Abstract

Can shorter maturity European options be statically hedged with longer maturity plain vanilla options? This problem appears, for example, when analysing options on forwards in relation to liquid options on the spot underlying. Under mild assumptions on the underlying security price process and the option’s payoff function, we show that approximate static hedges exist and we provide a recipe for constructing them. Examples illustrate the power of the hedge and its sensitivity to modelling assumptions. The results can be extended to formulating semi-static hedging strategies for discretely monitored path-dependent contingent claims.

Similar content being viewed by others

Notes

Compare Remark 2.7.

According to the L-curve criterion, one would rather choose μ=10−5, but the resulting hedging strategy entails trading approximately 20 options, which is not reasonable in practice.

Again by the L-curve criterion, one would choose μ=2−7, resulting in a large number of traded options.

Of course, the error from discrete rebalancing can be reduced by increasing the rebalancing frequency, but daily rebalancing is still prevalent in practice.

References

Abramowitz, M., Stegun, I.: Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables. Dover, New York (1972). 9th Dover printing, 10th GPO printing edn.

Albrecher, H., Mayer, P.: Semi-static hedging strategies for exotic options. In: Kiesel, R., Scherer, M., Zagst, R. (eds.) Alternative Investments and Strategies, pp. 345–373. World Scientific, Singapore (2010)

Andersen, L., Lipton, A.: Asymptotics for exponential Lévy processes and their volatility smile: survey and new results. Int. J. Theor. Appl. Finance 16, 1–98 (2013)

Bakshi, G.S., Chen, Z.: An alternative valuation model for contingent claims. J. Financ. Econ. 44, 123–165 (1997)

Bakshi, G., Madan, D.: Spanning and derivative-security valuation. J. Financ. Econ. 55, 205–238 (2000)

Barndorff-Nielsen, O.: Exponentially decreasing distributions for the logarithm of particle size. Proc. R. Soc. Lond. Ser. A, Math. Phys. Sci. 353, 401–419 (1977)

Barndorff-Nielsen, O.E.: Normal inverse Gaussian distributions and stochastic volatility modelling. Scand. J. Stat. 24, 1–13 (1997)

Barndorff-Nielsen, O.E.: Processes of normal inverse Gaussian type. Finance Stoch. 2, 41–68 (1998)

Bertero, M., Boccacci, P.: Introduction to Inverse Problems in Imaging. Taylor & Francis, London (1998)

Björck, Å.: Numerical Methods for Least Squares Problems. SIAM, Philadelphia (1996)

Boyarchenko, S., Levendorskii, S.: Non-Gaussian Merton–Black–Scholes Theory. World Scientific, Singapore (2002)

Breeden, D.T., Litzenberger, R.H.: Prices of state-contingent claims implicit in option prices. J. Bus. 51, 621–651 (1978)

Carr, P., Bowie, J.: Static simplicity. Risk 7, 45–50 (1994)

Carr, P., Madan, D.: Towards a theory of volatility trading. In: Jarrow, R. (ed.) Risk Book on Volatility. Risk, Berlin (1998)

Carr, P., Madan, D.B.: Option valuation using the Fast Fourier Transform. J. Comput. Finance 2(4), 61–73 (1999)

Carr, P., Wu, L.: Static hedging of standard options. J. Financ. Econom. 12, 3–46 (2014)

Carr, P., Ellis, K., Gupta, V.: Static hedging of exotic options. J. Finance 53, 1165–1190 (1998)

Carr, P., Geman, H., Madan, D.B., Yor, M.: The fine structure of asset returns: an empirical investigation. J. Bus. 75, 305–333 (2002)

Conway, J.: A Course in Functional Analysis, 2nd edn. Springer, New York (1990)

Derman, E., Ergener, D., Kani, I.: Static options replication. J. Deriv. 2, 78–95 (1995)

Dupire, B.: Pricing with a smile. Risk 7, 18–20 (1994)

Eberlein, E., Raible, S.: Some analytic facts on the generalized hyperbolic model. In: European Congress of Mathematics, pp. 367–378. Springer, New York (2001)

Eberlein, E.: Application of generalized hyperbolic Lévy motions to finance. In: Barndorff-Nielsen, O., Mikosch, T., Resnick, S. (eds.) Lévy Processes—Theory and Application, pp. 319–336. Springer, Berlin (2001)

Engelmann, B., Fengler, M.R., Nalholm, M., Schwendner, P.: Static versus dynamic hedges: an empirical comparison for barrier options. Rev. Deriv. Res. 9, 239–264 (2006)

Green, R.C., Jarrow, R.A.: Spanning and completeness in markets with contingent claims. J. Econ. Theory 41, 202–210 (1987)

Hadamard, J.: Sur les problèmes aux dérivées partielles et leur signification physique. Princeton Univ. Bull. 13, 49–52 (1902)

Hansen, P.: Rank-Deficient and Discrete Ill-Posed Problems: Numerical Aspects of Linear Inversion. SIAM, Philadelphia (1998)

Hansen, P.: Discrete Inverse Problems: Insight and Algorithms. SIAM, Philadelphia (2010)

Heston, S.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327 (1993)

Jacod, J., Shiryaev, A.N.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, Berlin (2003)

Kou, S.G.: A jump-diffusion model for option pricing. Manag. Sci. 48, 1086–1101 (2002)

Lewis, A.L.: A simple option formula for general jump-diffusion and other exponential Lévy processes (September 2001). Available at SSRN: http://ssrn.com/abstract=282110 or http://dx.doi.org/10.2139/ssrn.282110

Lipton, A.: The vol smile problem. Risk 15, 61–66 (2002)

Madan, D., Seneta, E.: The variance gamma (VG) model for share market returns. J. Bus. 63(4), 511–524 (1990)

Madan, D., Carr, P., Chang, E.: The variance gamma process and option pricing. Eur. Finance Rev. 2, 79–105 (1998)

Merton, R.C.: Option pricing when the underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Nachman, D.C.: Spanning and completeness with options. Rev. Financ. Stud. 1, 311–328 (1988)

Nalholm, M., Poulsen, R.: Static hedging and model risk for barrier options. J. Futures Mark. 26, 449–463 (2006)

Press, W.H., Teukolsky, S.A., Vetterling, V., Flannery, B.P.: Numerical Recipes in C: the Art of Scientific Computing, 2nd edn. Cambridge University Press, Cambridge (1992)

Rudin, W.: Real and Complex Analysis, 3rd edn. McGraw-Hill, San Francisco (1987)

Schoutens, W.: Lévy Processes in Finance. Wiley, New York (2003)

Scott, L.O.: Pricing stock options in a jump-diffusion model with stochastic volatility and interest rates: applications of Fourier inversion methods. Math. Finance 7, 413–426 (1997)

Tompkins, R.G.: Static versus dynamic hedging of exotic options: an evaluation of hedge performance via simulation. J. Risk Finance 3, 6–34 (2002)

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Application of the Nyquist–Shannon theorem

We apply the Nyquist–Shannon theorem (Whittaker–Shannon theorem, sampling theorem) to derive an approximate hedging strategy for a call option; see e.g. Sect. 2.2 of Bertero and Boccacci [9] for the theorem.

Theorem A.1

(Nyquist–Shannon theorem)

Let f be a bandlimited and square-integrable function with band interior to the interval [−Ω,Ω]. Then

where \(\operatorname{sinc} x= \frac{\sin(\pi x)}{\pi x}\).

In the following, we set τ:=π/Ω.

Let us first assume that \(\tilde{p}\) satisfies the conditions of Lemma 3.1. Then, assuming that \(\tilde{p}\) has bandwidth Ω and using the decomposition (A.1), we obtain, using that the Fourier transform (FT) is a linear transform,

The FT of the sinc function is given by

By using that the FT has the properties

we obtain

Continuing above, we have

which can be calculated numerically, using (2.3) and (2.4) to calculate \(\mathfrak {F}(\gamma)\).

If the payoff function \(\tilde{p}\) is not bandlimited, one can approximate the hedging strategy by forcing \(\tilde{p}\) to be bandlimited through an appropriate choice of Ω.

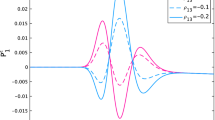

The example in Fig. 1 is parameterised as follows. The payoff to be hedged (resp., replicated) is a call option with strike K=0.9 maturing at 0.5, that is, the payoff is \(p(x)=\left(\mathrm{e}^{x}-0.9\right)^{+}\), and \(\tilde{p}(x)=\mathrm {e}^{-(1+\alpha) x} (\mathrm{e}^{x}-0.9)^{+}\). We choose α=1. The hedging instruments are call options maturing at time 1. We assume a BSM model for the underlying asset price process, with volatility σ=0.16836.

In order to apply the Nyquist–Shannon theorem, we choose Ω=16 so that τ=π/16, and furthermore, we let the sum in (A.1) range from −30 to 30.

Appendix B: Market data

Rights and permissions

About this article

Cite this article

Mayer, P.A., Packham, N. & Schmidt, W.M. Static hedging under maturity mismatch. Finance Stoch 19, 509–539 (2015). https://doi.org/10.1007/s00780-014-0254-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-014-0254-7