\), is a \(Q^{\theta }\)-supermartingale. We get \(\sup _{n} (H^{n}_{0})^{-}< \infty \) in the same way as in the proof of Theorem 3.6. Consequently, (4.6), (4.7) and the boundedness of \((H^{n}_{0})^{-}\), \(n \in \mathbb{N}\), give

Noting that \((\tilde{S}^{\theta }, Q^{\theta })\) is a \(\lambda \)-strictly consistent price system, we obtain from the above arguments that

Lemma A.1 implies the existence of convex weights \(\alpha ^{n} _{j} \ge 0\), \(j=n,\ldots ,M(n)\), with \(\sum _{j=n}^{M(n)} \alpha _{j} ^{n} = 1\) such that \(\tilde{H}^{n}:= \sum _{j=n}^{M(n)} \alpha _{j}^{n} H^{n} \to H^{*}\) in \(\mathbf{V}\). Since the utility function is concave, \(\tilde{H}^{n}\), \(n \in \mathbb{N}\), is also a maximising sequence.

We now prove that \(H^{*} \in \mathcal{A}(x)\); in other words, the process \(V^{x}(\theta ,H^{*})\) is a \(Q^{\theta }\)-supermartingale, for each \(Q^{\theta } \in \mathcal{M}^{\theta }_{V}\) and each \(\theta \in \varTheta \). To do so, it suffices to control the negative part of \(V^{x}(\theta ,H^{*})\). It should be emphasised that (4.6) is not enough for our purposes and a stronger statement using Orlicz space theory is needed (see Sect. A.2). Using concavity of \(U\) and linearity of \(V^{x}(\theta , \cdot )\), we get from (4.4) that

Applying Lemma A.3 to the sequence of random variables in (4.8), we obtain convex weights \(\alpha ^{\prime \,n}_{j} \ge 0\), \(n\le j\le M(n)\), with \(\sum _{j=n}^{M(n)} \alpha ^{\prime \,n}_{j} = 1\) such that

satisfy

By the Fenchel inequality and (4.9),

for each \(Q^{\theta } \in \mathcal{M}^{\theta }_{V}\). When \(L = 0\), we have that \(E^{Q^{\theta }}[\sup _{n}Z^{n}] =0\) trivially. Now we define

which is also a maximising sequence. Using the fact that the negative part of a supermartingale is a submartingale, we get \(V^{x}_{t}( \theta ,\overline{H}^{n})^{-} \le E^{Q^{\theta }}[V^{x}_{T}(\theta , \overline{H}^{n})^{-} |\mathcal{F}_{t}] \) and thus

Taking expectations on both sides of the above inequality, we obtain

using (4.10). Since the random variable \(\sup _{n}(V^{x}_{t}( \theta ,\overline{H}^{n}))^{-} \) is an upper bound of the sequence \(V^{x}_{t}(\theta , \overline{H}^{n})^{-}\), \(n \in \mathbb{N}\), this proves uniform integrability of that sequence under \(Q^{\theta }\) at any time \(t \in [0,T]\).

Clearly, \(\overline{H}^{n} \to H^{*}\) in \(\mathbf{V}\) and therefore \(V^{x}_{t}(\theta ,\overline{H}^{n}) \to V^{x}_{t}(\theta ,H^{*})\) a.s., for every \(t \in [0,T]\setminus Z\) where \(Z\) has Lebesgue measure 0; see Remark A.2. Also,

where the latter process is a martingale, and hence \((V^{x}_{t}( \theta ,H^{*}))_{t \in [0,T]}\) is uniformly integrable. Let \(0\le s \le t < T\) be both in \([0,T]\setminus Z\). Noting the supermartingale property, Fatou’s lemma yields

The same argument works for \(t=T\), too. Now it extends to arbitrary \(t\in [0,T]\) by using Fatou’s lemma and (4.11). Finally, it extends to arbitrary \(s\in [0,T]\) by the backward martingale convergence theorem and by right-continuity of \(s\to V^{x}_{s}(\theta ,H^{*})\). This means that \(V^{x}(\theta ,H^{*})\) is a \(Q^{\theta }\)-supermartingale and therefore \(H^{*} \in \mathcal{A}(x)\).

Since \(U\) is bounded from above, by Fatou’s lemma,

which proves the optimality of \(H^{*}\). □

Remark 4.8

We can compare our approach to that of [30] where in a general setting, supermartingale portfolio processes and their terminal values are considered, relying on [13]. In order to get optimal strategies, a certain Fatou-closure property of such terminal values is used. It is known that the proof of such a property (see e.g. [30, Lemma 4.1]) is rather subtle and does not construct the optimal strategy simply as a convex combination of an approximating sequence of strategies. In other words, only an optimal terminal value is obtained there, without obtaining an optimal strategy. When model ambiguity is present, this approach is doomed to fail since there does not seem to exist a method that provides Fatou-closedness “uniformly in the family of possible models”. For this reason, the techniques of [30] cannot cope with model uncertainty in markets with or without friction.

5 Conclusions

It is possible to extend our results in Sect. 4. One could treat the multi-asset “conic” framework of [19]; unbounded utilities could also be incorporated along the lines of [30, Theorem 3.12]; random endowments (or random utilities) can be added at little cost since we do not consider the dual problem at all. These extensions, however, require no essential new ideas while they would considerably complicate the presentation. Our emphasis here is on introducing a new approach, and not on striving for the utmost generality.

Admitting jumps in the price process leads to a more involved class of strategies. The treatment of that setting is a direction of research worth pursuing in the future.

References

Ansel, J.-P., Stricker, C.: Couverture des actifs contingents et prix maximum. Ann. Inst. Henri Poincaré Probab. Stat. 30, 303–315 (1994)

Bartl, D.: Exponential utility maximization under model uncertainty for unbounded endowments. Ann. Appl. Probab. 29, 577–612 (2019)

Bartl, D., Cheridito, P., Kupper, M.: Robust utility maximization with medial limits. J. Math. Anal. Appl. 471, 752–775 (2019)

Biagini, S., Bouchard, B., Kardaras, C., Nutz, M.: Robust fundamental theorem for continuous processes. Math. Finance 27, 963–987 (2017)

Biagini, S., Frittelli, M.: A unified framework for utility maximization problems: an Orlicz space approach. Ann. Appl. Probab. 18, 929–966 (2008)

Biagini, S., Pınar, M.Ç.: The robust Merton problem of an ambiguity averse investor. Math. Financ. Econ. 11, 1–24 (2017)

Biagini, S., Černý, A.: Admissible strategies in semimartingale portfolio selection. SIAM J. Control Optim. 49, 42–72 (2011)

Blanchard, R., Carassus, L.: Multiple-priors optimal investment in discrete time for unbounded utility function. Ann. Appl. Probab. 28, 1856–1892 (2018)

Bouchard, B., Nutz, M.: Arbitrage and duality in nondominated discrete-time models. Ann. Appl. Probab. 25, 823–859 (2015)

Campi, L., Schachermayer, W.: A super-replication theorem in Kabanov’s model of transaction costs. Finance Stoch. 10, 579–596 (2006)

Czichowsky, C., Schachermayer, W.: Portfolio optimisation beyond semimartingales: shadow prices and fractional Brownian motion. Ann. Appl. Probab. 27, 1414–1451 (2017)

Czichowsky, C., Schachermayer, W., Yang, J.: Shadow prices for continuous processes. Math. Finance 27, 623–658 (2017)

Delbaen, F., Owari, K.: Convex functions on dual Orlicz spaces. Positivity (2019, forthcoming). https://doi.org/10.1007/s11117-019-00651-x

Denis, L., Kervarec, M.: Optimal investment under model uncertainty in nondominated models. SIAM J. Control Optim. 51, 1803–1822 (2013)

Guasoni, P.: Optimal investment with transaction costs and without semimartingales. Ann. Appl. Probab. 12, 1227–1246 (2002)

Guasoni, P., Rásonyi, M., Schachermayer, W.: Consistent price systems and face-lifting pricing under transaction costs. Ann. Appl. Probab. 18, 491–520 (2008)

Guasoni, P., Rásonyi, M., Schachermayer, W.: The fundamental theorem of asset pricing for continuous processes under small transaction costs. Ann. Finance 6, 157–191 (2010)

Kabanov, Y.: Hedging and liquidation under transaction costs in currency markets. Finance Stoch. 3, 237–248 (1999)

Kabanov, Y., Safarian, M.: Markets with Transaction Costs: Mathematical Theory. Springer, Berlin (2009)

Knispel, T.: Asymptotics of robust utility maximization. Ann. Appl. Probab. 22, 172–212 (2012)

Kramkov, D., Schachermayer, W.: The asymptotic elasticity of utility functions and optimal investment in incomplete markets. Ann. Appl. Probab. 9, 904–950 (1999)

Lin, Q., Riedel, F.: Optimal consumption and portfolio choice with ambiguity. arXiv:1401.1639 (2014)

Lin, Y., Yang, J.: Utility maximization problem with random endowment and transaction costs: when wealth may become negative. Stoch. Anal. Appl. 35, 257–278 (2017)

Matoussi, A., Possamaï, D., Zhou, C.: Robust utility maximization in nondominated models with 2BSDE: the uncertain volatility model. Math. Finance 25, 258–287 (2015)

Neufeld, A., Nutz, M.: Robust utility maximization with Lévy processes. Math. Finance 28, 82–105 (2018)

Neufeld, A., Šikić, M.: Robust utility maximization in discrete-time markets with friction. SIAM J. Control Optim. 56, 1912–1937 (2018)

Nutz, M.: Utility maximization under model uncertainty in discrete time. Math. Finance 26, 252–268 (2016)

Owen, M.P., Žitković, G.: Optimal investment with an unbounded random endowment and utility-based pricing. Math. Finance 19, 129–159 (2009)

Quenez, M.-C.: Optimal portfolio in a multiple-priors model. In: Dalang, R.C., et al. (eds.) Seminar on Stochastic Analysis, Random Fields and Applications IV. Progress in Probability, vol. 58, pp. 291–321. Birkhäuser, Basel (2004)

Rásonyi, M.: On utility maximization without passing by the dual problem. Stochastics 90, 955–971 (2017)

Rásonyi, M., Meireles-Rodrigues, A.: On utility maximisation under model uncertainty in discrete-time markets. arXiv:1801.06860 (2018)

Schachermayer, W.: Optimal investment in incomplete markets when wealth may become negative. Ann. Appl. Probab. 11, 694–734 (2001)

Schachermayer, W.: A super-martingale property of the optimal portfolio process. Finance Stoch. 7, 433–456 (2003)

Schied, A.: Risk measures and robust optimization problems. Stoch. Models 22, 753–831 (2006)

Tevzadze, R., Toronjadze, T., Uzunashvili, T.: Robust utility maximization for a diffusion market model with misspecified coefficients. Finance Stoch. 17, 535–563 (2013)

Acknowledgements

Open access funding provided by MTA Alfréd Rényi Institute of Mathematics (MTA RAMKI). The authors thank Walter Schachermayer and two anonymous referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Both authors were supported by the “Lendület” grant LP2015-6 of the Hungarian Academy of Sciences and by the NKFIH (National Research, Development and Innovation Office, Hungary) grant KH 126505.

Appendix

Appendix

1.1 A.1 Finite-variation processes

Let \(\mathcal{V}\) denote the family of nondecreasing, right-continuous functions on \([0,T]\) which are 0 at 0. Let \(r_{k}\), \(k\in \mathbb{N}\), be an enumeration of \(D:=(\mathbb{Q}\cap [0,T])\cup \{T \}\) with \(r_{0}=T\). For \(f,g\in \mathcal{V}\), define

The series converges since \(|f(r_{k})-g(r_{k})|\leq f(T)+g(T)\), and it defines a metric. The corresponding Borel \(\sigma \)-field is denoted by \(\mathcal{G}\).

Let \(\mathbf{V}\) denote the set of triplets \(H=(H^{\uparrow },H^{ \downarrow },H_{0})\) where \(H^{\uparrow }_{t}\), \(H^{\downarrow }_{t}\), \(t\in [0,T]\), are optional processes such that \(H^{\uparrow }(\omega ),H^{\downarrow }(\omega )\in \mathcal{V}\) for each \(\omega \in \varOmega \) and \(H_{0}\in \mathbb{R}\) (deterministic). Considered as mappings \(H^{\uparrow },H^{\downarrow }:(\varOmega , \mathcal{F}) \to (\mathcal{V}, \mathcal{G})\), they are measurable, by the definition of the metric \(\rho \). We identify elements of \(\mathbf{V}\) when they coincide (as functions in \(t\)) outside a \(P\)-null set. We say that a sequence \((H^{n})\) in \(\mathbf{V}\) is convergent to some \(H\in \mathbf{V}\) if \(H^{n,\uparrow }\to H^{\uparrow }\) and \(H^{n,\downarrow }\to H^{\downarrow }\) a.s. in \(\mathcal{V}\) as \(n\to \infty \) and also \(H^{n}_{0}\to H_{0}\) (in the topology of ℝ).

Convex-compactness-type results for finite-variation processes have been introduced in various forms in the literature. The following result is very similar to [18, Lemma 3.5].

Lemma A.1

Let\(H^{n}\in \mathbf{V}\), \(n\in \mathbb{N}\), be such that

for some\(Q\approx P\). Then there are\(H\in \mathbf{V}\)and convex weights\(\alpha ^{n}_{j}\geq 0\), \(j=n,\ldots ,M(n)\), with\(\sum _{j=n} ^{M(n)}\alpha ^{n}_{j}=1\), \(n\in \mathbb{N}\), such that

It follows that for\(P\)-almost every\(\omega \in \varOmega \),

at\(t=T\)and at each\(t\)which is a continuity point of both\(H^{\uparrow }(\omega )\)and\(H^{\downarrow }(\omega )\).

Proof

Recall that \(D = ([0,T] \cap \mathbb{Q}) \cup \{T\}\). By assumption, the sequence \(H^{n,\uparrow }_{T}\), \(n \in \mathbb{N}\), is bounded in \(L^{1}(Q)\) for some \(Q \approx P\); so we use the Komlós theorem together with a diagonalisation procedure to obtain sequences of convex weights \(\alpha ^{n}_{j}\) such that

for some \(\mathcal{F}_{t}\)-measurable random variables \(H^{\uparrow } _{t}\), on an event \(\tilde{\varOmega }\) with \(P[\tilde{\varOmega }] = 1\). Since the limiting process, if it exists, is nondecreasing and right-continuous, we set

We prove that for \(\omega \in \tilde{\varOmega }\),

for each \(t \in [0,T)\) that is a continuity point of the function \(s \to H^{\uparrow }_{s}(\omega )\). Fix \(\varepsilon > 0\). Using continuity at \(t\) of \(H^{\uparrow }\), we find two rational numbers \(q_{1}\), \(q_{2}\) such that \(q_{1} < t < q_{2}\) and \(H^{\uparrow }_{q _{2}}(\omega ) - H^{\uparrow }_{q_{1}}(\omega ) < \varepsilon \). From (A.1), there exists \(N = N(\omega )\) such that

We estimate, for all \(n \ge N\),

Therefore, using monotonicity of \(\tilde{H}^{n,\uparrow }\), we obtain for all \(n \ge N(\omega )\) that

Notice that (A.2) also holds for \(t=T\). The same argument can be repeated for the sequence \(\tilde{H}^{n,\downarrow }\), \(n \in \mathbb{N}\), and also \(H_{0}^{n}\to H_{0}\) can be guaranteed with some \(H_{0}\in \mathbb{R}\) by extracting a further subsequence. □

Remark A.2

The above proof shows that if \(f_{n}\to f\) in \(\mathcal{V}\) as \(n\to \infty \), then \(f_{n}(x)\) tends to \(f(x)\) in every continuity point \(x\) of \(f\). Consequently, for any continuous \(g:[0,T] \to \mathbb{R}\), we have \(\int _{0}^{T} g(t)\,df_{n}(t)\to \int _{0} ^{T} g(t)\,df(t)\) as \(n\to \infty \), where the integration is meant with respect to the measures induced by \(f_{n}\), \(f\).

As a consequence, for the sequence \((\tilde{H}^{n})\) constructed in Lemma A.1 above, we have

and \(V^{x}_{t}(\theta ,\tilde{H}^{n})(\omega )\to V^{x}_{t}(\theta ,H)( \omega )\) as \(n\to \infty \), almost surely, in \(t=T\) and in every \(t\) which is a continuity point of both \(H^{\uparrow }(\omega )\), \(H ^{\downarrow }(\omega )\), and in particular for Lebesgue-a.e. \(t\). Fubini’s theorem thus implies that there is a set \(Z\) of zero Lebesgue measure (excluding \(T\)) such that for all \(t\in [0,T]\setminus Z\), \(W^{x,\mathrm{liq}}_{t}(\theta ,\tilde{H}^{n})\to W^{x,\mathrm{liq}} _{t}(\theta ,H)\) and \(V^{x}_{t}(\theta ,\tilde{H}^{n})\to V^{x}_{t}( \theta ,H)\) hold \(P\)-almost surely.

1.2 A.2 Orlicz spaces

We call \(\varPhi :\mathbb{R}_{+} \to \mathbb{R}_{+}\) a Young function if it is convex with \(\varPhi (0) = 0\) and \(\lim _{x\to \infty }\varPhi (x)/x = \infty \). The set

is a Banach space with the norm

where \(B_{\varPhi }:=\{ X \in L^{0}: E[ \varPhi (|X|) ] \le 1 \}\) is the unit ball of \(L^{\varPhi }\). Define the conjugate function \(\varPhi ^{*}(y):= \sup _{x\ge 0}(xy - \varPhi (x))\), \(y \in \mathbb{R}_{+}\). This is also a Young function and \((\varPhi ^{*})^{*} = \varPhi \). We say that \(\varPhi \) is of class \(\Delta _{2}\) if

We recall [13, Corollary 3.10], a compactness result which is used to handle the losses of trading strategies in this paper.

Lemma A.3

Let\(\varPhi \)be a Young function of class\(\Delta _{2}\)and let\(\xi _{n}\), \(n\ge 1\), be a norm-bounded sequence in\(L^{\varPhi ^{*}}\). Then there are convex weights\(\alpha ^{n}_{j} \ge 0\), \(n \le j \le M(n)\), with\(\sum _{j=n}^{M(n)}\alpha ^{n}_{j} = 1\)such that

converges almost surely to some\(\xi \in L^{\varPhi ^{*}}\)as\(n\to \infty \), and\(\sup _{n}|\xi '_{n}|\)is in\(L^{\varPhi ^{*}}\).

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Chau, H.N., Rásonyi, M. Robust utility maximisation in markets with transaction costs. Finance Stoch 23, 677–696 (2019). https://doi.org/10.1007/s00780-019-00389-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-019-00389-0