Abstract

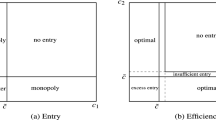

Conventionally, entry is thought to enhance welfare by enhancing competition and hence lowering prices and increasing the output. Contrary to the conventional wisdom, working with an \(n\)-firm Cournot oligopoly set up and using the trigger strategies, we show that entry may or may not impact welfare. However, entry has the potential to alter the market structure from collusion to Cournot competition, and when it does so, there is a discontinuous rise in welfare.

Similar content being viewed by others

Data availability

No data was used for the research described in the article.

References

Brito D, Catal o-Lopes, M. (2023) Profit raising entry under mixed behavior. J Econ 138:51–72

Chang M-H (1991) The effects of product differentiation on collusive pricing. Int J Ind Organ 9(3):453–469

Collie DR (2006) Collusion in differentiated duopolies with quadratic costs. Bull Econ Res 58(2):151–159

Corchón LC, Torregrosa RJ (2020) Cournot equilibrium revisited. Math Soc Sci 106:1–10

Dastidar KG, Marjit S (2022) Market size, entry costs and free entry Cournot equilibrium. J Econ 136:97–114

Deneckere R (1983) Duopoly supergames with product differentiation. Econ Lett 11(1–2):37–42

Dixit A, Stiglitz J (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67:297–308

Fudenberg D, Maskin E (1986) The folk theorem in repeated games with discounting or with incomplete information. Econometrica 54(3):533–554

Garcia F, Paz y Miño, J.M., Torrens, G. (2020) The merger paradox, collusion and competition policy. J Pub Econ Theory 22(6):2051–2081

Gibbons R (1992) Game theory for applied economists. Princeton University Press, Princeton

Harrington JE Jr (1989) Collusion among asymmetric firms: the case of different discount factors. Int J Ind Org 7(2):289–307

Lahiri S, Ono Y (1988) Helping minor firms reduce welfare. Econ J 98:1199–1202

Mankiw NG, Whinston MD (1986) Free entry and social inefficiency. Rand J Econ 17:48–58

Martin S (2001) Industrial organization: a European perspective. Oxford University Press, Oxford

Marjit S, Misra S, Banerjee DS (2017) Technology improvement and market structure alteration. Econ Bull 37(2):1106–1112

Miralles A (2010) Self–enforced collusion through comparative cheap talk in simultaneous auctions with entry. Econ Theor 42:523–538

Perry MK (1984) Scale economies, imperfect competition, and public policy. J Ind Econ 32:313–333

Ross TW (1992) Cartel stability and product differentiation. Int J Ind Organ 10(1):1–13

Schmalensee R (1976) Is more competition necessarily good? Ind Org Rev 4:121–121

Shy O (1996) The industrial organization. The MIT Press, Cambridge

Spence AM (1976) Product selection, fixed costs, and monopolistic competition. Rev Econ Stud 43:217–236

Spence AM (1984) Cost reduction, competition, and industry performance. Econometrica 52:101–121

Stiglitz JE (1981) Potential competition may reduce welfare. Am Econ Rev Proc 71:184–189

Suzumura K, Kiyone D (1987) Entry barriers and economic welfare. Rev Econ Stud 54:157–167

Symeonidis G (2002) Cartel stability with multi–product firms. Int J Ind Organ 20(3):339–352

Tirole J (1988) The theory of industrial organization. The MIT Press, Cambridge

von Weizsäcker CC (1980a) A welfare analysis of barriers to entry. Bell J Econ 11:399–420

von Weizsäcker CC (1980b). Barriers to entry: a theoretical treatment. Springer, Berlin.

Weibull JW (2006) Price competition and convex costs. SSE/EFI working paper series in economics and finance, No. 622.

Wernerfelt B (1989) Tacit collusion in differentiated Cournot games. Econ Lett 29(4):303–306

Williamson O (1968) Economies as an antitrust defense: Welfare trade–offs. Am Econ Rev 58:18–36

Acknowledgement

I am deeply indebted to Giacomo Corneo, the Editor-in-Chief, Journal of Economics and an anonymous referee for a set of excellent comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We hereby declare that none of the authors has any conflict of interest with any entity/organization.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Generalizations

Appendix A: Generalizations

1.1 Bertrand Oligopoly

With the same demand and cost as in Sect. 2 (an inverse demand function of the form \(p\left( q \right) = 1 - q\); \(n\) firms with symmetric cost function of the form \(c_{i} \left( {q_{i} } \right) = cq_{i}\); \(0 \le c < 1\), \(i = 1,2, \ldots ,n\), and \(q = \mathop \sum \limits_{i = 1}^{n} q_{i}\) where \(q_{i}\) is the output produced by firm \(i\) and \(q\) is the industry output), consider collusion in a Bertrand oligopoly set up. If all the \(n\) firms decide to collude, they will sell at the agreed collusive price, say \(P^{c}\), in all the time periods, and \(P^{c} \in \left( c \right.,\left. {P^{m} } \right]\) where \(P^{m}\) is the monopoly price (as in Eq. (3)). When each firms chooses the same price, i.e., \(P^{c}\), it earns the collusive profit every time-period (as in Eq. (4)). Thus, as above, the present discounted value of the lifetime profit from collusion is \(\Pi_{i}^{c} = \frac{{\pi_{i}^{c} }}{1 - \delta } = \frac{{\left( {1 - c} \right)^{2} }}{{4n\left( {1 - \delta } \right)}}\).

However, if the \(i^{th}\) firm deviates it charges a price \(P^{d} = P^{c} - \varepsilon ; \varepsilon > 0\) and captures the entire market and earns a profit of \(\pi \left( {P^{c} } \right)\) and a profit of zero thereafter as all the firms revert to the Nash equilibrium of the one-shot Bertrand game. Hence, collusion would be an SPE iff,

Finally, \(\delta \ge \frac{{\pi_{i}^{d} - \pi_{i}^{c} }}{{\pi_{i}^{d} - \pi_{i}^{o} }} = \frac{{\left( {n - 1} \right)}}{n} \equiv \underline {\delta }^{b}\). As in Sect. 2, \(\frac{{\partial \underline {\delta }^{b} }}{\partial n} > 0\) and \(\frac{{\partial^{2} \underline {\delta }^{b} }}{{\partial n^{2} }} < 0\). We denote the critical discount factor under Bertrand oligopoly by superscripting it with “b” to distinguish it from its Cournot counterpart.

Proposition (A.1)

\(\forall \delta \in \left( {\frac{1}{2},1} \right),\) \(\exists\) a unique \(\hat{n}\) satisfying \(\underline {\delta }^{b} \left( n \right) = \delta\), such that \(\forall n \le \hat{n}\) collusion is the SPE outcome and Cournot competition otherwise.

Proof

\(\mathop {\lim }\limits_{n \to 2} \underline {\delta }^{b} = \frac{1}{2}\) while \(\mathop {\lim }\limits_{n \to \infty } \underline {\delta }^{b} = 1\). Hence, \(\forall \delta \in \left( {\frac{1}{2},1} \right)\), there exists a unique \(n\), say \(\hat{n}\), such that \(\underline {\delta }^{b} \left( n \right) = \delta\). If \(n \le \hat{n}\), then \(\delta \ge \underline {\delta }^{b}\) and collusion is the SPE, else, Cournot competition is the SPE. Q.E.D.

Hence all the propositions of Sect. 3 are valid here as well.

1.2 General demand function

Consider a general inverse demand function of the form \(p = \left( {1 - q} \right)^{\beta }\). This form of the demand function allows for the fuller analysis of (the different curvatures) the demand curve. \(0 < \beta < 1\) corresponds to the concave demand curve, \(\beta = 1\) to the linear demand curve while \(\beta > 1\) to the convex demand curve. We retain the constant marginal cost assumption, however, we assume it to be zero.

Cournot competition

The individual firm’s output in equilibrium is \(q_{1}^{o} = q_{2}^{o} = \ldots = q_{i}^{o} = \ldots = q_{n}^{o} = \frac{1}{n + \beta }\) while the total output and price in equilibrium are

The profit of the \(i^{th}\) firm is,

Corchón and Torregrosa (2020) consider an inverse demand function of the form \(p = a - bq^{\beta }\) and show that \(n + \beta > 0\) is a necessary and sufficient condition for existence of a Cournot equilibrium. We also get the same result as summarized in proposition A.2 as follows.

Proposition (A.2):

\(n + \beta > 0\) is a necessary and sufficient condition for existence of a Cournot equilibrium.

Proof: \(q_{1}^{o} = q_{2}^{o} = \ldots = q_{i}^{o} = \ldots = q_{n}^{o} = \frac{1}{n + \beta } > 0\) if \(n + \beta > 0\) and \(q^{o} > 0\), \(p^{o} > 0\) and \(\pi_{i}^{o} > 0\) if \(n + \beta > 0\) (Eqs. A–2 and A–3). Q.E.D.

Collusion

In equilibrium each firm produces \(q_{i}^{c} = \frac{1}{{n\left( {1 + \beta } \right)}}\), hence the total output and price are,

The profit of the \(i^{th}\) firm is,

Deviation/cheating

While each firm produces the collusive output, \(q_{i}^{c} = \frac{1}{{n\left( {1 + \beta } \right)}}\), the deviating firm’s output (which it chooses as per its reaction function) and the price in deviation are,

The profit of the deviating firm is,

Thus, \(\delta \ge \frac{{\pi_{i}^{d} - \pi_{i}^{c} }}{{\pi_{i}^{d} - \pi_{i}^{o} }} = \frac{{\beta^{\beta } \left( {\frac{{\left( {1 + n\beta } \right)}}{{n\left( {1 + \beta } \right)^{2} }}} \right)^{1 + \beta } - \beta^{\beta } \frac{1}{{n\left( {1 + \beta } \right)^{1 + \beta } }}}}{{\beta^{\beta } \left( {\frac{{\left( {1 + n\beta } \right)}}{{n\left( {1 + \beta } \right)^{2} }}} \right)^{1 + \beta } - \beta^{\beta } \frac{1}{{\left( {n + \beta } \right)^{1 + \beta } }}}} \equiv \underline {\delta }\).

Finally, \(\delta \ge \frac{{\left( {n + \beta } \right)^{1 + \beta } \left( {\left( {1 + n\beta } \right)^{1 + \beta } - n^{\beta } \left( {n + \beta } \right)^{1 + \beta } } \right)}}{{\left( {\left( {1 + n\beta } \right)\left( {n + \beta } \right)} \right)^{1 + \beta } - \left( {n\left( {1 + \beta } \right)^{2} } \right)^{1 + \beta } }} \equiv \underline {\delta }^{g}\). Similarly, as above, \(\frac{{\partial \underline {\delta }^{g} }}{\partial n} > 0\) and \(\frac{{\partial^{2} \underline {\delta }^{g} }}{{\partial n^{2} }} < 0\).

We denote the critical discount factor under the general demand function by superscripting it with “g” to distinguish it from its Cournot and Bertrand counterparts. Following proposition has the results for various values of \(\beta\) (highlighting the demand curvatures) and \(\underline {\delta }^{g}\).

Proposition (A.3)

For \(\beta = \frac{1}{2}\) and \(\forall \delta \in \left( {.5571, 1} \right)\), for \(\beta = 1\) and \(\forall \delta \in \left( {\frac{9}{17},1} \right)\) and for \(\beta = 2\) and \(\forall \delta \in \left( {.5018, 1} \right)\), \(\exists\) a unique \(\hat{n}\) respectively satisfying \(\underline {\delta }^{g} \left( {n,\beta } \right) = \delta\), such that \(\forall n \le \hat{n}\) collusion is the SPE outcome and Cournot competition otherwise.

Proof

\(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {2, \frac{1}{2}} \right)}} \underline {\delta }^{g} = .5571\) and \(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {\infty , \frac{1}{2}} \right)}} \underline {\delta }^{g} = 1\), \(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {2,1} \right)}} \underline {\delta }^{g} = \frac{9}{17}\) and \(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {\infty ,1} \right)}} \underline {\delta }^{g} = 1\) while \(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {2, 2} \right)}} \underline {\delta }^{g} = \frac{1088}{{2168}} = .5018\) and \(\mathop {\lim }\limits_{{\left( {n,\beta } \right) \to \left( {\infty 2} \right)}} \underline {\delta }^{g} = 1\). Hence, for the above respective values of \(\beta\) and the indicated respective ranges of \(\delta\), there exists a unique respective \(n\), say \(\hat{n}_{\beta }\), such that \(\underline {\delta }^{g} \left( {n,\beta } \right) = \delta\). If \(n \le \hat{n}_{\beta }\), then \(\delta \ge \underline {\delta }^{b}\) and collusion is the SPE, else, Cournot competition is the SPE. Q.E.D.

Hence, in both Bertrand oligopoly as well as with the general demand function, the results hold.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mishra, S. Entry, market structures and welfare. J Econ (2024). https://doi.org/10.1007/s00712-024-00859-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00712-024-00859-w