Abstract

Recent evidence suggests that banks are interconnected through investment externalities among their borrowers. We study how such investment externalities affect the ability of unregulated, competitive banks to facilitate risk sharing among bank depositors, adapting a canonical model of banks as creators of liquidity subject to fundamental risks to bank returns. Failures occur when banks become insolvent. We find that investment externalities render fundamental risks to bank returns endogenous, risk sharing among depositors inefficient, probabilities of bank failures too high, and payouts to depositors in the event of a bank failure too low. These effects arise because productivity is too low in the presence of investment externalities. Minimum liquidity standards and bank bailouts dampen productivity further.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent evidence suggests that banks are interconnected through investment externalities among their borrowers. They arise because firms in the same sector or region enjoy positive externalities, which bear a positive mutual impact on their returns. Accordingly, the returns a firm makes on borrowed funds are higher if other firms in their region or sector also obtain external funding (Jorge and Rocha 2020). Conversely, cuts in a single bank’s business loans reduce the overall economic activity in the regions where its borrowers operate (Berg et al. 2021), with adverse effects on loan demand and borrower quality there. Such knock-on effects can be attributed to region-specific agglomeration and industry spillovers (Huber 2018), to spillovers within business groups (Wang and Kafouros 2020; Naaraayanan and Wolfenzon 2023), or to spillovers from financially distressed firms to geographically co-located firms (Bernstein et al. 2019). Yet, they are not confined to the regional economy since local shocks can spill over to other regions through firms’ interregional networks of branches (Giroud and Müller 2019). In sum, if a bank finances productive investments, it seems to boost the profitability of other banks’ lending business.

If a bank does not internalize the effects of its own lending on other banks, such investment externality can lead to inefficiencies with important repercussions for banks themselves. Since a key function of a bank is to create liquidity, the focus of the present paper is on two related questions. What are the consequences of investment externalities for bank liquidity creation? What are the effects on bank stability?

To answer these questions, this paper starts from the Allen and Gale (1998) version of the Diamond and Dybvig (1983) model. In this model, banks insure investors against idiosyncratic liquidity risks while the productive assets financed by banks are risky. We introduce investment externalities that interact with bank lending as a novel feature to this framework. Specifically, we consider the returns on the productive investments that a bank finances as increasing in aggregate investments financed by all banks. Competitive banks do not internalize such investment externalities, creating a wedge between social and private returns on investment. As a further implication, the fundamental risk to banks’ asset returns is not bank-specific and purely exogenous, but involves an aggregate, and hence endogenous, component.

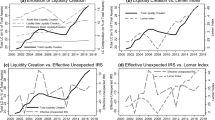

We determine the banks’ portfolio choices and the probability of their failure as a result of insolvency, and compare them with the solution to the problem of a social planner who takes the externality into account. We show that banks underinvest in productive assets, and thus provide too much insurance against liquidity risks, which exposes them to too high a risk of failure. This is consistent with observations according to which high liquidity creation is, on the bank level, positively related to a larger probability of bank failures (Fungacova et al. 2021) and, on the aggregate level, helps predicting financial crises (Berger and Bouwman 2017). It is also consistent with empirical evidence showing that more concentrated banking systems are less likely to experience financial crises (Beck et al. 2006) and that banks with a strong regional focus in lending, such as continental European cooperative banks, are characterized by lower than average default rates (Chiaramonte et al. 2015).

The present framework allows to reassess the potential societal benefits of bank failures as part of a mechanism to allocate risks. The literature has shown that it can be generally optimal for banks to pass aggregate risks on not only to patient investors but to impatient investors as well (Hellwig 1994), and that bank failures are an efficient way to do so (Allen and Gale 1998). We argue that these results no longer obtain if there are investment externalities. Instead, the probability of bank failures is inefficiently high in an unregulated competitive banking sector. Moreover, regulatory interventions designed to promote the stability of banks, such as minimum liquidity requirements and bank bail-outs, may have unintended consequences as they can reduce expected aggregate productivity.

We derive at these conclusions without introducing either banking panics driven by coordination failures or a sequential service of depositors. A coordination failure occurs when a depositor withdraws her deposits from a bank only because she expects everyone else to do so.Footnote 1 Such bank failures are thus the result of random withdrawals of deposits, triggered by sunspots (Cooper and Ross 1998). However, random withdrawals of deposits from banks as cause of bank panics in unregulated banking markets do not fit the historical evidence (Calomiris and Gorton 1991). Moreover, sunspot-driven banking panics cannot occur under reasonable conditions. Specifically, as in our model, this holds true if long-term bank assets are fully illiquid, their value at maturity does not depend on the fate of the funding bank, and optimal deposit contracts do not imply a sequential service of depositors (Ennis and Keister 2010).

Sequential service has often been imposed as a constraint (or considered as a primitive or first principle) in many variations of the Diamond and Dybvig (1983) model. It has been generally left unclear, however, how such sequential service constraint can be justified. In principle, banks should be able to impose suspension of convertibility and thus protect themselves (and their depositors) from inefficiencies arising from a sequential service constraints (Allen and Gale 1998; Gorton and Tallman 2018 ) unless servicing depositors sequentially also has some benefit. In models like ours, unregulated banking sectors are able to suspend the convertibility of deposits into cash. There is also no benefit that would justify a sequential service as part of an optimal banking arrangement as all consumers are equally well informed about bank asset returns and there are no further contracting issues.

Two recent papers are particularly closely related to ours. Andolfatto and Nosal (2020) explain bank failures as one of multiple equilibria in the withdrawal game without making reference to a sequential service constraint. Multiplicity of equilibria arises there from fixed production costs which render long-term investments on the individual bank level as increasing returns-to-scale. The effect is like that of an externality in the productivity of long-term investments that arises at the withdrawal stage. In this setting, sunspot-driven bank runs can occur if fixed production costs are sufficiently large. In the present paper, we also do not impose a sequential service constraint. However, we consider investment externalities at the stage of the depositing game, and while multiple equilibria (if any) may occur only at that stage, they are not in the focus of our analysis.

Leonello et al. (2022) argue that the probability of bank failures depends on aggregate savings deposited with banks. Individual depositors take the savings by others as given and do not internalize the associated savings externality, which arises from the effect of their own savings decisions on the probability of bank failures. Provided runs are driven by fundamentals (as in our paper), investors save inefficiently much with banks and those additional savings make banks more fragile. However, this mechanism relies on investors exhibiting strong relative risk aversion and reverses its effects for weak relative risk aversion (unlike in our paper).

Our paper complements an important strand in the macroeconomic literature in which positive externalities and strategic complementarities play a role. These are used, for example, to derive Keynesian multiplier or accelerator effects (Cooper and John 1988; Acemoglu 1993) or to justify an AK-type macroeconomic production function that generates endogenous economic growth (as introduced by Romer 1990). While in the latter class of models extremely strong externalities are necessary to generate the results, linear-in-capital production in the present model is merely a means to keep the analysis manageable. Other models use investment externalities to infer the role of liquidity-providing banks in aggregate capital formation (e. g., Bencivenga and Smith 1991; Ennis and Keister 2003; Fecht et al. 2008), without considering investment externalities as an independent cause of banking inefficiencies and instabilities.

Finally, our analysis is complementary to studies of interconnections among financial intermediaries through financial sector linkages. Such linkages can improve the allocation of capital and risks within the financial sector, and thus foster aggregate bank lending (Dietrich and Hauck 2020). However, direct links, such as interbank deposits, can give rise to contagion (Allen and Gale 2000). Indirect links, which arise from a common exposure to financial markets, can entail fire-sale spillovers (e. g., Acharya et al. 2011). Moreover, they can lead to a desire in lenders to coordinate their strategies, which can explain phenomena such as self-fulfilling credit market freezes (as in Bebchuk and Goldstein 2011). Coordination problems also arise with respect to, e. g., monitoring incentives in syndicated lending (Biswas and Gómez 2018), withdrawing from mutual funds (Chen et al. 2010), or holding liquidity (Ratnovski 2009). Our focus is different, as we study the (in)efficiency of the collective behavior of competitive banks with respect to bank liquidity creation and the associated stability of banks in the context of real economic linkages in absence of coordination failures.

The paper proceeds as follows: Sect. 2 presents the model and contains the main results. Section 3 discusses implications for bank stability and expected productivity, and section 4 derives some policy implications. Section 5 concludes.

2 Model

We follow Allen and Gale (1998) and consider investors who face an idiosyncratic liquidity risk arising from uncertainty about the timing of their consumption needs. Banks are means to share those liquidity risks among investors subject to the insolvency risk associated with productivity shocks affecting their long-term, illiquid investments. Banks do so by enabling impatient investors to withdraw more resources upon early consumption needs than they could in autarky for the same portfolio choice, i. e. banks create liquidity. Returns on productive investments are increasing in aggregate investments, banks do not internalize such externalities, and there are endogenous, aggregate fundamental risks to banks’ asset returns.

2.1 Setup

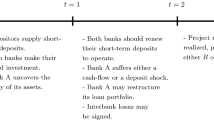

Consider a single-good economy spanning three dates \(t\in \{0,1,2\}\). The good can be consumed, stored, and used as input for production. The economy is populated by a continuum of identical investors \(i\in [0,1]\) and a continuum of banks \(j\in [0,1]\). The aggregate state s of the economy is a continuous random variable, drawn from a uniform distribution with the unit interval as support, i.e. \(s\in [0,1]\). While everyone knows only the distribution of states at the initial date \(t=0\), everyone learns the actual state at the middle date \(t=1\).

Each investor is endowed with one unit of the good at date \(t=0\) and nothing thereafter. At date \(t=1\), a share \(\lambda >0\) of investors will be impatient whereas the remaining share \(1-\lambda\) of investors will be patient. Impatient investors value their consumption \(c_{1}>0\) of the good only at date \(t=1\), patient investors are indifferent between their consumption \(c_{2}>0\) at \(t = 1\) and at \(t=2\). As of date \(t=0\), the share \(\lambda\) of impatient investors is common knowledge and the chances for each investor to be impatient are the same and independent. Therefore, an investor’s probability to be impatient is \(\lambda >0\) and to be patient is \(1-\lambda\). At date \(t=1\) investors learn their type, but this is private information. Investors are risk averse with a utility function u of the consumer’s respective total consumption, \(c_1\) or \(c_2\), satisfying \(u^{\prime }(c)>0\), \(u^{\prime \prime }(c)<0\), \(\lim _{c\rightarrow \infty }u^{\prime }(c)=0\), and \(\lim _{c\rightarrow 0}u^{\prime }(c)=\infty\).

Banks transform investors’ endowments into consumption \(c_{1}\) and \(c_{2}\) by holding a portfolio of stored goods and investments in the production of goods. Since everyone knows the realized state s at the middle date \(t=1\), consumption can be made contingent on the realization of the state. The good can be stored between dates at each date \(t\in \{0,1\}\). Production of goods can be initiated at date \(t=0\), cannot be liquidated at \(t=1\), and generates goods at date \(t=2\). Production returns (per unit) are larger than one and depend on both, the aggregate state s of the economy and aggregate investment in production. Regarding the latter, we focus on positive investment externalities due to, e. g., demand and agglomeration effects. Specifically, let \(y_{j}\) and \(Y=\int _{0}^{1}y_{k}\,\textrm{d} k\) denote investment by bank j and aggregate investment, respectively. Bank j’s production at date \(t=2\) is \(B(Y,s)y_{j}\) with \(B(Y,s)\ge 1\) and \(\partial B(Y,s)/\partial s>0,\,\partial B(Y,s)/\partial Y>0\) for all s and Y. Henceforth, to simplify notations, let \(B_{s}(Y,s)=\partial B(Y,s)/\partial s\) and \(B_{Y}(Y,s)=\partial B(Y,s)/\partial Y\).

Banks operate under perfect Bertrand competition, with two immediate implications. First, they make zero profits in equilibrium because storage of goods and production of goods are both constant returns-to-scale technologies from an individual bank’s perspective. Second, investors deposit their endowments only with banks that maximize their expected utility. Therefore, banks are identical, ex-ante and ex-post, and we can avoid further notational clutter by disregarding index j.

Finally, in exchange for the initial endowment of investors at date \(t=0\), banks fix the amount for every investor who wants to withdraw at date \(t=1\). If total withdrawal demands exceed what a bank holds in storage, the bank defaults and pays the available resources pro rata to those who wish to withdraw. Such simple deposit contract is also optimal in an environment like the one considered here, where production of goods cannot be liquidated at \(t=1\), its value does not depend on how produced goods are being shared among investors, and there is no asymmetric knowledge about the realized state s at date \(t=1\).Footnote 2

2.2 Optimal consumption plan, bank deposits, and bank failure

Since investors do not derive utility from consumption at date \(t=0\), their entire endowments are put into storage and production of goods. A consumption plan \((c_1,c_2)\) is feasible if (i) consumption by impatient investors is covered by the goods stored between dates \(t=0\) and \(t=1\), i.e. \(\lambda c_1\le (1-y)\), and (ii) consumption by patient investors is covered by the total of the goods produced at date \(t=2\) and the stored goods left over from date \(t=1\), i.e. \((1-\lambda )c_2\le B(Y,s)y+(1-y)-\lambda c_1\). Feasibility of a consumption plan is, therefore, conditional on individual and aggregate investment, y and Y. As all investments are irreversible, the optimal consumption plan solves the following risk-sharing problem

The first and second constraints are the feasibility constraints on \(c_1\) and \(c_2\), respectively. The third constraint ensures incentive compatibility, requiring that patient investors have no incentive to pretend to be impatient. Recall that the realization of the state s is publicly known at date \(t=1\).

For now, suppose the incentive constraint is not imposed. Non-satiation implies that the second constraint holds with equality. Hence, \(c_2\) can be replaced in the objective function accordingly. The first-order condition with respect to \(c_{1}\) then requires to balance marginal utilities between impatient and patient investors, \(u^{\prime }(c_{1})=u^{\prime }(c_{2})\), provided the first feasibility constraint \(c_{1}\le (1-y)/\lambda\) permits. The following Lemma identifies all states where this constraint is binding.

Lemma 1

(Threshold state) Let \({\hat{s}}:[0,1]^{2} \mapsto [0,1]\cup \emptyset\) be a correspondence with \({\hat{s}}(Y,y)=\{s\in [0,1]\left| {}\right. B(Y,s)y/(1-\lambda )=(1-y)/\lambda \}\). Then, provided \({\hat{s}}(Y,y)\ne \emptyset\), it defines a unique threshold state such that \(B(Y,s)y/(1-\lambda )<(1-y)/\lambda\) for all states \(s<{\hat{s}}(Y,y)\) and \(B(Y,s)y/(1-\lambda )>(1-y)/\lambda\) for all states \(s>{\hat{s}}(Y,y)\).

Accordingly, if \(s\le {\hat{s}}(Y,y)\), then balancing marginal utilities by giving patient and impatient investors the same amounts \(c_{1}=c_{2}=B(Y,s)y+(1-y)\) is feasible because doing so satisfies \(c_{1}\le (1-y)/\lambda\). If \(s>{\hat{s}}(Y,y)\), then equal consumption for patient and impatient investors violates \(c_{1}\le (1-y)/\lambda\). Hence, patient investors get more than impatient investors, i.e. \(c_{1}\,{=}\,(1{-}y)/\lambda\) and \(c_{2}\,{=}\,B(Y,s)y/(1{-}\lambda )\). If \({\hat{s}}(Y,y)=\emptyset\) then either \(c_1<c_2\) in every state \(s\in [0,1]\), or \(c_1=c_2\) in every state. Accordingly, this optimal consumption plan indeed never violates the incentive compatibility constraint.

Taking individual and aggregate investment as given, the optimal consumption plan can be illustrated as in Fig. 1 (Allen and Gale 1998). If the state is high, say \(s_1\), productive investment has a high yield. Giving patient and impatient investors the same would require to give impatient investors more than what is available at the date of their consumption, which is not feasible. Therefore, impatient investors get what storage of the good permits, which amounts to \({(1-y)}/{\lambda }\) per capita. If the state is low, say \(s_2\), productive investment yields only small returns. Sharing equally the value of storage and production among patient and impatient investors is feasible. Accordingly, the amount immediately available at date \(t=1\) is not only given to impatient investors but also to (some) patient investors, and consumption for either investor type is thus below the horizontal line through \({(1-y)}/{\lambda }\).

Competitive banks can implement the optimal, state-contingent consumption profile for given individual and collective investments using simple deposit contracts. These contracts require that banks promise to pay at date \(t=1\) a fixed amount should an investor want to withdraw at that date. Suppose this fixed amount is \((1-y)/\lambda\). Then, if more than \(\lambda\) investors want to withdraw at \(t=1\), the bank is unable to satisfy all demands at face value. In those instances of bank failures, it collects all withdrawal demands and pays all resources available at date \(t=1\) pro rata to those who withdraw. This happens if the state is below state \({{\hat{s}}} (Y,y)\) identified in Lemma 1, which can thus be interpreted as the bank failure threshold state.

Given this payout structure, an impatient investor always withdraws at date \(t=1\) because she cannot afford to wait. As for a patient investor, if the state observed at date \(t=1\) is such that the investor would get (weakly) more by waiting until date \(t=2\) than by withdrawing already at date \(t=1\), the former is the better course of action for all patient investors. However, if the state observed at date \(t=1\) is such that the investor would get less by waiting until date \(t=2\) than by withdrawing already at date \(t=1\), the latter is the better course of action. In such a state all impatient investors plus some patient investors with a combined share \(\mu \in ]\lambda ,1[\) in the total population are hence paid at date \(t=1\) in equilibrium, sharing the goods stored; the remaining patient investors are paid at date \(t=2\), sharing the goods produced. The equilibrium share \(\mu\) is determined by the marginal patient investor who is just indifferent between requesting payment at date \(t=1\) and waiting until \(t=2\), i.e. \(\mu =\left( 1-y\right) /\left( B(Y,s)y + 1 - y\right)\). It is straight-forward to see that the resulting payouts to investors imply that banks implement the optimal consumption profile.

Given the (optimal) withdrawal strategies of investors, there can thus be states in which a bank fails to pay to the impatient investors the fixed amount initially promised. Such bank failures occur without a requirement to service investors sequentially. They are caused by low bank returns, not by shifts in sentiment. Indeed, bank failures form part of a mechanism here that facilitates the efficient state-contingent allocation of resources when their realized amount becomes known (Allen and Gale 1998).

2.3 Banks’ portfolio choice

As each bank (and every individual investor) takes aggregate investment Y as given, the problem of a bank that seeks to attract investors at date \(t=0\) is ultimately one of making an investment \(y^*\) that maximizes the investors’ expected utility for the given aggregate investment, i.e.

The constraints limit a bank’s portfolio choice to optimal consumption plans as explained above. Inserting the constraints into the objective function, an investor’s expected utility can be rewritten as a function \(U:[0,1]\times [0,1]\mapsto {\mathbb {R}}\) defined by

Accordingly, the unconstrained portfolio choice problem of a bank is to maximize U(Y, y), and its solution has the following properties.

Lemma 2

(Bank portfolio choice) Let \({\overline{y}}: [0,1] \mapsto [0,1]\) be a function defined by \({\overline{y}}(Y)= \{y \in [0,1] \left| \right. B(Y,0)y/(1-\lambda ) = (1-y)/\lambda \}\). Then, a continuous function \(\upsilon \,{:}\,[0,1]\mapsto [0,1]\) exists such that a bank’s optimal investment is characterized by \(y^{*}\,{=}\,\upsilon (Y)\) with \(\upsilon (0)\,{>}\,0\) and \(\upsilon (1)\,{<}\,1\). The function \(\upsilon\) is the bank’s reaction function. It is implicitly defined by \(U_y(Y,y)=0\) where

-

1.

provided

$$\begin{aligned} U_y(Y,y)=-u^{\prime }\left( \tfrac{1-y}{\lambda }\right) + \displaystyle \int _0^{1}B(Y,s){u^{\prime }\left( \tfrac{B(Y,s)y}{1-\lambda }\right) }\textrm{d}s \end{aligned}$$(4)and

$$\begin{aligned} -u^{\prime }\left( \tfrac{1-{\overline{y}}(Y)}{\lambda }\right) + \displaystyle \int _0^{1}B(Y,s){u^{\prime }\left( \tfrac{B(Y,s){\overline{y}}(Y)}{1-\lambda } \right) }\textrm{d}s > 0, \end{aligned}$$(5) -

2.

otherwise.

$$\begin{aligned} \begin{aligned} U_y(Y,y)&= \displaystyle \int _0^{{\hat{s}}(Y,y)}{\Big [ (B(Y,s)-1)u^{\prime }\left( B(Y,s)y+(1-y)\right) \Big ]}\textrm{d}s \\&\quad + \displaystyle \int _{{\hat{s}}(Y,y)}^{1}{B(Y,s)u^{\prime } \left( \tfrac{B(Y,s)y}{1-\lambda }\right) }\textrm{d}s \\&\quad - (1-{\hat{s}}(Y,y))u^{\prime }\left( \tfrac{1-y}{\lambda }\right) \end{aligned} \end{aligned}$$(6)

Proof

See Appendix. \(\square\)

The Lemma states that for any aggregate investment, Y, the solution \(y^{*}\) to a bank’s portfolio choice problem is unique. The optimal portfolio choice satisfies the respective first-order condition, which depends on whether or not it is optimal for a bank to fail at all. It is optimal that the bank never fails provided condition (5) holds, which states that the solution to Eq. (4) is at least as large as \({\overline{y}}(Y)\). Then, the first-order condition \(U_y(Y,y)=0\) holds for \(U_y(Y,y)\) as stated in Eq. (4). Should it be optimal that the bank fails in at least some states (because condition (5) does not hold), the first-order condition holds for \(U_y(Y,y)\) as stated in Eq. (6). Note \(\upsilon (0)>0\) and \(\upsilon (1)<1\) because \(\lim _{c\rightarrow 0}u^{\prime }(c)=\infty\) together with \(B(0,0)\ge 1\) implies that a single bank always holds a mixed portfolio of productive investment and storage, regardless of the aggregate investment made by all other banks.Footnote 3

2.4 Nash equilibrium

Aggregate investment is determined in equilibrium. We consider symmetric Nash equilibria in pure strategies. At those equilibria, individual investments are the same across all banks and, hence, also equal to aggregate investment. Let \(Y^{\textrm{N}}\) denote equilibrium investments. It thus satisfies \(Y^{\textrm{N}}\in \{Y\in [0,1]\left| \right. \upsilon (Y)=Y\}\).

It is useful to specify a critical level of symmetric investment \({\overline{Y}}\) that determines whether there are states in which banks fail, i.e. patient and impatient investors get the same amount. Such \({\overline{Y}}\) is implicitly defined by \(B({\overline{Y}},0){\overline{Y}}/(1-\lambda )=(1-{\overline{Y}})/\lambda\). If each bank were to invest \(y<{\overline{Y}}\), and aggregate investment thus also \(Y<{\overline{Y}}\), the feasibility constraint \(c_1\le (1-{Y})/\lambda\) would be binding at least in the worst state \(s=0\). Accordingly, all banks give patient investors and impatient investors the same amount in some states \(s>0\) if \(y=Y<{\overline{Y}}\), whilst patient investors get strictly more than impatient investors in any state \(s>0\) if \(y=Y={\overline{Y}}\), and in all states, including \(s=0\), if \(y=Y>{\overline{Y}}\).

Proposition 1

(Nash equilibrium) A symmetric Nash equilibrium \(Y^{\textrm{N}}\in \left\{ Y\in [0,1]\left| \right. \upsilon (Y)=Y\right\}\) exists with

Proof

See Appendix \(\square\)

A Nash equilibrium exists because the banks’ reaction function \(\upsilon\) is continuous and banks wish to hold mixed portfolios regardless of aggregate investment. As for its properties, two possible cases are to be distinguished. If \(Y_1\) is such that \(\upsilon (Y_1)=Y_1\) according to the first-order condition (4), and this solution is not smaller than \({\overline{Y}}\), then there is a symmetric Nash equilibrium in which banks will indeed pay patient investors more than impatient investors in every state \(s>0\). Similarly, if \(Y_2\) is such that \(\upsilon (Y_2)=Y_2\) according to the first-order condition (6), and this solution is smaller than \({\overline{Y}}\), there is a symmetric Nash equilibrium in which banks will pay impatient and patient investors the same amount in some poor states \(s>0\). Since an equilibrium always exists, at least one of the two cases applies.

An equilibrium is unique provided \(\upsilon (Y)\,{>} \,Y\) for all \(Y\,{<}\,Y^{\textrm{N}}\) and \(\upsilon (Y)\,{<}\,Y\) for all \(Y\,{>} \,Y^{\textrm{N}}\). Conversely, a necessary condition for multiplicity of equilibria is \(\upsilon ^{\prime }(Y)\,{>}\,1\) for some \(Y\,{\in }\,[0,1]\).Footnote 4 Should multiple Nash equilibria exist, investors prefer \(Y^{\textrm{N}}\,{=}\,\max \{Y\,{\in }\,[0,1]\,\left| \,\upsilon (Y)\,{=}\,Y\right. \}\) over all other Y satisfying \(\upsilon (Y)=Y\). This is because expected utility is increasing in Y by the envelope theorem. Note, in the Nash equilibria with the highest and with the lowest expected utility, \(\upsilon ^{\prime }(Y)\,{<}\,1\) holds in some neighborhood of \(\upsilon (Y)=Y\).

Figure 2 depicts possible graphs of \(y=\upsilon (Y)\), \(y=Y\) (as \(45^{\circ }\) line), and \({\overline{Y}}\) for two alternative scenarios, each with a unique Nash equilibrium. A Nash equilibrium is located at the intersection of \(\upsilon (Y)\) with the \(45^{\circ }\) line. Banks never fail if and only if the intersection point is to the right of \({\overline{Y}}\). The graphs in Fig. 2 are based upon the following parametrization.

Example 1

Let \(u(x)=-x^{-1}\) (i.e. the coefficient of relative risk aversion is constant and equal to 2) and \(B(Y,s)=1+2Y+s\). For \(\lambda =0.2\) the Nash equilibrium is \(Y^{\textrm{N}}\approx 0.7022\) with \(Y^{\textrm{N}}>{\overline{Y}}\), i.e. the probability of bank failures is \(p=0\) (Fig. 2a). For \(\lambda =0.8\) the Nash equilibrium is \(Y^{\textrm{N}}\approx 0.1582\) with \(Y^{\textrm{N}}<{\overline{Y}}\), i.e. \(p>0\) (Fig. 2b). In both cases, \(\upsilon (Y)\) is monotonically decreasing in Y for all \(Y\,{\in }\,]0,1[\), and the respective equilibria are hence unique.

2.5 Social optimum

Consider a social planner who faces the same risks as banks but takes the externality into account and, therefore, solves the problem

Note that a planner will allocate any given resources across consumption at dates \(t=1\) and \(t=2\) just like banks do. After all, the deposit contract efficiently allocates the idiosyncratic liquidity risks and the aggregate risk to bank returns for any given individual and aggregate investments. Therefore, efficiency in a Nash equilibrium depends solely on how the banks’ portfolio choice at date \(t=0\) differs from the planner’s choice.

Proposition 2

(Social optimum) Let \(Y^{\textrm{P}}\) be the solution to the social planner’s problem. Then \(Y^{\textrm{P}}>\max \{Y\in [0,1]\,\left| \right. \,\upsilon (Y)=Y\}\).

Proof

See Appendix. \(\square\)

Hence, the planner wants to make strictly more investments than banks do in any Nash equilibrium.

2.6 Discussion

Two aspects of our framework are worth discussing. The first is about sunspot-driven bank failures. Taking an optimal contracts approach, it has been shown that deposit contracts can often be designed to protect a bank from sunspot-driven coordination failures; seminal papers in this field include Green and Lin (2003), Peck and Shell (2003), and Ennis and Keister (2009, 2010). Also, sunspot-driven bank failures may not occur in the presence of a secondary market for long-term productive bank assets (see Bucher et al. 2018). Furthermore, sunspot-driven bank failures have received criticism on grounds of leaving open why swings in the beliefs of investors occur. For example, with global games refinement of the equilibrium concept, sunspot equilibria typically disappear and coordination failures are instead triggered by poor fundamentals (Goldstein and Pauzner 2005). Finally, sunspot-driven bank failures are not considered useful for policy analysis because they fail to generate unique predictions (Ennis and Keister 2005). At any rate, any belief-driven bank failure is generally ruled out if the bank-financed long-term projects are fully illiquid and if they do not lose value when the bank that has provided funding for them collapses.Footnote 5

The second, and related, aspect refers to the sequential service of depositors. It is typically considered a first principle. There are only few exceptions that explain why banks service depositors sequentially. Wallace (1988) derives a sequential service constraint by assuming (spatial) separation of consumers who are unable to form post-withdrawal insurance mechanisms among themselves. However, to generate system-wide bank failures (as obtained in our paper) on account of sequential service, one would also need to impose restrictions on any interbank insurance mechanisms.Footnote 6 An alternative rationale for sequential service as (endogenous) part of an optimal banking arrangement stems from heterogeneity among depositors in their ability to value bank assets. Those who are better able should have an incentive to do so, which happens if depositors are served sequentially (Chari and Jagannathan 1988; Calomiris and Kahn 1991). Finally, Diamond and Rajan (2001) suggest that sequential service arises endogenously as part of an optimal banking arrangement if deposit contracts are subject to fraudulent, opportunistic renegotiations by banks.

In the present paper, sunspots or sequential service play no role as long-term projects are fully illiquid, lose no value when the bank fails, and information about the economy is symmetric at all dates.

3 Consequences for bank stability and expected productivity

That positive investment externalities imply socially insufficient investments in production is rather standard (e. g., Picot 1980; Steg and Thijssen 2023). However, there are unique consequences of the liquidity insurance provided by banks for their stability, and for the effect of aggregate risks on expected productivity.

With respect to bank liquidity insurance and bank stability, note that bank failures occur if the realized productivity is so low that banks are unable to pay at least \((1{-}Y^{\textrm{N}})/\lambda\) to all investors. This can happen provided \(Y^{\textrm{N}}<{\overline{Y}}\), in which case bank failures occur in all states \(s < {\hat{s}}(Y^{\textrm{N}},Y^{\textrm{N}})\). Therefore, as states are uniformly distributed, the probability p of bank failures is

Accordingly, in Example 1, the probability of bank failures is \(p=0\) for \(\lambda =0.2\) (Fig. 2a) and \(p\approx 1.45\%\) for \(\lambda =0.8\) (Fig. 2b).

As \(Y^{\textrm{N}}\) determines \({\hat{s}} (Y^{\textrm{N}},Y^{\textrm{N}})\) and is itself an equilibrium outcome, the bank failure probability p is endogenous and depends on the collective behavior of banks. However, banks do not internalize the effect of their own investment on other banks, and aggregate investment as outcome of the collective behavior of banks is hence inefficient. This leads to the first implication.

Corollary 1

In a Nash equilibrium, banks provide too much liquidity insurance. Provided \(p>0\) , the bank failure probability is too high, and payouts in the event of a bank failure are too low.

The intuition is as follows. Too much liquidity insurance is when banks promise to pay to impatient investors more than socially efficient. As promised payments are \((1-y)/\lambda\) with \(y=Y\), they are indeed too high because banks’ investment is inefficiently small. Regarding the probability of bank failures, provided it is positive in a Nash equilibrium, this probability is \({\hat{s}}(Y^{\textrm{N}},Y^{\textrm{N}})\) according to Eq. (8). Since

this probability is inefficiently high because \(Y^{\textrm{P}}>Y^{\textrm{N}}\). With too high a payment promised to impatient investors, patient investors get less because investment in production is lower. Banks are thus overly likely to lack the sufficient resources to pay all investors at least the amount promised to impatient investors. Finally, investors equally share the value of total bank assets in a bank failure. This value is inefficiently low in a Nash equilibrium because the low investment causes low productivity, implying low total resources in any given state.

Next, we turn to expected aggregate productivity. To illustrate that investment externalities have implications for the real economy in more general terms, we refer to the banking nexus between volatility and capital accumulation, which has become central to modern growth theory (see, e. g., Aghion et al. 2010). To focus on the most direct effects of volatility, we restrict attention to CRRA utility and to a production function for which productivity is linear in Y and s, i.e. \(B(Y,s)= \beta +\gamma Y+\delta s\) with \(\beta > 1\), and \(\gamma ,\,\delta >0\). Risk is higher if productivity is more sensitive to the realized state s, i.e. if \(B_{s}(Y,s)=\delta\) is higher. However, holding everything else equal, changes in \(\delta\) affect not only risk but also expected productivity \(\int _{0}^{1}{B(Y,s) \textrm{d}s}\). To isolate the effect of risk, we impose restrictions on \(\beta\) such that the combined effects of \(\delta\) and \(\beta\) on expected productivity cancel each other out for a given Y. Doing so is reminiscent of introducing a mean preserving spread on the distribution of investment returns. Expected productivity is the same for some \((\beta _0,\delta _0)\) and some other \((\beta ,\delta )\) provided \(\int _0^1{(\beta {+}\gamma Y {+} \delta s)\,\textrm{d}s} = \int _0^1{(\beta _0{+}\gamma Y {+} \delta _0 s)\,\textrm{d}s}\), or, after integration and rearranging terms, if

Aggregate risk is then said to be higher with \((\beta ,\delta )\) than with \((\beta _0,\delta _0)\) provided \(\delta >\delta _0\) and \(\beta =\beta _0-0.5(\delta -\delta _0)\).

Example 2

Consider an economy where \(u(c) = ( c^ {1 - \alpha } {-} 1)/(1 {-}\alpha )\) with relative risk aversion \(\alpha >1\), and \(B(Y,s)=\beta +\gamma Y + \delta s\) with \(\beta >1\) and \(\gamma ,\,\delta > 0\). Expected productivity \(\int _0^1{B(Y^{\textrm{N}},s)\textrm{d}s}\) is increasing in aggregate risk if either

-

1.

\(Y^{\textrm{N}}>{\overline{Y}}\),

or

-

2.

\(Y^{\textrm{N}}<{\overline{Y}}\) provided \(Y^{\textrm{N}}\) is in some neighborhood of \({\overline{Y}}\).

Details for this example are provided in the Appendix. The intuition is clearest for decreasing aggregate risks. Conditional on investors being patient, lower risks increase their expected utility. With relative risk aversion greater than one, investors want to benefit from these gains should they become impatient. Higher payoffs to impatient investors, however, require more storage and thus less investment.Footnote 7 If \({\textrm{d}Y^{\textrm{N}}}/{\textrm{d}\delta }\) denotes such change of investment in response to changes in aggregate risk, then expected productivity changes by \(\left( \int _0^1{B_Y(Y^{\textrm{N}},s)\textrm{d}s}\right) {\textrm{d}Y^{\textrm{N}}}/{\textrm{d}\delta }>0\). Therefore, productivity is lower for lower aggregate risks due to the investment externality, with a stronger response of productivity the larger the extent of the externality \(B_Y(Y^{\textrm{N}},s)\).

4 Policy implications

If banks do not to internalize the effect of their lending decisions on other banks, there are adverse consequences. In this section, we briefly discuss some policy implications, restricting attention to effects on risk sharing and aggregate productivity of selected existing government interventions, even though these interventions may have been introduced out of stability concerns only.

The first government intervention we consider is liquidity standards. These standards have been introduced by the Basel Committee with the objective to make the financial system safer. Yet, their implications remain largely unknown (Allen and Gale 2017). If bank runs are driven by sunspots and deposit contracts are subject to sequential service, the reserve holdings of competitive banks are constrained-efficient and do not imply any buffer of liquid assets (Peck and Shell 2003; Ennis and Keister 2006), such that bank liquidity regulation cannot improve outcomes. Others make a case for banks’ tendency to hold too little liquid assets relative to expected outflows. The reason for this lies in the inability of banks to internalize the societal benefits of liqudity holdings, for example because they free-ride on the liquidity provided by an interbank money market. Accordingly, liquidity requirements lower the probability of bank failures, although at the expense of bank lending and bank profits (Curfman and Kandrac 2021). Yet others argue that in order to improve risk sharing among depositors in the presence of unobservable trades, it depends on the type of shock whether a liquidity cap or minimum liquidity standards are optimal (Farhi et al. 2009).

Our analysis points to some unintended consequences of the current regulatory framework for liquidity standards. Specifically, it indicates that positive investment externalities cause banks to provide excessive liquidity insurance. Accordingly, liquidity caps can mitigate this inefficiency regardless whether we consider the ratio of liquid reserves to the volume of deposits issued at \(t=0\) or to the expected outflow of deposits at \(t=1\). If liquidity regulation would stipulate banks to hold reserves in excess of their expected liquidity outflow in non-failure states, banks cannot make optimal payouts to investors for any given investment profile. Importantly, banks would also finance even fewer investments, which only further aggravates the underlying problem.

The second government intervention we look at is bank bailouts. In broad terms, they are measures to avert the failure of banks at the expense of taxpayers. They may prevent financial crises, which can be costly by leading to permanent misallocations of resources and thus hampering overall economic productivity (Sandleris and Wright 2014). Such view implies that bailing out banks that are about to fail would also help productivity. In our model, however, where probabilities of widespread bank failures and expected productivity are joint equilibrium outcomes, bank bailouts can further dampen productivity, as we show next.

As in Allen et al. (2018), we consider a government with budget \(G>0\) that can be used at date \(t=1\) to fund either bank bailouts or the provision of public goods. Such split of the government’s budget can be socially beneficial in our setting as it renders the provision of public goods dependent on the aggregate state of the economy and thus widens the scope for risk sharing. We focus on the effects of bailouts on expected productivity. To avert bank failures, a banking authority has to ensure that \((1-y)/\lambda \le c_2\) for all \(s\in [0,1]\). In equilibrium, the banking authority does so in anticipation of the responses by banks and the resulting Nash equilibrium, henceforth denoted \(Y^{\textrm{BO}}\).

Suppose the Nash equilibrium \(Y^{\textrm{N}}\) that obtains in absence of bailouts entails a positive probability of bank failures, i.e. \(Y^{\textrm{N}}<{\overline{Y}}\) (as in Fig. 2b). Without loss of generality, let the amount the authority gives to patient investors at date \(t=1\) depend on the state, and denote such transfers (per-capita) as g(s). Then, provided that giving g(s) actually averts a looming bank failure, impatient investors get \(c_1=(1-y)/\lambda\) and patient investors get \(c_2=B(Y,s)y/(1-\lambda )+g(s)\). The smallest possible g(s) that averts the failing of a bank satisfies \(B(Y,s)y/(1-\lambda )+g(s)=(1-y)/\lambda\) for all \(s<{\hat{s}}(Y,y)\), i.e.

Accordingly, \(g(s)>0\) for all \(s< {\hat{s}}(Y,y)\) and \(g(s)=0\) for all \(s\ge {\hat{s}}(Y,y)\).

To determine the Nash equilibrium that obtains with public bailouts, consider first the problem for individual banks. They take the bailout policy into account but aggregate investment Y as given, such that their problem reads

We can rewrite this as an unconstrained optimization problem, bearing in mind that the second constraint implies \(c_2=(1-y)/\lambda\) for all \(s<{\hat{s}}(Y,y)\) and \(c_2=B(Y,s)y/(1-\lambda )\) for all \(s\ge {\hat{s}}(Y,y)\). Hence,

This reflects that investors get at least the promised payments \((1-y)/\lambda\), regardless of the realized state s. With probability \(\lambda\) an investor is impatient. Because of the support by the banking authority, these investors always get this payout, even if bank returns are very low. With probability \((1-\lambda ){\hat{s}}(Y,y)\) an investor is patient while bank returns are too small to generate at least \((1-y)/\lambda\) for all investors. In this case, the banking authority provides additional funds to match the originally promised amount of \((1-y)/\lambda\). Patient investors get \(B\left( Y,s\right) y/(1-\lambda )>(1-y)/\lambda\) only if the state is sufficiently high, and thus bank returns sufficiently large, such that the bank will not fail.

Similar to the case without bailouts, the solution to a bank’s problem with public bailouts, \(y^{\textrm{BO}}\), satisfies \(y^{\textrm{BO}}\in ]0,1[\) for all \(Y\in [0,1]\). The Nash equilibrium with public bailouts, \(Y^{\textrm{BO}}\), thus solves the first-order condition for problem (13) for \(y^{\textrm{BO}}=Y^{\textrm{BO}}\), which readsFootnote 8

Should there be more than one solution to Eq. (14), we focus on the largest one; the results are qualitatively the same for its smallest solution too because it holds in both cases that \(\textrm{d}y^{\textrm{BO}}/\textrm{d}Y<1\), which implies that the expression on the left in Eq. (14) is necessarily decreasing in Y in either case. Moreover, the first-order condition (14) (that applies with bailouts) differs from the first-order condition (6) (that applies without bailouts) only with respect to their first term. Since it is positive in (6) and negative in (14), we obtain \(Y^{\textrm{BO}}<Y^{\textrm{N}}\). This leads to the following Corollary.

Corollary 2

Bank bailouts adversely affect expected productivity.

Intuitively, bailing out banks subsidizes withdrawals at date \(t=1\). To take optimal advantage of this subsidy, depositors require higher payouts in case they withdraw at date \(t=1\). As higher payouts require more storage and less productive investment, aggregate investment will be smaller and so will be productivity.

A comprehensive policy analysis is beyond the scope of this paper. It would have to include at least three further aspects. First, bailouts have opportunity costs; they improve welfare only as long as the marginal increase in expected utility from increasing consumption in poor states at least compensates for the marginal decrease in expected utility associated with a lower provision of public goods. Second, the necessary bailout sum in the poorest possible states may exceed the budget available to the banking authority. Taking these two aspects into account implies that optimal bailouts are possibly only partial. Finally, the banking authority may be unable to commit at date \(t=0\) to a specific bailout policy to be executed at date \(t=1\), which may give rise to too generous bailouts with further adverse effects on productivity.

5 Conclusion

Our objective was to show that investment externalities can have important repercussions for banks themselves. This is because investment externalities influence the liquidity insurance by banks and the probability of their failure. Compared to the social optimum, banks provide inefficiently much liquidity insurance as investment in long-term projects is inefficiently small. This underinvestment also adversely affects the stability of banks as probabilities of bank failures are too large, and, if they happen, investors are left with inefficiently little consumption.

The analysis has shed new light on the (unintended) consequences of macroprudential policy. The macroprudential toolkit addresses risks typically related to the interaction of the financial system with the rest of the economy and to the collective behavior of financial institutions. In our analysis, the interaction of banks with the rest of the economy gives rise to spillovers from the lending activity of individual banks to the profitability of other banks’ lending activity. However, a bank takes the investments financed by other banks as given, and its own decision to finance investments has negligible effects on aggregate investment. Excessive probabilities of bank failures and repressed expected productivity are thus jointly determined; neither are high probabilities of bank failures the cause of low expected productivity, nor the other way around. Instead, both result from a collective failure of banks to internalize the knock-on effects of their lending decisions within the real sector. One important policy implication thereof is that imposing minimum liquidity standards for banks can be counterproductive as they may imply lower expected productivity and higher probabilities of bank failures. Another implication is that bailing out banks in distress can further dampen expected productivity.

We made a number of assumptions. First, we restricted attention to positive investment externalities. Our results do not merely revert for negative externalities, though. For example, to generate too low a probability of bank failure, the negative externality must not be too strong. Conjecturing that investment in a Nash equilibrium would be larger than the efficient investment, banks hold too little storage. Hence they promise to little to pay impatient consumers and are thus, ceteris paribus, too little prone to failure. However, if the negative externality is very strong, too high an investment significantly reduces what patient consumers can expect, making them more likely to get less than what has been promised to impatient consumers. A necessary condition for this to happen would be that the absolute value of the elasticity of bank asset returns with respect to aggregate investment (\(B_{Y}(Y,s)Y/B(Y,s)\), see Eq. (9)) is larger than one.

Second, we assumed a symmetric, perfectly competitive banking sector. While a monopolistic bank could potentially fully internalize the externality, this would come at the expense of the efficiency of the deposit contract and thus of investors. While the former effect would tend to improve the stability of the bank, the effect of the latter probably depends on the time horizon of the bank owners. With more complex, strategic interactions among banks with asymmetric market power, the effects on banks’ liquidity provision and stability are even less obvious.

Finally, we have refrained from considering shifts in investor sentiment, triggered by weak fundamentals. In a standard global games setting without externalities in production, competitive banks tend to provide too little liquidity insurance. This may suggest that in the presence of positive investment externalities some of the ineffciencies arising from shifts in investor sentiment could be mitigated, but at the expense of aggregate productivity and thus the fundamental stability of banks.

Notes

There are thus multiple equilibria in the withdrawal game, i. e. equilibria with and without panic-driven bank runs coexist (the distinction between depositing and withdrawal game goes back to Peck and Shell (2003)).

Also, patient investors have thus no incentive to panic and run on a bank’s assets, even if they were serviced sequentially.

Note, \(B(0,0)\ge 1\) is sufficient but not necessary for unique bank portfolio choices. By continuity, our results hold for \(B(0,0)+\varepsilon < 1\) at least for \(\varepsilon >0\) in some neighborhood of 0.

The possibility of multiple equilibria refers here to the depositing game, not the withdrawal game.

Solvent banks also withstand sunspot-driven runs if those shifts in beliefs are bank-specific rather than aggregate. Patient depositor who withdraw prematurely from one bank, will redeposit their funds with another bank, which in turn can lend this excess liquidity to the troubled bank – unless there are solvency problems.

Calomiris and Gorton (1991), among others, reason that restrictions on interbank insurance mechanisms are a side-effect of (ill-suited) banking regulation.

For risk aversion smaller than one, the effect of decreasing aggregate risks remains intact qualitatively as long as the investment externality is not too strong.

According to Leibniz rule for differentiation of definite integrals with variable integral boundaries.

References

Acemoglu D (1993) Learning about others’ actions and the investment accelerator. Econom J 103(417):318–328

Acharya VV, Shin HS, Yorulmazer T (2011) Crisis resolution and bank liquidity. Rev Financial Stud 24(6):2166–2205

Aghion P, Angeletos G-M, Banerjee A, Manova K (2010) Volatility and growth: Credit constraints and the composition of investment. J Monet Econ 57(3):246–265

Allen F, Carletti E, Goldstein I, Leonello A (2018) Government guarantees and financial stability. J Econom Theory 177:518–557

Allen F, Gale D (1998) Optimal financial crises. J Financ 53(4):1245–1284

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Allen F, Gale D (2017) How should bank liquidity be regulated? In: Evanoff DD, Kaufman GG, Leonello A, Manganelli S (eds) Achieving financial stability: challenges to prudential regulation. World Scientific, pp 135–157

Andolfatto D, Nosal E (2020) Shadow bank runs. FRB St Louis 2020-012A, Federal Reserve Bank of St Louis

Bebchuk LA, Goldstein I (2011) Self-fulfilling credit market freezes. Rev Financial Stud 24(11):3519–3555

Beck T, Demirgüç-Kunt A, Levine R (2006) Bank concentration, competition, and crises: First results. J Banking & Finance 30(5):1581–1603

Bencivenga V, Smith B (1991) Financial intermediation and economic growth. Rev Econ Stud 58(2):195–209

Berg T, Reisinger M, Streitz D (2021) Spillover effects in empirical corporate finance. J Financ Econ 142(3):1109–1127

Berger AN, Bouwman CH (2017) Bank liquidity creation, monetary policy, and financial crises. J Financ Stab 30:139–155

Bernstein S, Colonnelli E, Giroud X, Iverson B (2019) Bankruptcy spillovers. J Financ Econ 133(3):608–633

Biswas SS, Gómez F (2018) Contagion through common borrowers. J Financ Stab 39:125–132

Bucher M, Dietrich D, Tvede M (2018) Coordination failures, bank runs and asset prices. Deutsche Bundesbank discussion paper, No. 39/2018

Calomiris C, Gorton G (1991) The origins of banking panics: Models, facts, and bank regulation. In Financial Markets and Financial Crises. National Bureau of Economic Research, Inc, pp 109–174

Calomiris CW, Kahn CM (1991) The role of demandable debt in structuring optimal banking arrangements. Am Econ Rev 81(3):497–513

Chari VV, Jagannathan R (1988) Banking panics, information, and rational expectations equilibrium. J Financ 43(3):749–761

Chen Q, Goldstein I, Jiang W (2010) Payoff complementarities and financial fragility: evidence from mutual fund outflows. J Financ Econ 97(2):239–262

Chiaramonte L, Poli F, Oriani ME (2015) Are cooperative banks a lever for promoting bank stability? evidence from the recent financial crisis in oecd countries. Eur Financ Manag 21(3):491–523

Cooper R, John A (1988) Coordinating coordination failures in keynesian models. Q J Econ 103(3):441–463

Cooper R, Ross TW (1998) Bank runs: liquidity costs and investment distortions. J Monet Econ 41(1):27–38

Curfman CJ, Kandrac J (2021) The costs and benefits of liquidity regulations: lessons from an idle monetary policy tool. Review of Finance rfab024, in press

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91(3):401–419

Diamond DW, Rajan RG (2001) Liquidity risk, liquidity creation, and financial fragility: a theory of banking. J Polit Econ 109(2):287–327

Dietrich D, Hauck A (2020) Interbank borrowing and lending between financially constrained banks. Econ Theor 70(2):347–385

Ennis HM, Keister T (2003) Economic growth, liquidity, and bank runs. J Econom Theory 109(2):220–245

Ennis HM, Keister T (2005) Government policy and the probability of coordination failures. Eur Econ Rev 49(4):939–973

Ennis HM, Keister T (2006) Bank runs and investment decisions revisited. J Monet Econ 53(2):217–232

Ennis HM, Keister T (2009) Run equilibria in the Green-Lin model of financial intermediation. J Econom Theory 144(5):1996–2020

Ennis HM, Keister T (2010) Banking panics and policy responses. J Monet Econ 57(4):404–419

Ennis HM, Keister T (2010) On the fundamental reasons for bank fragility. Economic Quarterly First Quarter 33–58

Farhi E, Golosov M, Tsyvinski A (2009) A theory of liquidity and regulation of financial intermediation. Rev Econ Stud 76(3):973–992

Fecht F, Huang KXD, Martin A (2008) Financial intermediaries, markets, and growth. J Money, Credit, Bank 40(4):701–720

Fungacova Z, Turk R, Weill L (2021) High liquidity creation and bank failures. J Financ Stab 57:100937

Giroud X, Müller HM (2019) Firms’ internal networks and local economic shocks. Am Econom Rev 109(10):3617–3649

Goldstein I, Pauzner A (2005) Demand-deposit contracts and the probability of bank runs. J Financ 60(3):1293–1327

Gorton GB, Tallman EW (2018) Fighting Financial Crises. University of Chicago Press, Chicago and London

Green EJ, Lin P (2003) Implementing efficient allocations in a model of financial intermediation. J Econom Theory 109(1):1–23

Hellwig M (1994) Liquidity provision, banking, and the allocation of interest rate risk. Eur Econ Rev 38(7):1363–1389

Huber K (2018) Disentangling the effects of a banking crisis: evidence from German firms and counties. Am Econom Rev 108(3):868–898

Jorge J, Rocha J (2020) Agglomeration and industry spillover effects in the aftermath of a credit shock. Int J Cent Bank 16(3):1–50

Leonello A, Mendicino C, Panetti E, Porcellacchia D (2022) Savings, efficiency, and the nature of bank runs. Working Paper 2636, ECB

Naaraayanan SL, Wolfenzon D (2023) Business group spillovers. Working Paper 31107, National Bureau of Economic Research

Peck J, Shell K (2003) Equilibrium bank runs. J Polit Econ 111(1):103–123

Picot A (1980) The management of investment externalities within the private investment decision process. Manag Int Rev 20(3):71–82

Ratnovski L (2009) Bank liquidity regulation and the lender of last resort. J Financial Intermed 18(4):541–558

Romer PM (1990) Endogenous technological change. J Polit Econ 98(5):S71–S102

Sandleris G, Wright MLJ (2014) The costs of financial crises: Resource misallocation, productivity, and welfare in the 2001 argentine crisis. Scand J Econ 116(1):87–127

Steg J-H, Thijssen JJ (2023) Strategic investment with positive externalities. Games Econom Behav 138:1–21

Wallace N (1988) Another attempt to explain an illiquid banking system: the Diamond and Dybvig model with sequential service taken seriously. Fed Reserve Bank Minneap Q Rev 12(4):3–16

Wang EY, Kafouros M (2020) Location still matters! how does geographic configuration influence the performance-enhancing advantages of fdi spillovers? J Int Manag 26(3):100777

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Dietrich gratefully acknowledges the hospitality of the Department of Finance at University of Vienna. We thank two anonymous reviewers, Sonny Biswas, Murillo Campello, Giorgio Fazio, Bartosz Gebka, and Thomas Gehrig for comments and suggestions. The usual disclaimer applies.

Appendices

Appendix

Proof of Lemma 2

Some notations are useful:

-

1.

\({\overline{y}}: [0,1] \mapsto [0,1]\) is a function defined by

$$\begin{aligned} {\overline{y}}(Y)= \left\{ y \in [0,1] \left| \frac{B(Y,0)y}{1-\lambda } = \frac{1-y}{\lambda }\right. \right\} \end{aligned}$$ -

2.

\({\underline{y}}: [0,1] \mapsto [0,1]\) is a function defined by

$$\begin{aligned} {\underline{y}}(Y)= \left\{ y \in [0,1] \left| \frac{B(Y,1)y}{1-\lambda } =\frac{1-y}{\lambda }\right. \right\} \end{aligned}$$

-

1.

Suppose a bank’s portfolio choice is limited to \([0,{\underline{y}}(Y)]\). The bank’s objective is

$$\begin{aligned} \max _{y\,{\in }\,[0,{\underline{y}}(Y)] } U(Y,y) \end{aligned}$$with

$$\begin{aligned} U(Y,y) = \displaystyle \int _0^{1}{u\left( B(Y,s)y+(1-y)\right) }\textrm{d}s \end{aligned}$$Since \(u^{\prime }(c)>0\) and \(B(Y,s)-1>0\), we obtain \(U_y(Y,y)>0\) for all \(y\in [0,{\underline{y}}(Y)]\), such that \({\underline{y}}(Y) = \arg \max \{U(Y,y)\,\left| \,y\,{\in }\,[0,{\underline{y}}(Y)]\right. \}\).

-

2.

Suppose a bank’s portfolio choice is limited to \([{\underline{y}}(Y), {\overline{y}}(Y)]\). Since \({\hat{s}}(Y,y)=0\) for \(y={\overline{y}}(Y)\) and \({\hat{s}}(Y,y)=1\) for \(y={\underline{y}}(Y)\), the bank’s objective is

$$\begin{aligned} \max _{y\,{\in }\,[{\underline{y}}(Y), {\overline{y}}(Y)] } U(Y,y) \end{aligned}$$with

$$\begin{aligned} \begin{aligned} U(Y,y)&= \displaystyle \int _0^{{\hat{s}}(Y,y)}{u\left( B(Y,s)y+(1-y)\right) }\textrm{d}s \\&\quad + \displaystyle \int _{{\hat{s}}(Y,y)}^1 {\Big [\lambda u\left( \tfrac{1-y}{\lambda }\right) +(1-\lambda ) u\left( \tfrac{B(Y,s)y}{1-\lambda }\right) \Big ]}\textrm{d}s, \end{aligned} \end{aligned}$$(15)and, by applying the Leibniz rule for differentiation of definite integrals with variable integral boundaries,

$$\begin{aligned} \begin{aligned} U_y(Y,y)&= \displaystyle \int _0^{{\hat{s}}(Y,y)}{\Big [(B(Y,s) -1)u^{\prime }\left( B(Y,s)y+(1-y)\right) \Big ]}\textrm{d}s \\&\quad + \displaystyle \int _{{\hat{s}}(Y,y)}^{1}{B(Y,s)u^{\prime } \left( \tfrac{B(Y,s)y}{1-\lambda }\right) }\textrm{d}s \\&\quad - (1-{\hat{s}}(Y,y))u^{\prime }\left( \tfrac{1-y}{\lambda }\right) . \end{aligned} \end{aligned}$$(16)\(U_{yy}(y,Y)<0\) since \(u^{\prime \prime }(c)\,{<}\,0\). For \(y={\underline{y}}(Y)\), and thus \({\hat{s}}(Y,y)=1\), we have \(U_y(Y,y)>0\). For \(y={\overline{y}}(Y)\), and thus \({\hat{s}}(Y,y)=0\), we have \(U_y(Y,y)\le 0\) provided

$$\begin{aligned} -u^{\prime }\left( \tfrac{1-{\overline{y}}(Y)}{\lambda }\right) + \displaystyle \int _0^{1}B(Y,s){u^{\prime }\left( \tfrac{B(Y,s){\overline{y}}(Y)}{1-\lambda } \right) }\textrm{d}s \le 0. \end{aligned}$$(17)Therefore, if (17) holds, there is a unique \(y_2\,{\in }\, \{y\,{\in }\,]{\underline{y}}(Y),{\overline{y}}(Y)[\,\left| \,U_y(Y,y) =0\right. \}\) such that \(y_2 = \arg \max \{U(Y,y)\,\left| \,y\,{\in }\,[{\underline{y}}(Y),{\overline{y}}(Y)]\right. \}\). If (17) does not hold, then \({\overline{y}}(Y) = \arg \max \{U(Y,y)\,\left| \,y\,{\in }\,[{\underline{y}}(Y),{\overline{y}}(Y)]\right. \}\).

-

3.

Suppose a bank’s portfolio choice is limited to \([{\overline{y}}(Y),1]\). Then, the bank’s objective is

$$\begin{aligned} \max _{y\,{\in }\,[{\overline{y}}(Y),1] } U(Y,y) \end{aligned}$$with

$$\begin{aligned} U(Y,y) = \lambda u\left( \tfrac{1-y}{\lambda }\right) + (1-\lambda ) \displaystyle \int _0^{1} {u\left( \tfrac{B(Y,s)y}{1 - \lambda }\right) }\textrm{d}s, \end{aligned}$$(18)and

$$\begin{aligned} U_y(Y,y)=-u^{\prime }\left( \tfrac{1-y}{\lambda }\right) + \displaystyle \int _0^{1}B(Y,s){u^{\prime }\left( \tfrac{B(Y,s)y}{1-\lambda }\right) }\textrm{d}s. \end{aligned}$$(19)Note that \(U_{yy}(y,Y)<0\) since \(u^{\prime \prime }(c)<0\), and \(\displaystyle \lim _{c\rightarrow 0}u^{\prime }(c)=\infty\) and \(\displaystyle \lim _{c\rightarrow \infty }u^{\prime }(c)=0\). If condition (17) does not hold, there is a unique \(y_1\in \{y\in ]{\overline{y}}(Y),1[\,\left| \,U_y(Y,y) =0\right. \}\) such that \(y_1 = \arg \max \{U(Y,y)\,\left| \,y\,{\in }\,]{\overline{y}}(Y),1[\right. \}\). If condition (17) is met, then \({\overline{y}}(Y) = \arg \max \{U(Y,y)\,\left| \,y\,{\in }\,[{\overline{y}}(Y),1]\right. \}\).

Therefore, \(y^{*}\) is a continuous function \(\upsilon \,{:}\, [0,1] \,{\mapsto }\, [0,1]\) implicitly defined by \(U_y(Y,y^*)\,{=}\,0\), with \(U_y(Y,y^*)\) according to Eq. (16) if aggregate investment Y is such that \({\overline{y}}(Y)\) satisfies condition (17), and otherwise with \(U_y(Y,y^*)\) according to Eq. (19).

Proof of Proposition 1

Since \(\upsilon \, {:}\, [0,1]\,{\mapsto }\,[0,1]\) is continuous according to Lemma 1, \(\upsilon\) has a fixed point, \(\upsilon (Y^{\textrm{N}})\,{=}\,Y^{\textrm{N}}\), according to Brouwer’s fixed point theorem. \(Y^{\textrm{N}}\) is implicitly defined by \(U_y(Y^{\textrm{N}},Y^{\textrm{N}})\,{=}\,0\) with \(U_y(Y^{\textrm{N}},Y^{\textrm{N}})\) defined by either (16) or (19).

Proof of Proposition 2

Let \({\underline{Y}} = \{Y \in [0,1] \, \left| \, B(Y,1)Y/(1-\lambda ) = (1 - Y) / \lambda \right. \}\), and \({\tilde{s}}: [0,1] \mapsto [0,1]\cup \emptyset\) be a correspondence with \({\tilde{s}}(Y)\,{\ =}\, \{s\in [0,1]\, \left| \,B(Y,s)Y/(1{-}\lambda ) \,{=}\, (1{-}Y)/\lambda \right. \}\). Then, \({\tilde{s}}(Y)={\hat{s}}(Y,Y)\), \({\tilde{s}}({\overline{Y}})=0\) and \({\tilde{s}}({\underline{Y}})=1\).

-

1.

Claim: \(\min \{Y^{\textrm{N}},Y^{\textrm{P}}\}>{\underline{Y}}\).

We know that \(Y^{\textrm{N}}>{\underline{Y}}\). As for \(Y^{\textrm{P}}\), suppose the planner’s choice is limited to \([0,{\underline{Y}}]\). The planner’ objective function W is

$$\begin{aligned} W(Y) = \displaystyle \int _0^{1}{u\left( B(Y,s)Y+(1-Y)\right) }\textrm{d}s \end{aligned}$$with \(W^{\prime }(Y)>0\) for all \(Y\in [0,{\underline{Y}}]\). Hence, \(Y^{\textrm{P}}>{\underline{Y}}\).

-

2.

Claim: If \(Y^{\textrm{N}}\in [{\overline{Y}},1]\), then \(W^{\prime }(Y^{\textrm{N}})>0\).

Suppose the planner’s choice is limited to \([{\overline{Y}},1]\). Their objective function W is

$$\begin{aligned} W(Y)=\lambda u\left( \tfrac{1-Y}{\lambda }\right) + (1-\lambda ) \displaystyle \int _0^{1} {u\left( \tfrac{B(Y,s)Y}{1 - \lambda }\right) }\textrm{d}s. \end{aligned}$$with

$$\begin{aligned} W^{\prime }(Y)= -u^{\prime }\left( \tfrac{1-{Y}}{\lambda }\right) + \displaystyle \int _0^{1}\Big [\left( B({Y},s)+B_Y({Y},s){Y} \right) {u^{\prime }\left( \tfrac{B({Y},s){Y}}{1-\lambda }\right) }\Big ]\textrm{d}s. \end{aligned}$$(20)If \(Y^{\textrm{N}}\in [{\overline{Y}},1]\), then \(U_y(Y^{\textrm{N}},Y^{\textrm{N}})=0\) with

$$\begin{aligned} U_y(Y,y)=-u^{\prime }\left( \tfrac{1-y}{\lambda }\right) + \displaystyle \int _0^{1}B(Y,s){u^{\prime }\left( \tfrac{B(Y,s)y}{1-\lambda } \right) }\textrm{d}s \end{aligned}$$evaluated at \(Y=Y^{\textrm{N}}\) and \(y=\upsilon (Y^{\textrm{N}})\). Therefore, \(W^{\prime }(Y^{\textrm{N}})>0\).

-

3.

Claim: If \(Y^{\textrm{N}}\in [{\underline{Y}},{\overline{Y}}]\), then \(W^{\prime }(Y^{\textrm{N}})> 0\).

Suppose the planner’s choice is limited to \([{\underline{Y}},{\overline{Y}}]\). Their objective function W is

$$\begin{aligned} W(Y) = \displaystyle \int _0^{{\tilde{s}}(Y)}{u\left( B(Y,s)Y{+}(1{-}Y)\right) }\textrm{d}s + \displaystyle \int _{{\tilde{s}}(Y)}^1 {\Big [\lambda u\left( \tfrac{1{-}Y}{\lambda }\right) {+}(1{-}\lambda ) u\left( \tfrac{B(Y,s)Y}{1{-}\lambda }\right) \Big ]} \textrm{d}s. \end{aligned}$$with

$$\begin{aligned} \begin{aligned} W^{\prime }(Y)&=\displaystyle \int _0^{{\tilde{s}}(Y)}{(B(Y,s){-}1 {+}B_Y(Y,s)Y)u^{\prime }\left( B(Y,s)Y{+}(1{-}Y)\right) }\textrm{d}s \\&\quad + \displaystyle \int _{{\tilde{s}}(Y)}^{1}{(B(Y,s)+B_Y(Y,s)Y) u^{\prime }\left( \tfrac{B(Y,s)Y}{1-\lambda }\right) }\textrm{d}s \\&\quad - (1-{\tilde{s}}(Y))u^{\prime }\left( \tfrac{1-Y}{\lambda }\right) . \end{aligned} \end{aligned}$$(21)If \(Y^{\textrm{N}}\in [{\underline{Y}},{\overline{Y}}]\), then \(U_y(Y^{\textrm{N}},Y^{\textrm{N}})=0\) with

$$\begin{aligned} \begin{aligned} U_y(Y,y)&= \displaystyle \int _0^{{\hat{s}}(Y,y)}{\Big [(B(Y,s) -1)u^{\prime }\left( B(Y,s)y+(1-y)\right) \Big ]}\textrm{d}s \\&\quad + \displaystyle \int _{{\hat{s}}(Y,y)}^{1}{B(Y,s)u^{\prime } \left( \tfrac{B(Y,s)y}{1-\lambda }\right) }\textrm{d}s \\&\quad - (1-{\hat{s}}(Y,y))u^{\prime }\left( \tfrac{1-y}{\lambda }\right) . \end{aligned} \end{aligned}$$evaluated at \(Y=Y^{\textrm{N}}\) and \(y=\upsilon (Y^{\textrm{N}})\). Therefore, \(W^{\prime }(Y^{\textrm{N}})>0\).

According to Weierstrass’ extreme value theorem, W has a maximum on the closed interval [0, 1]. Since \(W^{\prime }(Y) >0\) for all \(Y\le {\underline{Y}}\) and \(\lim _{Y\rightarrow 1}W^{\prime }(Y) = - \infty\), continuity of W for all \(Y\in [0,1]\) together with differentiability of W for all \(Y\in ]0,{\underline{Y}}[\), for all \(Y\in ]{\underline{Y}},{\overline{Y}}[\), and for all \(Y\in ]{\overline{Y}},1[\), implies \(Y^{\textrm{P}}=\arg \max \{W(Y)\,\left| \,Y\,{\in }\,[0,1]\right. \}\) satisfies \(Y^{\textrm{P}}> {\underline{Y}}\), \(Y^{\textrm{P}}<1\), \(W^{\prime }(Y^{\textrm{P}})=0\) and \(W^{\prime \prime }(Y^{\textrm{P}})<0\), with \(W^{\prime }\) according to Eq. (20) if \(Y^{\textrm{P}}\in [{\underline{Y}},{\overline{Y}}]\) or Eq. (21) if \(Y^{\textrm{P}}\in [{\overline{Y}},1]\).

Recall that \(\upsilon (Y)\,{=}\,\arg \max \left\{ U(Y,y)\,\left| \,\right. y\,{\in }\,[0,1]\right\}\), and that \(\upsilon (Y)\) is unique. Since \(U(Y,Y) \,{=}\, W(Y)\), we have \(U\left( \upsilon (Y),Y\right) \,{\ge }\, W(Y)\) for all \(Y\,{\in }\,[0,1]\) and \(U\left( \upsilon (Y),Y\right) \,{=}\, W(Y)\) for all \(Y\, {\in }\, \{Y\,{\in }\,[0,1]\,\left| \,\right. \upsilon (Y) \,{=}\, Y\}\). By the envelope theorem, \(\textrm{d}U\left( \upsilon (Y),Y\right) /\textrm{d}Y>0\). Therefore, \(U\left( \upsilon (Y),Y\right) \,{<}\, W(Y^{\textrm{N}})\) for all \(Y\,{<}\,Y^{\textrm{N}}\), and together with \(U\left( \upsilon (Y),Y\right) \,{\ge }\,W(Y)\) for all \(Y\,{\in }\,[0,1]\), we obtain \(W(Y)\,{<}\,W(Y^{\textrm{N}})\) for all \(Y\,{<}\,Y^{\textrm{N}}\). As \(Y^{\textrm{P}}=\arg \max \left\{ W(Y)\,\left| \,Y\,{\in }\,[0,1]\right. \right\}\), \(W(Y^{\textrm{P}})\ge W(Y^{\textrm{N}})\) for all \(Y^{\textrm{N}}\), including \(Y^{\textrm{N}}\,{=}\, \max \left\{ Y\,{\in }\,[0,1]\,\left| \,\upsilon (Y)\,{=}\,Y\right. \right\}\). Finally, as shown above, \(W^{\prime }(Y^{\textrm{N}})\,{>}\,0\) for all \(Y^{\textrm{N}}\). Therefore, \(Y^{\textrm{P}}\,{>}\, \max \left\{ Y\,{\in }\,[0,1]\,\left| \, \upsilon (Y)\,{=}\,Y\right. \right\}\).

Example 2

Let functions \(Q_1\ {:}\ ]0,1[\mapsto {\mathbb {R}}\) and \(Q_2\ {:}\ ]0,1[\mapsto {\mathbb {R}}\) be defined by

Suppose \(Y^{\textrm{N}}\,{>}\, {\overline{Y}}\). Then, \(Y^{\textrm{N}}\) satisfies

Eqs. (10) and (22) define \(Y^{\textrm{N}}\) and \(\beta\) as implicit functions of \(\delta\), with

Hence,

The denominator is negative since \(\alpha \,{>}\,1\). For the numerator, integration by parts delivers

This expression is positive because

for all \(Y\in ]0,1[\) implies

Therefore, \(\left( \int _0^1 {B_Y(Y^{\textrm{N}},s) \textrm{d}s} \right) \frac{\textrm{d}Y^{\textrm{N}}}{\textrm{d}\delta } \,{>}\,0\).

Suppose \(Y^{\textrm{N}}\, {\ <}\, {\overline{Y}}\) and, therefore, \({\hat{s}}(Y^{\textrm{N}},Y^{\textrm{N}})\,{>}\,0\). Then, \(Y^{\textrm{N}}\) satisfies

Eq. (23) and \(\beta = \beta _0 -0.5(\delta -\delta _0)\) define \(Y^{\textrm{N}}\) and \(\beta\) as implicit functions of \(\delta\) with

\(\partial Q_2(Y^{\textrm{N}})/\partial Y^{\textrm{N}}\,{<}\,0\) since \(\upsilon ^{\prime } (Y)\,{<} \,1\) at least in some neighborhood of \(Y^{\textrm{N}}\). The sign of \({\partial Q_2(Y^{\textrm{N}}) }/{\partial \delta }{-}0.5{\partial Q_2(Y^{\textrm{N}})}/{\partial \beta }\) is not generally clear. However, \(Q_1(Y^{\textrm{N}}) = Q_2(Y^{\textrm{N}})\) and \(\frac{\textrm{d}Y^{\textrm{N}}}{ \textrm{d}\delta } \,{>}\, 0\) if \(Y^{\textrm{N}}={\overline{Y}}\). Therefore, by continuity, \(\frac{\textrm{d}Y^{\textrm{N}}}{\textrm{d}\delta } \,{>}\,0\), and hence \(\left( \int _0^1{B_Y(Y^{\textrm{N}},s)\textrm{d}s}\right) \frac{\textrm{d}Y^{\textrm{N}}}{\textrm{d}\delta } >0\), also for \(Y^{\textrm{N}}<{\overline{Y}}\) provided \(Y^{\textrm{N}}\) is in some neighborhood of \({\overline{Y}}\).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Dietrich, D., Vollmer, U. Investment externalities, bank liquidity creation, and bank failures. J Econ 141, 137–162 (2024). https://doi.org/10.1007/s00712-023-00846-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-023-00846-7