Abstract

This paper provides a new theoretical justification for entry to raise incumbent’s profit. In an industry with product differentiation and when firms use different strategic variables, we show that entry by an additional price setter may end up benefitting another price setting incumbent. This is due to the response of existing quantity setters, who contract their output after entry. Such reduction in output, which creates demand for the price setters, may more than compensate the reduction in price that is brought about by entry, provided that the products are not sufficiently differentiated.

Similar content being viewed by others

Notes

Chen and Riordan (2008) also show that duopoly prices may be higher than the monopoly price (for the case of symmetrically differentiated products) due to a price sensitivity effect.

By making \(k=n\) or \(k=0\), Lemma 1 illustrates that when firms are all of the same type, given the current demand and cost assumptions, entry never benefits incumbents. Indeed, in this case we have, respectively, \(\pi _{i}^{Q}(n,n)=\frac{\left( u+1\right) \left( n+u\right) }{\left( 2n+u\left( n+1\right) \right) ^{2}}\) and \(\pi _{i} ^{P}(n,0)=\frac{n+u\left( n-1\right) }{\left( 2n+u\left( n-1\right) \right) ^{2}}\) with \(\frac{\partial \pi _{i}^{Q}(n,n)}{\partial n}=-\left( u+1\right) \frac{2n+u\left( n+2u+3\right) }{\left( 2n+u+nu\right) ^{3} }<0\) and \(\frac{\partial \pi _{i}^{P}(n,0)}{\partial n}=-\frac{2n+u\left( u+3\right) \left( n-1\right) }{\left( 2n+u\left( n-1\right) \right) ^{3}}<0\): entry of one additional firm when all choose the same strategic variable lowers individual profits. For this symmetric case, see Mukherjee (2005).

This condition is equivalent to \(k<\frac{1}{2}\left( 2n+u\left( n-1\right) \right) \frac{2n+u+2nu}{nu\left( u+2\right) }\). Given that \(\frac{1}{2}\left( 2n+u\left( n-1\right) \right) \frac{2n+u+2nu}{nu\left( u+2\right) }>n-1\), it is always satisfied.

References

Amir R, Lambson VE (2000) On the effects of entry in Cournot markets. Rev Econ Stud 67(2):235–254

Askar SS (2014) On Cournot-Bertrand competition with differentiated products. Annals Oper Res 223:81–93

Barthel A-C, Hoffman E (2020) On the existence and stability of equilibria in N-firm Cournot-Bertrand oligopolies. Theory Decis 88(4):471–491

Besanko D, Perry MK, Spady RH (1990) The logit model of monopolistic competition: brand diversity. J Ind Econ 38(4):397–415

Bylka S, Komar J (1976) Cournot-Bertrand mixed oligopolies. In: Los MW, Los J, Wieczorek A (eds) Warsaw Fall Seminars in Mathematical Economics, 1975. Springer-Verlag, New York, pp 22–33

Chen Y, Riordan MH (2008) Price-Increasing Competition. RAND J Econ 39(4):1042–1058

Correa-Lopez M (2007) Price and quantity competition in a differentiated duopoly with upstream suppliers. J Econ Management Strategy 16(2):469–505

de Jong A, Nguyen TT, van Dijk MA (2007) Strategic debt: evidence from Bertrand and Cournot competition. ERIM Report Series: Research in Management September: 1–30

Fanti L, Buccella D (2017) Profit raising entry effects in network industries with corporate social responsibility. Econ Bus Lett 6:59–68

Höffler F (2008) On the consistent use of linear demand systems if not all varieties are available. Econ Bull 4(14):1–5

Ishibashi I, Matsushima N (2009) The existence of low-end firms may help high-end firms. Market Sci 28(1):136–147

Ishida J, Matsumura T, Matsushima N (2011) Market competition, R &D and firm profits in asymmetric oligopoly. J Ind Econ 59:484–505

Kopel M, Putz EM (2021) Information sharing in a Cournot-Bertrand duopoly. Managerial Decis Econ. https://doi.org/10.1002/mde.3348

Mukherjee A (2005) Price and quantity competition under free entry. Res Econ 59(4):335–344

Mukherjee A (2019) Profit raising entry in a vertical structure. Econ Lett, 183, Article 108543

Mukherjee A, Broll U, Mukherjee S (2009) The welfare effects of entry: the role of the input market. J Econ 98:189–201

Mukherjee A, Zhao L (2017) Profit raising entry. J Ind Econ 65(1):214–219

Nariu T, Flath D, Okamura M (2021) A vertical oligopoly in which entry increases every firm’s profit. J Econ Manag Strategy 30:684–694

Naylor RA (2002) Industry profits and competition under bilateral oligopoly. Econ Lett 77:169–175

Reisinger M, Ressner L (2009) The choice of prices versus quantities under uncertainty. J Econ Manag Strategy 18(4):1155–1177

Sakai Y, Eguchi S, Ishigaki H (1995) Price and quantity competition: Do mixed oligopolies constitute an equilibrium? Keio Econ Stud 32(2):15–25

Seade J (1980) On the Effects of Entry. Econometrica 48:479–490

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Shubik M, Levitan R (1980) Market Structure and Behavior. Harvard University Press, Cambridge, MA

Toshimitsu T (2016) Price and quantity competition in a differentiated duopoly with network compatibility effects. Japanese Econ Rev 67(4):495–512

Tremblay CH, Tremblay VJ (2011) The Cournot-Bertrand model and the degree of product differentiation. Econ Lett 111(3):233–235

Tremblay CH, Tremblay VJ (2019) Oligopoly games and the Cournot-Bertrand model: a survey. J Econ Surveys 33:1555–1577

Tremblay VJ, Tremblay CH, Isariyawongse K (2011) Endogenous Timing and Strategic Choice: the Cournot-Bertrand Model. Bull Econ Res 65:332–342

Tremblay VJ, Tremblay CH, Isariyawongse K (2013) Cournot and Bertrand competition when advertising rotates demand: the case of Honda and Scion. Int J Econ Bus 20(1):125–141

Tyagi RK (1999) On the effects of downstream entry. Manag Sci 45:59–73

Wang LFS, Lee J-Y (2015) Profit-raising entry in vertically related markets. Managerial Decis Econ 36:401–407

Acknowledgements

Margarida Catalão-Lopes gratefully acknowledges financial support from Fundação para a Ciência e Tecnologia (FCT), through PTDC/EGE-ECO/29332/2017 and UIDB/00097/2020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix I

In this appendix we present the proofs of the results in the paper.

Proof of Lemma 1

Let there be n firms, k of which set quantities. In order to have different types of firms we assume that \(k\in \left[ 1,n-1\right]\). Without loss of generality let these firms be firm 1, ..., k. Firms \(k+1,...,n\) set prices. There are such \(n-k\) firms. The demand for the product of any firm i is given by

Aggregating the demands for the two types of firms we obtain, respectively for the firms that set quantities and for the firms that set prices

with \(P_{k}=\sum _{j=1}^{k}p_{j}\) and \(P_{n-k}=\sum _{j=k+1}^{n}p_{j}\) and likewise for quantities. As \(Q=Q_{k}+Q_{n-k}\), we have

or

Consider one of the quantity setting firms. The demand for its product is

We want to write this as a function of the quantities of the other quantity setting firms, \(Q_{k-i}\), and of the prices of the price setting firms, \(P_{n-k}\). So,

where \(Q_{k-i}=Q_{k}-q_{i}\).

Consider now one of the price setting firms. The demand for its product is

We want to write this as a function of the quantities of the other quantity setting firms, \(Q_{k}\), and the prices of the other price setting firms, \(P_{n-k-i}\). So,

where \(P_{n-k-i}=P_{n-k}-p_{i}\).

Hence, we have

or

respectively for the quantity and for the price setting firms .

For the quantity setting firms the profit function is

and the first-order conditions for profit maximization are

Due to firm symmetry (\(q_{1}=...=q_{k}=q\) and \(p_{k+1}=...=p_{n}=p\)) this simplifies to

For the price setting firms the profit function is

and the first-order conditions for profit maximization are

or, due to symmetry,

Solving the system

with respect to p, q we obtain:

Plugging these prices and quantities in (1) and (2) under the symmetry assumption, we obtain the price of a quantity setting firm (say firm 1)

and the quantity of a price setting firm (say firm \(k+1\))

It should be noted that if the two types of firms exist, that is, if \(1\le n-k\le n-1\), the condition \(2n\left( 2+u\right) \left( n+u\left( n-k\right) \right) -u^{2}\left( n+1\right) >0\), which is always true, assures that quantities are positive and that price is above marginal cost.Footnote 4

Finally, profits are

and

\(\square\)

Proof of Proposition 1:

Let \(k=n-g\). Entry increases the profit of a price setter if and only if

with

and

Note that for \(g=1\)

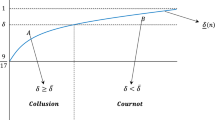

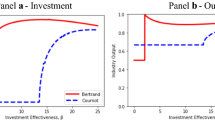

Regardless of the sign of \(f_{7}(n,1)\) there is one variation in polynomial \(\sum _{i=0}^{8}f_{i}(n,g)u^{i}\) (the number of variations in a polynomial is defined as the number of times that two of its consecutive terms have different signs) and so, using Descartes’ Rule of Signs, there is one positive root, \(u_{r}\). As \(f_{0}(n,g)=64n^{4}\left( n+1\right) ^{4}>0\), we have \(\pi _{i}^{P}(n+1,n-g)-\pi _{i}^{P}(n,n-g)>0\) for \(u>\) \(u_{r}\).

When \(g=2\) we have that

meaning that there are no roots as all coefficients are positive. Finally, given that

and

there are also no real roots for \(g\ge 2\). \(\square\)

Appendix II

In this appendix we show that entry by an additional price setter may benefit another price setting incumbent when Singh and Vives (1984)’s demand structure is considered. Assuming the demand for firm i is given by

with \(a>c\), \(b>0\) and \(\gamma \in \left[ 0,1\right)\), for the case of duopoly we have that the relevant inverse demand and demand curves are

and the equilibrium prices and quantities result from

The best response functions are

that yield equilibrium duopoly prices and quantities:

Before entry, profits are given by

After entry, we will have a triopoly with one quantity setter (firm 1) and two price setters (firms 2 and 3). The relevant demand and inverse demand curves are now

The Nash equilibrium is the solution to

that corresponds to the following best response functions (given the symmetry of the price setters, one can obtain the best response function for the quantity of firm 1 with respect to any common price set by firms 2 and 3, \(p_{i}\), as well as firms 2 and 3 equilibrium price for any given level of \(q_{1}\)):

yielding

Equilibrium profits are

The profit of firm 2 increases with entry if and only if

There is one variation in polynomial \(h(\gamma )\) and so, using Descartes’ Rule of Signs, there is one positive root, \(\gamma _{r}\). As \(h(0)=-4<0\) and \(h(1)=1>0\), we have that \(\gamma _{r}\in (0,1)\), and for \(\gamma >\gamma _{r}\) entry increases the profit of firm 2.

Appendix III

In this appendix we show that entry by an additional price setter may benefit another price setting incumbent when Höffler (2008)’s "consistent formulation" of the demand structure is considered.

Consumers choose quantities and Y (a composite good) to maximize utility

subject to the budget constraint \(\sum _{i=1}^{n}p_{i}q_{i}+Y=I\). In other words, consumers maximize

Shubik and Levitan (1980)’s demand follows from the utility function

with \(Q=q_{1}+...+q_{n}\). In the main text we have assumed that before entry \(n=2\) and after entry \(n=3\). An alternative would be to assume that \(n=3\) both before and after entry but that before entry there is an infinite price for firm 3’s product (the representative consumer is constrained not to buy the entrant’s product before entry). From utility maximization, demands are given by

yielding

The equilibrium quantity for firm 1 and price for firm 2 are given by

and the corresponding normalized profits are

with

Once more, there is one variation in polynomial \(h(u):=\left( u^{4} -90u^{3}-423u^{2}-648u-324\right)\) and so, using Descartes’ Rule of Signs, there is one positive root, \(u_{r}\). As \(h(0)=-324<0\), we have that for \(u>u_{r}\) entry increases the profit of firm 2.

Rights and permissions

About this article

Cite this article

Brito, D., Catalão-Lopes, M. Profit raising entry under mixed behavior. J Econ 138, 51–72 (2023). https://doi.org/10.1007/s00712-022-00797-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-022-00797-5