Abstract

We examine the implications of different ways in which downstream firms can exercise buyer power over their upstream suppliers. We derive several variations of a model in which two upstream firms supply a differentiated product under exclusive contracts to two downstream firms which compete in prices in the retail market. We begin with a benchmark model (upstream first-mover pricing), and then compare its outcomes with those of models that feature different modes of exercising buyer power: downstream first-mover pricing; Nash Bargaining with linear and two-part tariffs; and vertical integration. We rank these five regimes in terms of wholesale and retail prices, social welfare, the pass-through rates of changes in upstream costs, and downstream firms’ profits. We show under what conditions more powerful downstream firms benefit consumers by exercising ‘countervailing power’ against upstream suppliers. We also show that the lump-sum component of the two-part tariff can go in either direction (a slotting allowance or a franchise fee), depending in a very precise way only on parameters representing bargaining power and the degree of product differentiation. Exactly the same configuration of these parameters is shown to determine the ranking of wholesale and retail prices, pass-through rates, and downstream profits, as between the Nash Bargaining regimes with linear and two-part tariffs. Finally, we show that downstream firms which possess buyer power always prefer vertical arrangements that are socially sub-optimal.

Similar content being viewed by others

Notes

Analyzing the buyer power of e-commerce giants like Amazon requires a different theoretical framework, involving two-sided platforms with indirect network externalities, which we do not attempt to model in this paper.

The concept of countervailing power in this context was originally advanced by Galbraith (1952), but it has been formally modelled only since Dobson and Waterson (1997). Unlike them and later literature (e.g. Gaudin 2018 and other papers cited by him), we do not model increased buyer power as growing concentration arising from horizontal mergers of downstream firms, or their polarization into a dominant retailer and a competitive fringe (Chen 2003). Chen et al (2016) analyse countervailing buyer power in the form of both increased concentration among retailers and greater bargaining power of a dominant retailer in an exclusive contract with a monopoly upstream supplier, while it competes with a fringe of price-taking small retailers. This market structure rules out the kind of strategic effects that play an important role in our model, which assumes an unchanging market structure of symmetric duopoly at both levels, and several different modes of exercising buyer power.

For the same reason, we also do not deal with other issues that are prominent in the vertical contracting literature, such as raising rivals’ costs, foreclosure of entry, investment incentives, and horizontal merger at upstream or downstream levels.

For the sake of greater generality, as motivated in the preceding subsection, we henceforth refer to upstream and downstream firms, rather than manufacturers and retailers. But in our Nash Bargaining model with two-part tariff, we shall continue to refer to franchise fees and slotting allowances, even though these terms are traditionally associated with retailers.

This simplifies the analysis and also rules out the problem of post-contractual opportunism, whereby firms can renege on unobservable exclusivity contracts, as pointed out by Hart and Tirole (1990) and Fumagalli and Motta (2001). (Some of the explanations for exclusivity discussed above could also make such opportunism unprofitable or technologically impossible.).

Results are not defined for values of γ=1, therefore we bound γ strictly less than 1.

Even though with exclusive supply chains there is no market for the intermediate good, these functions give the wholesale price chosen by each upstream firm as its best response to the other upstream firm’s wholesale price. This is because the optimal wholesale prices are indirectly related through the downstream firms’ interaction in the final goods market.

Most of our subsequent results are based on inequalities which involve complicated expressions. It turns out that factorization usually allows the parameters a and c to be segregated into the simple expression in Lemma 1. This helps to determine the direction of the more complicated inequalities, and to show that it remains unaffected by the values of these two parameters.

Manasakis and Vlassis (2014) present only the results of a similar model, without deriving them, but with different notation, and upstream marginal costs assumed to be zero. We have confirmed that this special case of our more general results corresponds to theirs. The focus of their paper is very different, i.e. to compare the equilibrium choice of Bertrand vs Cournot competition in the final goods market.

Yoshida (2018, Sects. 3 and 4) examines the consequences of varying degrees of bargaining power in a model of competing supply chains with Nash Bargaining over linear prices within each chain (corresponding to our NB1 model), but with asymmetric downstream costs. He finds that an increase in upstream bargaining power decreases the quantity and profits of the more efficient downstream firm, but may increase the quantity and profits of the less efficient one.

Exceptions to this result arise for the special cases of \(\mu=0\) in the NB1 regime and \(\upgamma =0\) in the NB2 regime, both of which yield w* = c, for which we provided the intuition above.

No such reversal was possible in the case of retail prices, because in equilibrium they coincide in the benchmark and FM regimes. In contrast, equilibrium wholesale prices are lower in the FM as compared to the benchmark regime. This gap allows wholesale prices in the NB1 regime to exceed those in the FM regime for high enough μ. This characterizes Zone 3 of Fig. 3, which has no counterpart in Fig. 2.

This can be confirmed by plotting the curves for dP/dc as a function of γ∈ (0, 1) in each case. The derivative increases continuously from 0 to 1 over this interval.

The corresponding results for upstream firms' profits are not included because they are harder to interpret, as well as because of the length of the paper and its focus on buyer power. However, the ratio of upstream to downstream profits under each regime is given in the last row of Table 1. This confirms that upstream profits are less than downstream profits for any regime which exhibits buyer power as we have defined it.

The case where the alternative to VI is separation was worked out from the perspective of upstream firms by Bonanno and Vickers (1988) and Lin (1990) with full extraction of downstream profits through a franchise fee, and by McGuire and Staelin (1983) and Cyrenne (1994) with and without a franchise fee.

It can be shown that the sign of the above inequality can be reversed for values of μ > 0.5, so that downstream firms with less bargaining power would receive lower profits as compared to the benchmark regime with upstream linear pricing. The limiting case of this is when μ = 1, when they surrender their entire profits to the upstream firms in the form of a franchise fee.

References

Adachi T (2020) Hong and Li meet Weyl and Fabinger: modeling vertical structure by the conduct parameter approach. Econ Lett 186(C):108732

Alipranti M, Petrakis E (2020) Fixed fee discounts and Bertrand competition in vertically related markets. Math Soc Sci 106(C):19–26

Alipranti M, Petrakis E (2022) Upstream market structure and the timing of technology adoption. Manag Decis Econ 43(5):1298–1310

Bonanno G, Vickers J (1988) Vertical separation. J Ind Econ 36(3):257–265

Basak D, Wang LFS (2016) Endogenous choice of price or quantity contract and the implications of two-part-tariff in a vertical structure. Econ Lett 138(C):53–56

Buccella D, Fanti L (2022) Downstream competition and profits under different input price bargaining structures. J Econ 136:251–268

Chen Z (2003) Dominant retailers and the countervailing-power hypothesis. RAND J Econ 34(4):612–625

Cyrenne P (1994) Vertical integration versus vertical separation: an equilibrium model. Rev Ind Organ 9(3):311–322

Chen Z (2019) Supplier innovation in the presence of buyer power. Int Econ Rev 60(1):329–353

Chen Z, Ding H, Liu Z (2016) Downstream competition and the effects of buyer power. Rev Ind Organ 49(1):1–23

Din H-R, Sun C-H (2023) Centralized or decentralized bargaining in a vertically-related market with endogenous price/quantity choices. J Econ 138(1):73–94

Dobson PW, Waterson M (1997) Countervailing power and consumer prices. Econ J 107(441):418–430

Fudenberg D, Tirole J (1984) The fat-cat effect, the puppy-dog ploy, and the lean and hungry look. Am Econ Rev 74(2):361–366

Fumagalli C, Motta M (2001) Upstream mergers, downstream mergers, and secret vertical contracts. Res Econ 55(3):275–289

Galbraith JK (1952) american capitalism: the concept of countervailing power. Houghton Mifflin, New York

Gal-Or E (1991) Duopolistic vertical restraints. Eur Econ Rev 35(6):1237–1253

Gaudin G (2016) Pass-through, vertical contracts, and bargains. Econ Lett 139(C):1–4

Gaudin G (2018) Vertical bargaining and retail competition: what drives countervailing power? Econ J 128(614):2380–2413

Gupta S (2022) Buyer power, exclusive contracts and vertical mergers in competing supply chains: implications for competition law and policy. GNLU J Law Econ 5(1):1–24

Hart O, Tirole J (1990) Vertical integration and market foreclosure. Brookings Papers Econ Activity Microeconomics 21:205–276

Horn H, Wolinsky A (1988) Bilateral monopolies and incentives for merger. RAND J Econ 19(3):408–419

Lin Y (1990) The dampening-of-competition effect of exclusive dealing. J Ind Econ 39(2):209–223

Li G, Wu H, Xiao S (2020) Financing strategies for a capital-constrained manufacturer in a dual-channel supply chain. Int Trans Oper Res 27(5):2317–2339

Manasakis C, Vlassis M (2014) Downstream mode of competition with upstream market power. Res Econ 68(1):84–93

McGuire TW, Staelin R (1983) An industry equilibrium analysis of downstream vertical integration. Mark Sci 2(2):161–191

Milliou C, Petrakis E (2007) Upstream horizontal mergers, vertical contracts, and bargaining. Int J Ind Organ 25(5):963–987

O’Brien DP, Shaffer G (1993) On the dampening-of-competition effect of exclusive dealing. J Ind Econ 41(2):215–221

Shaffer G (1991) Slotting allowances and resale price maintenance: a comparison of facilitating practices. RAND J Econ 22(1):120–135

Symeonidis G (2010) Downstream merger and welfare in a bilateral oligopoly. Int J Ind Organ 28(3):230–232

Singh N, Vives X (1994) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Wang X, Li J (2020) Downstream rivals’ competition, bargaining, and welfare. J Econ 131(1):61–75

Wang YY, Sun J, Wang JC (2016) Equilibrium markup pricing strategies for the dominant retailers under supply chain to chain competition. Int J Prod Res 54(7):2075–2092

Wang V, Lai CH, Lee LS, Hu SW (2010) Franchise fee, contract bargaining, and economic growth. Econ Innov New Technol 19(6):539–552

Yoshida S (2018) Bargaining power and firm profits in asymmetric duopoly: an inverted-U relationship. J Econ 124(2):139–158

Zhang R, Liu B, Wang W (2012) Pricing decisions in a dual channels system with different power structures. Econ Model 29(2):523–533

Acknowledgements

We thank Abhijit Banerji, Uday Bhanu Sinha, and three anonymous referees of this journal for helpful comments on earlier drafts. The usual disclaimer applies.

Funding

No funding was received for this research. No third-party data were used.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Derivation of the demand function

Following Singh and Vives (1994), we assume a representative consumer’s utility function as:

Here qi is quantity produced by upstream firm i. \({q}_{0}\) is a Hicksian composite commodity consisting of all other goods outside the market of interest. Since we are working with real prices we are normalizing price one unit of this basket equal to 1. We assume \(\alpha >0, \beta >0.\) To derive the demand function we maximize this utility function for q0, q1 and q2:

Subject to the budget constraint:\(Y={q}_{0}+{p}_{1}{q}_{1}+{p}_{2}{q}_{2}\)

On maximization we get the following inverse demand function

On rearranging terms we get direct demand functions as

where,

where \(\delta \equiv (\beta ^{2} - \lambda ^{2} )\)

-

When γ/b approaches 1 it implies \(\frac{\gamma }{b} = \frac{{{\uplambda }/{\updelta }}}{{{\upbeta }/{\updelta }}} = \frac{{\uplambda }}{{\upbeta }} \to 1\), which implies that δ\(\to 0\), where the demands are undefined. Therefore, we assume γ < b. We have adapted this restriction for the case where b = 1, which is used to derive the results. b = 1 implies \(\frac{\beta }{\delta }=1\).

-

Most papers in economics journals follow Singh and Vives (1994) by substituting the parameters of the inverse demand function into the a, b and γ parameters of the direct demand function before proceeding with the firms’ profit-maximization exercise. The direct demand specification without substitution was used in the early papers on vertical relationships with downstream competition in prices, e.g. Lin (1990) and O’Brien and Shaffer (1993). It was actually first used by McGuire and Staelin (1983), and continues to be used extensively in the literature on marketing and operations research (although it is not derived from maximizing a utility function). See Wang et al (2016), Li et al (2020) and many other papers cited there. However, it creates a problem of discontinuity as γ/b approaches 1.

-

Another problem with using the direct demand specification, which does not seem to have been noticed by earlier authors, is that it gives the same 'monopoly' results when either γ = 0 (signifying independent demands and no competition), or pj = 0 (signifying intense competition). This can be averted by bounding prices above zero by assuming positive marginal costs, with \(\alpha \ge c\), and the upstream firm assumed to have constant marginal cost of production equal to c.

Appendix 2: First order conditions for the Nash Bargaining model with two-part tariff

An upstream firm’s profit can be written as

where,

\({w}_{1}\): wholesale price.

\({S}_{1}\): slotting allowance

Downstream firm’s profit can be written as

Define the Nash product of upstream and downstream profits as:

On differentiating with respect to S1, we get

When we solve the above first order condition for \({\uppi }_{D1}\) we get

When we substitute into equation A4 above the profit function of the upstream and downstream firms, we get below equation

On rearranging the terms on both sides, we get:

On differentiating N with respect to wholesale price w, we get

Substituting equation A4 into the above equation we get

Appendix 3: Proof of Proposition 2

We have already shown above that prices are the same in the FM and benchmark cases. Now we prove the inequalities successively.

-

1.

\({{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}\le {{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}\)

$${{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}=\frac{a(2\left(2+\mu \right)-2{\gamma }^{2})-c(2-{\gamma }^{2})(\mu -2)}{(2-\gamma )(4-2{\gamma }^{2}-\gamma \mu )}, {{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}=\frac{a+{\text{c}}}{(2-\upgamma )}$$$${{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}-{{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}=\frac{a\left(2\left(2+\mu \right)-2{\gamma }^{2}\right)-c\left(2-{\gamma }^{2}\right)\left(\mu -2\right)}{\left(2-\gamma \right)\left(4-2{\gamma }^{2}-\gamma \mu \right)}- \frac{a+{\text{c}}}{(2-\upgamma )}$$$$=\frac{(a+c(-1+\gamma ))(2+\gamma )\mu }{(2-\gamma )(4-2{\gamma }^{2}-\gamma \mu )}\ge 0, \, \mathrm{with equality for} \, \mu =0$$

In the above expression, in the numerator \(\left(a+c\left(-1+\gamma \right)\right)>0\) by Lemma 1, and (\(2+\gamma )>0\). So, the numerator is positive. In the denominator, \(\left(2-\gamma \right)>0\) and \(\left(4-2{\gamma }^{2}-\gamma \mu \right)>0\) for all values of \(\gamma {\text{and}} \mu\) in the given ranges. Thus, \({{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}\le {{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}\), with the vertically integrated outcome emerging when downstream firms have all bargaining power, as explained in the text.

-

2.

\({{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}\le {{\text{p}}}_{{\text{i}},{\text{NB}}2}^{*}\)

$${\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} = \frac{{2a + c\left( {2 - \gamma^{2} } \right)}}{{\left( {4 - 2\gamma - \gamma^{2} } \right) }}, {\text{p}}_{{{\text{i}},{\text{VI}}}}^{*} = \frac{a + c}{{\left( {2 - \gamma } \right)}}$$$${\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} - {\text{p}}_{{{\text{i}},{\text{VI}}}}^{*} = \frac{{2a + c\left( {2 - \gamma^{2} } \right)}}{{\left( {4 - 2\gamma - \gamma^{2} } \right) }} - \frac{a + c}{{\left( {2 - \gamma } \right)}}$$\(= \frac{{\gamma^{2} \left( {a - \left( {1 - \gamma } \right)c} \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma - \gamma^{2} } \right) }} \ge 0\), with equality for \(\gamma <0\)

The denominator here is positive, as \(\left(2-\upgamma \right)>0, \left(4{-2\upgamma }^{2}-\upgamma \right)>0\). In the numerator, \(\left(a-\left(1-\upgamma \right)c\right)>0\) and \({\upgamma }^{2}\ge 0\) for all values of γ between 0 and 1. This shows that \({{\text{p}}}_{{\text{i}},{\text{VI}}}^{*}\)≤\({{\text{p}}}_{{\text{i}},{\text{NB}}2}^{*}\) holds true for all relevant values of \(\upgamma\) and c. Once again, the vertical integration outcome emerges when goods are independent.

-

3.

\({{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}\lesseqgtr{{\text{p}}}_{{\text{i}},{\text{NB}}2}^{*} \, {\text{as}} \, 2\mu \lesseqgtr{\gamma }^{2}\)

$${\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} = \frac{{2a - c\left( {\gamma^{2} - 2} \right)}}{{\left( {4 - 2\gamma - \gamma^{2} } \right) }}, {\text{p}}_{{{\text{i}},{\text{NB}}1}}^{*} = \frac{{a\left( {2\left( {2 + \mu } \right) - 2\gamma^{2} } \right) + c\left( {2 - \gamma^{2} } \right)\left( {2 - \mu } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma^{2} - \gamma \mu } \right)}}$$$$\begin{gathered} {\text{p}}_{{{\text{i}},{\text{NB}}1}}^{*} - {\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} = \frac{{a\left( {2\left( {2 + \mu } \right) - 2\gamma^{2} } \right) + c\left( {2 - \gamma^{2} } \right)\left( {2 - \mu } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma^{2} - \gamma \mu } \right)}} - \frac{{2a + c\left( {2 - \gamma^{2} } \right)}}{{\left( {4 - 2\gamma - \gamma^{2} } \right)}} \hfill \\ = \frac{{2\left( {a + c\left( { - 1 + \gamma } \right)} \right)\left( {2 - \gamma^{2} } \right)\left( {\gamma^{2} - 2\mu } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma - \gamma^{2} } \right)\left( { - 4 + 2\gamma^{2} + \gamma \mu } \right)}} \hfill \\ \end{gathered}$$

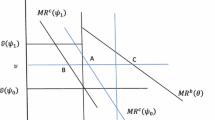

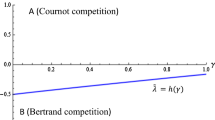

Note that \(\left(a+c\left(-1+\gamma \right)\right)>0\) by Lemma 1; the second term in the numerator and the first two terms in the denominator are also positive; but the last term in the denominator is strictly negative. So the sign of the entire expression will be the opposite of the sign of \({(\gamma }^{2}-2\mu )\), which determined the sign of S* in Proposition 1. Not surprisingly, therefore, when \(\frac{(2-{\gamma }^{2})({\gamma }^{2}-2\mu )}{(2-\gamma )(4-2\gamma -{\gamma }^{2})(-4+2{\gamma }^{2}+\gamma \mu )}\) is plotted in Mathematica software, the region for which \({{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}>{{\text{p}}}_{{\text{i}},{\text{NB}}2}^{*}\) turns out to be identical to the zone consistent with a franchise fee (unshaded region) in Fig. 2.

-

4.

\({p}_{i,NB1}^{*}\le {p}_{i,FM}^{*}\), with equality for \(\mu\)=1.

$${{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}=\frac{a\left(2\left(2+\mu \right)-2{\gamma }^{2}\right)+c\left(2-{\gamma }^{2}\right)\left(2-\mu \right)}{\left(2-\gamma \right)\left(4-2{\gamma }^{2}-\gamma \mu \right)}$$$${{\text{p}}}_{{\text{i}},{\text{FM}}}^{*}= \frac{6a-2a{\upgamma }^{2}+c({2-\upgamma }^{2})}{(4-2{\upgamma }^{2}-\upgamma )(2-\upgamma )}$$$$\begin{aligned} {\text{p}}_{{{\text{i}},{\text{FM}}}}^{*} - {\text{p}}_{{{\text{i}},{\text{NB}}1}}^{*} & = \frac{{6a - 2a\gamma ^{2} + c\left( {2 - \gamma ^{2} } \right)}}{{\left( {4 - 2\gamma ^{2} - \gamma } \right)\left( {2 - \gamma } \right)}} \\ & \quad - \frac{{a\left( {2\left( {2 + \mu } \right) - 2\gamma ^{2} } \right) + c\left( {2 - \gamma ^{2} } \right)\left( {2 - \mu } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma ^{2} - \gamma \mu } \right)}} \\ & = \frac{{2\left( {a - \left( {1 - \gamma } \right)c} \right)\left( {2 + \gamma } \right)\left( {2 - \gamma ^{2} } \right)\left( {1 - \mu } \right)}}{{\left( {2 - \gamma } \right)\left( {2\gamma ^{2} + \gamma - 4} \right)\left( {2\gamma ^{2} + \gamma \mu - 4} \right)}} \\ \end{aligned}$$

In the numerator \(\left(a-\left(1-\gamma \right)c\right)>0\) by Lemma 1, \(\left(1-\mu \right)\ge 0\), \(\left({2-\gamma }^{2}\right)>0\). So, the numerator is positive. In the denominator, \(\left(2-\gamma \right)>0\), \(\left(2{\gamma }^{2}+\gamma -4\right)<0\) and \(\left(2{\gamma }^{2}+\gamma \mu -4\right)<0\) for all values of \(\gamma\) and μ in the relevant ranges (the last two expressions are non-factorizable and checked in Mathematica for the direction of their signs). Thus, \({{\text{p}}}_{{\text{i}},{\text{FM}}}^{*}\ge {{\text{p}}}_{{\text{i}},{\text{NB}}1}^{*}.\)

-

5.

\({{\text{p}}}_{{\text{i}},{\text{NB}}2}^{*}<{{\text{p}}}_{{\text{i}},{\text{FM}}}^{*}\)

$${\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} = \frac{{2a + c\left( {2 - \gamma^{2} } \right) }}{{\left( {4 - 2\gamma - \gamma^{2} } \right) }};\quad {\text{p}}_{{{\text{i}},{\text{FM}}}}^{*} = \frac{{6a - 2a\gamma^{2} + c\left( {2 - \gamma^{2} } \right)}}{{\left( {4 - 2\gamma^{2} - \gamma } \right)\left( {2 - \gamma } \right)}}$$$$\begin{aligned} {\text{p}}_{{{\text{i}},{\text{FM}}}}^{*} - {\text{p}}_{{{\text{i}},{\text{NB}}2}}^{*} &= \frac{{6a - 2a\gamma^{2} + c\left( {2 - \gamma^{2} } \right)}}{{\left( {4 - 2\gamma^{2} - \gamma } \right)\left( {2 - \gamma } \right)}} - \frac{{2a + c\left( {2 - \gamma^{2} } \right) }}{{\left( {4 - 2\gamma - \gamma^{2} } \right)}} \hfill \\ &= \frac{{2\left( {2 - \gamma^{2} } \right)^{2} \left( {a - \left( {1 - \gamma } \right)c} \right)}}{{\left( {4 - 2\gamma^{2} - \gamma } \right)\left( {2 - \gamma } \right)\left( {4 - 2\gamma - \gamma^{2} } \right)}} > 0 \hfill \\ \end{aligned}$$

All three terms in both the numerator and denominator are strictly positive for all values of γ between 0 and 1.

Combining results 1–5 and excluding the polar cases for μ and γ proves Proposition 2, which gives us a ranking of retail prices across the five regimes.

Appendix 4: Binary comparisons of wholesale prices

-

1.

\({{w}_{i,B}^{*}\ge w}_{i,NB1}^{*}\), with equality for \(\mu\) = 1.

$$\begin{aligned} w_{i,B}^{*} - w_{i,NB1}^{*} & = \frac{{a\left( {2 + \gamma } \right) - c\left( {\gamma^{2} - 2} \right)}}{{4 - 2\gamma^{2} - \gamma }} - \frac{{a\left( {2 + \gamma } \right)\mu + c\left( {\gamma^{2} - 2} \right)\left( {\mu - 2} \right)}}{{2\left( {2 - \gamma^{2} } \right) - \gamma \mu }} \\ & = \frac{{2\left( {a + c\left( { - 1 + \gamma } \right)} \right)\left( {2 + \gamma } \right)\left( {2 - \gamma^{2} } \right)\left( {1 - \mu } \right)}}{{\left( {4 - \gamma - 2\gamma^{2} } \right)\left( {4 - 2\gamma^{2} - \gamma \mu } \right)}} \\ \end{aligned}$$

For \(0\le \mu\) < 1, all terms in the numerator and denominator are positive; while for \(\mu =1\) the numerator is zero. Hence proved.

-

2.

\({w}_{i,FM}^{*}>{w}_{i,NB2}^{*}\)

$${w}_{i,FM}^{*}-{w}_{i,NB2}^{*}=\frac{a\left(2-{\gamma }^{2}\right)+c(6-4\gamma -2{\gamma }^{2}+{\gamma }^{3})}{(2-\gamma )(4-2{\gamma }^{2}-\gamma )}-\frac{{a\gamma }^{2}+c\left(({2-\gamma }^{2})(2-\gamma )\right)}{\left(4-2\gamma -{\gamma }^{2}\right)}$$$${w}_{i,FM}^{*}-{w}_{i,NB2}^{*}=\frac{2\left(4-2\gamma -7{\gamma }^{2}+4{\gamma }^{3}+2{\gamma }^{4}-{\gamma }^{5}\right)\left(a-\left(1-\gamma \right)c\right)}{(2-\gamma )(4-2{\gamma }^{2}-\gamma )\left(4-2\gamma -{\gamma }^{2}\right)}$$

All three terms in the denominator of the above expression are positive for \(\gamma <1\). In the numerator, \(\left(a-\left(1-\upgamma \right)c\right)>0\) (Lemma 1), and the expression \(4-2\upgamma -7{\upgamma }^{2}+4{\upgamma }^{3}+2{\upgamma }^{4}-{\upgamma }^{5}\) can be factorized to \((1-\upgamma )(4+2\upgamma -5{\upgamma }^{2}-{\upgamma }^{3}+{\upgamma }^{4})\) which is positive for all values of \(\gamma\) between 0 and 1. Hence proved.

Finally, amongst the five vertical regimes, it is obvious that wholesale price will be lowest for vertical integration, as firms maximize their integrated profit behaving as single entity, setting wholesale price equal to the upstream marginal costs. From Table 1 and our earlier discussion, the NB1 regime gives the same outcome when μ = 0, corresponding to what we described as “wholesale price maintenance” when the downstream firm has all the bargaining power and can extract the entire channel profit. Along with Lemma 2, and excluding the polar cases for μ and γ, these results rule out all except the three orderings in the text, on the basis of which we proved Proposition 3.

Appendix 5: Binary comparisons of downstream profits

-

1.

Comparing downstream profits from Vertical integration and Nash Bargaining contract with two-part tariff:

$$\begin{aligned} \pi_{{{1},{\text{NB2}}}}^{{{\text{D}}*}} - \pi_{{{1},{\text{VI}}}}^{{{\text{D}}*}} & = \frac{{2(1 - \gamma )(2 - \gamma^{2} )(a - c(1 - \gamma ))^{2} }}{{(4 - \gamma^{2} - 2\gamma )^{2} }} - \frac{{(1 - \gamma )(a - c + \gamma c)^{2} }}{{(2 - \gamma )^{2} }} \\ & = \frac{{\gamma^{3} \left( {1 - \mu } \right)\left( {4 - 3\gamma } \right)\left( {a - c\left( {1 - \gamma } \right)} \right)^{2} }}{{\left( {4 - \gamma^{2} - 2\gamma } \right)^{2} \left( {2 - \gamma } \right)^{2} }} \ge 0,\;{\text{with}}\;{\text{equality}}\;{\text{for}}\;\gamma \;{\text{or}}\;\mu \, = \,{1} \\ \end{aligned}$$

For μ < 1 and γ strictly between 0 and 1, both the numerator and denominator of the above expression are positive.

-

2.

Comparing profits from First-mover pricing model and Linear Pricing (benchmark) model

This result was already implied by our earlier finding that the only difference between the two regimes is that wholesale prices are lower, and therefore downstream margins are higher, in the FM case. However, this can be confirmed explicitly by comparing the profit expressions as follows:

All the terms in both the numerator and denominator of this expression are positive for all values of \(\upgamma\) between 0 and 1.

-

3.

Comparing profits from Nash Bargaining with two-part tariff and Linear Pricing (benchmark),

$$\begin{aligned} \pi_{{{1},{\text{NB2}}}}^{{^{{{\text{D}}*}} }} &= \frac{{2\left( {1 - } \right)\left( {2 -^{2} } \right)\left( {a - c\left( {1 - } \right)} \right)^{2} }}{{\left( {4 -^{2} - 2} \right)^{2} }} - \frac{{\left( {2 -^{2} } \right)^{2} \left( {a + \left( { - 1} \right)c} \right)^{2} }}{{\left( {\left( {4 - 2^{2} - } \right)\left( {2 - } \right)} \right)^{2} }} \hfill \\ &= \frac{{\left( {^{2} - 2} \right)\left( {a - c\left( {1 - } \right)} \right)^{2} \left( {2\left( { - 1} \right)\left( {\left( {4 - 2^{2} - } \right)\left( {2 - } \right)} \right)^{2} - \left( {^{2} - 2} \right)\left( {4 -^{2} - 2} \right)^{2} } \right)}}{{\left( {4 - 2^{2} - } \right)^{2} \left( {2 - } \right)^{2} \left( {4 -^{2} - 2} \right)^{2} }} > 0 \hfill \\ \end{aligned}$$

The denominator of the above expression is positive as all the terms are squared. In the numerator, \(\left(a-\left(1-\upgamma \right)c\right)>0 ;\left({\upgamma }^{2}-2\right)<0\) for all values of \(\gamma\) between 0 and 1. The expression \(\left(2\left(\upmu -1\right){\left(\left(4-2{\upgamma }^{2}-\upgamma \right)\left(2-\upgamma \right)\right)}^{2}-\left({\upgamma }^{2}-2\right){\left(4-{\upgamma }^{2}-2\upgamma \right)}^{2}\right)\) can be shown by numerical simulation to be negative for all relevant values of \(\mu\) and \(\gamma .\) This shows that π1,NB2D* > π1,BD* holds true for all relevant values of \(\gamma , \mu\) and c.Footnote 16 The two-part tariff enables each chain to maximize its combined profit, and downstream firms with more bargaining power benefit from this.

-

4.

Comparing profits from vertical integration and downstream first-mover model:

$$\begin{aligned} \pi_{{{1},{\text{VI}}}}^{{{\text{D}}*}} - \pi_{{{1},{\text{FM}}}}^{{{\text{D}}*}} & = \frac{{\left( {1 - \mu } \right)\left( {a - c + \gamma c} \right)^{2} }}{{\left( { - 2 + \gamma } \right)^{2} }} - \frac{{\left( {a - c + c\gamma } \right)^{2} \left( {2 - \gamma^{2} } \right)\left( {2 + \gamma } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma^{2} - \gamma } \right)^{2} }} \\ & = \frac{{\left( {a - c + \gamma c} \right)^{2} }}{{\left( {2 - \gamma } \right)^{2} \left( {4 - 2\gamma^{2} - \gamma } \right)^{2} }}\left[ {\left( {4 - 2\gamma^{2} - \gamma } \right)^{2} \left( {1 - {\upmu }} \right) - \left( {2 - {\upgamma }^{2} } \right)\left( {4 - {\upgamma }^{2} } \right)} \right] \\ \end{aligned}$$

All the expressions are squared, except the one in square brackets. If we plot this expression \([\left( {4 - 2\gamma^{2} - \gamma } \right)^{2} \left( {1 - {\upmu }} \right) - \left( {2 - {\upgamma }^{2} } \right)\left( {4 - {\upgamma }^{2} } \right)]\) in (μ, γ) space we get Fig. 5.

-

5.

Comparing profits from downstream first-mover contract and Nash Bargaining contract with a two-part tariff, i.e.,

$$\begin{aligned} {\uppi }_{{1,{\text{NB}}2}}^{{\text{D*}}} - {\uppi }_{{1,{\text{FM}}}}^{{\text{D*}}} & = \frac{{2\left( {1 - \mu } \right)\left( {2 - \gamma^{2} } \right)\left( {a - c\left( {1 - \gamma } \right)} \right)^{2} }}{{\left( {4 - \gamma^{2} - 2\gamma } \right)^{2} }} \\ & \quad - \frac{{\left( {a - c + c\gamma } \right)^{2} \left( {2 - \gamma^{2} } \right)\left( {2 + \gamma } \right)}}{{\left( {2 - \gamma } \right)\left( {4 - 2\gamma^{2} - \gamma } \right)^{2} }} \\ & = \left( {2 - {\upgamma }^{2} } \right)\left( {a - c\left( {1 - {\upgamma }} \right)} \right)^{2} \left( {\frac{{2\left( {1 - {\upmu }} \right)}}{{\left( {4 - {\upgamma }^{2} - 2{\upgamma }} \right)^{2} }} - \frac{{\left( {2 + {\upgamma }} \right)}}{{\left( {2 - {\upgamma }} \right)\left( {4 - 2{\upgamma }^{2} - {\upgamma }} \right)^{2} }}} \right) \\ \end{aligned}$$

We can plot \(\left(\frac{2(1-\upmu )}{{\left(4-{\upgamma }^{2}-2\upgamma \right)}^{2}}-\frac{\left(2+\upgamma \right)}{\left(2-\gamma \right){\left(4-2{\gamma }^{2}-\gamma \right)}^{2}}\right)\) in \((\mu , \gamma )\) space to get Fig. 6.

-

6.

Comparing profits from Vertical Integration and Benchmark models i.e.,

$$\begin{aligned} {\uppi }_{{1,{\text{VI}}}}^{{\text{D*}}} - {\uppi }_{{1,{\text{B}}}}^{{\text{D*}}} & = \frac{{\left( {1 - \mu } \right)\left( {a - c + \gamma c} \right)^{2} }}{{\left( {2 - \gamma } \right)^{2} }} - \frac{{\left( {2 - \gamma^{2} } \right)^{2} \left( {a + \left( {\gamma - 1} \right)c} \right)^{2} }}{{\left( {\left( {4 - 2\gamma^{2} - \gamma } \right)\left( {2 - \gamma } \right)} \right)^{2} }} \\ & = \frac{{\left( {a + \left( {\gamma - 1} \right)c} \right)^{2} \left( {\left( {1 - \mu } \right)\left( {4 - 2\gamma^{2} - \gamma } \right)^{2} - \left( {2 - \gamma^{2} } \right)^{2} } \right)}}{{\left( {\left( {4 - 2\gamma^{2} - \gamma } \right)\left( {2 - \gamma } \right)} \right)^{2} }} \\ \end{aligned}$$

If we plot \(\left((1-\upmu \right){\left(4-2{\upgamma }^{2}-\upgamma \right)}^{2}-{\left(2-{\upgamma }^{2}\right)}^{2})\) in (μ, γ) space we get Fig. 7.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bhattacharjea, A., Gupta, S. Alternative forms of buyer power in a vertical duopoly: implications for profits, welfare, and cost pass-through. J Econ (2024). https://doi.org/10.1007/s00712-024-00855-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s00712-024-00855-0

Keywords

- Bertrand duopoly

- Buyer power

- Countervailing power

- Nash bargaining

- Vertical contracts

- Cost pass-through

- Vertical integration