Abstract

In location-based models of price competition, traditional sufficient conditions for existence and uniqueness of an equilibrium (Caplin and Nalebuff in Econometrica 59(1):25–59) are not robust for the firm that serves the right-tail of the consumers’ distribution. Interestingly, as we relax these conditions, we observe only two new alternative cases. Moreover, we identify a novel, easily testable condition for uniqueness that is weaker than log-concavity and that can also apply to Mechanism Design. Thanks to this general framework, we can solve the equilibrium of general vertical differentiation models numerically and show that inequality has a U-shaped effect on profits and prices of a high-quality firm. Moreover, we prove that extreme levels of concentration can dissolve natural monopolies and restore competition, contrary to the Uniform case.

Similar content being viewed by others

Availability of data and material:

Not applicable.

Notes

The Gini index is a popular statistical measure of dispersion and inequality. When working with continuous distributions, it can be computed as \(G = \frac{1}{2 \mu } \int _0^\infty \int _0^\infty f(x) f(y) |x - y |\,dx \,dy\), where \(\mu\) denotes the expected value of the distribution.

Because the VD basic setting does not allow for entry nor exit in the market, we follow the literature referring to a monopoly as a situation where the low-quality firm receives zero market shares, independently of the price it charges.

This effect prevents the applicability of supermodularity to the game (Milgrom and Roberts 1994, see, for instance,), as supermodularity requires continuity up to upward jumps.

A real valued function \(f : T \rightarrow {\mathbb {R}}\), with \(T \subseteq {\mathbb {R}}^n\) convex, is said to be \(\rho\)-concave, for some \(\rho \in {\mathbb {R}}\) if \(f(\lambda x + (1-\lambda )y )^{\rho } \ge \lambda f(x)^{\rho } + (1-\lambda ) f(y)^{\rho }\) holds for any \(x, y \in T\) and any \(\lambda \in [0,1]\). The definition was first proposed by Martos (1966) (Balogh and Ewerhart 2015, see). The application to economic models of price differentiation is due to Caplin and Nalebuff (1991), who prove that existence of equilibria in prices is granted by asking \((-1)-\)concavity of the distribution, while uniqueness requires 0-concavity of the density, also known as log-concavity (i.e. we take \(\ln f\) instead of \(f^\rho\)).

Notice that their classic result does not apply to the VD setting, as the VD game features payoff functions that are continuous but not quasi-concave.

Gal-Or (1982), studying MS equilibria in the classic Hotelling game, conjectures that “mixed strategies are not enough to re-establish the principle of minimum differentiation”. For the VD case, we indeed prove that the principle of minimum differentiation is incompatible with a price-equilibrium in mixed strategies.

The maximization problem of firm L is restricted to the interval \(p_L \in [MC,p_H]\). Because its profits are zero at the extremes, and nonnegative in-between, the solution must be interior. On the other hand, firm H maximizes its profit over \(p_H \in [p_L,\infty ]\). We impose a finite expected value to rule out the possibility of a best response \(p^*_H = \infty\).

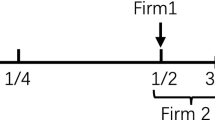

For instance, place firm L in position \(x_L = -1/2\), and firm H in position \(x_H = 1/2\). Then, let preferences for a consumer \(\theta\) be represented by the following utility function: \(U_{j}(\theta ) = V - \frac{\Delta s}{2} \left( \theta -x_j \right) ^2 - p_j\), with \(j = L, H\).

The only exception is the Beta distribution, but only over a range of values that is irrelevant for the duopoly problem.

Although it is possible to fabricate complex distributions that feature multiple zeros of the function \(g_H'\).

Interestingly, for other configurations of the parameters, the Log-Normal can also fall into Class 2.

The problem of a price-setting monopolist can be expressed as \(\max _p (p-c){\overline{F}}(p/s)\), with FOC \({\overline{F}}(p/s) - (p-c)/s f(p/s) = 0\), which can be written as \(g_H(p/s) = - c/s < 0\).

This requires proving that \({\overline{F}}(\phi ^*) > F(\phi ^*)\). But, from the definition of \(\phi ^*\), \(m(\phi ^*) = {\overline{F}}(\phi ^*) - F(\phi ^*) - \phi ^* f(\phi ^*) = 0\), which implies \({\overline{F}}(\phi ^*) - F(\phi ^*) = \phi ^* f(\phi ^*) > 0\).

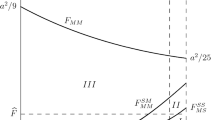

On the other hand, both equilibrium profit and price of the low-quality firm increase with the Gini index.

To make meaningful comparisons, we must fix any percentile of the distribution. For simplicity, we choose the median. In many families, holding the median fixed implies that there is a one-to-one map between the Gini index and the parameters of the distribution.

References

Anderson SP, De Palma A (1988) Spatial price discrimination with heterogeneous products. Rev Econ Stud 55(4):573–592

Anderson SP, De Palma A, Thisse JF (1992) Discrete choice theory of product differentiation. MIT press, Cambridge

Anderson SP, Goeree JK, Ramer R (1997) Location, location, location. J Econ Theory 77(1):102–127

Balogh T, Ewerhart C (2015) On the origin of r-concavity and related concepts. University of Zurich, Department of Economics, Working Paper (187)

Benassi C, Chirco A, Colombo C (2006) Vertical differentiation and the distribution of income. Bull Econ Res 58(4):345–367

Benassi C, Chirco A, Colombo C (2019) Vertical differentiation beyond the uniform distribution. J Econ 126(3):221–248

Bonanno G, Haworth B (1998) Intensity of competition and the choice between product and process innovation. Int J Ind Organ 16(4):495–510

Bonnisseau JM, Lahmandi-Ayed R (2007) Vertical differentiation with non-uniform consumers distribution. Int J Econ Theory 3(3):179–190

Caplin A, Nalebuff B (1991) Aggregation and imperfect competition: on the existence of equilibrium. Econometrica 59(1):25–59

Champsaur P, Rochet JC (1989) Multiproduct duopolists. Econometrica 57(3):533–557

Cremer H, Thisse JF (1991) Location models of horizontal differentiation: a special case of vertical differentiation models. The Journal of Industrial Economics pp 383–390

Dasgupta P, Maskin E (1986) The existence of equilibrium in discontinuous economic games, I: Theory. Rev Econ Stud 53(1):1–26

d'Aspremont C, Gabszewicz JJ, Thisse JF, (1979) On Hotelling's Stability in Competition. Econometrica 47(5):1145–1150

Filippini L, Martini G (2004) Vertical differentiation and innovation adoption. Mimeo

Gabszewicz JJ, Thisse JF (1979) Price competition, quality and income disparities. J Econ Theory 20(3):340–359

Gabszewicz JJ, Thisse JF (1980) Entry (and exit) in a differentiated industry. J Econ Theory 22(2):327–338

Gal-Or E (1982) Hotelling's spatial competition as a model of sales. Econ Lett 9(1):1–6

Glicksberg IL (1952) A further generalization of the Kakutani fixed point theorem, with application to Nash equilibrium points. Proc Am Math Soc 3(1):170–174

Hotelling H (1929) Stability in competition. Econ J 39:41–57

Johnson JP, Myatt DP (2006) On the simple economics of advertising, marketing, and product design. Am Econ Rev 96(3):756–784

Lahmandi-Ayed R (2000) Natural oligopolies: a vertical differentiation model. Int Econ Rev 41(4):971–987

Lahmandi-Ayed R (2004) Finiteness property in vertically differentiated markets: a note on locally increasing and decreasing returns. Econ Theory 23(2):371–382

Lahmandi-Ayed R (2007) Finiteness property with vertical and horizontal differentiation: does it really matter? Econ Theory 33(3):531–548

Lin S (2017) Add-on policies under vertical differentiation: Why do luxury hotels charge for internet while economy hotels do not? Mark Sci 36(4):610–625

Martos B (1966) Nem-lineáris programozási módszerek hatóköre. Magyar Tudományos Akadémia Közgazdaságtudományi Intézet, MTA, Budapest

McWilliams B (2012) Money-back guarantees: Helping the low-quality retailer. Manag Sci 58(8):1521–1524

Milgrom P, Roberts J (1994) Comparing equilibria. Am Econ Rev pp 441–459

Mussa M, Rosen S (1978) Monopoly and product quality. J Econ Theory 18(2):301–317

Shaked A, Sutton J (1982) Relaxing price competition through product differentiation. Rev Econ Stud pp 3–13

Shaked A, Sutton J (1983) Natural oligopolies. Econometrica 51(5):1469–1483

Wang XH (2003) A note on the high-quality advantage in vertical differentiation models. Bull Econ Res 55(1):91–99

Yurko AV (2011) How does income inequality affect market outcomes in vertically differentiated markets? Int J of Ind Organ 29(4):493–503

Acknowledgements

We wish to thank Justin Johnson, the participants to the Marco Fanno Workshop 2018 in Trento, Carmine Guerriero, Bruce McWilliams, Pierpaolo Battigalli, Andrei Gonberg, Emiliano Catonini, Jean Jaskold Gabszewicz, Romans Pancs, Federico Boffa, Dino Gerardi, David Myatt, the participants to the Carlo Alberto seminars and two anonymous referees. J. Hernández Cortés acknowledges the financial support of the Asociación Mexicana de Cultura, A.C.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Contributions

Conceptualization, formal analysis, writing: Hernández-Cortés and Morganti; Software: Hernández-Cortés; Editing: Morganti.

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that there is no conflict of interest.

Code availability

custom code available under request.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Proofs

Proofs

Proof

of Proposition 1. First, we apply a change of variable to the profits, so that they can be both expressed in terms of the marginal consumer, instead of their respective individual prices. Then we show that the system of FOCs does not depend on qualities. Because every pure strategy equilibria must solve such system, it follows that also the number of solutions will not depend on qualities.

For \(x,y \ge 0\) we define the (possibly multi-valued) functions:

Then we can write the best response functions as:

Clearly, \((p^*_L, p^*_H)\) is a NE if and only if \((p^*_H- p^*_L)/\Delta s = \nu _H \left( (p^*_L - MC)/\Delta s \right) = \nu _L \left( (p^*_H - MC)/\Delta s \right)\).

If we can find a pair x, y that satisfies the system of equations

then the relations \(p^*_H = MC + \Delta s \times y\) and \(p^*_L = MC + \Delta s \times x\) define a NE. Therefore, conditional on \(\Delta s > 0\), the number of equilibrium points equals the number of solutions of (8), which is independent of \(s_L\), \(s_H\), and \(\Delta s\). In particular, if (8) has no solutions, there are no equilibria for any \(\Delta s \ne 0\). \(\square\)

Proof

of Lemma 2. First step) A finite expected value \({\mathbb {E}}[\theta ]<\infty\) implies \(\lim _{b \rightarrow \infty } \int _0^b x f(x) \,dx\) \(={\mathbb {E}}[\theta ]\) and \(\lim _{b \rightarrow \infty }\int _b^\infty x f(x) \,dx =0\). Then:

Therefore we have:

Moreover, a standard argument for improper integrals shows that a finite expected value forces \(\lim _{x \rightarrow \infty } x f(x) = 0\). We will show a useful result:

Denote \(L_0 := \lim _{x \rightarrow 0} x^2 f(x)\). We will first show that \(L_0 = 0\), and leverage that fact to prove (10). Assumption 2 implies that the limit \(L_0\) exists, and clearly \(0 \le L_0 \le \xi ^2 f(\xi ) < \infty\). If \(L_0 > 0\), then \(L_0 \le x^2 f(x)\) on \(x \in [0,\epsilon ]\) for some \(\epsilon\). But \(\infty> {\mathbb {E}}[\theta ] > \int _0^{\epsilon } x f(x) \,dx \ge \int _0^{\epsilon } L_0/x \,dx = \infty\) is a contradiction, therefore \(L_0 = 0\).

To prove (10), first notice that if \(z \le x \le y \le \xi\) then the Single-Peakedness implies \(z^2 f(z) \le x^2 f(x) \Rightarrow z^2 f(z) / x^2 \le f(x)\). Integrating from z to y:

Then \(z f(z) < z^2 f(z)/y + F(y)\) for all \(z \le y \le \xi\). Because F(y) decreases to 0 as y decreases to 0, for any \(\epsilon > 0\) there exists a \(y_\epsilon \le \xi\) such that \(F(y_\epsilon ) < \epsilon /2\). Also, because \(L_0 = 0\), there exists a \(\delta _\epsilon > 0\) such that \(z^2 f(z) < \epsilon y_\epsilon /2\) for all \(0< z < \delta _\epsilon\). Therefore \(z f(z)< z^2 f(z)/y_\epsilon + F(y_\epsilon ) < \epsilon\). That is, \(z f(z) < \epsilon\) for all \(z < \delta _\epsilon\), which proves (10).

Second step) Define the auxiliary function \(m_H(x) := 1 - F(x) - x f(x)\) with derivative \(m_H'(x) = - [2 f(x) + x f'(x)]\). Because \(m'_H(x) \lessgtr 0\) if \(x \lessgtr \xi\), then \(\xi\) is the absolute minimum of \(m_H\). By (9)–(10) we have that \(m_H(0) = 1\) and \(m_H(\infty ) = 0\). Because \(m_H\) is strictly increasing over \((\xi , \infty )\), then \(m_H(\xi ) < 0\). Hence, because \(m_H(0)>0\), and \(m_H\) is strictly decreasing in \([0,\xi ]\), it follows that it must have only one zero in \((0, \xi )\), which we label \(\eta\). Notice that \(m_H(x) = f(x) g_H(x)\), so we have the very useful relation (3).

Third step) Notice that \(m_H(x) = m(x) + F(x) > m(x)\), and \(m'(x) = - [3 f(x) + x f'(x)] = m_H'(x) - f(x) <m_H'(x)\), which imply that m is decreasing on \((0, \xi )\). Because \(m(0) = 1\) and \(m(\eta ) < m_H(\eta ) = 0\), m must have exactly one zero \(\phi ^* \in (0, \eta )\). \(\square\)

Proof

of Propositions 3 and 4. In both Classes 2 and 3, there is a critical \({\overline{p}}_L\) at which the best response function \(p^*_H(p_L)\) has a discontinuity. Denote by \(p^1_H < p^2_H\) the two endpoints of this jump. The proof consists in finding conditions for which the best response of firm L can cross the one for firm H, avoiding the jump.

We define \({\overline{\phi }}_L := \frac{{\overline{p}}_L - MC}{\Delta s}\), \(\phi ^1_H := \frac{p^1_H - MC}{\Delta s}\) and \(\phi ^2_H := \frac{p^2_H - MC}{\Delta s}\), and also: \(\phi ^1 := \frac{p^1_H - {\overline{p}}_L}{\Delta s} = \phi ^1_H - {\overline{\phi }}_L\) and \(\phi ^2 := \frac{p^2_H - {\overline{p}}_L}{\Delta s} = \phi ^2_H - {\overline{\phi }}_L\). Then, at \({\overline{p}}_L\), firm H is indifferent between the two optimal prices \(p^1_H,p^2_H\). That is, \(\Pi _H(p^1_H) = \Pi _H(p^2_H)\). This is equivalent to \(\phi ^1_H {\overline{F}}(\phi ^1) = (\phi ^1 + {\overline{\phi }}_L) {\overline{F}}(\phi ^1) = (\phi ^2 + {\overline{\phi }}_L) {\overline{F}}(\phi ^2) = \phi ^2_H {\overline{F}}(\phi ^2)\). The difference between the two classes is that, in Class 2, \(p^1_H\) is a boundary solution in \([{\overline{p}}_L,\infty )\). That is, \(\phi ^1 = 0\). On the other hand, in Class 3, both prices \(p^1_H,p^2_H\) are interior. Therefore \(0= \phi ^1< \eta _0< \phi ^2 < \eta\) in Class 2, and \(0< \phi ^1< \eta _0< \phi ^2 < \eta\) in Class 3. Also, in Class 3 both optima satisfy the first and second order conditions: \(g_H(\phi ^1) = g_H(\phi ^2) = {\overline{\phi }}_L\), \(g'_H(\phi ^1)<0\) and \(g'_H(\phi ^2)<0\). Plugging the FOCs into the indifference condition gives us \(\big ( \phi ^1 + g_H(\phi ^1) \big ) {\overline{F}}(\phi ^1) = \big ( \phi ^2 + g_H(\phi ^2) \big ) {\overline{F}}(\phi ^2)\). With some algebraic manipulations we obtain the equations in Proposition 4.

However, in Class 2, the first and second order conditions only apply to \(\phi ^2\) (in fact, for \(\phi ^1 = 0\) we have that \(g_H(0)<{\overline{\phi }}_L\) and \(g'_H(0)>0\)). The indifference condition in this class is simply \({\overline{\phi }}_L = (\phi ^2 + {\overline{\phi }}_L) {\overline{F}}(\phi ^2) = \phi ^2_H {\overline{F}}(\phi ^2)\). By the FOC \(g_H(\phi ^2) = (\phi ^2 + g_H(\phi ^2)) {\overline{F}}(\phi ^2)\). After some algebra we obtain: \(\phi ^2 f(\phi ^2) = F(\phi ^2) {\overline{F}}(\phi ^2)\). In Propositions 3 we rename \(\phi ^2\) as \({\overline{\phi }}\).

By Theorem 1, if there exists a NE in classes 2 or 3, it must be the one described in (4). For this to be a NE, the two best response functions must cross. Therefore, there is no NE if and only if the best response of firm L passes through the gap created by the jump: \(p^*_L(p^1_H)< {\overline{p}}_L < p^*_L(p^2_H)\). This is equivalent to: \(\phi ^1 - g_L^{-1}({\overline{\phi }}_L + \phi ^1)< 0 < \phi ^2 - g_L^{-1}({\overline{\phi }}_L + \phi ^2)\). On the other hand, we can use the identity \(g_L(x) = g_H(x) + x - (m/f)(x)\) to show that \(g_L(\phi ^i) = {\overline{\phi }}_L + \phi ^i - \frac{m}{f}(\phi ^i)\) for \(i=1,2\). Hence, there is no NE if and only if \(m(\phi ^1)> 0 > m(\phi ^2)\). By the proof of Theorem 1, \(\phi ^1< \phi ^* < \phi ^2\). For Class 2, we only need to apply the previous reasoning to \(\phi ^2 = {\overline{\phi }}\). \(\square\)

Proof

of Theorem 3. The strategy of this proof is to transform the expected profits using a change of variable to show that the difference in qualities remains a scaling factor even when companies play mixed strategies. Then it follows that both firms will choose maximum differentiation.

First step) Denote by \(\sigma _L(dp_L)\) and \(\sigma _H(dp_H)\) possible mixed strategies in the second stage for each firm, that is, probability measures on \({\mathbb {R}}\), with support inside the interval \(I=[MC,\infty )\). Both firms simultaneously choose \(\sigma _i\) to maximize their expected profits \(E_i\), for \(\sigma _{-i}\) fixed:

With the goal of making a simplifying a change of variable, we first rewrite these expected profits as:

where the function \(\Phi : I \rightarrow [0,\infty )\) is defined as \(\Phi (p)=(p-MC)/\Delta s\). Function \(\Phi\) induces the push-forward measures \(\mu _L,\mu _H\) on \({\mathbb {R}}\) defined for any Borel set \(A \subset {\mathbb {R}}\) as: \(\mu _H(A)=\sigma _H\left( \Phi ^{-1}(A)\right)\) and \(\mu _L(A)=\sigma _L\left( \Phi ^{-1}(A)\right)\). Both are probability measures with supports in \({\mathbb {R}}^+=[0,\infty )\). Furthermore, for any function \(G : {\mathbb {R}} \rightarrow {\mathbb {R}}\) we have:

We can use the function \(G(y) = \Phi (p_L) F\big (y- \Phi (p_L)\big )\), for fixed \(p_L\), to rewrite the inner integral of \(E_L\):

Next, we use the function \(G(x)=\int _{y\in {\mathbb {R}}^+} x F(y-x)\,\mu _H(dy)\) to rewrite the outer integral of \(E_L\):

We can follow the same procedure for \(E_H\) to obtain:

Because \(\Phi\) is a bijection, there is a one-to-one relationship between the new measures \(\mu _L,\mu _H\) and the original ones \(\sigma _L,\sigma _H\), and also between any pair x, y and the corresponding prices: \(p_H = MC+y\Delta s\) and \(p_L = MC+x\Delta s\). In the second stage, \(\Delta s\) is a given constant. Hence, solving the equilibrium problem for \(E_L,E_H\) is equivalent to solving the new equilibrium problem:

The key observation is that this equivalent game is independent of the qualities \(s_L,s_H\). By assumption, for some particular \(\Delta s >0\) there exists a unique equilibrium \(\sigma ^*_L,\sigma ^*_H\) for the original problem in \(E_L,E_H\). This NE can be expressed in terms of \(\mu ^*_L,\mu ^*_H\). Therefore, \(\mu ^*_L,\mu ^*_H\) is the unique NE for the equivalent problem. From this equilibrium we can easily construct the unique equilibrium for any other pair of qualities. This argument generalizes Proposition 1 to mixed strategies.

Second step) Denote:

Then \(e^*_L,e^*_H\) are constants independent of \(s_L,s_H\). In the first stage both firms must solve \(\max _{s_H}E^*_H(s_L,s_H) =\max _{s_H}\Delta s\times e^*_H\) for fixed \(s_L\), and \(\max _{s_L}E^*_L(s_L,s_H) =\max _{s_L}\Delta s\times e^*_L\) for fixed \(s_H\). Therefore, the only possible equilibrium is maximum differentiation. \(\square\)

Proof

of Theorem 4. Denote the space of prices \((p_L,p_H)\) for which both profits are non-negative as \(P = [MC,\infty )\times [MC,\infty )\). This space can be partitioned into two disjoint regions:

It is easy to see that in region C both demands are positive \(D_H,D_L>0\), while in region M only the demand of firm H is positive, that is \(D_H>0\) and \(D_L=0\).

The proof will be divided in three steps. In a first step we show that Condition-\(\eta\) implies that the best response of the firm H to any price of the firm L cannot be in region C, that is, Condition-\(\eta\) is incompatible with positive market shares for firm L. However, this alone does not imply the existence of an equilibrium in region M. In a second step we will find the conditions for \(p_H\) that forces the best response for firm L to be in region M. Here we will distinguish two cases. One case is when H can hold a monopoly only by setting a limit price, so as to force firm L’s price down to its marginal cost. The other case is where the exogenous parameters allow for an unconstrained monopoly price. In a third step will formally prove the existence of a monopolistic equilibrium. That is, we show that firm H can sustain an equilibrium in region M.

First step) For any fixed \(p_L\ge MC\) we have:

In region C, \(MC /s_L \le p_L / s_L< p_H /s_H < \Delta p/\Delta s\), which, together with Condition-\(\eta\), implies that \(\eta <\Delta p/\Delta s\), hence \(g_H(\Delta p/\Delta s)<0\). This in turn implies that \(\Pi _H\) is strictly decreasing in region C. Therefore, the best response \(p_H^{*}(p_L)\) for any choice of \(p_L\) must be in region M:

Second step) Notice that, if the interval \((MC,p_Hs_L/s_H)\) is non-empty, then the best response \(p_L^{*}(p_H)\) must be in region C, because \(\Pi _L \le 0\) otherwise. Therefore an equilibrium in region M can exist if and only if that interval is empty, which is equivalent to:

If that is the case, then \(\Pi _L(p_L,p_H)=0\) for all \(p_L\ge MC\) and, therefore, the best response for firm L is the whole semi-line \(p_L^{*}(p_H)=[MC,\infty )\).

On the other hand, in region M firm H faces the “constrained monopoly problem” (6) with solution \(p_M = \min \{ p^*_M, p_L s_H/s_L \}\), where \(p^*_M\) is the solution of the unconstrained problem. In our working paper we show that this must exist. With (11) in sight, it is useful to analyze the relationship between \(p^*_M/s_H\) and \(MC/s_L\). Because \(g_H\) is strictly decreasing:

Or equivalently:

Define the threshold \(\sigma =\sigma (g_H,MC,s_L)=-MC/g_H(MC/s_L)\). Notice that, because \(MC/s_L\ge \eta\) then \(0<-g_H(MC/s_L)<MC/s_L\), which implies that \(s_L<\sigma\). We have two cases:

Case i) If \(s_H\) is sufficiently higher than \(s_L\):

Case ii) If \(s_H\) is close enough to \(s_L\):

Third step) Now assume that \((p_L^{eq},p_H^{eq})\), which must be in region M by Condition-\(\eta\), is an equilibrium. There are only two possible alternatives:

Because (11) must hold, in the first alternative we have

This can only occur in Case i), and all the points \((p_L^{eq},p_H^{eq})=\left( p_L^{eq},p^*_M\right)\), for any \(p_L^{eq}\ge MC\), are equilibria. In the second alternative we have that:

Because (11) also holds here, then the only possibility is \(p_L^{eq}=MC\). Then the point \((p_L^{eq},p_H^{eq})=(MC,MCs_H/s_L)\) is an equilibrium if and only if:

And this is exactly Case ii). \(\square\)

Rights and permissions

About this article

Cite this article

Cortés, J.H., Morganti, P. Existence and uniqueness of price equilibria in location-based models of differentiation with full coverage. J Econ 136, 115–148 (2022). https://doi.org/10.1007/s00712-021-00770-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-021-00770-8

Keywords

- Price Competition

- Product Positioning

- Vertical Differentiation

- Dispersion

- Discontinuous Games

- Existence of Equilibria